Who should submit the SZV-TD report

All enterprises that have hired personnel, including remote workers and part-time workers, are required to submit reports in the SZV-TD form, if during the reporting month:

- entries were made in the “Work Information” section of the work book, such as hiring, transfer, assignment of new qualifications;

- the employee wrote an application to continue maintaining a paper work record book or chose its electronic equivalent.

Employers who did not have any of the events listed above in 2021 submit the SZV-TD for the first time before February 15, 2021 (clause 2.5 of Article 11 of Federal Law No. 27-FZ of April 1, 1996).

Even if an organization enters into only fixed-term employment contracts for one year with all employees, it is imperative to record records of annual hiring and dismissal in the SZV-TD form. Pension Fund specialists specifically emphasize this at their seminars.

SZV-M for May 2021 – new form

The general algorithm remains the same, and the frequency of submitting the document to the Pension Fund has not changed - it is submitted monthly. The essence of the changes is to simplify the form by removing explanatory footnotes from it and clarifying controversial details.

How does the new SZV-M form for May 2021 differ from the old form:

1. The name of the policyholder can now be indicated either abbreviated or full - the main thing is that it corresponds to the constituent documentation.

2. The name of the employer can be entered in Latin letters, if that is how it is indicated in the registration documents. This clarification is important for divisions of foreign companies.

3. The reporting period is indicated in the format MM (month number) and YYYY (year).

4. The type of the reporting form is now specified in full - “Initial”, “Additional”, “Cancelling”.

5. The numbering in the tabular part of the report in the column “Item No.” must be continuous.

6. The list of persons reflected in the report has been clarified - the document records information on all insured individuals who are subject to compulsory pension insurance in accordance with Art. 7 of Law No. 167-FZ of December 15, 2001. Thanks to this, the dispute about the need to include information on the sole founder director in the form was resolved - now this information must be present in the report.

When to submit SZV-TD

In 2021, a report in the SZV-TD form must be submitted no later than the 15th day of the month following the month in which:

- there were personnel changes;

- the employee submitted an application to continue maintaining a work record book in paper format under Art. 66 Labor Code of the Russian Federation;

- the employee declared the choice of information about work activity in accordance with Art. 66.1 Labor Code of the Russian Federation.

The employee must write an application before December 31, 2020.

If in 2021 there were no personnel changes in relation to the employee and he did not submit an application to choose the format for maintaining a work record book, the employer must provide information about the work activity of such an employee as of 01/01/2020 until February 15, 2021.

From 2021, you need to submit a report only if there are personnel movements in the company before the 15th day of the month following the reporting month.

Who to include in reporting

From 2021, special conditions for drawing up the document apply. You should include all employees with whom contracts have been concluded (labor, civil, copyright). Moreover, it does not matter whether wages were accrued and paid for them during the reporting period. Look at the current contracts with employees to determine how many people need to be reflected in the SZV-M - as many as the number of employees working in the organization.

Let's look at several controversial examples of who to include in SZV-M:

- The employee was hired on the last day of the month; there was no payment under the employment contract. Should it be included in the report? Yes, include, since the agreement was signed during the reporting period.

- The employee was fired in July, and in August he was awarded a bonus. Should it be included in the August reporting? No, an employee fired last month is not included in the report.

- The organization has no employees. There is no agreement concluded with the founder, he does not receive payments. Should I generate reports for the Pension Fund? In such a situation, it is not necessary to provide a blank form. But many accountants play it safe and send zero forms.

Is it possible to submit SZV-TD on paper?

Employers with fewer than 25 employees can submit the SZV-TD form on paper.

The Pension Fund of Russia launched an electronic service on the Internet in which SZV-TD data can be passed through format-logical control. For companies that generate reports using special software but submit them on paper, the tool will be especially useful. Often these are small enterprises that do not have an electronic digital signature and use free programs such as Spu_orb to fill out SZV-TD. To work with the service, you will need to download the report file from such an application. Next, on the official website of the Pension Fund of Russia, on the “Insured Account” page, in the “Reporting” section, select the “Download draft reporting” service. The tool is also available to those enterprises that are not registered in the “Insured Account” on the Pension Fund of Russia website.

To download the file with the report, you will need to indicate the correct TIN and registration number of the insurance company.

After passing the verification, the form can be printed and submitted to the Pension Fund. A fund employee will check the SZV-TD data with the downloaded electronic report and send it for processing. It will be considered accepted on the day it is submitted in paper form.

The report on paper is filled out in ink, a ballpoint pen of any color except red and green, in block letters or using a computer, without erasures, corrections or abbreviations (clause 1.10 of the procedure approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p).

The form is certified by the signature of the head or authorized representative, and, if available, by the seal of the organization. Entrepreneurs certify documents with a personal signature. The details “Name of the manager’s position” and “Deciphering the signature” (full name must be indicated) must be filled in (clause 1.11 of the procedure).

Will the Pension Fund accept a report without a TIN?

If the TIN column in SZV-M remains empty, when checking the correct completion of this report, the verification program will issue an alert (warning): “The TIN element of the insured person must be filled out.” But this is not an obstacle to the adoption of the Pension Fund’s report - if there are no other more significant errors in this SZV-M.

So, will the Pension Fund accept the report if the TIN is not indicated in the SZV-M? Yes, he will. There will be no fine for this if the employee does not have a TIN and/or the employer really does not have data about him.

But reflecting a fictitious or erroneous TIN in the SZV-M is fraught with a fine of 500 rubles for the employer. for each individual for whom incorrect information was provided (Article 17 of Law No. 27-FZ).

Errors in SZV-M according to TIN are detected by a verification program, the algorithm of which includes format-logical control of the information reflected in SZV-M. In relation to the TIN, the correctness is verified by its check number.

If the wrong TIN is included in SZV-M, you will need two corrective reports - SZV-M with type “O” (this type is entered in section 3 “Form type (code)” of the correcting report). The first report will reset the incorrect data - you need to transfer the record from the original SZV-M with the incorrect TIN to it. In a supplementary form, repeat the data for the employee with the correct TIN.

Learn about the consequences of errors in various documents from the following materials:

- “Error 0400400011 in the calculation of insurance premiums”;

- “Error 508 in the FSS report - what it is and how to fix it.”

How to fill out SZV-TD

The form and procedure for filling out the SZV-TD form are approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p. Below we will look at several cases that require reflection in the report.

1. Filling out the SZV-TD for an employee for the first time

When submitting an SZV-TD for the first time for an employee, it is necessary to enter in its section “Information on the work activity of a registered person” the last entry from the section “Information about work” as of 01/01/2020 for this employer (clause 1.7 of the procedure for filling out the SZV-TD). Records of activities with other employers are not included in the report.

2. Submitting an application to continue maintaining a paper work book or choosing an electronic work book

When choosing a paper format, in the line “An application to continue maintaining a work book has been submitted,” the day the employee submitted the application is indicated.

When switching to a digital labor date, the expression of will is placed in the line “An application has been submitted to provide information about labor activity.”

In the section “Information on the work activity of a registered person”, the last entry from the section “Information on work” as of 01/01/2020 for this policyholder is indicated. Column 2 indicates the date of hiring or transfer to the position in which the employee worked on January 1, 2021.

3. Table “Filling out column 3 of the block “Labor activity” SZV-TD”

| Value in the column “Information on admission, transfer, dismissal” | Conditions and rules for filling |

| Reception | Employment, recruitment |

| Translation | Transfer to another location |

| Renaming | Change of employer name |

| Establishment (assignment) | Obtaining by an employee a second and subsequent professions, specialties, qualifications. The rank, class, category, class rank is indicated |

| Dismissal | Dismissal of an employee |

| Prohibition to hold a position (type of activity) | Prohibition in accordance with a court verdict to hold certain positions or engage in certain activities |

4. About filling out column 5 “Code of the function performed”

The Ministry of Labor of the Russian Federation, in letter dated 03/05/2020 No. 14-0/10/B-1704, clarified that information in column 5 must be entered starting from 01/01/2021 and only for those companies that apply professional standards.

A code is entered in the column, which consists of seven characters in the format “XX.XXX-XX, where:

- the first five, separated by a dot, are the code for the name of the type of professional activity containing the generalized labor function to which the work performed by the employee relates;

- the last two characters are the letter of the generalized labor function code and the number of the qualification level.

The Pension Fund of Russia has developed changes to the SZV-TD form, which should come into force in 2021. The document is posted on the portal for publishing draft regulatory legal acts. In the line “Code of the function performed”, where the seven-digit alphanumeric code “XX.XXX-XX” is indicated, you will need to indicate a five-digit digital code in the format “ХХХХ.Х”, where four characters are the code according to the all-Russian occupational classifier, and the fifth digit is check number.

5. Filling out SZV-TD for part-time workers

The Pension Fund of the Russian Federation in letter dated 03/05/2020 No. B-6181-19/10665-20 explained that if column 4 of the SZV-TD form indicates part-time employment, then the mark in the line of the form about filing an application regarding the preferred method of maintaining STD is not filled out. Since the work book of a part-time worker is kept by the main employer, only he has the opportunity to enter into it all information about the personnel events of its owner, including information about the places of his part-time work.

6. Filling out the SZV-TD if the employee is deprived of the right to hold a position

In accordance with clause 2.5.3 of the procedure for filling out the form approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 730p dated December 25, 2019, the prohibition on an employee’s right to hold a certain position by a court verdict must be reflected in column 3.

An entry can be made only if, according to a court verdict, a convicted employee who has not served his sentence is suspended from work for a certain position or type of activity with the obligatory indication of:

- in column 4 - the period of suspension from activity or position;

- in column 7 - the name of the document (sentence);

- in column 8 - dates of sentence;

- in column 9 - the number of the verdict.

An entry on a ban on conducting activities is reflected in the SZV-TD only upon termination of the employment contract, since Art. 47 of the Criminal Code of the Russian Federation, clause 4, part 1, art. 83 and para. 2 hours 1 tbsp. 84 of the Labor Code of the Russian Federation excludes the possibility of a convicted person to work. In this regard, the SZV-TD form cannot contain only one entry about the ban on holding a position; dismissal must also be reflected with it.

7. Establishing the employee’s profession, specialty or qualifications

The Ministry of Labor of the Russian Federation, in letter dated 03/05/2020 No. 14-0/10/B-1704, considered the issue of reflecting data in column 3 when assigning an employee a second or next profession, new specialty or qualification. As follows from the explanations, it should be filled out only if a new rank, class, other category of profession, specialty, or skill level was established for the employee directly by the employing organization.

8. Filling out the SZV-TD for the manager - the only participant

There is no need to create a SZV-TD form for the manager - the only participant and founder of the company in one person (letter of the Ministry of Labor of the Russian Federation dated March 24, 2020 No. 14-2/B-293). The Labor Code of the Russian Federation obliges employers to report in the SZV-TD form on all personnel activities, but the code is not applicable in this case. It does not provide for the opportunity for the head of the company to conclude an employment contract with himself. Legal relations in such a situation are regulated by the law on LLC (Federal Law dated 02/08/1998 No. 14-FZ).

9. Filling out the SZV-TD when moving from a part-time job to the main place of work

When an external part-time worker transfers to the main staff of the company, the current part-time contract is not automatically terminated. Therefore, it is possible to terminate the part-time job of such an employee by agreement of the parties (clause 1, part 1, article 77 of the Labor Code of the Russian Federation) or on his initiative (clause 3, part 1, article 77 of the Labor Code of the Russian Federation).

In the SZV-TD form, personnel changes must be reflected as follows (letter of the Ministry of Labor of the Russian Federation dated March 25, 2020 No. 14-2/B-308). If a new employment contract is drawn up:

- dismissal from part-time work;

- hiring for the main job.

If an additional agreement is drawn up, the transfer from part-time work to the main one is recorded.

Section 4. Information about the insured persons

This section is a list of insured persons for whom information is provided. For each employee you must indicate:

- Full name (patronymic name is indicated if available);

- SNILS (required);

- TIN (indicated if the policyholder knows this number).

For example, if the policyholder had only two employees during the reporting period, then section 4 of the SZV-M form will look like this:

Please note: the explanations to the SZV-M form do not say that dashes should be entered in the blank fields of the form. Thus, if the policyholder does not have information about the employee’s TIN, then the corresponding column must be left blank.

The explanation to section 4 of the SZV-M form states that this section contains information about employees with whom employment contracts were concluded, continue to be valid or terminated during the reporting period, as well as civil contracts (for the performance of work, provision of services and other types contracts, from payments of which contributions are transferred to the Pension Fund of the Russian Federation). Elena Kulakova draws attention to the fact that in this explanation, the insurer’s obligation to provide information on the employee is in no way connected with the fact of transferring any payments to this employee in the reporting period. Therefore, section 4 of the SZV-M form should include data on all employees who had valid employment contracts with the policyholder during the reporting period. In particular, information must also be provided on those employees who did not receive payments (for example, they were on leave without pay or on parental leave). For the same reason, it is necessary to enter into the monthly reports of SZV-M data on all employees executed under civil contracts, even if remuneration for them is not paid every month.

But what if in the reporting month the policyholder transferred a bonus or other payment to a dismissed employee whose employment contract was terminated before the start of the reporting period? If you follow the explanation to section 4 of the SZV-M form, then information on such an employee does not need to be included in the report.

The question may also arise as to whether it is necessary to submit “blank” monthly reports if the company has only one director (aka the only founder) with whom an employment or civil law contract has not been concluded? Elena Kulakova believes that in this case there is no need to represent SZV-M. The fact is that information about the full name and SNILS of employees must be filled out. There should not be any dashes or spaces in the fields intended to reflect this data. Consequently, if there is not a single valid contract with the employee (and therefore no basis for filling out section 4 of the SZV-M form), then reporting is not submitted.

In addition, you should pay attention to the format required for submitting the SZV-M in electronic form (it was approved by order of the Pension Fund of Russia board dated December 7, 2016 No. 1077p). The format stipulates that in the list of insured persons (that is, in section 4) there must be at least one entry with information about the employee. This also confirms that there is no need to submit “blank” reports.

The Ministry of Labor and the Pension Fund of the Russian Federation claim that the SZV-M form for the director-sole founder must be submitted (see “SZV-M for the director: the Pension Fund of the Russian Federation requires submission of reports even for those founding directors with whom there is no employment contract”).

Penalty for late submission of SZV-TD

From January 1, 2021, Federal Law No. 90-FZ dated 04/01/2020 classifies submission of SZV-TD late or with errors as an administrative offense. According to subparagraph “b” of paragraph 8 of the law, a warning or a fine is provided for failure to submit within the deadlines established by Decree of the Government of the Russian Federation of April 26, 2020 No. 590.

In particular, under Article 15.33.2 they will be held accountable for violations when submitting to the Pension Fund the documents specified in clause 2.1 of Art. 6 of the law on persuance. Sanctions are provided only for officials.

Thus, these offenses will entail a warning or a fine of 300 to 500 rubles.

Responsibility for violations

Despite the fact that the SZV-M form is quite simple to fill out, errors do occur. Most often this is a violation of the deadline for submitting data. It also happens that not all employees are included in the report or, conversely, those who do not belong there are indicated. Data errors can be corrected, often without penalties. But for late submission of SZV-M, a fine is inevitable.

They charge 500 rubles for each employee in an incorrect report. This means that for companies with large staff, just one day late can be very costly.

Responsibility for violations in the field of personalized accounting is described in Law No. 27-FZ (Part 4, Article 17).

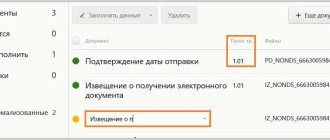

Why don't they take SZV-TD?

The list of conditions under which the Pension Fund verifies the SZV-TD report file is established by the appendices to the Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2019 No. 730p. A protocol with an error code of 50 indicates that the submitted report was not accepted by the Pension Fund. This may happen for the following reasons:

- the file is not a correctly filled XML document;

- the file does not comply with the XSD schema;

- SNILS is not unique within the report;

- the electronic signature is incorrect;

- the PFR registration number is not registered with the fund as of the date of the audited report;

- The TIN does not correspond to the information about the policyholder in the Pension Fund;

- the date of filling out the SZV-TD is later than the current date or earlier than 2020.

Error code 30 is not so critical; it indicates that the SZV-TD has been accepted, but some information requires clarification. It is indicated in the inspection report in the following cases:

- the date of the event is later than the current date or the date the report was completed;

- “date from” is later than “date to”;

- if the value is “Reception”, none of the “Position” or “Information” elements are filled in;

- if the value is “Dismissal”, none of the elements “Article number of the Labor Code of the Russian Federation”, “Grounds for dismissal”, “Reason” are filled in;

- “Grounds for dismissal” is indicated, but the element “Regulatory document” or at least one of the elements: “Article”, “Part”, “Clause”, “Subclause” is not filled in;

- if the value is “Renaming”, the “Details” element is not filled in;

- if the value is “Establishment (assignment) or “Prohibition to occupy a position (type of activity)”, the element “Information” and “Position” is not filled in;

- the unique event identifier (UII) is not unique within the report;

- SZV-TD does not contain either the “Application” block or the “Labor activity” block;

- if the application status is “Submitted”, the date of its submission is not indicated;

- the year on some of the dates does not consist of four digits;

- error in the last two digits of the insurance number;

- FULL NAME. or SNILS do not correspond to the Pension Fund data;

- no canceling measures were taken for the employee because the source data was not found;

- An event with the UIM specified in the report has already been previously registered for the employee.

Error 20 will not affect the acceptance of the report, but it does indicate that there may be an error in the report because one of the following logical inconsistencies has been detected:

- an event has already been previously registered for the employee with the same type, date and part-time mark;

- The checkpoint does not correspond to the checkpoint on the policyholder's card.

Helpful advice

The fact that the developers of the SZV-M form did not include the TIN in the group of mandatory information does not mean that the column with the TIN can always be left empty.

If you do not know the employee’s TIN, it is better to clarify and check the data once again. Use the Federal Tax Service service for this:

To use this service, you will need the following employee information:

- FULL NAME.;

- Date of Birth;

- series and number, date of issue of the identity document.

You need to fill out the required fields of the request form and send it by clicking on the “Send request” button. If your employee is registered with the tax authorities and has been assigned an INN, the service will instantly respond: “Information about the INN has been found” and will indicate this INN.

We tell you more about the work of the “Find out TIN” service here. Now you have a TIN at your disposal, which can be found in SZV-M. If the service did not find information about the TIN, feel free to leave this field empty in the report.

Whatever result the Federal Tax Service gives you when checking your TIN, take a screenshot of the screen with the result. This will help you subsequently justify your actions for not filling out the employee’s TIN in SZV-M if the Pension Fund has complaints about the incompleteness of the personalized information provided.

How to correct a passed SZV-TD

It is impossible to correct SZV-TD without canceling the original information. The Pension Fund informs about changes in the verification of SZV-TD forms received from policyholders. Control measures for the presence of duplicative personnel activities were adjusted. In this regard, to clarify the SZV-TD, you will first need to fill out a cancellation form. This applies to any errors, even if they do not affect SNILS, the policyholder’s registration number, the date and type of personnel event, as well as the sign of part-time employment.

Thus, in order to correct previously submitted information, regardless of the type of error, you need to cancel it and at the same time create a report with the correct information. This algorithm for correcting errors is also set out in the Resolution of the Pension Fund of December 25, 2019 No. 730p.

If you need to correct the electronic form, in addition to the date and type of event, you must indicate the same UUID (universally unique identifier) of the canceled entry as in the information originally submitted, and also mark the part-time job, if any.

Signature and seal

If the policyholder reports “on paper”, then after filling out all sections, the SZV-M form must be signed, indicate the date of preparation and put a seal (if any). Let us remind you that currently organizations have the right not to have a round seal (see “LLCs and JSCs may refuse to use seals: how to do this and in which documents a seal still remains a mandatory requisite”). Let's give an example of filling.

Please note: the SZV-M form states that when signing the report, you must enter “name of the manager’s position.” However, as was said at the beginning of the article, policyholders who are individual entrepreneurs are also required to submit this form. In this regard, the question arises: should the individual entrepreneur leave the field blank, which is intended to indicate the position of the manager, or should the words “individual entrepreneur” be entered in this field? There is no answer to this question. But in any case, the entrepreneur must certify the SZV-M form with his personal signature.