Maintaining accounting records in St. Petersburg for enterprises in St. Petersburg means significant savings on payroll taxes. Running a business without a competent accountant is problematic. If at the initial stage it is possible to somehow work without a chief accountant to the detriment of your company, then as volumes grow, accounting is an indispensable assistant in financial matters. A serious staff of accountants is not always within the capabilities of small or even medium-sized businesses. However, every manager whose goal is to grow the company and make a profit understands the value of outsourcing accounting by professional accountants.

List of accounting services

| Name of service | price, rub. | |

| Preparation of quarterly reports | from 3,500 rub. | |

| Preparation of annual reports | from 6,000 rub. | |

| Management accounting | from 9,900 rub. | |

| Turnkey accounting services for LLC on the simplified tax system | from 14,500 rub. | |

| Turnkey accounting services for LLC on OSNO | from 20,700 rub. | |

| Unblocking a bank account | from 5,500 rub. | |

| Submission of financial statements | from 5,500 rub. | |

| Zero report | 1,500 rub. | |

| LLC registration | from 4,000 rub. | |

With our services for maintaining company records, you can completely forget about drawing up primary documents, do not think about calculating salaries, and receive financial guarantees and responsibility. Our accounting firm in St. Petersburg provides accounting services for legal entities. For individual entrepreneurs, we prepare tax returns for UTII, USN, prepare and submit 3-NDFL, and VAT, and also maintain tax records. Many entrepreneurs who have stores engaged in construction and installation work, or who own beauty salons turned to our company to restore their accounting and have remained our clients for many years.

You can get a free consultation on our services by phone: + 7(981) 968 32 88

Accounting for LLC on OSNO

Accounting services for companies using the general taxation system are slightly different in document flow than those under the simplified taxation system, but the responsibility to regulatory authorities is higher. Drawing up VAT and profit returns on your own can confuse you if you are an engineer, director, or production worker, and if an organization is engaged in foreign trade activities, then outsourcing accounting in a quality and error-free manner will help you avoid financial risks and administrative liability, and possibly criminal liability. Saving on accounting services - as their complete absence is not beneficial for the company.

KBK for payment of penalties under compulsory pension insurance for employees

Penalties are calculated by regulatory authorities in case of untimely fulfillment of obligations by taxpayers and policyholders. During the calculation process, the current refinancing rate of the Central Bank of the Russian Federation (also known as the key rate) is used. If contributions are not paid within the 30 day period, a calculation formula is applied taking into account 1/300 of the key rate multiplied by the amount outstanding; for a period over 30 days (calendar) – 1/150 of the key rate. Penalties are charged for each day of delay in transferring funds (Article 75 of the Tax Code of the Russian Federation).

According to paragraph 3 of Art. 431 of the Tax Code of the Russian Federation, the deadline for payment of compulsory insurance premiums is approved as the 15th day of the month following the billing month. If the date coincides with a holiday or weekend, the payment deadline is postponed to the next business day. For example, contributions for August 2021 must be transferred to the Federal Tax Service no later than September 17, 2018, since September 15 is a Saturday.

For late pension contributions for an employee to the Pension Fund, tax authorities have the right to charge penalties. If you do not pay the penalty, a monetary sanction in the form of a fine will be added to it. Therefore, when paying penalties on pension contributions to OPS for employees, KBK 18210202010062110160 is written on the payment slip.

If the penalty is not paid, the organization is punished with a fine, which is added to the first debt. It is recommended to pay fines regarding pension contributions to the tax service budget for employees immediately, using KBK 18210202010063010160.

Maintaining LLC accounting using the simplified tax system

Services for maintaining company records using the simplified tax system in St. Petersburg and the Leningrad region will help organize order in the book of income and expenses, correctly reflect all transactions for the receipt of goods, cash receipts, and cash receipts. Our specialists will calculate your salary in a timely manner and submit all declarations, which will prevent penalties and fines from the Federal Tax Service. Accounting services for the simplified tax system include quarterly reporting to the tax office, preparation of annual reports, and tax returns under the simplified taxation system.

When was the BCC for insurance premiums last updated?

The last update of the BCC on insurance premiums took place on April 14, 2019.

If nothing changes, then these same BCCs will remain in effect in 2021. But let's go in chronological order. Since 2021, the bulk of insurance premiums (except for payments for accident insurance) began to be subject to the provisions of the Tax Code of the Russian Federation and became the object of control by the tax authorities. As a result of these changes, in most aspects, insurance premiums were equated to tax payments and, in particular, received new, budgetary BCCs.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

The presence of a situation where, after 2021, contributions accrued according to the old rules can be transferred to the budget, required the introduction of special, additional to the main, transitional BCCs for such payments.

As a result, from 2021, there are 2 BCC options for insurance premiums supervised by the Federal Tax Service: for periods before December 31, 2021 and for periods after January 2021. At the same time, the codes for contributions to accident insurance that remain under the control of the Social Insurance Fund have not changed.

Read more about KBK in this material.

From April 23, 2018, the Ministry of Finance introduced new BCCs for penalties and fines on additional tariffs for insurance premiums paid for employees entitled to early retirement. KBK began to be divided not by periods: before 2017 and after - as before, but according to the results of a special labor assessment.

We talked about the details here.

From January 2021, BCC values are determined in accordance with Order of the Ministry of Finance dated June 8, 2018 No. 132n. These changes also affected codes for penalties and fines on insurance premiums at additional tariffs. If in 2021 the BCC for penalties and fines depended on whether a special assessment was carried out or not, then at the beginning of 2021 there was no such gradation. All payments were made to the BCC, which is established for the list as a whole.

We talked about the nuances in the material “From 2021 - changes in the KBK.”

However, from April 14, 2019, the Ministry of Finance returned penalties and fines for contributions under additional tariffs to the 2021 BCC.

Current BCCs for insurance premiums, including those changed as of April 14, 2019, can be seen in the table by downloading it in the last section of this article.

From 01/01/2020, the procedure for determining the BCC will be regulated by a new order of the Ministry of Finance dated 06/06/2019 No. 86n. Which BCCs will change and whether the changes will affect penalties on contributions, find out here.

Salary calculation

Outsourcing of payroll calculations in St. Petersburg for companies and individual entrepreneurs includes the preparation of all tax returns, payments to the Pension Fund, Social Insurance Fund. Accrual of travel and sick leave, as well as reimbursement of maternity leave. Payroll services include timesheet review.

Reporting

Reporting in an accounting company - the company’s services for the preparation and submission of zero reports, as well as reporting when carrying out business activities. In our company you can order accountant services:

- Accountant services for maintaining zero reporting, which includes monthly accounting support for companies without economic activity, in this case we simply prepare and submit all declarations to the Federal Tax Service, Pension Fund, Social Insurance Fund. The cost of accounting services for a zero company is 3,500 rubles per quarter.

- Accountant services for maintaining UTII reporting, including calculation, preparation of UTII declaration, submission electronically through an operator.

- Accountant services for maintaining financial statements

- Accountant services for tax reporting include full subscription services and support for companies with VAT, or on the simplified tax system.

- Accountant services for maintaining salary reports for LLCs and individual entrepreneurs.

Table with decoding of code 18210202010061010160

| Code | Decoding |

| 182 1 0210 160 | Insurance contributions for compulsory pension insurance |

| 182 1 0210 160 | Penalty |

| 182 1 0210 160 | Fines |

Every month, organizations contribute funds to the budget for employee insurance pensions. To deposit money into the OPS for employees, use the KBK number 18210202010061010160. The code applies to making a payment, the amount of which was accrued during the period from January 1, 2017. And to pay the insurance premium for an employee whose fee is calculated before this period, KBK 18210202010061000160 is used.

The code consists of 20 digits and seven blocks, the indicators of which detail the payment by budget and revenue group. Thus, the name of the payment guides the Federal Tax Service on what payment the tax agent is making. In the cipher in question, this is a standard fee. There are also: penalties - 18210202010062110160, interest - 18210202010062210160, fines - 18210202010063010160.

Detailed decryption of the code:

- 182 - an institution to which money is credited for mandatory pension insurance for employees. For this code - Federal Tax Service.

- 1 - identifies the group of income coming to the treasury. In this case, tax revenues.

- 02 - defines the collection subgroup: insurance premiums for compulsory health insurance sent to the Pension Fund budget. Moreover, these are fees accrued from January 1, 2021, for employees.

- 02010 - indicates a subtype of tax revenue and the budget that is replenished with these funds: pension contributions for employees to the federal budget.

- 06 — territorial affiliation of the budget: regional.

- 1010 - name of payment under code 18210202010061010160: standard payment for compulsory pension insurance for employees, which is calculated from January 1, 2021.

- 160 - specifies revenues: contributions for compulsory social insurance.

Advantages of accounting in Aspect-Consulting

- No additional jobs required

- Savings on payroll taxes are up to 50%, and all expenses of your company are reduced by the amount of accounting services provided

- Accounting is under the control of the Chief Accountant

- Our accounting company has extensive experience in various fields of activity.

- All services are provided under a contract, every month/quarter you receive a certificate for the work performed

- We independently resolve issues with tax and government agencies, and carry out budget reconciliations every quarter

- Guarantee of receiving a 1C database after the end of service

What BCCs for insurance premiums are established for the Social Insurance Fund in 2019–2020

Contributions to the FFOMS, as well as contributions to the Pension Fund, are paid by:

- IP - for yourself;

- Individual entrepreneurs and legal entities - for hired employees.

https://www.youtube.com/watch?v=ytcreatorsru

Contributions for individual entrepreneurs to the FFOMS are paid for themselves using KBK 18210202103081013160 (if related to the period from 2017) and KBK 18210202103081011160 (if related to the period before 2017).

For hired employees, individual entrepreneurs and legal entities must pay contributions to the Federal Compulsory Medical Insurance Fund using KBK 18210202101081013160 (for payments accrued from 2021) and KBK 18210202101081011160 (for accruals made before 2021).

Payments to the Social Insurance Fund are classified into 2 types:

- paid towards insurance for sick leave and maternity leave;

- paid towards insurance for accidents and occupational diseases.

Individual entrepreneurs working without hired employees do not list anything in the Social Insurance Fund.

Individual entrepreneurs and legal entities working with hired personnel make payments for them:

- for sick leave and maternity insurance - using KBK 18210202090071010160 (if we are talking about accruals made since 2017) and KBK 18210202090071000160 (if accruals were made before 2017) - contributions are administered by the Federal Tax Service;

- for insurance against accidents and occupational diseases - in the amount determined taking into account the class of professional risk by type of economic activity, using BCC 393 1 0200 160 - contributions are transferred directly to the Social Insurance Fund.

Individual entrepreneurs and legal entities concluding civil contract agreements with individuals pay only the second type of contributions, provided that this obligation is specified in the relevant agreements.

Read more about the specifics of calculating insurance premiums when signing civil contracts in the article “Contract and insurance premiums: nuances of taxation.”

High quality accounting services

How to find quality accounting services? Outsourcing accounting firms are opening in large numbers nowadays. Accounting in Aspect-Consulting is carried out by specialist accountants who are well versed in accounting. It is quite difficult to choose high-quality accounting services among the many accounting firms. It is not always the case that a small or new company will conduct its accounting in bad faith. A small accounting firm devotes significantly more time to clients due to the light workload.

Accounting services are inexpensive, is it worth pursuing such services? At the initial stage, accounting can be inexpensive, in cases where the Customer has just registered a company, when there is no activity, when zero reports are submitted. But cheap accounting services cannot be of high quality; in this case, the accounting company that services it has a large number of clients, or accountants with low qualifications and little experience, which can negatively affect bookkeeping.

At Aspect-Consulting, you communicate directly with accountants, and not with managers. All taxes are strictly agreed upon and will not confuse you. The extensive experience of accountants in various types of activities allows us to accurately carry out all accounting operations and accurately calculate taxes.

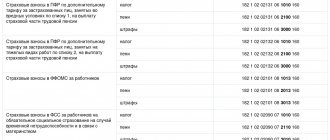

KBK for payment of contributions

It is necessary to use the following KBK:

for employees

Each organization must pay insurance premiums for its employees, and for this the following BCCs are used:

| Payment | KBK | ||

| OPS | Compulsory medical insurance | FSS | |

| Contribution | 18210202010061010160 | 18210202101081013160 | 18210202090071010160 |

| Penya | 18210202010062110160 | 18210202101082013160 | 18210202090072110160 |

| Fine | 18210202010063010160 | 18210202101083013160 | 18210202090073010160 |

at an additional rate

When applying an additional tariff due to harmful or dangerous working conditions for such employees, it is necessary to transfer insurance premiums according to the following BCC:

| Payment | KBK | |

| the tariff does not depend on the special assessment | the tariff depends on the special assessment | |

| For insured persons employed in the work specified in clause 1, part 1, article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 1) | ||

| Contribution | 18210202131061010160 | 18210202131061020160 |

| Penya | 18210202131062100160 | |

| Fine | 18210202131063000160 | |

| For insured persons employed in the work specified in paragraphs. 2-18 Part 1 Article 30 of the Federal Law of December 28, 2013 No. 400-FZ (list 2) | ||

| Contribution | 18210202132061010160 | 18210202132061020160 |

| Penya | 18210202132062100160 | |

| Fine | 18210202132063000160 | |

Individual entrepreneur for himself

Entrepreneurs are required to pay insurance premiums for themselves. For this purpose the following KBKs are used:

| Payment | KBK | |

| OPS | Compulsory medical insurance | |

| Fixed contributions | 18210202140061110160 | 18210202103081013160 |

| Contributions in the amount of 1% on the amount of income over 300 thousand rubles. | – | |

| Penya | 18210202140062110160 | 18210202103082013160 |

| Fine | 18210202140063010160 | 18210202103083013160 |

for employees “for injuries”

Employers are also required to pay insurance premiums for injuries for their employees. KBK look like this:

| Payment | KBK |

| Contribution | 39310202050071000160 |

| Penya | 39310202050072100160 |

| Fine | 39310202050073000160 |