The main essence of the tax

A loss can be accepted for previous periods when calculating income tax (IP), but only if the activity was “plus”. In the absence of excess income, the loss is carried forward to future periods. It is allowed to take into account the negative difference for “simplifiers” at the end of the year. The minus amount can be taken into account 100% or partially, depending on the entrepreneur’s request.

Example: I made a profit of 3 million rubles in the first three months of 2021. The company has a tax loss for 2019, which amounts to 1 million rubles. Thanks to this, the Technomash accountant will reduce the tax base in the declaration by the amount of the transferred loss.

The plant’s NP will be calculated at 2 million, not 3 million rubles. Its size will be 400 thousand rubles (2 million * 20%).

Previously, there was a time limit for accounting for tax losses - 10 years. After 2021, such requirements no longer exist. The profit of an enterprise may decrease by the amount of losses incurred in any time period.

PBU 18/02: loss of the year

N. Bukharina, PB expert

Has the company made a loss? If yes, IT will appear in the accounting, and maybe SHE will appear. Or some kind of PNO. Let's decide.

In the current quarter, firms are required to summarize their work for the past year. If expenses exceed income, a loss occurs. In accounting, its amount is reflected in the debit of account 99 “Profits and losses”. The loss is not reflected in tax accounting (clause 8 of Article 274 of the Tax Code of the Russian Federation). This creates differences. Temporary and/or permanent, depending on the situation.

The loss is the same

Situation one: in tax and accounting based on the results of 2004, the same loss was received. In this case, deductible temporary differences arise: they are taken into account in accounting, and later in tax accounting. There are some nuances with tax accounting. So, you have the right to write off the entire loss of 2004 in 2005 only if its amount does not exceed 30 percent of the taxable base. The remaining part is transferred to subsequent periods, but not more than 10 years (Article 283 of the Tax Code of the Russian Federation).

How to reflect the difference that has arisen?

First, fix the so-called conditional income (clause 20 of PBU 18/02). It is defined as the product of the accounting loss and the income tax rate. Conditional income is reflected in the debit of account 68 “Accounting for settlements of taxes and fees” in correspondence with the credit of account 99 “Profits and losses”.

Then calculate the deferred tax asset (DTA). To do this, multiply the deductible temporary difference by the income tax rate (24 percent). Reflect the amount of IT in the debit of account 09 “Deferred tax assets” in correspondence with account 68 (clause 17 of PBU 18/02).

Since in our case the accounting loss is equal to the deductible temporary difference, the amount of conditional income and the amount of IT will be the same. Accordingly, account 68 will be closed. Let us illustrate this with an example.

Example 1

Based on the results of 2004, Passiv LLC received a loss of 10,000 rubles in accounting and tax accounting. The accountant made the following entries:

Debit 68 Credit 99 subaccount “Conditional income tax income”

– 2400 rub. (RUB 10,000 x 24%) – conditional income tax income has been accrued;

Debit 09 Credit 68

– 2400 rub. (RUB 10,000 x 24%) – reflected by ONA.

So, we reflected the difference that arose. However, it will decrease as last year's loss is reflected in tax accounting. Along with it, the deferred tax asset (DTA) will also decrease until it is completely written off. As a result, account 09 will be closed (clause 17 of PBU 18/02).

Example 2

Let's use the data from the previous example. Let's assume that in the first quarter of 2005, Passiv LLC made a profit of 35,000 rubles. It is enough to write off the 2004 loss. The following entries will be made in accounting on March 31, 2005:

Debit 68 Credit 09

– 2400 rub. – SHE is decommissioned.

The accounting loss is greater than

the tax one.

Situation two: based on the results of 2004, a loss was received, but now the accounting loss is greater than the tax one. In this situation, both deductible temporary differences and permanent differences arise:

– deductible temporary differences arise in the amount of the “tax loss”;

– for the remaining amount – permanent differences.

Let us note the fundamental difference between permanent and temporary differences. Temporary differences disappear over time. Permanent - no. An example is entertainment expenses. In tax accounting they are reflected within the norms (no more than 4 percent of labor costs), in accounting - in full.

We discussed above how to take into account deductible temporary differences. Let's move on to taking into account permanent differences.

Having decided on their amount, the accountant must calculate the permanent tax liability (PNO). To do this, multiply the amount of the permanent difference by the income tax rate. For the amount of PNO, an entry is made to the debit of account 99 and the credit of account 68.

Example 3

Based on the results of 2004, Passiv LLC received a loss of 12,000 rubles in accounting, and 10,000 rubles in tax accounting. The difference arose due to the inclusion of entertainment expenses in excess of the norm (in the amount of 2,000 rubles).

In this case, the amount of deductible temporary differences was RUB 10,000. The accountant reflected it like this:

Debit 68 Credit 99 subaccount “Conditional income tax income”

– 2400 rub. (RUB 10,000 x 24%) – conditional income tax income has been accrued;

Debit 09 Credit 68

– 2400 rub. (RUB 10,000 x 24%) – reflected by ONA.

The amount of permanent differences is 2000 rubles. The accountant calculated permanent tax liabilities and reflected them in accounting as follows:

Debit 99 subaccount “Fixed tax liabilities” Credit 68

– 480 rub. (RUB 2,000 x 24%) – PNO reflected.

The tax loss is greater than

the accounting one.

Situation three: at the end of 2004, the tax loss turned out to be greater than the accounting one. A new type of difference is entering the arena - taxable temporary differences: expenses are taken into account in tax accounting, and later in accounting. A simple example with depreciation of fixed assets. According to accounting data, it amounted to 100 rubles, and according to tax data – 300 rubles. As a result, the taxable temporary difference will be 200 rubles. Like all previous differences, it must be reflected.

It's easy to do. Calculate the deferred tax liability (DTL) using the familiar formula: multiply the taxable temporary difference by the income tax rate. Then reflect the amount of IT in the debit of account 68 in correspondence with account 77 “Deferred tax liabilities” (clause 18 of PBU 18/02).

Example 4

Based on the results of 2004, Passiv LLC received a loss of 10,000 rubles in accounting, and 12,000 rubles in tax accounting. The difference was due to the use of different methods of depreciation of fixed assets. In tax accounting it was written off completely, in accounting it remains to write off 2000 rubles.

The amount of taxable temporary differences amounted to RUB 2,000. The accountant calculated deferred tax liabilities and reflected them in accounting as follows:

Debit 68 Credit 77

– 480 rub. (RUB 2,000 x 24%) – IT is reflected.

In the future, the taxable temporary difference will decrease: as the accounting records reflect the amounts previously taken into account in tax accounting. Along with the difference, the deferred tax liability (DT) will also decrease until it is completely written off. As a result, account 77 will be closed (clause 18 of PBU 18/02).

Example 5

Let's continue with example 4. Let's assume that in the first quarter of 2005, the fixed assets in accounting were completely depreciated. As a result, there was no taxable temporary difference. On March 31, 2005, the accountant made the following entry:

Debit 77 Credit 68

– 480 rub. – ONO has been written off.

Please note: in the case under consideration (when the tax loss is greater than the accounting loss), permanent differences may also arise. We described above how to take them into account.

Finally there was a profit

Situation four: at the end of the year, a profit was generated in tax or accounting records. But there is little joy in this. Overshadowed by either taxable temporary differences (for profits in accounting), or deductible temporary differences (for profits in tax accounting), or permanent differences (can arise in any case). There are also situations where permanent and temporary differences occur simultaneously. We discussed above how to take them into account.

How are taxes calculated on a loss?

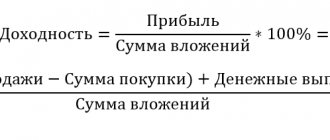

NP, just like any other, begins to be calculated by determining the tax base. The company's income is taken and expenses are subtracted from this amount. Next, the resulting amount is multiplied by the rate (usually 20%). If there are losses from previous years, then they also “cut” income.

Example: the Lazurit enterprise earned 10 million in 2020 and spent 7 million rubles on office maintenance and other purposes. The tax base (that is, profit) will accordingly be 3 million rubles. You will have to pay 20% of this amount (unless other rates are established in the region).

These 600 thousand rubles (20% from 3 million rubles) are usually paid in advance payments once a quarter, and then the remaining amount is paid at the end of the year.

Now let's see what happens if the company wants to take into account last year's losses in the amount of 500 thousand rubles. It is necessary to deduct from income not only the entire amount of expenses, but also these half a million. Total: 10 million - 7 million - 500 thousand rubles = 2.5 million rubles.

The NP, taking into account the loss, will amount to 500 thousand rubles (20% from 2.5 million rubles). These are the simplest calculations, without detailing expenses and income. For convenience, you can use the calculator on the website: ppt.ru/nalogi/pribyl/raschet.

Transferring losses to the future - is it possible?

The Tax Code of the Russian Federation allows losses to be carried forward to the future. But the rule applies only to those companies that pay the IR in full, and not at a zero rate, and do not try to reduce profits by selling shares in the authorized capital, bonds or other securities.

Today, legal entities are allowed to take into account their losses for previous years so that profits are not cut by more than 50% due to the transfer. Previously, there was no such restriction. The 50% limit does not apply if the company operates in a SEZ, TASED, SEZ.

If there is a negative result not for one year, but for many years, the transfer of losses is done in the order of priority. The right to such a transfer in the event of a company reorganization is transferred to the legal successor.

Please note that we are not talking about current losses (for example, for a quarter, half a year), but for longer time periods (a year). Only in this case will the amount be considered a “loss from previous years” in the next tax period.

If there is a loss at the end of the year, NI is not paid, since there is no profit. Current losses for a quarter or half a year will be taken into account when reducing the amount of income and will be taken into account automatically in calculations.

As practice shows…

If a loss occurs, then income tax is not calculated in the reporting period. Therefore, losses that run counter to the interests of the state in terms of replenishing the budget receive special attention from tax authorities. In addition to invitations to meetings of the “loss commission,” taxpayers are visited by on-site tax audits. The amendment to Article 88 of the Tax Code introduced on January 1, 2014 gives the tax authorities the right to demand, within 5 days, an explanation from the taxpayer regarding a loss-making declaration, as well as an updated declaration with a reduced tax amount.

As a rule, the taxpayer, in order to avoid such problems, tries to minimize expenses.

The most popular measure is to refuse to create reserves next year - provided that they exist in this period.

Then the unused balances will be used to pay one-time bonuses, pay for vacations, repair equipment, etc. can be taken into account at the end of the reporting period as non-operating income. Also, if there are losses from previous years, they can not be taken into account in the current period of expenses or taken into account partially.

How to justify it legally?

Losses must be supported by appropriate documentation. They are also indicated when filling out the NP declaration in the “Calculation of the amount of loss” appendix.

The tax office has the right to request supporting documents and request explanations within five days as part of a desk tax audit. For example, losses can be confirmed by extracts from accounting registers, invoices and other documents.

They can use:

- contracts with counterparties, payments, checks;

- confirmation of bankruptcy or liquidation of the supplier (for example, a claim for bankruptcy, a court decision, etc.);

- business correspondence.

If the company is engaged in seasonal business and periodically experiences downturns in activity, then the constituent documentation, which describes the nature of the activity, will be sufficient. A sample explanation of loss can be downloaded here.

The explanation must also indicate what the company is doing to reduce its unprofitable financial results and, if possible, attach a business plan or other evidence of its readiness to reduce losses in the future.