What role do deposits play for legal entities? First of all, it brings additional income to the organization. And it doesn't matter whether it's commercial or not.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Almost every bank in the Russian Federation develops and introduces deposit programs for legal entities. By making deposits as accessible as possible, financial organizations make their relationships with organizations more profitable and productive.

Types of deposits subject to taxation

For legal entities, banks offer a wide range of deposits. These include:

- Open deposit. This is a type of deposit where money is credited to an account with further interest being received. There are several types of open deposits:

- Demand deposit – there are no restrictions on investment and storage period, issuance is carried out at the first request of the depositor;

- Time deposit – when opening an account, the storage period for funds is negotiated and specified; partial or complete withdrawal of funds is not provided for;

- Permanent deposit – no specific period for storing funds is specified.

- Closed deposit. This type of deposit is a sealed container with a seal, which is transferred to the bank for storage.

- Safe deposit. The bank provides a legal entity with a safe where you can store jewelry, money, metal, and the like.

It is important to remember that no matter what type of contribution the organization chooses, it must be reported to the tax authorities. Concealing the presence of a deposit may result in fines or criminal penalties.

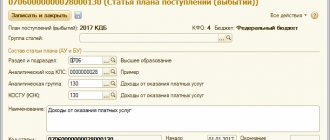

How to reflect deposit transactions in 1C Accounting: 3.0

This follows from the provisions of Article 210, paragraph 2 of Article 212 and subparagraph 3 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

If there is a significant violation of the quality requirements for the goods, the buyer has the right to refuse the transaction and demand a refund of the amount paid.

Please tell me when we placed a deposit, the bank opened deposit accounts for us. The accumulation of interest and the entire deposit amount is reflected in these accounts. It turns out that I transfer from my regular account to account 55 as usual, but I don’t quite understand how I should post the receipt of the amount in the deposit account.

If there is a significant violation of the quality requirements for the goods, the buyer has the right to refuse the transaction and demand a refund of the amount paid.

A bank deposit agreement is concluded on the terms of issuing the deposit on demand (demand deposit) or on the terms of returning the deposit after the expiration of the period specified in the agreement (time deposit).

If, on the contrary, it is beneficial for you that the proceeds from the sale be taken into account in income under the simplified tax system, then the real estate should be used in business. It is also better to enter the corresponding type of activity into the Unified State Register of Individual Entrepreneurs (for the sale of real estate and for the income that real estate brings).

Taxation options

Taking into account Russian legislation, a tax on the profitability of deposits is imposed if the interest rate exceeds the refinancing rate of the Central Bank of the Russian Federation, which must be increased by 10 points if the deposit was opened from December 15, 2014 to December 31, 2015, and by 5 points if the deposit was opened from December 15, 2014 to December 31, 2015. if the deposit has been opened since 2021.

Today the refinancing rate is 8.25%. If you add another 10% to this, you get 18.25%.

We get the following: if the deposit rate is greater than the received number, then it is subject to taxation; if less, you won't have to pay. It is noteworthy that tax is deducted only on the difference in percentage. For example, if the deposit rate is 19.5%, then only the difference of 1.25% is paid.

The tax amount is withheld automatically, so no additional documents need to be filled out.

Why do you need to conduct and do you need to take KUDiR

The ledger for accounting income and expenses is a special register where taxpayers using the simplified taxation system (STS) enter business transactions for subsequent calculation of the tax base for the STS tax.

The obligation to keep a book of income and expenses, or KUDiR, as accountants often call it, is established by Article 346.24 of the Tax Code of the Russian Federation.

If KUDiR is not maintained or there are violations in filling it out, you can earn a fine from 10,000 to 30,000 rubles. And if violations lead to an underestimation of the tax base, a fine of 20% of the amount of unpaid tax. This is enshrined in Article 120 of the Tax Code of the Russian Federation.

At the same time, there is no obligation to submit KUDiR to the tax office. If the tax authorities require you to provide a Book of Income and Expenses during an audit, then you are required to provide the Book in paper form, bound, numbered and signed.

KUDiR may be needed to show the expenditure of targeted financing, or to show the Pension Fund of Russia income to determine the rate of insurance premiums for individual entrepreneurs, or in a bank for a loan.

The book is started for a year. It can be maintained in paper and electronic form. Of course, many accounting programs and web services (such as Kontur.Accounting or Elba) allow you to maintain a book in electronic form with varying degrees of simplicity. If the tax office requires it, you can print it out and take it.

Taxation of deposits of legal entities on the simplified tax system

Taxation for legal entities under the simplified tax system is formed on the basis of profits received from the sale of goods and unrealized income. This is determined by Art. 249 of the Tax Code of the Russian Federation and Article 250 of the Tax Code of the Russian Federation. Profit from deposit accounts is classified as unrealized income.

But you need to keep in mind that the deposit amount that is returned to the account of a legal entity is not taken into account for taxation, because it is not revenue from the sale of goods.

In accordance with Art. 346.17 of the Tax Code of the Russian Federation, the date of receipt of profit by a legal entity on the simplified tax system is the day the money arrives in the account of this person. If interest is transferred to a deposit account, then it is not subject to taxation, since the company cannot dispose of it.

Taxation arises only from the time when the money is in the current account of a legal entity.

If the contract with the bank is terminated prematurely, the interest rate is also reduced, but this does not affect the organization in any way, since the specified profit is recognized on the day the funds actually arrive.

In some cases, the legal entity’s deposit account receives funds from other organizations for services provided. Here, the funds received can be called income, and they are taken into account when calculating tax (Letter of the Ministry of Finance of Russia dated March 12, 2009 N 03-11-09/99

Video: Systems for enterprises

BASIC

For organizations on OSNO, when calculating tax, money deposited, as well as transferred by a financial institution, is not counted among the tangible assets of this organization.

This is reflected in clause 12 of article 270, clause 10 of clause 1 of article 251 of the Tax Code of the Russian Federation. In other words, no VAT consequences are expected for the investor if:

- Money has been deposited;

- The money was returned by the financial institution to the deposit account;

- The profit is deposited into the deposit account.

According to clause 6 of Article 250 of the Tax Code of the Russian Federation, profit on the deposit belongs to unrealized income.

When calculating according to documents where the validity period fell on more than one reporting period, the profit is recognized as received and is included in the total income at the end of the month of a specific reporting period. This also includes the day the contract ends or early termination.

Interest on a deposit is included by a legal entity in the tax base on the basis of a report on the flow of funds in the account of this organization.

If you are interested in dual-currency deposits. Read the article, accounting for structural dual-currency deposits. What does Prominvestbank offer for deposits? More details here.

UTII

If a legal entity located on UTII opens a deposit in any financial organization, this leads to the receipt of additional income in the form of interest. And this fact falls under non-operating income.

And since the revenue received from the use of the deposit is not regarded as a dividend from the functioning of a legal entity, it must be taxable (Letter of the Federal Tax Service of Russia dated March 24, 2011 N KE-4-3/4649).

It should be remembered that legal entities that conduct several types of activities simultaneously must maintain separate records of property, liabilities, and business transactions. Simply put, the type of activity subject to a single tax is taken into account separately, and the activity that is subject to income tax is taken into account separately.

If the company operates on UTII and the simplified system, while receiving a percentage of deposits, then this form of profit must be considered from the point of view of the simplified system (Letter of the Ministry of Finance of Russia dated July 6, 2005 N 03-11-04/3/7).

Postings

In order to track the movement of funds that come from the deposit or, on the contrary, invested funds, it is recommended to contact subaccount 3 “Deposit accounts” of account 55 “Special accounts in banks”.

At the same time, the payment that was made to the deposit account is recognized as a cash investment. And to record these monetary transactions, there is account 58 “Financial investments”. And in this case, it would be correct to use subaccount 5 “Bank deposit”. Which account is used is necessarily recorded in the accounting policy of the legal entity.

Taking into account all of the above, the accounting entry will look like this:

Debit 58-5 (55-3) Credit 51

- transfer of funds to a deposit account.

If a legal entity opened a demand deposit, then it is classified as a highly liquid cash investment and is displayed as “Cash and cash equivalents.”

Interest on this deposit is considered other income and is indicated in the debit of account 76 “Settlements with various debtors and creditors” and the credit of subaccount 1 “Other income” of account 91 “Other income and expenses”.

In an example it looks like this:

Debit 76 Credit 91-1

- accrual of interest due.

If interest income relates to the previous year, then in the accounting entry it goes as other expense as a loss.

The note looks like this:

Debit 91-2 Credit 76

- the amount of reduction in interest on the deposit due to early termination is included in other expenses.

Tax return

On January 1, 2009, Federal Law No. 155 of July 22, 2008 came into force, according to which a tax return under the simplified tax system is submitted only once a year, in particular by taxpayer organizations - until March 31 of the year following the expired tax period (clause 1 Article 346.23 of the Tax Code of the Russian Federation).

Order of the Ministry of Finance of Russia dated June 22, 2009 No. 58n approved a new form of tax return, according to which for the first time it is necessary to report on the results of 2009. In accordance with the Procedure for filling out a tax return approved by this document, in Section 2, line code 210, the amount of income received for the tax period must contain the amount of non-operating income, in particular in the form of interest on a deposit.

A large percentage is not always profitable

If a legal entity wants to make money on deposits, then you should not aim at high interest rates. Indeed, according to the legislation of the Russian Federation, there is a norm in the form of a refinancing rate, which is equal to 8.25% in 2021.

And if the income from the deposit exceeds the deposit by 5 points from the rate, then the financial organization taxes the income. The tax rate is 35%, because the income can be classified as unearned money. Therefore, a high percentage is not always beneficial for the investor, especially if it is a legal entity.

Deposit: predictable income and unexpected expenses

How to account for transactions involving placing money on a bank deposit

If there is free money in the organization's current account, it can be placed in a bank deposit at interest. Accounting for operations to open and close a deposit is simple, but non-standard situations are also possible. For example, your organization claimed the deposit ahead of schedule and lost most of the already accrued income. Or the bank's license was revoked. Our article will help you take such “surprises” into account correctly.