Who should report for the 4th quarter of 2016

All policyholders are required to report in form RSV-1 for the 4th quarter of 2021:

- organizations and their separate divisions;

- individual entrepreneurs;

- lawyers, private detectives, private notaries.

At the same time, policyholders need to generate RSV-1 for the 4th quarter of 2021 if they have insured persons, namely:

- employees under employment contracts;

- director is the sole founder;

- individuals - performers under civil contracts (for example, contract agreements).

If no activity was carried out

Organizations need to report in form RSV-1 for the 4th quarter of 2021, regardless of the fact of doing business from January to December 2016. It also does not matter whether there were actual wages or other payments to employees during this period. Indeed, despite this, in relation to employees, the organization is still the insurer of pension and health insurance. If you are in a similar situation, we can recommend paying attention to the article “Zero RSV-1: which sections to fill out.”

Let's talk separately about individual entrepreneurs. If an individual entrepreneur does not have employees officially registered under labor law and did not make payments or remuneration to individuals for the period from January to December 2021, then the RSV-1 for 2021 is not required, since in such a situation the individual entrepreneur is not recognized as an “insurer.” If an individual entrepreneur does not have employees, then he pays contributions only “for himself.” And you are not required to submit any reports to the funds.

New RSV-1 form for the 4th quarter of 2016

From January 1, 2021, the RSV-1 form, approved by Resolution of the Pension Fund Board dated January 16, 2014 No. 2p, has been cancelled. Instead, there is a new form for calculating insurance premiums, approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551. It must be used for reporting to the Federal Tax Service. See “Unified calculation of insurance premiums from 2021: rules for the new form.”

However, submit the report for 2021 in the form RSV-1 of the Pension Fund of Russia, approved by Resolution of the Board of the Pension Fund of January 16, 2014 No. 2p. It is necessary to use the previous format, which is used for submitting “pension” reports in electronic form. Thus, there is no new RSV-1 form for reporting for the 4th quarter of 2021. Searching for it to download on the Internet is useless. Use the old RSV-1 form.

In any form?

The calculation is presented on paper or in electronic form in accordance with the legislation of the Russian Federation. At the same time, organizations with a staff of 25 people or more, from January 1, 2015, must submit reports to the Pension Fund of the Russian Federation in form RSV-1 only in electronic form with an electronic signature.

Since the first half of 2015, the updated RSV-1 form has been presented

Approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2P “On approval of the form of calculation for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory medical insurance to the Federal Compulsory Medical Insurance Fund by insurance premium payers making payments and other remuneration to individuals, and the Procedure for filling it out" as amended by Resolution of the Board of the Pension Fund of the Russian Federation dated 06/04/2015 No. 194p "On amendments to the Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p" (Registered with the Ministry of Justice on 07/23/2015 registration No. 38153, published on the official Internet portal of legal information on July 27, 2015).

- Resolution of the Board of the Pension Fund No. 194P dated 06/04/2015

Deadline for submitting annual calculations to the Pension Fund

The deadline for submitting RSV-1 for the 4th quarter of 2021 depends on the reporting method used by the company or individual entrepreneur. In the table we summarize the deadlines for submitting RSV-1 for the 4th quarter of 2016 to the territorial bodies of the Pension Fund. See “RSV-1 due date for 2021.”

| Method of submitting RSV-1 for 2021 | Deadline |

| RSV-1 on paper | no later than February 15, 2021 |

| RSV-1 in electronic form | no later than February 20, 2021 |

Submit RSV-1 for the 4th quarter of 2021 to the Pension Fund of Russia, and not to the Federal Tax Service. Tax authorities will not accept reports relating to periods before 2017. See “Where to submit RSV-1 for 2021: to the Pension Fund or the tax office?”

What's happened?

The Federal Tax Service of Russia and the Pension Fund (PFR) issued a joint letter No. BS-4-11/ [email protected] , No. LCh-08-24/8824 dated 05/08/2018, which they sent for execution to their lower inspections and departments. Officials are concerned about the situation in which a significant number of taxpayers have discrepancies between two types of reports:

- calculations for insurance premiums (DAM), which payers submit to the Federal Tax Service;

- reports in the SZV-STAZH form, which employers submit to the Pension Fund of Russia.

Although, according to the released control ratios, these types of reporting should complement each other, and the data in them should converge with each other, the Pension Fund of the Russian Federation verified the completeness of the submission by payers of insurance premiums of information on the insurance experience of insured persons using the SZV-STAZH form. It turned out that employers made many discrepancies. Now the Pension Fund of Russia and the Federal Tax Service will require updated calculations from such employers who pay insurance premiums.

Cover page: general information about the policyholder

On the title page, fill out all the cells, with the exception of the subsection “To be filled out by a Pension Fund employee.” Let's talk about some aspects of filling out annual indicators for 2021.

Clarification data

In the “Clarification number” field, reflect “000” if the RSV-1 calculation for the 4th quarter of 2021 is submitted for the first time. If you are clarifying the indicators of past reports, then enter the serial number of the clarification (for example, “001”, “002”, 003...).

For what period is the calculation submitted?

In the “Reporting Period” field on the title page, display “0” (zero). In the “Calendar year” field – 2021 (despite the fact that you submit the calculation in 2021). In this way, you will inform the fund that you are presenting the annual calculation of RSV-1 for 2021.

Organization name and individual entrepreneur details

In the “Name” field, indicate the full name of the insured - organization (as in the constituent documents). If the calculation is submitted by an individual entrepreneur, then his last name, first name, and patronymic are included (as in the passport).

OKVED: what classifier

Until January 1, 2021, two classifiers of OKVED codes were in effect: the old OK 029-2001 and the new OK 029-2014. Which of these classifiers should you use? Let me explain.

Organizations or individual entrepreneurs that are registered as such after July 11, 2021, indicate in the calculation of RSV-1 for the 4th quarter of 2021 the encoding from the new classifier OK 029-2014 (approved by order of Rosstandart dated January 31, 2014 No. 14-st) .

If a company or individual entrepreneur was registered with the Pension Fund of Russia before July 11, 2016, then you can mark the codes from the old classifier OK 029-2001 or the new OK 029-2014. That is, in this case, there is a choice. The fact is that the “old” classifier can be used, since it is referenced in paragraph 5.8 of Appendix No. 2 to the Resolution of the Pension Fund Board of January 16, 2014 No. 2p. This rule is still in effect. Accordingly, officials of the territorial bodies of the Pension Fund of the Russian Federation do not have the right to “force” only new codes according to the OK 029-2014 classifier to be indicated in the annual calculation. Also see “OKVED reduced tariffs of insurance premiums”.

Number of insured persons

In the “Number of insured persons” field, indicate the total number of employees for whom insurance premiums were paid, in accordance with the number of sections submitted in Section 6 of the calculation with the type of information “initial” (clause 5.10 of Section II of the Procedure, approved by the Resolution of the Pension Fund Board of January 16, 2014 No. 2p). Here is an example of filling out a title page.

When filling out the “Average number of employees” field of RSV-1 for the 4th quarter of 2021, take into account the procedure for calculating the number of employees that you use when preparing statistical reporting. That is, there are no special features when filling out RSV-1.

What didn't add up in the reporting?

After a reconciliation carried out by the Federal Tax Service and the Pension Fund of Russia, they compiled lists of employers who:

- a report has been submitted to the Pension Fund of the Russian Federation in the form SZV-STAZH, but there is no calculation of insurance premiums and insured persons, which had to be submitted to the territorial Federal Tax Service of Russia;

- on the contrary, the calculation of insurance premiums has been submitted to the Federal Tax Service and there is no report in the SZV-STAZH form to the Pension Fund of Russia;

- There are significant discrepancies in the reports, for example, one report indicates more (fewer) employees than another.

In such situations, Federal Tax Service inspectorates and Pension Fund branches must take measures to correct violations. To do this, they are instructed to request that employers-insurers clarify the relevant reporting with correct data. The territorial bodies of the Pension Fund and the Federal Tax Service must fulfill this order by June 15, 2021.

Section 2: Amounts of payments and contributions

Section 2 summarizes the amounts of accrued remuneration (payments) and insurance premiums. It consists of the following subsections:

- 2.1 “Calculation of insurance premiums according to the tariff” - must be generated by everyone;

- 2.2 “Calculation of insurance premiums at an additional tariff” - group if there are workers employed in hazardous industries;

- 2.3 “Calculation of insurance premiums at an additional rate” - generalize if there are workers employed in heavy production.

Section 2 also reflects temporary disability benefits and “children’s” benefits (at the birth of a child, for registration in the early stages of pregnancy, for pregnancy and childbirth and for caring for a child up to 1.5 years old). The amount of benefits paid in subsection 2.1 of the calculation for the 4th quarter of 2021 is shown in lines 201, 211 of subsection 2.1 (as part of non-taxable payments). However, if your region is participating in the FSS pilot project, then benefits are not required to be reflected in Section 2. See “Participants in the FSS pilot project.”

Here is an example of filling out Section 2.1, which is mandatory for everyone. Please note: if from January to December 2021 insurance premiums were calculated at only one rate, subsection 2.1 must be completed once. If contributions were calculated at different rates, create a subsection for each rate.

Adjustment of calculation of insurance premiums in 1C: Salaries and personnel management ed. 3.1

Published 01/27/2021 08:10 Author: Administrator Calculation of insurance premiums in itself is considered one of the complex reports in payroll accounting. And its correction – even more so. Even with all the care in the process of filling out a report, it is very easy to make a mistake. In this article we will not only talk about the most popular errors in the DAM, which entail the need to submit adjustments, but also show how to do this using the example of the 1C program: ZUP ed. 3.1

So, the procedure for filling out the report form “Calculation of insurance premiums” is regulated by Order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11 / [email protected] “On approval of the form for calculation of insurance premiums, the procedure for filling it out, as well as the format for submitting calculations for insurance premiums in electronic form and on the invalidation of the order of the Federal Tax Service dated 10.10.2016 N ММВ-7-11/ [email protected] "; (Registered with the Ministry of Justice of Russia on October 8, 2019 N 56174)

In the practice of an accountant, situations often arise when it is necessary to make clarification on the calculation of insurance premiums (DAM).

Conventionally, types of corrections can be divided into three types:

1. If the base and calculated insurance premiums have decreased;

2. Errors in the employee’s personal data;

3. Other data errors.

Situations may be different:

• correction of inaccuracy or error in calculation;

• change in data as a result of reversal of calculations for the period for which information was transferred.

You can also highlight situations when errors are detected in the personal data of employees (section 3):

• mistaken full name, erroneous or incorrect SNILS, etc.;

• change of employee's passport data and other similar situations.

Each clarification option has its own characteristics.

When making changes and clarifying information on insurance premiums, you should be guided by the Letter of the Federal Tax Service dated April 2, 2021 No. BS-4-11 / [email protected] On the submission of updated calculations on insurance premiums.

Let's look at the situations using examples.

Let's consider the initial calculation of insurance premiums for 9 months.

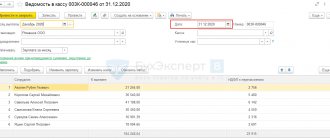

Section 3.2.1 reflects the amount of income of an individual. Sheets were generated separately for each employee.

Errors in accruals and personal data will be caused by V.M. Kiselev’s employees. and Sviridova M.V.

Section 1 of the report shows the amounts broken down by insurance premiums and detailed by month of accrual.

Situation No. 1: adjustment of the DAM as a result of a reversal of accrual

Let's consider an example when the calculation base changes and, accordingly, the amount of insurance premiums for the period for which they have already reported.

One example would be a situation where a recalculation (reversal) occurs, for example, in the 4th quarter, and the amounts of the 3rd quarter are affected.

If the report for the 3rd quarter is submitted, then clarification of the information is submitted, i.e. adjustment report.

But not in all cases a reversal results in filing an adjustment.

If the amount of income being reversed is less than the accrued amount in the current period, then no adjustment is required. If the reversed amount of the previous period exceeds the current accrual for the employee, then clarification is necessary.

Let's look at specific examples.

Let's analyze two situations in parallel.

In October, employees of Sviridov M.V. and Kiselev V.M. provided sick leave certificates. The salary for the month of September has already been accrued and the DAM for 9 months has already been paid. In both situations, the date of onset of the disease affects September: from September 24, 2020 to October 29, 2020.

Both employees had their wages recalculated for the previous period – for September. And this “minus” was reflected in October.

But employee Sviridov M.V. for October the accrued payment was more (RUB 4,806.82) than the amount being reversed (RUB 1,534.09). And Kiselev V.M. less was accrued in October (RUB 2,045.45) than the reversal for September (RUB 10,227.27).

As a result, employee V.M. Kiselev the program recalculated insurance premiums for September, because The salary reversal for September is greater than the current accrual and in this case the base for calculating insurance premiums for September has changed. If the reversed amount does not exceed the current accrual (as with employee M.V. Sviridov), no recalculation occurs and there is no need to clarify the DAM.

In Kiselev V.M. The repayment for September is greater than the accrued salary in October, so there has been a change in the base for calculating insurance premiums, requiring an adjustment to the DAM.

Let’s create an adjustment report “Calculation of insurance premiums”.

Step 1. Go to the “Reporting, certificates” section - “1C – Reporting”.

Step 2. Create a new DAM report and indicate the adjustment number “1” on the title page.

Step 3. After taking sick leave and calculating wages for October, generate an adjustment report using the “Fill” button.

Section 1 reflects the amount of contributions, taking into account the change - the total amount and the month that affected the recalculation. In our example, this is the 3rd month of the period – September.

Section 3 shows only those employees for whom the amount of income and contributions has changed. The rest of the employees are not repeated.

Table 3.1 shows personal data that remained unchanged - provided that there was no error or correction in it.

In our example, a sheet appeared for employee V.M. Kiselev, on which the amount of clarification for September is reflected in section 3.2.1. Those. instead of 45,000 rub. we see the base taking into account the amount being reversed - 34,722.73 rubles.

According to employee Sviridov M.V. the amounts remained unchanged, because The September reversal did not exceed the accrued salary in October and no clarification is required.

Let's conclude:

• Adjustment is NOT REQUIRED if the reversal income for the 3rd quarter overlaps with the income for the 4th quarter, i.e. the amount of reversal income is less than the income of the current month.

• An adjustment is REQUIRED if the recalculation was performed after the report was submitted and the reversed income of the 3rd quarter is greater than the amount of income of the current month.

All created types of reports with notes are saved in the journal, for example K/1 - adjustment 1.

Situation No. 2: Adjustment of the DAM due to changes in personal data

Situations often arise when an error is made in personal data - an error in the full name or SNILS.

We decided to consider this example. The program initially entered the employee's last name with an error and, accordingly, the initial DAM report was generated and submitted with incorrect personal data.

According to the explanations of the Federal Tax Service, clarification is made as follows:

When receiving an updated calculation of insurance premiums for the corresponding billing (reporting) period, the personalized information reflected by the payer in the initial calculation is compared using the set of details “SNILS”, “Last Name, First Name, Patronymic”.

If it is necessary to adjust the indicators specified in subsection 3.2 for individual insured persons. “Information on the amount of payments and other remuneration accrued in favor of an individual, as well as information on calculated insurance contributions for compulsory pension insurance” calculation (hereinafter referred to as subsection 3.2), whose personal data (“SNILS” has changed on the date of submission of the updated calculation) “Last Name, First Name, Patronymic”) the calculation is filled out in the manner corresponding to the explanations set out in the letter of the Federal Tax Service of Russia dated June 28, 2017 N BS-4-11/ [email protected]

In particular, for each insured individual for whom, at the time of submission of the updated calculation, the personal data (“SNILS”, “Last name, First name, Patronymic”) has changed in the corresponding lines of subsection 3.1 “Data about the individual in whose favor payments and other payments have been accrued” remuneration" calculation (hereinafter referred to as subsection 3.1), the personal data reflected in the initial calculation is indicated; in the lines of subsection 3.2 of the calculation, the total indicators are filled in with the value “0”.

At the same time, for the specified insured individual, subsection 3.1 of the calculation is filled out, indicating the personal data current on the date of submission of the updated calculation and the line of subsection 3.2 of the calculation in accordance with the established procedure.

Let's move on to a specific example.

So, employee Kiselev V.M. the surname is misspelled - KisIlev V.M. and this was discovered after the report was generated and submitted. Personalized information about the insured persons is reflected in section 3 of the report.

Let's consider the formation of the corrective DAM step by step.

Step. 1. Create a report in the “Reporting, references” - “1C – reporting” section.

Step 2. In the “Tax reporting” section, select the “Calculations for insurance premiums” report.

Step 3. Set the adjustment number on the title page of the report. If adjustments have already been made, then the next number is set (2, 3, etc.). Let in our case be adjustment No. 2.

Step 4. After correcting the error in the last name (or SNILS), generate a report - the “Fill” button.

When changing personal data in section 3, two sheets are generated for each employee:

• the first sheet - with the established sign of cancellation of information - the number “1”, which reflects the “old” information”, canceling erroneous data. Section 3.2 – not completed;

• second sheet – updated, new data.

And the next sheet reflects the corrected data indicating the income data for the “faithful” employee, we corrected the name V.M. Kiselev.

When saving a corrective report, the program will ask you to create a new report or save the current one. We answer “Yes, create a new one” and then all adjustments will be saved separately in the journal.

In this simple way, an adjustment is created to change erroneous data about individuals.

Situation No. 3: Adjustment of the DAM in case of other personal data errors

Let's look at another common mistake when filling out the RSV form - incorrectly filled out or blank passport data.

In this case, the correction occurs in a slightly different form - the correction number is indicated on the title page, and in Section 3 the general data is repeated for the entire list of employees and a correction is made for the employee with the error. Let's look at an example.

In section 3 of the DAM report on employee M.V. Kiselev. When submitting the report, they did not indicate passport information.

Go to the “Personnel” section of the “Employees” directory and on the “Personal Data” tab, add information about V.M. Kisilev.

Save the employee’s data and generate another report “Calculations for insurance premiums”. On the title page, set the correction number (next sequential) and click “Fill”.

In section 3, all employees will be displayed again, and for the employee being corrected, two sheets will be displayed - the first sheet with the cancellation sign set to “1”. Section 3.2. it is not filled in.

And the second sheet - with the corrected data of the employee and with transferred information about his income in section 3.2.

Thus, correct elimination of errors in primary documents leads to the normal completion of the adjustment calculation for insurance premiums.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Irina Plotnikova 02.24.2021 18:41 I quote Denis:

Good afternoon Do you have a question regarding Situation No. 3. Must the adjustment DAM include all employees or is only the corrected employee sufficient?

Good evening.

When generating an adjustment report, the program itself pulls up data only for those employees for whom changes have been made. So yes, you submit adjustments only for the employees being adjusted. Quote 0 Denis 02.24.2021 18:27 Good afternoon! Do you have a question regarding Situation No. 3. Must the adjustment DAM include all employees or is only the corrected employee sufficient?

Quote

Update list of comments

JComments

Section 4: additional charges and adjustments

Section 4 is presented as part of RSV-1 for the 4th quarter of 2021 only in some cases, namely:

- The PFR division has assessed additional insurance premiums based on reports of desk or on-site inspections, for which in the 4th quarter of 2016 decisions on holding (or refusing to hold) accountable came into force, as well as if the Pension Fund has identified excessively accrued amounts of contributions.

- an organization or individual entrepreneur independently discovered an understatement of insurance premiums in previous periods (both for the 4th quarter of 2021 and for previous periods);

- the organization independently adjusts the basis for calculating insurance premiums of previous periods based on accounting data that is not recognized as an error.

Reasons for forming the clarification

There may be many reasons for a company to create an updated document. For example:

- The company's accountant discovered discrepancies in the report, which had already been submitted to the Pension Fund of the Russian Federation.

- In the quarter, which has not yet ended, it turned out that it would be necessary to recalculate insurance premiums for previous reporting periods. For example, an employee went on vacation, which he has not yet earned (in advance), and now he is resigning, so part of the paid vacation must be returned, which is done by the accountant.

The correctness of filling out the updated document depends on the mistake made. For example, the RSV-1 adjustment for the 1st quarter of 2016 will be submitted in the next period. If the error was discovered later, you will also need to fill out a corrective report, indicating the type in section 6.

The adjustment document must be filled out according to certain rules.

Section 6: Personalized Reporting

Compile this section as part of RSV-1 for the 4th quarter of 2021 for each employee. Please keep in mind that section 6 of the RSV-1 Pension Fund form for 2021 is filled out for the period from January to December 2021 for each person:

- who was in an employment relationship;

- with whom a civil (or copyright) contract was concluded.

Form Section 6 both for those individuals who received payments and rewards (for example, wages) from January to December 2016 inclusive, and for those who were in an employment relationship, but payments were not accrued to them during this period. That is, if a person was on leave without pay in the 4th quarter of 2021, then this employee must also be recorded in Section 6. Moreover, if the employee quit in previous reporting periods (for example, in the first quarter), then in RSV-1 for the 4th quarter of 2021, do not include information about him in the sixth section of the annual reporting.

Subsection 6.1: data of an individual

In subsection 6.1, indicate the last name, first name and patronymic of the individual and enter his SNILS.

Subsection 6.2: reporting period

In the “Reporting period (code)” field of RSV-1 for 9 months of 2021, enter the code “0”, and in the “Calendar year” field - 2021.

Subsection 6.3: type of information

In subsection 6.3 of the annual RSV-1, indicate the type of information adjustment:

- or "original";

- or “corrective”;

- or "cancelling".

Required field o. The “Original” field is provided for information that is being submitted for the first time. When submitting initial information, the fields “Reporting period (code)” and “Calendar year” in subsection 6.3 of the report for the 4 quarters of 2021 are not filled in.

The “adjusting” field in RSV-1 for the 4th quarter, if you are clarifying previously submitted information about a person. If you completely eliminate information about him, then select the “cancelling” field. For any of these types of data, in the “Reporting period (code)” and “Calendar code” fields, indicate the reporting period code and the year for which the information is being updated or canceled. At the same time, submit sections 6 in which o or “cancelling” together with section 6 with the “initial” type for the reporting period for which the reporting deadline has arrived. That is, together with RSV-1 for the 4th quarter of 2021.

Subsection 6.4: payments to the employee

In subsection 6.4 of the annual RSV-1, highlight the amounts of payments and other benefits accrued to the employee. For these purposes

- in line 400 - show all payments since the beginning of 2021 on a cumulative basis;

- in lines 401 - 403 - show payments for October, November and December 2021 (that is, for the 4th quarter).

In columns 4, 5, 6 and 7 of this subsection, post the payments transferred to an individual within the framework of labor relations or under civil contracts. Moreover, highlight separately the amount paid within the base for calculating “pension” contributions, and the amount that exceeds this amount. In 2021, the maximum base, we recall, is 796,000 rubles (Resolution of the Government of the Russian Federation dated November 26, 2015 No. 1265).

Column 3, as you can see, indicates the category code of the insured person in accordance with the Classifier of parameters used when filling out personalized information (Appendix No. 2 to the Procedure). The most frequently used code is “NR”, associated with employees who are subject to the basic tariff for calculating insurance premiums (22%).

Subsection 6.5: Payments within the Base

In subsection 6.5, indicate the amount of pension contributions accrued at all insurance premium rates in October, November and December 2016 from payments and other remunerations not exceeding the maximum base value (796,000 rubles). Let's explain with an example:

Subsection 6.6: Adjustments

Fill out subsection 6.6 in forms with the “original” information type if data submitted in previous reporting periods were adjusted in October, November or December 2021. If there is data in this subsection, then it is also required to submit corrective (cancelling) sections 6 of the calculation and (or) forms SZV-6-1, SZV-6-2, SZV-6-4 for the past. If there are no adjustments, then do not fill out this subsection and leave it blank.

Subsection 6.7: early retirement

In this subsection, show payments to employees employed in jobs with special working conditions (harmful, difficult, etc.), giving the right to early retirement. For example, in subsection 6.7 of the RSV-1 calculation for the 4th quarter of 2021, indicate:

- in line 700 - the amount of payments on an accrual basis since 2016;

- in lines 701 - 703 - payments for October, November and December 2016 (that is, for the 4th quarter).

If the organization has carried out a special assessment of working conditions, in column 3 you need to enter the special assessment code according to the code classifier (according to Appendix No. 2 to the Procedure).

Subsection 6.8: information about experience

This subsection indicates the working conditions in which the employee worked in October, November and December 2021 (that is, in the 4th quarter), as well as data on the length of service and conditions for early assignment of a pension.

Group the columns “Beginning of period” and “End of period” in the format dd.mm.yyyy. Here is a sample of filling out columns 2 and 3 of subsection 6.8 of the RSV-1 for 2021, if the employee works in October, November and December 2016.

Please note that columns 4-9 of subsection 6.8 will be filled out using codes in accordance with Appendix No. 2 to the Procedure. So, for example, in column 7 you need to highlight some periods of the employee’s work experience that took place in the fourth quarter of 2021. Let us explain some common codes that may be required when filling out RSV-1 for the 4th quarter of 2021.

| Column code 7 | What does it mean |

| CHILDREN | Parental leave until the child reaches the age of one and a half years, granted to one of the parents |

| DECREE | Maternity leave |

| AGREEMENT | Work under civil contracts that extends beyond the billing period |

| DLOTPUT | Staying on paid leave |

| NEOPL | Vacation without pay, downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work) |

| VRNETRUD | Period of temporary incapacity for work |

| QUALIFY | Off-the-job training |

| ACCEPTANCE | Additional leave for employees combining work and study |

| NEOPLDOG | The period of work of the insured person under a civil law contract, payments and other remunerations for which are accrued in the following reporting periods |

RSV-1 PFR: working on mistakes

"General Book", 2021, N 5

RSV-1 PFR : WORKING ON ERRORS

The “pension” reporting campaign for 2015 is over. And although the PFR RSV-1 calculation is far from new, the questions we receive from readers show that there are still many difficulties in filling it out. So it's time to start preparing for the next report. And perhaps by correcting errors made in the annual calculation of the RSV-1 Pension Fund.

Before moving on to specific questions, let us recall the general rule for correcting errors in the RSV-1 Pension Fund <1>:

(If)

at the end of the period for which the erroneous calculation was submitted,

3 months have not yet passed

- submit the updated RSV-1 Pension Fund, which includes individual information (Section 6) with the “initial” type. Even if in these sections. 6 changes made! For the 2015 report, this correction is in effect until April 1, 2021;

(If)

at the end of the period for which the erroneous calculation was submitted,

3 months or more have passed

and you correct the error:

- in individual information - submit “corrective” or “Reason for clarification”, put code 2. Since this is the only code that requires clarification of individual accounting information <10>. A PFR specialist confirms this to us.

From authoritative sources

Dashina Tamara Nikolaevna, Deputy Manager of the Branch of the Pension Fund of the Russian Federation for Moscow and the Moscow Region

“When submitting an updated calculation of the RSV-1 Pension Fund on its title page, you must fill in

the field “Reason for update” by putting one of the following codes <10> :

(or)

1 - in case of a change in the amounts of paid insurance contributions for compulsory pension insurance (including at additional tariffs);

(or)

2 - in case of a change in the amounts of accrued insurance contributions for compulsory pension insurance (including additional tariffs);

(or)

3 - in case of clarification of the calculation regarding insurance premiums for compulsory health insurance or other indicators that do not affect individual accounting information.

If the changes made to the calculation of the RSV-1 Pension Fund of the Russian Federation do not affect the amount of accrued and (or) paid insurance contributions for compulsory pension insurance, but relate to the length of service reflected in the individual accounting information,

code 2 must be entered in the “Reason for clarification”

field In lines 200 (210) and 201 (211) sec. 2 calculations of the RSV-1 Pension Fund, which are intended to reflect, respectively, the amounts of all accrued payments and payments not subject to pension contributions (for health insurance), indicate the corrected amounts taking into account the “forgotten” benefit <11>.

Let's move on to correcting individual information. Since you did not submit the original form for 9 months of 2015 at all, then in the Pension Fund database in your employee’s personal account there is no data at all for the third quarter of 2015. And therefore, there is no technical possibility to make corrections by submitting a corrective form. Therefore, first you need to retroactively fill out the section. 6 with the “original” type for 9 months of 2015, including data only on length of service. No amounts! The file with this section must be submitted to the Pension Fund separately, before submitting updated individual information.

Then, with the calculation for the first quarter of 2021, you will need to file Sec. 6 in 9 months with the “corrective” type. In column 4 of subsection 6.4, where accrued payments are shown, indicate the amounts taking into account “forgotten” benefits. Subsections 6.5 - 6.7 do not need to be completed. And in subsection 6.8 show the periods of work:

- from 07/01/2015 to 08/13/2015 with the code “DECREE”;

- from 08/14/2015 to 09/30/2015 with the code “CHILDREN”.

Submit this Sec. 6 in a separate pack.

———————————

<6> Part 1 art. 17 of Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

<7> Clause 1 part 1 art. 9 of Law No. 212-FZ.

<8> Part 2 art. 17 Law No. 212-FZ; Art. 15 of the Law of 01.04.1996 N 27-FZ.

<9> Clause 3, Part 1, Art. 12, part 2 art. 14 of the Law of December 28, 2013 N 400-FZ.

<10> Clause 5.1 of the Procedure.

<11> Clauses 9.3, 9.13 of the Order.

They didn’t “count” and didn’t “code” the employee,

who is on "children's" leave...

We submitted RSV-1 Pension Fund for 2015 immediately after the holidays. The program did not generate any errors; the Pension Fund accepted the report. But after a few days it turned out that in Sect. 6 for an employee who is on maternity leave (from one and a half to 3 years old), we forgot to enter the code “DLDETI”. And we did not include it in the average number. Is it worth submitting a clarification?

M.E. Kharitonova, Pskov

You are not required to submit an updated report, since failure to enter the “DLCHILDREN” code did not lead to an underestimation of contributions <12>. And you calculated the average headcount correctly: employees who are on parental leave are not taken into account when determining it <13>.

It turns out that your error is only in individual information. Moreover, this will not affect the employee’s length of service in any way - the period of such leave is not included in it. But if you do decide to make corrections, you will need to submit Sec. 6 for an employee with the code “DLCHILDREN” in subsection 6.8 <14>:

(or)

with the “original” type as part of the updated calculation for 2015 with the update reason code 2;

(or)

with the “corrective” type together with the report for the first quarter of 2021, if you decide to make corrections after April 1, 2021.

———————————

<12> Part 1 art. 17 of Law No. 212-FZ.

<13> Clause 81.1 of Rosstat Order No. 428 dated October 28, 2013.

<14> Clause 5.1 of the Procedure.

How to adjust

RSV-1 Pension Fund if the Social Insurance Fund has not fully

reimbursed the benefit

In January, we received an inspection decision from the Social Insurance Fund: part of the sick leave paid in the first quarter of 2014 and in the second quarter of 2013 was not accepted for credit. The employee to whom we overpaid sick leave in the first quarter of 2014 returned the excess benefit. And the employee, whose benefit was calculated incorrectly in 2013, has already quit. FSS employees said that we would have to accrue contributions, including to the Pension Fund, for the amount of unreimbursed benefits. How can we reflect in RSV-1 Pension Fund the contributions additionally accrued for unreimbursed sick leave amounts for 2014 and 2013?

A.V.Kutsaeva, Moscow

First, let's deal with the uncredited benefits paid in 2013. There are clarifications from the Ministry of Labor and the Ministry of Health and Social Development that prescribe pension contributions to be calculated for the amounts of benefits not offset by the Social Insurance Fund <15>. However, according to the courts, the amounts of benefits not accepted by the FSS for offset do not automatically become wages <16>. And if the employee was truly disabled, the FSS’s refusal to offset the benefit does not change the social nature of the unaccepted payments <17>.

If you decide not to argue, additional contributions for the unreimbursed amount of benefits for an employee who has already resigned will need to be reported as follows:

- draw up an adjusting SZV-6-4 for this employee for the second quarter of 2013, indicating the correct amounts (including additional accruals). Submit the packet with this form along with the PFR RSV-1 report for the first quarter of 2016, reflecting information about it in subsection 2.5.2. Forms ADV-6-5, ADV-6-2 do not need to be completed <18>;

- in the RSV-1 Pension Fund for the first quarter of 2021 (the reporting period in which the inspection decision came into force), indicate the amounts of additional accrued contributions in section. 4 and line 120 <19>.

Section 6 with the “original” type for the first quarter of 2021 does not need to be filled out for a retired employee with data only in subsection 6.6 <20>.

Now about the uncredited benefit paid in 2014. Since the employee returned the amount of the overpaid benefit to you, you have no reason to accrue additional contributions, because there is no longer any payment. And if so, then the tax base does not change and you may not reflect in your reporting at all the fact that the Social Insurance Fund did not offset part of the sick leave. But do not forget that current reporting will need to be prepared as if you had not made any recalculations of benefits and returns/deductions. That is, lines 200 (210) and 201 (211) of subsection 2.1 must be filled out without taking into account the amount of the reversed benefit. Otherwise, you may distort current reporting indicators.

If you decide to correct your reporting, you will need to submit an adjusting report for the first quarter of 2014, reducing the values of lines 200, 201 and 210, 211 by the amount of sick leave returned by the employee. There is no need to submit individual information with this report. Corrective section 6 per employee for the first quarter of 2014 you will submit as part of the current reporting. In subsection 6.4 of this individual information, in column 4 you will need to indicate the value reduced by the amount of the returned benefit. Similarly, it will be necessary to adjust subsections 6.7, 2.2 and 2.3 if the employee was charged additional tariff contributions.

———————————

<15> Letters of the Ministry of Labor of Russia dated 09/03/2014 N 17-3/OOG-732; Ministry of Health and Social Development of Russia dated August 30, 2011 N 3035-19.

<16> Resolution of the AS ZSO dated July 22, 2015 N F04-21838/2015.

<17> Resolution of the AS UO dated November 28, 2014 N F09-8045/14.

<18> Clauses 17.7 - 17.16 of the Procedure.

<19> Clauses 7.3, Order.

<20> Clause 32 of the Procedure.

How to record unpaid days of incapacity for work

The employee was on sick leave to care for a child (5 years old) for 13 days from December 9 to December 21, 2015. She was paid benefits only for 7 days from December 9 to December 15, 2015, since the paid 60 calendar days of sick leave for child care had expired this child. In Sect. 6 RSV-1 Pension Fund we reflected the period from 12/09/2015 to 12/21/2015 from o. And a colleague says that with this code you can only show paid sick days, and not reflect unpaid ones at all. But in the Procedure for filling out the RSV-1 Pension Fund of the Russian Federation, nothing is said about the “VRNETRUD” code. Is our colleague right and we need to correct the mistake?

M.I. Nazarova, Smolensk

Yes, the code “VRNETRUD” is entered only in relation to the period of incapacity for work for which the benefit was accrued. And this follows precisely from the Procedure for filling out the RSV-1 Pension Fund form, more precisely, from the Classifier of parameters used when filling out personalized information. Thus, the code “VRNETRUD” is intended to reflect periods of incapacity for work included in the insurance period <21>. And it only includes the days of receiving benefits <22>.

Regarding the reflection of unpaid sick days in the Pension Fund of the Russian Federation, we were given the following explanations.

From authoritative sources

Dashina T.N., PFR

“If an employee was on sick leave to care for a five-year-old child from December 9 to December 21, 2015, and benefits were paid to her only for 7 days from December 9 to December 15, 2015, then the period from December 16, 2015 to December 21, 2015 must be reflected in

subsection 6.8 c .

Thus, you needed to fill out subsection 6.8 like this:

| N p/p | Start of period from (dd.mm.yyyy) | End of period (dd.mm.yyyy) | Territorial conditions (code) | Special working conditions (code) | Calculation of insurance period | Conditions for early assignment of labor pension | ||

| Base (code) | Additional information | Base (code) | Additional information | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 | 01.10.2015 | 08.12.2015 | ||||||

| 2 | 09.12.2015 | 15.12.2015 | VRNETRUD | |||||

| 3 | 16.12.2015 | 21.12.2015 | NEOPL | |||||

| 4 | 22.12.2015 | 31.12.2015 | ||||||

An error made in individual information will affect the employee’s length of service, so it should be corrected. To do this, you can file Sec. 6 per employee with the correct length of service. As a reminder, the type of individual information (“original” or “corrective”) will depend on when you decide to make the correction.

———————————

<21> Appendix No. 2 to the Procedure (table “Calculation of insurance experience: additional information”).

<22> Clause 2, Part 1, Art. 12 of the Law of December 28, 2013 N 400-FZ.

E.O.Kalinchenko

Economist accountant

Signed for seal

19.02.2016

Control ratios

Next, we present the control ratios on the basis of which the programs of the Pension Fund of the Russian Federation will begin to check the calculation of DAM-1 for the 4th quarter of 2016.

| Section 1 value | What is equal to |

| Line graphs 100 | Columns of line 150 of section 1 of RSV-1 for 2015 |

| Line 110 column 3 | The sum of lines 205 and 206, column 3 of all subsections 2.1 |

| Line 110 column 8 | The sum of lines 214 columns 3 of all subsections 2.1 |

| Line 120, column 3 (if this line is filled in) | Line “Total conversion amount”, column 6, section. 4 |

| Line 120, column 8 (if this line is filled in) | Line 120, column 8 (if this line is filled in) |

Next, you can complete the RSV-1 calculation for the fourth quarter of 2016.

Correct filling of the adjustment RSV 1

The accountant identified an error in the report, which was submitted, for example, in the 2nd quarter of the reporting period. Now you will need to generate a document with the already corrected data. If the RSV-1 adjustment for the 2nd quarter of 2021 is submitted before the end of the next reporting quarter, then you will need to make the following entries in section 6:

- In field 6.3 “Original” we put X.

- We indicate the number of the clarifying document - “001”.

Next, all fields are filled in as usual with correct data. Then the document is submitted to the Pension Fund.

If the error was discovered when the next quarter was already completed, then the document is filled out in the following order (PFR PP clause 27):

- “6.3”—indicate the period and year of the reporting period in which corrections need to be made. For example, 1 sq. is corrected. 2016, and reporting is submitted in the 3rd quarter, then in the corrective document you need to enter 1st quarter. 2021

- An X is placed in the field for corrective data, which means that the document is already a correction of the previous submitted report.

- The following lines are filled in according to the usual rules with the correct data.

Section 6 contains three types of document forms:

- Initial - if the document is submitted initially.

- Corrective - if errors need to be corrected in the document.

- Undoing - to cancel previous data in the document.

Based on which document needs to be corrected, canceled or the original created, the type of document is selected and marked in the appropriate field. If the reason for the clarification in RSV-1 and its decoding is completely clear, let’s see what codes there are for the reason for the clarification and what they correspond to.

| Updated document code | In what case should you use |

| 1 | Changes in information about contributions that have been paid. |

| 2 | Changing the details of contributions that have been accrued. |

| 3 | To clarify information on contributions that were paid to the medical service. fear. |