Preparation for the formation of balance sheet indicators

The construction of an enterprise's balance sheet is carried out on the basis of accounting data, namely account balances. At the end of the reporting period (quarter or year), turnover for such a period is formed on certain accounting accounts and final balances are formed on the debit and credit of such accounts.

Note 1

The debit balances in the total amount completely coincide with the credit balances of the accounting accounts. This is the main rule, and if the balances do not match, it means an error was made in the accounting that needs to be detected and corrected. Also, the accountant must check that the balances of active accounts are formed as a debit account, and passive accounts - as a credit account.

Finished works on a similar topic

- Coursework Formation of a balance sheet 480 rub.

- Abstract Formation of a balance sheet 240 rub.

- Test work Formation of a balance sheet 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

The procedure for forming a balance sheet asset

The assets of the balance sheet reflect all types of property of the enterprise, as well as its finances (cash), accounts receivable and other assets. As a rule, the property of an enterprise is reflected in the debit balances of accounts, although there are exceptions. For example, the residual value of fixed assets is reflected based on the balance in the debit of account 01 “Fixed assets” minus the amount of accumulated depreciation reflected in the credit of account 02 “Depreciation of fixed assets”.

Thus, the accountant groups the balances into accounts where the organization’s property is reflected according to the lines of the balance sheet. The line “Cash” reflects the amount of all the company’s funds available at the end of the reporting period. In the line “Accounts receivable”, the balances of such debt are formed by their types. These may be account balances:

- 62 – debt from buyers and customers for shipped products or work performed;

- 60 – the amount of advances transferred to suppliers that were not covered by deliveries of products or goods;

- 68 – the amount of debt from the budget for overpayments of taxes or as a result of the recalculation of such taxes;

- 75 – the amount of debt of the participants (founders) of the enterprise for contributions to the authorized capital;

- 71 – amount of debt of accountable persons for amounts issued;

- etc.

Are you a student at any Russian university? We invite you to a paid interview! The topic of the interview is preparation for the session and problems that arise during this Find out more

The remaining asset lines of the balance sheet are formed similarly.

The procedure for generating balance sheet indicators (Form No. 1)

The column “At the beginning of the reporting year” shows data at the beginning of the year (opening balance sheet), which must correspond to the data in the column “At the end of the reporting period” of the previous year (final balance sheet), taking into account the reorganization carried out at the beginning of the reporting year, as well as changes in the assessment of indicators accounting statements related to the application of the Regulations on accounting and financial reporting in the Russian Federation and the Accounting Regulations “Accounting Policy of the Organization” PBU 1/98.

The column “At the end of the reporting period” shows data on the value of assets, capital, reserves and liabilities at the end of the reporting period (month, quarter, year).

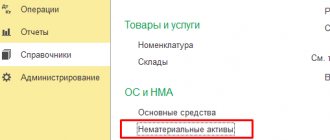

In the section “Non-current assets” for the group of articles “Intangible assets” the presence of intangible assets is shown at their residual value (with the exception of intangible assets for which depreciation is not accrued in accordance with the established procedure).

Intangible assets can be contributed by the founders (owners) of the organization on account of their contributions to the authorized capital of the organization, received free of charge (including under a gift agreement), or acquired by the organization in the course of its activities.

For this group of items, purchased individual apartments in residential buildings, recorded in accordance with the established procedure, are also shown. The cost of housing assets (including individual apartments) reflected in this group of items is given at the original cost (acquisition cost).

For the group of articles “Fixed assets”, indicators are given for fixed assets, both operating and those under reconstruction, modernization, restoration, conservation or in reserve at their residual value (with the exception of fixed assets for which, in accordance with the established procedure, depreciation is not accrued ). When calculating depreciation charges, you should be guided by the Regulations on accounting and financial reporting in the Russian Federation and the Accounting Regulations “Accounting for fixed assets” PBU 6/97, approved by Order of the Ministry of Finance of the Russian Federation dated September 3, 1997 N 65n (registered with the Ministry Justice of the Russian Federation on January 13, 1998, registration N 1451), as well as Methodological guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated July 20, 1998 N 33n (according to the conclusion of the Ministry of Justice of the Russian Federation dated August 19, 1998 N 5677-VE, the specified Order does not require state registration).

The results of the revaluation carried out by the organization in accordance with the established procedure before the beginning of the reporting year as of the first day of the reporting year of fixed assets are subject to reflection in accounting in the month of January and are taken into account in the financial statements when generating data at the beginning of the reporting year.

This group of articles also shows land plots owned by the organization, environmental management facilities (water, subsoil and other natural resources), capital investments in perennial plantings, radical land improvement (drainage, irrigation and other reclamation works) and in leased fixed assets, included in the prescribed manner as part of fixed assets.

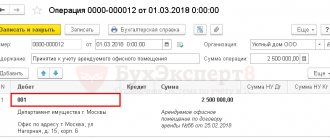

An organization is a lessee, which provides for the transfer of property received under a lease agreement for an enterprise as a whole as a property complex and related to fixed assets into its ownership (redemption) upon the expiration of the lease period or before its expiration, subject to the latter paying the entire redemption price stipulated by the agreement, in this group of articles reflects the fixed assets included in the leased property complex.

The item “Construction in progress” shows the costs of construction and installation work (carried out both by economic and contract methods), the acquisition of buildings, equipment, vehicles, tools, inventory, other durable material objects, other capital works and costs (design - survey, geological exploration and drilling work, costs of land acquisition and resettlement in connection with construction, training of personnel for newly constructed organizations, and others).

This article reflects the cost of capital construction projects that are in temporary operation until they are put into permanent operation, as well as the cost of real estate assets for which there are no documents confirming the state registration of real estate assets in cases established by law.

Unfinished capital investments are reflected in the balance sheet at actual costs for the developer (investor).

In addition, this item reflects the costs of forming the main herd, the cost of equipment that requires installation and is intended for installation.

When filling out the item “Construction in progress”, you should be guided by the Accounting Regulations for Long-Term Investments, approved by Order of the Ministry of Finance of the Russian Federation dated December 30, 1993 N 160, and the Accounting Regulations “Accounting for Agreements (Contracts) for Capital Construction” PBU 2/94 , approved by Order of the Ministry of Finance of the Russian Federation dated December 20, 1994 N 167 (according to the conclusion of the Ministry of Justice of the Russian Federation dated December 29, 1994 N 07-01-816-94, the specified document does not require state registration).

For the group of articles “Income-generating investments in tangible assets,” organizations making profitable investments in tangible assets provided for a fee for temporary possession and use (including under a financial lease agreement, under a rental agreement) for the purpose of generating income reflect the residual value of the specified property.

When filling out this group of articles, you must be guided by Order of the Ministry of Finance of the Russian Federation dated February 17, 1997 No. 15 “On the reflection in accounting of transactions under a leasing agreement” (according to the conclusion of the Ministry of Justice of the Russian Federation dated March 7, 1997 No. 07-02-232 -97 the specified document does not require state registration).

For the group of items “Financial investments”, data must be presented in the balance sheet, divided into long-term and short-term. Financial investments are presented as short-term if their circulation (repayment) period is no more than 12 months after the reporting date. The remaining financial investments are presented as long-term and are reflected in the “Non-current assets” section.

The group of articles “Long-term financial investments” shows, along with long-term investments in subsidiaries and dependent companies, long-term investments of the organization in the authorized (share) capital of other organizations, in government securities, bonds and other securities of other organizations, as well as provided to other organizations loans.

Objects of financial investments (except for loans) that have not been paid in full are shown on the asset side of the balance sheet in the full amount of actual costs for their acquisition with the assignment of the outstanding amount to the corresponding item in the group of items “Accounts payable” in the liability side of the balance sheet in cases where rights have been transferred to the investor to the object. In other cases, amounts contributed to pay for financial investment objects subject to acquisition are shown in the asset balance sheet under the corresponding item in the group of items “Accounts receivable”.

When reflecting articles in the group of articles “Long-term financial investments”, you should be guided by the Procedure for reflecting transactions with securities in accounting, approved by Order of the Ministry of Finance of the Russian Federation dated January 15, 1997 No. 2 (registered with the Ministry of Justice of the Russian Federation on June 10, 1997, registration N 1324).

In the section "Current assets" for the corresponding articles of the group of articles "Inventories" the balances of inventories intended for use in the production of products, performance of work, provision of services, management needs of the organization (raw materials, supplies and other similar values) are shown, for sale or resale (finished products, goods), as well as other material assets (animals for growing and fattening). For this group of items, the organization's costs included in work in progress (distribution costs) and deferred expenses are subject to reflection in the corresponding items.

Material and industrial inventories are reflected in the balance sheet in the assessment provided for by the Regulations on accounting and financial reporting in the Russian Federation, the Accounting Regulations “Accounting for material and industrial inventories” PBU 5/98, approved by the Order of the Ministry of Finance of the Russian Federation dated June 15, 1998 No. 25n (registered with the Ministry of Justice of the Russian Federation on July 23, 1998, registration No. 1570).

When organizations record the procurement of inventories using accounts 15 “Procurement and acquisition of materials” and 16 “Deviation in the cost of materials” in the balance sheet, the amount of deviations of actual expenses for the acquisition of inventories from their accounting price recorded at the end of the reporting period or deviations associated with the provision of discounts (mark-ups) to the organization in accordance with the contract, the occurrence of amount differences in settlements for purchased inventories, is added to the cost of the balances of inventories reflected in the relevant articles of the group of items “Inventories”, or is deducted when determining the final data according to the article in case of receiving discounts, amount differences arise.

The procedure for writing off detected deviations in actual expenses for the acquisition of inventories from their accounting price is established by the organization independently when adopting an accounting policy.

The article “Costs in work in progress (distribution costs)” of the group of articles “Inventories” shows the costs of work in progress and work in progress (services), which are accounted for in the corresponding accounting accounts for production costs. In this case, work in progress is reflected in the assessment adopted by the organization when forming its accounting policy in accordance with regulatory documents on accounting.

Organizations (construction, scientific, engaged in geology, etc.) that carry out settlements with customers in the current year in accordance with concluded contracts for completed stages of work that have independent significance, and use account 36 “Completed stages of work in progress” to account for them. , reflect under this article the stages accepted in the prescribed manner by the customer at the contractual cost. In this case, the customer reflects the cost of work in accounting upon completion of all stages.

This item also shows the costs of rafting forest products and unfinished agricultural production, which are reflected minus the cost of production, costs of repair work on fixed assets that was not completed by the end of the reporting period.

If organizations engaged in trading activities, providing public catering services, do not recognize the recorded distribution costs in the cost of goods (services) sold in full in the reporting period as expenses for ordinary activities, then the amount of distribution costs (in terms of transportation costs) attributable to for the balance of unsold goods and raw materials, is reflected in the balance sheet under the item “Costs in work in progress (distribution costs)” of the group of items “Inventories”.

When an organization transitions from the beginning of the reporting year in accordance with the adopted accounting policy to the procedure for recognizing commercial and administrative expenses in full in the cost of sold products, goods, works, services as expenses for ordinary activities, commercial expenses and (or) not written off in the previous reporting year distribution costs are subject to inclusion in the cost of sold products, goods, works, services at the beginning of the reporting year, or the organization may decide to evenly include these amounts in the cost of sold products, goods, works, services over a certain period of time (for example, a quarter, half a year ).

The article “Finished products and goods for resale” of the group of articles “Inventories” shows the actual production cost, standard (planned) cost (or in another estimate provided for by the Regulations on accounting and financial reporting in the Russian Federation) of the balance of products that have passed all stages (phases, stages) provided for by the technological process, as well as complete products that have passed testing and technical acceptance. This article shows the cost of remaining goods purchased by an organization engaged in trading activities or providing public catering services. At the same time, an organization providing public catering services also reflects the remains of raw materials in kitchens and pantries, and the remains of goods in buffets under this article. This article reflects the cost of finished products purchased by an organization to complete its finished products and not included in its cost in accordance with the terms of the contract with customers.

The balance of goods is reflected in the balance sheet at the cost of their acquisition, formed in accordance with the Accounting Regulations “Accounting for Material and Inventory Inventories” PBU 5/98 and the Accounting Regulations “Organization Expenses” PBU 10/99, approved by the Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 33n (registered with the Ministry of Justice of the Russian Federation on May 31, 1999, registration N 1790).

When an organization engaged in retail trade accounts for goods in accordance with the established procedure at sales prices, the difference between the acquisition cost and the cost at sales prices is reflected in the financial statements separately in the Appendix to the balance sheet (Form No. 5).

The item “Shipped Goods” of the group of items “Inventories” reflects data on the full actual cost, standard (planned) full cost (or in another estimate provided for by the Regulations on Accounting and Financial Reporting in the Russian Federation) of shipped products (goods) in the event , if, in accordance with the requirements of regulatory documents on accounting, the conditions for recognizing revenue from the sale of goods (products) have not yet been met.

When it becomes determined that the sufficient conditions for recognition of revenue in accounting will not be met, the organization recognizes receivables in an amount equal to the value of previously recorded goods shipped. If an organization, in accordance with the established procedure, recognizes selling expenses in the cost of products sold in full in the reporting period as expenses for ordinary activities, then the goods shipped are reflected in the valuation without taking them into account.

The item “Deferred expenses” of the group of items “Inventories” reflects the amount of expenses recognized in accounting in accordance with the established procedure, but not related to the formation of costs for the production of products (works, services) for the reporting period. Such expenses, in particular, include expenses associated with mining and preparatory work, preparatory work for production in seasonal industries, the development of new organizations, production facilities, workshops and units, expenses for unevenly carried out repairs of fixed assets (for organizations that do not form the established the order of reserve for the repair of fixed assets), expenses for advertising, personnel training, etc.

The article “Other inventories and costs” shows the cost of material and production assets and expenses recognized by the organization that are not reflected in the previous lines of the group of articles “Inventories”.

If the organization does not recognize the recorded selling expenses in the cost of goods (services) sold in full in the reporting period as expenses for ordinary activities, then the packaging and transportation costs not written off by the organization in the prescribed manner, taken into account as part of selling expenses, related to the balance unshipped (unsold) products are reflected in the above item.

The group of articles “Value added tax on acquired assets” reflects the amount of value added tax on acquired inventories, intangible assets, capital investments, etc., works and services, subject to attribution in the prescribed manner in the following reporting periods to reduce tax amounts for transfer to the budget or to appropriate sources of its coverage.

Data on the accounting accounts of the organization's settlements with other organizations and citizens in the balance sheet are presented in expanded form: for analytical accounting accounts for which there is a debit balance - in assets for which there is a credit balance - in liabilities.

When regulating the amounts of receivables and payables for which the statute of limitations has expired, and in other cases, one should be guided by the Regulations on accounting and financial reporting in the Russian Federation.

For the group of items “Accounts receivable”, data on receivables, payments for which are expected more than 12 months after the reporting date, and receivables, payments for which are expected within 12 months after the reporting date, are shown separately. Accounts receivable are presented as short-term if their maturity is no more than 12 months after the reporting date. The remaining accounts receivable are presented as long-term. In this case, the calculation of the specified period is carried out starting from the first day of the calendar month following the month in which this asset was accepted for accounting.

Accounts receivable, presented in the balance sheet as long-term and expected to be repaid in the reporting year, can be presented at the beginning of this reporting year as short-term. The fact that accounts receivable, previously recorded as long-term, is presented as short-term must be disclosed in the notes to the balance sheet.

The article “Buyers and customers” of the group of articles “Accounts receivable” reflects the debt of buyers and customers listed as of the reporting date in the accounting records in the amount in accordance with the terms of contracts for goods sold to them, products, work performed and services rendered (including discounts (surcharges) ), changes in the terms of the contract, settlements in kind, etc.).

The debt of buyers and customers and other debtors listed in the accounting records for goods sold to them, products, work performed and services provided, secured by bills of exchange, is reflected in the item “Bills receivable”.

The article “Debt of subsidiaries and dependent companies” of the group of articles “Receivables”, as well as the article “Debt to subsidiaries and dependent companies” of the group of articles “Accounts payable” reflect the organization’s data on current transactions with its subsidiaries as of the reporting date in the accounting records ( dependent) companies (inter-balance sheet settlements).

The article “Debt of participants (founders) for contributions to the authorized capital” of the group of articles “Receivables” shows the debt of the founders (participants) of the organization for contributions to the authorized (share) capital of the organization.

The article “Advances issued” of the group of articles “Receivables” shows the amount of advances paid to other organizations and individuals for upcoming settlements in accordance with the terms of contracts.

The article “Other debtors” of the group of articles “Accounts receivable” shows debt, including overpayments of taxes, fees and other payments to the budget, state extra-budgetary funds, debt of employees of the organization for loans provided to them at the expense of this organization, for compensation of material damage to the organization and so on.

The article “Other debtors” of the group of articles “Accounts receivable” also shows debt owed to accountable persons, debt for settlements with suppliers for shortages of inventory items discovered upon acceptance, for settlements with state and (or) municipal bodies, fines, penalties, penalties recognized by the debtor or for which decisions have been received from a court (arbitration court) or other body that, in accordance with the legislation of the Russian Federation, has the right to make an appropriate decision on their collection.

The group of articles “Short-term financial investments” reflects the actual costs of the organization to repurchase its own shares from shareholders, the organization’s investments in securities of other organizations, government securities, etc., loans provided by the organization to other organizations.

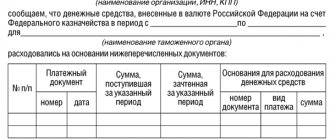

For the group of articles “Cash”, the items “Cash”, “Cash Accounts”, “Currency Accounts” show the balance of funds in the cash register, in current and foreign currency accounts in credit institutions.

The group of items “Other current assets” shows amounts that are not reflected in other groups of items in the section “Current assets” of the balance sheet.

In the section “Capital and reserves” of the balance sheet in the group of articles “Authorized capital” the amount of the authorized (share) capital of the organization is shown in accordance with the constituent documents, and for state and municipal unitary enterprises - the amount of the authorized capital. Increases and decreases in the authorized (share) capital, made in accordance with the established procedure, are reflected in accounting and financial statements after making appropriate changes to the constituent documents.

Share premium of a joint-stock company (amounts received in excess of the nominal value of issued shares by the company (minus the costs of their sale), amounts from additional valuation in accordance with the established procedure of non-current assets of the organization, part of retained earnings remaining at the disposal of the organization in the amount allocated to capital investments are included in additional capital and are shown as part of the data in the group of items “Additional capital”.

The group of articles “Reserve capital” reflects the amount of balances of reserve and other similar funds created in accordance with the legislation of the Russian Federation or in accordance with the constituent documents.

The data for the article “Social Sphere Fund” includes the balance of the social sphere fund formed by the organization in the case of the presence of housing facilities and external improvement objects (received free of charge, including under a gift agreement, acquired by the organization), which were not previously included in the charter (share) capital, authorized capital, additional capital.

Under the article “Targeted financing and revenues,” non-profit organizations reflect the balances of received and unused targeted funds as entrance, membership and voluntary contributions and other sources. Data on the balances of targeted financing funds at the beginning of the reporting period by their types and sources, on their receipt and use during the reporting period, balances at the end of the reporting period by non-profit organizations are given in the Report on the targeted use of funds received (Form No. 6).

The balances of the amounts of targeted financing received by a commercial organization (from the budget, from other organizations and citizens) are reflected in the group of items “Deferred income”. The reduction of these balances is carried out as non-operating income is recognized in the reporting period (when releasing for the purpose of the organization’s activities material and industrial reserves acquired at the expense of earmarked funds; depreciation on property acquired at the expense of these funds; completion and delivery of scientific research work, etc. .).

Data on the balances of target financing funds at the beginning of the reporting period by their types and sources, on their receipts and use during the reporting period, balances at the end of the reporting period by commercial organizations are given in the statement of changes in capital after the section “Changes in capital”. If an organization receives assets free of charge, including under a gift agreement (fixed assets, intangible assets, cash, etc.), these assets are reflected in the balance sheet in the same way as in the procedure for reflecting funds for targeted financing.

The group of articles “Retained earnings of previous years” shows the balance of profit remaining at the disposal of the organization based on the results of work for the last reporting year and decisions made on its use (direction to reserves formed in accordance with the law or in accordance with the constituent documents to cover losses , for the payment of dividends, etc.).

In accordance with regulatory documents on accounting in the balance sheet, the balances of funds (consumption fund, accumulation fund, etc.) formed in accordance with the constituent documents of the organization and the adopted accounting policy at the expense of the profit remaining at the disposal of the organization (retained earnings) based on the results of work per year are not reflected separately. The corresponding explanations characterizing the use of profits remaining at the disposal of the organization are given in the explanations to the balance sheet and profit and loss statement (in particular, in the statement of changes in equity).

In the group of articles “Retained earnings of the reporting year” during the reporting year, the retained earnings of the reporting period are shown in net amount, calculated as the difference between those identified on the basis of accounting of all operations of the organization and the assessment of balance sheet items in accordance with the Regulations on accounting and financial reporting in the Russian Federation, the financial result for the reporting period and the amount of taxes and other similar obligatory payments due in accordance with the legislation of the Russian Federation, including sanctions for non-compliance with tax rules (including settlements with state extra-budgetary funds), at the expense of profit.

Moreover, if an organization carries out expenses in the absence of sources of covering them at the expense of the profit remaining at the organization’s disposal based on the results of work for the previous year (years), the amount of these expenses during the reporting year is reflected in the section “Capital and reserves” separately and is deducted when determining results for the specified section.

The group of articles “Uncovered loss of previous years” shows the balance of the uncovered loss resulting from the results of the organization’s activities for the periods preceding the reporting period.

In the group of articles “Uncovered loss of the reporting year” the loss of the organization for the reporting period is shown as the difference between the financial result for the reporting period identified on the basis of accounting of all operations of the organization and the assessment of balance sheet items in accordance with the Regulations on maintaining accounting and financial reporting in the Russian Federation and the amount of taxes and other similar obligatory payments due for payment in accordance with the legislation of the Russian Federation, including sanctions for non-compliance with tax rules (including settlements with state extra-budgetary funds), at the expense of profit.

In the annual balance sheet, data on the groups of items “Reserve capital”, “Retained earnings of previous years”, “Uncovered loss of previous years”, “Retained earnings of the reporting year”, “Uncovered loss of the reporting year” are shown taking into account the results of the organization’s activities for the reporting year , decisions made on covering losses, paying dividends, etc.

When considering the results of the reporting year’s activities and deciding on the sources of covering losses (both the reporting year and previous years), the profit remaining at the disposal of the organization (except for that taken into account as a source of covering capital investments) can be directed to these purposes in the order of its distribution; reserve fund formed in accordance with the law; additional capital (except for the amount of increase in the value of property due to revaluation), as well as bringing the amount of the authorized capital to the value of the organization’s net assets.

The group of articles “Loans and credits” of the “Long-term liabilities” section shows the outstanding amounts of received loans and borrowings that are subject to repayment in accordance with agreements more than 12 months after the reporting date.

If the amounts of loans and borrowings listed in the accounting records are subject to repayment in accordance with the agreement within 12 months after the reporting date, then their amounts not repaid at the end of the reporting period are reflected under the corresponding items in the section “Short-term liabilities”. In this case, the calculation of the specified period is carried out starting from the first day of the calendar month following the month in which these obligations were accepted for accounting, taking into account the terms of agreements on the terms of repayment of obligations. Liabilities presented in the balance sheet as long-term and expected to be repaid in the reporting year may be presented at the beginning of this reporting year as short-term. The fact that liabilities previously accounted for as long-term are presented as short-term must be disclosed in the notes to the balance sheet. The necessary breakdown of the composition and changes during the reporting year in the amounts of the organization's obligations for loans and borrowings is given in the explanations to the balance sheet and profit and loss statement.

The section “Current liabilities” reflects the amounts of accounts payable that are subject to repayment within 12 months after the reporting date. In the balance sheet, the amount of the organization's debt on received loans and borrowings is reflected taking into account the interest due at the end of the reporting period.

In the group of articles “Accounts payable”:

— the article “Suppliers and contractors” shows the amount of debt to suppliers and contractors for material assets received, work performed, services provided to the organization;

— the item “Bills payable” shows the amount of debt to suppliers, contractors and other creditors to whom the organization issued bills of exchange to secure their supplies, works, and services;

— under the article “Debt to the personnel of the organization” the accrued but not yet paid amounts of wages are shown, and under the article “Debt to state extra-budgetary funds” the amount of debt for contributions to state social insurance, pensions and health insurance of the organization’s employees is reflected, as well as to the employment fund;

— the article “Debt to the Budget” shows the organization’s debt for settlements with the budget for taxes, fees, including employee income tax;

— the article “Advances received” shows the amount of advances received from third-party organizations for upcoming settlements under concluded contracts;

— the article “Other creditors” shows the organization’s debt for settlements, data on which is not reflected in other articles of the “Accounts Payable” group.

In particular, this article may reflect the organization’s debt on payments for compulsory and voluntary insurance of the organization’s property and employees and other types of insurance; debt on contributions in accordance with the procedure established by the legislation of the Russian Federation to extra-budgetary funds and other special funds (except for funds, debt on contributions to which is reflected under the article “Debt to state extra-budgetary funds”); the amount of lease obligations of the rental organization for fixed assets transferred to it under long-term lease terms, etc.

The debit balance of the accounting accounts for wages and insurance is shown for the corresponding items in the group of items “Accounts receivable” in the “Current assets” section of the balance sheet.

The group of articles “Debt to participants (founders) for payment of income” reflects the amount of debt of the organization for dividends due for payment, interest on shares, bonds.

The group of articles “Deferred income” shows the amounts taken into account in accordance with accounting rules as deferred income.

The group of articles “Reserves for future expenses” shows the balances of funds reserved by the organization in accordance with the Regulations on accounting and financial reporting in the Russian Federation. If, when clarifying the accounting policy for the next reporting year, the organization considers it inappropriate to accrue reserves for future expenses, then the balances of the reserves for which there are carryover balances in the established order, as of January 1 of the following year after the reporting year, are subject to inclusion in the financial result of the organization with reflection in accounting of the organization for January.

The group of articles “Other short-term liabilities” shows the amounts of short-term liabilities that are not reflected in other groups of articles in the section “Short-term liabilities”.

Organizations are recommended to provide information on the availability of assets recorded on off-balance sheet accounts in Form No. 1 “Balance Sheet” for information on the organization’s assets, capital and reserves and liabilities of the organization. The data is filled in based on the instructions given in the Chart of Accounts, as well as taking into account the specific list of off-balance sheet accounts used by the organization.

To contents

Back to the section “Procedure for preparation and presentation of financial statements”

Go ahead to the section “Procedure for generating data in the Profit and Loss Statement (Form No. 2)”