Why do you need statistics form No. 5-Z?

The form in question is a statistical reporting document and must be sent to Rosstat by all legal entities that are not SMPs, banks, insurance and other financial firms, and also not included in the budget system.

Small businesses include companies that:

- have a staff of up to 100 people (subclause 2, clause 1.1, article 4 of the law “On the development of small and medium-sized businesses” dated July 24, 2007 No. 209-FZ);

- have revenue not exceeding RUB 800,000,000. per year (clause 1 of the Decree of the Government of the Russian Federation dated July 13, 2015 No. 702).

- have an authorized capital of which no more than 25% belongs to the state (or municipality), 49% to foreign or other legal entities that are not subjects of the SMP.

Such firms are not required to send the reporting document in question to Rosstat.

Using Form 5-Z, Rosstat is informed about the company’s expenses for the production and sale of goods, services and work. This information is reflected for the entire legal entity as a whole - the document also takes into account those figures that characterize the activities of the company’s divisions.

At the same time, Form 5-Z is submitted to Rosstat by the company, its subsidiaries, as well as organizations dependent on it, separately. Information about subsidiaries and dependent organizations is not recorded by the reporting company in the financial statements.

Form 5-Z must be submitted based on the results of the 1st quarter, half a year and 9 months - before the 30th day of the month following the reporting period. Thus, in 2021 the deadlines for submitting the form are as follows:

- until 04/30/2021 - for the 1st quarter;

- until July 30, 2021 - for half a year;

- until 01.11.2021 - 9 months.

For the full calendar for submitting statistical reports for 2021, see ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

Form No. 5-Z, current in 2021, was approved by Rosstat order No. 320 dated July 15, 2015.

Instructions for filling out Form 5-Z for 2021 were approved, among other things, by Rosstat Order No. 40 dated January 30, 2020.

basic information

The obligation to submit this form falls on all legal entities that are not credit institutions, small business organizations, insurance companies, as well as other financial organizations that are not part of the budget system.

Statistical form 5-3 must be submitted based on the results of such reporting periods as: the first quarter, half a year and nine months. It must be submitted to the territorial office of Rosstat before the thirtieth day of the month following the tax period.

Section 1

Section 1 of Form 5-Z reflects the main economic indicators of the organization given in column 1 of the table in this section - for the reporting period, as well as for the same period last year.

The corresponding economic indicators can be classified into the following main groups:

1. Indicators of shipment and sale of goods, services and works.

The sales volume in line 01 must be indicated excluding customs and export duties.

2. Expenses:

- for the purchase of goods for resale;

Lines 03 and 04 reflect real estate purchased for resale; there are also a number of clarifications for persons associated with construction.

- for the purchase of raw materials, materials, semi-finished products for production;

- for the purchase of fuel, energy, water;

- for the purchase of raw materials, materials and semi-finished products purchased for production, but subsequently resold;

- for the reclamation of land areas;

- for wages, contributions to state funds;

- for insurance;

- for rent;

- to pay for the services of third-party companies;

- for the purchase of forest plantations;

- representative;

- others.

3. Balance indicators:

- for goods originally purchased for resale;

On lines 04 and 05, unsold real estate items are reflected in the balance of goods.

- on raw materials, materials and semi-finished products for production;

- for finished products;

- for work in progress.

4. Depreciation:

- fixed assets;

- intangible assets.

5. Taxes included in the cost of goods, services, and work.

Section 1 of Form 5-Z is also supplemented with a reference block. It records, in relation to the reporting period, as well as the same period last year:

- cost of used raw materials;

- the amount of VAT for the reporting period;

- the amount of subsidies received from the budget;

- the amount of fees for using the infrastructure given in lines 67–70 of the table in section 1 (as part of the costs).

The data in the table of section 1 is recorded in thousands of rubles.

Procedure for filling out the first section

The first section of Form 5-Z includes information about the company’s main economic indicators. Information must be provided both for the current reporting period of this year and for the same period of the previous year.

All indicators from this section are divided into the following groups:

- Indicators related to the shipment and sale of products, provision of work and services.

- Expenses:

- for insurance;

- for the purchase of products for subsequent resale;

- for the purchase of raw materials for own commodity production;

- for rent;

- representative;

- others.

- Balance indicators for:

- finished products;

- materials and raw materials for the manufacture of goods;

- goods purchased for resale;

- unfinished production.

- Depreciation:

- intangible assets;

- fixed assets.

- Taxes that are included in the price of products, services and work.

Section 2

Section 2 of Form 5-Z reflects data on electricity and thermal energy produced by the company and supplied to the market. In correlation with such indicators as production volume, as well as production and transmission costs - for the period from the beginning of the year to the reporting and similar periods of last year, the following information is indicated:

- on electricity production;

- on the production of thermal energy;

- about transmission services for each type of energy.

The data in the table in section 2 is also recorded in thousands of rubles.

Rosstat has updated instructions for filling out the reporting form

The innovations will take effect when submitting reports for January-March of the current year.

Content

The Federal State Statistics Service (Rosstat) has approved updated Instructions for filling out the federal statistical observation form N 5-Z “Information on the costs of production and sale of products (goods, works, services).” This document cancels the previous rules for filling out form No. 5-Z, introduced by Rosstat order No. 29 dated January 25, 2013.

The innovations will apply to all legal entities, regardless of their form of ownership (except for banks, insurers, budgetary organizations and small businesses) that produce goods and services for further sale. Form No. 5-Z must also be provided by branches, representative offices and divisions of foreign organizations operating in the Russian Federation.

However, there are not too many differences in the instructions themselves. Thus, on line 01 it is no longer necessary to reflect the cost of culinary products and culinary semi-finished products sold by public catering organizations through their retail facilities, and management organizations in the housing and communal services sector that have entered into an agreement to manage an apartment building and provide housing and communal services must reflect the cost of purchased utility resources only on line 06, without filling out line 08.

At the same time, there is a requirement for medical organizations to reflect, within the framework of the compulsory medical insurance program, information about the actual funds received for services provided to insured persons, and the cost of material assets indicated on line 20 is reflected additionally on line 02 at sales prices. In addition, the document states:

if goods were purchased for resale, but were actually used for the production and sale of products (works, services) (credit 41 - debit 10; credit 10 - debit 20, 23, 25, 26, 29, 44), their cost is not reflected in lines 03 , 04, but should be reflected on lines 06, 21.

At the same time, on lines 21, 22 it will be necessary to reflect the cost of balances in fuel warehouses intended for the production of products (goods, works, services) at the actual cost of its acquisition, respectively, at the beginning and end of the reporting year, and the balance of accounting accounts of industrial inventories , respectively, at the beginning and end of the reporting period. Line 27 should indicate the depreciation of capitalized regular large costs for repairs, technical inspection, and replacement of certain elements of fixed assets, periodically carried out at certain long time intervals (more than 12 months), which are reflected in accounting as a separately formed accounting object.

Legal documents

- Order of Rosstat dated February 10, 2015 N 53

- by order of Rosstat dated January 25, 2013 N 29

Document signature

The certification block of the form following Section 2 must include:

- date of completion of the document;

- signature of the head of the company or employee who has the authority to certify the document;

- an indication of the position of the person who signed the form, as well as his contact information.

This is the sequence of filling out form No. 5-Z. There are a number of nuances of working with the document that are useful to pay attention to - they are taken into account in the instructions for filling out Form 5-Z.

Filling out statistics form No. 5-Z: what to pay attention to?

When filling out form No. 5-Z, you must keep in mind that:

- the information indicated for a particular period of the previous year must completely coincide with that presented in the reports for the corresponding period earlier (unless the legal entity was reorganized or the methodology for reflecting indicators in the reports was changed);

- if the company was nevertheless reorganized or there were changes in the methodology for reflecting indicators in reporting, the information in Form 5-Z is provided based on the relevant changes;

- in any case, discrepancies between the indicators for the periods of last year, recorded earlier in the reporting and reflected in the current reporting, must be explained in the explanation to the document;

- information in the form is reflected on an accrual basis from the beginning of the year;

- data on business indicators reflected in the form must correspond to the documentation maintained by the company as part of accounting.

Filling out form 5-З

One of the reports that must be submitted to the regional statistics department for legal entities is Form 5-3. This form reflects the costs of providing services, producing goods and performing work.

When and which business entities are required to submit Form 5-3 to the regional statistics department?

Form 5-3 must be submitted to the regional statistics department by all economic entities - legal entities that are not small businesses (SMBs), part of the budget system, banks, financial firms, including insurance companies.

Signs that determine whether a company belongs to a small business entity (SMB)

- The number of employees of the company does not exceed 100 employees (Article 4 of the Federal Law of July 24, 2007 No. 209-FZ).

- The authorized capital of the organization has the following structural relationships:

– the state owns no more than 25.0% of the authorized capital;

– foreign companies own no more than 49.0% of the authorized capital.

Enterprises that meet all of the above requirements do not have to submit Form 5-3 to statistics departments.

Thanks to this form, the statistical office receives information about what funds are spent by enterprises (organizations, firms) in order to organize and produce products, sell goods, provide services and perform work. Information of this nature is indicated for the entire enterprise.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How should information about the costs of the structural divisions of an enterprise and its subsidiaries be reflected in Form 5-3?

Form 5-3 must also take into account information regarding the activities of structural divisions of enterprises. But to do this, you need to fill out Form 5-3 separately for each structural unit of the organization.

Which form to use to fill out Form 5-3 in 2021

In the current 2021, to prepare and submit Form 5-3, you can use the form that was approved earlier in 2015 (Rosstat Order No. 320 dated July 15, 2015). The form of the form did not change during its approval in 2015.

Important! Recommendations for entering data into Form 5-3, relevant for 2021, are fixed by Rosstat order dated February 12, 2019. No. 65. Their application was supplemented by the order of Rosstat dated February 12, 2019. No. 63.

How to correctly enter data into statistical form 5-3

In order to enter data into statistical form 5-3 without errors, you should perform a number of actions in a certain sequence:

- Fill out the required information on the cover page.

- Enter data into the main information base of the report, which consists of 2 sections.

- Enter data into the certification part of the report.

Completing the cover page includes:

– indication of the edematous period;

– enter the full name of the organization in accordance with the statutory documents, also abbreviated if it exists;

– indication of the legal address of the company, if there is an actual address different from the legal one, we register that too;

– indication of the OKPO code, the main OKVED code of the enterprise.

After filling out the title page, move on to the next part of the report 5-3, to section No. 1.

Section No. 1. This section reflects the main indicators of the financial activity of the enterprise, the list of which is located in column 1 of Section No. 1 for two periods: the reporting period of the current year and the similar reporting period of the previous year.

The main indicators of the financial activity of the enterprise are divided into several main groups:

- Indicators of sales, shipment of goods, provision of services, performance of work

Important! According to the latest recommendations of Rosstat, in line 01 it is necessary to indicate the volume of sales of goods, which does not include export and customs duties.

- Enterprise costs:

- For the purchase of goods for the purpose of further resale.

Important! According to the recommendations and clarifications of Rosstat, when filling out lines 03 and 04, starting from 2021, data on real estate that was purchased for the purpose of further resale is used.

- For the purchase of materials, raw materials, semi-finished products for own production.

- For the purchase of water, fuel, energy.

- For the purchase of materials, raw materials, semi-finished products purchased for own production, but subsequently resold for various reasons.

- To pay employees, transfers to extra-budgetary funds.

- For the reclamation of natural areas.

- For various compulsory types of insurance.

- For rent of premises and equipment.

- To pay funds for services provided by third parties.

- For the purchase of forest plantings (for example, tree seedlings).

- Entertainment expenses

- Other expenses.

- Information on balance indicators:

- For those goods that were originally purchased by the company for further resale.

Important! According to the recommendations and clarifications of Rosstat, from 2021, when filling out lines 04 and 05 in the indicator of goods balances, data on real estate that has not been sold is included.

- Based on available finished products.

- Based on materials, raw materials, semi-finished products purchased for production needs.

- For objects of the company's work in progress.

- Depreciation data:

- Intangible assets of the company (if any).

- Fixed assets of the enterprise.

- The amount of taxes that were included in the cost of goods produced at the enterprise, services provided, and work performed.

In Form 5-3, section No. 1 must be supplemented with an information and reference block, in which for the reporting periods of the current and corresponding last year the following are indicated:

- Value added tax amount.

- The amount of cost of raw materials used by the enterprise.

- The amount of costs for using the infrastructure, which is reflected in lines 67-70.

- The amount of subsidies received from the state budget.

In the first section, indicators in monetary terms are indicated in thousands of rubles.

Section No. 2. In this section of Form 5-3, you should indicate information about the thermal and electrical energy that was produced by the enterprise and supplied to the market. Indicators of volume and production costs for periods from the beginning of the current year and the same period last year should be reflected in relation to the following data:

- About the production of thermal energy at the enterprise.

- On the production of electrical energy at the enterprise.

- About the services provided for the transfer of thermal and/or electrical energy.

In the second section, indicators in monetary terms are indicated in thousands of rubles.

Form 5-3 confirmation block

Form 5-3 assumes the presence of a block that contains information about responsibility for the information provided, it includes:

- Signature of the immediate manager of the enterprise or employee who has the authority to fill out and certify Form 5-3.

- Transcription of the signature of the responsible person who signed the report, his contact information (for example, phone number).

- The date the report was completed.

We examined the sequence of preparing Form 5-3 for submission to the statistics department. In addition, there are a number of nuances that are taken into account in the instructions for filling out statistical report 5-3.

What you should pay special attention to when filling out statistical form 5-3

- The data in the document is recorded on an accrual basis from the beginning of the year.

- Information on the indicators of the financial and economic activities of the enterprise specified in Form 5-3 must coincide with the documentation that is generated at the enterprise when organizing and maintaining accounting records.

- Data characterizing a particular period of the past year should not differ from the data that was indicated in the reporting documents of a separate period earlier (except for cases where the enterprise (organization, firm) was reorganized, or there were changes in the calculation and filling methodology) .

- When reorganizing an enterprise, as well as when changing the methodology for presenting data in the reporting document, data in Form 5-3 is indicated in accordance with the changes that have occurred.

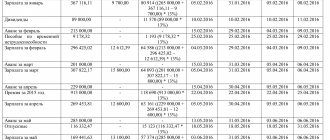

An example of filling out section No. 2 of the form 5-3 thousand rubles.

Results

Rosstat, collecting data as part of scheduled observations, instructs legal entities that are larger in scale than small enterprises (but do not belong to economic entities in the financial and budgetary sectors) to inform the agency about the costs associated with the production and sale of goods. For these purposes, form No. 5-Z is used.

You can find other information about reporting to Rosstat in the articles:

- “Procedure and sample for filling out the P-2 quarterly form”;

- “Procedure and sample for filling out form No. 1-Enterprise.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.