OKVED: what it contains and where it is used

OKVED (All-Russian Classifier of Types of Economic Activities) contains code designations for economic sectors. In 2018, OK 029–2014, or OKVED 2, is in force. In the classifier, economic areas such as manufacturing, agriculture, construction, real estate transactions and others are represented by codes. The encoding is adopted in statistics to reflect information about each economic unit and is used for management purposes.

A business representative, indicating the economic sectors in the registration form, becomes a participant in the process of systematization and collection of information by classes and codes.

The class is characterized by common characteristics, and grouping into classes occurs on the basis of a single methodological approach. Classification allows:

- collect statistical indicators of each business representative;

- present indicators by economic sector and tax regime;

- summarize information at the state level and by region.

Video: in simple words about classification

Why do we need OKVED-2018 codes with decoding?

The type of activity that an officially registered business entity is engaged in is not only significant for its characteristics, but also makes it possible to:

- justify the use of the selected special regime;

- take advantage of tax benefits;

- establish one or another rate of premiums for accident insurance.

Indication of the type of activity is required in most official reporting documents, including those submitted to tax authorities, extra-budgetary funds, and Rosstat.

However, the types of activities carried out in the Russian Federation are not only quite diverse, but sometimes they also have a rather cumbersome verbal description. That is why it was necessary to create a directory on them, and this directory not only included a general list of types of activities, systematizing them, but also established the correspondence of each type to a specific digital code. That is, a voluminous verbal description was replaced by a set of numbers from 2 to 6, which made it possible to make the information reflected in reporting documents compact.

The reference book itself is called the All-Russian Classifier of Types of Economic Activities, or OKVED for short.

Systematization of businesses by codes and classes

The classifier contains 21 sections. Each section corresponds to a type of economy. Each species is divided into classes.

Table: sections of OKVED 2

| SECTION A | Agriculture, forestry, hunting, fishing and fish farming |

| SECTION B | Mining |

| SECTION C | Manufacturing industries |

| SECTION D | Providing electricity, gas and steam; air conditioning |

| SECTION E | Water supply; water disposal, organization of waste collection and disposal, pollution control activities |

| SECTION F | Construction |

| SECTION G | Wholesale and retail trade; repair of vehicles and motorcycles |

| SECTION H | Transportation and storage |

| SECTION I | Activities of hotels and catering establishments |

| SECTION J | Activities in the field of information and communication |

| SECTION K | Financial and insurance activities |

| SECTION L | Real estate activities |

| SECTION M | Professional, scientific and technical activities |

| SECTION N | Administrative activities and related additional services |

| SECTION O | Public administration and military security; social Security |

| SECTION P | Education |

| Section Q | Activities in the field of health and social services |

| SECTION R | Activities in the field of culture, sports, leisure and entertainment |

| SECTION S | Provision of other types of services |

| SECTION U | Activities of extraterritorial organizations and bodies |

Entries in the classifier are indicated by codes with interpretation. Deciphering the codes is aimed at ensuring that each user of OKVED 2 understands the areas of economics and accurately indicates the code of their business. The number of numbers determines the structural affiliation and specifics of the business. For example, the main activity 68.20 “Rent and management of own or leased real estate” belongs to subclass 68.2 “Rent and management of own or leased real estate”. Subclass 68.2 is included in Class 68, Real Estate Transactions. Group 68.20 includes the following codes:

- 68.20.1 rental and management of own or leased residential real estate;

- 68.20.2 rental and management of own or leased non-residential real estate.

The designation of the code structure is given in the table.

Table: OKVED 2 codes

| Code designation | Record value |

| XX | Class |

| XX.X | subclass |

| XX.XX | group |

| XX.XX.X | subgroup |

| XX.XX.XX | view |

OKVED 2 details

Compared to OKVED 2001, the OKVED 2 classifier contains more sections and nuances of division into types and classes. Decoding the codes takes into account current areas of the economy and reflects the specifics of entrepreneurial activity. For example, if an entrepreneur indicates code 68.20.1, then we are talking about renting residential real estate.

In the registration form, it is enough to indicate a four-digit code XX.XX without decoding.

Information about codes according to the All-Russian Classifier of Types of Economic Activities

Codes with decoding using the example of section L of OKVED 2 are presented in the photo gallery.

Photo gallery: OKVED 2, section L “Activities in real estate transactions”

purchase and sale of own real estate

rental and management of own or leased real estate

activities of real estate agencies for a fee or on a contract basis

management of real estate for a fee or on a contract basis

Sections of OKVED 2 with codes and decoding can be found here.

Where can I find OKVED-2018 codes with breakdowns by type of activity?

The current OKVED-2018 with decodings by type of activity was approved by Rosstandart order No. 14-st dated January 31, 2014, has the official number OK 029-2014 (NACE, rev. 2) and is mandatory for use from January 1, 2017. For brevity, it is also called OKVED 2. In the period from the date of approval to the year of mandatory application, it could be used on a voluntary basis.

For information on how OKVED 2 data is linked to the codes contained in the classifier that preceded it, read the material “The Federal Tax Service explained how OKVED 2 codes were assigned.”

The OKVED-2018 code classifier with decoding has a number of differences from the original version of this document, since changes were repeatedly made to it during 2015-2017. The latest of them were made at the end of December 2021 and came into force on March 1, 2018, extending their validity to the period beginning in 2014. Thus, OKVED-2018 with decoding by type of activity in its final version has an edition dated December 21, 2017, created by Rosstandart orders No. 2046-st and No. 2048-st dated this date.

The 2021 OKVED 2 reference book with decoding of codes is a rather voluminous document. It is divided into lettered sections that correspond to the main areas of possible areas of activity:

- Agriculture;

- mining;

- provision of energy resources;

- water supply, drainage, waste disposal;

- construction;

- trade;

- transportation;

- hotel services and catering;

- communication services;

- financial and insurance activities;

- real estate transactions;

- scientific, technical and certain types of professional activities;

- administrative;

- public administration, security and social security;

- education;

- healthcare;

- culture, sports, entertainment;

- other types of services;

- household;

- extraterritorial structures.

Within these sections, activities are divided into classes that are numbered throughout the entire directory and detailed as necessary. This detailing ensures the creation of a digital OKVED code. Section letter designations are not used in this code.

You can download the full version of the current OKVED-2018 classifier with deciphering the codes on our website.

Licenses, taxes and OKVED

A formal approach to specifying codes leads to difficulties in obtaining permits.

For example, the registration form contains the main code 47.73 Retail sale of medicines in specialized stores (pharmacies). A decision is made to obtain a license to produce medicines. The production of medicines, OKVED code 21.20, is a licensed activity (Federal Law No. 99-FZ of May 4, 2011). The licensing authority will refuse a license if code 21.20 is missing.

Entrepreneurs enjoy tax preferences according to the main OKVED code.

Entrepreneurs on the simplified taxation system (STS), by decision of the local authorities, are given a zero rate if the OKVED codes correspond to the production, social, and scientific spheres (Article 346.20 of the Tax Code of the Russian Federation).

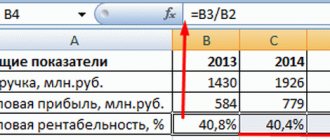

How the codes and the choice of taxation mode are related can be seen in the example.

An entrepreneur plans to sell books. To trade books in the store, the code is 47.61. Code 47.91 applies to selling books online. Books are sold online using the simplified tax system. Selling books in a store is allowed under the simplified tax system and UTII (Unified Tax on Imputed Income).

Table: tax regime and OKVED code

| Kind of activity | OKVED code | Decoding the code | Tax regime |

| Selling books in a store | 47.61 | Retail sale of books in a specialized store | USN, UTII (Unified tax on imputed income) |

| Selling books online | 47.91 | Retail trade by mail or via the Internet information and communication network | simplified tax system |

Compulsory social insurance and OKVED

Insurance premium rates depend on the main OKVED code specified during registration. The insurance fund determines the risk class and the amount of the contribution by code.

For example, retail trade via the Internet, code 47.91, belongs to the first risk class, the rate is 0.2%. Extraction and enrichment of coal and anthracite, code 05.10, belongs to class 32, rate 8.1%.

For organizations and entrepreneurs on the simplified tax system with an income of up to 79 million rubles, whose main activity code according to OKVED relates to the social sphere and production, in 2021 an insurance premium rate of 20% will be applied. This applies in particular to entrepreneurs engaged in:

- food production - OKVED 10 (10.1–10.9);

- clothing production - OKVED 14 (14.1–14.3);

- repair of machinery and equipment - OKVED 33 (33.1–33.2);

- fitness activities (“activities of fitness centers”) - OKVED 93.13, etc.

According to clause 6 of Article 427 of the Tax Code of the Russian Federation, a type of economic activity is recognized as the main type of economic activity, provided that the share of income from the sale of products and services provided is at least 70% of the total income.

You can find out whether your type of activity is considered “preferential” here.

Table: rates of insurance premiums for individual entrepreneurs on the simplified tax system

| Base for calculating insurance premiums | Compulsory pension insurance (OPI) | Compulsory social insurance in case of temporary disability and in connection with maternity (OSS) | Compulsory health insurance (CHI) |

| From the amount of payments within the established maximum value of the base for calculating insurance premiums: for compulsory insurance - 1,021,000 rubles; for OSS - 815,000 rubles. | 20.0% (max RUB 204,200) | 0,0% | 0,0% |

What information is contained in the code?

The structure of the OKVED code classifier for 2021 with decoding is based on the division of all the codes listed in it:

- to classes;

- subclasses;

- groups;

- subgroups;

- kinds.

This gradation makes it possible to detail the activity being carried out, identifying smaller groups within it that specify individual additional characteristics (for example, by field of activity, production process or materials used).

The code of the smallest group (type) consists of 6 digits, separated in pairs by dots. The transition upward (to each larger unit) will be accompanied by the exclusion of the last digit from the set of characters corresponding to the next level.

The assignment of codes corresponding to the main and additional types of activity of an economic entity occurs at the time of its registration. All necessary codes are indicated in the unified state register (Unified State Register of Legal Entities or Unified State Register of Legal Entities) along with other mandatory data entered into this register. When changing types of activities, it is necessary to submit information about this to the registration authority so that the register reflects information about them that corresponds to reality.

Read more about the procedure for changing codes here.