The tax when purchasing an apartment in 2021 for individuals is calculated independently, and the tax rate is fixed by the Tax Code and is equal to 13% for residents. The income of non-residents is taxed at an increased rate - 30%. The calculation is as follows: (Income from sale – Amount of property tax deduction) x Tax rate.

At the end of the year in which the purchase and sale transaction was concluded, a declaration in form 3-NDFL must be submitted to the Federal Tax Service, even if the tax base after applying the deduction is zero. Tax obligations to the budget must be repaid no later than July 15 of the year following the year in which the sale was made (Article 228 of the Tax Code of the Russian Federation).

Do I need to pay tax when buying an apartment?

According to tax legislation, all persons receiving income must pay income tax (NDFL). When purchasing a home, a person does not receive money, but actually loses it. Therefore, he has no profit or income, and therefore no need to pay personal income tax.

According to the logic of the legislator, a person buys an apartment with legally earned money. This means that personal income tax has already been withheld from the funds he earned. And Russian laws prohibit double taxation. Therefore, it is the seller’s responsibility to pay the required thirteen percent to the state.

However, after purchasing an apartment, its new owner not only receives rights, but also must bear the burden of maintaining it. Therefore, you will have to pay the state a certain amount for the existing property.

On the other hand, having spent money on the purchase of a long-awaited apartment, you can exercise your right to receive a tax deduction. In essence, this is a refund of part of the personal income tax paid earlier. Accordingly, those who have official earnings from which deductions of the specified tax were made can count on it. However, the deduction must be submitted to the tax office by submitting all documents confirming the expenses. She will not calculate and reimburse you the deduction on her own.

Thus, when purchasing an apartment, buyers do not need to pay personal income tax. Moreover, they can return part of the tax previously paid if certain conditions are met. However, everyone must pay taxes to the state annually to own real estate.

Deadlines for paying taxes when purchasing an apartment

As soon as the buyer becomes the new owner, the former owner, represented by the seller, is obliged to pay the Federal Tax Service. To do this, the payer must submit a 3-NDFL declaration to the Federal Tax Service at the place of registration by April 30 of the next year.

Important! The previous owner must pay tax on the purchase of the apartment. The maximum period for depositing cash on a receipt is until July 15 of the following year. The fee is paid by the seller once. If the seller refuses to provide information to the Tax Service or pay income taxes, a late penalty will be charged.

Payment nuances

The seller must report to the Tax Service by April 30 of the following year. Even if a citizen did not receive real benefits from the transaction, he is required to provide a declaration. A document with zeros in the “profit” column is the basis on which the payer is released from financial obligations. The absence of documents or exceeding the maximum permissible deadlines for providing certificates is considered a violation of the legislation of the Russian Federation. The Federal Tax Service will apply penalties in the form of fines and penalties to the violator.

Reference! Banks and other financial services do not charge a commission when paying tax receipts from the sender. For cash transfers to pay off penalties, the client must pay an additional 5%.

Exemption from tax burden

When a citizen buys an apartment, the property is taxed in most cases. The obligation to deposit funds to the Federal Tax Service rests with the seller. Exception: transactions in which the property belonged to the owner for 5 years or more.

In some cases, the law provides for tax exemption for the seller for 3 years of ownership of an apartment (donation, rent, inheritance, privatization).

Apartments purchased before 01/01/2016 must be owned by the citizen for 3 years. In this case, there is no mandatory payment required upon purchase.

What is the tax on the sale of a privatized apartment

You can sell an apartment and not pay tax if more than 3 years have passed since privatization (clause 2, clause 3, article 217.1 of the Tax Code of the Russian Federation).

Example:

In May 2021, you decided to sell the apartment that you privatized in January 2021. More than three years have passed since privatization, which means, by law, you are exempt from income tax on sales. In addition, you do not need to inform the tax authority and submit a 3-NDFL return.

What is the tax on the sale of real estate received as a gift?

If real estate was received as a gift from a family member or close relative, you do not need to pay sales tax three years after receiving ownership rights (clause 1, clause 3, article 217.1 of the Tax Code of the Russian Federation).

Close relatives, according to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation and Art. 14 of the Family Code of the Russian Federation, are relatives in a direct ascending and descending line: parents and children; grandparents and grandchildren; full and half brothers and sisters.

Example:

In February 2021, your brother gave you a room in a communal apartment. If you sell it after March 2021, you have the right not to file a 3-NDFL declaration and not pay personal income tax on the sale. Since the room was received as a gift from a close relative, you are subject to a 3-year tenure period.

What is the tax on the sale of inheritance

If you inherited real estate, you have the right not to pay personal income tax on the sale 3 years after receiving ownership of the apartment, that is, from the date of death of the testator.

Base: pp. 1 clause 3 art. 217.1 Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated June 19, 2021 N 03-04-05/41648.

Example:

In March 2021, you inherited a plot of land from your mother. To avoid paying tax, you can sell the plot at any time from April 2021, as you are subject to a minimum ownership period of 3 years. You have the right not to file a 3-NDFL return and not notify the tax office about the transaction.

What is the tax on the sale of real estate received by the rent payer under a lifelong maintenance agreement with dependents?

If you received the property under a life annuity agreement, you are entitled to a 3-year minimum holding period.

Example:

You have entered into an annuity and life support agreement with your elderly neighbor. You paid her rent every month.

After your neighbor died, you legally became the owner of her apartment. Three years after registering ownership of the apartment, you can sell it tax-free.

Tax obligations arising when purchasing a home

I would like to immediately, without going into the intricacies of the current legislation, reassure those who have already bought a new home and those who are just about to make such a transaction.

To him, in accordance with clause 17.1 of Art. 217 of the Tax Code of the Russian Federation, you will have to pay a tax of 13 percent on the purchased apartment (except for cases when the housing has been owned for more than three or five years - this is indicated by the provisions of Article 217.1 of the Tax Code of the Russian Federation; the same article provides a complete list of grounds for which it is used minimum period of three years).

Tax on the purchase of an apartment with a mortgage, as in other cases, is not paid. Moreover, despite the presence of a mortgage loan, the buyer can use all the income tax benefits when purchasing an apartment, and even increase the maximum refund amount by 390,000 rubles, returning part of the funds from the interest paid.

Another situation that often arises in practice and requires clarification is the taxation of real estate exchange transactions. In this case, an exchange agreement is concluded; accordingly, the parties to the transaction do not receive any income.

Is it necessary to pay tax when exchanging an apartment, or does the execution of such an agreement automatically relieve apartment owners from the obligation to pay tax? Let's find the answer to this question too.

Art. 567 of the Civil Code of the Russian Federation equates an exchange agreement to a purchase and sale agreement. However, tax on the exchange of real estate is paid only if the value of one home transferred under this agreement exceeds the value of the other home. Moreover, the tax will not be levied on the entire cost of housing, but only on the amount of the surcharge.

Now you know whether the buyer pays tax when buying an apartment, what benefits he can receive from the state in this case, and what the amount of tax paid by the home seller is.

How is property tax calculated?

The legislation establishes the obligation for all citizens to pay taxes for objects owned by them. The payer will be the persons who are officially the owners of the property. This should follow from the title documents and entries in the Unified State Register.

Such an obligation cannot be imposed on the actual owners or persons living in the residential premises. This tax must be paid for the following types of property:

- residential premises and houses;

- unfinished construction projects;

- other buildings, structures, premises, real estate complexes;

- garages.

The basic rules for the calculation and payment of property tax were approved in Chapter 32. Tax Code of the Russian Federation. At the local level, within the established framework for the implementation of the law, their own regulations are adopted. Therefore, for each region and city, the actual tax amounts may vary.

In addition, at the moment there are two calculation options. In one, the inventory value of the object is taken as a basis, and in the other, the cadastral value. The last option is applied only in those regions where they have already switched to a new system for calculating the tax base. Their full list can be seen on the website of the Federal Tax Service of the Russian Federation. The rest of the regions can use the old system before 2021.

However, the calculation scheme is the same for everyone: the tax base multiplied by the tax rate. The size of the rates is determined by acts of local authorities. The size of the tax base when calculating the cadastral value is reduced by the amount of the deduction (minus 10 sq. m. for rooms, 20 sq. m. for apartments and 50 sq. m. for houses). The inventory must be multiplied by the deflator coefficient (for the current year - 1.329). The tax office is responsible for calculating the amount to be paid.

Calculating tax

The income tax on the purchase of an apartment is paid not by the buyer, but by the seller. It is easy to calculate the amount of contributions: 13% of the transaction under the contract. The seller, like the buyer, can use a property deduction in the amount of 1 million rubles. By this amount it is allowed to reduce the cost of the base for calculating contributions.

Another option for reducing tax is providing certificates about the costs of purchasing housing. If the profit amount is less than the purchase costs, the payer does not have to pay the Federal Tax Service. When a property is sold at half price or even cheaper, the cadastral value of the property is used for calculation with a coefficient of 0.7. When calculating contributions after purchase, the former owner chooses which benefit option to choose.

Expert opinion

Klimov Yaroslav

More than 12 years in real estate, higher legal education (Russian Academy of Justice)

Ask a Question

Example: Sergeev sold property for 3.4 million, which he acquired in 2017 for 2.7 million rubles. under a mortgage agreement. The seller still had documents from the bank, so Sergeev decided to use a deduction taking into account the difference in income and expenses to reduce the base. Before July 15 of the following year, Sergeev is obliged to submit:

(3400000-2700000)×13%=91,000 rub.

If Sergeev had chosen a deduction of 1 million, he would have to transfer to the budget:

(3400000-1000000) ×13%=312,000 rub.

Reference! The seller may only use one basis reduction option. Unlike benefits for the buyer, this method of reducing contributions can be used repeatedly, but not more than once a year for the selected property.

Which sales are not subject to tax?

There is a concept of a minimum period of ownership of property. If you own an apartment or other real estate for longer than the minimum period, you do not have to pay tax when selling it.

Reason: clause 17.1 of Art. 217 Tax Code of the Russian Federation, paragraph 4 of Art. 229 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 14, 2015 No. 03-04-05/146.

There are two minimum terms for real estate - 3 years and 5 years. The period depends on when and how the property was acquired.

A three-year holding period applies if:

- the property was purchased before 01/01/2016;

- an apartment or other real estate is an inheritance or a gift from close relatives;

- this is a privatized apartment;

- the apartment was received under a lifelong maintenance agreement with dependents.

For all other cases, a period of five years applies. Below we will consider in detail all possible situations.

Sales tax if the property was purchased before January 1, 2016

If you purchased real estate before January 1, 2021 and you have owned it for more than 3 years, you have the right not to pay personal income tax on the sale.

Despite the fact that changes were made to the Tax Code in 2021, this rule is still in effect today.

Example:

In February 2015, you bought a house under a sales contract and registered ownership of it. The house was sold in March 2021. In 2019, you do not have to pay sales tax because the house was purchased before 01/01/2016.

In your case, the minimum period is 3 years. Also, you are not required to file a 3-NDFL declaration and notify the tax office about the transaction.

Sales tax if property was purchased after January 1, 2021

On January 1, 2016, changes to Art. 217.1 Tax Code of the Russian Federation. Now, in order to sell an apartment and not pay tax, you need to own it for at least 5 years. This rule applies to housing purchased after 01/01/2016.

From 2021, the minimum tenure for housing purchased after 01/01/2016 has decreased to 3 years. In this case, the following conditions must be met:

- The only home for sale. That is, at the time of the transaction you do not own another apartment. Otherwise the minimum term is 5 years.

- But if you sell the first apartment within 90 days after purchasing the second apartment, then the minimum holding period for the first apartment is 3 years.

Example:

In March 2021 you bought your first apartment. In May 2021 you will buy a second apartment. To sell your first apartment without tax, you need to do this in May, June or July 2021. That is, within 90 days from the date of purchase of the second apartment.

In this case, the minimum period of ownership of the first apartment will be 3 years, despite the fact that at the time of sale it was not your only home.

Clause 3 of Article 217.1 of the Tax Code of the Russian Federation describes situations where “the minimum maximum period of ownership of a real estate property is three years.”

Tax deduction when purchasing an apartment in 2021. At what point does the right to deduction arise?

Many believe that the right to deduction arises in the year of signing the purchase agreement, others - in the year of full payment under the agreement, and still others - in the year of full repayment of the mortgage. In fact, none of the described options is correct.

The right to a tax deduction arises:

in the year of signing the acceptance certificate, if you had an agreement on shared participation in construction, an agreement on the assignment of rights of claim to an agreement on shared participation in construction, a housing cooperative agreement.

List of documents for property deduction for DDU

in the year of entry into the register of rights to real estate. In other words, when you became the owner of the purchased property. This date is indicated in the Certificate of Ownership, in the extract from the Unified State Register, in the extract from the Unified State Register.

List of documents for property deduction under a purchase and sale agreement

In what cases is property tax not paid?

Although everyone must pay taxes, the law provides for some exceptions. This list is directly prescribed by Article 407 of the Tax Code of the Russian Federation and cannot be arbitrarily supplemented. The benefit may be provided, inter alia, to the following persons:

- disabled people of the first, second groups, as well as childhood;

- Heroes of the USSR and the Russian Federation;

- participants in hostilities;

- pensioners;

- military personnel.

In addition, this benefit can be provided only in relation to one piece of real estate, with the exception of unfinished construction and complexes. Real estate that is used by an entrepreneur to carry out his activities is also not covered.

In order to take advantage of the benefit, you must submit a corresponding application to the tax office before November 1 of the current year. In this case, it is necessary to indicate in relation to which object it is provided. Otherwise, the tax inspectors themselves will do it. If there are several owners, then the tax amount is divided between them. For minor property owners, parents or other representatives are required to pay.

Who pays the tax

Let's consider whether buyers pay tax when purchasing real estate. When carrying out transactions for the purchase and sale of an apartment, you are required to pay tax. But buyers don’t have to worry, it won’t be collected from them. This is the seller's responsibility. But even for this category of people it does not always arise.

Only those sellers of real estate who have been its owners for a short period of time pay income tax.

Although there is no tax charged when purchasing real estate, it is too early to relax. This is due to property taxes. Buyers are required to pay it for the year they became owners. Even if it happened in December. True, you will not have to pay in full for the year, but only for those months when the property has already become the property of the new owner.

Who is exempt from paying tax

Let's consider whether everyone needs to pay tax after purchase. Tax legislation provides significant relief in this matter for certain categories of citizens.

According to Art. 407 of the Tax Code of the Russian Federation the following groups of citizens will not be taxed, regardless of the period of ownership of real estate:

- Heroes of the USSR and the Russian Federation.

- All categories of pensioners.

- Citizens who have been officially assigned disability group 1 or 2, as well as those who have been disabled since childhood.

- Persons who were career military personnel and served in the Armed Forces for at least 20 years.

- Other categories specified in the Tax Code of the Russian Federation.

But representatives of these groups are not allowed to own more than one property without levying a tax. Those. if such a person owns two apartments, he will be exempt from having to pay property taxes for only one of them.

There is no tax payment when purchasing an apartment. Personal income tax is charged only to the seller. Additionally, the buyer receives the right to a property deduction.

How to calculate the tax amount

Calculating the tax amount is simple. If a citizen sold an apartment for 4 million rubles, he will need to contribute 13% of this amount to the treasury. This will be 520 thousand rubles. If the seller buys a home in the same year, he will have to pay less taxes. Because he is entitled to a property deduction. The maximum will be 260 thousand rubles. It is subtracted from the personal income tax amount for the first transaction. In total, the seller will have to pay 260 thousand rubles as tax for the year.

Is it possible to reduce property taxes?

Many people dream of finding a way to reduce the amount of tax they owe. However, the law does not provide any grounds for reducing it.

At the same time, in legal practice you can find advice from experienced lawyers on how to minimize your costs. One of them is to register real estate in the name of several persons.

With joint ownership, the costs of maintaining the property are also distributed among the co-owners. Another opportunity to reduce the amount of tax is to challenge the cadastral value established for a real estate property. This can be done for the following reasons:

- due to an error in calculations;

- due to its excess of the market price of the property.

Errors mean not only incorrect arithmetically calculations, but also a false assessment of the characteristics of an object and other conditions affecting its value. You can make such a statement to a special commission under Rosreestr, or through the court.

Considering the specifics of the problem, in such cases it is better to use the help of a lawyer. A qualified specialist will help you understand the situation, offer the best solution to the problem, prepare legally competent documents and correctly substantiate your client’s position.

How to apply for a benefit?

Benefit options:

- A lump sum to the payer's account. Issued by the Federal Tax Service.

- Gradually, by exempting from paying 13% of the salary. It is completed by the Federal Tax Service or through the accounting department at work.

In the first case, funds are paid if the entire amount was transferred as income tax during the last 4 years. If the employee’s income during this period is not enough to return all contributions, you can annually submit a 3-NDFL declaration until the limit is exhausted.

The second option for receiving benefits involves a temporary exemption from paying 13%. The employee's salary will not be subject to contributions until the employee receives 260 thousand rubles.

Example: Ivanov’s salary is 50 thousand rubles. Before purchasing an apartment worth 2.3 million rubles. The employer withheld contributions in the amount of 6,500 rubles from the payer’s salary every month. (13 %). After Ivanov became the owner of his own home, he filed a tax deduction through his employer. Thus, over the next 3 years and 4 months. (260,000/6500=40 months) 13% of the salary will not be withheld from Ivanov.

If Ivanov had chosen the first option, he would have been able to receive the entire amount (260 thousand rubles) in full. The condition is that Ivanov’s experience at his current place of work must exceed 4 years, and the salary must be sufficient to transfer the entire amount to the budget for the specified period. If over the last 4 years of employment, 13% of the employee’s income exceeded the amount of contributions for the required period, the government agency will provide compensation in a one-time payment of 100% of the amount.

In what cases is the benefit not provided?

Unlike the privilege when selling property, the condition applies to a purchased apartment only within a non-renewable limit. If the owner has been paid 260 thousand rubles by the Federal Tax Service, the citizen cannot re-use the privilege. The restriction applies to all contracts for the sale and purchase of property. The benefit is provided in the amount of the remaining part if the payer under the purchase and sale agreement used the refund partially for the first time.

Example: Petrov in 2021 received a 13% return for the purchase of property, 200 thousand rubles were transferred to his account. In 2021, Petrov bought real estate again. He has the right to reimburse 60 thousand transferred by the Federal Tax Service, since this part of the deduction amount remained unclaimed after the previous transaction.

Important! Once the limit has been exhausted, you cannot return 13% by concluding a new contract for the purchase of property.

What is a property deduction for mortgage interest?

The maximum amount that a property deduction can have

A citizen who bought real estate with a mortgage is obliged to pay, in addition to the principal debt for the apartment, a certain amount to the bank every month. Over the entire payment period, a certain amount of repaid debt accumulates. The borrower has the right to repay at a time 13% of the amount for mortgage interest, but not more than three hundred ninety thousand rubles.

This feature applies to loans issued after 2014. A citizen can receive a mortgage interest deduction once in his life.

About tax deductions

When purchasing housing or other real estate, the buyer not only does not pay personal income tax, but can also return part of the funds spent on it. At the same time, you can receive a refund of part of the personal income tax not only for one property.

Persons with official earnings can count on receiving a property tax deduction in the amount of thirteen percent. However, this requires compliance with a number of conditions.

Firstly, you can only return what was paid. That is, persons whose income was used to make contributions to the budget are entitled to receive deductions. Unemployed people, entrepreneurs, and citizens who retired more than three years ago do not have this right.

Secondly, no matter what money the apartment was purchased for, a refund can be obtained in an amount not exceeding two million rubles. In this case, it does not matter whether the payment is made in cash or borrowed funds (mortgage). However, when making payments using certificates or maternity capital funds, no refund is made.

In fact, the maximum deduction amount will be two hundred and sixty thousand rubles (13% of 2 million rubles). At the same time, it will not be returned at once, but in the amount in which personal income tax was paid this year. If we imagine that the buyer’s refund amount was one hundred thousand, and the deductions amounted to only fifty thousand, then the remainder will be transferred to the next year.

Previously, this right could only be used once. Since 2014, the situation has changed as follows. You can receive deductions more than once, but within the above maximum amount. You should know that when concluding a transaction with relatives and other dependent persons, their payment is not due.

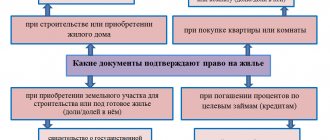

In what cases can you get a tax deduction when purchasing real estate?

- if you purchased a home;

- if you purchased a land plot located under the acquired residential building or for the construction of a residential building on it;

- if you built a house;

- if you have paid off interest on mortgage loans or on loans received for the purpose of refinancing (refinancing) such loans.

When purchasing real estate, you can also include expenses for completion and finishing as a property deduction, but this can only be done if the documents on the purchase of real estate indicate that it is being sold without finishing.

How does the tax deduction work when purchasing real estate?

By applying for a tax deduction when purchasing real estate, you can get back part of the previously paid personal income tax. A deduction can be issued only after taking ownership (signing a transfer agreement) and only for tax periods (calendar years) following the purchase of housing. That is, you will get back some of the income taxes you paid in the years after your purchase. You cannot take advantage of the deduction for periods preceding the purchase of real estate. An exception is left for pensioners, who can transfer the deduction to periods in which they received income subject to personal income tax, but for no more than three years.

The maximum amount of property deduction when purchasing real estate is 2 million rubles (13% of this amount will be returned to you). That is, if you, for example, bought an apartment worth 3 million rubles, you can only claim 2 million rubles as a deduction. If the property you purchased cost less than 2 million rubles, the remaining deduction can be

There is no statute of limitations for obtaining a property deduction. But you can only declare it for the last three years (that is, you will get back part of the taxes paid for the last three years). For example, in 2021, you can apply for a deduction for 2021, 2018 and 2021 (if the property was purchased before 2017).

What can be included in the cost of purchasing real estate to receive a deduction?

Actual expenses for new construction or acquisition of a residential building or share(s) in it, which can be claimed for a property tax deduction, may include:

- costs for the development of design and estimate documentation;

- expenses for the purchase of construction and finishing materials;

- expenses for the acquisition of a residential building or share(s) in it, including if its construction is not completed;

- expenses associated with construction work or services (completion of a residential building or share(s) in it, if construction is not completed) and finishing;

- costs of connecting to electricity, water and gas supply and sewerage networks or creating autonomous sources of electricity, water and gas supply and sewerage.

The actual costs of purchasing an apartment, room or share(s) in them may include the following costs:

- expenses for the acquisition of an apartment, room or share(s) in them or rights to an apartment, room or share(s) in them in a house under construction;

- expenses for the purchase of finishing materials and work related to the finishing of an apartment, room or share(s) in them, as well as expenses for the development of design and estimate documentation for finishing work.

Expenses for the completion and finishing of an acquired residential building or share(s) in it or the finishing of an acquired apartment, room or share(s) in it will be deductible only if the agreement provides for the acquisition of a residential building, the construction of which is not completed, an apartment, rooms or share(s) in them without decoration.

What documents are needed to receive a deduction?

To apply for a property deduction when purchasing an apartment (house, land, etc.) through the tax office, you will need:

- a certificate from the employer in form 2-NDFL for the period for which you want to issue a tax deduction;

- a copy of the agreement on the acquisition of a residential building or share(s) in it, documents confirming the ownership of the residential building or share(s) in it (extract from the Unified State Register of Real Estate) (during the construction or acquisition of a residential building or share(s) in it);

- a copy of the agreement on the acquisition of an apartment, room or share(s) in them and documents confirming the ownership of the apartment, room or share(s) in them (extract from the Unified State Register of Real Estate) (when purchasing an apartment, room or share(s) in them in own);

- a copy of the agreement for participation in shared construction and the transfer deed or other document on the transfer of the shared construction object by the developer and its acceptance by the participant in shared construction, signed by the parties when acquiring rights to the shared construction object (an apartment or room in a house under construction);

- copies of documents confirming ownership of a land plot or share(s) in it, and documents confirming ownership of a residential building or share(s) in it (extract from the Unified State Register of Real Estate) (when purchasing land plots or share(s) in them provided for individual housing construction, and land plots on which the acquired residential buildings or share(s) in them are located);

- a copy of the child’s birth certificate (if parents purchase real estate as the property of their children under the age of 18);

- a copy of the decision of the guardianship and trusteeship authority to establish guardianship or trusteeship (when guardians acquire real estate as the property of their wards under the age of 18);

- copies of documents confirming expenses incurred for completion and finishing (receipts for receipt orders, bank statements on the transfer of funds from the buyer's account to the seller's account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller and other documents) - when deducting expenses for completion and finishing;

- a copy of the marriage certificate (when purchasing property in common joint ownership);

- a written statement (agreement) on the agreement of the parties involved in the transaction on the distribution of the amount of property tax deduction (when acquiring property into common joint ownership);

If you paid off the loan:

- a copy of the target credit agreement or loan agreement, mortgage agreement concluded with credit or other organizations, the loan repayment schedule and payment of interest for the use of borrowed funds;

- copies of documents evidencing payment of interest under a target credit agreement or loan agreement, mortgage agreement (in the absence or loss of information in cash receipts, such documents can serve as extracts from the taxpayer’s personal accounts, certificates from the organization that issued the loan about the interest paid for using the loan).

How to apply for a tax deduction from an employer?

You can apply for a tax deduction from your employer without waiting for the end of the tax period (calendar year). But to do this, you will still have to submit documents to the tax office to confirm your right to receive a deduction.

Along with documents confirming your right to a deduction, you must submit an application to the tax office at your place of residence confirming the taxpayer’s right to receive a property tax deduction.

You can submit documents:

- at a personal reception>;

- online, using the “Taxpayer Personal Account” service on the Federal Tax Service website.

Within 30 days, the tax office must confirm your eligibility for the deduction. You will then need to provide the employer with:

- notification of confirmation of the right to deduction;

- a free-form application for a tax deduction.

The employer must provide you with a deduction starting from the month in which you contact him. If he withholds personal income tax without taking into account the tax deduction, he will have to return to you the amount of excess tax withheld. To do this, you will need to submit an application to the accounting department for the return of excessively withheld personal income tax, indicating in it the bank account for transferring the overpayment. The employer must transfer the excess withheld amount to you within three months from the date of receipt of your application.

The procedure for obtaining a property deduction

Refunds are not made at once, but gradually. Let's consider the procedure for obtaining a deduction when purchasing an apartment worth 3,120,000 rubles in 2021 by a taxpayer with a monthly income of 20,000 rubles.

If the taxpayer has not done this earlier, then after 2021 the buyer can contact the tax service with an application for a tax deduction. Tax refunds can be made only for the three years preceding the year of application to the Federal Tax Service, i.e. for 2021 (year of purchase), 2021 and 2021.

It is important to take into account that you can submit a declaration for 3 years only if the apartment was purchased 3 years ago. If in our example a citizen bought a home in 2021, then he could submit only one 3-NDFL in 2021.

The only exception to the rule are pensioners. For them, there are special, preferential conditions for income tax refund when purchasing real estate.

But if our citizen “remembered” about the tax benefit due to him in 2021, then in this case he could file 3NDFL declarations for 2021, 2021 and 2021.

In order to apply for a deduction, you need to calculate its size and the amount of tax to be paid. To do this, we determine the amount of earnings for each year of work:

- in 2021: 20,000 * 12 = 240,000 rubles;

- in 2021 and 2021 – a similar amount.

This calculation example is simplified: it is obvious that in practice the amount of income cannot be the same in every month for three years, and not all funds received are subject to personal income tax.

To calculate the exact amount of income received, you need to get a 2-NDFL certificate from the accounting department - it indicates the amount of funds transferred to the taxpayer, the amount of deductions already applied, and the amount of tax withheld. Based on this certificate, a 3-NDFL declaration is drawn up, and as it is prepared, the amount of funds to be returned is determined.

We suggest you read: Vacation for workers with state secrets

Well, we will return to our simplified calculation.

Let's determine the amount of tax paid:

- in 2021 – 240,000 x 0.13 = 31,200 rubles;

- in 2021 and 2021 – a similar amount.

In just three years, our taxpayer paid 31,200 * 3 = 93,600 rubles in tax. It is these funds that he will be able to return after completing all the necessary documents.

We will determine the balance that can be returned in the future. To do this, from 260,000 rubles (the maximum possible refund amount), we will subtract 93,600 rubles (the money that the tax office has already returned). We will receive 166,400 rubles.

This money can be returned after the home buyer again has taxable income. For example, in a year.

You can issue a return in two ways:

- through the tax office, waiting until the end of the next year;

- through the employer, providing him with documents confirming the right to receive benefits - in this case, the salary tax will simply not be withheld.

Exemption from income tax when purchasing an apartment will be valid until the total refund amount is 260,000 rubles.