Assignor, assignee and debtor: who is this in the example of an assignment agreement

When a person goes to a bank for the first time to get a loan, he learns a lot of new definitions from the employees of this organization. We are talking about the assignor, assignee, debtor and assignment agreement. Most often, these definitions are used by employees of banks, real estate agencies, and legal consultations.

Assignor, assignee and debtor

The assignor is the main party to the assignment agreement. An assignment is the granting of property or rights of claim. Ownership of the asset must be proven with documents.

An assignment is an agreement under which receivables are assigned. Three parties play a role in the agreement: the creditor transfers to the second party the rights to demand the debt from the third party.

The assignor is the one who transfers the rights.

The assignee is the party who purchases the rights as a result of their assignment. The assignor is responsible for the relevance of the rights that were transferred and is not responsible for debt collection.

For example, a bank is able to assign the right to claim funds for a loan issued to individuals or legal entities. The assignment is controlled by the Civil Code of the Russian Federation.

Assignor, assignee, who is this as an example:

- When a business is sold, the owner of the enterprise (assignor) changes, but the name and area of operation of the company often remains, becoming the property of the new owner (assignee).

- The sale is formalized as a business reorganization. In addition to the official owner, the name of the company will change, the scope of activity and work processes will remain unchanged.

- Assignment of debt. The right of claim passes from the assignor to the new assignee, but the debtor does not change. For example, an unpaid loan contract.

Assignment agreements

A contract that confirms the legality of the assignment of rights with documents is an assignment agreement. An assignment is the assignment of the rights of one person to another. These are primarily contracts and property rights. The debtor receives a notice about the replacement of the creditor, or he is obliged to autonomously certify such a contract:

- In a bilateral or trilateral manner, the rights of claim are transferred, the debtor must participate.

- The assignee pays the amount of remuneration under the compensation contract under the compensation contract.

- In a gratuitous contract, the new lender has no obligation to pay a fee, which should be reflected in the contract. The former creditor is not responsible for the debtor's unfulfilled promises. However, if he is a guarantor, the situation is different.

If you have a court decision to collect the debt of the first creditor, transferring the mortgage will not be difficult. You need to go to court with the assignment agreement. With a ruling to replace a party in a case made by a court, you can contact the Federal Bailiff Service, and they will begin their collection work.

Debt collection

After the conclusion of a contract between three parties: the assignor, the assignee and the debtor, there are different examples of how the showdown takes place. The assignee becomes the payer. If the debt remains unpaid, or deadlines are violated, they resort to the help of collectors. If the complaint remains unsatisfied, they sue the debt collectors.

The new creditor sends a notice to the debtor with his details to repay the debt. If the debtor was not sent a notice and he paid the first creditor, the assignee is the defendant because he did not notify the debtor with fresh information for payment of the debt.

The contract can be challenged if there are arguments. The main argument is a claim to protect consumer rights before the stage of receiving notification of a change of creditor. But this may be as a result of the lack of information about the upcoming assignment in the absence of a license from the assignee.

Liability of the assignee to the assignor

We have discussed the main definitions. In a similar transaction, all 3 parties are considered intensive participants. If the assignee does not pay the assignor, consequences cannot be avoided. If there is no payment within 6 months for the transferred right of claim, the contract is terminated and the assignor is restored to the rights of a creditor.

There is also an obligation of the new creditor - he must transfer the debt to the assignor within a certain period of time. When a debtor is intimidated, he breaks the law. The debtor has the right to go to court and hold him accountable.

If you have serious problems, then it is smarter not to hide from the bank and not to refuse to pay according to the agreement, but to come to its branch and tell about your current financial situation. Now banks are very loyal and can offer deferred payments.

The assignee is

Entities that have certain obligations are called debtors. This term has a somewhat narrow meaning. Nevertheless, in accordance with existing practice, it can mean not only monetary obligations, but also debts of other kinds. For example, this could be an obligation to perform work/provide a service, transfer ownership, and so on. The entity acting as the creditor is called the assignor in the assignment. This person transfers to a third party the ability to demand payment of the debt. The latter is called the assignee in the transaction. He gets the opportunity to demand payment of the debt in his favor. An individual, as a result of concluding a transaction to transfer the legal ability to demand repayment of a debt, assumes the full scope of powers that the original creditor had. The latter then withdraws from the contract. The assignee is a party to the transaction who, in accordance with the agreement concluded with the original creditor, has the opportunity not only to demand repayment of the debt, but also to apply sanctions to the person who evades this.

Features of the transfer of rights to foreclose

Quite often, assignment agreements are concluded when selling a business. In this case, the original owner of the company transfers the right to use the assets to the new owner of the company

It should be noted that when drawing up such contracts, it is very important to take into account all the interests and rights of each of the parties involved in the transaction. If one or more terms of the concluded agreement contradict current legislation, then the transaction cannot be executed

It is also necessary to take into account a number of legal nuances. In some cases, the terms of the contract stipulate a prohibition on transferring rights to claim debt to third parties. Despite this, the assignment contract concluded between the assignor and the assignee is considered completely legal. In this case, penalties are imposed on the original owner of the debt for failure to comply with the terms of the agreement.

What debts can be transferred

According to the established rules, not all types of debts can be considered as subjects of assignment agreements. Most often, such transactions are concluded when transferring rights to the following debts:

- unpaid loans and credits;

- outstanding loans;

- securities, including bills of exchange;

- accounts receivable.

The three hundred and eighty-eighth article of the Civil Code provides regulations governing the process of transferring debt obligations

This regulation limits the transfer of rights in cases where the identity of the lender is important to the borrower. This means that concluding an assignment agreement is prohibited in cases where close relatives act as lender and debtor

The triangle of relationships: assignor, assignee and debtor must be equilateral in the sense that no one’s rights, enshrined in law, should be violated when assigning rights

Must the assignor notify the debtor of the transfer?

In a tripartite agreement, the assignee acts as a third party who is not party to the original agreement. Each of the participants in such legal relations has its own rights and obligations. Many people who encounter this concept often ask the question of whether the original owner of the debt is required to inform the borrower about the transfer of rights to the debt. According to current laws, the assignor does not need to contact the debtor to obtain consent to transfer the debt to a third party. This means that an assignment contract can be concluded without the participation of the debtor himself. However, after the conclusion of the transaction, the original owner of the debt is obliged to notify the debtor of the fact of transfer of rights to claim the debt. As practice shows, many financial institutions often forget about this obligation.

Notifying the debtor of the fact of transfer of rights to claim the loan to a third party to the transaction allows minimizing the risk associated with incorrect execution of payments. A person who does not know that the debt has been transferred to a new person will continue to make payments in the name of the old owner. The development of such a situation contributes to the emergence of new debts. It must also be said that there is an exception to this rule. The parties who have entered into a loan agreement may indicate in the agreement the possibility and procedure for transferring the rights in question. According to lawyers, even in the case when the original owner of the debt obligations does not notify the borrower about the transfer of rights to the debt to a third party, the assignment agreement receives the status of a legitimate document.

What are the benefits of assignments for the parties?

The conclusion of an assignment agreement brings certain benefits to each of the parties. The original owner of the rights to the outstanding loan gets the opportunity to fully or partially cover the existing losses. The party acting as assignee can either buy the debt at the time of the transaction or transfer the funds after the borrower repays the debt obligations.

The party acting as assignee also has its own benefits. This can be either accrued interest for the time of delay in payments, or compensation associated with the transfer of debt. In addition, it must be taken into account that this party can receive material benefits in the case where collateral was used when applying for a loan. As practice shows, such agreements are concluded in situations where the object of the agreement is an overdue debt with “vague prospects.” In such a situation, it is more profitable for the lender to transfer the right to claim the debt to third parties than to wait for the loan to be repaid.

According to Art. 388 of the Civil Code of the Russian Federation, assignment of a claim by the assignor to the assignee is allowed if it does not contradict the law

What is the benefit of the parties

For the assignor, the main benefit is the ability to partially or fully compensate for losses. There are two options here - when the debt is completely purchased by a third party or transferred free of charge for collection, but then receives reimbursement of the debt minus interest.

There are several options for making a profit for the assignee:

- compensation for transfer of debt;

- the opportunity to receive material benefits if the loan was in kind.

In most cases, only overdue debts with losses, the prospects for recovery of which are unclear, are transferred by assignment. In this case, it is more profitable for the creditor to transfer the rights to it to another organization with compensation than to seek repayment of the loan and losses on their own.

An easy way to negotiate

But what kind of relationship did the two states enter into?

| Assignor | Assignee |

| He gave away part of his territories or ceded certain rights. | Received lands or privileges, further right to use them. |

| I usually received a certain amount as compensation. | I was paying the bills for my new acquisition. |

| Completely lost any right of ownership and disposal. | All rights passed to the new owner, the position was not disputed. |

| He had no right to take it back unilaterally. | The new state of affairs was fixed by international treaties. |

Was it beneficial and beneficial for everyone? Of course. If the Union and Finland had been able to come to an agreement in the forties of the last century, there would not have been another bloody war. After all, the whole essence of the conflict was the desire to move the border away from the strategically significant Leningrad.

Just imagine, several hundred square kilometers of land in exchange for gold or any other hard currency. And no problems, no corpses on both sides. The idea is good and not at all new, but it has not been used so often lately.

Over the past half century, it is difficult to find examples of such agreements, except for the exchange of territories between Moldova and the Odessa region at the end of the last millennium.

Types of agreements

All agreements can be divided into several types.

Agreements between legal entities

Such an agreement may include reorganization (change of the name of the debtor organization). Such an agreement must be drawn up in accordance with the law, that is, the details of both parties, seals and signatures must be present.

Agreements between individuals

This may include the division of property during a divorce, the provision of assistance from third parties in obtaining a loan, and others. In such an agreement, it is necessary to indicate the passport details of the parties, all amounts, payment terms under such an agreement. A seal in such agreements is not required; the signatures of the parties are sufficient.

Since the main party of the agreement on the assignment of rights of claim is the return of the invested funds of individuals, a serious question arises as to what it should be so that, as a result of its signing, both persons who signed such an agreement remain in profit.

The law does not establish a standard form for such an agreement; it is only important to comply with all the requirements.

- The contract must be specific, then there will be a minimum of questions about it. One side alienates, and the other accepts.

- A prerequisite is the presence of the contract number and the date of its preparation.

- It is important to indicate the correct amount of such an agreement.

- It is necessary to attach supporting documents (loan agreement and receipt of the debtor for receipt of funds). Here you can also indicate the amount of remuneration to the assignor for the transaction, settlement terms and possible forms.

Most often, the need to conclude an assignment agreement arises if a cash loan agreement was previously drawn up and for certain reasons the debtor is not able to repay the loan on time and in full.

Transfer of debt, when one party is a legal entity and the other is an individual

During the crisis, this procedure was especially popular when a company is declared bankrupt, and the director of this company assumes all obligations to pay the debt of the organization, but as an individual.

Such an agreement is drawn up in accordance with the law; a seal must be present on the part of the organization, a personal signature on the part of the individual, and passport data must be indicated.

Tripartite agreement

It is concluded to ensure that all parties to the contract are notified of any changes in the assignment of claims. The main feature of such an agreement is the fact that the debtor agrees to transfer the return of his debt to another person and this consent is of an official nature , whereas with a bilateral agreement, the debtor is only notified of the fact that the change of creditor has already occurred. This is considered the main guarantee that the debt will be paid by the debtor.

Assignment agreement of a paid or gratuitous nature

to be compensated if all obligations are transferred for a price specified in the contract. The assignment of claims may be a necessary measure to return at least the minimum amount spent. Typically, such a concession occurs to collectors.

However, if payment is not provided for the assignment of rights of claim, then such an agreement is usually considered gratuitous .

Free or paid debt transfer

For example, the debtor is changed either through a non-payment agreement or for a certain cost, which, logically, will exceed the original amount of the debt.

Assignment by writ of execution. Such a right can either be given free of charge or a certain price can be set for it.

Bank assignment

Separately, I would like to consider the agreement for the assignment of claims in banking services. When concluding a loan agreement between an individual and a banking institution, a situation may arise when, when paying off the loan, the borrower may experience financial difficulties, which may lead to late payment of the loan.

Sometimes the bank sells such debts to collection firms for a certain amount. In this case, the collection company fully assumes the entire burden of collecting the debt from the debtor. In this case, there are two legislative opinions:

- first, the state assigns the right to claim the debt strictly to the bank and apply legislative norms governing lending,

- second, the legislation on loans, regulated by the Civil Code, makes it possible to assign the right to claim a debt to a party that does not have the authority of a credit institution.

Therefore, such issues are usually resolved in court.

Obligations of the parties

The assignor can be either an individual or a legal entity. From a legal point of view, his function in this process is extremely simple - he transfers his right of claim to another subject of business relations. Example of an operation: the previous creditor cedes the opportunity to fully receive funds under the bill from the borrower. When it comes to debts to a bank or collection organizations, an assignment agreement is drawn up between them and the assignor.

The previous lender receives a kickback of 5-10% of the remaining amount, thereby eliminating the need to ensure the correctness of payments from the borrower. They can sometimes be insurance companies: they resell the obligations given to you to ensure payments in the event of emergencies, specified in the relevant documents, to another organization of a similar type.

During the assignment process, the assignee will act as the party accepting your previous obligations. If the case involves a business reorganization followed by the sale of the enterprise, you will actually become its new owner. The divorce procedure may be accompanied by an assignment agreement, according to which new property is transferred to one of the spouses. As in the case of the assignor, the new assignee also acts as the subject of the relationship during the reinsurance. If collectors do not work under an agency agreement, rights of claim may be transferred to them in cases where the borrower is threatened with an inventory and confiscation of property on account of the debt.

Let's take a closer look at these examples:

- Breakup of marriage. The practice is used only abroad; it has not yet taken root in Russia. Its essence lies in the fact that one of the family members transfers, through the document in question, part of the property that was documented in his name.

- Assignment of debt. If the assignor has his own borrower, using the amount of funds or other assets issued to him, you can repay your arrears to the bank, collection offices or other financial organizations.

- Re-registration of business with its reorganization. Thus, you remove the negative consequences highlighted in the previous paragraph. Only in this case will your enterprise act as a means of settlement with the creditor; with the help of its products, capacities and other things, you will repay your debt. In this case, not only the owner of the enterprise will change, but also its name.

The relationship between the parties to this agreement, namely the assignor, assignee and debtor, resembles an equilateral triangle. That is, for a normal outcome of events, the rules of law must be observed by each of them. For example, Article 388 of the Civil Code of the Russian Federation states that the execution of an assignment agreement can only be carried out if this in no way contradicts the law. To clarify, it is worth saying that the latter are prohibited from transferring rights to the following things:

- obligations to pay alimony support;

- compensation for damage caused to a person’s moral condition;

- compensation for damage to life, health and other things caused to a third party.

The interesting thing is that sometimes it is determined by the fact that the existing debt cannot be assigned. However, if the latter does happen and the transfer document is signed, it will still take effect and have legal validity. The assignor, in turn, will be responsible before the law for such actions under the relevant article. Article 389 of the Civil Code of the Russian Federation indicates that in order to avoid various kinds of problems and inconsistencies, the assignment agreement must be drawn up in documentary form.

It is worth paying attention to the DDU or equity participation agreement. It is drawn up with the developer

Under its terms, you undertake to provide this company with financial assistance, which will be equal to the final cost of housing. Thus, upon completion of construction, you will be able to choose an apartment in the new building.

https://youtube.com/watch?v=lD57ELOM3RU

The assignee is

The rights of the assignee at the conclusion of the transaction have the same scope and the same limits as those of the original lender. For example, the agreement provided for the possibility of repaying obligations by transferring property. The creditor can thus turn it to his advantage. The assignee also has the same opportunity. This will not depend on whether notice of the transaction was sent to the debtor. Payment (repayment of obligation) can be made in any form (cash/in-kind). But in all cases it is necessary to determine the powers that the new creditor has. In practice, payments are rarely made in cash. Typically, repayment of obligations is made by crediting to an account held by the assignee. This can also be done by issuing promissory notes, checks, and other negotiable documents. In accordance with the principle of autonomy of the will of the participant, the parties to the assignment agreement may differently resolve the issue concerning the rights of the assignee to sums of money and property received in pursuance of the original agreement.

Please note => Without insurance, how many days can you drive without

The assignor is who, rights and obligations

Also, an assignment agreement is used as a guarantee of the fulfillment of obligations for the supply of various goods, as well as when issuing a loan. In this case, the transaction does not require the participation of a notary. To conclude it, only the signatures of the participants, the presence of their passport data and the basic terms of the agreement are required.

The parties involved in this agreement are called assignors and assignees. The participant in the transaction who assigns the right of claim under the contract is the assignor, and the receiving party is the assignee. The document certifying the assignment of rights is called title. The ability to collect debt passes from one creditor to another. Actually, the debtor does not participate in this at all (with the exception of tripartite assignment agreements, which we mentioned above), the legal act is completed without him, and he learns about everything, as a rule, after the conclusion of the transaction. There is an assignment of debt. Initially, when determining contractual obligations, the borrower has obligations to the assignor, and after the assignment of rights - to the assignee. The relations arising as a result of the conclusion of these agreements are regulated by Russian legislation in sufficient detail.

How conflict situations between creditors are resolved

Let's look at the situation when the assignee did not pay the assignor under the assignment agreement. How is such a conflict situation resolved? Firstly, all conditions for the transfer of debt, including material remuneration of the parties, are clearly indicated in the agreement.

Secondly, failure by the assignee to fulfill its obligations towards the assignor in a timely manner may give rise to legal proceedings. Thirdly, the transfer of the right to claim debt is in any case unconditional, that is, Russian legislation does not provide for the possibility of returning rights to the original owner.

Therefore, if the assignment agreement is signed, but the assignee does not fulfill its obligations to collect and return funds, the original creditor must collect the overdue debt not from the borrower, but from a third party. The concluded assignment deprives him of the right to appeal to the debtor.

Important nuances

When concluding contracts, all parties must adhere to a number of conditions:

- Openness. It is necessary to indicate all the required details, including signatures and seals for legal entities, as well as passport data from individuals.

- Conditions. All conditions for the transfer of rights must be clearly reflected in the contract, because only in this case can each party be completely confident in their legal security.

- Price. Indicated in the case where the contract is paid

. If it is free of charge, then this will also need to be indicated. - Documentation. A complete list of documentation that was provided to confirm ownership of the property, as well as all additional formalities, is indicated.

- The agreement that started it all. It must certainly be available, and its data must be transferred to the newly compiled one.

- Date of. This specifies the precise moment at which rights and obligations are transferred from one party to the other. Most often, this moment is the signing of the contract, although the time of transfer of all necessary accompanying documents is often used.

There are a number of factors that make the conclusion of such agreements impossible. Among them are the payment of alimony, compensation for material damage incurred as a result of harm to health or life

.

In addition, it should be remembered that such a transaction cannot contradict the law or other legal acts

. For example, the assignor is a party to a joint activity agreement, which is why he will certainly need the consent of all participants in this agreement.

Declaring insolvency can be made much easier by a bankruptcy lawyer. In difficult cases, it is better to seek help from a specialist at the very beginning of the process. Credit organizations often transfer the rights to collect debt to third parties, that is, they enter into an assignment agreement

. Find out more about where to get protection from creditors here. You should not delay contacting specialists.

Additional aspects

The assignor and assignee are equally interested in ensuring that the debtor fulfills its obligations by legal means. Most often, the methods of claim and possible sanctions are prescribed in the text of the contract itself, although it is often necessary to refer to the current legislation.

In the process of concluding an agreement, only two parties often participate, and the third party is notified of the transfer of rights only after signing. This is due to the fact that this action will not bring any legal changes to the latter, and the party to whom compensation will be sent can be absolutely anyone.

If the debtor was not notified and sent the funds to the assignor at the address indicated in the original agreement, then the obligations are considered fulfilled to the assignee. All further disputes should no longer affect the rights and freedoms of the debtor, and all imposed sanctions should be declared unlawful and immediately cancelled.

When can a contract be invalidated?

In most cases, the debtor does not participate in the signing of this agreement and is faced with the fact of a change of creditor. Many are dissatisfied with this change and go to court with a demand to declare the assignment invalid.

Russian judicial practice shows that the majority of such claims are unsatisfied , especially if, from the point of view of legislation and paperwork, the contract was drawn up correctly. Please note that even the presence in the original agreement of a ban on the sale of debt is often not a restriction. Therefore, there is practically no chance of challenging the assignment agreement in court.

Parties to an agreement for the assignment of rights of claim or property

In fact, the procedure for assigning rights involves the involvement of three parties: a person who, by virtue of the original civil law contract, has certain obligations to the other party, a person who, by virtue of the same contract, is a party to whom the first person has obligations, and the person to whom the claims are assigned in accordance with the current civil law contract.

However, it is clear that it is still interested in returning the amount of money transferred to the borrower as a loan.

A possible way out of this situation may be the assignment of rights of claim to them under the loan agreement. As a rule, such an assignment implies the involvement of a third party in the relationship between the two parties, in respect of whom the assignment will be made. At the same time, the process of transfer of rights between the parties involved in this transaction, as well as their rights and obligations in relation to the party bound by obligations to the original creditor, should be considered in detail. Date: March 18, 2021

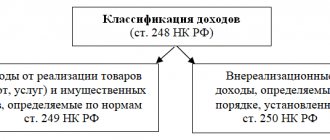

Legislative regulation of assignment in Russia

The basis of the Russian legislative framework in the field of assignment agreements is Chapter 24 of the Civil Code “Change of persons in an obligation”, Articles 155 and 279 of the Tax Code. Letters from the Ministry of Finance and clarifications from the Supreme Court are devoted to certain regulatory parameters.

The activities of collection agencies are regulated by Federal Law 230-FZ, dedicated to the protection of the rights and interests of individuals when returning overdue debts and carrying out the activities of microfinance organizations.

Please note that in January 2021, changes were made to this law that significantly reduced the rights of collectors.

Basic Concepts

Putting aside complex economic terms that may not be clear to the average person, the term “cession” can be described as the transfer of rights to demand repayment of a debt . This process involves several parties, each of which has a certain list of rights and obligations.

Assignor (from the English “cedent” - transferor of the right) is a party to the transaction (individual or legal entity) who transfers (assigns) the rights of claim to another person

Who is the assignor

The assignor is the original owner of the debt of an organization or individual . As a rule, this status is given to financial structures that issue funds in the form of loans to organizations and individuals. If difficulties arise with the return of funds, financial institutions can contact the collection service. This approach can significantly reduce the amount of loss due to late repayment of issued loans. It should be noted that credit organizations operate on the basis of current legislation that allows the transfer of the right to claim debt to third parties. This means that concluding an assignment agreement is a completely legal process.

It is important to note that in the case under consideration, the object of the contract is only debt. The parties cannot transfer to each other the right to claim additional compensation and cover additional costs. To the amount of the total debt, you can add accrued penalties and fines in the form of interest. According to the established rules, the parties can transfer the debt only in its original form. This means that the parties are prohibited from making additional amendments to the contract with the debtor that change the terms of repayment of the loan.

Who is the assignee

The assignee is the second party to the agreement who receives the right to demand repayment of the debt . This status can be assigned to both a collection service and a third-party banking structure. The assignee acts as a third party who is not mentioned when concluding an agreement between the lender and the borrower.

The new owner has the same rights to demand repayment of the debt as the original owner of the debt. In the case where the contract between the lender and the borrower mentions the possibility of covering debts through the transfer of property assets, the assignee also has the opportunity to exercise this right. If the contract does not contain this clause, then the third party to the contractual relationship cannot call on the debtor to repay the loan by selling material assets.

Definition of debtor

Debtor status can be assigned to an individual who has an unclosed loan taken out from a financial institution. A legal entity can also be a debtor.

Assignee (from the English “cessionary” - legal successor) is a party to an assignment agreement that assumes the obligation to act as a new creditor or a legal successor receiving ownership rights