Who is required to report to statistics?

Articles 6 and 8 of Federal Law No. 282 of November 29, 2007 determine that the following entities are required to submit statistical reporting:

- bodies of state power and local self-government;

- legal entities registered in Russia;

- operating branches and representative offices of Russian organizations;

- representative offices, branches and divisions of foreign organizations operating in Russia;

- individual entrepreneurs;

- notaries.

Business entities using a simplified taxation system or other special regimes are also required to report to statistics on a general basis in accordance with their status and field of activity.

Reports must be sent to Rosstat departments at the place of registration of the respondent. But from 2021, the rule regarding the reporting method is changing. Information should be sent exclusively in electronic form, unless we are talking about small businesses. They were allowed to switch to electronic document management with Rosstat from 2022 (see Federal Law No. 500-FZ of December 30, 2020).

What to submit to the statistics authorities

There are about 300 existing statistical forms for submitting data to Rosstat. Not all of them are mandatory for every company. But there are mandatory information that almost all legal entities that are not small businesses submit. Which ones are among them, see below.

| OKUD code | Name of the statistical observation form, date and number of the Rosstat order for approval | Index |

| 0602001 | Information on the availability and movement of fixed assets (funds) and other non-financial assets, No. 384 of 07/15/2020 | |

| 0602002 | Information on the availability and movement of fixed assets (funds) of non-profit organizations, No. 384 of 07/15/2020 | 11 (short) |

| 0602003 | Information on transactions with fixed assets on the secondary market and their rental, No. 384 of 07/15/2020 | 11 (deal) |

| 0602004 | Information on the availability, movement and composition of contracts, leases, licenses, marketing assets and goodwill (business reputation of the organization), No. 428 dated 06/26/2017 | 11-NA |

| 0601009 | Basic data on the organization’s activities, No. 411 dated July 24, 2020 | 1-Enterprise |

| 0610016 | Basic information about the activities of the organization, No. 411 dated July 24, 2020 | P-5(m) |

The following reporting forms should be highlighted separately:

- Form P-3 “Information on the financial condition of the organization.” In 2021, you must report for 2020 by 02/01/2021. Data is sent monthly until the 28th of the month following the reporting month, but at the end of the quarter and year this deadline shifts to the 30th or even the 1st. All legal entities whose payroll number of employees exceeds 15 people rent out. The report was approved by Rosstat order No. 421 dated July 24, 2019, and instructions - No. 711 dated November 27, 2019. For reporting for 2021, respondents are required to use the form contained in Rosstat Order No. 400 dated July 21, 2020.

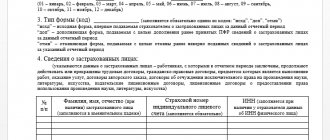

- Form P-4 - data on the number and wages of company employees. All organizations and their separate divisions are required to submit it by the deadline: the 15th day after the end of the reporting quarter or month (depending on the category of respondents). The report was approved by Rosstat order No. 404 dated July 15, 2019, and instructions for filling out the form were approved by order No. 711 dated November 27, 2019. For reporting for months and quarters of 2021, you should use the form from Rosstat Order No. 412 dated July 24, 2020. Instructions are also contained there.

- Form P-4 (NZ) “Information on part-time employment and movement of workers.” The report was approved by the order indicated above (for statistical form P-4), and it must be submitted by the 8th day of the month following the reporting quarter. Available to all organizations with more than 15 employees. As for the reporting forms, for the last year they report taking into account Rosstat Order No. 404 dated July 15, 2019, and for 2021 - according to Rosstat Order No. 412 dated July 24, 2020. The instructions are contained in the same regulatory act.

Please note what reporting forms are required for small businesses to submit to Rosstat this year. They differ from and complement the ones mentioned above. For small businesses and entrepreneurs the following are considered mandatory:

| OKUD code | Name of the statistical observation form, date and number of the Rosstat order on its approval | Index |

| 0601013 | Information on the main performance indicators of a small enterprise, No. 419 dated July 22, 2019. Instructions - Rosstat order No. 22 dated January 23, 2020. For reporting for the first quarter of 2021, use the form from Rosstat Order No. 411 dated July 24, 2020. Additional instructions are posted in Rosstat Order No. 22 dated January 23, 2020. | PM |

| 0610010 | Information on the production of products by a small enterprise, No. 472 dated 07/31/2018, and for reporting for 2021, use Rosstat order No. 411 dated 07/24/2020 | PM-prom |

| 0601024 | Information on the production of products by a micro-enterprise for the past year, No. 411 dated July 24, 2020 | MP (micro)-nature |

| 0601018 | Information on the activities of an individual entrepreneur, No. 419 dated July 22, 2019. When you start reporting for the months of 2021, use the form from Rosstat order No. 411 dated July 24, 2020 | 1-IP (month) |

Among them are:

- PM form “Information on the main performance indicators of a small enterprise.” The report is submitted by legal entities belonging to small enterprises, with the exception of microenterprises. The deadline is the 29th day of the month following the reporting quarter. For the first quarter of 2021, the report is due by 04/29/2021.

- PM-prom “Information on the production of products by a small enterprise.” All small enterprises and entrepreneurs, with the exception of microenterprises, with the number of employees from 16 to 100 people are rented. Sent monthly before the 4th day of the month following the reporting month (if there are no transfers).

- 1-IP (months) “Information on the activities of an individual entrepreneur.” All individual entrepreneurs who are not agricultural producers rent them out at the end of the year. Due date: monthly, on the 4th day after the reporting period.

- 1-IP (trade) “Information on the activities of an individual entrepreneur in retail trade” (statistical form approved by Rosstat order No. 418 dated July 22, 2019). Rented by individual entrepreneurs engaged in retail trade. The deadline is no later than October 17 of the year following the reporting year (in some months the deadlines are postponed).

Micro-enterprises registered as legal entities and individual entrepreneurs must submit to statistics Form N MP (micro)-nature “Information on the production of products by a micro-enterprise”, approved. by order of Rosstat No. 411 of July 24, 2020. The deadline for submission is January 25 of the year following the reporting year.

Previously, all organizations, in accordance with the provisions of Article 18 of Federal Law No. 402 of December 6, 2011 “On Accounting,” provided the statistical authority with a mandatory copy of the annual accounting report. This obligation applied to absolutely everyone, with the exception of government organizations and the Bank of Russia. The deadline for submitting annual financial statements is no later than 3 months after the end of the year.

It includes:

- balance sheet;

- income statement;

- mandatory annexes to the balance sheet and income statement, such as: statement of changes in equity capital, statement of cash flows and statement of intended use of funds.

Small businesses submitted only their balance sheet and financial statements to Rosstat. This was determined in the order of the Ministry of Finance No. 66n dated July 2, 2010.

But now the legislation has changed, and now there is no need to submit your balance to the statistics authorities. Unless your company is controlled by the Central Bank, is on the government’s list, and does not work with state secrets. Documents are sent only to the tax office before March 31 of the year following the reporting year.

Remember: organizations and individual entrepreneurs are still sending industry information. Some forms of statistical observation are subject to approval at the regional level, but most of them are still federal, and they are approved by Rosstat.

Reporting forms to Rosstat

All companies and individual entrepreneurs in the country submit statistical reports. This is a mandatory type of reporting, and it should be treated as carefully as usual accounting and tax reporting. Based on the collected statistics, a state strategy is built and new laws are adopted.

It is generally accepted that the history of Russian statistics began in 1802 and for more than two hundred years the state has been collecting statistical data from organizations and people.

Who needs to submit reports?

Everyone is required to submit statistical reporting. Both government agencies and individual entrepreneurs. Legal entities, branches, separate divisions and territorial representative offices, as well as representative offices and branches of foreign companies are required to submit reporting forms. But if representatives of large businesses submit statistical reports on an ongoing basis, then small businesses and individual entrepreneurs do so only if they are included in the Rosstat sample.

At the same time, responsibility for failure to provide documents lies with the respondent, and not with Rosstat, which sent the letter to an invalid address, and not with the post office, which did not deliver the letter. Therefore, it is especially important for individual entrepreneurs, small and micro businesses to regularly monitor themselves in this year’s Rosstat sample.

Continuous statistical observation

Continuous observation is a nationwide project during which statistics are collected on representatives of small and medium-sized businesses. Once every five years, all individual entrepreneurs, as well as small and micro businesses, are required to submit reports to Rosstat. With the help of such continuous sections, the statistics service receives data on the main indicators of small businesses: expenses and revenue, address, composition of funds, number of employees, etc. The last time small businesses came under continuous surveillance was in 2021, submitting documents for 2015, which means that the next cut will be in 2021.

Based on continuous observation data, the government is developing measures to support small businesses. Therefore, during continuous monitoring, everyone, without exception, needs to submit reports to Rosstat.

When and how to submit reports to Rosstat

You need to fill out documents for Rosstat annually, quarterly or monthly. Different types of organizations have different deadlines for submission. You can find out when and what reports you need to submit on the Rosstat website by TIN or use the statistical calendar posted there. Keep in mind that in addition to federal reporting forms, there are also regional reports that are also required to be submitted.

In 2021, the deadline for submitting documents was briefly postponed due to the period of self-isolation.

Since small businesses are checked randomly by Rosstat, it is worth getting into the habit of regularly checking your company on the Rosstat website at the beginning of the year and once a quarter. If your company is included in the sample by TIN, then the statistical agency is obliged to send you an official letter with a list of templates and deadlines. But, since mail may be delayed or lost, it is better to independently check your company by TIN. So how do you find out what kind of reporting needs to be submitted to Rosstat? In order to understand whether you need to submit reports to Rosstat, you need to enter the company’s TIN in a special service on the Rosstat website. You can search not only by INN, but also by OKPO or OGRN. If you don’t need to hand over anything, the service will tell you about it, and you can sleep peacefully. If you need to submit any reports, then opposite the company name you will find a list of required documents. There is no need to be afraid of this; for small enterprises, reporting forms to the statistical agency are more like questionnaires and they are not difficult to fill out.

How do you know which forms are current? Samples to fill out can be found on the Rosstat website. Please note that the sample forms that need to be submitted are regularly updated, so you should always check the website. Or use the services of electronic reporting operators. For example, Online Sprinter of the Taxcom company. There you will definitely always find valid reporting templates.

You can submit completed report forms in several ways:

— personally take the completed documents to the territorial authority;

- send by mail in a valuable letter;

— use the services of an electronic reporting operator.

A draft amendment to the Federal Law “On Official Statistical Accounting...” is under consideration, which will oblige all business representatives to report only electronically. The document was expected to come into force this year, but the timing of its approval is not yet clear. In any case, you need to be prepared for the fact that the entire business will sooner or later submit statistical reports remotely.

Fines and adjustments

For failure to submit reports on time, a fine of up to 70,000 rubles may be imposed on a company or individual entrepreneur; in case of repeated violation, the fine may be increased to 150,000 rubles. Entrepreneurs can also be fined for submitting incorrect initial information about the company. However, amendments to the Code of Administrative Offenses of the Russian Federation should come into force next year, which imply a reduction in the amount of such fines.

If you find an error in the documents already submitted or receive a letter indicating the error from Rosstat, you need to submit corrections and an explanation of why the error was made. This must be done within three days from the moment the error was discovered.

What forms of reporting are there?

Unfortunately, there is no single list of who is required to submit what forms of reporting. The need to submit certain types of reports depends on the number of employees of the company, type of activity, and turnover. In addition, there are not only federal, but also regional types of reporting. In total, there are about 300 existing templates that must be used to submit reports to Rosstat.

You can find information about what forms you need to submit on the Internet, but it is better to use the website of the statistical service itself.

Required Forms

There are a number of forms that almost all legal entities are required to fill out, with the exception of small businesses. You can find out whether your specific organization needs to submit this form at the territorial office of Rosstat.

— Information about the movement of funds

— Basic information about the organization

— Data on financial condition

— Data on the number and salary of employees

— Information about the movement of employees

From small enterprises, Rosstat requests data on key performance indicators, manufactured products and innovation activities. As a rule, reporting forms for small businesses are quite simple and filling them out does not take much time.

Balance sheet

Until 2021, along with statistical reporting, companies were required to submit a balance sheet to Rosstat. Now this rule has been canceled and the balance sheet is submitted only to the territorial body of the Federal Tax Service. The obligation to submit financial statements to Rosstat remains only for organizations whose activities are related to state secrets.

So, in order to find out which reports to submit, you need to check your company by TIN or other details in a special service of Rosstat at the beginning of the reporting period. Then study the current report templates, fill them out, and no later than the deadline indicated on the title page, send them to the territorial statistics office in person, by letter or with the help of an electronic document management operator.

The last option is optimal. Modern services automatically pull up updated templates from the Rosstat website and notify the user about the need to fill them out. In addition, the use of telecommunication channels will always help you in controversial cases and if you do not know what reports to submit. The operator records the time the report was sent and allows you to see the feedback status.

To always submit reports to Rosstat on time, use the Online Sprinter service. Unlimited exchange of documents, always up-to-date auto-updating forms, accountant calendar and many other useful functions. Online Sprinter will help you submit your reports to Rosstat on time and without errors.

reporting accounting reporting submission of reports business Rosstat continuous observation

Send

Stammer

Tweet

Share

Share

When to take it

In addition to the official Rosstat resource, there is another way to find out which forms will have to be submitted this year: contact the territorial body of the department at the place of registration and clarify the list of valid reports. Statistical service employees are required to inform business entities about all reporting forms and the procedure for filling them out, in accordance with the rules approved by Decree of the Government of the Russian Federation No. 620 of August 18, 2008. Additional information is available on the official website of Rosstat.

Since administrative fines are provided for violating the deadlines for submitting statistical reports, we have made a table of deadlines for submitting reports to statistics for the 4th quarter of 2021 and the entire year 2021, which will help to submit forms on time.

| Statistical Observation Form | Reporting period and deadlines |

| No. 1-T “Information on the number and wages of employees” | For 2021 - until 02/01/2021 |

| No. 7-injuries - about injuries at work and occupational diseases | For 2021 - until 01/25/2021 |

| No.MP (micro)-nature - data on the production of products by a micro-enterprise | For 2021 - until 01/25/2021 |

| No. 1-Enterprise - about the activities of the organization | Until 04/01/2021 - for last year |

| No. 12-F - on the use of funds | Until 04/01/2021 - for last year |

| No. 57-T - on wages of workers by profession and position | The form is submitted once every 2 years, the next time - no later than November 29, 2021 for 2021 |

Tax authorities will not accept accounting reports for 2021 on paper

Financial statements for 2021 submitted on paper will be considered not submitted.

The Ministry of Finance and the Federal Tax Service of the Russian Federation warn taxpayers about this in letters No. 07-04-07/110599 and No. VD-4-1/ [email protected] dated December 17, 2020.

The departments remind you that from January 1, 2021, in accordance with Article 18 of the Law “On Accounting” (N 444-FZ as amended on November 28, 2021), all economic entities (with certain exceptions) are required to submit one copy of the annual accounting (financial) ) reporting to the tax authority at the location in electronic format.

Based on these reports, the Federal Tax Service of the Russian Federation creates a state information resource for accounting (financial) reporting (GIR BO).

The following are exempt from submitting legal deposit reports:

—

organization of the budgetary sphere;

—

Central Bank of the Russian Federation and organizations submitting financial statements to the Central Bank of the Russian Federation;

—

religious organizations;

—

organizations whose reports contain information classified as state secrets;

—

organizations in cases established by Decree of the Government of the Russian Federation No. 35 of January 22, 2021.

Small businesses were allowed to submit a mandatory copy of their reports for 2021 on paper.

Starting from the annual financial statements for 2021, all economic entities, including small businesses, are required to submit a legal copy of the statements exclusively in the form of an electronic document.

In this regard, the submission of a legal copy of reporting for 2021 on paper is grounds for refusal to accept it by the tax authority.

Taxcom company offers three solutions for quick and convenient submission of reports in electronic format to all regulatory authorities.

—

Web account "Online-Sprinter", which works through a browser. To submit reports, you only need a computer and Internet access. The service has an intuitive interface and does not require installation of additional software on your PC. Data and documents are stored in the operator’s secure cloud archive.

—

Docliner software installed on the user's PC. In this case, the documents are stored on the user's computer.

—

“1C: Electronic reporting” is for those who are accustomed to working in the 1C accounting system and do not plan to install additional programs.

Works from most configurations of the 1C:Enterprise family of versions 8.2 and higher. reporting accounting reporting submission of reports

Send

Stammer

Tweet

Share

Share

Responsibility for failure to submit reports to statistical authorities

For failure to submit or untimely submission of statistical data by companies and individual entrepreneurs to Rosstat bodies, the sanctions of Article 13.19 of the Code of Administrative Offenses of the Russian Federation provide for an administrative fine in the amount of:

- from 10,000 to 20,000 rubles - for officials;

- from 20,000 to 70,000 rubles - for legal entities.

Repeated commission of such an administrative offense will entail an administrative fine for officials in the amount of 30,000 to 50,000 rubles, and for legal entities - from 100,000 to 150,000 rubles. Similar liability is provided for the provision of false indicators to statistics.

Legal documents

- Federal Law of November 29, 2007 N 282-FZ

- Decree of the Government of the Russian Federation of August 18, 2008 N 620

- Order of Rosstat dated July 15, 2020 N 384

- Order of Rosstat dated June 26, 2017 N 428

- Order of Rosstat dated July 24, 2020 N 411

- Order of Rosstat dated November 27, 2019 N 711

- Order of Rosstat dated July 21, 2020 N 400

- Order of Rosstat dated July 15, 2019 N 404

- Order of Rosstat dated July 24, 2020 N 412

- Order of Rosstat dated July 22, 2019 N 419

- Order of Rosstat dated January 23, 2020 N 22

- Order of Rosstat dated July 31, 2018 N 472

- Order of Rosstat dated July 22, 2019 N 418

- Federal Law of December 6, 2011 N 402-FZ

- Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n

- Article 13.19 of the Code of Administrative Offenses of the Russian Federation. Failure to provide primary statistical data