We will consider the composition of reporting to government authorities for Limited Liability Companies LLC on different taxation systems.

At the beginning of the year, all organizations need to start preparing their annual report for 2021. Annual reports must be submitted between January and the end of March 2021. The types and deadlines for submitting reports depend on what taxation system the company uses.

In 2021, organizations will have to submit annual financial statements for 2021, then monthly or quarterly tax returns to the Federal Tax Service and calculations of insurance contributions to funds based on the results of each quarter, half-year and 9 months. What reports are included in the reporting for LLCs under the general taxation system and special regimes (STS and UTII).

LLC on the general taxation system (OSNO)

Organizations take OSNO exams:

Accounting statements

- Balance sheet (OKUD 0710001)

- Financial results report (OKUD 0710002)

- Statement of changes in capital (OKUD 0710003)

- Cash flow statement (OKUD 0710004)

- Report on the intended use of funds (OKUD 0710006)

- Explanations to the balance sheet and income statement.

Tax reporting:

- VAT declaration

- Income tax return

- Property tax declaration

- Transport tax declaration

- Land tax declaration

- 6-NDFL

- 2-NDFL

- Information on the average number of employees

- Unified calculation of insurance premiums

Reporting to funds

- Calculation according to the RSV-1 form for 2021

- SZV-M

- Calculation according to form 4-FSS for 2021

- Calculation of contributions for compulsory insurance against industrial accidents and occupational diseases (from the 1st quarter of 2017)

- Confirmation of the main type of activity in the Social Insurance Fund

New form of certificate 2-NDFL 2018

Let's consider all the changes in the 2-NDFL certificate form that came into force on February 10, 2021.

- Two new columns appeared on the title page:

- form of reorganization (liquidation):

- 0 – liquidation,

- 1 – transformation,

- 2 – merger,

- 3 – separation,

- 5 – connection,

- 6 – separation with simultaneous joining.

- TIN/KPP of the reorganized organization (separate division).

The legal successor organization for the reorganized company will fill in the new lines.

- 1 – indicate tax agents and their legal successors;

- 2 – representatives of tax agents and legal successors indicate.

Download the new 2-NDFL certificate form in Excel format

Financial statements

All organizations are required to submit annual financial statements. Reporting must be submitted to the Federal Tax Service and Rosstat.

Annual accounting (financial) statements consist of a balance sheet, a statement of financial results and appendices thereto. The composition of the reporting is approved by paragraph 1 of Article 14 of the Federal Law of December 6, 2011 No. 402-FZ. Small businesses are allowed to submit simplified reporting forms.

The deadline for submitting annual reports is established by subparagraph 5 of paragraph 1 of Article 23 of the Tax Code of the Russian Federation and paragraph 2 of Article 18 of the Federal Law of December 6, 2011 No. 402-FZ.

The deadline for submitting annual reports for 2021 is 03/31/2017.

The deadline for submitting annual reports for 2021 is 04/02/2018*.

Is it possible to submit form 2-NDFL without an employee’s TIN?

In the 2-NDFL certificates of the old and new format there is a field “TIN in the Russian Federation”, which indicates the identification number of the individual taxpayer, confirming the registration of this individual with the tax authority of the Russian Federation.

The rules for format and logical control of 2-NDFL certificates established by the Federal Tax Service work as follows: the “TIN in the Russian Federation” field is checked if code 643 is specified in the “Citizenship (country code)” field. If the employee’s TIN is not specified, then the protocol for receiving information will contain the message: “Warning. The TIN for a Russian citizen has not been filled in.”

We remember that a warning is just a warning, and if there are no indications of other errors in the protocol for receiving information, the submitted 2-NDFL certificate will be accepted by the tax authorities. This was confirmed by the Federal Tax Service of Russia in a letter dated 09/06/2017 No. BS-4-11/ [email protected]

But if an incorrect TIN is indicated, then a fine of 500 rubles for each 2-NDFL certificate cannot be avoided.

WE CONCLUSION: we don’t know the employee’s INN or we doubt its correctness - it’s better to check on the website of the Federal Tax Service of Russia “Find out INN” (https://service.nalog.ru/inn.do).

Tax reporting

VAT declaration

Organizations submit a VAT return based on the results of each quarter: for the 1st quarter, half a year, 9 months and a year. The deadlines and procedure for submitting a declaration, as well as paying tax, are specified in Article 174 of the Tax Code of the Russian Federation.

In 2021, VAT returns must be submitted within the following deadlines:

- for the fourth quarter of 2021 - until January 25, 2021;

- for the first quarter of 2021 - until April 25, 2021;

- for the second quarter of 2021 - until July 25, 2021;

- for the third quarter of 2021 - until October 25, 2021;

- for the fourth quarter of 2021 - until January 25, 2021.

Electronic VAT reporting

The VAT declaration is submitted via telecommunication channels in electronic form, through an electronic document management operator. This rule applies to all taxpayers, including tax agents who pay VAT.

Few categories of payers are allowed to report on paper.

Only tax agents who are not VAT payers or are exempt from VAT can submit a return on paper. In addition, they should not be the largest taxpayers, and the average number of their employees should not exceed 100 people. This procedure is defined in paragraph 5 of Article 174 of the Tax Code of the Russian Federation.

Payment of VAT

VAT is paid in equal installments over three months following the reporting period - quarter. Payments must be sent by the 25th of each month. For example, tax for the first quarter of 2017 must be transferred from April to June, on the following dates: before 04/25/2017, 05/25/2017, 06/27/2017*.

In addition, according to clause 5.2. Article 174 of the Tax Code of the Russian Federation, organizations that are not VAT payers and are not recognized as tax agents, if they issue invoices, are required to submit to the tax inspectorate a log of received and issued invoices in electronic form. Deadline – no later than the 20th day of the month following the expired tax period.

Income tax return

Income tax reporting is submitted quarterly: based on the results of the first quarter, half year, 9 months and year. The deadlines for reporting income tax are established by Article 285 of the Tax Code of the Russian Federation.

In the income tax return, revenue and expenses are indicated on an accrual basis from the beginning of the year.

The reporting period for income tax is quarter or month. The tax period for income tax is one year. It is important not to be confused.

The deadlines and procedure for filing a declaration, as well as the deadlines for paying advance payments and taxes are established in Articles 287 and 289 of the Tax Code of the Russian Federation.

In 2021, the income tax return must be submitted:

- for 2021 - until March 28, 2021;

- for the first quarter of 2021 - until April 28, 2021;

- for the first half of 2021 - until July 28, 2021;

- for 9 months of 2021 - until October 30, 2021*.

Organizations that make monthly advance payments for income tax submit monthly declarations no later than the 28th day of the month following the reporting month. The deadlines for filing income tax returns are determined in paragraph 3, Article 289 and Article 287 of the Tax Code of the Russian Federation.

The income tax return must be submitted electronically via telecommunications channels through an electronic document management operator.

A paper income tax return can be submitted to an organization if the average number of employees is no more than 100 people.

Declaration on property tax of organizations

Corporate property tax is paid by companies that have property on their balance sheets. The tax period for corporate property tax is a calendar year.

Please note that starting from 2021, different tax periods apply when calculating property taxes.

If property tax is calculated based on cadastral value, the reporting periods for property tax will be: I, II and III quarters of the calendar year.

If property tax is calculated from its average annual value, the reporting periods will be the first quarter, half a year and nine months of the calendar year.

The terms and procedure for paying property taxes and advance payments are established by the constituent entities of the Russian Federation. Check with your state to see if you need to submit an estimate of advance property tax payments.

Calculation of advance payments for property tax must be submitted to the tax office quarterly. Based on the results of the first quarter, half a year, nine months, it must be submitted within 30 days after the end of the corresponding reporting period.

At the end of the year, a declaration is submitted no later than March 30 of the following year.

The 2021 property tax return is due by March 30, 2021.

The 2021 property tax return is due by March 30, 2021.

The deadline for submitting a property tax return for the year is established by Article 386 of the Tax Code of the Russian Federation.

Calculations of advance payments for property tax are submitted quarterly:

- for the first quarter of 2021 - until May 2, 2021*;

- for the first half of 2021 - until July 31, 2021;

- for 9 months of 2021 - until October 31, 2021.

If the number of employees is more than 100 people, the declaration must be submitted electronically.

Transport tax declaration

Only organizations that have a registered vehicle submit a transport tax return and pay the tax. According to Article 357 of the Tax Code of the Russian Federation.

The procedure and terms for payment of transport tax and advance payments are established by the laws of the constituent entities of the Russian Federation. The date for payment of transport tax at the end of the year cannot be set earlier than February 1, in accordance with paragraph 1 of Article 363 of the Tax Code of the Russian Federation.

The transport tax declaration is submitted 1 (one) time a year no later than February 1 in accordance with Article 363.1 of the Tax Code of the Russian Federation.

If the organization has more than 100 employees, the declaration must be submitted electronically.

Land tax declaration

Organizations that own land plots recognized as objects of taxation are required to submit a Land Tax Declaration and pay this tax. Article 388 of the Tax Code of the Russian Federation.

The procedure and terms for payment of land tax and advance payments are determined and approved by the heads of municipalities. However, as a general rule, in accordance with Article 397 of the Tax Code of the Russian Federation, the tax payment date for the year cannot be set earlier than February 1.

The tax return for land tax is submitted 1 (one) time a year no later than February 1.

If the organization has more than 100 employees, the declaration must be submitted electronically.

Personal income tax reporting in 2021

All organizations with employees submit reporting to the tax office on personal income tax quarterly and annually.

Reporting on form 6-NDFL

Reporting to the Federal Tax Service on personal income tax in 2021 is submitted quarterly in form 6-NDFL. Clause 2 of Article 230 of the Tax Code of the Russian Federation.

Form 6-NDFL must be submitted in 2021:

- for 2021 - no later than April 3, 2021*;

- for the first quarter of 2021 - no later than May 2, 2021;

- for the first half of 2021 - no later than August 1, 2021;

- for 9 months of 2021 - no later than October 31, 2021.

The annual calculation in form 6-NDFL is submitted no later than April 1 of the year following the reporting year.

So, for 2021, the report in form 6-NDFL will need to be submitted no later than April 3, 2021.

For 2021, the report on Form 6-NDFL will need to be submitted by April 2*, 2021.

Reporting in form 2-NDFL

In addition to reporting in Form 6-NDFL, organizations are required to submit a 2-NDFL certificate to the Federal Tax Service. This certificate is submitted 1 (one) time per year.

Certificate 2-NDFL for 2021 must be submitted to the Federal Tax Service before 04/03/2017.*

Certificate 2-NDFL for 2021 must be submitted to the Federal Tax Service before 04/02/2018.*

If the number of individuals for whom information is submitted is up to 25 people, the organization has the right to submit reports on paper. If there are more than 25 people, you only need to report electronically.

Information on the average number of employees

Information on the average number of employees is submitted to the Federal Tax Service only 1 (one) time per year.

In 2021, information on the average number of employees must be submitted to the tax office no later than January 20, 2017.

Unified calculation of insurance premiums

A unified calculation of insurance premiums appears in the reporting of organizations from the 1st quarter of 2021.

It appeared after the transfer of control over mandatory insurance contributions to the Federal Tax Service, which in 2021 all companies paid to the funds.

All organizations that have employees submit the calculations. Reporting is submitted to the INFS quarterly: based on the results of the first quarter, half year, nine months and calendar year. In accordance with paragraph 7 of Article 431 of the Tax Code of the Russian Federation. Reporting must be provided in electronic format.

So, all organizations with employees submit a Unified calculation of insurance premiums:

- for the first quarter of 2021 - no later than April 30;

- for the second quarter of 2021 - no later than July 31*;

- for the third quarter of 2021 - no later than October 30.

Who rents

This form is submitted by all companies and individual entrepreneurs that are tax agents in relation to individuals (Article 226 of the Tax Code of the Russian Federation). In general, you need to submit 2-NDFL certificates for all persons to whom income was paid (accrued) in 2017. Certificates are submitted both for full-time employees and for employees working under GPC contracts.

The Tax Code of the Russian Federation contains a list of income that is not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation). There are several dozen such payments in total. Let's name the most common income from which personal income tax does not need to be withheld:

- maternity benefits;

- alimony;

- financial assistance to an employee in connection with the death of a family member;

- gifts to employees worth no more than 4,000 rubles;

- income paid to individual entrepreneurs (the entrepreneur pays personal income tax on his own if such an obligation arises), etc.

If during the reporting year only non-taxable payments were made to an individual, the 2-NDFL certificate does not need to be submitted. If there was both taxable income and non-taxable income, only taxable payments need to be reflected in Form 2-NDFL.

Reporting to funds

Form RSV-1 for 2021 in the Pension Fund of Russia

In 2021, you need to submit a report to the Pension Fund on form RSV-1 for 2016.

Deadline: no later than 02/15/2017 in paper form; no later than 02/20/2017 in electronic form.

Reporting is submitted electronically if the average number of employees is more than 25 people. If the company has less than 25 employees, reporting can be submitted on paper.

In the future, during 2021, the RSV-1 report does not need to be submitted quarterly to the Pension Fund. This report replaced the Unified Calculation of Insurance Premiums, which has been submitted quarterly to the Federal Tax Service since 2021.

Form SZV-M in the Pension Fund of Russia

Every month, organizations are required to report to the Pension Fund of Russia in the SZV-M form.

Reporting to the Pension Fund of Russia in 2021 in the SZV-M form must be submitted no later than the 15th day of the month following the reporting month.

Form 4-FSS

All organizations that have employees submit reports. Most organizations are required to submit reports electronically. Only organizations with an average headcount of less than 25 people can submit paper reports.

In 2021, you need to submit reports in Form 4-FSS for 2021 1 (one) time.

Further in 2021, there is no need to submit calculations using Form 4-FSS to the FSS. Instead of this form, new reporting has been introduced - “Unified calculation of employee insurance contributions”, which is submitted to the Federal Tax Service starting from the 1st quarter of 2021.

Calculation of contributions for compulsory insurance against industrial accidents and occupational diseases

Reporting to the Social Insurance Fund is submitted quarterly: based on the results of the first quarter, half a year, nine months and a calendar year.

Calculation of contributions for compulsory insurance against industrial accidents and occupational diseases for 2021 is submitted as part of the reporting in Form 4-FSS to the Social Insurance Fund.

In 2021, the Social Insurance Fund will submit the Calculation of Contributions for Compulsory Insurance against Industrial Accidents and Occupational Diseases. The calculation must be submitted to the Social Insurance Fund quarterly, starting from the 1st quarter of 2021.

The deadlines for submitting reports are established by paragraph 1 of Article 24 of the Federal Law of July 24, 1998 No. 125-FZ.

Most organizations are required to submit reports electronically. If an organization has an average number of employees of more than 25 people, then it is necessary to submit reports electronically. If the company has less than 25 employees, reporting can be submitted on paper.

Calculation of contributions for compulsory insurance against industrial accidents and occupational diseases must be submitted in 2021:

- for the first quarter of 2021 - until April 20 (on paper), April 25 (electronically);

- for the first half of 2021 - until July 20 (on paper), July 25 (electronically);

- for 9 months of 2021 - until October 20 (on paper), October 25.

Confirmation of main activity

Every year, the organization is required to confirm its type of activity with the Social Insurance Fund. This requirement was approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55.

The insurer must submit to the Social Insurance Fund by April 15:

- application for confirmation of the main type of economic activity;

- certificate confirming the main type of economic activity;

- a copy of the explanatory note to the balance sheet for the previous year (except for insurers - small businesses);

- calculation of contributions for compulsory insurance against industrial accidents and occupational diseases (from the 1st quarter of 2017).

Personal income tax 2021 – what’s new?

ATTENTION: The income tax rate in 2021 remains the same: 13%.

Below are all the innovations regarding income tax that an accountant needs to take into account in his work in 2018.

- New form of certificate 2-NDFL from February 10, 2021, according to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] and the latest changes from the order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected] More details about the new form 2-NDFL will be discussed later in this article.

- New form of certificate 3-NDFL from February 19, 2021, according to the order of the Federal Tax Service of Russia dated December 24, 2014 No. ММВ-7-11/ [email protected] and the latest changes from the order of the Federal Tax Service of Russia dated October 25, 2017 N ММВ-7-11/ [email protected]

- New form of calculation of 6-NDFL from March 26, 2021, according to the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] and the latest changes from the order of the Federal Tax Service of Russia dated January 17, 2018 No. ММВ-7-11/ [email protected]

- Payment of income tax on lottery winnings that exceed RUB 4,000. (Clause 28, Article 217 of the Tax Code). If the winnings are less than the specified limit, you do not need to pay personal income tax.

- If the lottery winnings exceed 15,000 rubles, income tax is withheld by the lottery organizer. When winning from 4,000 to 15,000 rubles, personal income tax is paid by the individual who is the recipient of the winnings.

- Compensations paid to shareholders in the event of bankruptcy of a development company from a special fund are not subject to income tax (Clause 71, Article 217 of the Tax Code).

- The successor organization is required to submit reports in Form 2-NDFL at the end of the year, if the company liquidated as a result of the reorganization did not submit such reports. Form 6-NDFL is submitted both for the quarter and for the year (clause 5 of Article 230 of the Tax Code).

- Payment of personal income tax on material benefits under a loan agreement is carried out in the following situations:

- the loan agreement is drawn up between the employee and the employer;

- the loan agreement was concluded between related parties;

- saving on interest is actually financial assistance;

- Saving on interest is the result of fulfilling a counter-obligation, for example, as payment for work, the company provided an interest-free loan to an individual contractor (subclause 1, clause 1, article 212 of the Tax Code).

Deadlines for submitting reports in 2021 for LLCs using the simplified tax system

Organizations that use the simplified tax system are exempt from paying VAT, income tax and property tax. The exception is the cases expressly specified in paragraph 2 of Article 346.11 of the Tax Code of the Russian Federation.

Organizations using the simplified taxation system of the simplified tax system maintain accounting records and, like everyone else, they must submit annual financial statements to the Federal Tax Service and Rosstat.

All organizations that have employees are required to report to the Social Insurance Fund and the Pension Fund of the Russian Federation, regardless of the taxation system they use.

The Federal Tax Service must submit information about the average number of employees and certificates in forms 2-NDFL and 6-NDFL.

The reporting procedure, timing and composition of reporting to the Social Insurance Fund and the Federal Tax Service in forms 2-NDFL and 6-NDFL are discussed in this article above. They are the same as for organizing on OSNO.

Transport and land tax must be paid if the organization has property on its balance sheet that is subject to taxation.

A declaration under the simplified tax system is submitted 1 (one) time per year.

The simplified taxation system declaration for 2021 must be submitted by March 31, 2017, either in paper or electronic form. This period is established in Article 346.23 of the Tax Code of the Russian Federation.

The declaration under the simplified tax system for 2021 must be submitted no later than April 2, 2021.

Tax for 2021 must be transferred to the budget by March 31, 2017.

Organizations using the simplified tax system must pay advance tax payments in accordance with paragraph 7 of Article 346.21 of the Tax Code of the Russian Federation within the following periods:

- for the first quarter of 2021 - until April 25;

- for the first half of 2021 - until July 25;

- for 9 months of 2021 - until October 25.

Procedure for filling out 2-NDFL

For 2021, the 2-NDFL certificate should be submitted using the updated form.

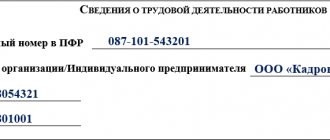

The certificate form includes five sections. In the first section you need to indicate the details of the tax agent (reporting company or individual entrepreneur).

The second section includes information about the recipient of the income. In addition to standard information about an individual, the 2-NDFL certificate must indicate the status of an individual taxpayer. There are six statuses in total. For tax residents of the Russian Federation, status 1 is assigned, for non-residents status 2–5, for foreigners on a patent, status 6 is assigned.

Section No. 3 is completed separately for each tax rate. Here you indicate income and tax deductions broken down by month. Standard, property and social deductions do not need to be reflected in this section. Here we are talking about tax deductions that apply to specific types of income (Articles 217, 221 of the Tax Code of the Russian Federation). For example, in section No. 3 you need to reflect the deduction from the cost of gifts with code 501 (the non-taxable amount of the gift is reflected up to 4,000 rubles).

Please note that the list of income and deduction codes has been supplemented (Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] ).

In the fourth section, the tax agent indicates the standard, social and property deductions provided to the individual. Also in this section you need to indicate the details of notifications that give you the right to deduct.

Section No. 5 is filled out based on the data from the previous sections. It must reflect the total amount of income, tax base, personal income tax (calculated, withheld, transferred). For each tax rate, its own section No. 5 is completed. Thus, the information in the fifth section must correspond to the data specified in section No. 3.

Important! Personal income tax from the December salary must be reflected in section No. 5, even if it is listed in January 2021. Most often, the amount of calculated, withheld and transferred tax is the same.

Certificate 2-NDLFL can be signed by:

- director of a company or individual entrepreneur - in this case, put 1 in the corresponding field;

- authorized person (chief accountant, accountant, etc.) - in this case, put 2 in the corresponding field.