What is TORG-12

A consignment note is a document that is used to document the movement of material assets and goods received from the supplier. There is a unified form used for individual entrepreneurs and legal entities. The primary documentation was approved by Decree of the State Statistics Committee No. 132.

Despite the presence of the recommended form, a completed consignment note TORG 12, which does not correspond to the unified form, can also be used. According to Tax legislation, primary documentation may not have an established template. The main thing is that the paper contains information confirming the organization’s expenses and details of the company filling out the document.

In some cases, representatives of the Federal Tax Service may refuse to accept an invoice citing the requirements of the accounting law. To avoid such an individual entrepreneur, you should know how to fill out TORG 12.

This resolution regulates only two conditions regarding the type and form of filling out this document:

- drawing up paper in two copies;

- mandatory availability of information about the parties to the transaction and the characteristics of the goods being shipped.

Since there is no sample of a completed TORG 12 invoice, which would be mandatory, individual entrepreneurs working without VAT may have difficulties with how to correctly fill out the TORG 12 invoice.

There are generally accepted rules according to which filling out invoices must be carried out for all types of business transactions. At the same time, individual entrepreneurs and LLCs can independently develop a document form that needs to be displayed in the accounting policies of the enterprise.

Knowing how to fill out TORG 12 without VAT will allow you to avoid tax problems in the year and take into account expense transactions when calculating income tax.

On video: Consignment note TORG 12

General rules

- How to set TN according to TORG-12? If the sale of goods is intended, then the basis for drawing up TORG-12 is a supply agreement. The price and quantity of products that belong to the transfer are indicated in the contract or annexes.

- The form contains information about the shipper, supplier, payer; date and number of the invoice; a table is filled in with a list of supplied products in accordance with the data in the invoice for this delivery batch; three signatures are placed.

- The invoice is prepared by the supplier of the goods.

- The sequence number is considered a property and is used to take into account the order and synchronization of processes. But at the same time, the lack of numbering is not a serious error and the document will be valid. The law does not provide for strict numbering for this document, so the type of numbering is chosen by the enterprise itself.

- The paper form must have five signatures: three on the seller’s side and two on the buyer’s side. On the supplier's side, all signatures must be required; their absence leads to tax liability.

But at the same time, there are no negative consequences for the buyer if one signature (in the “Cargo accepted” column) is missing.Two electronic signatures are placed on the electronic version, on the part of the supplier and on the part of the recipient. Both signatures are required.

- Is a buyer's stamp required on the TORG-12 document issued for the goods? The delivery note (both copies) must be certified with a seal if receipt is made without a power of attorney. Is a seal required, if there is a power of attorney and the goods are received according to it, is it necessary to simultaneously put a stamp on TORG-12 and present the document? If received by proxy, a stamp is not needed; moreover, the seller’s requirement to simultaneously affix a stamp and present a power of attorney is unlawful.

Read about why you need a bill of lading, whether it can replace a sales receipt, and from this article you will learn about the difference between an invoice and a delivery note, as well as the nuances of using both documents.

How to fill out the TORG-12 form correctly

Despite the lack of a clear form, there are rules governing the filling out of the consignment note:

- availability of two copies (one for each participant in the transaction);

- A point that the Federal Tax Service strictly monitors, especially when shipping goods for export, is the coincidence of the shipment dates indicated in the invoice with the real ones. To do this, it is recommended to fill out the form directly upon shipment or after its completion;

- the “sending organization” line must include information about the supplier, bank details and legal address;

- the field where the structural unit is indicated includes not only data about the shipper, but also a list of shipped goods and materials;

- Another important condition regulating how an individual entrepreneur fills out TORG-12 is the presence of the organization’s seal with signatures;

- the columns “ Supplier” and “ Payer” must contain information similar to that in the line about the sender;

- in the “grounds” column it is necessary to indicate the contract or other document that forms the basis of the contractual relationship between the supplier and the consignee;

- when drawing up an invoice in Excel, in each line and column you must indicate the quantity of goods, VAT, and basic information about the products supplied;

- It is allowed to make adjustments to existing samples. This is possible if you fill out the TORG 12 invoice online, which will allow you to make corrections and changes to the form in real time.

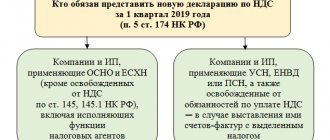

Who should apply?

This document is prepared by the shipper. How to receive goods? The goods are received by an employee of the purchasing organization . He must put a stamp and signature on the TN, or provide a power of attorney and sign (read about who should sign the columns “received the cargo”, “received the cargo” and others here).

But before putting his signature, the employee must check the inventory items for compliance with the data specified in the invoice, as well as the characteristics of quantity and quality.

If upon acceptance it is discovered that the characteristics of the goods do not correspond to the data in the document, then first of all this is documented - a report is drawn up. After the report is drawn up, a claim is drawn up and sent to the supplier along with a copy of the report.

This procedure must be completed within the deadline established by the contract (if no deadline is established, then simply as quickly as possible).

The buyer may claim in a claim that:

- refuses the product and demands a refund (if payment has been made);

- demands to transfer the missing goods (in case of shortage);

- agrees to a smaller quantity of products and requires a refund of part of the money if payment has been made.

Nuances of filling out and generating an invoice

There are some features that determine the rules for drawing up documentation for cargo turnover. When delivering cargo by a third-party organization, TORG-12 and TTN are required by power of attorney, which must comply with Form 1-T.

When delivering goods by the seller himself or through rented vehicles, you can fill out the TORG 12 consignment note online. It would be enough. Also, in addition to TN, when selling goods and materials, it is necessary to issue an invoice in 1C if the individual entrepreneur is on the simplified tax system or invoices for payment in the absence of the latter.

It often happens that the goods are picked up from the warehouse by an ordinary driver by proxy or by a forwarder. In this case, the invoice is handed over to the person who came to collect the goods and materials, who is obliged to hand it over to the consignee. If you fill out TORG-12 online for free, then the paper version of the invoice does not need to be handed over to the driver or forwarder. To carry out electronic document management, an electronic signature and registration of the right to endorse documents by authorized persons are required.

On video: Primary accounting documents. Design nuances and pitfalls

How to do TN correctly?

In printed version according to TORG-12

To compile it, it is advisable to use TORG-12. The document contains information about the seller and buyer .

How many copies need to be issued? The delivery note must be written out in two copies:

- one copy must remain with the company supplying the goods, since this is the primary accounting document for writing off the goods;

- the second must be with the organization purchasing the products, and is the right to use inventory items.

The paper version requires 5 signatures:

- three from the supplier side;

- one on the recipient's side;

- another one is placed by the person responsible for the cargo, in the line “The cargo was received by the consignee.”

You can find out how to correctly fill out a delivery note, as well as study the form and a sample of the TORG-12 form in our material.

Requirements for the electronic version

The formation of an electronic version is similar to a paper one , the only difference is that the electronic technical specification is created in one copy. It consists of two files: the first file is compiled by the seller, the second - on the buyer’s side, when sending the document.

An electronic signature is used to sign the electronic version. There should be only two signatures on the invoice - one on each side.

Thus, the paper version of the TN does not require an electronic signature; it can be compiled and transmitted without the use of a computer or the Internet.

An electronic version of the TN can be drawn up in cases where both parties have access to the Internet and everyone has an electronic signature.

Who does the design

Everything is quite simple here. According to the current rules, the consignment note in 2021 can be filled out by the owners or sellers of goods. This is possible in cases where transportation is directly carried out by the cargo owner or seller himself. Then his prerogative becomes the mandatory execution of Form 1T. There are situations when the cargo owner or seller uses the services of an intermediary. To do this, a special agreement is drawn up with the cargo carrier, which undertakes obligations to deliver the cargo to its destination. The agreement with carriers is filled out on behalf of the recipient or sender. Then both parties can fill out the invoice. In simple terms, the responsibility for issuing a bill of lading rests with the company or party that hires the freight carrier. You should also strictly adhere to the rules according to which the consignment note for the carriage of goods is filled out.

If the transported goods do not have a TTN in the package of accompanying documents, such cargo transportation may encounter serious difficulties.

What should I do if the buyer does not return the signed TN?

After the document is stamped and signed, the buyer must return the technical specification to the supplier. This is done in order to record receipt of the goods by the customer.

If the buyer does not return the invoice, the supplier has every right through the court to demand the execution of a product acceptance certificate from the recipient.

To do this, it is necessary to competently approach the evidence of the fact of delivery of the goods to the buyer. It is better to hire a lawyer to file a claim for return to court . To file a claim yourself, you need to adhere to the rules established by law.

The statement of claim is submitted exclusively in the form of a written document. The claim must indicate:

- Name of the court where the application is being filed.

- Full official name of the plaintiff.

- Full official name of the defendant.

- What are the violations of rights? Plaintiff's claims.

- Cost of claim.

- Circumstances on the basis of which claims are made.

- Proof.

- Documents attached to the application.

- The date the document was compiled.

Accounting

The rules for recording this document are not established by law, therefore the organization has the right to approve the rules for transportation and storage of invoices independently.

In most cases, a commodity report is generated at the warehouse, which is a document on the basis of which the report reflects data on the sale of objects and their cost.

Invoices are attached to the report . They are arranged in chronological order. When accounting for objects, records are kept in a journal or computer database, reflecting changes in the condition of the products that are taken into account. These entries are called entries.

Postings for receiving goods:

- Dt 41 Kt 60 – receipt of products.

- Dt 19 Kt 60 – reflection of incoming VAT.

- Dt 68-VAT Kt 19 – VAT accepted for crediting.

- Dt 44-TZR Kt 60 – cost of services of third-party companies.

- Dt 60 Kt 51 – transfer of prepayment.

- Dt 41 Kt 42 - reflection of the value of the trade margin.

- Dt 15 Kt 60 – a reflection of the actual cost of materials.

Postings for shipment of goods:

- In case payment is made later.

- Dt 90.02 Kt 43, 41 – shipment of finished delivered objects.

- Dt 62.01 Kt 90.01 – reflection of revenue including VAT.

- Dt 90.03 Kt 68.2 – the amount of VAT.

- Dt 51 Kt 62.01 - reflection of the repayment of debt for shipment.

- If prepayment has been made

- Dt 51 Kt 62.02 – crediting of prepayment.

- Dt 76.AV Kt 68.02 – VAT calculation.

- Dt 90.2 Kt 43.41 – shipment of products.

- Dt 62.01 Kt 90.1 – revenue including VAT.

- Dt 62.02 Kt 62.01 – crediting the advance to the shipment account.

- Dt 68.02 Kt 76.AB – the amount of VAT is credited from the prepayment that was made earlier.

Postings for sales of products (wholesale):

- Dt 51 Kt 62.02 – payment is credited.

- Dt 76.AV Kt 68.02 – preparation of an invoice for advance payment.

- Dt 62.01 Kt 90.01.1 – accounting for revenue from the sale of products.

- Dt 90.03 Kt 68.02 – VAT calculation.

- Dt 90.02.1 Kt 41.01 – write-off of sold units.

- Dt 62.02 Kt 62.01 – crediting the advance.

- Dt 68.02 Kt 76.AV – deduction of advance VAT.

Postings for the supply of products:

- Dt 90.2 Kt 41 – reflection of disposal of goods.

- Dt 62.01 Kt 90.1 – reflection of revenue on the sale price of objects including VAT.

- Dt 90.3 Kt 68.2 – reflection of the amount of VAT.

Read about the important rules for filling out TORG-12 with and without VAT here, and from this article you will learn how to correctly fill out a bill of lading for an individual entrepreneur.