A loan or a loan for various needs can be obtained not only from banks, large or small credit institutions, but also from an employer, and under favorable conditions, even without interest.

The modern world offers many things, the costs of which are not always included in the family budget. Lending is widespread and just as widely used. The lending market is saturated with offers, and the applicant can only choose the most profitable one for himself.

Purposes of loans to employees

If an employee can apply for borrowed funds from an employer, there is no point in going to a bank or credit institution. The employer will not require proof of income or guarantors. The terms of the loan issued can be individual for each employee, as well as beneficial to the employer himself without infringing on the rights of the borrower.

As for the benefits for the lender, the loan may involve the payment of some additional funds in excess of the agreed amount, or be issued without additional obligations. Interest-free loans to employees are a fairly common practice.

The purpose of borrowed funds can be completely different:

- providing paid treatment;

- payment for vacation in case of insufficient vacation funds;

- housing construction;

- purchase of residential real estate;

- purchasing a vehicle or a garage for it;

- purchase of necessary household appliances.

There are no legal restrictions on the use of borrowed funds received from an employer. Restrictions can be set directly by the lender himself, but here the human factor comes into play.

Features of conflict resolution

A loan to an employee from an organization is provided with the simultaneous execution of official documents regulating the relationship between the parties. Often you have to face some difficulties:

- if an employee decides to quit, the company has the right to demand that he repay the remaining debt early;

- if disagreements arise, they are initially resolved peacefully, for which negotiations are held;

- If a compromise cannot be reached, the dispute is resolved in court.

The employer does not have the right to demand early return of the previously issued amount without compelling reasons.

Applying for an interest-free loan for an employee of an organization

Having previously verbally agreed on the terms of the proposed loan and received permission from the company management, the employee can take out funds on the terms without interest or with any additional payments.

There are template documents for drawing up an agreement for a loan of financial resources. You can use them, or draw up an original agreement that has legal force and does not violate anyone’s rights. The mandatory components of the contract are:

- Conclusion date.

- Place of conclusion of the contract.

- The subject of the agreement is in this case the amount of borrowed funds.

- Deadlines for refunds.

- Interest rates (indicated even for interest-free loans).

- Rights and obligations of both parties to the agreement.

- Responsibility of the parties in all possible cases.

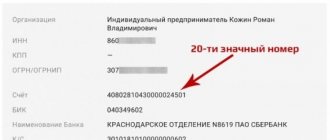

- Details of the organization and identification information about the borrower, including contact information.

This agreement must be signed by the borrower and the head of the organization, in two copies.

A separate addition may be a loan payment schedule if the amount is large enough to be paid in one lump sum. Also taken into account is the period for which the loan is issued and individual, possible agreements between the parties on the subject of the agreement.

Next, we will dwell in a little more detail on the agreement itself and the various conditions that need to be clarified when concluding it.

Terms of service

The company issues a loan to the employee on individual terms favorable to the parties. The director can approve an interest-free loan for a specific purpose or for any personal needs. The law does not provide any restrictions on loans to company employees.

The applicant usually indicates the following goals:

- Buying a car;

- Construction of a summer house, garage, etc.;

- Repair;

- Purchase of equipment;

- Education;

- Treatment;

- Rest, etc.

The Civil Code does not have requirements regarding the timing of loan provision and repayment.

As practice shows, firms issue loans for a short period - a year and a half. At the request of the borrower and with the consent of the lender, a deferment may be granted. Loans to employees are provided only in the national currency - Russian rubles. There are no additional requirements for the parties to the transaction (organizations and employees).

Applying for an interest-free loan for employees

The drawing up of an agreement (if a template form developed by government agencies is not used) occurs in compliance with all the conditions of the Labor Code and the Civil Code.

As mentioned above, the agreement must be made in two copies, one of which remains with the employer, and the other is transferred directly to the borrower. The agreement is considered to come into force as soon as it is signed by both parties.

In addition to the payment schedule, the following may be attached to the agreement:

- an act confirming the transfer of funds from the employer to the borrower;

- a receipt for receipt of borrowed funds by the applicant.

The section of duties, rights and responsibilities should stipulate various cases of behavior of the parties. Eg:

- actions of the creditor in case of untimely repayment of part of the borrowed funds specified in the payment schedule;

- payment terms in the absence of a schedule of mandatory payments (standardly, in the event of a deliberate refusal to indicate the terms for the return of funds, a time period of thirty calendar days is used from the moment the creditor contacts the issue of return);

- the presence of fines and penalties for the borrower in case of failure to meet the deadlines for repayment of funds on an interest-free (interest-bearing) loan for employees;

- the presence of sanctions for the employer or borrower in case of non-compliance with the agreement;

- return of funds by the borrower in case of dismissal from work.

The agreement itself implies an explanation of all the points that may arise in the process of relations between the lender and the borrower. In some cases, if situations arise that are not provided for in the contract, or if one of the parties disagrees with current circumstances, any party to the agreement may appeal to the courts.

When all preliminary issues have been clarified by agreement, you can proceed to the direct transfer of funds.

Payment and return of funds on a loan

The borrower can obtain the necessary financial resources in one of the generally accepted ways, which is pre-agreed in the agreement:

- cash in hand;

- transfer of non-cash funds to the details specified by the borrower.

In each of these cases, the organization’s accounting department is required to document the transfer of funds for subsequent reporting, both for internal financing and for tax authorities.

A more important issue is the method by which the borrower will return the funds received to the employer. True, there are no particular difficulties here. You can transfer funds in one of three ways:

- Depositing cash into the company's cash desk.

- Withholding borrowed funds from an employee’s salary according to an agreed schedule.

- Refund of funds to the company's accounts using the specified details in the most convenient way for the borrower (transfer through bank transactions, etc.).

An important point is the mandatory adherence to the methodology for repaying borrowed funds. This is certainly indicated in the concluded agreement and cannot be changed unilaterally - only with the consent and agreement between the employer and the borrower.

Even if an employee of an organization who took out an interest-free loan for some reason did not pay the agreed amounts according to the payment schedule, if the agreement provides for such a method of repayment, the organization does not have the right to withdraw funds through deductions from the employee’s salary.

Can a company write off debt?

Firms are allowed to forgive debts to employees, but personal income tax added to the borrowed amount will still have to be paid to the citizen. Tax is deducted from the specialist’s income until the required amount is transferred to the budget. The written-off debt is subject to taxation at the rate of 13%. For the company, such a decision is considered not very profitable, since it loses a significant amount given to the employee. Usually such actions are performed as a reward for a truly important and necessary specialist.

Taxation

Naturally, as soon as an agreement on the transfer of financial resources is concluded, the Tax Code comes into force, which implies the payment of a fee on the income received. In this case, income is considered to be the funds received by the employee, that is, the loan amount will be subject to a corresponding fee.

After the employee repays the entire debt on the issued interest-free loan, the company reports to the tax service and pays a fee for the individual’s income. It turns out that the borrower (employee) himself does not need to submit declaration papers to the tax service.

There may be some obstacle to filing, in which case the organization is obliged to inform the fiscal authority about the impossibility of submitting reporting on fees. The tax service will review the case and make the necessary decision.

The amount that the employee saved when paying interest on the loan issued will serve as the tax base for collecting income. Calculating it is not difficult - how to do this will be indicated a little below.

The rate in this case is a deduction of thirty-five percent from material benefits, but there are certain moments when an employee is exempt from this fee. If a loan is issued to an employee for the following needs:

- building your own home,

- purchase of residential real estate,

- mortgage loan calculation,

then the borrower has the right to expect to receive a tax deduction. This relaxation is available to any citizen of the Russian Federation, without exception, but you can use your right to a deduction only once. Now we can take a closer look at calculating the material benefits received by the borrower.

Tax consequences

When a company issues an interest-free loan to an employee, the latter receives a material benefit from saving on interest. This amount qualifies as income and is subject to income tax.

In some cases, interest savings are not taxable:

- The loan is issued for the construction or purchase of housing (house, apartment, room, share) in Russia;

- Acquisition of a plot for individual housing construction or a plot with a finished house.

Regarding the terms of the agreement:

- In this regard, the terms of the contract need to be thought out in advance;

- If money is actually issued for a specific purpose - the construction or purchase of housing, this must be stipulated in the contract as a separate clause;

- Otherwise, the borrower will be charged tax on the material benefit from the interest savings;

- Merely specifying this condition is not enough. The employee is obliged to provide the employer with a documentary report on the intended use of funds: purchase and sale agreement, receipts, checks, etc.

Material benefit to the borrower. Calculation method

We have already found out that the amount saved by an employee on an interest-free loan is taken as a material benefit. And it is from this that the personal income tax transferred by the employer is calculated.

Such a benefit cannot be considered until the employee has fully returned the borrowed funds to his creditor, who is the employer.

The formula for calculating the material benefit is simple - it is the product of the loan amount divided by three hundred sixty-five days, the total number of days for which the loan was issued, and two-thirds of the refinancing rate adopted by the Central Bank (the value accepted in the region on the day of the final settlement between the borrower and the lender is taken) .

The following points are especially worth mentioning:

- for the loan amount, either the full amount of financial resources included in the agreement is taken, or only the part returned by the borrower at a certain moment;

- The days that appear in the formula are the period from the day the interest-free loan is issued until the moment of its full (partial) repayment.

To better understand the situation, you can consider the calculation of material benefits using a simple example.

Employee N. enters into an agreement with the employer for an interest-free loan for a period of one hundred days. The amount of the proposed loan is sixty thousand rubles. The agreement concluded by the parties implies payment of the loan in a lump sum.

- When calculating the material benefit, a refinancing rate is taken equal to eight point twenty-five hundredths of a percent, then two-thirds of it will be five and a half.

- The sum of sixty thousand is divided by three hundred sixty-five days to obtain a value of one hundred sixty-four point thirty-eight.

- We multiply the obtained values and the number of days for which the interest-free loan was issued and we obtain the amount of material benefit of nine hundred four rubles and nine kopecks.

- Taking thirty-five percent of the result obtained, we find out that the organization must pay three hundred sixteen rubles forty-three kopecks for employee N.

When is a loan considered repaid?

The moment of loan repayment is the day when the employee fully repays the debt to the employer. If it was provided in kind, then the employee’s obligations end at the moment the property is returned.

If such a loan is repaid in partial payments represented by salary deductions, then the moment of termination of the relationship under the interest-free loan agreement will be considered the day when the entire amount is paid in full.

Bottom line

Applying for borrowed funds to an employer for a working citizen is a much more profitable undertaking than going to a banking organization or to small and large credit companies.

The positive aspects of such an event are:

- no difficulties with registration (the employer already has information about the employee);

- low interest rates, or their absence;

- freedom of negotiated conditions, limited only by law.

Obtaining an interest-free loan from an employer is beneficial for the employee, and if the company meets its employees halfway, then they, in turn, will treat their work more responsibly.

Reflection in accounting

When issuing loans to employees, it is necessary to correctly reflect this procedure in accounting. Therefore, the entries corresponding to this operation must be used for an interest-free loan to an employee. These include:

- D73.1 K50 – issuing money to an employee on the basis of a loan agreement;

- D73.1 To 91.1 - accrual of interest, which should not be higher than the refinancing rate, since otherwise the loan will not be interest-free;

- D50 or D51 K73.1 – loan repayment.

If a loan is actually provided by the company, then this indicates that the employee is responsible and serious. If the entries for an interest-free loan to an employee are incorrectly reflected, this may give rise to problems with the tax authorities. Therefore, even under an interest-free agreement, the company may need to pay taxes.