New edition of Art. 346.17 Tax Code of the Russian Federation

1. For the purposes of this chapter, the date of receipt of income is the day of receipt of funds into bank accounts and (or) the cash desk, receipt of other property (work, services) and (or) property rights, as well as repayment of debt (payment) to the taxpayer in another way (cash method).

When the buyer uses a bill of exchange in payments for goods (work, services) purchased by him, the date of receipt of income from the taxpayer is the date of payment of the bill of exchange (the day of receipt of funds from the drawer or another person obligated under the specified bill of exchange) or the day the taxpayer transfers the specified bill of exchange by endorsement to a third party.

If the taxpayer returns amounts previously received as advance payment for the supply of goods, performance of work, provision of services, transfer of property rights, the income of the tax (reporting) period in which the return was made is reduced by the amount of the refund.

Amounts of payments received to promote self-employment of unemployed citizens and stimulate the creation by unemployed citizens who have opened their own businesses of additional jobs for the employment of unemployed citizens at the expense of the budgets of the budgetary system of the Russian Federation in accordance with programs approved by the relevant government bodies are taken into account as part of income in for three tax periods with the simultaneous reflection of the corresponding amounts as expenses within the limits of actually incurred expenses of each tax period, provided for by the conditions for receiving the specified amounts of payments.

In case of violation of the conditions for receiving payments provided for in paragraph four of this paragraph, the amounts of payments received are reflected in full as part of the income of the tax period in which the violation was committed. If at the end of the third tax period the amount of payments received specified in paragraph four of this paragraph exceeds the amount of expenses taken into account in accordance with this paragraph, the remaining unaccounted amounts are reflected in full as part of the income of this tax period.

Funds of financial support in the form of subsidies received in accordance with the Federal Law “On the Development of Small and Medium-Sized Enterprises in the Russian Federation” are reflected in income in proportion to the expenses actually incurred from this source, but no more than two tax periods from the date of receipt. If, at the end of the second tax period, the amount of financial support funds received, specified in this paragraph, exceeds the amount of recognized expenses actually incurred from this source, the difference between the specified amounts is reflected in full as part of the income of this tax period.

The procedure for recognizing income, provided for in paragraphs four to six of this paragraph, is applied by taxpayers who use income reduced by the amount of expenses as an object of taxation, as well as by taxpayers who use income as an object of taxation, provided that they keep records of the amounts of payments (funds) indicated in paragraphs four to six of this paragraph.

Financial support funds received from the budgets of the budget system of the Russian Federation under a certificate for attracting labor resources to the constituent entities of the Russian Federation included in the list of constituent entities of the Russian Federation, the attraction of labor resources to which is a priority, in accordance with the Law of the Russian Federation of April 19, 1991 N 1032-I “On Employment of the Population in the Russian Federation” are taken into account as income during three tax periods with the simultaneous reflection of the corresponding amounts as expenses within the limits of actually incurred expenses of each tax period, provided for by the conditions for receiving the specified financial support funds.

In case of violation of the conditions for receiving financial support provided for in paragraph eight of this paragraph, the amount of financial support received is reflected in full as part of the income of the tax period in which the violation was committed. If at the end of the third tax period the amount of financial support funds received, specified in paragraph eight of this paragraph, exceeds the amount of expenses taken into account in accordance with this paragraph, the remaining unaccounted amounts are reflected in full as part of the income of this tax period.

The provisions of paragraph six of this paragraph apply both when spending subsidy funds after receiving them, and for the purpose of reimbursement of taxpayer expenses incurred in the tax period before receiving subsidy funds in the same tax period.

2. Expenses of the taxpayer are recognized as expenses after their actual payment. For the purposes of this chapter, payment for goods (work, services) and (or) property rights is recognized as the termination of the obligation of the taxpayer - purchaser of goods (work, services) and (or) property rights to the seller, which is directly related to the supply of these goods (performance of work, provision of services) and (or) transfer of property rights. In this case, expenses are taken into account as expenses, taking into account the following features:

1) material expenses (including expenses for the acquisition of raw materials and materials), as well as labor costs - at the time of repayment of debt by writing off funds from the taxpayer’s current account, payment from the cash register, and in the case of another method of repayment of debt - at the time of such repayment. A similar procedure applies to payment of interest for the use of borrowed funds (including bank loans) and when paying for services of third parties;

Partnerships of real estate owners, including homeowners' associations, management organizations, housing or other specialized consumer cooperatives that have entered into resource supply agreements (agreements for the provision of services for the management of municipal solid waste) with resource supply organizations (regional operators for the management of municipal solid waste) in in accordance with the requirements established by the legislation of the Russian Federation, when calculating tax as part of material expenses, funds transferred to pay for utility services are not taken into account if such funds were received by these organizations from owners (users) of real estate in payment for utility services provided to them and were not taken into account when determining the object of taxation in accordance with subparagraph 4 of paragraph 1.1 of Article 346.15 of this Code;

2) expenses for payment of the cost of goods purchased for further sale - as the said goods are sold. For tax purposes, a taxpayer has the right to use one of the following methods for valuing purchased goods:

at the cost of the first in time of acquisition (FIFO);

paragraph three is no longer valid;

at average cost;

at the cost of a unit of goods.

Costs directly related to the sale of these goods, including costs of storage, maintenance and transportation, are taken into account as expenses after their actual payment;

2.1) taxpayers - organizations whose information is included in the unified state register of legal entities on the basis of Article 19 of the Federal Law of November 30, 1994 N 52-FZ “On the entry into force of part one of the Civil Code of the Russian Federation”, which have switched to a simplified taxation system with object of taxation in the form of income reduced by the amount of expenses provided for in this chapter, has the right to take into account the costs of paying the cost of goods purchased by them for further sale during the period of activity before the date of entering the specified information, after conducting an inventory carried out in the manner in force before January 1 2015, when determining the tax base for the tax paid in connection with the application of the simplified taxation system, as the specified goods are sold in accordance with subparagraph 2 of this paragraph. Moreover, such expenses can be taken into account when determining the tax base for the tax payable in connection with the application of the simplified taxation system, only if they were not taken into account when calculating the tax payable when carrying out business activities before the date of entering information about such taxpayers into the unified state register of legal entities on the basis of Federal Law of November 30, 1994 N 52-FZ “On the entry into force of part one of the Civil Code of the Russian Federation” and Article 1202 of part three of the Civil Code of the Russian Federation;

3) expenses for paying taxes, fees and insurance contributions - in the amount actually paid by the taxpayer when independently fulfilling the obligation to pay taxes, fees and insurance contributions or when repaying a debt to another person arising as a result of payment by this person in accordance with this Code for the taxpayer amounts of taxes, fees and insurance premiums. If there is a debt to pay taxes, fees and insurance contributions, expenses for its repayment are taken into account as expenses within the limits of the actually repaid debt in those reporting (tax) periods when the taxpayer repays the specified debt or debt to another person arising as a result of payment by this person in accordance with with this Code for the taxpayer of the amounts of taxes, fees and insurance contributions;

4) expenses for the acquisition (construction, production) of fixed assets, completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets, as well as expenses for the acquisition (creation by the taxpayer himself) of intangible assets, taken into account in the manner prescribed by paragraph 3 of Article 346.16 of this Code , are reflected on the last day of the reporting (tax) period in the amount of amounts paid. In this case, these expenses are taken into account only for fixed assets and intangible assets used in carrying out business activities;

5) when the taxpayer issues a bill of exchange to the seller in payment for purchased goods (work, services) and (or) property rights, expenses for the acquisition of the specified goods (work, services) and (or) property rights are taken into account after payment of the specified bill. When the taxpayer transfers to the seller a bill of exchange issued by a third party in payment for purchased goods (work, services) and (or) property rights, the costs of acquiring the specified goods (work, services) and (or) property rights are taken into account on the date of transfer of the specified bill for the purchased goods (works, services) and (or) property rights. The expenses specified in this subparagraph are taken into account based on the contract price, but not more than the amount of the debt obligation specified in the bill of exchange.

3. Lost power.

4. When a taxpayer switches from an object of taxation in the form of income to an object of taxation in the form of income reduced by the amount of expenses, expenses related to the tax periods in which the object of taxation in the form of income was applied are not taken into account when calculating the tax base.

5. Revaluation of property in the form of currency values and claims (liabilities), the value of which is expressed in foreign currency, including on foreign currency accounts in banks, in connection with a change in the official exchange rate of foreign currency to the ruble of the Russian Federation, established by the Central Bank of the Russian Federation, in for the purposes of this chapter is not carried out, income and expenses from this revaluation are not determined and not taken into account.

USN: cash method or accrual method – 2021

The application of the accrual method provides for the recognition of income/expenses at the time of their implementation, without taking into account the fact of payment. With the cash method, the main aspect is the moment of payment.

The main accounting criterion for the cash method has not changed in 2021 - it is exclusively the movement of money (receipt/write-off). With the cash method, there are no situations characteristic of the accrual method, when work performed has not yet been paid for, but, nevertheless, their implementation is already a fait accompli, the consequence of which is the accrual and payment of tax.

There is no need to choose the cash or accrual method on the simplified tax system: “simplified” people are required to use the cash method of accounting when accounting for income and expenses. This method is the only acceptable one for enterprises operating on the simplified tax system (clause PBU 9/99 and clause PBU 10/99); there is no other alternative for them.

This principle is simple and very convenient for entrepreneurs and small companies, even if they operate by deferring payments for partners and clients.

Read also: Book of income and expenses under the simplified tax system - 2019

Cash method under the simplified tax system: accounting for income

A characteristic feature of the cash method is that income is determined by the actual amount of receipts to the account or cash register. The receipt of income in another (non-monetary) way is also taken into account, for example, by offsetting goods or transferring compensation in any form, the value of which is determined in accordance with current market prices. In this case, the income actually received will be taken into account, i.e., if, according to the concluded agreement, the amount of income exceeds that actually received, only the amount actually transferred will be reflected in the income structure.

The most important aspect in accounting for income using the cash method is the receipt of prepayment. It is also considered income and leads to the accrual of a single tax, although due to various circumstances the work may not be completed, and the advance received will subsequently be returned. Such situations are not isolated; they can be resolved by applying the norms of paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation, which stipulates that the income received in the tax period when the return was made can be reduced by the amount of the returned advance. If, during the period when the refund must be made, the company switched to a different tax regime or has no income, it will not be possible to return the excessively accrued tax amount (letter of the Ministry of Finance of the Russian Federation No. 03-11-11/204 dated 07/06/2012).

Read also: Accrual of the simplified tax system: postings

As in 1C: Accounting 8th edition. 3.0 set up the recognition of expenses under the simplified tax system?

It is extremely important for an accountant using the simplified tax system to be able to correctly determine the moment of recognition of income or expense. With income, everything is extremely simple: the date of receipt of income is the day the funds are received in the company’s current account or cash register. The amounts received immediately go into general and recognized income, on which you will have to pay tax. With expenses, everything is much more complicated. In this article we will look at how in 1C: Accounting 8th edition. 3.0 configure the recognition of expenses under the simplified tax system.

The list of expenses that we can take into account in a simplified manner is given in Article 346.16 of the Tax Code of the Russian Federation and is closed. Thus, not any costs can be taken into account, but only those that are justified and documented, listed in the specified list.

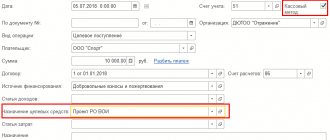

In this article we will discuss the mechanism for accepting expenses in the 1C: Enterprise Accounting program ed. 3.0. First, the user should check the accounting policies, tax and reporting settings. Here we reflect the simplified taxation system “Income minus expenses” (Fig. 1),

and also set the parameters for recognizing expenses for the purposes of the simplified tax system (Fig. 2).

If an existing organization that used the general taxation system before the transition switches to the simplified tax system, then the program must inform about this with the appropriate flag and be sure to indicate the date of transition to the simplified tax system. In the future, it will help you correctly enter account balances and registers.

Next, we move on to setting up the list of recognized expenses. For some expenses, the checkboxes are automatically selected and cannot be turned off. These business transactions represent the conditions for recognizing expenses. The user is given the opportunity to set additional checkboxes if desired. Although, usually too many boxes checked make the accountant's job more difficult. That’s why we don’t mindlessly check the boxes.

Now let's move on to describing the settings.

In the directory we can observe five types of expenses of the simplified tax system, for each of which recognition conditions are established.

- Material costs.

To reflect this type of expense in the tax base of the simplified tax system, it is necessary to generate the receipt of material and payment to its supplier. That is, we create documents “Receipt of goods” (Fig. 3)

and “Write-off from current account” with the transaction type “Payment to supplier” (Fig. 4).

Please note: documents must not only be created, but also posted! Otherwise, the entry will not end up in the corresponding accumulation register, which is responsible for the formation of KUDiR.

To fulfill the third condition, we must transfer the material to production with the appropriate “Requirement-invoice” document. Having formed the KUDiR of the simplified tax system, we will see a reflection of the operation (Fig. 5).

- Expenses for purchasing goods.

Based on the accounting policy settings, we understand that we must reflect transactions for the receipt of goods, their payment and sale. The program processes the documents indicated in Figures 6, 7 and 8.

When processing a payment received for a product or service, we must indicate the type of transaction “Payment from buyer” (Fig. 9).

Opens the KUDiR USN report, which is located in the “Reports” section (Fig. 10).

- Input VAT.

There is a condition in the list of transactions: to recognize VAT in expenses, the operation “Accepted expenses for purchased goods (works, services)” is required. Which means: we will not be able to accept input VAT as expenses until we reflect (accept) the purchased goods as expenses (Fig. 11).

- Additional expenses included in the cost price.

In the 1C program we register “Receipt of additional expenses” (the “Purchases” tab), and also pay the supplier without fail. In our example, we set the next condition for recognizing expenses - “Write-off of inventories”. In this case, the product for which we have allocated additional delivery costs, for example, must be written off from our warehouse (sold).

- Customs payments.

When forming the tax base of the simplified tax system, we must register the documents “Receipt of goods”, “Customer declaration for import” and “Write-off from the current account” to the customs authorities.

If the “Goods written off” checkbox is specified in the settings, then the taxable base will include the amounts recorded by the regulatory operation “Write-off of customs duties for the simplified tax system” in the “Month Closing” processing. Of course, this operation should be highlighted in green. This way we understand that it is relevant and there will be no distortion in the reporting.

Let's summarize.

If in the program 1C: Accounting 8th ed. 3.0 make the above settings correctly, then there will be no problems with closing the period and recognizing expenses. We would like to note that it is very important to follow the sequence of documents. If there is a violation of the sequence, the documents must be re-posted before closing the month.

If you have any additional questions about working in 1C, you can contact the 1C Expert Support Center. Our experts will remotely connect to your workplace and eliminate errors in 1C programs and documents. 1C ambulance when you need it!

Expenses: cash method in accounting under the simplified tax system

Costs under the cash method are also taken into account based on the date of payment or repayment of the debt, but the fact of payment must be confirmed. For example, a recognized expense can only be the fulfilled obligation of the supplier - the delivery/work/service is completed, and payment is a prerequisite. It is impossible to take into account the listed advance payment in costs, since confirmation of the completed operation is necessary.

In addition, there are special recognition rules for a number of costs. For example, goods purchased for resale can be included in expenses only after their sale, and the company has the right to write off expenses for the purchase of an operating system after its commissioning. In this case, the object must belong to the category of production fixed assets, and its value is evenly distributed and written off quarterly in the tax period when it began to be used.

Let's look at how the cash accounting method is used on the simplified tax system using an example.

the procedure for determining and recognizing expenses for taxpayers using the simplified taxation system (STS). The procedure for determining expenses under the simplified tax system is established in Art. 346.16 Tax Code. 1. When determining the object of taxation, the taxpayer reduces the income received by the following expenses:

1) expenses for the acquisition of fixed assets (Chapter 26.2 establishes the features of tax accounting for expenses for the acquisition of fixed assets under the simplified tax system);

2) expenses for the acquisition of intangible assets;

3) expenses for repairs of fixed assets (including leased ones);

4) rental (leasing) payments for rented (leased) property;

5) material costs;

6) labor costs;

7) expenses for compulsory insurance of employees and property, including insurance contributions for compulsory pension insurance, contributions for compulsory social insurance against industrial accidents and occupational diseases, made in accordance with the legislation of the Russian Federation;

VAT amounts on purchased goods (works and services);

VAT amounts on purchased goods (works and services);

9) interest paid for the provision of funds (credits, borrowings) for use, as well as expenses associated with payment for services provided by credit institutions;

10) expenses for ensuring fire safety of the taxpayer in accordance with the legislation of the Russian Federation, expenses for services for the protection of property, maintenance of fire alarm systems, expenses for the purchase of fire protection services and other security services;

11) rental payments for leased property (rent);

12) expenses for the maintenance of official transport, as well as expenses for compensation for the use of personal cars and motorcycles for official trips within the limits established by the Government of the Russian Federation;

13) business travel expenses, in particular for:

— travel of the employee to the place of business trip and back to the place of permanent work;

- rental of residential premises (under this item of expenses, the employee’s expenses for paying for additional services provided in hotels are also subject to reimbursement; with the exception of expenses for service in bars and restaurants, expenses for room service, expenses for the use of recreational and health facilities);

— daily allowance or field allowance within the limits approved by the Government of the Russian Federation;

— registration and issuance of visas, passports, vouchers, invitations and other similar documents;

— consular fees, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals (canal fees), other similar structures and other similar payments and fees;

14) payment to a state and (or) private notary for notarization of documents (such expenses are accepted within the limits of tariffs approved in the prescribed manner);

15) expenses for audit services;

16) expenses for the publication of financial statements, as well as for publication and other disclosure of other information, if the legislation of the Russian Federation imposes an obligation on the taxpayer to publish (disclose) them;

17) expenses for office supplies;

18) expenses for postal, telephone, telegraph and other similar services, expenses for payment for communication services;

19) costs associated with the acquisition of the right to use computer programs and databases under contracts with the copyright holder under license agreements (these costs also include costs for updating computer programs and databases);

20) expenses for advertising manufactured (purchased) and (or) sold goods (works, services), trademark and service mark;

21) expenses for the preparation and development of new production facilities, workshops and units. The above expenses are accepted subject to their compliance with the criteria specified in paragraph 1 of Art. 252 NK. In order to make a deduction, expenses must be justified, documented, actually incurred by the taxpayer in the relevant tax period, and also must not relate to expenses not taken into account for tax purposes. The expenses specified in paragraphs. 5, 6, 7, 9-21, are adopted in relation to the procedure provided for calculating corporate income tax, art. 254 (material costs), 255 (labor costs), 263 (costs of compulsory and voluntary property insurance) and 264 (other costs associated with production and (or) sale) Tax Code. The recognition procedure is established in paragraph 2 of Art. 346.17 Tax Code. Expenses of taxpayers are recognized as expenses after their actual payment. Expenses for the acquisition of fixed assets are reflected on the last day of the reporting (tax) period in accordance with the peculiarities of tax accounting for expenses for the acquisition of fixed assets under the simplified tax system.