Employees of the Ministry of Labor in Letter dated August 15, 2016 No. 16-5/B-421[1] recommended the form of a certificate of average earnings for the last three months of work, which is issued at the last place of work. This certificate is issued to a dismissed or former employee to receive unemployment benefits from the employment service at his place of residence. In the article we will remind you how the average earnings are calculated to fill out such a certificate.

According to paragraph 2 of Art. 3 of the Law of the Russian Federation No. 1032-1[2], a certificate of average earnings for the last three months at the last place of work is necessary for a dismissed employee to receive unemployment benefits from the employment service.

For your information:

The employer is obliged to issue this certificate upon a written application from the employee no later than three working days from the date of filing such an application (Article 62 of the Labor Code of the Russian Federation).

Despite the fact that the Ministry of Labor recommended the certificate form in its letter, its use is not mandatory. This means that if the specified certificate is drawn up by the employer in any form, but contains information necessary to determine the amount and timing of payment of unemployment benefits, then there are no grounds for refusing to accept it. Such clarifications are presented in letters of the Ministry of Labor of the Russian Federation dated August 15, 2016 No. 16-5/B-421, Rostrud dated November 8, 2010 No. 3281-6-2.

Note:

A citizen can obtain a certificate of average earnings for the last three months at his last place of work from an archival organization. Such a certificate will also be accepted by social security officials to calculate unemployment benefits. These clarifications are presented in paragraph 20 of the Information of the Ministry of Labor of the Russian Federation dated 03/05/2013[3].

What details should a certificate drawn up in any form contain?

So, the certificate drawn up in any form must contain the following information:

- name, TIN and legal address of the institution where the citizen worked;

- Full name of the employee;

- the period of his work and position (the same as they are indicated in the work book);

- information about working conditions (full or part-time);

- average earnings for the last three months of work;

- information about the presence, during the 12 months preceding dismissal, of periods not included during paid work - when the employee did not work, but his average earnings were retained (for example, maternity leave, parental leave, temporary disability, business trips, etc.);

- basis for issuing a certificate (personal accounts, payment documents);

- signatures of the head and chief accountant of the organization, seal impression.

Certificate form

At the request of the employee, the employer is obliged to issue him a certificate for the labor exchange. The employer has the right to draw up a document in any form indicating all the necessary indicators, but the employment service usually requires using the one recommended by the Ministry of Labor (Letter No. 16-5/B-421).

The Ministry of Labor of the Russian Federation, in order No. 62 of August 12, 2003, establishes how to calculate the average earnings for an employment center, what period to use, what payments to include.

ConsultantPlus experts discussed how to obtain a certificate of average earnings for unemployment benefits. Use these instructions for free.

Calculation of average earnings

Currently, the calculation of average earnings must be made in accordance with the Procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities, approved by Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 62 (hereinafter referred to as Procedure No. 62).

Average earnings are necessary to determine the amount of unemployment benefits paid to laid-off citizens. It is accrued to citizens from the first day of their recognition as unemployed (clause 3 of Article 31 of Law of the Russian Federation No. 1032-1). According to paragraph 1 of Art. 34 of the Law of the Russian Federation No. 1032-1 unemployment benefits for citizens dismissed for any reason during the 12 months preceding the start of unemployment, who during this period had paid work for at least 26 weeks on a full-time (full-time) or part-time basis days (part-time working week) recalculated to 26 weeks with a full working day (full working week) and recognized as unemployed in the prescribed manner, is accrued:

a) in the first (12-month) payment period:

– for the first three months – in the amount of 75% of their average monthly earnings (salary), calculated for the last three months at the last place of work (service);

– for the next four months – in the amount of 60%;

– in the future – in the amount of 45%, but in all cases not higher than the maximum amount of unemployment benefits and not lower than its minimum amount, increased by the regional coefficient;

b) in the second (12-month) payment period - in the amount of the minimum amount of unemployment benefits, increased by the regional coefficient. This period concerns unemployed citizens who are not employed after the first period of unemployment benefits. They have the right to receive unemployment benefits again, unless otherwise provided by law. The total period for payment of benefits to a citizen cannot exceed 24 months in total for 36 months (Clause 5 of Article 31 of Law of the Russian Federation No. 1032-1).

For your information: For 2021, Decree of the Government of the Russian Federation dated November 12, 2015 No. 1223 established the following amounts of unemployment benefits:

– minimum – 850 rubles;

– maximum – 4,900 rub.

Legal regulation

To better understand the basic principles of calculating average earnings, an accountant, HR employee or manager should familiarize themselves directly with the standards of legislative regulation of this issue:

- Article 139 of the Labor Code of the Russian Federation contains general principles for calculating average wages, but does not provide a detailed consideration of all possible situations.

- Decree of the Government of the Russian Federation No. 522 of December 24, 2007. This document approves standardized and currently valid complete rules for calculating the average wage of employees.

These are the basic documents you need to know to calculate the average salary. In practice, regulations that directly regulate the principles of accounting, the calculation of additional remuneration for labor, as well as many other regulations, depending on each specific case, may also be important. However, in general situations, knowledge of the above legislation will be enough to independently calculate average earnings.

Calculation period for calculating average earnings for calculating unemployment benefits

Clause 3 of Procedure No. 62 establishes that the employee’s average earnings are calculated for the last three calendar months (from the 1st to the 1st) preceding the month of dismissal.

Example 1 An employee quit on November 7, 2016. What billing period should I take to fill out the certificate?

In this case, the calculation period will be from 07/01/2016 to 10/31/2016.

Note:

If an employee quits on the last day of the month, the month of dismissal can be included in the billing period, but only if the average earnings are higher (Definition of the RF Armed Forces dated June 8, 2006 No. KAS06-151).

Example 2

The employee resigned on October 31, 2016. What billing period should be taken in this case?

In the case under consideration, the period from 07/01/2016 to 10/31/2016 can be taken as the calculation period, if the average earnings calculated for this period are greater than the average earnings for the period from 06/01/2016 to 09/30/2016. The average earnings may be higher, for example, if the employee was paid a bonus in the month of dismissal.

We draw your attention to clause 4 of Procedure No. 62, which states that days should be excluded from the billing period when:

- the employee retained his average earnings in accordance with the legislation of the Russian Federation;

- the employee received temporary disability benefits or maternity benefits;

- the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but due to this strike he was unable to perform his work;

- the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

- in other cases, the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation;

- the employee was provided with days of rest (time off) in connection with work beyond the normal working hours under the rotation method of organizing work and in other cases in accordance with the legislation of the Russian Federation.

How to determine the billing period if it consists entirely of days excluded from it in accordance with clause 4 of Procedure No. 62?

In this case, the average earnings are determined based on the amount of wages actually accrued for the previous period of time equal to the calculated one (clause 5 of Procedure No. 62). Example 3 An employee quit on the last day of maternity leave – November 7, 2016. Before this, she had maternity leave. How to determine the billing period?

In connection with these vacations, the employee was absent from work from June 20, 2013 to November 7, 2016. Thus, the billing period determined according to the general rules consists entirely of days excluded from it. Therefore, it is necessary to take the period from 03/01/2013 to 05/31/2013 as the calculated period.

How to determine the payroll period if the employee did not have actual accrued wages or actually worked days during the payroll period and before it? Average earnings in this case are determined based on the amount of wages accrued for the days actually worked by the employee in the month of dismissal (clause 6 of Procedure No. 62).

Example 4

The employee resigns on November 23, 2016. He has been working at the institution since November 1, 2016. How to determine the billing period?

In this case, the calculation period will be the period of work of this employee in the institution, that is, from November 1, 2016 to November 23, 2016.

Billing period

To calculate, you need to take the three months that precede the employee’s dismissal. The following times must be excluded from the period:

- illness, child care, maternity leave;

- being on a business trip or paid leave;

- absence from work with or without maintaining income.

There are situations when an employee quits on the last day of the month. In this case, to calculate the average monthly salary, it is allowed to use three months, taking into account the month of dismissal. It is advisable to apply this procedure if the employee received a significant bonus and the average monthly salary calculated for this period exceeds the average earnings calculated according to the general rules (Definition of the Supreme Court No. KAS06-151).

Payments that are included in the calculation of average earnings

By virtue of clause 2 of Order No. 62, when calculating average earnings, all types of payments provided for by the remuneration system applied in the relevant organization are taken into account, regardless of the sources of these payments, which include:

- wages accrued to employees at tariff rates (official salaries) for time worked, at piece rates, issued in non-monetary form;

- monetary remuneration accrued for time worked to persons holding government positions;

- wages accrued to teachers of primary and secondary vocational education institutions for hours of teaching work in excess of the reduced annual teaching load (counted in the amount of 1/10 for each month of the billing period, regardless of the time of accrual);

- the difference in the official salaries of employees who transferred to a lower-paid job (position) while maintaining the amount of the official salary at the previous place of work (position);

- wages finally calculated at the end of the calendar year, determined by the remuneration system (counted in the amount of 1/12 for each month of the billing period, regardless of the time of accrual);

- allowances and additional payments to tariff rates (official salaries) for professional excellence, class, qualification category (class rank, diplomatic rank), length of service (work experience), special conditions of civil service, academic degree, academic title, knowledge of a foreign language, work with information constituting a state secret, combining professions (positions), expanding service areas, increasing the volume of work performed, performing the duties of a temporarily absent employee without exemption from the main job, leading a team;

- payments related to working conditions, including payments determined by regional regulation of wages (in the form of coefficients and percentage bonuses to wages), increased wages for hard work, work with harmful and (or) dangerous and other special working conditions, for work at night, payment for work on weekends and non-working holidays, payment for overtime work;

- bonuses and remunerations, including remuneration based on the results of work for the year and one-time remuneration for length of service;

- other types of payments in accordance with the existing remuneration systems in the organization.

Please note: As already mentioned, clause 4 of Order No. 62 establishes periods that are excluded from the calculation. Amounts paid during this time are also not taken into account when calculating average earnings.

What payments will be included in the calculation?

When making calculations, you must include all payments that were made to the employee during the pay period. You should not include payments for time away from work (vacation, sick leave, business trips, etc.). Also, various types of compensation payments (for the use of a car) and one-time payments not related to wages (financial assistance, anniversary bonus) are not subject to accounting.

In a special manner, bonuses received by the employee are included in the calculation.

| Type of award | Accounting procedure |

| Menstrual | Fully one for each bonus basis (for example, revenue volume, number of sales) |

| For a period of more than a month: quarterly, semi-annual | In the amount of a monthly portion for each basis for each month of the billing period |

| At the end of the year | At the rate of one quarter for each base |

If any month is not fully worked, then bonuses paid for a longer period should be adjusted according to the time actually worked:

Formula for calculating average earnings

Clause 7 of Order No. 62 provides that to determine average earnings, it is necessary to use the average daily earnings, which is calculated using the formula:

| Average daily earnings | = | The amount of wages actually accrued for the billing period |

| Number of days actually worked during this period |

| Average earnings | = | Average daily earnings | X | Average monthly number of working days in the billing period (depending on the length of the working week established in the organization) |

Note:

When an employee is assigned part-time work (part-time work week, part-time work), the average daily earnings are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a five-day (six-day) work week falling on the time worked in the billing period.

Let's give an example of calculating average earnings.

Example 5

The employee resigned on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). Let's calculate his average earnings to compile a certificate for the employment service.

The amount of wages actually accrued to the employee for the billing period will be 94,000 rubles. (32,000 + 30,000 + 32,000).

The number of days actually worked during the billing period is 66 working days (23 + 22 + 21), where 23, 22 and 21 are the number of working days according to the production calendar for August, September and October 2021, respectively.

The average daily earnings of an employee will be 1,424.24 rubles. (94,000 rubles / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

Average earnings will be 31,333.28 rubles. (RUB 1,424.24 x 22 working days).

Formula for calculating average earnings with summarized accounting of working hours

Paragraph 8 of Procedure No. 62 states that when determining the average earnings of an employee for whom a summarized recording of working time is established, the average hourly earnings are used, determined as follows:

| Average hourly earnings | = | The amount of wages actually accrued for the billing period |

| Number of hours actually worked during this period |

| Average earnings | = | Average hourly earnings | X | Average monthly number of working hours in the billing period depending on the established length of the working week |

Let's give an example of calculating average earnings.

Example 6 An employee was fired on November 7, 2016. The billing period from 08/01/2016 to 10/31/2016 has been fully worked out. During the billing period, the employee was provided with a summarized recording of working time. The number of working hours according to the 40-hour workweek schedule in accordance with the production calendar for 2021 is as follows:

– in August – 184 hours, 176 hours worked, salary – 28,000 rubles;

– in September – 176 hours, 182 hours worked, salary – 32,000 rubles;

– in October – 168 hours, 170 hours worked, salary – 30,000 rubles.

Let's calculate the average employee's earnings to prepare a certificate for the employment service.

So, first we determine the average hourly earnings. It will be equal to 170.45 rubles. ((28,000 rub. + 32,000 rub. + 30,000 rub.) / (176 hours + 182 hours + 170 hours)).

The average employee's earnings will be RUB 29,999.20. (RUB 170.45 x ((184 hours + 176 hours + 168 hours) / 3 months)).

Calculation of average earnings if the employee had earnings only in the month of dismissal

Example 7

An employee quits on November 23, 2016. He works at the institution from November 1, 2016 to November 23, 2016. In this case, the estimated period of work of this employee in the institution will be. During the billing period, his salary amounted to 28,000 rubles. The employee has a 40-hour work week (five working days). Let's calculate his average earnings.

The amount of payments included in the calculation of average earnings accrued to him for this period is equal to 28,000 rubles, the number of days worked is 17. The number of working days according to the production calendar for November 2021 is 21.

The average employee's earnings will be 34,588.24 rubles. (RUB 28,000/)

17 work days x 21 workers days).

Calculation of average earnings taking into account bonuses

Clause 9 of Order No. 62 establishes the procedure for calculating average earnings taking into account bonuses depending on the type of bonus: monthly, quarterly or annual.

Let's look at each award in more detail. When calculating average earnings, you must take into account:

1) monthly bonuses and rewards - no more than one payment for the same indicators for each month of the billing period.

Example 8

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period was fully worked out by him. The employee has a 40-hour work week (five working days). In addition, he was paid a monthly bonus of 6,000 rubles. Let's calculate the average salary of an employee to prepare a certificate for the employment service.

First, we determine the amount actually accrued to the employee for the billing period. It will be 112,000 rubles. (32,000 rub. + 30,000 rub. + 32,000 rub. + 6,000 rub. x 3 months). The number of days actually worked during the billing period is 66 working days.

The average daily earnings of an employee will be 1,697 rubles. (RUB 112,000 / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

The average salary of an employee will be 37,334 rubles. (RUB 1,697 x 22 working days).

Note:

If an employee is awarded two bonuses for one indicator in one month, for the calculation it is necessary to take the bonus whose amount is greater.

2) bonuses and remunerations for a period of work exceeding one month - no more than one payment for the same indicators in the amount of a monthly portion for each month of the billing period.

Example 9

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 is equal to:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). He was also paid a monthly bonus in the amount of 6,000 rubles, and was also given a quarterly bonus in the amount of 24,000 rubles. Let's calculate the average salary of an employee to prepare a certificate for the employment service.

So, when calculating average earnings, it is necessary to take into account all bonuses paid to the employee:

– monthly bonuses in the amount of 18,000 rubles. (RUB 6,000 x 3 months);

– quarterly bonus in full, that is, 24,000 rubles. (RUB 24,000 / 3 months x 3 months).

The average daily earnings will be 2,060.60 rubles. (RUB 136,000 / 66 working days).

The average monthly number of working days in the billing period is 22 (66 working days / 3 months).

The average salary of an employee will be 45,333.20 rubles. (RUB 2,060.60 x 22 working days).

3) remuneration based on the results of work for the year, a one-time remuneration for length of service (work experience), other remuneration based on the results of work for the year, accrued for the previous calendar year - in the amount of 1/12 for each month of the billing period, regardless of the time the remuneration was accrued.

Example 10

The employee was fired on November 7, 2016. His salary for the billing period from 08/01/2016 to 10/31/2016 was:

– for August – 32,000 rubles;

– for September – 30,000 rubles;

– for October – 32,000 rubles.

The billing period has been fully worked out. The employee has a 40-hour work week (five working days). In addition, in April 2016, he was paid a bonus for 2015 in the amount of 36,000 rubles. Let's calculate his average earnings to fill out a certificate for the employment service.

The annual bonus accrued for the previous calendar year must be taken into account when calculating average earnings in the amount of 1/12 for each month of the billing period, regardless of the time the remuneration was accrued. This means that the annual bonus will be taken into account in the amount of 9,000 rubles. (RUB 36,000 / 12 months x 3 months). Thus, the average employee’s earnings will be 34,333.34 rubles. (RUB 103,000 / 66 working days x 22 working days).

4) bonuses and remunerations in the event that the time falling within the billing period is not fully worked or time was excluded from it in accordance with clause 4 of Procedure No. 62 - in proportion to the time worked in the billing period (except for monthly bonuses paid together with wages for a given month).

Example 11

The employee was fired on November 7, 2016. He was given a 40-hour work week (five working days). The billing period from 08/01/2016 to 10/31/2016 was not fully worked out by him:

– from 09/12/2016 to 09/16/2016 (five calendar days) he was on sick leave;

– from 10.10.2016 to 14.10.2016 (five calendar days) the employee was on a business trip.

In addition, during the billing period he was paid bonuses:

– in August for the second quarter of 2021 – in the amount of 18,000 rubles;

– in September for August – in the amount of 6,000 rubles;

– in October for September – in the amount of 6,000 rubles, for October – in the amount of 6,000 rubles, for the third quarter of 2021 – in the amount of 18,000 rubles.

Let's calculate the total amount of bonuses when determining the average earnings for the employment service.

The number of working days according to the production calendar for 2016 for the billing period (from 08/01/2016 to 10/31/2016) was 66 working days, and the number of days worked by the employee during this period was 56 working days.

When calculating average earnings, bonuses will be taken into account in the following amounts:

– for August 2021 – RUB 5,090.90. (RUB 6,000 / 66 work days x 56 work days);

– for September 2021 – RUB 5,090.90. (RUB 6,000 / 66 work days x 56 work days);

– for October 2021 – 6,000 rubles, since this is a monthly bonus paid along with wages for a given month;

– for the second quarter of 2021 – RUB 15,272.72. (RUB 18,000 / 66 work days x 56 work days);

– for the third quarter of 2021 – RUB 15,272.72. (RUB 18,000 / 66 work days x 56 work days).

The total amount of bonuses taken into account when calculating average earnings for an employment center will be 46,727.24 rubles. (5,090.90 + 5,090.90 + 6,000 + 15,272.72 + 15,272.72).

Note:

If an employee has worked in an organization for an incomplete working period, for which bonuses and rewards are accrued, and they were accrued in proportion to the time worked, they are taken into account when determining average earnings based on the actually accrued amounts according to the rules established by clause 9 of Procedure No. 62.

How to use the calculator

When issuing a certificate for a resigning employee for the employment service, use the convenient and easy-to-use calculator on our website to determine your average monthly earnings. Let's show with an example how to calculate the average salary for an employment service using a calculator.

Initial data

11/19/2021 driver Ivan Eduardovich Sergienko resigns. The period for calculating the average salary is August-October 2021.

For the last three months before dismissal, the employee received the following payments:

| Month of accrual/Type of accrual | Work days | Sum |

| August | ||

| Salary | 12 | 16 956,52 |

| Vacation (14.08–27.08) | 10 | 15 569,33 |

| Monthly bonus | 20 000,00 | |

| Total for August: | 22 | 52 525,85 |

| September | ||

| Salary | 18 | 24 285,71 |

| Disability benefit (09/03–09/08) | 4 | 6259,70 |

| Total for September: | 22 | 30 545,71 |

| October | ||

| Salary | 21 | 30 000,00 |

| Total for October: | 21 | 30 000,00 |

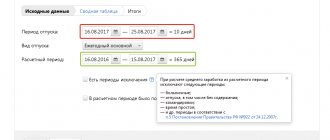

Step-by-step instructions: average earnings for an employment center, calculation using a calculator

Step 1. Enter the date of dismissal

Step 2. Enter information about payments for time worked (salary and bonus)

Step 3. Enter data on the working days that the employee was absent from the workplace (on vacation, sick leave, for other reasons)

Step 4. After filling in all the data, click the “Calculate” button and get the result of calculating average earnings

Calculation of average earnings when increasing salaries in an organization

Clause 10 of Procedure No. 62 establishes the rules for calculating average earnings when tariff rates (official salaries, monetary remuneration) increase in an organization (branch, structural unit).

In this case, the average earnings of employees increases as follows: 1) if the increase occurred during the billing period, payments taken into account when determining the average earnings and accrued for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate (official salary, monetary remuneration ), established in the month of occurrence of the event that is associated with the preservation of average earnings, at tariff rates (official salaries, monetary remuneration) of each month of the billing period.

Example 12

The employee was fired on November 7, 2016. The billing period is from 08/01/2016 to 10/31/2016. From September 1, 2016, the organization increased salaries from 28,000 to 32,000 rubles. The employee has worked out the entire pay period. Let's calculate the average salary for the employment service.

Let's determine the increase factor. It will be equal to 1.14 (32,000 rubles / 28,000 rubles).

The average daily earnings of an employee will be 1,453.34 rubles. ((28,000 rub. x 1.14 + 32,000 rub. + 32,000 rub.) / 66 working days), where 66 working days is the number of days actually worked in the billing period.

The average earnings that must be indicated in the certificate for the employment service will be equal to 31,973.48 rubles. (RUB 1,453.34 x (66 work days / 3 months)).

2) if the increase occurred after the billing period before the day of dismissal, the average earnings calculated for the billing period increase.

Example 13

The employee was fired on November 7, 2016. The billing period is from 08/01/2016 to 10/31/2016. From November 1, 2016, salaries increased from 28,000 to 32,000 rubles. The employee has worked out the entire pay period. Let's calculate the average salary for the employment service.

First, it is also necessary to determine the increase factor. It will be equal to 1.14 (32,000 rubles / 28,000 rubles).

The average daily earnings of an employee will be 1,272.72 rubles. ((28,000 rub. + 28,000 rub. + 28,000 rub.) / 66 working days), where 66 working days is the number of days actually worked in the billing period.

The average salary of an employee, which must be reflected in the certificate for the employment service, is RUB 31,919.82. (RUB 1,272.72 x (66 work days / 3 months) x 1.14).

3) if the increase occurred after the employee was dismissed, the average salary does not increase.

Indexation of payments

If there was a salary increase at the enterprise as a whole or in the department where the leaving employee worked, then the increase must be taken into account when calculating the average monthly earnings:

- if the increase occurred during the billing period, then payments before the increase are indexed;

- if after, then the average monthly salary is indexed.

The conversion factor is determined by the formula:

Let's return to our example. From November 1, salaries were increased throughout the enterprise. The salary for the driver position has been increased from RUB 30,000. up to 33,000 rub.

The conversion factor is:

We recalculate the average monthly salary, since the increase occurred after the billing period:

This is the amount that should be reflected in the certificate.