When to check?

We all know that tax and accounting legislation does not provide room for maneuver, although the work of an accountant is a creative profession (colleagues will understand). The Civil Code is much more flexible. Simply put, when concluding an agreement, conditions are included in it that will suit both parties, and they can be absolutely anything (if they do not violate the same Civil Code, Tax Code or other law).

An accountant needs a contract as a primary document; it specifies the key terms of payment, delivery, and offsets. It is not necessary that it will cover all situations, but joint reconciliations of accounts are written about quite often.

The frequency depends on:

- Volumes of supplies or work. The larger the batches of goods or the more objects you build, for example, the higher the likelihood of errors.

- Taxation systems for the supplier (and yours). Value added tax is paid monthly or quarterly (similarly to income tax), therefore, if the counterparty is on OSNO, he is concerned about the correct reflection of sales and purchases in accounting.

- Permanence of the deal. If one product has been sold for a year, there is no point in checking every month to see if anything has changed in the calculations, and vice versa: every day you ship even small batches, you need to monitor document flow and payments.

- The scope of activities of the counterparty organization. Large companies are often guided by internal instructions and directives that require regular inventory counts.

- Your internal orders.

In addition to contractual conditions, there are cases of mandatory inventory established by the Regulations on Accounting. In particular, the most famous one is before the preparation of annual reports. Force majeure, reorganization (liquidation), and cases of theft also stand out. Let's look at each in more detail later.

Annual inventory

Summing up annual results is the foundation for accounting and tax reporting. Making changes and adjustments throughout the year is easier. Once a balance has been approved and submitted, corrections of errors are generally not encouraged. Moreover, based on the results of the year, most dividends are paid and decisions are made on current activities (for example, part of the profits received is allocated to major acquisitions).

An annual inventory is carried out in relation to all payments, a reconciliation is performed for all existing obligations, including accounts payable, regardless of the number of transactions. Those. in this case, even a single sale must be verified and the confirmed balance for it must be documented.

Considering that the volume of sales, services provided and work performed for the year is decent, reconciliation begins not in the last days, but at least a month before the New Year holidays. This gives a preliminary picture of the status of settlements and time to make adjustments. The most common errors are related to the lack of documents or incorrect entry of data into the database (banal typos, incorrect use of accounts, analytics).

Several different situations can arise when errors are detected:

- until the end of the year;

- after the end of the reporting period, but before the submission of financial statements;

- after depositing the balance.

Materiality also matters. Depending on the combination of these factors, five possible solutions can be identified. I will give specific examples.

Important! The materiality criterion is determined by the organization independently. As a percentage of revenue, as a share of a balance sheet item in relation to its overall results, by the specific impact of a mistake on the decisions made by the owners, etc.

Example 1

The supplier issued an invoice on November 12, 2021, but the company's courier did not bring it to the accounting department on time, lost it, then found it and provided it only on December 18. On the date of the reconciliation—December 1, 2021—a discrepancy with the data of the supplier and buyer was revealed, but while they were clarifying the circumstances and looking for documents, time passed. What to do with the invoice? We reflect it with the date of discharge (if we haven’t closed the month and pretend that everything was fine from the very beginning) or the date of receipt of 12/18/19 (we record delivery in the incoming correspondence journal). The basis is clause 5 part 2 of PBU 22/2010. It does not matter whether the error was material.

Example 2

The individual contractor completed the repair work in August 2021, but did not provide a report, and it was impossible to contact him by phone or email. The customer did not record the expenses in accounting. The contractor wrote objections to the reconciliation report sent on December 31, 2021 (where only prepayment is indicated) and indicated that he issued the report on August 20 and this is reflected in his sales book. It turned out that the documents were sent to the wrong address. The customer received the documents already in 2021, but before the director signed the financial statements.

According to paragraph 6 of part 2 of PBU 22/2010, the identified accounting error in this case is reflected in December of the reporting year (2019). We choose December 31 as the date.

Note! In the examples described, the accounting error was detected much earlier than the date of reflection, but the problem is that the detection also needs to be confirmed. Therefore, later receipt of documents and an entry in this journal is confirmation, but conversations on the phone are not. Accordingly, you can vary the month for showing expenses (erroneously not indicated earlier).

Example 3

Let's use the conditions of the previous example, but imagine that the manager has already signed the reports, but did not have time to hand them over to the participants of the companies for review. This is where the materiality criterion comes into play:

- The error is significant - you need to enter data on December 31, 2021 and, at the same time, if the reporting has already been submitted to the Federal Tax Service, replace it with an adjusted one indicating the reasons for the adjustment. Clause 7 of part 2 of PBU 22/2010.

- The error is insignificant - we show the data already in the current 2020, and if this affected the financial results, we use account 91 (respectively, subaccount 1 “other income” or 2 “other expenses”); in our case, most likely, it is insignificant, which means that the wiring will be D 91.2 K 60 for the amount of repair work. Clause 14 of PBU 22/2010.

Example 4

Let’s take the conditions of example No. 3 again, but imagine that the balance sheet was not only signed, but also handed over to the participants. In this situation, if there is a significant error, you will have to make an adjustment on December 31 and transfer the corrected reports to those who managed to receive them, including the Federal Tax Service (clause 8 of part 2 of PBU 22/2010). Insignificant is reflected as in example No. 3 - in the current year through account 91.

Example 5

All the same initial data - the “missing” individual entrepreneur and late received documents. But let’s assume that the mistake became clear very late. The director managed to sign the accounting statements, give them to the participants, and they approved them and, possibly, distributed the profits. In order not to cause confusion in the activities of the PBU, it is allowed to reflect the error on account 84 in the quarter when it was discovered (for a significant one) or in the month of discovery on account 91 (for a non-significant one).

By the way! For organizations that use a simplified method of accounting (mainly SMP), a different procedure applies, see the last paragraph of paragraph 9 of PBU 22.

Force Majeure

Force majeure refers to circumstances beyond the control of the parties. For the purpose of mandatory inventory, the following are taken into account:

- natural disasters;

- fire;

- other emergencies caused by extreme conditions.

All cases must be officially confirmed by the police, the Ministry of Emergency Situations, the Hydrometeorological Center of Russia, the fire service and other departments.

As a result of a fire, for example, paper documents, computers, external drives, flash drives and other storage media can be destroyed. If the documentation was not saved in a cloud service or on safety flash drives, then you will have to completely restore accounting, including settlements with suppliers and contractors.

If during this period the tax office sends demands, then in your response refer to special circumstances and the inability to provide documents, but you must do everything to obtain them.

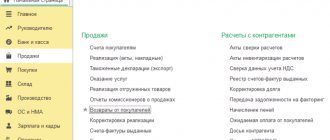

The best way to restore at least the balances at the beginning of the year is to request copies of reconciliations from counterparties. And here it must be said that modern accounting programs allow you to create a reconciliation report in various variations:

- In terms of contracts . This is convenient because... the total balance is not informative; it shows the total debt or overpayment, but does not reflect analytics.

- Broken down by object . This is more typical for the construction industry. Costs are collected object by object, and the calculation within the framework of a specific construction project is clearly visible.

- For separate accounting accounts . Settlements are not always reflected exclusively on one account - 60 or 76. It happens that both are involved in transactions for the same supplier. For example, if claims are made, settlements on them are reflected in account 76. In the settings of the reconciliation report, it is enough to check the necessary boxes and generate two separate documents - for each accounting account.

When restoring, it is advisable to request detailed reports. Entering documents, even within the framework of electronic document flow, takes considerable time; before filling the database, you will have to rely on the balances provided by counterparties.

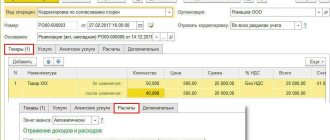

Filling procedure

The main part of the reconciliation report, which contains information about business transactions carried out by counterparties, is a table. It consists of two parts. On the left, as a rule, the activities of the organization that compiled the document are reflected. It includes four columns. The first of them indicates the serial number of the entry, the second - a brief content of the business transaction, the third and fourth - its monetary value by debit or credit. The right side of the table remains blank; The data is recorded there by the counterparty when he performs reconciliation. Thus, the act in question contains, in chronological order, records of all operations carried out by the organization, with the participation of a specific counterparty, for a certain period. After that, debit and credit turnovers are calculated, and the ending balance is determined for the required date.

Reorganization or liquidation

It is necessary to take an inventory of calculations not only in the process of activity, but also when the enterprise itself changes:

- when carrying out a reorganization (transformation from an LLC to a JSC, etc., merger - one or more others are joined to one legal entity, the reverse process - separation, merger - several legal entities are merged into one new one, the reverse procedure is division);

- complete elimination.

By the way! An individual entrepreneur is not required to carry out an inventory of payments, since he does not keep accounting records. It is recommended to carry it out when deregistering in relation to government agencies - the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, etc. and to confirm the absence of debt to suppliers. If an individual entrepreneur goes through bankruptcy proceedings, then reconciliation reports are necessary to assess the financial situation of the entrepreneur.

Reconciliation is carried out during reorganization in order to identify real settlement balances and decide how they will be distributed among new legal entities (successors) or to understand what prospects await the merging companies. Accounting statements usually do not provide analytics, and accounts payable are what worries future partners. In addition, the detailed report will also show possible bad debts.

Document status

The reconciliation act allows you not only to identify errors in accounting, but also to avoid disagreements with counterparties. If, for example, a debtor of an organization signs a document, then he agrees with the state of settlements and thereby expresses his readiness to pay the debt. The act of reconciliation with certain other supporting documents also serves as the basis for writing off bad debts after the expiration of their limitation period. A document signed by both parties is also required when the company goes to court to collect debt from the counterparty for goods supplied or services provided.

Theft of property

Theft in this case may mean the transfer of funds to a shell organization. In popular parlance - “withdrawal to offshore”. This is usually what dishonest hired managers do (and, admittedly, even chief accountants).

A company is created in the name of a figurehead, and documents are issued from this organization (for services or work, less often for goods - it’s easier to check their availability), according to which payment is made. Since beginning businessmen are usually not checked in the first year, at the end of the first reporting period the company (which most likely submitted zero reports) will close, and the money will be withdrawn or transferred to other accounts.

Considering that management is involved in the fraud, it is difficult to calculate the theft, but if an ordinary employee is involved in it, for example, a purchasing manager, then the accountant may notice deviations: the appearance of a new, recently registered counterparty or a one-time purchase or service not justified by necessity. For example, purchasing cartridges for equipment whose brand is not among the organization’s property.

Regular reconciliation in a large company helps to identify such transactions and “one-time” suppliers. It may seem that in order to obtain a visa on the account you will have to connect management, but for small purchases they do not go to the general director or chief accountant; they are approved by lower-ranking bosses, who are not necessarily concerned about verification. It is easier for an accountant to bring together information to notice non-standard transactions.

As for accounting. If goods were delivered according to the documents, then they either continue to be listed in the warehouse, or were “sold” to another one-day company (with OSNO it is dangerous to carry out the scheme, there are many checks, including counter ones). In the warehouse, the absence of goods is detected using inventory. For more information on how to formalize the results, read the article “Writing off inventory shortages.”

If services were purchased, you will have to make a correction in the BU (and in the NU, if the base was underestimated, but in the NU this happens in the period when the error was made, i.e. it is necessary to resubmit the declarations), the errors are corrected using the methods described above, depending from the discovery period. The perpetrators are brought to justice (including criminal liability). When such persons are not identified, companies have the opportunity to take into account lost money in income tax expenses (see Letter from the Ministry of Finance dated 12/17/18), but the absence of the culprit must be documented. Under the given conditions this is hardly realistic.

Signing Rules

The document must be signed by the director and chief accountant of the company. The organization's seal is placed in the space provided for this purpose. It should catch the last couple of letters of the signatures. In the absence of the manager or chief accountant, the reconciliation act is certified by the signatures of other officials of the organization who have the right to sign such documents. At the same time, their position is indicated.

Settlement

When offsetting mutual obligations, reconciliation acts are the main document. They confirm that each party is a supplier and a buyer, or reflect other types of debt. Let’s say Organization “A” bought goods from Organization “B” and owes it money, and “B” previously took out a loan and, in turn, turned out to be a debtor.

Note! The Civil Code provides for the possibility of unilateral set-off (Article 410), provided that this is not prohibited by law or contract.

The most common questions when offsetting: when to reflect income on the simplified tax system, at what point to take into account loan repayment, payment of interest or penalties, etc. The legislation says: in accounting as of the date of signing the act. It confirms that the parties have repaid their mutual obligations, which means they have actually made the payment.

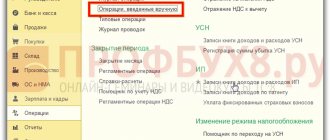

Tax accounting depends on the tax return system. For example, with the simplified tax system on the date of the act, income or expenses will be taken into account, because accounting uses the cash method, and with income tax nothing will change if the accrual method is used, because we are talking only about calculations.

Document form

Each enterprise can develop and approve its own form of reconciliation report, which will suit all interested parties and will allow the inspection to be carried out correctly. Regulatory acts do not provide for a unified form of this document. But, since it is primary, when drawing it up, all the requirements imposed by law for the preparation of this type of documentation must be taken into account. In particular, the reconciliation report must have the following details:

1. Name.

2. Date of its formation.

3. Information about the compiler.

4. Brief summary of the operation performed.

5. Meters of the specified business transactions.

6. Indication of the positions of persons responsible for recording business transactions and documenting them.

7. Handwritten signatures of the indicated officials.

Receipt of payments from third parties. Tripartite act and reconciliation

A special case is when you repay the debt to the supplier not yourself, but with the help of a third party. This is a complex procedure and several important steps must be completed:

- Make sure that the method of repayment by a third party is permitted (or at least not prohibited) by the agreement.

- Discuss with the supplier the acceptance of money. Possible problems:

- an individual will pay, but the supplier does not accept such payments, because does not use an online cash register;

- the supplier will not accept payment from a specific organization, because does not consider it reliable (previously payments were checked, the account was blocked, documents were requested for counter verification, requests were received from the Federal Tax Service, etc.);

- The supplier's account is blocked, and, unlike the first point, he wants to receive cash.

- Draw up reconciliation reports and make sure that the data matches, including in terms of contracts (if there are several of them). Moreover, a reconciliation must be carried out both with the supplier and with a third party if it is repaying the debt to fulfill its own obligations to you. Example: LLC Romashka supplied equipment worth 100,000 rubles to JSC Lyutik. At the same time, Buttercup sold other equipment to Rozochka LLC for the same amount. The account of JSC Buttercup was blocked due to failure to submit a declaration. In order not to delay payment to the supplier, “Lutik” turned to “Rozochka” with a request to transfer funds not to his account, but to the account of Romashka LLC. During the reconciliation, it turned out that “Rozochka” had previously made an advance payment for several shipments of goods at once, exceeding 100 thousand rubles (the accountant of “Lutika” accidentally reflected the received amount not on 60, but on 76 account and did not see the advance payment in the turnover sheet), so she refused transfer funds.

- Prepare the text of letters: to a third party with a request to pay the debt (indicated in the payment order in the purpose of payment) and to the supplier with a request to accept payment (the basis for the supplier to correctly accept it for accounting and reflect analytics). Or draw up a tripartite netting act indicating who owes what to whom, for what, and what debts are offset. Then the basis for all operations will be the act.

Important! The third party does not necessarily have a debt to you, but cannot simply transfer money. It is necessary to conclude, for example, a loan agreement, which indicates the purpose and details for the transfer.

The last thing I want to talk about is the inconsistent reconciliation of calculations. Every accountant has encountered errors in supplier (contractor) accounting. This is especially true when working with individual entrepreneurs who do not keep accounting records. With entrepreneurs, I recommend conducting reconciliation at least monthly, and if there are a large number of shipments (you sell small lots for retail daily or several times a day), then weekly.

There are quite bleak encounters with reconciliations: during the restoration of accounting (after an emergency, a careless colleague, or when the participants suddenly decided to resurrect a business that had long since died). The only way to go is through negotiations. If there are liquidated counterparties who cannot provide reconciliations, follow the principle of exclusion - restore everything that is possible, and assign the rest to those liquidated ones.

Advice from the chief accountant: save electronic document databases, scans and archives of accounting programs on external media stored personally with you (if permitted by the employer’s regulations, since the information contains both personal data and trade secrets), on a special server (cloud storage) or with an authorized persons (system administrator, manager), i.e. anywhere, anywhere, but physically in a location other than the main office. Many of my colleagues scan ALL primary documentation and save it in the archive.