Is it true that residents of the Krasnoyarsk Territory are entitled to salary increases?

Exactly. Krasnoyarsk Territory is a region with special climatic conditions. It has regional coefficients and northern allowances, which increase the federal minimum wage (minimum wage).

The minimum salary level, taking into account bonuses and regional coefficients in the region from the beginning of 2021, is:

- Norilsk, Taimyr (Dolgano-Nenets) district, Khatanga village - 31,538 rubles;

- Turukhansky district (north of the Nizhnyaya Tunguska and Turukhan rivers), Evenkiy district (north of 63 north latitude) - 29,112 rubles;

- North Yenisei district, Evenki district (south of 63 north latitude) - 27,899 rubles;

- Turukhansky district (south of the Lower Tunguska and Turukhan rivers) - 25,473 rubles;

- Kezhemsky district - 25,473 rubles;

- Boguchansky, Yenisei, Motyginsky districts, the cities of Yeniseisk, Lesosibirsk - 21,834 rubles;

- other districts - 19,408 rubles.

+7 ext. 143 (St. Petersburg and region)

Good afternoon. I am 25 years old. Born and registered in Novosibirsk. I have been living and working in Nizhnevartovsk for a year (I am not registered and there is no temporary registration in this city). Do I have the right to receive northern allowances without having a residence permit in this city (Nizhnevartovsk)?

Northern allowances Nizhnevartovsk

Good afternoon. I am 25 years old. Born and registered in Novosibirsk. I have been living and working in Nizhnevartovsk for a year (I am not registered and there is no temporary registration in this city). Do I have the right to receive northern allowances without having a residence permit in this city (Nizhnevartovsk)?

The “special” zone contains tundra and arctic deserts. The soil practically does not warm up during the short summer and there is always “permafrost” underfoot. Because of the cold, nature is unusually scarce in both plant and animal resources.

So, for example, if the head of an organization opened in the Far North lives and works in a branch located in the central region of the country, then receiving a “northern” salary supplement will not be available to him personally, and only those employees who carry out work will be able to take advantage of it. activities directly in the North.

How are regional coefficients calculated in Khanty-Mansi Autonomous Okrug, Yamal-Nenets Autonomous Okrug and other regions?

Application of regional coefficients, for workers employed in the regions of the Far North, as well as whose work is of a certain nature, the following conditions apply:

The procedure for establishing regional coefficients is regulated by the Law of the Russian Federation No. 4520-1 of February 19, 1993 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas”, as well as Chapter 50 of the Labor Code of the Russian Federation “Features of regulation labor of persons working in the Far North and equivalent areas." To determine the regions of the Far North and areas equivalent to them, the List of regions of the Far North and areas equivalent to areas of the Far North is currently used, which was approved on November 10, 1967 by Resolution of the Council of Ministers of the USSR No. 1029 (with subsequent additions). In accordance with Article 316 of the Labor Code of the Russian Federation, the size of the regional coefficient and the procedure for its application for calculating wages of employees of organizations located in the regions of the Far North and equivalent areas are established by the Government of Russia. Considering that such regulatory documents have not yet been adopted, when determining the size of the regional coefficient, they are currently guided by the information letter of the Department for Pensions of the Ministry of Labor of the Russian Federation dated 06/09/2021 No. 1199-16. This letter systematizes the following regional coefficients, taking into account previously adopted legal regulations of the USSR and the Russian Federation. 1. Areas where a coefficient of 2.0 is applied to employee wages: Islands of the Arctic Ocean and its seas (except for the White Sea islands and Dikson Island); Republic of Sakha (Yakutia) - areas where enterprises and construction sites of the diamond mining industry are located, at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines, Nizhnekolymsky district, the village of Ust-Kuiga, Ust-Yansky district; Sakhalin region - North Kuril, Kuril, South Kuril regions; Kamchatka region - Aleutian region; Chukotka Autonomous Okrug is the entire territory of the Autonomous Okrug. 2. Regions where a coefficient of 1.80 is applied to employee wages: Krasnoyarsk Territory - Norilsk and populated areas subordinate to its administration; Murmansk region - Murmansk-140. 3. Regions where a coefficient of 1.70 is applied to employee wages: Republic of Sakha (Yakutia) - Lensky district (north of 61 degrees north latitude), Mirny and settlements subordinate to its administration; Magadan region - the entire territory of the region; Murmansk region - town. Fog. 4. Regions where a coefficient of 1.60 is applied to employee wages: Komi Republic - the city of Vorkuta and settlements subordinate to its administration; Republic of Sakha (Yakutia) - Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Verkhnevilyuysky, Verkhnekolymsky, Verkhoyansky, Vilyuysky, Zhigansky, Kobyaisky, Nyurbinsky, Mirninsky, Momsky, Oymyakonsky, Oleneksky, Srednekolymsky, Suntarsky, Tomponsky, Ust-Yansky (except for the village of Ust -Kuiga) and Eveno-Bytantaysky districts; Taimyr (Dolgano-Nenets) Autonomous Okrug - the entire territory of the Autonomous Okrug; Evenki Autonomous Okrug - the northern parts of the Evenki Autonomous Okrug (north of the Lower Tunguska River); Krasnoyarsk Territory - Turukhansky (north of the Lower Tunguska and Turukhan rivers) region, areas located north of the Arctic Circle (with the exception of the city of Norilsk and settlements subordinate to its administration), the city of Igarka and settlements subordinate to its administration; Khabarovsk Territory - Okhotsk region; Kamchatka region - the entire territory of the region (with the exception of the Aleutian region); Koryak Autonomous Okrug - the entire territory of the Autonomous Okrug; Sakhalin region - Nogliki, Okha districts, Okha. 5. Regions where a coefficient of 1.50 is applied to employee wages: Komi Republic - the city of Inta and settlements subordinate to its administration; Republic of Sakha (Yakutia) - town. Kangalassy; Republic of Tyva - Mongun - Taiginsky, Todzhinsky, Kyzylsky (territory of Shynaan rural administration) districts; Nenets Autonomous Okrug - the entire territory of the Autonomous Okrug;

Tyumen region - Uvat district;

Khanty-Mansiysk Autonomous Okrug - the northern part of the autonomous okrug (north of 60 degrees north latitude); Yamalo-Nenets Autonomous Okrug - the entire territory of the Autonomous Okrug;

Tomsk region - Alexandrovsky, Verkhneketsky, Kargasoksky, Kolpashevo, Parabelsky and Chainsky districts, the cities of Kedrovy, Kolpashevo, Strezhevoy.

We recommend reading: Can bailiffs seize your only home after they have blocked a bank card?

Persons working in the regions of the Far North and equivalent areas are paid a percentage increase in wages for length of service in these areas or areas (Article 317 of the Labor Code of the Russian Federation).

Northern allowance and regional coefficient in Khabarovsk

- Salary from the date of entry into position (that is, actual earnings, including base and official salary, salary schedules).

- Additional payments to wages, including amounts for length of service (continuous service).

- Bonuses based on the results of the production year.

- Allowances for existing categories (tariff rates), excellence and academic degrees.

- Compensation for work at night, in dangerous or harmful conditions.

- Payments for temporary employment relationships and seasonal work.

- Minimum wage.

- Payments to employees working part-time or part-time.

- Pension (the right to use the regional coefficient when calculating a pension is retained only if you live in the territory for which such allowances are applied).

- 2.0 for workers on the islands of the Arctic Ocean and the seas related to it (except for Dikson Island and the White Sea islands). This also includes some areas of the Sakha Republic, the Kuril regions (Southern and Northern) and islands, Chukotka Autonomous Okrug;

- 1.8 for Murmansk-140, the city of Norilsk and its administrative entities;

- 1.7 for the Lensky district, the city of Mirny and its administrative entities. In addition, such an additional payment is due to residents of the town of Tumanny (located in the Murmansk region);

- 1.6 for Vorkuta and its administrative entities, for most districts of the Sakha Republic (Anabarsky, Abyisky, Bulunsky, Verkhoyansky, Oleneksky, Zhigansky, Mirninsky, etc.). The same coefficient is provided for the Turukhansky district of the Krasnoyarsk Territory, the city of Igarka and the settlements that are located next to it, for areas located north of the Arctic Circle;

- 1.5 for Inta and all administrative entities of this city (Komi Republic). In addition, this coefficient is valid in the Khanty-Mansi Autonomous Okrug, the town of Kangalassy (Yakutia), some areas of the Republic of Tyva and throughout the Yamalo-Nenets Autonomous Okrug;

- 1.4 for the Republic of Sakha, the city of Kem and surrounding settlements, the entire Republic of Tyva and a number of other settlements;

- 1.3 for Karelia, Buryatia, Komi, Evenki Autonomous Okrug and Krasnoyarsk Territory, Amur, Irkutsk, Chita, Tomsk and other regions (the most widespread coefficient);

- 1.2 for some cities of the Komi and Buryatia republics, for the Primorsky, Khabarovsk territories and the entire Arkhangelsk region;

- 1.15 for the whole of Karelia.

We recommend reading: At what age does the veteran of labor benefit apply?

In addition, for violating labor legislation, the director of an enterprise may be held administratively liable in the form of a fine of 1 thousand to 5 thousand rubles, and the legal entity itself may be fined in the amount of 30-50 thousand rubles. , or he faces suspension of work for a period of up to 90 days. If the violation is committed repeatedly, and the official has previously been brought to administrative liability under a similar article, then a more severe penalty is applied to him - disqualification for a period of 1-3 years.

What is not covered?

In this situation, it is necessary to follow the law. As the main criterion for calculating regional coefficients and bonuses to a worker’s salary, he singles out work in the relevant region, and not the employee’s place of residence or registration. Therefore, in this case, you will have to pay an additional payment to your salary.

- vacation pay, since they are calculated on the basis of the full salary, and that, in turn, is calculated taking into account regional allowances;

- financial assistance if it is paid one-time and not on an ongoing basis, and the accrual rules are not specified in the collective agreement;

- periodic bonuses;

- travel expenses if the trip is to a region for which a regional coefficient has not been established;

- when calculating the “northern” bonus, since a separate increasing indicator is provided for work in the Far North, increasing the same income group of employees involved in such conditions.

What other allowances are there?

Supplements can be not only northern. In Art. 149 of the Labor Code states that the employer is obliged to pay additionally for:

- dangerous, harmful and difficult working conditions;

- for working in harsh climatic conditions (for example, if the employee spends the whole day outside);

- for night work, if the schedule is not shiftable;

- if the employee performs work that requires a high level of knowledge and skills;

- if the employee combines several positions.

The list of work that an employee is required to perform is determined by the employment contract, so read it carefully when you sign it, otherwise you will not be able to demand a salary increase.

Conditions and procedure for calculating northern allowances

It is worth noting that small businesses and private entrepreneurs will be able to take advantage of this right; state and municipal institutions are obliged to charge additional payments in the manner previously established by law.

Conditions and procedure for calculating the regional coefficient

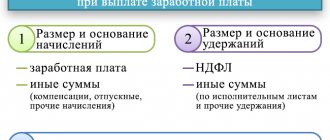

These additional payments are mandatory for all categories of employees working both permanently as part of the organization’s staff and part-time, remotely or on a rotational basis. They are used when calculating the following types of cash payments:

The district coefficient increases the size of the financial payment by a certain percentage. The accounting department calculates payments according to the usual scheme valid for the entire country, and then multiplies the resulting figures by its regional coefficient.

- Art. 316 of the Labor Code says that regional indexing coefficients are set directly by the Government of the Russian Federation, which does not exclude the possibility of additional “additions” from local budgets;

- Art. 146, art. 148 Labor Codes decipher in detail the concept of RK as a state-guaranteed supplement to various types of payments for working citizens;

- the territories in which the fixed RK will be relevant are given in Resolution of the Ministry of Labor dated September 11, 1995 No. 49;

- Art. 10 of Federal Law N 4520-1 of February 19, 1993 covers in detail the “northern” allowances.

Who can qualify for regional surcharges?

- 10% for the first six months of work;

- every 6 months there is a 10% increase up to the established limit of 80%, and in some areas - up to 100%;

- territories equated to the Far North allow you to increase the bonus by 10% only after a year of work and do this once a year with an increase of up to 50% (in some regions up to 30%);

- special standards are relevant for young specialists (up to 30 years of age) - they receive a double increase (20%) at an accelerated rate, starting from the first working day, if they have lived in the given region for 5 or more years before starting work.

The amount, conditions and procedure for compensation of expenses associated with moving from the regions of the Far North and equivalent areas to the persons specified in part six of this article are established by the Government of the Russian Federation.

In addition to the additional leaves established by law, provided on a general basis, persons working in the northern regions of Russia are also provided with additional annual leave of duration as compensation:

Northern allowances in 2021-2021

By Decree of the Government of the Russian Federation of January 31, 2021 N 60, changes were made to paragraph 7 of Section I, which come into force from the date of official publication of the said resolution and apply to legal relations arising from January 1, 2021.

More to read —> How the Benefits for Labor Veterans of the Ryazan Region are Calculated for Paying Housing and Utilities in Ryazan

Tomsk region - Aleksandrovsky, Verkhneketsky, Kargasoksky, Kolpashevo, Parabelsky and Chainsky districts, municipal formation "City of Kedrovy" (Kedrovy, Pudino village, villages of Ostanino, Kalininsk, Rogalevo, Tavanga and Lushnikovo), cities. Kolpashevo, Strezhevoy and Seversk;

Can an employer make salary increases on his own initiative?

Certainly. The employer, interested in ensuring that employees do not leave him and work more efficiently, rewards employees with rubles. However, the law does not regulate the amount of additional remuneration. Here are some examples of allowances.

Thus, a bonus can be received for mentoring - when experienced employees teach young employees the intricacies of the work process. Or for a high professional classification, having an academic degree, access to state secrets or knowledge of foreign languages.

Payments as a measure to reward employee achievements are established at any time, and employees are given additional warning before canceling them.

The law does not regulate the amount of additional remuneration

Surcharge percentage

- it is accrued only for “labor” payments as a percentage of the salary, without taking into account the northern coefficient, and also without taking into account: travel allowances;

- vacation pay;

- material assistance;

- other one-time payments.

Supplement after 30 years

The effect of the district coefficient in 2021-2021 applies to pensions and benefits only at the time when a person lives in a given region. If you change your place of residence to a more favorable one, the premium will be reduced (or completely canceled).

May 06, 2021 yuristco 127

Share this post

- Related Posts

- How much does a cube of hot heating water cost?

- Benefits for Labor Veterans for Payment of Electricity in 2021 in the Moscow Region

- Adjustment of Calculation of Insurance Premiums If SNILS was Incorrectly Indicated

- How many people will join the army in 2021

If my employer doesn't pay bonuses, how can I get them?

The minimum wage does not include the regional coefficient for work in the regions of the Far North and in areas equivalent to them (detailed clarifications were given by the Constitutional Court in April 2019).

An important clarification: if an employee works part-time, the salary will be less than the minimum wage, in proportion to the schedule.

Supplements can be not only northern, but also related to the direct skills and abilities of the employee.

If you suspect that your employer is deceiving you, apply for protection of your rights to the labor inspectorate in the territorial affiliation of the employer (complaints are accepted online) or to the prosecutor's office. To do this, you will need a written application, to which you must attach written evidence of infringement of wage rights:

- certificates from the accounting department;

- salary account statement;

- a written explanation from the employer (if he provided it) and other documents.

What is the regional coefficient

All employees, regardless of the organizational and legal form or type of activity of the enterprise, working and living in areas experiencing difficulties with the following basic conditions can apply for a regional supplement:

When not applicable

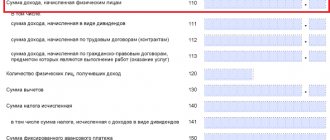

- Minimum wage and payments calculated from the minimum wage;

- basic salary, wage rate, that is, all income from work received by the employee;

- compensation, incentives, bonus payments and allowances;

- increase for hazardous work or work in dangerous conditions;

- temporary disability benefits;

- wages of part-time workers and employees under GPC agreements;

- contributions to the Pension Fund;

- additional payments established in accordance with the provisions of the collective agreement.

The difference between the coefficients for different regions is quite significant. So, for Muscovites this figure is 2.0, and for residents of the Leningrad region - 1.3. Where does such a big difference in calculations come from?

Below is a detailed table of coefficients for the MTPL territory in 2021. With its help, you can clarify how the cost of the policy depends on the region in which the vehicle is operated. Please note: for car owners who are individuals, the territorial coefficient is indicated depending on the place of registration of the owner.

Why is the MTPL insurance ratio different by region?

The cost of a compulsory insurance policy depends on the basic tariffs of the insurance company established for the current year and additional adjustment factors that are the same for all. The final price of insurance is also influenced by the territory in which the vehicle will be used.

With cumulative accounting of working hours, a shift method and seasonal work organization, bonuses are accrued on earnings not exceeding 400 rubles per month when working the monthly standard hours. In cases where the time actually worked according to the schedule in the billing month is less or more than the monthly norm of hours, bonuses are accrued on earnings calculated in proportion to the time worked according to the schedule in hours, according to the formula:

We recommend reading: Amount of state pension for Chernobyl victims in 2021

Lawyer Anisimov Representation and defense in court

In accordance with the above, to the basic amounts of one-time state benefits for insured persons (employees), and persons not subject to compulsory social insurance in case of temporary disability and in connection with maternity, living in the central and southern regions of the Krasnoyarsk Territory and the city of Krasnoyarsk, should apply the regional coefficient established centrally - 1.20.

We recommend reading: How to find out whether a land plot is registered in the cadastral register online

By Order of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 3 (hereinafter referred to as Instruction No. 3), wage supplements established by the Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions dated April 6, 1972 No. 255 are paid to all employees of enterprises, institutions, organizations, regardless of form properties located, including in the southern regions of the Krasnoyarsk Territory . In this territory, guarantees and compensation are provided as provided for by Resolution of the Council of Ministers of the RSFSR dated October 22, 1990 No. 458.

Regional coefficient by regions of Russia in 2018: what is it, what payments does it affect, table

Important! The additional payment that is due for the use of the regional coefficient should be assigned to employees who live and operate in the regions specified in the list, regardless of the form of ownership of their places of work. The coefficient should be used for all people without exception with employment contracts from the very moment of their employment.

We recommend reading: How to register a real estate property without documents

When appointing it, transport accessibility, infrastructure of the place of residence, environmental conditions and other indicators are considered. Companies can also determine their own coefficients, but they should not be lower than those established by law in the region.