The accounting policy (AP) is a “particularly important” document that contains aggregate information on the maintenance of accounting and tax accounting methods at the enterprise (primary observation, cost measurement, current grouping and generalization of the results of economic activity facts).

The purpose of creating a management program is to ensure the possibility of combining all accounting information about the situation in the company. The UP contains the financial and economic indicators of the company, the procedure for their formation and what these indicators reflect.

In trade, as well as for other industries, accounting policy is an important element of the system of internal control over activities.

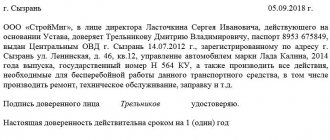

The regulations of the legislation of the Russian Federation stipulate that the UE is formed by the chief accountant, or the person responsible for this area of work.

Each individual economic entity independently forms its own management system, which is based on the facts/conditions of conducting business activities.

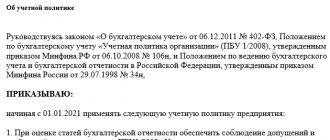

When drawing up the UE, the following regulations must be applied:

| • Law “On Accounting” dated December 6, 2011 No. 402-FZ; • PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n; • Tax Code of the Russian Federation (Article 313); • other regulations (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, letters and clarifications of the Ministry of Finance, etc.); |

These regulations set out the basic principles and requirements for drawing up accounting policies necessary for carrying out activities.

On what basis is the organization’s accounting policy formed?

The accounting policy of the organization is formed on the basis of the rules set out in:

- PBU 1/2008 “Accounting policies of the organization” (for accounting purposes);

- Tax Code (for profit tax purposes).

Therefore, accounting policy includes at least two concepts - accounting policy and tax policy. Let's see what definitions the regulatory documents give it:

“The accounting policy of an organization is understood as the set of accounting methods adopted by it - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity” (clause 2 of PBU 1/2008).

“Accounting policy for tax purposes is a set of methods (methods) permitted by this Code for determining income and (or) expenses, their recognition, assessment and distribution, as well as taking into account other indicators of the taxpayer’s financial and economic activity necessary for tax purposes” (Article 11 NK).

As you can see, there are no fundamental differences, and the essence is the same. Both accounting and tax accounting policies are a list of accounting methods chosen by an organization (accounting and tax), when it has such a right to choose.

Creating an accounting policy in an organization

In this article we will take a closer look at accounting policies for accounting purposes. PBU 1/2008 does not contain detailed instructions on how to compose it and does not provide ready-made formulations. We can only find a list of information required for disclosure (clause 4 of section II) and principles of formation (clause 5 of section II).

What is included in the accounting policy:

- working chart of accounts;

- forms of primary accounting documents, documents for internal reporting;

- forms of accounting registers;

- inventory procedure;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business operations;

- other solutions necessary for organizing accounting.

How exactly all this information will be described is a personal matter for the organization.

When drawing up an accounting policy, include in it only rules for those transactions that are currently occurring in the organization. For example, if you do not have intangible assets or financial investments, and this is also not planned in the near future, then there is no need to write about it.

Why? It is possible that by the time these operations finally appear in the organization, the accounting rules will change. Or in general, the option chosen in advance will not work. But if you haven’t chosen methods in advance, then when new operations appear, you can describe the rules for their reflection at the moment of their appearance. And this will not be considered a change in accounting policy (clause 10 of PBU 1/2008).

GLAVBUKH-INFO

All organizations have the right to independently develop their accounting policies, guided by the legislation of the Russian Federation and regulations governing accounting.The purpose of accounting policy is to enable users of accounting information to objectively judge the state of affairs in the organization.

The accounting policy of an organization is understood as the set of accounting methods adopted by the organization - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity.

Accounting methods include:

- grouping and assessing facts of economic activity;

- repayment of assets;

- organization of document flow;

- inventory of property and financial obligations;

- application of accounting accounts;

- information processing and other appropriate methods.

All of the above methods of accounting are described in detail in the previous chapters of this manual.

The accounting policy of an organization for accounting purposes must be formed by the chief accountant (accountant) of the organization in the form of a separate document approved by order or instruction of the head of the organization. The very form of the order or instruction on the accounting policy of the organization is not regulated by regulatory documents.

The accounting policy of an organization is an important document that should disclose all the features of accounting in the organization. In the current system of regulatory regulation of accounting, the accounting policy of an organization is a level IV document and refers to the working documents of the organization.

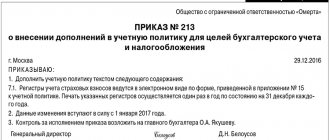

The accounting policy adopted by the organization must be applied from January 1 of the year following the year of approval of the order or instruction on the organization's accounting policy. For example, an order on an organization’s accounting policy for 2008 must be dated no later than December 31, 2007.

The accounting policy of the organization must include the following main components of the organization and accounting:

- organizational and technical, providing for the choice of a method for organizing accounting work, the choice of equipment and forms of accounting;

- methodological, providing for the choice of accounting methods in relation to the specifics of the organization’s activities.

In addition to the specifics of the organization’s activities, the following factors influence the choice and justification of accounting policies:

- organizational and legal form;

- types and scale of the organization’s activities;

- strategy for financial and economic development (long-term prospects for the development of the organization, investment prospects, etc.);

- level of material resources and information support (availability and level of computer and office equipment, software, databases, etc.);

- the scale of the organization’s management structure (in general) and accounting (in particular);

- level of qualifications of the organization's management, accounting and economic personnel.

The main point in forming the accounting policy of an organization in a specific area of maintaining and organizing accounting is the reasonable choice of one method from several methods of organizing and maintaining accounting allowed by legislation and regulations on accounting. If the regulatory documents do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on the accounting provisions.

The methodological basis for the formation (selection and justification) and disclosure (making public) the accounting policy of the organization is established by the Accounting Regulations “Accounting Policy of the Organization” PBU 1/08.

PBU 1/08 applies to:

- in terms of the formation of accounting policies - for all organizations, regardless of organizational and legal forms;

- in terms of disclosure of accounting policies - to organizations that publish their financial statements in whole or in part in accordance with the legislation of the Russian Federation, constituent documents or on their own initiative.

The accounting methods chosen by the organization when developing its accounting policies are applied by all branches, representative offices and other divisions of the organization (including those allocated to a separate balance sheet), regardless of their location.

A newly created organization draws up its accounting policy before the first publication of its financial statements, but no later than 90 days from the date of acquisition of the rights of a legal entity (state registration). The accounting policy adopted by the newly created organization is considered to be applied from the date of acquisition of the rights of a legal entity.

When forming and disclosing accounting policies, the basic requirements and assumptions established by the norms of PBU 1/98 must be observed.

In particular, when forming an accounting policy, the requirements of completeness, timeliness, prudence, priority of content over form, rationality must be ensured, and assumptions of property isolation, continuity of activity, consistency in the application of accounting policies, and temporal certainty of the facts of economic activity must be provided.

Simultaneously with the approval of the accounting policy, the organization must develop and approve the following working documents as appendices to the order on the accounting policy:

- working Chart of Accounts, containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents used to document facts of economic activity, for which standard forms of primary accounting documents are not provided, as well as forms of documents for internal accounting reporting;

- the procedure for conducting an inventory of the organization’s assets and liabilities;

- methods for assessing assets and liabilities;

- document flow rules and accounting information processing technology;

- procedure for monitoring business transactions.

The requirements for drawing up a working Chart of Accounts as an element of the organization’s accounting policy are discussed in paragraph 3 of this chapter.

Here we briefly note that primary accounting documents compiled according to the forms contained in the albums of unified (standard) forms of primary accounting documentation should be accepted for accounting.

Forms of primary accounting documents used to document facts of economic activity, for which standard forms of primary accounting documents are not provided, as well as forms of documents for internal accounting reporting are developed by the organization independently and approved as appendices to the order on the accounting policy of the organization.

When an organization approves forms of primary accounting documents for which unified forms are not provided, one should be guided by the rule according to which such documents must contain the following mandatory details:

- name of the document (form), form code;

- date of compilation;

- name of the organization on behalf of which the document was drawn up; content of a business transaction;

- business transaction indicators (in physical and monetary terms);

- names of positions of persons responsible for carrying out a business transaction and the correctness of its execution, personal signatures and their transcripts (including cases of creating documents using computer technology).

PBU 1/98 requires that the accounting policy reflect the accepted procedure for conducting an inventory of the organization's assets and liabilities. As a rule, this procedure determines the forms and timing of planned and. unscheduled inventories, as well as a list of property and financial obligations of the organization subject to inventory.

The organization determines this procedure in accordance with the requirements of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” and the Guidelines for the inventory of property and financial liabilities, approved by Order of the Ministry of Finance of the Russian Federation of June 13, 1995 No. 49.

The document flow rules approved by the chief accountant serve as the basis for organizing the primary accounting of the organization’s documents.

These rules establish a schedule for the passage of documents from the moment they are issued to the time they are deposited in the archive. The document flow schedule determines the circle of persons responsible for the preparation of documents* and indicates the order and time for the passage of documents from the moment of preparation to delivery to the archive.

The accounting policy adopted by the organization must be applied consistently from one reporting year to another, i.e., the accounting policy must remain unchanged both during the reporting year and during several subsequent reporting periods. This allows you to create a certain stability in accounting.

A change in the organization's accounting policy must be justified and can be made in the following cases:

- changes in Russian legislation or accounting regulations;

- the organization's development of new accounting methods. The use of a new method of accounting requires a more reliable representation of the facts of economic activity in the accounting and reporting of the organization or less labor intensity of the accounting process without reducing the degree of reliability of the information;

- significant change in operating conditions. A significant change in the operating conditions of an organization may be associated with a reorganization of the organization, a change of owners, a change in types of activities, etc.

It is not considered a change in accounting policy to approve the method of accounting for facts of economic activity that are essentially different from facts that occurred earlier or that arose for the first time in the organization’s activities.

Changes in accounting policies are also subject to registration with relevant organizational and administrative documentation (orders or instructions from the head of the organization).

The change in accounting policy must be introduced from January 1 of the year (beginning of the financial year) following the year of its approval by the relevant organizational and administrative document.

The consequences of changes in accounting policies that have had or are likely to have a significant impact on the financial position, cash flow or financial performance of the organization are assessed in monetary terms.

The assessment in monetary terms of the consequences of changes in accounting policies is made on the basis of data verified by the organization as of the date from which the changed method of accounting is applied.

The consequences of changes in accounting policies caused by changes in the legislation of the Russian Federation or regulatory acts on accounting are reflected in accounting and reporting in the manner prescribed by the relevant law or regulatory act.

If the relevant law or regulation does not provide for the procedure for reflecting the consequences of changes in accounting policies, then these consequences are reflected in accounting and reporting in the following order.

The consequences of changes in accounting policies that could have a significant impact on the financial position, cash flow or financial performance of the organization are reflected in the financial statements based on the requirement to present numerical indicators for at least two years. The exception is cases where the assessment in monetary terms of these consequences in relation to periods preceding the reporting period cannot be made with sufficient reliability.

If the specified requirement for reflecting the consequences of changes in accounting policies is met, one should proceed from the assumption that the changed method of accounting was applied from the first moment the facts of economic activity of this type arose. Reflection of the consequences of changes in accounting policies consists of adjusting the relevant data included in the financial statements for the reporting period for the periods preceding the reporting period. These adjustments are reflected only in the financial statements. In this case, no accounting records are created.

In cases where the monetary assessment of the consequences of a change in accounting policy in relation to periods preceding the reporting period cannot be made with sufficient reliability, the changed method of accounting is applied to the relevant facts of economic activity that occurred only after the introduction of such a method.

Information about changes in the organization's accounting policies for the year following the reporting year must be reflected in the form of a separate section in the explanatory note.

Information about changes in accounting policies should include:

- the reason for the change in accounting policy;

- assessment of the consequences of changes in monetary terms (in relation to the reporting year and each other period, data for which are included in the financial statements for the reporting year);

- an indication that the relevant data from the periods preceding the reporting period included in the financial statements for the reporting year have been adjusted.

| Next > |

Forms of primary accounting documents

As can be seen from the list above, one of the components of the accounting policy is the approval of the forms of primary accounting documents. Law No. 402-FZ “On Accounting” gives the organization the right to use, at its discretion, standard forms approved by the State Statistics Committee or its own forms.

You can also use the forms recommended by the Federal Tax Service - UPD (universal transfer document) and UCD (universal adjustment document). But both those, and others, and the third should be approved in the accounting policy. All forms you use must be printed and attached. What does this look like in practice?

Accounting for expenses in a trading company

| The list of expenses for trading companies is larger than for manufacturing companies. Accounting for expenses should be specified in the accounting policy. For example, the costs of delivering goods to customers are recognized as expenses related to sales. Selling expenses are usually written off monthly: 1.According to the accumulated amount for the corresponding period in full; 2. Distribution of the accumulated amount to the actual goods sold. The remaining expenses are formed on the “44-account”, corresponding to the balance of goods in the warehouse. |

Working chart of accounts in the accounting policies of the organization

The chart of accounts and instructions for its use, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, contain accounts that are used for accounting. Synthetic accounts from the Plan cannot be changed, and you can use your own subaccounts.

How can a working chart of accounts in an organization’s accounting policy differ from the Chart of Accounts:

- The Working Chart of Accounts should contain details on subaccounts, depending on the specifics of the activity. Moreover, subaccounts can be not only of the first, but also of the second, third and hundredth order. It all depends on your needs for detailed accounting and the possibilities of their implementation.

- The Working Chart of Accounts may not contain accounts that the organization does not use, for example, 15, 16, 23, 29, 40, etc.

- In addition, if the accounting department needs to prepare any internal reports, for example, for making management decisions, then this also needs to be taken into account in the working chart of accounts.

The working chart of accounts usually takes the form of a table, for example, like this:

| Account number and name | Subaccount number and name |

| 20 "Main production" | 20-1 “Product release A” |

| 20-2 “Product release B” |

Structure of the accounting policy of a trading company

Trade can be wholesale or retail; regardless of this, when developing accounting policies, the following important points must be taken into account:

- Application of the system for taxation;

- Methods of maintaining (organizing) accounting and tax accounting;

- Certain aspects (for example, maintaining simplified accounting for a small business entity, correcting errors, etc.)

- Application of a working chart of accounts, maintaining tax registers for tax accounting;

- Other important points for the correct conduct of tax and accounting records.

The nuances when forming the accounting policy of a trading company will be the following:

- the procedure for accounting for goods;

- the procedure for calculating trade margins;

-procedure for accounting for transportation costs, etc.

Many companies formulate accounting policies separately, i.e. on tax accounting and accounting, but the law does not prohibit the formation of a single UP, so it is possible to form one policy with tax and accounting sections.

Document flow rules

Document flow rules are a document that states who draws up what primary documents, in how many copies, how they are drawn up, when, who hands them over and to whom, who signs them, etc. And if in a tiny organization you can still try to justify the absence of these rules, citing unnecessaryness and bureaucracy, then in a large company without an approved procedure you will not find any solutions.

Still, accounting is based on documents, and they must be drawn up in a timely manner, during a business transaction or immediately after it. Document flow rules will not allow someone to “forget” about documents.

Document flow rules are drawn up as an annex to the accounting policies or as a separate provision to which a link is given.

What do the document flow rules look like? This is a voluminous table, the form of which can be seen in the “Regulations on documents and document flow in accounting”, approved by the USSR Ministry of Finance of July 29, 1983 No. 105 (not repealed and is valid to the extent that does not contradict current legislation).

The Regulations simply provide an example of a form that you can edit to suit your needs. Here's what it might look like.

Control procedure, information processing technology and inventory in accounting policies

Three more issues that the creation of an accounting policy in an organization does not avoid, but which we will not discuss in detail:

- The procedure for monitoring business operations: depends on the organizational structure of the company and its size:

In a large organization, for example, an internal audit service is created, which functions in accordance with the Regulations on Internal Control.

“The rules for internal control of the facts of economic life are established in the Regulations on the rules of internal control dated December 10, 2021 No. 10, as well as in the Regulations on the internal control service dated December 10, 2021 No. 11.”

In a small enterprise, control is exercised by the manager himself or his deputy, and specific responsibilities and control measures are prescribed in the job description. In the accounting policy, it is enough to indicate who is assigned control responsibilities.

- Technology for processing accounting documentation: in the accounting policy you need to indicate whether accounting and tax accounting is carried out manually, using a special program, or in combination (program + additional registers compiled manually).

It is the chosen technology that determines which registers will be considered approved for use - those compiled manually or generated by an accounting program, or both. In addition, a list of registers and their samples are provided in a separate provision or annex to the accounting policy.

“Use registers generated by the accounting computer program “1C: Accounting 8th ed.” as accounting registers. 3.0". The forms of these registers are given in Appendix No. 3 to this order.”

- Inventory procedure. The accounting policy for inventory must reflect the frequency and timing of inventory.

So, we have covered general issues.

Now let's take a closer look at some of the methods for valuing assets and liabilities in accounting.

Nuances of VAT accounting

In terms of VAT, the UP of a trading enterprise should include at least:

1. Application (or non-application) of VAT exemption on the list of goods in accordance with Art. 149 of the Tax Code of the Russian Federation. As well as the procedure for maintaining separate accounting for groups of goods with different VAT taxation.

2. If there are transactions taxed at a rate of 0% (in particular, exports), the procedure for maintaining separate accounting for goods taxed at a rate of 0% and taxed at regular rates.

3. Basic aspects of document flow, for example:

• principle of numbering of invoices;

• the procedure for maintaining records of received and issued invoices, the purchase book and the sales book (for example, the method of entering data by department).

Certain questions regarding inventory

The nuances that will need to be included in the UE will depend on the specifics of the trading activity. For example,

• For those who sell food products, it is necessary to stipulate in the UP that the frequency of inventory is more frequent than for those who sell non-food products. It is necessary to provide for nuances associated with such specific issues as natural loss rates. In addition, it is necessary to establish a procedure for promptly identifying and writing off expired goods that have lost their consumer properties.

• For pharmacy organizations, it is necessary to provide in the UP both the procedure for identifying and writing off medical products by expiration date, and compliance with certain conditions for the storage and release of certain goods.

Accounting for fixed assets in accounting policies

Just as no company can do without fixed assets, so the creation of an accounting policy in an organization cannot do without the corresponding section. PBU 6/01 will tell us what exactly to include in it.

1) We determine what will be taken into account as fixed assets, i.e. We set a cost limit for recognizing an object as a fixed asset.

In paragraph 5 of PBU 6/01 there is a clause - if an object can be considered a fixed asset, but it costs less than the limit provided for by PBU (currently 40 thousand rubles), then it can be taken into account as inventories. Regardless of service life.

2) Whether or not an inventory card is created for the rented object and whether an inventory number is assigned (clause 14 of the Methodological Guidelines for Accounting for Fixed Assets, it says “recommended”).

3) What is the initial cost of the OS formed from (actual costs or purchase + installation)

4) Materiality threshold for accounting for fixed assets consisting of several parts. For example, if you set the useful life of fixed assets in accounting according to the Classifier, then the materiality criterion may be that parts of the object fall into different depreciation groups (for example, elevator equipment and utility networks in a multi-story building).

5) Is revaluation carried out in the organization. If so, when (annually or once every few years), what (which specific groups of fixed assets, for example, buildings) and how is revalued (by indexation or direct recalculation at market prices).

6) Methods for calculating depreciation of fixed assets. Usually one method is chosen for all basic assets, but those who like the “zest” can set different methods for groups of homogeneous objects. Frequency of depreciation calculation (monthly, once a year or other period).

7) Determination of the useful life of fixed assets. It is usually established that the period will be determined on the basis of Government Decree No. 1 of 01/01/2002, which is used in tax accounting.

Accounting for disposal of real estate. Real estate is removed from the fixed assets at the time of signing the transfer and acceptance certificate, and income and expenses from the sale must be recognized on the date of transfer of ownership to the buyer (date of state registration). Until the transfer of ownership, real estate can be accounted for on account 01 “Disposal of fixed assets” or 45 “Goods shipped”.

Accounting for disposal of real estate. Real estate is removed from the fixed assets at the time of signing the transfer and acceptance certificate, and income and expenses from the sale must be recognized on the date of transfer of ownership to the buyer (date of state registration). Until the transfer of ownership, real estate can be accounted for on account 01 “Disposal of fixed assets” or 45 “Goods shipped”.

Transport cost accounting

| The procedure for accounting and distribution of TZR for accounting purposes is determined in the order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n. It also provides several possible options for accounting for TRP: • using a separate calculation and distribution account 15 “Procurement of materials and materials” for goods and materials; • using a subaccount on the accounts for recording incoming goods (for example, on account 41); • with the inclusion of TZR in the cost of goods. The trading company chooses the accounting method itself and necessarily reflects it in the UP. |

In tax accounting, the procedure for accounting for transport costs is carried out in accordance with Article 320 of the Tax Code of the Russian Federation.

Accounting for materials in accounting policies

Materials are another type of asset that will be found in any organization. Accounting for materials in the accounting policy should be especially carefully prescribed if the field of activity is production. So, what points should be included in the creation of an accounting policy in an organization:

1) Is there a single methodology for accounting for materials and goods, or are they different?

2) Formation of the cost of inventories at actual cost - on account 10 (41 for goods) or 15 “Procurement and acquisition of material assets.” Or the formation of cost based on the supply price.

3) Accounting for transportation and procurement costs (TZR). The first point is the reflection of the costs of maintaining the procurement and warehouse apparatus. They can be included in the TZR or written off as part of current expenses. The second point is the procedure for writing off the fuel and equipment themselves. For example, with their small share, they are immediately included in current expenses.

4) Assessment of inventories when released to production or externally. The first point is that the selected write-off method will apply to all groups of inventories or a different method will be set for each group. The second is the choice of the write-off method itself (unit cost, average - weighted or moving, FIFO). Or the inventories are immediately written off as current expenses.

5) At what price should containers be taken into account: at actual cost or at accounting prices (types of accounting prices - at contract prices, actual cost of past periods, planned prices, average group price). Reusable collateral packaging - you will have it accounted for on account 10/4 (or 41/3 for trading) or 002 on the balance sheet.

6) Formation of the cost of goods for trading organizations: the costs of procuring and delivering goods to central warehouses until they are transferred for sale are taken into account as sales expenses or included in the actual cost of goods.

7) Accounting for goods in retail trade organizations - at the purchase price or at the sales price (taking into account the markup).

By what principle is the product accounted for – by type (grade) (suitable for average write-off methods) or by batch (suitable for unit cost and FIFO write-off methods).

By what principle is the product accounted for – by type (grade) (suitable for average write-off methods) or by batch (suitable for unit cost and FIFO write-off methods).

9) The procedure for the formation and restoration of a reserve for a decrease in the value of material assets: when it is created (at each reporting date, if interim reporting is generated, or at the end of the reporting year), in what context (for a specific type of materials or group), where to restore (attributed to composition of income or reduce the amount of expenses). Or the reserve is not created.

Determining the procedure for accounting for goods and trade margins

Goods in trading companies are taken into account:

- At cost (actual);

- At prices, for sale.

In accounting, accounting for goods is formed on “account-41-“Goods”. Companies (organizations) engaged in trading activities and using Account-41 take into account purchased packaging.

The following subaccounts can be opened for the “41-Goods” account:

“41-1-“Goods in warehouses”;

“41-2-“Goods in retail trade”;

“41-3-“Container under the goods and empty”;

“41-4-“Purchased products”, etc.

According to the “cost” method, goods are recorded on account “41” at the purchase price, according to the “selling prices” method, respectively, at the “sale” cost. The trade margin on goods accepted for accounting is reflected by the posting “D-t-41, K-t-42.

When selling goods wholesale, there are certain issues, for example, in the case of goods being shipped from a warehouse, but not yet delivered to the buyer, i.e. they are on the way with a transport company transporting this product, then in this case the goods are accounted for on account 45 “Goods shipped”. The posting upon the fact of release of goods from the warehouse is reflected by the posting “D-t -45, K-t-41”.

Write-off from account 45 occurs in the same way as write-off from account 41 “D-t-90, K-t-45”.

The cost of goods sold is written off using the following methods:

- "in FIFO";

- “average s/s;

- “according to the cost of each unit of goods.

The company (company), depending on the specifics of the goods sold, can use any of the methods; this method is subject to reflection in the accounting policy.

Accounting policy for production costs

This is one of the most important sections of accounting policies, which we will also consider. Here it is important to distinguish between expenses for core activities and other expenses, list which expenses are direct, and how general business expenses will be written off. So, we continue to create an accounting policy in the organization, an accounting policy for production costs is being formed:

1) Distribution of expenses between main and other activities (this is usually stated in the section on income). If the activity of providing property for temporary use, granting rights for the use of intellectual property, participation in the authorized capital of other organizations is the main one, then this should be noted.

2) Cost accounting methods - whether costs are allocated between specific types of products. Which accounts are used for cost accounting -20, 21, 25, 26. If expenses are distributed, then what is chosen as the basis for distributing expenses - in proportion to direct cost items, salaries of key production personnel, the cost of materials released for production, standard costs, or your option . How are general business expenses written off - distributed between types of products or written off in full to account 90 “Sales”.

3) Assessment of work in progress: by direct cost items, by actual cost (inventory is carried out), by the cost of raw materials, materials, semi-finished products, by standard cost.

4) If there is an auxiliary production, then you need to decide whether the costs for it are taken into account on account 23 (usually if there are separate divisions) or on account 25 (auxiliary productions are not separately allocated). If costs are collected on account 23, then indicate the method by which they are distributed by type of product (preferably similar to the distribution of overhead costs).

Finished and shipped products in accounting policies

And the last section of the accounting policy, which we will consider in the article, is the accounting policy of finished and shipped products. Consider the following questions:

1) In what account are the manufactured products recorded - 43 or 40 “Product Output”, and how are they valued - at planned or actual cost. Maintain continuity, choose the same method as when assessing work in progress.

2) The procedure for creating a reserve for reducing the cost of finished products: the frequency of creation and adjustment, the principle of creation (by groups or by accounting units), the procedure for restoration. This point is generally similar to the one we discussed above for materials and goods, and it is desirable that the rules for them coincide.

3) Methodology for writing off business expenses: distributed between sold and unsold products or completely written off as expenses.

Who should be responsible for creating accounting policies?

Creating an accounting policy in an organization is a painstaking and extremely responsible process. It is best to have an experienced professional do this.

We suggest contacting us for accounting and tax services!

Why are we more reliable than in-house accountants?

- You have a whole team working for you, not just one person. Which means additional verification from experienced certified specialists.

- We have not only accountants, but also lawyers, so we know all the features of drawing up documents.

- Thanks to the extensive experience of our team and each individual employee, we can predict in advance possible errors in filling out 2nd personal income tax and promptly correct them before filing reports.

Fill out the feedback form or call us at the specified phone number to find out about the cost and procedure. Remember, it is easier to prevent mistakes than to correct them!