Regulations on bonuses - a sample of this local act is available for free download via the link at the end of the article. This document allows you to ensure the legality of employee incentive payments and determine the criteria by which they are made. If the provision is drawn up correctly, then the employer does not have to worry that he may have any problems when calculating bonuses. After reading the article, the reader will receive information about how the regulations on the payment of bonuses are drawn up, and what information must be reflected in the document.

Why do you need a Bonus Regulation?

Each enterprise has the right to independently develop a bonus system for its employees. The only condition for this is that it fully complies with the framework of the current legislation of the Russian Federation.

Generally speaking, the Regulations establish which employees, for what services and under what circumstances can receive financial incentives from the company’s management.

Thus, by developing the Regulations on bonuses, the enterprise administration usually achieves several goals at once:

- increased labor productivity and employee efficiency,

- the quality of products improves,

- labor discipline is strengthened,

- general prospects are expanding.

In some cases, in the future, the Regulations may become a legally significant document that has evidentiary force in court - for example, when resolving labor disputes and disagreements regarding the payment of wages and other material incentives to an employee. That is why its preparation should be treated with the utmost care, taking into account all the subtleties and nuances of the enterprise.

Example of the content of a provision on the payment of bonus payments

The structure of the document can be absolutely anything. It all depends on what goals the document is being drawn up and what provisions are planned to be included in it.

In general, the structure might look like this:

- General information, including about the organization, its structural divisions, the remuneration system, etc.

- List of types of bonus payments that can be accrued to company employees.

- The procedure according to which bonuses will be calculated. Here you can enter various efficiency coefficients, formulas, take into account different labor indicators, etc.

- A list of reasons on which the bonus amount may be reduced, for example the presence of disciplinary violations, etc.

- List of grounds for refusal to pay bonuses.

This structure is only an illustration, since the head of the organization has significant freedom in shaping the structure of the bonus provision. The law does not prohibit introducing additional elements into the content of the document and establishing additional rules.

General provisions

In this section, in addition to the above information, you can additionally touch upon the goals for which bonuses are awarded to employees. In particular, these may include motivating employees, improving work performance, increasing productivity, and improving efficiency.

Here you can indicate which specific employees are covered by the document. This could be all employees, employees of individual structural divisions, or individual employees. Additionally, you can indicate that only full-time employees receive bonuses.

List of types of bonus payments

This section reflects various types of awards. They can be:

- Annual, quarterly, monthly.

- Current, one-time.

- Targeted and non-targeted.

- Specific, for example, for completing a work plan for a month, or abstract, for example, for good work, quality service, etc. It is recommended to indicate the reasons for payments as specifically as possible.

Procedure for calculating and paying bonuses

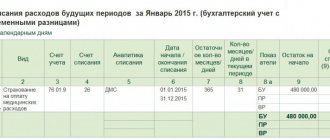

You can specify what documents employees must provide in order for bonuses to be accrued. In addition, you can assign responsible employees for the calculation and payment of bonuses. As a rule, these are accounting employees.

The size of the bonus can be determined in various ways and can be:

- fixed;

- as a percentage of salary or wages;

- as a proportion of salary or wages.

Grounds for reducing the size of the premium or depriving of bonus payments

This section, as a rule, indicates violations, if committed by employees, the amount of bonus payments is reduced. For example, this could be various kinds of disciplinary sanctions, failure to fulfill the plan, lack of material assets, etc. In addition, the grounds may include violations in the field of labor protection, non-compliance with labor regulations, failure to comply with management orders, damage to property and material assets belonging to the employer.

Who draws up the Regulations

The responsibility for developing this document on bonuses for employees usually falls within the competence of the company's lawyer, personnel officer, and less often - the secretary or the manager himself. In any case, this must be a person who has the necessary theoretical knowledge in the field of labor and civil legislation and the skills to write such documents. And regardless of who is directly involved in this work, the final version of the regulation must be submitted for approval to the director of the organization.

In what form and how is the provision drawn up?

In large organizations where employees work in several departments, in which work processes are structured differently, it is advisable to develop several provisions for each department. In small companies, drawing up one document is enough.

It is permissible to include the text of the provision in a local act regulating the procedure for remuneration for work. This may be advisable when there is no desire to approve a significant number of internal documents and complicate paperwork.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Of course, depending on the legal form of the company (or institution), the documents will differ. Thus, a sample provision on bonuses for employees of an LLC may differ significantly from the same provision in a PJSC or in a budgetary educational organization, but in essence, these are very similar documents.

Is it necessary to familiarize employees with the Regulations?

Theoretically (and often practically) the Regulation applies to every employee of the enterprise, so all employees must be familiar with it. As a rule, the document is studied directly during employment or, if the document was developed during the period of active work of the organization, at any stage of its activities.

Typically, companies have special journals in which employees sign that they are familiar with the company’s internal regulations, including the Regulations on Bonuses.

The procedure for material incentives for employees

The Labor Code of the Russian Federation does not contain a definition of the concept of bonuses, nor does it oblige employers to award bonuses to employees. At the same time, the Labor Code contains rules by which bonuses can be awarded, and also determines the procedure for fixing the procedure for bonuses.

So, according to the provisions of Art. 129 of the Labor Code of the Russian Federation, wages are not a single payment. It is divided into various components such as:

- Payments for employees performing their duties. The amount of such payments depends on various criteria, namely: the qualifications of employees, the complexity of the work performed, its quantitative and qualitative indicators, and working conditions.

- Compensation payments. These are various types of additional payments that are subject to accrual to employees subject to certain conditions. For example, such additional payments are awarded in northern climate zones, for special working conditions in hazardous industries, etc.

- Incentive payments. They include bonuses, allowances, and additional payments.

Due to the requirements of Art. 191 of the Labor Code of the Russian Federation, bonuses are a method of rewarding an employee who properly performs job duties, i.e. in fact, he works well and is not subject to penalties. The employer himself determines the amount of incentive payments, the terms and procedure for calculation. The bonus regulations may reflect the conditions for payment of bonuses, the procedure for their implementation, size, grounds for refusal to accrue, etc. Below we will talk about how to compose a document. A sample provision on bonuses for employees can be found at the end of the article.

Rules and example of drawing up Regulations on bonuses

There is no standard, unified, one-size-fits-all form of this document, so organizations can develop the Regulations in free form. The main condition is that it contains:

- name of company,

- creation date

- and the signature of the manager.

It is recommended to note a number of information that it is desirable to include in the document, these are:

- conditions for awarding the award,

- its size

- and payment terms.

It is also advisable to note that bonuses are solely the initiative of the employer - this, if anything happens, will help avoid unreasonable demands from subordinates.

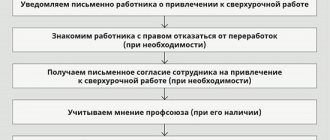

How to approve a position

The regulation on the payment of bonuses is a local act, and accordingly, the procedure for its approval corresponds to the procedure for approving any local act.

The employer approves the document. If the company has a trade union (which is rare in Russian realities), then it is necessary to take into account the opinion of this body, even if it consists of a small number of employees.

The form of the document is written. It should be familiarized to the performers who are appointed responsible (for example, accounting employees), as well as to the employees who are affected by the position (actually, those receiving bonuses).

Thus, if desired, the organization can adopt a Regulation on bonuses. This is not a mandatory document, but it is recommended that it be drawn up if you plan to clearly systematize the procedure for awarding bonuses to employees. A sample bonus clause can be downloaded from the link below.

Rules for document execution

The document can be drawn up on a simple blank A4 sheet or the organization’s letterhead - this does not matter, just like whether it is written by hand or printed on a computer. The only rule is that it must have the signature of the head of the company or another person responsible for the approval of such employee documents. It is not necessary to certify the document with a seal, since from 2021 legal entities, as previously and individual entrepreneurs, have the right not to use seals and stamps to endorse their documentation.

The regulation is usually drawn up in a single copy , registered in the company's accounting policies, and then contained together with other internal regulations in a certain order. After losing its relevance, it is transferred for storage to the archive of the enterprise, where it remains exactly as much as is established by law. After the expiration of this period, the Regulation can be disposed of.

How to develop and what documents to support?

We note that rewarding employees with bonuses is enshrined in the norms of the Labor Code of the Russian Federation (paragraph 4, paragraph 1, article 22 of the Labor Code of the Russian Federation, paragraph 1, article 191 of the Labor Code of the Russian Federation).

But to justify the costs of bonuses for its employees, the employer is obliged to fulfill a number of conditions: 1. Provide this remuneration. To do this, it is necessary to supplement the regulations on remuneration and labor (collective) agreements with information on bonuses for employees, but it is advisable to issue a new local regulatory act of the organization, namely a regulation on bonuses.

2. It is necessary to identify and consolidate specific and differentiated bonus indicators in personnel documents. This is necessary to comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. An important criterion when developing bonus regulations is the use of realistically measurable indicators. It is important to avoid vague language.

Thus, in order to take into account the bonuses in question for tax purposes, the employment (collective) agreement, bonus provision or other local regulatory act must contain the following criteria:

- grounds for payment of bonuses, specific measurable performance indicators for bonuses;

- sources of bonus payment;

- amounts of bonuses and the procedure for their calculation.

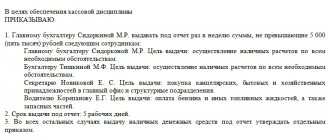

3. It is necessary to have documents confirming the basis for payment of bonuses (clause 1 of Article 252 of the Tax Code of the Russian Federation). Such documents can be a petition, a memo from the immediate supervisor, supported by actual performance indicators of the employee, etc. Also, in order to document the costs of bonuses to employees, the employer must make these payments on the basis of an order (instruction) on rewarding employees (form T-11, T-11a or according to a form developed by the employer).

An important circumstance is that the bonus should not be paid at the expense of the organization’s net profit, special-purpose funds or targeted income. Payments from these sources are not taken into account for tax purposes (clause 1, 22, article 270 of the Tax Code of the Russian Federation).

Document Format

There is no standard form of the Regulation on bonuses in the legislation. This document is drawn up in any form.

Typically, the Bonus Regulations indicate:

- general provisions (information about who has the right to receive bonuses, according to what rules the bonuses are distributed, from what source they are financed);

- bonus indicators (for which the employee is entitled to a bonus);

- bonus procedure;

- circle of employees to whom bonuses are awarded;

- bonus amounts (fixed amount, percentage of salary);

- frequency of payment of bonuses (monthly, quarterly, etc.);

- conditions for reducing and not accruing bonuses to the employee (deprivation of the employee’s bonus).

Situation: is it possible to include in the Bonus Regulations a condition that no bonuses are awarded to employees who are undergoing a probationary period?

No you can not.

Employees who are undergoing a probationary period are subject to all provisions of the Labor Code of the Russian Federation, collective agreements, agreements, and local regulations (Article 70 of the Labor Code of the Russian Federation). The regulation on bonuses is a local regulatory act. It must establish indicators and conditions for bonuses for each category of personnel (workshop, department, group, etc.) or for each position held. At the same time, the accrual of bonuses and their sizes should depend only on the degree of fulfillment of these indicators (conditions). A different approach would discriminate against employees who successfully perform their duties during the probationary period.

Any discrimination in determining wage conditions is prohibited (Article 132 of the Labor Code of the Russian Federation). Moreover, the concept of “wages” includes not only wages, but also compensation and incentive payments, including bonuses (Article 129 of the Labor Code of the Russian Federation). Compliance with labor legislation is monitored by labor inspectorates. An employee who has not been awarded a bonus only because he is undergoing a probationary period has the right to contact the labor inspectorate with a complaint to the organization. Even if such a condition is stated in the Regulations on Bonuses.

If the employee proves that all the indicators and conditions for bonuses have been met, then the labor inspectorate or the court may bring the organization and its leader to administrative liability under Article 5.27 of the Code of Administrative Offenses of the Russian Federation (Article 23.12 and Part 2 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation). The fine is:

- for a manager – from 1000 to 5000 rubles;

- for an entrepreneur – from 1000 to 5000 rubles;

- for an organization – from 30,000 to 50,000 rubles.

Repeated violation carries the following punishment:

- for a manager (official) – a fine in the amount of 10,000 to 20,000 rubles. or disqualification for a period of one to three years;

- for an entrepreneur – a fine in the amount of 10,000 to 20,000 rubles;

- for an organization – a fine in the amount of 50,000 to 70,000 rubles.

Such measures of liability are provided for in parts 1 and 4 of Article 5.27 of the Code of the Russian Federation on Administrative Offenses.