» IP management » Patent

Individual entrepreneurial activity is always associated with clear rules set by the state in order to receive tax payments on time. For individual entrepreneurs who decide to work under a simplified tax payment system, there is a procedure for obtaining special patents, which makes it easier to pay fees. This involves maintaining a special book for special accounting of income, without making any expenses. In fact, this is a special form, subject to strict reporting, where individual entrepreneurs enter their income only from the activity for which a patent has been issued. It is about it and the rules for filling it out that we will talk about.

- 2 Procedure

- 3 What financial transactions are not included in the income book

- 4 What is confirmation of income accounting

- 5 Procedure for filling

- 6 Financial sanctions for incorrect bookkeeping

What is the purpose of recording income from a patent?

Art. 346 of the Tax Code of the Russian Federation stipulates that it is mandatory to have a book for recording income on a patent. Entries in it for the tax authorities are confirmation of compliance with the income limit, the amount of which should not exceed 60 million rubles. for 2021.

Violation of the limit threatens entrepreneurs with loss of rights to use the patent. In this case, they are automatically transferred to a simplified regime, subject to timely submission of notification of this to the simplified tax system. Entrepreneurs can also be transferred to OSNO.

The book does not have the status of a strict reporting document, but may be required for verification by tax authorities when conducting an audit of an individual entrepreneur. The gravest violation in this case would be its absence. According to Article 120 of the Tax Code of the Russian Federation, an entrepreneur may face material penalties:

- one violation per tax period is punishable by a fine of 10,000 rubles.

- several violations for different periods - up to 30,000 rubles.

What financial transactions are not included in the income book?

Economic activity under a patent provides for certain restrictions on accounting for income and expenses, which will be discussed. Individual entrepreneurs carrying out activities under a patent and, in connection with this, applying a simplified taxation system need to be aware that various expenses should not be indicated in it.

Expenses mean such financial transactions that do not bring profit (purchase of materials, payment for related services, etc.), but lead to the waste of money for the needs of the business entity, in this case individual entrepreneur.

Number of books and rules for their design

Order of the Ministry of Finance dated October 22, 2012 No. 135n contains 3 and 4 appendices regulating the procedure and form for filling out the book.

Each patent comes into force from the beginning of the year, so the profitability book for it is opened for 365 days. In cases where the patent is valid for less than a year, income is recorded in a new book.

According to paragraph 1 of Art. 346.53 of the Tax Code of the Russian Federation, it is allowed to introduce one book on profitability when acquiring several patents at the same time. You can create a book for each of them separately, which does not contradict the law.

The income accounting book can have an electronic or paper version. The first option requires a printout at the end of the deadline for further submission to the tax authorities. It is numbered and laced, and the last sheet is stamped and signed by the legal entity.

Procedure

Despite the fact that the above income book for individual entrepreneurs who operate on a patent tax system has mandatory fields and columns to fill out, it can be maintained in two ways:

- on paper sheets, in the form of a stitched and numbered book;

- electronic.

In the first case, income accounting is recorded in the designated columns, and after the end of the tax period, or the term of the patent, individual entrepreneurs must take it to the tax office at the place of registration of the individual entrepreneur to check the correctness of maintaining and paying taxes.

In the second case (electronic version), special files are created on the computer, which contain the necessary columns and columns where the individual entrepreneur enters income from his activities. When, again, the tax period ends, or the validity period of the patent, the business entity must print out the electronic version on paper, after which all sheets are bound, properly executed, and submitted to the tax office for verification.

It should also be noted that all individual entrepreneur records must be kept in Russian. If the activity involves working with foreign business entities, or supporting documents were written in a language used by residents of different subjects of the Federation, then they must be translated into Russian. Usually the translation is written in the next column, after the document or entry in another language. The translation must be signed by the entrepreneur and stamped with a date. If the latter is not available, then a signature is sufficient.

Here you can familiarize yourself with such a book in electronic form, and immediately create your own electronic version, which can then be easily printed.

It is important to know that all transactions that are subject to accounting must be recorded in chronological order. At the same time, filling out such a book must be clear and without corrections. If any errors are made that need to be corrected, this is done carefully, after which the reason and confirmation that the accounting was done incorrectly is indicated in the column opposite the correction. This fact must be confirmed by a relevant financial document, with the signature of the entrepreneur, as well as a stamp. If it is not there and never was, it is enough to put a signature on it.

A clear example of the title page of an accounting book

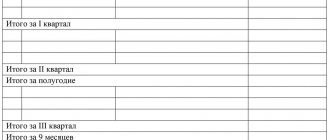

A table indicating the amount of income is contained in Section I. All income from the patent is entered there. Other income is not included there.

All amounts are entered in strict chronological order, starting with the earliest income and ending with the latest.

The Section includes four columns:

- serial number in Column 1

- checks, income statements indicating the number and date in Column 2

- information about transactions performed in Column 3

- total amount in Column 4

The total amount of income is entered in the last line of the book.

Section I Example

Here we will talk about accounting for income and methods of this process.

When filling out the book, a number of certain nuances should be taken into account. It is necessary to clearly understand what documents are needed for this, how to enter income and advances.

Sample book of income accounting for individual entrepreneurs on a patent

The form of the book is also approved by Order No. 135n. It consists of a title page and section I “Income”. On the title page you must indicate:

- the year for which the book was opened;

- date of compilation;

- FULL NAME. entrepreneur;

- his TIN;

- name and OKATO code of the region in which the patent was received;

- its validity period;

- IP residence address;

- numbers of his bank accounts and names of credit institutions in which they are open.

Filling out the title page might look like this:

Section I “Income” is designed in the form of a table consisting of four columns:

- in the first one you need to indicate the record number in order: 1, 2, 3, 4...;

- in the second - the number and date of the primary document (purchase agreement, contract for the performance of work or provision of services, certificate of completion of work (services rendered), invoice, payment order, cash receipt, strict reporting form, report on closing a shift from the cash register and etc);

- in the third - the content of the business operation (payment under the contract, receipt of prepayment, retail revenue for such and such a date, and so on);

- in the fourth - the amount of income received in rubles.

In the last line you need to calculate the total amount of income received for the tax period.

An example of filling out Section I “Income”:

How often is new data added?

All individual entrepreneurs are required to continuously enter current and reliable data on receipt of income under a patent in accordance with Order of the Ministry of Finance No. 135n. dated October 22, 2012

Violation of the timely display of data in the book falls under a gross violation of accounting norms and rules in accordance with Article 120 of the Tax Code of the Russian Federation. Each amount of income is necessarily recorded in the book on the day it is received by the entrepreneur. Making entries in unreliable dates and months is not permissible from the point of view of the tax legislation of our country.

How to correct errors in the income ledger

It all depends on how the entrepreneur keeps the book. If it’s in electronic form, then until the document is printed and bound, it’s easy to make edits—it’s enough to correct the data in electronic form. You can also delete unnecessary entries or insert missing ones. After deleting or inserting, you need to check the correctness of the sequence numbers of the records.

If the e-book is printed or the document is generally maintained on paper, to make edits you need to:

- carefully cross out incorrect information;

- Enter the correct information next to it;

- indicate the date of amendments;

- certify the changes with the entrepreneur’s signature and seal (if available).

The procedure for filling out the book requires that changes be made with justification. Therefore, you additionally need to draw up an accounting certificate in which you need to explain why the changes were made. Most often, the reason for edits is clerical errors and typos, or the entrepreneur’s forgetfulness when records are not kept daily.

Accounting for customer prepayments

Profits received in the form of advance payments from customers are recorded in the income ledger on the day the transaction is carried out. Letter of the Ministry of Finance of Russia dated 02/03/2017 N 03-11-12/5800 prescribes accounting and compliance with the size of the limit when receiving an advance payment.

Returning advance income already received to the client in advance allows you to deduct its amount from the total income for a specific tax period. This can be easily done by changing the data in the fourth column of the income book. It is enough to put a minus and subtract the amount of the advance payment returned to the buyer.

When to consider income

Income must be taken into account on the day of receipt (clause 2 of Article 346.53 of the Tax Code of the Russian Federation):

- when received in cash, this day will be the date of receipt of funds in cash, the date of their transfer to the bank account of the entrepreneur or transfer on his instructions to the accounts of other persons;

- when receiving income in kind - the date of its transfer;

- when paying or repaying in another way - the date of receipt of property rights, works, services, goods;

- when the buyer pays by bill of exchange - the date of receipt of funds from the drawer or the day of transfer of the bill of exchange by endorsement to a third party.

The prepayment received must be recorded in the book on the day it was received (letter of the Ministry of Finance of the Russian Federation dated 02/03/2017 No. 03-11-12/5800). If the advance had to be returned, then the income of the tax period in which the return was made should be reduced by its amount (clause 4 of Article 346.53 of the Tax Code of the Russian Federation).

Income received in foreign currency must be converted into rubles at the official exchange rate of the Bank of Russia, which was in effect on the day the funds were received, and then summed up with other income.

Income received in kind should be recorded at market prices.

When selling goods, works, and services at retail, income received in cash can be displayed in different ways:

- record each issued check on a separate line;

- record all revenue for the day in one line, indicating the shift closing report as the primary document.

When paying with a card, you need to pay attention to two points.

Firstly, the income must include the commission charged by the bank for acquiring. For example, services worth 5 thousand rubles were paid for by card. The entrepreneur’s account received 4,700 rubles; the bank retained 300 rubles as a commission. In the accounting book, the entrepreneur must reflect income in the amount of 5 thousand rubles, and not 4,700 rubles.

Secondly, there is no single position on the issue of what date to reflect income: the date the check was punched or the date of receipt of funds to the entrepreneur’s account from the acquiring bank. Some experts believe (with reference to the letter of the Ministry of Finance of the Russian Federation dated April 3, 2009 No. 03-11-06/2/58) that money should be taken into account after it is received into the account. Another part believes that these clarifications do not apply to the patent and the date of issue of the check should be recorded in the book. In practice, banks transfer funds on the day on which the payment was made, so there are no difficulties with indicating dates.

When concluding an acquiring agreement, we recommend that you pay attention to the timing of the bank’s transfer of money. To avoid problems, this should be the date of payment for goods, works, services by card.

Displaying changes in income data without a cash book

Clause 1 of the Central Bank Directive No. 3210-U dated March 11, 2014 determines the procedure for simplified cash transactions for legal entities with a patent. Individual entrepreneurs are exempt from setting a limited cash balance without drawing up outgoing and incoming cash orders. In this case, there is no need to keep a cash book, but at the entrepreneur’s own request, he can do this.

Income received through the cash register online is displayed in the book in two ways:

- Based on data from accounting reporting documentation for a specific time period (day, week, quarter), according to the OFD report, according to revenue data.

- By recording all cash receipts in the ledger.

How to flash KUDiR correctly

The State does not have strictly regulated requirements for the firmware process. It is important to observe only a few conditions: the stitching area must be sealed and certified, and the pages must be numbered.

You can flash it like this:

- We fold the sheets and make holes: with a needle if the document is small, and a hole punch if it is thick.

- We thread the threads or ribbon and tie a knot on the back of the book.

This is enough to flash.

You can print in two ways:

- Take a small piece of paper and bend it: the narrow part should cover the ribbon/thread from the side of the first sheet, and the wide part should cover the back. We glue and write the number of pages in words and numbers, the date, and the name of the certifier. You can put a stamp if you have one. Also don't forget to sign. It will be better if the signature is located both on the sheet and on the document.

- We make a hole in the book through all the sheets. We pass threads/ribbon through them and make a knot on the back side of the document. We fix the ends with a piece of paper on which we write the same information as in the previous method.

Displaying income in the book by bank transfer

A cash receipt is issued to the client even in the case of non-cash payment for goods or services. The acquiring fee in this case is included in the total amount of income received. For example, a profit received in the amount of 20 thousand rubles. taking into account the deduction of a commission for conducting banking transactions of 200 rubles, it is entered into the income book in full.

The day and date of the banking transaction is not taken into account in this case. The date of issue of the sales receipt to the buyer is entered in the book. To do this, mutual settlement must be carried out without fail between the parties, the goods have been received, and the money has been written off.

Some nuances of working with KUD

The exact frequency of entering data into the CUD has not been established. With a small number of transactions, it is best to enter data for each income received, that is, for each transaction.

If the activity is related to retail trade, then it is irrational to enter each check into the CUD, since this is too labor-intensive a process. In this case, it would be correct to enter the total amount of revenue at the end of each day.

IMPORTANT! The use of online cash registers does not relieve the patentee from maintaining the CUD.

The income book reflects the entire volume of revenue, without excluding expenses from these amounts. For example, the bank commission for acquiring should also be included in the CUD.

In this regard, patent entrepreneurs often have problems confirming income for the purpose of receiving benefits and subsidies. The individual entrepreneur does not submit any declarations on the patent. There are no fields or lines for indicating expenses in the CUD, so you cannot reflect your real profit in the CUD. Based on this, theoretically, an income book can be provided to confirm your income, but the data indicated there will be interpreted not in favor of the taxpayer. How best to confirm your real income as an individual entrepreneur on PSN, you need to find out from the territorial social security authority.

We described what kind of reporting an individual entrepreneur submits on PSN in the article “Individual entrepreneur reporting on PSN - pros and cons .

What income and how to take it into account in CUD

The book reflects income only from “patent” types of activities according to the rules established by tax legislation and taking into account the explanations of controllers (Article 249, paragraphs 2-5 of Article 346.53 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated December 28, 2018 No. 03-11-12 /96212).

For example, in the book of a patentee-retailer, it is necessary to take into account all amounts received under commission agreements, including commission fees (Letter of the Ministry of Finance dated December 11, 2020 No. 03-11-11/108679).

And if an individual entrepreneur, within the framework of “patent” activities, leases non-residential premises, then the amounts received as compensation for losses (damages, lost profits), penalties (fines, penalties), as well as compensation for termination of the lease agreement on the initiative of tenant. Such income is recognized as part of “patent” income (Letter of the Ministry of Finance dated October 10, 2017 No. 03-11-12/66090).

Income received from other types of business activities under other tax regimes does not need to be shown in the patenter’s income book (Letter of the Ministry of Finance dated January 25, 2019 No. 03-11-11/4350).

Thus, if, under a transportation contract, an entrepreneur provides additional services (for example, sorting and loading of products), then these activities are not included and must be taxed under the general or simplified taxation system. An individual entrepreneur on PSN does not reflect revenue from these services in the income book (Resolution of the Volga-Vyatka District Administrative District dated January 30, 2019 in case No. A28-13889/2017).