Article 244 of the Labor Code is devoted to the characteristics of written agreements on the full financial responsibility of employees.

It also describes the existing restrictions on the use of this type of contractual relationship. Labor Code of the Russian Federation

dated December 30, 2001 N 197-FZ

Full text of the article, guides, additional information - in ConsultantPlus

Conditions necessary to bring an employee to full financial responsibility

Financial liability is the obligation of one of the parties to an employment contract to bear responsibility for damage caused by it to the other party as a result of culpable unlawful behavior (actions or inactions).

An employee’s financial liability can be of two types: full and limited. Limited financial liability is the employee’s obligation to compensate for direct actual damage caused to the employer, but not in excess of the maximum limit established by law, determined in relation to the amount of wages he receives. This maximum limit is the employee’s average monthly earnings (Article 241 of the Labor Code of the Russian Federation).

Full financial liability is the employee’s obligation to compensate the direct actual damage caused to the employer in full (Article 242 of the Labor Code of the Russian Federation).

According to paragraph 1 of part 1 of Article 243 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code), financial responsibility in full is assigned to the employee if there is an indication in the federal law of such liability of the employee for causing damage to the employer in the performance of work duties.

Therefore, in order to hold an employee to full financial liability, the following conditions must be met:

- the presence in federal law of an indication of the full financial responsibility of employees;

- performance by the employee of a labor function, which, in accordance with federal law, implies full financial responsibility;

- causing direct actual damage to the employer when the employee performs his job duties.

To bring an employee to full financial liability in accordance with Art. 244 of the Labor Code, the following conditions must be present:

- the employee reaches the age of 18;

- performance by the employee of functions that are related to the servicing of monetary and commodity valuables, according to the position provided for in the List of Positions and Works;

- conclusion of an agreement on full individual financial liability;

- the employee commits guilty and illegal actions when servicing the valuables entrusted to him;

- causal relationship.

Financial liability in the full amount of damage caused is assigned to the employee in the following cases:

- When, in accordance with the Labor Code of the Russian Federation or other federal laws, the employee is financially responsible in full for damage caused to the employer during the performance of the employee’s job duties

- Shortages of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document

- Intentional causing of damage

- Causing damage while under the influence of alcohol, drugs or other toxic substances

- Causing damage as a result of criminal actions of an employee established by a court verdict

- Causing damage as a result of an administrative violation, if established by the relevant government body

- Disclosure of information constituting a secret protected by law (state, official, commercial or other), in cases provided for by federal laws

- Causing damage not while the employee was performing his job duties.

Financial liability in the full amount of damage caused to the employer can be established by an employment contract concluded with the deputy heads of the organization and the chief accountant.

Based on Art. 244 of the Labor Code of the Russian Federation, agreements on full individual financial liability can be concluded only with employees performing work or holding positions named in the list approved by the Ministry of Labor of Russia. The position “driver” is not included in this list, but, for example, workers who transport material assets are mentioned.

However, courts most often recognize this practice as illegal, pointing to the fact that a car by its nature is not a transportable material value, but is a tool with which an employee performs a labor function.

An agreement on liability with a driver cannot be concluded in relation to a vehicle, since a vehicle is a material and technical means used and necessary to perform the driver’s labor function. The car assigned to the employee was provided to him to perform the job function of a driver, and not as material assets for reporting. In this regard, there are no grounds for imposing full financial liability on the employee.

With regard to the obligations voluntarily assumed by the employee to compensate for damage, the court noted that the provisions of Art. 248 of the Labor Code of the Russian Federation (according to which an employee who is guilty of causing damage to the employer can voluntarily compensate it in full or in part) are not an additional basis for the employee to have full financial liability, and a written obligation for the employee to compensate the employer for damage should not contradict the requirements of Art. 241 of the Labor Code of the Russian Federation, which limits the amount of financial liability of an employee.

The driver may bear full financial responsibility under the relevant contract for the cargo he transports, but not for the car itself. This conclusion is contained in a certificate from the Supreme Court of the Republic of Buryatia based on the results of a study of the practice of considering cases of employee financial liability for 2015 - 2017.

The review presents a case in which the legality of bringing to full financial liability a forwarding driver who allowed a vehicle to overturn, resulting in damage to both the vehicle and the cargo being transported, was assessed. At the same time, an agreement on full financial liability was concluded with the employee, in connection with which the employer considered it possible to demand compensation from him for the full amount of damage.

We invite you to familiarize yourself with: Tax accounting of expenses for online cash registers

The court of first instance upheld the employer, but this decision was not appealed on appeal. However, the court of the republic in its review did not agree with the conclusions of the first instance. The court indicated that an agreement on full financial liability could not be concluded with the employee as a driver.

Therefore, the driver cannot bear such responsibility for the car on the basis of this agreement. This would have been possible if it had been established that the employee had committed an administrative offense that resulted in an accident, but the relevant information was not provided in court. At the same time, the agreement on full financial liability was legally concluded with the employee as a person transporting material assets.

And for these values, the driver can be held accountable for the full amount of damage caused. Therefore, the employer had the right to demand full compensation for damaged cargo. The fairness of this approach is also recognized by other courts (for example, the rulings of the Altai Regional Court dated September 7, 2021 No.

In accordance with paragraph 2 of part 1 of Article 243 of the Labor Code, an employee may be held fully financially liable if there is a shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document.

Those. a necessary condition for bringing to responsibility is an indication of the law (for example, a manager) or the presence of a special written agreement on the full financial responsibility of the employee for the shortage of material assets entrusted to him or a one-time document (for example, an invoice and (or) a power of attorney to receive material assets ).

When hiring persons whose job responsibilities include responsibilities for receiving, storing, selling, forwarding, etc. inventory items and cash, along with the employment contract, it is also necessary to conclude a written agreement on full individual or collective (team) financial liability, that is, on compensation to the employer for damage caused in full for the shortage of property entrusted to employees.

According to current legislation, agreements on full liability can be concluded only with certain categories of employees:

- With employees who have reached the age of majority, i.e. 18 years;

- With employees whose labor function involves the maintenance or use of monetary, commodity valuables or other property and is named as part of the work or positions (professions) included in the Lists approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85.

It must be remembered that concluding an agreement on full financial liability is the right, and not the obligation, of the employer, while it is an obligation for an employee whose labor function is related to the maintenance of material assets and is indicated as part of the work or positions (professions) in the Lists approved by the Resolution of the Ministry of Labor Russia dated December 31, 2002 No. 85. This means that the employee does not have the right to refuse to enter into an agreement on full financial liability.

Failure to conclude such an agreement with employees means their release from the obligation to bear full financial responsibility.

As a general rule, an agreement on full financial responsibility must be concluded simultaneously with an employment contract. The refusal of a person applying for a position (profession), the labor function of which is related to the maintenance of material assets, gives the employer grounds for refusing to conclude an employment contract.

There are situations when an employer simultaneously enters into an individual and collective agreement with the same employee on full financial responsibility. I believe that such actions are not based on the law.

- The procedure for bringing to disciplinary liability

- Raising the retirement age

- Sample notification of changes in the terms of an employment contract

- Additional agreement to the employment contract: when is it concluded, form, procedure for conclusion

- Incentive payments: premiums, bonuses, additional payments and allowances

- Consent to the processing of personal data

- Effective contract

- Differences between an employment contract and a civil law contract

- Qualification requirements for drivers

- Regulation of labor of minor workers

- Work time

- Irregular working hours

- Overtime work

- Errors in the employment contract

- Recruitment

- Rules for hiring a foreign worker (registration procedure and necessary documents)

- What documents does an employer have the right to require to conclude an employment contract (hiring)?

- What documents are required when applying for a job?

- What conditions must an employment contract contain?

- Hiring an employee - registration procedure and necessary documents (detailed instructions)

- Sample (approximate form) of an employment contract

- Internal labor regulations (sample)

- Sample (approximate form) of an agreement on the full individual financial responsibility of an employee and the necessary conditions for its conclusion

- Transfer to another job (change of terms of the employment contract)

- Dismissal at your own request

- Dismissal due to reduction

- Dismissal at the initiative of the employer (other cases)

- Wages, sick leave, dismissal payments

- Vacations

- Labor disputes

- Other labor law issues

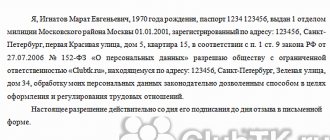

Moscow January 11, 2009

Work agreement

- Preamble wording . It is necessary to provide the full names of the parties to the agreement: indicate the details of legal entities and individual entrepreneurs, provide passport details of individuals.

- Subject of the agreement . In the next paragraph it is necessary to state what the customer’s task is. For details, you can refer to the annexes to the contract, where all the necessary qualities will be specified in detail.

- Duration of the contract . Indicate specific dates for the start and completion of work, and, if necessary, intermediate dates.

- Money issues . It is necessary to indicate the price of the work (in monetary or other equivalent), if an estimate is provided, agree on it and make a note about the permissibility of excess (hardness). In this paragraph, it is advisable to stipulate the terms of payment and the procedure for payments under the agreement, the possibility of an advance payment, etc.

- Obligations and responsibilities of the parties . Despite the generally accepted nature of many norms, it is better to state them as specifically as possible, stipulating liability in case of failure to fulfill obligations.

- Production . In this section it is worth clarifying the procedure for compliance with requirements during the execution of work and the customer’s control over the execution process.

- Handover and acceptance of work . It is necessary to provide for the conditions under which the transfer of the subject of the contract will take place, and especially the drawing up of a corresponding separate document about this - the acceptance certificate. In this paragraph it is also necessary to indicate the timing of signing the act after completion of work.

- Guarantees . Here the sureties and guarantees under the contract, possible risks of the contractor and the customer are prescribed.

- the procedure and conditions for termination in a separate paragraph.

We recommend reading: Course tax benefits and deductions

A contract with an individual is an extremely convenient form of cooperation, especially for an employer. All liability that the employer bears to the employee is limited only by the scope of the contract. Use it by downloading from the links below:

Useful links on the topic “Full individual financial responsibility of the employee”

Financial liability to the employer exists for all employees. But it can take different forms:

- Limited (Articles 231, 238, 241 of the Labor Code of the Russian Federation), in which an agreement on financial liability is not concluded, the employer has the right to independently recover damages from the employee in a limited amount, and if the amount established by law is exceeded, only through going to court (Article 248 Labor Code of the Russian Federation).

- Full individual (Articles 242, 243 of the Labor Code of the Russian Federation), which arises when the volume of property for which the employee is responsible is easily specified, the employee is provided with the conditions for control over it and the employee is assigned the corresponding responsibility.

- Full collective (Article 245 of the Labor Code of the Russian Federation), which differs from full individual in that a certain amount of property is under the control of a group of persons who are simultaneously assigned this responsibility.

Both types of full financial liability are accompanied by the employer drawing up a written (Articles 244, 245 of the Labor Code of the Russian Federation) agreement on financial liability: in the first case - with each financially responsible person, in the second - with all members of the group. Material assets are transferred to them according to the inventory and are periodically subjected to inventory.

A complete list of positions and work in which either one or another type of responsibility arises is contained in Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2002 No. 85. Examples include:

- for individual - cashier, storekeeper, forwarder, driver;

- for a collective one - a team of sellers, a team of builders or storekeepers.

We invite you to familiarize yourself with: On the approval of standards for the accumulation of solid household waste for educational institutions in the city of Moscow (lost force from 01/01/2020 on the basis of Moscow Government Decree dated 10/16/2019 N 1356-PP)

It is advisable to draw up an agreement on financial responsibility either simultaneously with the appointment of an employee to a position involving corresponding responsibility, or when starting work with this responsibility. Persons under 18 years of age are not allowed to enter into such agreements (Article 244 of the Labor Code of the Russian Federation).

All the nuances of the relationship between the employer and employees regarding financial liability can be systematized in an internal regulatory act.

Do you have any doubts about how to correctly carry out this or that procedure related to personnel records management? On our forum you can dispel any doubts. So, here you can clarify with whom and in what form an employment contract with financial responsibility is required.

Sample and rules for drawing up a civil contract with an individual

The responsibility of the parties to an employment contract is much higher than that of the customer and the contractor. While in an employment relationship, the parties may be subject to administrative or even criminal liability.

The payment method is different, but most often payment for services is made by bank transfer to the bank details of the contractor, which are indicated in the contract. An advance payment is often provided - part of the funds due to the contractor, but transferred to him until all work is completed.

Ensuring control over the safety of material assets

Imposing financial responsibility on employees requires control over the safety of the material assets entrusted to them. For these purposes, the institution should regularly conduct an inventory of property, since its purpose is precisely to identify the actual availability of property and compare it with accounting data (clause 1.4 of Methodological Instructions N 49{amp}lt;2{amp}gt;).

Compliance with the procedure for registering financial liability and carrying out control measures in the institution will allow you to avoid possible negative situations.

If damage is detected during the inventory, the day of its discovery is considered the day the corresponding act is signed. If it is detected in another way, then the day the damage caused by the employee was discovered is considered the day when the administration became aware of its existence. In any case, a written explanation must be obtained from the employee regarding this fact (Article 247 of the Labor Code of the Russian Federation). In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

Looking for an answer? It's easier to ask a lawyer!

to our lawyers - it’s much faster than looking for a solution.

Lawyer's Encyclopedia. 2005.

See what “RECEIPT” is in other dictionaries:

Receipt - (voucher) A receipt for money or any other document that is posted in the accounts. Business. Dictionary. M.: INFRA M, Ves Mir Publishing House. Graham Betts, Barry Brindley, S. Williams and others. General editor: Ph.D. Osadchaya I.M..... Dictionary of business terms

RECEIPT - RECEIPTS, receipts, female. 1. units only Action under Ch. write in 1, 2 and 3 digits. paint. Wall painting. Receipt of accounts according to books. 2. A document with a signature issued as evidence of receipt of something. Receipt for receipt of money. Pass... ... Ushakov's Explanatory Dictionary

RECEIPT - a document with a signature certifying that the signatory has received something. In law, it is one of the types of written evidence. In some cases, it indicates the conclusion of an agreement. Dictionary of financial terms... Financial dictionary

receipt - guarantee, power of attorney, warrant, receipt; document, bondage, recording, certificate, identification, persuasion, bill of lading, paper, enticement, promise, receipa Dictionary of Russian synonyms. receipt noun, number of synonyms: 19 • adr (1) • ... Dictionary of synonyms

RECEIPT - a document signed by the person who gave the receipt and certifying in writing that this person received money, things, material assets from another person and undertakes to return them. A receipt, correctly executed and notarized ... Economic Dictionary

RECEIPT - a one-sided document with a signature certifying the fact of receipt of something (for example, fulfillment of an obligation, certificate, license, safety briefing, summons). In law, it is one of the types of written evidence. In... ... Legal Dictionary

RECEIPT - RECEIPT, and, female. 1. see paint, xia. 2. A document with a signature certifying receipt of something. Give a receipt to someone. R. in receiving an advance. Ozhegov's explanatory dictionary. S.I. Ozhegov, N.Yu. Shvedova. 1949 1992 ... Ozhegov's Explanatory Dictionary

receipt - RECEIPT, and, g. 1. Persuasion, cajoling. 2. Whose l. promise that l. do. From paint, sign... Dictionary of Russian argot

receipt - and, g. dépiecer. corner, mol. Razor, blade, small knife. AIF 1998 No. 15. Wed. Schedule, Write. Lex. Mokienko 2000: painting/ska ... Historical Dictionary of Gallicisms of the Russian Language

receipt - A signed document certifying that the signatory has received something. In law, it is one of the types of written evidence. In some cases, R. indicates the conclusion of an agreement (for example, a loan agreement).... ... Technical Translator's Directory

Receipt - (English receipt) a document with a signature certifying the fact that the person who issued the R. received a certain benefit, mainly property. In law, it is one of the types of written evidence. In some cases, it indicates a law ... Encyclopedia of Law

Large legal dictionary. - M.: Infra-M. A. Ya. Sukharev, V. E. Krutskikh, A. Ya. Sukhareva. 2003.

See what “RECEIPT” is in other dictionaries:

Receipt - (voucher) A receipt for money or any other document that is posted in the accounts. Business. Dictionary. M.: INFRA M, Ves Mir Publishing House. Graham Betts, Barry Brindley, S. Williams and others. General editor: Ph.D. Osadchaya I.M..... Dictionary of business terms

RECEIPT - RECEIPTS, receipts, female. 1. units only Action under Ch. write in 1, 2 and 3 digits. paint. Wall painting. Receipt of accounts according to books. 2. A document with a signature issued as evidence of receipt of something. Receipt for receipt of money. Pass... ... Ushakov's Explanatory Dictionary

RECEIPT - a document with a signature certifying that the signatory has received something. In law, it is one of the types of written evidence. In some cases, it indicates the conclusion of an agreement. Dictionary of financial terms... Financial dictionary

receipt - guarantee, power of attorney, warrant, receipt; document, bondage, recording, certificate, identification, persuasion, bill of lading, paper, enticement, promise, receipa Dictionary of Russian synonyms. receipt noun, number of synonyms: 19 • adr (1) • ... Dictionary of synonyms

RECEIPT - a document signed by the person who gave the receipt and certifying in writing that this person received money, things, material assets from another person and undertakes to return them. A receipt, correctly executed and notarized ... Economic Dictionary

RECEIPT - RECEIPT, and, female. 1. see paint, xia. 2. A document with a signature certifying receipt of something. Give a receipt to someone. R. in receiving an advance. Ozhegov's explanatory dictionary. S.I. Ozhegov, N.Yu. Shvedova. 1949 1992 ... Ozhegov's Explanatory Dictionary

receipt - RECEIPT, and, g. 1. Persuasion, cajoling. 2. Whose l. promise that l. do. From paint, sign... Dictionary of Russian argot

receipt - and, g. dépiecer. corner, mol. Razor, blade, small knife. AIF 1998 No. 15. Wed. Schedule, Write. Lex. Mokienko 2000: painting/ska ... Historical Dictionary of Gallicisms of the Russian Language

receipt - A signed document certifying that the signatory has received something. In law, it is one of the types of written evidence. In some cases, R. indicates the conclusion of an agreement (for example, a loan agreement).... ... Technical Translator's Directory

Dismissal of a financially responsible person

At its core, financial liability is the employee’s obligation to compensate the employer for damage caused to him as a result of culpable unlawful behavior, action or inaction (Article 233 of the Labor Code of the Russian Federation).

According to Art. 243 of the Labor Code of the Russian Federation, financial liability in the full amount of damage caused is assigned to the employee in the following cases:

- shortage of valuables entrusted to him on the basis of a special written agreement or received by him under a one-time document;

- intentional causing of damage;

- causing damage while under the influence of alcohol, drugs or other toxic substances;

- causing damage as a result of the employee’s criminal actions established by a court verdict;

- causing damage as a result of an administrative violation, if established by the relevant government body;

- disclosure of information constituting a secret protected by law (state, official, commercial or other), in cases provided for by federal laws;

- causing damage if an employee fails to fulfill his job duties.

The legislator has established a list of cases when the imposition of financial liability on an employee is excluded (Article 239 of the Labor Code of the Russian Federation), namely if damage to the employer is caused due to:

- extreme necessity (within the framework of necessary defense);

- failure by the employer to fulfill the obligation to provide appropriate conditions for storing property entrusted to the employee;

- force majeure, that is, an emergency and unpreventable event under given conditions (for example, a natural disaster, fire), as well as within the limits of normal economic risk.

We suggest you familiarize yourself with: Property tax 2 2

By concluding an agreement on full financial liability, the employee undertakes to compensate the damage caused to the institution in full (clause 1 of Article 243 of the Labor Code of the Russian Federation).

If a fact of damage is detected, it should be confirmed with documentation, for example, an inventory report for a shortage of material assets, drawn up by the inventory commission. The absence of a document confirming the fact of causing damage and determining its amount makes the guilt of the financially responsible employee unproven and deprives the employer of the opportunity to hold him financially responsible for this damage.

Before making a decision on compensation for the damage caused by the financially responsible person, the employer must find out whether the employee’s behavior was unlawful and his guilt in causing the damage, whether there are circumstances that exclude financial liability in this case, whether there was intent, etc.

The amount of damage caused by the financially responsible person is determined based on market prices prevailing in the given area on the day the damage was caused, but not lower than the book value of the property, taking into account its depreciation (Article 246 of the Labor Code of the Russian Federation). To determine the amount of damage, the employer has the right to involve an independent appraiser.

Recovery of the amount of damage from the financially responsible person is carried out on the basis of an order signed by the head of the institution, and it must be issued no later than a month from the moment the employer finally establishes the amount of damage caused to him (Article 248 of the Labor Code of the Russian Federation). The financially responsible person from whose salary the deduction will be made must be familiarized with this document against signature.

One of the reasons for conducting an inventory of material assets is the change of financially responsible persons (on the day of acceptance and transfer of cases) (clause 1.5 of Methodological Instructions No. 49).

Thus, upon dismissal, the financially responsible person must transfer the material assets assigned to him to another person.

If, during the inventory, a shortage of property is discovered due to the fault of the financially responsible person being dismissed, then the employer has the right to go to court in disputes about compensation by the employee for damage caused to the employer within one year from the date of its discovery (Article 392 of the Labor Code of the Russian Federation).

In paragraph 3 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 52, judges are advised that they do not have the right to refuse to accept a statement of claim on the grounds that the employer missed the one-year period calculated from the date of discovery of the damage caused.

If the employer missed the deadline for going to court and they did not provide evidence of valid reasons for his absence, which could serve as the basis for his reinstatement, he will be denied acceptance of the statement of claim. Valid reasons for missing a deadline may include exceptional circumstances beyond the control of the employer that prevented the filing of a claim.

I.Zernova

Magazine editor

accounting and taxation"

What if the receipt was written under threats?

Good afternoon, my wife was fired for allegedly not getting enough at the bar and they forced her to write a receipt so that she would give the amount of 50,000, she did not take this money. They say that they saw on the cameras that she did not throw away some goods. As she explains, such goods as a pack of juice are not significant, well, money in the cash register. Just because of the rush. The director threatens her by saying that she has nowhere to get a job and will disgrace her on the entire Internet. And there are 7 other girls working there, the only complaint is to her, although she worked there for a year and had no complaints. What to do in this situation? Why not pay such an unreasonable amount?

Financial liability of managers

It is not necessary to conclude a separate agreement on full financial responsibility with the director, deputy directors of the company and the chief accountant. It is enough to include the corresponding clause in the text of the employment contract (Article 243 of the Labor Code of the Russian Federation).

In paragraph 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 52 {amp}lt;3{amp}gt; It is noted that by virtue of Part 2 of Art. 243 of the Labor Code of the Russian Federation, financial responsibility in full can be assigned to the deputy head of the organization or the chief accountant, provided that this is established by the employment contract. If the employment contract does not stipulate that these persons, in the event of damage, bear financial liability in full, then in the absence of other grounds giving the right to hold these persons accountable, they can be held liable only within the limits of their average monthly earnings.

An agreement on full financial liability will be concluded with an accountant only if he performs the functions of a cashier. Moreover, such agreements are drawn up according to the rules established by Art. 244 Labor Code of the Russian Federation.

However, the head of the institution bears full financial responsibility, even if this is not specified in his employment contract (Article 277 of the Labor Code of the Russian Federation).

Employment contract between individuals sample 2021 free download standard form example form

4.5. The Employee's annual leave may be granted to him either in full or in parts. Specific terms for granting annual leave are established by the head of the department in which the Employee works, in accordance with the vacation schedule.

We recommend reading: Agreement with Atelier for Sewing Products Sample

2.5.17. In the event of a controversial situation with the general director or employees of the company, take all measures to resolve the controversial situation within the company as quickly as possible. If it is impossible to resolve within the company, transfer the issue for approval and decision by the head of the SEB.

Inheritance IOU

My father borrowed a certain amount from his friend 10 years ago at three% per month, regularly paid the interest, partially repaid the debt, at that time the conditions were not the most favorable. As soon as his father’s business got back on its feet, he, having repaid the existing loans, took a new one equal to the amount on the receipt; when transferring the money, he decided to keep the amount of 500,000 thousand for himself, so he planned short-term investments, they decided not to show all this on the receipt, since many times already the amount of debt changed during this period. (The father took it and then returned it again) After 2 months, the creditor suddenly dies. The father contacted the heirs and offered to return the amount he owed, namely 500,000, the heirs objected that there was a different amount on the receipt, they did not agree with his arguments, he gave them 500,000. (Displaying this in the receipt). They didn’t bother him anymore, saying thank you and that was it. After 5 years, they sued him and presented the remaining amount +% for 5 years + legal costs. Since the receipt was drawn up without specifying the date for repayment of the debt amount (on first demand). The court of first instance fully satisfied the applicant's demands. Not only was it not possible to prove that the amount was paid earlier, but they also calculated 3% per annum for 5 years. Father, if he had to, would have given it back then! Each of us understands that 36% per year is a crazy amount for 5 years, especially when you don’t even know about it! The question is, is it possible to refute something in a court of 2nd instance? If so, what arguments should be used to appeal? Thank you

Lawyers' answers (2)

Good afternoon If the court of first instance made a decision in absentia, then you can submit an application for its cancellation within 7 days from the date of receipt of the decision. You need to indicate to the court that the statute of limitations has expired, the total period of which is three years. If they make a claim for the remaining amount, they are essentially admitting receipt of the principal amount.

Client clarification

3 years if the receipt specifies the return date

26 July 2021, 19:00

Client clarification

How does this relate to my case?

26 July 2021, 19:56

How and by whom are the identified discrepancies reflected?

The condition of property assets will be reflected in the inventory list (INV-3). Based on this paper, the accounting department then prepares a matching statement.

The inventory form is a table that displays:

- accounts and subaccounts with assigned numbers for each category;

- units of measurement of values;

- quantity;

- price.

The financially responsible employee participates in the inventory and may agree with the commission’s conclusions or challenge them. The inventory will be presented to him one way or another for his review. After this, the person involved signs both the fact of familiarization and the fact that he has no complaints against the inventory commission.

Identified discrepancies between the documentary and the actual are reflected in the documentation according to the following principle: the surplus is received and credited to the organization’s financial account. If we are talking about a budget enterprise, then to increase funding.

If inspectors find unusable or damaged materials, appropriate reports are drawn up about this.

Damage and shortages are written off:

- at the expense of the guilty person;

- to natural decline.

For a budget organization this will be a reduction in funding.

When and in what cases is it carried out?

- upon discovery of theft or damage;

- if a financially responsible employee is replaced;

- on the eve of the annual financial report;

- upon the occurrence of unforeseen extreme events;

- the foreman has changed or at least half of the members have left the brigade;

- at the request of one of the team members;

- if the company is reorganized or, on the contrary, closed;

- in other cases when required by law.

- development planning;

- ensuring people's safety;

- maintaining facilities in good condition.

Technical inventory means the inspection of buildings and structures, the generation and provision of a report on their presence and safety to all persons related to this.

What is it for?

Based on the results of this procedure, a technical passport is issued for each structure, where all the data is entered.