With a view to checking

A document such as a sick leave certificate has serious legal force, which gives the Social Insurance Fund grounds to conduct inspections. The issuance of this document implies the payment of monetary compensation to an employee who has lost his ability to work for a certain period of time. Also, according to it, companies deduct the costs of paying benefits.

Keep in mind: if it is necessary to conduct a desk audit, the Social Insurance Fund has the right to demand complete information on the documents prepared by the employer. How social insurance workers check sick leave can be found in Resolution of the Social Insurance Fund No. 81 of 04/07/2008.

Features of the FSS personal account

In your personal account you can use the following functions:

- View data on new certificates of incapacity for work.

- Add new data to the certificate of incapacity for work.

- View and print ELN.

- View sick leave payments and analyze benefits. To do this, you must enter the full name or individual number of the insured person.

- Send sick leave to create registers in the Social Insurance Fund.

- Send appeals to the FSS.

- View the log of data exchange between the policyholder and the Social Insurance Fund.

- View the notice for the policyholder from the Social Insurance Fund.

- Make an appointment with the FSS.

Anyone can use the electronic account of the Social Insurance Fund. But this service is not compulsory. Therefore, every citizen can make a choice. If an organization does not want to connect to such a system, then the employer will receive all documents, as before, on paper.

Social Insurance Fund

/ article author

Basics

A certificate of incapacity for work is a kind of support from the state and a guarantee of the material well-being of citizens. Based on this document, the employer pays for the employee’s disability even if he is absent from the workplace.

The sick leave must be properly completed and reviewed without fail. The official of the medical institution filling out this document is obliged to comply with the legal grounds for its discharge, and a specialist at the company is required to draw up regular reports on such documents received from employees.

Form and maintenance of the register

Articles on the topic (click to view)

- Economic Crime Lawyer

- What to do next after you have bought a plot of land?

- Official rating of companies providing bankruptcy support for legal entities

- The bank has demanded full repayment of the loan, what should you do in such a situation?

- ROIS - Customs Register of Intellectual Property Objects

- Electronic trading platforms for bankruptcy

- The theory of consumer behavior suggests that the consumer strives

Order of the fund dated June 15, 2012 No. 223 will help you develop your own version of the register of sick leave for FSS reimbursement and fill it out. In it you can find a form for the register of information necessary for the assignment and payment of benefits.

The full name of the enterprise and its form of ownership must appear on the top of the title page. The next line indicates the name of the document. After this, you must enter the policyholder's registration number. The following is a table with all the information that needs to be provided:

- number and series of sick leave;

- employee data;

- the reason for the disability;

- period of illness;

- employee's insurance record;

- benefit amount: total and at the expense of the Social Insurance Fund.

All available sick leave must be entered into the table, otherwise FSS inspectors will have questions for the company’s management or its individual employees. Please note that the absence of a specific format in the legislation does not deprive this document of its seriousness. Therefore, you should be extremely careful when filling it out.

Information must be sent to the Social Insurance Fund to assign and pay benefits.

To pay benefits to an employee, an organization with more than 25 employees must send information to the Social Insurance Fund in the form of an electronic register.

If the number of employees is smaller, the inventory can be submitted on paper. This must be done within 5 days after the employee brought you sick leave.

The form of the registers and the procedure for filling them out were approved by Order No. 578 of the Social Insurance Fund dated November 24, 2017.

In addition, to assign benefits, you will need to receive an application from the employee, which must also be completed in accordance with the form established by the Social Insurance Fund order dated November 24, 2017 No. 578. Submission of this application in free form is not permitted. The FSS will consider this a mistake.

Previously on the topic:

Direct FSS payments: new procedure for assigning benefits in 2021

Rules and algorithm for paying benefits directly from the Social Insurance Fund from 2021

Who fills it out and when?

The authenticity of the document is usually confirmed by the chief accountant of the enterprise. The manager's signature is desirable, but not required.

From a legal point of view, maintaining a register is an optional procedure, but it greatly simplifies the work with documentation. So, the registry:

- eliminates the need to make copies of existing sick leave certificates to transfer them to the Social Insurance Fund;

- simplifies the desk audit.

There is a program for filling out the register from the FSS. It is free, but requires manual input of information. You can use software from well-known software developers for accountants. Then the register will be generated automatically. But this option is not always justified for small businesses: it can cost a pretty penny. In addition, failures cannot be ruled out.

As a rule, in addition to the register, companies also maintain a journal where they enter received sick leave. Practice shows that they have similar graphs and, often, it is advisable to combine these two lists.

The register can be maintained both in paper and electronic versions. The FSS accepts any format for submission. But if we take into account modern practice, it is more convenient to perform it electronically.

Why does the policyholder need a personal FSS account?

Almost all organizations have created personal accounts for the convenience of providing services. An insured citizen or policyholder can use the Social Insurance Fund online.

The FSS personal account makes life easier for an accountant and the head of a company. Previously, all actions had to be performed manually, filling out a lot of paperwork, and submitting documents to the Social Insurance Fund. Now you can do everything electronically and you don’t need to visit the FSS office to transfer documents. Of course, such a service is very convenient.

In your personal account you can store all the necessary information on a medium. Now you don't need to look for forms or worry about losing them. All documents that were sent to the FSS can be viewed at any time in your personal account. If necessary, you can find the policyholder's form using individual data or a unique number.

Electronic transmission mechanism

- The register is compiled in special accounting software or Excel.

- The document must be converted into a format convenient for the Social Insurance Fund; You can use his own software for this.

- After affixing an electronic digital signature, it is encrypted. Encryption can be done using a free program or using the services of a certification center.

- The process of uploading files to the FSS server is carried out, after which the company receives a receipt for the successful submission of the register.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

To create a registry, in order to avoid errors, it is advisable to use programs from well-known developers. With their help, time costs will be minimal.

To create a register, some enterprises prefer to turn to specialized companies. They provide services for preparing any documents for successfully passing the FSS check. But you should choose a company with an extremely positive reputation.

FSS system requirements

In order for a legal entity to use a personal account, it is necessary to have a unique qualified electronic signature (UKES). In addition, it is advisable for the policyholder to have a computer that is reliably protected by crypto-security. This is necessary to verify and recognize the owner of the electronic signature.

There are no serious requirements for hardware, as well as for software. It is recommended to use the Windows 7,8 or 10 operating system. Of course, later versions of Microsoft are also suitable. It’s also worth choosing a reliable browser to work with.

Changes in compensation conditions under new legislation

Until relatively recently, there was a practice in which the employer was obliged to independently pay employees for sick leave. This forced him to evade such a responsibility in every possible way, which provoked a lot of problems for both sides.

If an employee became unable to work and was given sick leave, the company was obliged to pay him full compensation at its own expense.

After the legislative reform, enterprises were required to make contributions to the Social Insurance Fund from workers' wages. According to the new legislation, during the reporting period, the employer has the right to return a kind of social tax deduction, the amount of which is equal to the compensation paid to the employee.

The payment comes from the Social Insurance Fund, so the employer strictly reports to it for each sick leave taken.

Registration of the FSS personal account

Registering in your FSS personal account is very simple. Before starting work, it is recommended to study the capabilities and functionality of the system.

To register and log into your personal account, you need to open the official FSS website and choose one of three options:

- Office for the insured employee.

- Office for the policyholder.

- Office for ITU.

After opening the “Registration” section, you must enter the personal data of the individual: full name, phone number and email address. You can add registration after preliminary registration of the policyholder on the State Services website. After checking the data, the service will assign an individual access code. You can receive it by registered mail or at an identified center. You can choose the option that is convenient for you.

Using your password, you will log into your personal account. In your FSS personal account, you can add an organization this way:

- To add an organization and start working, a legal entity needs to open a personal account and fill out the organization’s data in Form 4.

- After you click next, the account activation section will open. You need to come up with a complex password to protect your personal account from hacking.

- The activation link will be provided after checking the data within 24 hours. After clicking on the link, an electronic portal opens where you can log in to your FSS personal account. To log in you need to enter your username and password.

- In the “Profile” tab, you need to open the “Organization” section, and then “Add”.

- An active certificate will be loaded, which allows you to submit a policyholder report through your FSS personal account. Each user has an individual certificate. If it is replaced, you need to enter new data.

- You can fill in the data in the “Profile” section: TIN, KPP, OGRN, name and address of the organization. In addition, you need to select the Social Insurance Fund with which you will work. Then click the "Save" button.

- In the personal account menu, you need to select “Application” and print the form. To complete the activation, you need to contact the fund with this application. Within up to 5 working days, you will be provided with all the features of your personal account, and in the “Profile” tab there will be about.

Authenticity of the illness document

The employer must be convinced that the sick leave provided by the employee is genuine. If there is no doubt about this and no violations are identified, then sick leave is paid. If you need to verify the authenticity of this document, you should perform the following steps:

- a written request is sent to the institution that issued the sick leave asking whether the doctor who signed the document is active there;

- by telephone you can verify the authenticity of the unique sick leave number/series, which should also be displayed in the register.

The general requirements for the appearance of the sheet include the mandatory presence of watermarks, the color of which includes shades of blue and yellow, as well as the presence of a series and barcode. The fields must be filled out in legible printed handwriting. Ink color is black. Corrections in the certificate of incapacity for work are unacceptable.

Register of ELN and register of direct payments to the Social Insurance Fund in ZUP version 3.1.17.135, 3.1.14.465

- home

- About company

- Articles

- Consultation line

- Register of ELN and register of direct payments to the Social Insurance Fund in ZUP version 3.1.17.135, 3.1.14.465

May 27, 2021

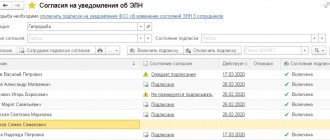

At the moment, the question often arises why, when trying to send or upload a register of direct payments from the Social Insurance Fund for an electronic sick leave certificate, the program gives an error: Before sending a register of direct payments for an electronic sick leave certificate, you need to send a register of an electronic sick leave certificate.

The fact is that in ZUP version 3.1.17.135, 3.1.14.465, before sending the FSS registry, we need to create and send (if we use 1C reporting) an ELN registry.

Where can we find it and how, if necessary, can we display it in the Reporting and Help section for quick access?

Let's look at it in order:

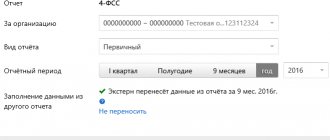

- We create a Sick Leave document through the menu Personnel – Sick Leaves:

- Since the ELN register is relevant only for electronic sick leave, we download the sick leave directly from 1C-reporting, or from the file:

- Please note that the certificate of incapacity data is no longer located in the Direct Social Security Payments tab, but next to the download buttons in the document header:

- When downloading electronic sick leave data, this data is filled in automatically, check:

- After the electronic sick leave certificate is completely filled out, we need to create an electronic sick leave register. It is located in the Reporting, references menu – 1C-Reporting:

- Using the Create button, we find the ELN register to be sent to the FSS in the ELN folder:

- The journal of the ELN Register for sending to the FSS can be made visible in the section Reporting, certificates . To do this, in this section, click the button in the upper right in the form of “gears” and select the item Navigation settings :

- After this, the navigation panel of the section will open, in the Available commands field we find the Register of ELN for sending to the FSS. Select it and use the Add button to move it to the Selected commands field. Click OK.

- We create an ELN register, fill it out using the Fill button, then it will be filled with all electronic sick leave certificates for which an ELN registry has not yet been created. Either through the Select button we select the specific electronic sick leave sheet that we need;

- If we send the register through 1C-Reporting, we can immediately send the register to the FSS from the document. If we use third-party programs for exchanging with the Social Insurance Fund, there is no need to download this register, we simply navigate and close the document:

After completing the ELN register, we fill out and send the register of direct payments to the Social Insurance Fund as usual. The error will no longer bother us.

The article was prepared by Svetlana Timofeeva, specialist at the consultation line of the InfoSoft franchise network.

Payment period

The Social Insurance Fund is obliged to make payments within ten days. The employee's compensation will appear on the next payroll.

If the sick leave was submitted a few days before payday, then most likely the payment will take place next month.

The employer is obliged to make all necessary calculations regarding the amount of compensation, which depends on the length of insurance, wages, duration of illness and the limit on the amount of compensation.

For some time now, the FSS has increasingly required the compilation of a register of sick leave for FSS reimbursement, for which it does not provide a sample form or design template. Firstly, this document is mandatory in the regions participating in the pilot project to automate document flow and calculations.

Secondly, officials in this way verify the authenticity of certificates of incapacity for work.

When the FSS transfers sick leave

For regional organizations participating in the pilot project, there is a special procedure for settlements with the Social Insurance Fund:

- Insurance contributions to the budget are paid in full. The amount of accrued contributions is not reduced by social benefits. insurance.

- Social insurance payments are not reflected in the reporting (4-FSS and calculation of insurance contributions).

- The employer transmits information about sick leave provided by employees to the territorial Social Insurance office.

- The FSS calculates sick leave and pays for it independently. Also, benefits are directly paid at the birth of a child, when registering in the early stages of pregnancy, for caring for a child up to 1.5 years old, and additional payment. leave for treatment.

- The employer pays for the first three days of incapacity at his own expense according to the usual rules (clause 6 of Government Decree No. 294, clause 1, part 1, article 5 255-FZ).

- The organization must also independently pay funeral benefits, pay for additional days off to care for a disabled child, and expenses for preventive measures. These payments also cannot be used to reduce the insurance premiums paid. But their amount is reimbursed by the FSS upon submission of the relevant documents to the territorial body (clauses 10, 11 of Resolution 294) and an application approved by Order of the FSS of the Russian Federation dated November 24, 2017 No. 578.

Who, how and when fills out the register of certificates of incapacity for work?

The register is prepared by the accounting department. Manual preparation is labor-intensive.

The program from the FSS is free, but requires manual data entry. Special software generates RBL automatically, but is not always justified for small businesses and is not always finalized.

When creating a RBL, it is worth considering that there is a sick leave register. It contains almost the same columns; perhaps it is worth combining the two lists.

In regions that are not participating in the pilot project, you can fill out the register of sick leave for FSS reimbursement in any way you like; a sample is available on the Internet. In this case, RBL must be provided only at the request of the Fund.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

However, some departments are introducing their own initiatives to identify fake sick leave certificates. When participating in a pilot project, RBL is required.

Only the technical side of data presentation is regulated; everything else is at the discretion of those filling it out.

Procedure for submitting information

The organization, having received the entire package of documents for assigning benefits from the employee, is obliged to transfer information about them to the territorial body of the Social Insurance Fund. Five calendar days are allotted for this.

To provide information, a register of sick leave for FSS reimbursement has been developed (sample documents for different types of benefits are presented in the appendices to FSS Order No. 579 dated November 24, 2017).

Next, the territorial body of the Social Insurance Fund checks the sick leave certificate, as well as other documents provided, and makes a decision on the assignment and payment of benefits. If the number of employees of the company does not exceed 25 people, then the package of documents can be provided on paper. If the number is higher, then provision is possible only in electronic form.

Register in the Social Insurance Fund on sick leave: sample

The algorithm for transmitting the sick leave register via the Internet is as follows:

The RBL is compiled in a convenient format, for example, in special accounting software or simply in Excel;

Translated into a format convenient for the Social Insurance Fund, you can use the state program; Some commercial ones implement uploading in the required format;

The document is signed with an electronic signature and encrypted. To do this, you can also use a free program or contact a certification center;

Uploaded to the FSS website, the process is similar to uploading files in other online services, including Yandex.Disk.

Based on the results of the download, the company receives a receipt if everything went well.

Systematization of data on cases of incapacity for work is carried out using the sick leave register. The document is drawn up in any form, indicating mandatory data that allows information users to identify the employee, the insured event and payments according to the bulletin.

The presence of a register makes it possible to simplify the desk check of the FSS based on ballots.

Filling out the sick leave register

In order for the Social Insurance Fund to accept the register, it must be completed in accordance with existing standards. However, the main difficulty is that there is no single sample BC register that could serve as an example when accountants create documents. If we talk about the official website of the FSS, then on its expanses you can find the following option.

Sample register provided by the FSS website

As mentioned earlier, in some cases the employer needs to enter additional information related to the sick leave of an employee. In this regard, it is advisable to study the order of the Social Insurance Fund No. 223, which allows you to understand the different variations of registers that may be needed under different circumstances.

Mandatory registry information

The form of the document is not established at the legislative level. Enterprises independently develop a register form, indicating in it sufficient data to control payments.

| Document details | Explanation |

| Last name, first name, patronymic of the person | Information is entered in accordance with the passport |

| Information about the certificate of incapacity for work | Provide data on the bulletin number and the reasons for the occurrence of the insured event according to the document encoding |

| Information about the period of incapacity for work | Indicate the start and end date of the disease, the number of days of incapacity for work, highlighting days paid by the enterprise |

| Amounts paid | The amounts paid at the expense of the employer and at the expense of the Social Insurance Fund are shown separately. |

Payments presented in the register are summarized at the end of the month.

Format for registering insurance cases

To generate the document, any of the available software is used - 1C, accounting programs, special developments of system administrators. 1C configurations provide registers for insurance cases for various purposes - disability, payment of benefits for care and birth of a child.

Enterprises with a small number of employees fill out the register data manually.

- The document is signed by the chief accountant of the enterprise. The signature is certified by the seal of the organization. Certification of the register with the signature of the manager is not mandatory.

- The form is submitted both on paper and in electronic form.

- The need to submit copies of certificates of incapacity for work is eliminated.

The register is compiled for a monthly period. For certificates of incapacity for work carried over to the next month, a separate note about continuation is made indicating the bulletin number (

Typical mistakes of organizations when sending information to the Social Insurance Fund

The FSS has already drawn attention to the fact that employers make common mistakes when filling out documents.

For example, they do not reconcile the employee’s account specified in his application with the details sent in the electronic register of information. As a result, the employee may receive money on another card. But transferring some benefits, for example, child care, is only possible to the Mir card.

Sending the register with errors or later than the established 5-day period is also a mistake, for which they may be held administratively liable under Part 4 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.

If you do not submit documents to the Social Insurance Fund for the assignment of benefits, or submit them incompletely or with errors, then the person who is responsible for this work in your organization will face a fine of 300 to 500 rubles.

In addition, when sending registers of information, there is no need to indicate the average daily earnings; an indication of the average earnings in the billing period is sufficient.

Also on topic:

The new format of the register of direct payments has been approved by the Federal Social Insurance Fund of the Russian Federation

How quickly does the Social Insurance Fund reimburse companies for the costs of paying benefits?

Design rules

Since 2021, there are two forms of sick leave in Russia - paper and electronic.

The external differences between these two forms are insignificant - the only difference between them is that the digital form is more convenient to use. Immediately after the doctor completes the paper or digital certificate of incapacity for work, information from these forms is automatically transferred to the general database of the BL registry.

Sometimes registers can combine information about sick leave and social benefits

The register of certificates of incapacity for work, in turn, can also be maintained in two ways - using a paper journal and using electronic accounting, which allows you to quickly access a particular form. The electronic register format currently exists in many programs developed for accountants, such as:

In order to make working with sick leave more convenient, the FSS website has provided an opportunity through which an accountant can activate his personal account. Thus, the specialist will have access to the database of employees who issued certificates of incapacity for work (this rule applies only to forms in electronic format).

You can read below about how to create a personal account on the Social Insurance Fund website and what functions it performs for the insured person.

In addition to familiarizing yourself with sick leave certificates, the presence of a personal account on the Social Insurance Fund website allows the accountant to carry out other useful actions, such as:

- subsequent printing of sick leave certificates;

- transfer of information about the policyholder to the electronic certificate of incapacity for work;

- indication in the BC form of all time periods during which the employee was incapacitated;

- instant transfer of information about the employee who filed a certificate of incapacity for work with the Social Insurance Fund, freeing the accountant from the tedious collection of paper reports and their subsequent sending;

- quick access to all payments for sick leave taken by employees using the Social Insurance Fund database.

An example of a completed sick leave register

There is a strong assumption that in the future, public clinics will increasingly begin to abandon paper BCs in favor of electronic ones. This step will allow accountants to work not with scattered papers, but with a single database connected to the Social Insurance Fund.

Thanks to this measure, it will significantly simplify not only the preparation of sick leave certificates, but also the calculation of payments to each employee.

How to fill

The list is required to confirm payment and when checking policyholders by fund specialists. Here's how to fill out the sick leave register in 2021:

- Enter information about the employer: name, registration number, subordination code, INN, KPP and OGRN, contact details of the contractor.

- Enter information about the employee: full name, date of birth and registration address, INN and SNILS, passport details.

- Indicate the number and date of the certificate of incapacity for work.

- Determine the start and end day of the illness, the number of total days of absence and the date of return to work.

- Calculate payments from the employer and the fund.

Sign the completed document with an electronic signature.

Transfer of data to the FSS

When transferring the register of sick leave to the Social Insurance Fund, the employer must first of all make sure of two things.

Table 1. What to consider when submitting certificates of incapacity for work to the Social Insurance Fund

| Criterion | Requirement | Details |

| Time | Data must be sent taking into account regulatory deadlines | Failure to meet delivery deadlines may result in fines and other sanctions for the company. |

| Form | The data was sent in an acceptable format | Format can be paper or electronic |

The question of what form the documentation should be supplied in directly depends on the number of employees involved in a particular organization. If we are talking about a small company that employs less than twenty-five people, then the employer has the right to transfer the BC register in paper format.

A larger number of employees makes this option of communication with the Social Insurance Fund impractical and requires a transition to an electronic format that facilitates data processing.

In order to compensate the employer for the benefits paid to employees, FSS employees check the registers to ensure that the entered data is correct.

On average, the Social Insurance Fund takes about one and a half weeks to review the received registers. During this period, specialists check in detail all the entered data and make a decision on whether to transfer funds to those employees who were on sick leave.

If this decision is positive, then financial compensation will be sent to the employees listed in the register according to the details specified in the document.

Corrective registers of direct payments to the Social Insurance Fund

- home

- About company

- Articles

- Consultation line

- Corrective registers of direct payments to the Social Insurance Fund

April 28, 2021

In the process of work, it often becomes necessary to send a corrective register of direct payments to the Social Insurance Fund. This may be related:

- with errors in calculating average earnings;

- changing card data for payment of benefits;

- other reasons that may arise during the process of registering direct payments to the Social Insurance Fund.

The FSS register of direct payments includes the documents “Sick leave” and “Information for the register of direct payments.”

Suppose we have an employee, the register of direct payments to the Social Insurance Fund for sick leave has already been submitted and accepted to the Social Insurance Fund.

Later we learn that the average earnings in the register we provided were calculated incorrectly. Let's say the wrong period was chosen for calculation or a certificate of income for previous periods was not entered.

First of all, we need to recalculate the sick leave. Go to the menu Personnel - Sick Leaves, open the sick leave to which you need to make corrections. We make the necessary corrections. If there is a need to save the primary data on the sick leave, you can use the edit line at the bottom of the sick leave form.

After clicking on this line, a document will be created to correct the current sick leave. After this, the primary sick leave will not be available for editing.

After making adjustments to the sick leave, we need to create a new register of direct FSS payments. The indicator for updating data in the register is assigned in the document “Information for the register of direct payments”.

Since we cannot correct the document “Information for the register of direct payments”, which is already attached to the sent register of direct payments, we need to make a duplicate application and attach it to the register of direct payments from the Social Insurance Fund.

We can find the document “Information for the register of direct payments” through the menu Reporting, certificates

—

Transferring information about benefits to the Social Insurance Fund

.

In the duplicate application, go to the benefit calculation tab. Check the Recalculation by reason checkbox and select the reason for recalculation from the drop-down list. We indicate the corrected average salary of the employee for calculating the Social Insurance Fund benefit.

Save.

We create a new register of direct payments from the Social Insurance Fund and fill in the corrected sick leave certificate for the employee and the document “Information for the register of direct payments” with the Recalculation due to reason attribute. We send the register. It will be accepted by the FSS as corrective.

Since it is planned to switch to the payment of maternity benefits exclusively to cards of the MIR payment system, this method is also relevant when changing the method of payment of benefits. In case of changing the payment card, we also create a duplicate document “Information for the register of direct payments”. We indicate the recalculation for a different reason and select new payment details for payment of benefits.

We fill out a new register of direct payments to the Social Insurance Fund with an information document for the register of direct payments with the attribute Recalculation for reason and new payment details and send it to the Social Insurance Fund.

The article was prepared by Svetlana Timofeeva, consultation line specialist.

Fines

As already mentioned, if reports are not submitted on time, only the organization itself will be punished - ordinary employees will not be affected by sanctions from the FSS. Among the preventive measures that potentially await the organization are:

- fines;

- administrative punishment.

Late submission of reports involves a fine issued on special receipts

Despite the fact that the fines are not so large, employers prefer not to delay sending important reports in order to avoid showdowns with government agencies. It is important to understand that the fine itself is not imposed for the lack of a register (since this document itself is optional), but for the delay in submitting certificates of incapacity for work.

Document structure

If we still take as a basis the sample that we gave above, then it consists of the following elements:

- at the top of the form there is information about the organization (in particular, its name and form of ownership);

- Below is the name of the document;

- immediately after the name, a place is provided for the registration number of the policyholder;

- Most of the sheet is occupied by a table, filling which is the most difficult part. We will talk about how such a table should be filled out and what information should be in it in this chapter.