In practice, there are often situations when the general director is the only founder. At the stage of development of a company, you always want to save money, including on paying yourself a salary and “salary” taxes, as well as by drawing up zero reporting, so as not to spend money on complex accounting.

But if you pay wages even at the “minimum wage” (in Moscow – 16,500 rubles), then taking into account income tax and contributions to funds, “salary” costs will be about 23,500 rubles. For many at the stage of business formation, even this amount is quite significant. In addition, when calculating salaries, there can be no talk of any “zero” reporting - reporting will have to be prepared, not only for the Federal Tax Service, but also for funds (FSS and Pension Fund). And this will lead to additional financial costs.

In this regard, the question arises: does the sole founder, who is the CEO, need to enter into an employment contract and pay himself a salary, or can this be somehow done without?

Let's start with the fact that the legislation of the Russian Federation does not provide for any clause or article that directly states that the sole founder-general director is allowed not to pay a salary. However, the legislation does not contain a rule obliging it to be paid. All justifications for the possibility of not paying wages are based on the interpretation of legal norms and explanatory letters from departments.

Let's figure it out.

Can a director work without salary?

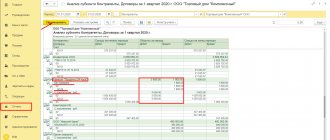

Auditors from the funds checked an actively operating company.

They found out that during the audited period its director performed his functions for free, that is, the director worked without salary. Inspectors consider this illegal. They added additional insurance premiums to the company based on the minimum wage (minimum wage), taking into account the regional coefficient. Shareholders, participants, beneficiaries of the company may well occupy any full-time positions in it. As a rule, directors. Since these individuals usually receive income from the company in another way (for example, in the form of dividends), they are of little interest in wages - they can easily perform their functions without it or for a nominal fee - less than the minimum wage. The employer is obliged to pay his employees in an amount not less than the minimum wage (Article 133 of the Labor Code of the Russian Federation). Violations of labor legislation threaten the company with fines of up to 50 thousand rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). But in practice, some managers, especially if they are also the owners of the company, work without salary, earning income in other ways. For example, in the form of dividends. You can defer the payment of personal income tax on dividends for a year

Loan schemes have become costly

How to issue an accrual order?

An order for remuneration of an employee holding the position of General Director is drawn up in accordance with the general requirements of office work.

The director has the right to independently sign an order to accrue his own wages based on the order of enterprise No. 1 (on the appointment of the general director and giving him the right to sign).

The general director's salary is calculated in the amount stipulated by the employment contract, instructions on remuneration and (or) the collective labor agreement.

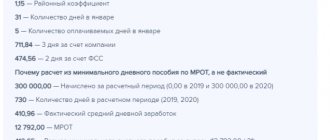

How is the base for insurance premiums calculated if there is no salary?

During the audited period, the company did not pay income to the director as part of the employment relationship and did not accrue it. The director did not enter into an employment contract with the company. The court decided that this indicates that the company does not have a basis for calculating insurance premiums (Part 1, Article 7 of Federal Law No. 212-FZ of July 24, 2009). The judges considered that the inspectors, when assessing additional contributions, reasoned erroneously. Federal Law No. 212-FZ of July 24, 2009 does not contain provisions that allow the fund, in the absence of a payer’s base for calculating insurance premiums, to independently determine the base for calculating insurance premiums based on the minimum amount of labor.

Courts are against charging additional contributions without actual payment of remuneration. This is not the first time that fund controllers have tried to charge additional contributions using the calculation method. This previously distinguished the auditors of the Ural and North Caucasus districts. In the case considered by the AS of the Ural District (resolution No. F09-5642/15 dated August 20, 2015), the inspectors, just as in the commented case, referred to the requirements of Article 133 of the Labor Code of the Russian Federation on establishing wages not lower than the minimum wage, taking into account the regional coefficient. And they added additional contributions based on the corresponding amount. The court agreed with the company's argument. The basis for calculating insurance premiums is the amount of payments and other remunerations of individuals (Part 1, Article 8 of the Federal Law of July 24, 2009 No. 212-FZ). During the audited period, the organization did not make payments in favor of the director or other individuals, and did not enter into employment contracts. According to the court, all this indicated that the company did not have a basis for calculating contributions. The court emphasized that Federal Law No. 212-FZ dated July 24, 2009 does not allow the fund, if the company does not have a taxable base, to independently determine it by calculation, based on the minimum wage. As a result, he canceled all additional charges. In the North Caucasus District, pensioners demanded that workers' wages be higher than the subsistence level. The company did not comply with this requirement. The auditors added additional insurance premiums using the calculation method. They proceeded from the difference between the cost of living and the actual salary. Disagreeing with the fund, the court recalled Articles 7 and 8 of the Federal Law of July 24, 2009 No. 212-FZ. Contributions for them are taken from payments accrued in favor of individuals, and not from conditional amounts (Resolution of the North Caucasus District Administration of January 18, 2016 No. A63-3315/2015).

How to withdraw money from LLC

Banks will notify tax authorities about transactions on individual accounts

Calculation of insurance premiums and reporting: are there any options?

We will separately dwell on the question of whether it is necessary to accrue insurance premiums for payments to the director - the sole founder and to include information about him in the reporting on contributions. Naturally, in the case when the manager is paid a salary on the basis of an employment contract, it is necessary to calculate insurance premiums and provide personalized information. But in practice there are situations when the above question is not so clearly resolved. Let's consider such situations.

The first situation: an employment contract has not been concluded with the director, and no payments are made in his favor (except for dividends).

In this case, it is obvious that the obligation to pay insurance premiums does not arise, since there is no taxable base (clause 1 of Article 419 of the Tax Code of the Russian Federation).

As for the presentation of reports, it must be taken into account that, according to the position of the Ministry of Finance of Russia (letter dated June 18, 2018 No. 03-15-05/41578), an organization that during the reporting (settlement) period did not make accruals at all in favor of individuals, all equally obliged to submit zero reports. As officials explained, the policyholder thereby declares the absence of payments and remunerations that are subject to insurance premiums, and, accordingly, the absence of paid contributions (see “The founding director does not receive a salary: is it necessary to indicate this information in the zero DAM?” ).

In addition, officials insist that for a director with whom an employment contract has not been concluded, the SZV-M form must be submitted (letter from the Pension Fund of the Russian Federation dated 03.29.18 No. LCH-08-24/5721 and the Ministry of Labor of Russia dated 03.16.18 No. 17-4/ 10/B-1846; see “SZV-M for directors: the Pension Fund of Russia requires submission of reports even for those founding directors with whom there is no employment contract”). And although in both letters the reasoning used by the departments is not convincing enough, failure to submit reports will most likely lead to a conflict with inspectors. o An employment contract must be concluded with the manager.

Arbitration practice is not in favor of payers. The Pension Fund of Russia won the dispute, proving that even in the absence of an employment contract, it is necessary to submit forms SZV-M and SZV-STAZH for the director-sole founder (Resolution of the AS of the West Siberian District dated November 29, 2019 No. A75-7182/2019).

Fill out, check and submit the SZV-M via the Internet Submit for free

IMPORTANT. What about the report in the SZV-TD form? Is it necessary to hand it over to the sole founder with whom an employment contract has not been concluded? No no need. This is what the Ministry of Labor thinks (letter dated March 24, 2020 No. 14-2/B-293; see “The Ministry of Labor informed whether it is necessary to submit a SZV-TD for the director - the sole founder”).

Second situation: an employment contract has been concluded with the manager, but wages are not accrued to him

All the conclusions made above are also relevant for the situation when an employment contract has been concluded with the manager, but wages are not accrued to him. The difference in this situation will be the even more precarious position of the organization in the event of initiation of legal proceedings. After all, if there is an employment contract, salary calculation is mandatory (Article of the Labor Code of the Russian Federation).

True, in 2021, a ruling by the Supreme Court of the Russian Federation dated 02/17/17 No. 309-KG16-20570 appeared, in which the judges recognized: if there is an employment contract with the director and in the absence of a salary accrued to him, contributions may not be paid (see “Supreme Court: if the organization does not pay the director a salary, she is not obliged to pay insurance premiums").

However, it is possible that inspectors will seek payments in favor of the director. And when they find it, they will try to justify that these payments are in the nature of remuneration for labor. If they succeed, the organization will be assessed additional fees, penalties and fines.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden Determine for free

Third situation: the organization does not operate

This situation is a variation of the first or second situation, but with the condition that the organization does not carry out any activities (that is, we are talking about a “sleeping” organization).

Tax officials insist that the Tax Code of the Russian Federation does not relieve payers of insurance premiums from the obligation to submit calculations if they do not conduct financial and economic activities and do not pay remuneration to individuals during a particular settlement (reporting) period. Therefore, a “sleeping” company is obliged to submit the DAM with zero indicators (letter of the Federal Tax Service of Russia dated November 16, 2018 No. BS-4-21 / [email protected] ; see “The LLC does not pay salaries and does not conduct business: is it necessary to submit a zero DAM?” ).

There is arbitration practice that is positive for the Federal Tax Service. Tax officials convinced the judges that blocking an account for an unsubmitted RSV in relation to the director-sole founder is legal (resolution of the Arbitration Court of the Ural District dated September 28, 2020 No. F09-5374/20; see “Can tax authorities block an account for failure to submit a zero RSV for a founding director : position of the court").

Fill out, check and submit a zero RSV for free via the Internet

The director is not paid a salary - taxes

Taxpayers, unlike pensioners, have the right to use the calculation method. However, the norms of subparagraph 7 of paragraph 1 of Article 31 of the Tax Code of the Russian Federation allow a limited list of cases for this: - refusal to allow the inspected person to inspect the premises and territory; — failure to provide documents for more than two months; — lack of accounting of income and expenses, the object of taxation, or record keeping with violations. Therefore, companies usually win similar disputes related to personal income tax. The court cancels the tax assessment based on the conditional amount. For example, the minimum wage or the subsistence minimum (resolutions of the FAS of the East Siberian district dated 09.23.10 No. A58-5012/09, West Siberian district dated 04.27.10 No. A81-3998/2009, Volga district dated 03.30.09 No. A12-12521/2008 and etc.). Arbitration does not recognize the calculation of tax from the minimum wage (resolutions of the Moscow Federal Antimonopoly Service dated August 26, 2010 No. KA-A41/9873–10, North-West Federal Antimonopoly Service dated June 19, 2009 No. A56-32491/2008, Uralsky dated March 10, 2009 No. Ф09-1039/09 -C2 districts). These indicators do not relate to the income received, that is, to the personal income tax base (clause 1 of article 210 of the Tax Code of the Russian Federation). There are such examples under the Unified Social Tax during the period of validity of Chapter 24 of the Tax Code of the Russian Federation. The courts rejected similar claims regarding the unified social tax and insurance contributions to the Pension Fund (resolutions of the Moscow Federal Antimonopoly Service dated August 26, 2010 No. KA-A41/9873–10, West Siberian Federal Antimonopoly Service dated October 30, 2008 No. Ф04-6627/2008(15063-А45-25), Far Eastern from 04.10.06 No. F03-A51/06–2/3285, East Siberian from 17.01.08 No. A19-7573/07-50-F02-9744/07 districts).

Dividends of LLC participants

Dividends can be paid from net profit - this is the company’s profit after taxes (Article 28 of Federal Law No. 14-FZ “On Limited Liability Companies”). All participants of the company who have a share in the authorized capital can receive dividends or a part of the profit, as specified in the law. Accordingly, if there is only one founder, then 100% of the net profit can be paid as dividends.

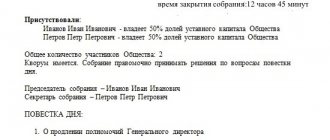

How to pay dividends?

To pay dividends, the Company must officially decide to distribute its net profit among the company's participants. The decision must indicate which participant is entitled to what share, how many days after the meeting the company will pay, and to which account it will transfer.

If the payment period is not defined in the decision or in the Charter, then by law it is 60 days from the date of signing the Decision. Then, in accordance with the decision, dividends are paid.

When can dividends be paid?

Dividends are transferred to the founders in accordance with the Payment Decision. If the payment period is not defined in the decision or in the Charter, then by law it is 60 days from the date of signing the Decision.

Society members can make such a decision no more often than once a quarter, and preferably once a year. Making the decision more than once a year, while legal, can cause problems. Dividends can be taken from profits, and you only know profits at the end of the year. If you distribute and give away the money earlier, you risk taking away too much and remaining at a loss.

Dividends should be paid at the end of the year, when financial results are summed up and annual profit is known.

At the same time, you can withdraw dividends not only for the year that has just ended. If the company has been profitable for several years, and you have not yet received dividends, you can take the net profit for all past years.

How much does it cost to pay out as dividends?

Dividends can only be paid from the company's net profit. This is the only factor limiting the size of dividends.

Recommendations on the amount of payments do not differ much from individual entrepreneurs - leave funds for investment in the company’s accounts.

Taxes on dividend payments?

An important point is that dividends are not the basis for calculating insurance premiums, unlike wages. This means that dividends can become an object of savings for the company.

Director works without salary - risks

However, practice has not always worked out in favor of employers. In a number of cases, when an employee or director works without salary, the courts support additional accruals based on the minimum wage. Let's consider what situations are at risk. The first and most obvious is if employment contracts are not concluded with employees (this does not apply to the director). At the same time, based on factual data and testimony, inspectors prove the existence of labor relations (Resolution of the Federal Antimonopoly Service of the Ural District dated April 24, 2008 No. F09-2804/08-S2). The Federal Antimonopoly Service of the North-Western District indicated that Article 37 of the Constitution of the Russian Federation guarantees workers a minimum wage. Therefore, a voluntary refusal of salary does not relieve the employer of obligations both to employees and to the Pension Fund. As a result, the court upheld the additional charges (resolution dated 02/03/2000 No. A56-27006/99). The norms of the Constitution of the Russian Federation on which the decision is based have not changed. This means that, despite the age of this judicial act, it is worth considering the risk of tax authorities and insurance funds using this argument. There is a risk that controllers will reclassify part of the dividends based on the monthly minimum wage into wages subject to insurance contributions. This is exactly what they did in relation to the remuneration that the director paid himself. Despite the fact that this payment also did not apply to labor relations or civil contracts, the court considered additional charges of insurance premiums to be lawful (resolution of the Thirteenth AAS dated 04.03.13 No. A21-8666/2012). In another case, the Federal Antimonopoly Service of the North-Western District stated that the company did not prove the fact of paying dividends, and not just remuneration to the only founder-director. The court further noted that relations arising as a result of election or appointment to a position are characterized as labor relations on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation). In situations where the employee and employer are the same person, the general provisions of the Labor Code of the Russian Federation apply. On this basis, the court concluded that an employee (read - founder), who is in an employment relationship with the company, has the right to compulsory pension insurance, and the company has the obligation to pay insurance premiums in respect of him (resolution dated September 26, 2011 No. A21-3113/ 2010). Another risk: tax authorities may consider that the company in such a situation has an economic benefit (Article 41 of the Tax Code of the Russian Federation). After all, she receives work or services free of charge. This may lead to additional charges for income tax (clause 8 of Article 250 of the Tax Code of the Russian Federation). However, in the event of a dispute, the courts qualify the relations of the parties as gratuitous if the following signs are present (Article 39 of the Tax Code of the Russian Federation, Articles 423, 572 of the Civil Code of the Russian Federation): - provision of goods, work or services under a gratuitous contract is carried out by only one of the parties, while the other party has no reciprocal obligations; — the contract or legal act contains a direct and unambiguous indication of the gratuitous nature of the relationship. If the company can prove that the other party also received economic benefits, not necessarily in monetary form, then the courts will cancel additional charges. An example of this is the resolution of the Moscow AS dated 08/05/15 No. A41-56516/14, the North-Western FAS dated 04/10/14 No. A56-30538/2013, the Central District dated 03/07/13 No. A54-1171/2011.

How to pay yourself if you are an individual entrepreneur

Beginning individual entrepreneurs have a question about their own salary. Everything is simple here.

The law does not provide for the calculation of wages for an individual entrepreneur. The Ministry of Finance explains this by saying that you cannot conclude an employment contract with yourself; there must be two parties - the employee and the employer. An individual entrepreneur is an individual who is engaged in business activities. That is, both parties to the contract will be the same person, which is not allowed by the Labor Code (Article 20 of the Labor Code of the Russian Federation and Article 56 of the Labor Code of the Russian Federation).

The owner of an individual entrepreneur cannot pay himself a salary. You can simply withdraw money in cash from the cash register or transfer it to a bank card. The main thing is to leave at least part of the profit for business development

Confusion is sometimes caused by banks and other organizations that, for the sake of convenience of personal accounting, classify individual entrepreneurs as legal entities. In such cases, you can use the explanations of the Ministry of Finance, as well as the norms of labor and civil codes.

How then can a business owner get money for his own needs? The property of an individual entrepreneur is not legally demarcated, so he can use the company’s profits for personal purposes (Article 128 and Article 209 of the Civil Code of the Russian Federation).

How to get money for personal needs?

You can withdraw money in cash from the cash register or transfer it from your current account to a bank card.

If you withdraw money from the cash register, you can use the simplified cash register procedure. This means that you don’t have to make entries in the cash book and don’t have to draw up an expense order. If you want to keep records of such transactions, then in the “Base” column you can write “Issuance of funds for the personal needs of an individual entrepreneur.”

When transferring money from a current account to a destination bank card, you can indicate “Transfer of own funds for personal needs of an individual entrepreneur.” The same reason must be indicated when withdrawing money from a bank using a checkbook.

When will I receive the money?

An individual entrepreneur can receive money for personal needs at any time, there are no restrictions.

How much money can you take?

The law does not limit in any way the amount of money withdrawn from a business; you can withdraw 100%. Legally, there is no difference between company money and personal money of an individual entrepreneur.

Beginners sometimes confuse income and profit, and spend all the funds received into their account. Do not repeat such mistakes, use only profits for personal purposes - that is, the money that remains after paying all taxes.

If you want your business to grow, it makes sense to use part of the profits for investment.

What taxes do I need to pay?

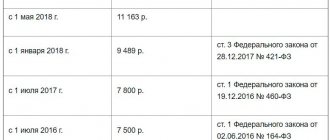

There is no need to pay personal income tax, as well as contributions to pension and insurance funds. This does not mean that the individual entrepreneur will be left without a pension in the future - the law establishes fixed contributions to the pension fund. For example, insurance premiums for individual entrepreneurs for themselves in 2021 are:

- 26,545 rubles per year for pension insurance;

- 5,840 rubles for health insurance.

If the income of an individual entrepreneur for 2021 exceeds 300 thousand rubles, then additional pension contributions, as before, will amount to 1% of the excess amount.

The director does not receive a salary - what does he live on?

If controllers accuse a company of understating insurance premiums or personal income tax, they will carefully check the expenses of the disinterested director. First of all, they will be interested in expensive assets that are subject to state registration: real estate, cars, their own business. Moreover, not only the director will be checked, but also his closest relatives. Next, most likely, will be securities, deposits, expensive travel and education, as well as other assets that can be tracked. The director should be prepared to answer questions from controllers about the sources of such acquisitions. Especially if they were made after the free work began. There can be many excuses: part-time work in another company, income of other family members, loans and borrowings, savings and other options. If during the first survey, conducted unexpectedly, the manager is unable to give clear explanations, this will confirm the suspicions of the inspectors.