In our country, businessmen at the legislative level are given the opportunity to choose a taxation system suitable for running their business. In some cases, when making transactions, it is necessary to know which of the existing types is used by the counterparty. Let's consider this issue in more detail, and also try to figure out what a certificate of the general taxation system is. We will provide a sample of it in the article.

Notice deadline

General OSNO taxation system: The application to switch to the simplified tax system was submitted before November 30. The application to terminate the transition to the simplified tax system was submitted before December 31.

In this situation, does the organization have the right to continue to apply the general taxation system in the year? On this issue, we adhere to the following position: Subject to documentary confirmation of the fact of sending a notice of transition to the simplified tax system and a notice of refusal to use the simplified tax system within the time frame specified by you in the question, your organization has the right to continue to apply the general taxation system in the year.

How to write an appeal to the Federal Tax Service? As the Federal Tax Service for the Kostroma Region said, taxpayers often need to obtain information or clarification from the tax authorities. In this case, it is very important to formulate the request correctly.

Surprising but true! On the eve of the next deadline for paying insurance premiums, tax officials decided to draw the attention of payers to the most common mistakes made when filling out payment orders for transferring contributions to the budget. Since there is no dependence of the amount of tax on the results of activities, there is an opportunity to reduce tax obligations to a minimum by correctly forming the proportions of expenses and income.

A written appeal can be submitted to the inspectorate of the Federal Tax Service of Russia by the taxpayer or his representative in person, sent by post, transmitted electronically via telecommunication channels or sent using the tax service website. Sample information letter Information letter - information of an official nature is conveyed. Often, a superior organization sends to its subordinates certain provisions of legislative and other regulatory legal acts with recommendations for their application.

Therefore, they are of a typical nature, mailing is carried out according to a list, that is, we recommend reading: When contributions are calculated under a civil contract, the addressee in the letter is indicated in general. A small digression from the topic.

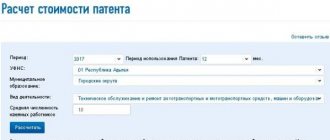

Form 26.2-1

An application for transition to the simplified tax system, or more precisely, a notification, is recommended by Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3 / [email protected] This form continues to be valid in 2021. The form is the same for individual entrepreneurs and organizations; below we will look at a sample of how to fill it out.

Download a free application for simplified training for 2021 (form)

Certificate of applicable taxation system: sample

How to write a notice of transition to the simplified tax system The simplified taxation system is a preferential regime for small businesses, which allows you to significantly reduce the tax burden.

Surprising but true! What should a certificate stating that an organization is a VAT payer contain: Guaranteed - no spam, only article announcements.

In this article you will find a notification about the transition to the simplified tax system, the Simplified tax form implies a special procedure for paying taxes for organizations and individual entrepreneurs; it is aimed at facilitating and simplifying tax and accounting records for representatives of small and medium-sized businesses. The simplified tax system was introduced by the Federal Law from the Claim for the return of insurance upon early repayment of a loan sample Accounting policy for the year: Look at the visual sample, and using the accounting policy designer, quickly generate a ready-made document.

Surprising but true! Since there is no dependence of the amount of tax on the results of activities, there is an opportunity to reduce tax obligations to a minimum by correctly forming the proportions of expenses and income.

The manager issues an order or instruction, which approves the accounting policy for the year. This is due to the entry into force of the order amending the VAT reporting form. On the eve of the next deadline for paying insurance premiums, tax officials decided to draw the attention of payers to the most common mistakes made when filling out payment orders for transferring contributions to the budget. For the first time, a new unified calculation of contributions must be submitted to the Federal Tax Service no later than May 2.

Certificate on the general taxation system: sample, features of obtaining and recommendations

August 31, 2017

In our country, businessmen at the legislative level are given the opportunity to choose a taxation system suitable for running their business. In some cases, when making transactions, it is necessary to know which of the existing types is used by the counterparty. Let's consider this issue in more detail, and also try to figure out what a certificate of the general taxation system is. We will provide a sample of it in the article.

What is the general taxation system (OSNO)

Tax legal relations in our country are regulated by the Tax Code. However, there is no concept of BASIC in it. This system is not considered a type of taxation regime, but only means the use of certain taxes. It is assigned by default if the entrepreneur did not select a tax regime during registration. Consequently, the application for switching to OSNO is not completed.

Experts recommend taking the issue of choosing a tax regime seriously, since it can only be changed at the beginning of the calendar year. But OSNO, with its positive aspects, has quite significant disadvantages. Let's consider the advantages and disadvantages of the general taxation system. The advantages include:

Cons of OSNO:

- All taxes (and there are enough of them) must be remitted in full.

- Maintaining accounting records is mandatory.

- It is necessary to maintain a fairly large amount of documentation and reporting for the tax service.

- Increased attention from law enforcement and tax authorities.

How to confirm OSNO

This question arises because of VAT. Companies using OSNO prefer to work with organizations on the same system in order to avoid problems when submitting taxes for deduction. Firms operating under simplified regimes are exempt from VAT. Therefore, if after the transaction the company received documents indicating “excluding VAT”, then it has the right to request a certificate or letter confirming the right not to allocate tax.

A sample certificate of application of the general taxation system, as well as a form, is not only difficult, but simply impossible to find. With a simplified system, for example, you can present a copy of the notice issued upon transition to this mode. Nothing like this is provided for OSNO. The Tax Code does not contain either a letter form or a certificate form that could notify the counterparty of the tax system used.

There are cases when taxpayers offer to confirm their system with a notification from the Federal Tax Service that the entrepreneur has lost the opportunity to use one of the special modes and has been transferred to the general one. This is possible, for example, if the organization exceeds the maximum permissible limit on income or when changing the type of activity that is not provided for by special regimes. It is in these cases that the tax inspectorate sends a paper demanding that you abandon the current tax regime and switch to OSNO. This message is drawn up in form 26.2-4.

Notification of transition to simplified tax system

To switch to the simplified tax system from January 1, 2021, you must submit a notification in the form

26.2-1

no later than December 31, 2021.

Individual entrepreneurs do not fill out the fields on the form for revenue for 9 months and the cost of fixed assets, therefore there are dashes in these fields

Certificate on the general taxation system: sample

It is compiled in free form. The certificate must indicate: the name and details of the organization, data on registration with the Federal Tax Service (taken from the registration certificate) and information that the organization, according to its taxation system, transfers value added tax. To confirm the accuracy of the data, you can attach a copy of the latest VAT return and other documents (copies) confirming the applied taxation system and indicating the transfer of tax to the budget. The certificate ends with the signature of the director with a transcript and an indication of the position.

Help for OSNO

To compose a letter in any form, use A4 letterhead. Follow the general rules of business correspondence. Do not forget to indicate the required details of the written notification of the chosen taxation system:

- Information about your organization, individual entrepreneur. Enter the full name in accordance with the registration documents. Please indicate your actual and legal addresses. Enter the TIN, KPP, OGRN and other information if necessary.

- Date of registration. Separately indicate the date of registration with the tax authority. It is acceptable to attach a copy of the document.

- Data that the company is a payer of VAT or other fiscal obligation, depending on the request of the business partner.

The document drawn up must be signed by the head of the company and certified with a seal. The signature of the chief accountant is not required, but is preferred.

In addition to the certificate, you can attach copies of documents that confirm the chosen system. For example, copies of payment orders for payment of VAT or income tax, a copy of the VAT tax return. If you are enclosing such documentation, please include a list of them in the letter.

Clarifying nuances

As practice shows, to be more convincing when drawing up a certificate, the following requirements must be met:

- Submit the certificate on letterhead with full details and stamp. This will make it easy to determine who the information came from.

- Indicate the start of work on the general taxation system (especially if the transition occurred recently) and attach supporting documents.

- Show in the certificate the combination of OSNO with special taxation regimes.

A certificate of general taxation system (an example of completion is presented above) is considered a formalized document. It is compiled handwritten or printed. In the case of a large number of counterparties, it is advisable to prepare the form in a standard way.

We apply for a certificate from the tax authority

In special cases (for example, when making large transactions), a certificate issued by the Federal Tax Service is required. Such a request to the tax authority is subject to several regulations. These are the laws:

- No. 59-FZ dated 02.05.2006 “On the procedure for considering applications...”;

- No. 8-FZ dated 02/09/2009 “On ensuring access...”.

And also the Tax Code, subp. 4 paragraph 1 of Article 32.

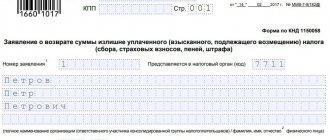

In general, Federal Law 59 regulates the consideration of applications to the tax authority. That is, before receiving a certificate of application of the general taxation system from the Federal Tax Service, you must draw up an application in which you must indicate:

- Name of the recipient organization.

- Name (or full last name, first name and patronymic) of the person making the request.

- Address to receive a response.

The application must be signed - this is important for identifying the applicant. Article 12 of Federal Law No. 59 regulates the period for consideration of a submitted application within thirty calendar days.

Is a certificate of application of OSNO sufficient to confirm the legality of the deduction?

Formally, to provide a VAT deduction, documents confirming the conduct of a business transaction and an invoice are sufficient. In practice, during a tax audit, these documents, as well as a certificate of application of OSNO, may not be enough. If a taxpayer claims to deduct VAT that was not paid by his counterparty to the budget, serious problems may arise related to the need to confirm the legality of the deduction, which will require proof of 2 aspects:

- performing verification activities on the counterparty;

- the reality of the business transaction carried out, its compliance with the business goal.

Obtaining a certificate of application of OSNO is only one of the elements of the first group of actions. At the same time, in the letters of the Federal Tax Service of the Russian Federation devoted to this issue, for example, dated July 24, 2015 No. ED-4-2/ [email protected] , dated June 24, 2016 No. ED-19-15/104, such a document is not mentioned. The main fiscal authority of the country instructs taxpayers to first check the reality of the existence of the counterparty.

IMPORTANT! Failure to verify a counterparty will not in itself entail additional taxes. As noted in the letter of the Federal Tax Service of the Russian Federation dated March 23, 2017 No. ED-5-9/ [email protected] , tax authorities should move away from the formal approach and pay attention to the procedure for selecting a counterparty, signs of coordination of actions, etc. Failure of the supplier to pay taxes to the budget in itself does not entail tax liability for the buyer who has submitted VAT for deduction.

So, a certificate of application of OSNO is a document, the form and obligation to submit which are not regulated by law. This type of letter can be provided by both the taxpayer and the tax authority upon request. In addition to such a letter, a prudent taxpayer may need a large number of other documents to verify the reliability of the counterparty and confirm his own integrity.

Confirmation of transition to OSNO

There is an opinion that a certificate about the general taxation system (a sample is presented in the article) can be replaced with a tax notice about the transition to OSNO. Is it so?

Organizations operating under special regimes do not pay VAT. Exceptions may be made in special cases stipulated by the Tax Code (import of goods into the country, etc.). At the same time, the same code states that for any type of activity, OSNO cannot be used only by those who have a direction using the simplified tax system, and other organizations using unified agricultural tax, UTII and PSN have the right to combine them with the main regime.

If a counterparty working in a special mode switches to the main mode for any reason, then the following happens:

- He sends a notification to the tax authority (in accordance with paragraphs 5, 6 of Article 346.13 of the tax legislation). In this case, the Federal Tax Service does not issue any documents confirming the transition.

- It is deregistered (if PSN or UTII was used). When a patent is closed (clause 4, article 346.45 of the Tax Code), a notification is not issued. But when switching from UTII, the tax authority issues a paper notifying about deregistration (clause 3, article 346.28 of the Tax Code). The form of the document (1-5-Accounting) is regulated by the order of the tax service numbered No. YAK-7-6 / [email protected] dated 08/11/2011.

It should be noted here that providing a copy of the described notice does not guarantee the counterparty’s transition to OSNO. If, for example, UTII was used in parallel with the simplified tax system, then if the UTII is abandoned, the organization returns to the simplified tax system. And in the 1-5-Accounting form itself there is no indication of which system the applicant is switching to.

What document confirms the right to special treatment?

Notification

If a company or individual entrepreneur switches to the simplified tax system, then they should send a notification to their Federal Tax Service about the transition to the simplified system. This is form No. 26.2-1 (approved by order of the Federal Tax Service dated November 2, 2012 No. MMV-7-3/829).

According to the provisions of paragraph 1 of Art. 346.13 of the Tax Code of the Russian Federation, this should be done before the beginning of January, in order from that moment to legally have the status of a tax payer under the simplified tax system.

Download on our website.

However, you should know that tax authorities are not required to provide any additional documentary evidence of the transition to a simplified tax system. The situation seems hopeless. After all, the tax inspectorate has the right not to send any permitting or notification letters to the counterparty. And where then can I get an answer to the letter about the application of the simplified taxation system?

Information letter

By order of the Russian Tax Service dated November 2, 2012 No. ММВ-7-3/829, another form of interest to us was approved - No. 26.2-7. This is an information letter. And not just a letter, but a very necessary document through which tax authorities confirm:

- receiving a notification from a company or individual entrepreneur about a change in their tax status and switching to a simplified tax system (in the letter form it is called an application);

- receiving reports under the simplified taxation system. Although information about submitted declarations may not be visible if the day for their submission has not yet arrived, and the information letter is already ready.

The form of this letter looks like this:

To receive such a letter, the simplifier should make a request for confirmation of the fact of application of the simplified tax system. And it is this document (its certified version) that will become the evidence that will confirm the status of a simplifier.

Also see “Moving from “imputation” to “simplified”.

Declaration

In the end, the status of your counterparty as a simplified person can be confirmed by the title page of a fresh declaration under the simplified tax system. In addition to the information letter from the Federal Tax Service, attention is drawn to this by the letter of the Ministry of Finance dated May 16, 2011 No. 03-11-06/2/75.

This is how the Federal Tax Service of the Russian Federation answers it

It seems that there are no rules prohibiting making such a request to the tax service. But tax officials do not support this idea, fearing the possible mass of appeals. The main fiscal authority argues its position with the Administrative Regulation of the Federal Tax Service No. 99 of July 2, 2012, paragraph 17. It states that tax authorities do not have the right to evaluate any circumstances or events from a legal point of view. That is, a direct question about whether an entrepreneur fulfills his tax payment obligations properly or improperly is impossible. Although there are forms of appeal to the Federal Tax Service, which they are required to respond to.

Here's what the Tax Code “thinks” about it

Perhaps the answer to the question posed will be a tax secret. This includes any information other than violations of tax norms and rules (Article 102 of the Tax Code of the Russian Federation, Article 1, subsection 3) and special regimes used by organizations (Article 102 of the Tax Code of the Russian Federation, Article 1, subsection 7).

Consequently, by force of law, the tax authority is obliged to respond to the counterparty by providing the necessary information. And based on the response received, we can conclude that the counterparty uses the general taxation system (OSNO).

Is it possible to obtain a certificate from the tax office without going through a counterparty?

It happens that a certificate about the use of OSNO by the counterparty is needed, but a response to the corresponding request is not received from him. At the same time, the need for such a document may be acute, for example, among budgetary organizations that are controlled by higher-level and regulatory authorities. What to do in this case? Is it possible to obtain information from the tax authority? These are the questions taxpayers ask.

Position of the Federal Tax Service of the Russian Federation

There is an option to contact the tax authority to find out whether a third party fulfills the duties of a taxpayer on OSNO. The Federal Tax Service of the Russian Federation does not support it, fearing the mass practice of appeals.

At the same time, the main fiscal authority of the country argues its position with reference to subparagraph. 3 clause 17 of the administrative regulations of the Federal Tax Service of the Russian Federation, approved. by order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n: tax officials do not have the right to give a legal assessment of any circumstances and events. Thus, the possibility of directly formulating the question of whether the obligations to pay taxes are properly fulfilled is excluded. However, there are variations of requests to which tax authorities are required to respond.

Norms of the Tax Code of the Russian Federation on tax secrecy

The likelihood of receiving an answer to the substance of the questions posed depends on whether the relevant information is a tax secret. This category includes any information, with some exceptions. In Art. 102 of the Tax Code of the Russian Federation, the list of exemptions includes the following data:

- on violations of tax legislation (subclause 3, clause 1, article 102 of the Tax Code of the Russian Federation);

- special regimes applied by the taxpayer (subclause 7, clause 1, article 102 of the Tax Code of the Russian Federation).

Thus, the tax authority is obliged to report these 2 parameters of the counterparty’s activities by force of law. Based on the answer to the question about special regimes, it will be possible to conclude whether the counterparty uses OSNO. It should be taken into account that only the use of the simplified tax system completely excludes the possibility of using the OSNO.

The request must be made according to the same rules as indicated above, clearly stating the questions in it. In addition, when drafting it, one should take into account the position of the Ministry of Finance of the Russian Federation, which is a superior body in relation to the Federal Tax Service of the Russian Federation.

Position of the Ministry of Finance of the Russian Federation

The Ministry of Finance of the Russian Federation, in its letter dated August 20, 2013 No. 03-02-08/33970, with reference to the decision of the Supreme Arbitration Court of the Russian Federation dated December 1, 2010 No. VAS-16124/10, indicated that information about the fulfillment by taxpayers of their obligations to pay taxes is not a tax secret, therefore, a request to apply OSNO should also not be left unanswered by the tax authority. At the same time, it was especially noted that such requests deserve attention if they are dictated by prudence in determining the counterparty.

Thus, according to the Supreme Arbitration Court of the Russian Federation and the Ministry of Finance of the Russian Federation, a request to the tax authority can be sent according to all 3 parameters:

- on the counterparty’s use of OSNO;

- bringing the counterparty to tax liability;

- application of special regimes.

There is judicial practice and the position of the Ministry of Finance of the Russian Federation confirming the legality of such a request and the obligation of the tax authorities to respond to the substance of the requests.

So, the letter or certificate has been received. Regardless of who submitted the certificate - the counterparty or the tax authority, the question inevitably arises: is such a document sufficient to completely protect oneself from claims from inspectors?

Position of the Ministry of Finance

In response to the decision of the Supreme Arbitration Court of Russia, the Ministry of Finance indicated that information about the fulfillment by organizations and individuals of their obligations to pay tax payments cannot be a tax secret. Consequently, tax authorities should not leave such requests unanswered.

Thus, requests can be sent to the Federal Tax Service according to three parameters:

- On bringing the counterparty to tax liability.

- On the counterparty's use of OSNO.

- About the use of special modes.

Law Explanatory Note to the Director: sample, writing features and recommendations

What is an explanatory letter to the director and in what cases should it be written? This will be discussed in this article. When is an explanatory note written? It is immediately worth noting that the explanatory note...

Travel Jordan, visa: necessary documents, features of obtaining and recommendations

Jordan is a new, but not yet very popular destination among tourists. This is why it is interesting to travelers who are already fed up with Egypt, Turkey and Thailand. Authentic nature, Dead Sea and oriental flavor...

Finance The main thing is...