Examples of powers of attorney

In accordance with the order of the Federal Tax Service of the Russian Federation dated July 31, 2014 N ММВ-7-6/ [email protected] when submitting a tax return (calculation) in electronic form under the TKS by a representative of the taxpayer, a document (copy of the document) giving the right to confirm the accuracy and completeness of the information, specified in the declaration (calculation) is provided to the tax authority before sending the tax return (calculation). A copy of this document is retained by the tax authority for 3 years after expiration.

You will need to provide the Federal Tax Service with a copy of the power of attorney in paper or scanned form. Also, in the Kontur-Extern system you will need to fill out a Message about representation (see Peculiarities of sending tax reports through an authorized representative).

We invite you to familiarize yourself with examples of powers of attorney for the following cases:

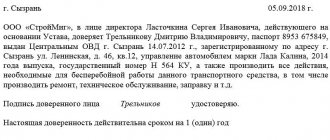

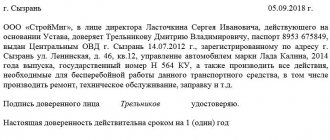

1. The reporting is signed by an electronic signature issued to the accountant of this organization

2. Reporting is carried out by a third-party organization indicating the responsible person authorized to submit reports

3. The reporting of an individual entrepreneur is maintained by another individual entrepreneur, and the power of attorney is notarized

1. The statements are signed with the electronic signature of the accountant

Such a power of attorney should be issued in the case where the electronic signature certificate is not issued to the head of the organization. For example, the head of Organization 1 LLC, represented by General Director I.I. Ivanov. authorizes the chief accountant Petrov P.P. represent interests in the Federal Tax Service.

Save a sample of this power of attorney (situation 1)

2. Reporting is carried out by a third-party organization indicating the responsible person authorized to submit reports

Such a power of attorney should be issued in the case where the reporting of Organization 1 is maintained by a third-party company - Organization 2. In this case, the power of attorney clearly indicates the authorized person in Organization 2, who has the right to sign. Thus, either the head of Organization 2 or its authorized representative specified in the power of attorney will be able to submit reports.

Save a sample of this power of attorney (situation 2)

3. The reporting of an individual entrepreneur is submitted by another individual entrepreneur, the power of attorney is notarized

Such a power of attorney should be issued in the case where the reporting of the individual entrepreneur Ivanov I.I. appears to be an individual entrepreneur S.S. Sidorov, and the power of attorney is notarized.

Save a sample of this power of attorney (situation 3)

>Power of attorney to submit electronic reporting

How to properly issue a power of attorney to submit electronic reporting if the interests of the company are represented not by the manager, but by another person?

Legal representative

The legal representative of an organization is a person authorized to express its interests on the basis of the law or constituent documents (that is, without a power of attorney). The basis is paragraph 1 of Article 27 of the Tax Code of the Russian Federation. For example, such an intermediary is:

- for a limited liability company and a joint stock company - their sole executive body. This is the general director, president or other person (Article 40 of the Federal Law of February 8, 1998 No. 14-FZ, Article 69 of the Federal Law of December 26, 1995 No. 208-FZ);

- for a production cooperative - its chairman (Article 17 of the Federal Law of May 8, 1996 No. 41-FZ);

- for a general partnership - its participant, unless the constituent agreement stipulates that all its participants conduct business jointly, or the conduct of business is entrusted to individual participants (Article 72 of the Civil Code of the Russian Federation).

The powers of the legal representative of the organization are confirmed by documents certifying his official position, including copies of constituent documents.

Let us note that the heads of representative offices and branches of the organization are its authorized representatives, and not legal representatives. After all, they act on the basis of the organization’s power of attorney (clause 3 of Article 55 of the Civil Code of the Russian Federation).

Reasons for refusing to accept a declaration due to signature

The tax authority will not accept a declaration that is signed in violation. There is an administrative regulation of the Federal Tax Service on this subject (order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n). The reasons for refusal are as follows:

- The representative submits a declaration under a power of attorney, but does not represent the power of attorney itself.

- The representative submits a power of attorney, but does not provide a document proving his identity.

- The power of attorney provided does not comply with legal requirements.

- The declaration was not signed by the person who has the right to do so by virtue of law or by power of attorney.

- The declaration in electronic form submitted under the TKS is not signed with an enhanced qualified electronic signature of the person authorized to do so. Or the data of the owner of the CEP certificate does not correspond to the data of the manager or entrepreneur (other authorized representative).

- The declaration is submitted to the wrong Federal Tax Service.

From all this it follows that the Federal Tax Service considers an unreliable signature to be an independent basis for not accepting a declaration.

Justification: letter dated July 10, 2018 No. ED-4-15/13247

How to draw up a power of attorney

There is no special form for a power of attorney to submit reports to the tax authority. It can be compiled in free form, but it is important to take into account several features arising from legal requirements:

- Date of issue. A prerequisite is to indicate the date of issue of the power of attorney, otherwise it will be declared invalid.

- Validity. The maximum period that can be specified in a power of attorney is three years. If no period is specified in the document, then by default it is valid for one year.

- Powers of the representative. The powers of the organization representative must be listed in detail. In this case, a power of attorney can be issued one-time to receive any document, for example, a reconciliation report with the tax authority or a request for tax payment. You can also issue a general power of attorney; it will allow you to perform the required actions that are related to representing any interests of the company in the tax authority. It is issued mainly to the chief accountant. It is important to correctly formulate the powers in the power of attorney. For example, the wording “I trust to represent the interests of the company in relations with the tax inspectorate” will not be entirely correct, since the rights indicated must be specified. It would be better to list the specific actions that the trustee has the right to perform, and in order to leave this list open, indicate in the last paragraph: “perform other legal actions related to the execution of this order.”

- Signature of the manager and company seal. The power of attorney can only be signed by its director. As for the seal, since April 2015, companies have the right not to put it on some documents. These include declarations, calculations, primary documents, etc. But the power of attorney must have a seal.

Important! The power of attorney to the tax authority must be stamped.

In what cases is a tax power of attorney used?

Under certain circumstances, any citizen may not visit the Federal Tax Service office in person, but give the right to provide documents to such a body to another person.

Typically this need is associated with the following situations:

- in case of illness of the principal;

- when leaving on vacation or a long business trip;

- in case of permanent residence in another city and the impossibility of appearing at the Tax Service office at the place of registration.

Powers of attorney of this kind are often issued to employees of organizations whose managers do not have time to independently deal with documentation related to taxation and fees. For example, a company accountant often has a power of attorney to submit reports to the tax office, but in this case such an employee may have limited powers.

In particular, an accountant may have the right to submit certain documents and receive various acts, but at the same time, the head of the organization may not give permission to sign certain types of papers received by the Federal Tax Service (documents for accounting accounts, acts of reconciliation of accounts, and others).

Attention! A power of attorney gives the right to represent the interests of the principal not only in the Federal Tax Service, but also in other services and bodies controlled by laws on taxes and fees. Such institutions include some extra-budgetary funds and customs authorities.

Inaccurate information in declarations

The tax service also spoke about the cases in which companies and individual entrepreneurs may be refused to accept declarations due to inaccurate information . This threatens those entities that:

- submit a “clarification” with an incorrectly specified correction number;

- failed to appear for questioning at least 2 times (director or entrepreneur);

- lawyers were brought in for questioning;

- gave power of attorney to representatives registered in other regions;

- in the previous reporting (tax) period they repeatedly submitted zero returns;

- indicated in the reports amounts of expenses close to the amounts of income, or deductions, the share of which is more than 98%;

- are absent at the place of registration;

- do not have lease agreements with the owners of the premises;

- have no more than 1 employee (according to the average number of employees);

- do not pay income to management;

- have problems with current accounts - they carry out transit operations, cash out funds, have too many accounts, do not have a current account at all, or open accounts in other constituent entities of the Russian Federation.

If the above signs are present, tax authorities will consider that the business entity may be a one-day company . There is a high chance that the activities of such a company will be checked.

Justification: letter dated July 10, 2018 No. ED-4-15/13247.

Right to delegate powers

From the point of view of the Tax Code of the Russian Federation, the taxpayer must personally participate in tax legal relations, but this is not always convenient. A full-time employee, a visiting accountant, a courier, or another person can submit reports and other documents to the inspection. To do this, you need to issue a power of attorney with the Federal Tax Service to represent the interests of an organization or individual entrepreneur.

Of course, you need to imagine whether the trustee will be able to provide explanations on the composition of the statements, if such a need arises. To do this, it is worth indicating only those actions for which the principal has authorized him. Otherwise, it may turn out that the tax inspectorate’s report on behalf of the taxpayer will include explanations from a courier who has nothing to do with the business.

The powers of a representative can be described as follows:

- submit reports, applications, complaints and other documents to the tax office;

- receive documents addressed to the company (or individual entrepreneur);

- provide explanations on issues of calculation and payment of taxes;

- participate in tax control activities, submit objections and explanations to the acts of the Federal Tax Service;

- certify with your signature on behalf of the company (or individual entrepreneur) acts, decisions, notifications, letters, protocols, notices, certificates, explanations.

Recommendations for choosing permissions

- - p.p. 08, 09 are required for opening and closing or changing bank accounts.

- - p.p. 13, 14, 15 are necessary for submitting requests and sending reconciliation reports to the Federal Tax Service.

- - p.p. 16, 17 are necessary for conducting a desk audit and tax refund.

- - p.p. 18, 19 relate to the import of goods.

Code 99 means full authority. You can specify one single code - 99. This way you will be given the right to submit and receive all documents to the Federal Tax Service, sign and perform all the listed actions.

If you do not know whether an authorized representative will need to perform any actions on your behalf, you can always issue a new power of attorney, which will add or revoke the necessary powers.

- Connect electronic reporting for a year (unlimited)

- Send electronic reporting one-time

Features of compilation

The power of attorney contains the following information:

- Name of paper.

- Date of grant of power of attorney.

- Company name, tax identification number and checkpoint.

- Full name of the employee whose authority is being transferred.

- Full name of the authorized individual.

- An indication of the rights that are being transferred.

- Validity period of the paper.

- Signatures of persons.

The duration of the document is not limited by law. That is, the principal has the right to indicate any validity period in the document. If there are no instructions, Article 186 of the Civil Code becomes relevant. It states: if the document does not include a deadline, the document will be valid for a year.

ATTENTION! The principal may revoke the power of attorney at any time. The rights granted on the basis of the document can also be waived by the authorized representative.

IMPORTANT! A power of attorney from an individual entrepreneur or individual must be certified by a notary. A power of attorney from the legal entity is provided signed by the company manager.

Transfer of powers

The authorized representative must personally perform those actions that are indicated in the power of attorney issued to him. He can entrust their implementation to another citizen or organization. To do this, the document must indicate that he is allowed to do this. Reassignment without such an indication is possible only due to circumstances to protect the interests of the person whose interests are expressed.

Let’s say a company has issued a power of attorney to a third-party company with the right to delegate powers to its employee. Then in this paper she should indicate such a right.

The authorized representative who transferred the authority must notify the principal about this and provide him with the necessary information about the new holder of the authority. Failure to fulfill this obligation makes the transferor responsible for the actions of the person to whom he delegated authority, as if for his own.

A power of attorney issued by way of delegation must be notarized. The period of its validity cannot exceed the validity period of the power of attorney on the basis of which it was issued (Article 187 of the Civil Code of the Russian Federation).

Suppose the company has transferred accounting maintenance to a specialized organization. At the same time, the head of the latter entrusted his authority to sign tax and accounting reports to his employee. In this situation, when submitting the company’s declarations to the tax authority, a third-party organization must attach to the reporting:

- a document confirming the authority of your manager to sign the declaration;

- a document that confirms the authority of the individual who signed the declaration to take such actions.

In addition, it is necessary to follow the established procedure for filling out tax return forms for a specific tax, including provisions for confirming the accuracy and completeness of information in the tax return by an authorized representative of the taxpayer.

What should a taxpayer do?

Meanwhile, the courts have repeatedly come to the conclusion that it is unlawful not to accept declarations due to an inaccurate signature. So if the tax authority refused to accept the report on this basis, there is a chance to challenge the decision in arbitration court .

This conclusion, for example, is contained in the resolution of the Arbitration Court of the Ural District dated June 27, 2018 No. A60-46912/2017. Judges point out that when accepting a declaration, tax officials cannot assess whether the signature on it is authentic. If the filing form is followed, the tax authority must accept the declaration and confirm this with a receipt for accepting the report in electronic form or a mark on a paper copy.

Tax experts also agree with the courts. They justify their position using the presumption of innocence , provided for in paragraph 6 of Article 108 of the Tax Code of the Russian Federation. The Federal Tax Service must prove through the court that the taxpayer whose declaration was not accepted is indeed dishonest. And he, in turn, can protect his rights in the manner prescribed by law.

Notarization

The need for notarization of a power of attorney raises many questions. Thus, there is a popular opinion that it can only be certified with the seal of an organization or individual entrepreneur. In the case of a legal entity, this is true - the head of the company could always transfer his powers to a representative, certifying the document with a personal signature and seal. And after the LLC seal has become an optional attribute, the imprint is no longer required, although it continues to be used in practice.

Until 2011, the same rule applied to individual entrepreneurs - if you have a seal, then you don’t need to go to a notary. This position is based on the provisions of Articles 23 and 185.1 of the Civil Code of the Russian Federation. According to them, the same rules apply to the activities of individual entrepreneurs as to legal entities. In particular, it was allowed to certify the powers of a trustee only with the seal and signature of the individual entrepreneur.

However, in 2011, Article 29 of the Tax Code of the Russian Federation was amended, and now legislative norms require that the powers of a representative of an individual entrepreneur be certified by a notary or in a manner equivalent to a notary. Moreover, this requirement applies only to a power of attorney for representing interests before the tax authorities. In other situations, a simple non-notarial form is appropriate.

Who owns the right to sign

Each tax return contains a section that confirms the completeness and accuracy of the information. In accordance with paragraph 5 of Article 80 of the Tax Code, the taxpayer or his legal representative has the right to do this. If we are talking about a company, then such a representative is a person who has the right to act on its behalf without a power of attorney. This is a leader - director, general director, president - the title of the position can be anything. As for the entrepreneur , only he personally has the right to sign a declaration without a power of attorney.

All other employees of the organization or individual entrepreneur, including the chief accountant, can sign tax returns only with a power of attorney. On behalf of the organization, this document is issued by the head, and notarization is not required. If a power of attorney is given by an individual entrepreneur, it must be drawn up by a notary.

Reporting is submitted according to TKS

When submitting reports electronically under the TCS, you must be guided by the Methodological Recommendations, which were approved by Order of the Federal Tax Service of Russia dated November 2, 2009 No. MM-7-6 / [email protected] According to them, a power of attorney (a copy thereof) certifying the right to confirm the accuracy and completeness The information specified in the declaration is sent by the taxpayer's representative to the inspectorate before submitting tax reports in electronic form. A copy of it is retained by the Federal Tax Service for three years after the expiration of the said document.

The software on the representative side sequentially performs the following actions:

- tax return in electronic form in accordance with the approved format and procedure for filling it out;

- an information message about the details of the power of attorney issued to this representative;

- a transport message containing a declaration encrypted for the tax authority and an information message about the details of the power of attorney.

The representative signs the generated reports, information and transport messages with his electronic digital signature.

The representative saves the declaration and information message about the details of the power of attorney signed with his electronic digital signature.

Notice of issued power of attorney

The message shall indicate the period for which the power of attorney was issued, its number, information about the person represented, the principal, the authorized representative, and the powers of the representative. Let us note that the document in question provides for 16 types of powers of a representative:

- sign a tax return and other reporting;

- submit a tax return and other reporting;

- receive documents from the Federal Tax Service of Russia;

- make changes to tax reporting documents;

- sign documents on registration and deregistration;

- submit documents on registration and deregistration;

- receive from the inspection of the Federal Tax Service of Russia documents for registration and deregistration, except for the certificate;

- sign documents for accounting of bank accounts;

- submit documents on accounting of bank accounts;

- submit documents on the application of special tax regimes and consolidation of accounting for separate divisions;

- receive documents from the Federal Tax Service of Russia inspectorate on the application of special tax regimes and consolidation of accounting for separate divisions;

- sign documents on consolidation of accounting for separate divisions;

- submit applications and requests for reconciliation of settlements with the budget, obtaining information on the status of settlements with the budget;

- receive reconciliation reports and certificates about the status of settlements with the budget from the Federal Tax Service of Russia inspection;

- sign an act of reconciliation of settlements with the budget;

- sign the tax audit report and decision.

Format

submission of information in an information message about a power of attorney issued to a representative granting him the authority to perform duties in the tax authorities in electronic form (version 5.03), part LXXXVI, established by Appendix No. 1 to the order of the Federal Tax Service of Russia dated November 9, 2010 No. ММВ-7-6 / [email protected]

Other requirements

Also, when generating an information message about a power of attorney issued to a representative, it is necessary to be guided by the Methodological Recommendations, which are approved by the Deputy Head of the Federal Tax Service of Russia A.S. Petrushin on November 21, 2011. They were brought to the attention of lower tax authorities by letter of the Federal Tax Service of Russia dated January 24, 2011 No. 6-8-04/ [email protected] According to these Methodological recommendations, the authorized representative sends an information message about the power of attorney to the Federal Tax Service only electronically form via TKS simultaneously with the electronic document. He must submit to the inspection a copy of the power of attorney on paper before he begins to carry out the actions entrusted to him.

This information message must indicate the details of the power of attorney and the powers of the person, the owner of the signature key certificate, who signs and submits the electronic document. In this case, the details of the signatory in the tax return (last name, first name, patronymic) must match the details (last name, first name, patronymic) of the owner of the signature key certificate.

Filling out the fields of the information message about the power of attorney in electronic form is essentially a reflection of the information located on paper - the original power of attorney issued by the taxpayer to the authorized representative.

Here are the recommended power of attorney details for correctly filling out the fields of the information message:

- power of attorney number;

- date of issue of the power of attorney;

- validity period of the power of attorney (no more than three years);

- reflection of the right to delegate powers, if any;

- details of the taxpayer organization on whose behalf (a direct power of attorney is issued) or for which (in case of delegation of powers) the authorized representative represents the interests;

- details of the principal (the person who issued and signed the power of attorney, if he is not the head of an organization or an individual entrepreneur, that is, in the case of sub-authorization);

- details of the authorized representative(s) (person) who is given the right to interact and sign reports;

- information about credentials.

The list of credentials is required to be completed. To submit declarations electronically under the TKS, an authorized representative must, at a minimum, indicate the code - “01” (sign the tax return). When granting full powers to an authorized representative, code “99” is indicated.

Types of authorized representatives

Authorized representatives who sign a tax return, confirming the accuracy and completeness of the information specified in it, are divided into two types.

The first type occurs in the following situation. The tax return is submitted by the taxpayer himself, and the declaration is signed by an employee of the taxpayer organization who is not a manager. In this case, in the name of the files of the tax return and the information message on the power of attorney, the taxpayer’s INN and KPP are entered; in the tax return, in the block “I confirm the accuracy and completeness of the information specified in this declaration,” the code “02” (authorized representative) and the surname, first name are entered , patronymic name of an employee of the taxpayer organization;

The second type - the tax return is submitted by an authorized representative, who is an organization or an individual entrepreneur. Then, in the name of the files of the tax return and the information message about the power of attorney, the TIN and KPP of the representative are entered, in the tax return in the block “I confirm the accuracy and completeness of the information specified in this declaration” the following are entered: code “02” (authorized representative), last name, first name, patronymic of an employee of the authorized organization (last name, first name, patronymic of the authorized individual entrepreneur) and full name of the authorized representative.

Power of attorney information messages are generated in various situations, including when:

- the head of the organization has signed a power of attorney in which he authorizes his employees to perform actions on behalf of the organization when submitting tax reports to the tax authorities;

- the head of the organization signed a power of attorney for an authorized representative, which is a third-party company, represented by the director and employees of the latter;

- the head of the organization signed a power of attorney for an authorized representative represented by an individual entrepreneur;

- the legal representative of the organization signed a power of attorney for its employee (employees);

- the head of the organization signed a power of attorney for the authorized representative, which is the company, represented by the head of the latter. In turn, if he has the appropriate rights, this manager signed powers of attorney for his employees;

- the head of the organization signed a power of attorney in which he authorizes the director of its branch to perform actions on behalf of the organization only in relation to the branch in the Federal Tax Service of Russia at the location of such division.

Recommendations for filling out a power of attorney for an authorized representative

The rules for the execution and validity of the power of attorney are regulated by Art. Art. 185 - 189 of the Civil Code of the Russian Federation.

The recommended list of authorities for submitting electronic reporting consists of 6 points.

| Name of representative's authority | Code |

| Sign a tax return, other reporting | 01 |

| Submit a tax return, other reporting | 02 |

| Receive documents from the Russian Federal Tax Service inspection | 03 |

| Make changes to tax reporting documents | 04 |

| Sign documents (information) | 21 |

| Submit documents (information) | 22 |

>Full list of powers

A complete list of powers is presented in the DSS directory.

Rules for issuing a power of attorney from a legal entity to the Federal Tax Service

If the head of the company cannot personally visit the bodies of the Federal Tax Service of the Russian Federation, this responsibility falls on the accountant or any full-time employee. Often, authority is transferred to an outsourcer company. In such a situation, a power of attorney is required.

IMPORTANT! According to paragraph 4 of Art. 185.1 of the Civil Code of the Russian Federation, not only the manager, but also any person specified in the constituent documentation or in the law, whose competence includes signing powers of attorney, has the right to delegate the responsibility of representing the interests of the company to the tax inspectorate.

The power of attorney to the Federal Tax Service must contain the following data:

- details of the organization (TIN, OGRN, KPP, legal address and name), as well as personal data of the head;

- name, date and place of registration;

- attorney's passport details;

- list of powers;

- period of validity of the document (if the time frame is not indicated, then it is valid for a year after issue).

At the end, the signatures of the parties and the company seal, if available, are affixed.

As a general rule, notarization of a power of attorney to represent interests in the tax office is not required from an organization. However, by virtue of paragraph 1 of Art. 185.1 of the Civil Code of the Russian Federation, the participation of a notary is necessary if the power of attorney is issued for the following purposes:

- to carry out transactions for which a notarized power of attorney is required;

- to change the information contained in the state register, for example, when entering additional OKVED codes.

In addition, according to paragraph 2 of Art. 188.1 of the Civil Code of the Russian Federation, a visit to a notary is necessary if an irrevocable power of attorney is issued.

Power of attorney to the Pension Fund

As in the case of submitting reports to the tax authority, a company can submit a report to the Pension Fund either through the director or through a representative of the company. The authorized representative must have the appropriate power of attorney to represent the interests of the company. As for entrepreneurs, if they make payments to their employees, they are required to report to the Pension Fund. At the same time, a representative of the organization can also submit reports if a power of attorney has been issued to him. At the same time, the following requirement applies to individual entrepreneurs: the power of attorney must be notarized.

Important! An individual entrepreneur’s power of attorney for submitting reports to the Pension Fund must be notarized.

If the declaration is signed by an authorized representative

If the tax return is signed by an authorized representative of the taxpayer, then the basis of the representation must be indicated in a special field in the return itself. And it must be accompanied by a copy of the power of attorney form for signing reports to the tax office (clause 5 of Article 80 of the Tax Code of the Russian Federation).

When submitting reports electronically, along with them, you must also send an electronic information message about the power of attorney to the tax authority. It indicates the details of the power of attorney (Letter of the Federal Tax Service of Russia dated August 10, 2016 N GD-4-11/ [email protected] ). But before submitting reports to the Federal Tax Service in this way, you need to provide the tax authorities with a copy of the power of attorney itself. It will be stored in the inspection for 3 years after expiration (clause 1.11 of the Methodological Recommendations, approved by Order of the Federal Tax Service of Russia dated July 31, 2014 N ММВ-7-6/ [email protected] ).

Nuances

Due to changes in laws relating to such a power of attorney, the certification of a document currently has a number of features. The document does not have to be certified by a notary: this is done mainly in case of mistrust between the two parties. In most cases, the signature of the head of the organization and a seal are sufficient, but if the power of attorney is issued by an individual entrepreneur who does not have his own seal (this is permissible under current legislation), only a signature is sufficient.

But it is better to notarize a tax power of attorney to represent the interests of a legal entity: it is impossible for the authorized person to perform certain actions without this. In general, certification in practice is more of a precautionary measure and a way, if necessary, to prove that the trustee did not have permission for any additional actions beyond those indicated in the official document.

Additional security measures may also include a mention in the power of attorney of the impossibility of transferring powers to third parties, as well as the ability to revoke the power of attorney unilaterally at any time.

Such a document automatically loses force in the event of death or incapacity of one of the parties and upon expiration of the power of attorney. Sometimes a document, which at first glance was drawn up without violations, may also lose force if one important circumstance is revealed. According to the laws, an employee of the internal affairs bodies, a judge, a prosecutor, a customs officer and a person working directly in the tax service cannot act as a proxy.

What threatens “unscrupulous” entities

The Federal Tax Service will carry out tax control measures against suspicious entities. First of all, the management of the organization or entrepreneur will be invited to the tax office for questioning. They may also request documents, conduct their examination, inspect the premises, and so on.

If an inaccurate signature is detected on the declaration, it will be canceled , and the subject will receive a notification that the report is invalid. We are talking about VAT and income tax returns.

If it turns out that an individual who is a director provided his data for a nominal appointment to a position for a fee, he may be prosecuted under Article 173.2 of the Criminal Code of the Russian Federation . There are such cases in judicial practice.

Contents of the power of attorney for representation of interests from individual entrepreneurs in 2021

A power of attorney to the Federal Tax Service from an individual entrepreneur of the 2021 model is not much different from a power of attorney for the right to represent interests in the same department from a legal entity. So, the document must contain:

- details of the individual entrepreneur (OGRNIP, INN) and the authorized representative;

- name, date and place of execution of the power of attorney;

- validity;

- date and signature of the attorney and principal;

- list of powers of the trustee.

If necessary, the power of attorney indicates the possibility of transferring powers to third parties (clause 1 of Article 178 of the Civil Code of the Russian Federation).

By the issued power of attorney, a person may be authorized to provide on behalf of the individual entrepreneur the requested extracts, certificates, letters, accounting and other documentation to the Federal Tax Service, as well as to receive from the tax inspectorate acts, decisions on tax audits and other documents sent to the principal.

How to issue a power of attorney to submit electronic reporting to the tax office?

A power of attorney to the Federal Tax Service must be executed in writing. It states:

- date and place of drawing up the power of attorney;

- information about the organization whose interests will be represented by the authorized person (name, tax identification number, address);

- information about the authorized representative. If this is an organization, then the full name, INN and location of the legal entity are indicated, if this is an individual, then - full name, passport details, residential address;

- what exactly is entrusted to the authorized person - “to represent the interests of the taxpayer in legal relations with the tax authorities”;

- rights of an authorized person;

- validity period of the power of attorney. If the validity period is not specified, the power of attorney will be valid for a year from the date of its execution.

The power of attorney must be certified by the signature of the head of the organization. A copy of the power of attorney sent to the inspection in an electronic version is certified with an electronic signature.

The legislative framework

| Legislative act | Content |

| Article 29 of the Tax Code of the Russian Federation | "Authorized representative of the taxpayer" |

| Article 186 of the Civil Code of the Russian Federation | "Term of power of attorney" |

| Letter of the Federal Tax Service of Russia No. OA-4-17/ [email protected] dated 09/06/2016 | “On the submission of a power of attorney on paper, previously sent to the tax authority in electronic form; on the presence of the seal of LLC and JSC on documents submitted to the tax authorities" |

| Article 119 of the Tax Code of the Russian Federation | "Failure to submit a tax return" |

Form of Power of Attorney for an Authorized Representative

UP Power of Attorney form (dated 07/01/2016)

- doc

- odt

- A power of attorney from an authorized representative provides the opportunity to submit electronic reports via the Internet for other organizations.

- This power of attorney is suitable both for submitting electronic reports via the Internet, and for submitting reports on paper when visiting the Federal Tax Service in person.

Submitting reports on insurance premiums

The opportunity to submit reports to extra-budgetary funds through a legal or authorized representative has been provided since January 1, 2011. After all, from this date the changes introduced by the Law of December 8, 2010 No. 339-FZ to the Law of July 24, 2009 No. 212-FZ (hereinafter referred to as Law No. 212-FZ) came into force.

According to the provisions of Article 5.1 of Law No. 212-FZ, the personal participation of the payer of insurance premiums in relations with the relevant extra-budgetary funds does not deprive him of the right to have a representative, just as the participation of the latter does not deprive the payer of the right to personal participation in these legal relations.

The powers of the representative of the insurance premium payer must be documented in accordance with Law No. 212-FZ and other federal laws.

Legal representatives

organizations in extra-budgetary funds are recognized as persons authorized to represent this organization on the basis of the law or its constituent documents.

Authorized representative

is recognized as an individual or legal entity authorized by an organization to represent its interests in relations with authorities monitoring the payment of insurance premiums and other participants in relations regulated by the legislation of the Russian Federation on insurance premiums.

An authorized representative of an organization in extra-budgetary funds exercises his powers on the basis of a power of attorney, which is drawn up and issued in accordance with the requirements specified in Articles 185-187 of the Civil Code.

Officials of bodies monitoring the payment of insurance premiums, tax authorities, customs authorities, internal affairs bodies, judges, investigators and prosecutors cannot be authorized representatives of the payer of insurance premiums.

Results

A power of attorney can be drawn up in ordinary written form, and also in cases specified by law, certified by a notary. The powers of the attorney in the power of attorney should be specified as precisely as possible in order to avoid disagreements with the employees of the Federal Tax Service.

Sources

- https://www.buhgalteria.ru/article/nalogovaya-otchetnost-cherez-predstavitelya

- https://assistentus.ru/forma/doverennost-na-sdachu-otchetnosti-v-nalogovuyu/

- https://online-buhuchet.ru/doverennost-dlya-sdachi-otchetnosti/

- https://infportal.ru/doc/doverennost-v-nalogovuyu-inspektsiyu.html

- https://www.regberry.ru/registraciya-ooo/doverennost-v-nalogovuyu-na-predstavlenie-interesov-yuridicheskogo-lica

- https://nalog-nalog.ru/nalogovaya_proverka/doverennost-v-nalogovuyu-obrazec/