You can go straight to the section you are interested in. To return to the menu, click on the arrow next to the magazine logo.

- Prepaid transactions

- Adjustment invoice for reduction

- Tax agent deduction

- Returning goods to the seller

- VAT refund for export transactions

- Registration of invoices in the purchase ledger for tax amounts previously recovered from transactions subject to a 0% tax rate

- Import related operations

- Simultaneous sale (purchase) of own goods and goods under a commission agreement

- Operations related to the sale of raw hides and scrap

How to capitalize imported goods in 1s 8 3 accounting

Release 3.0.70 was used.

In “1C: Accounting 8”, the customs declaration document for import is intended to account for customs duties paid upon import and indicated in the declaration of goods

.

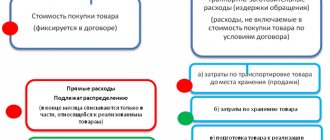

Customs fees and duties are included in the cost of goods. VAT paid on the import of goods can be deducted (the transaction type code 20 and the customs declaration number are indicated in the purchase book) or taken into account in the cost of goods in accordance with Art. 170 Tax Code of the Russian Federation. document for import

can be created based on the document “Receipt (act, invoice)” or directly in the “Purchases” section.

Please note that for this, Full

functionality or

Selective

functionality must be installed in the program settings with the

Imported goods

on the

Inventory

(section

Main

-

Functionality

) (Fig. 1).

When imported goods are received from a foreign supplier in the Receipt document (act, invoice)

(section:

Main

–

Shopping

):

- in the “% VAT” column, select “Without VAT”, because VAT paid at customs will be indicated in the import customs declaration

; - in the columns “Customs declaration number” and “Country of origin”, indicate the country of origin of the goods and the number of the cargo customs declaration (elements of the directories “Customs declaration numbers” and “Countries of the world” (the element can be added automatically using the “Add from classifier” button).

Create a customs declaration document for import

based on the document “Receipt (act, invoice)”) using the “Create based on” button (Fig. 2) or as a separate document (section:

Main

-

Purchases

).

In the customs declaration document for import

on the “Main” tab (Fig. 3):

- select the customs authority and the customs declaration number in the appropriate fields (the directory element “Customs Declaration Numbers”);

- in the “Deposit” field, select the directory element “Agreements” (only agreements with the type “Other” are displayed in the selection list), which was indicated in the document “Write-off from the current account” when transferring funds to the customs authority;

- using the link indicating the currency and exchange rate, open the “Prices in the document” form to change the document currency to rubles (then on the “Sections of the customs declaration” tab, the customs value can be specified in rubles; by default, the currency specified in the agreement with the supplier of goods is set);

- indicate the amount of customs duty in the field of the same name;

- in the “Settlements” field, follow the link to open the “Settlements” form, indicate the account for settlements with the customs authority 76.09 “Other settlements with various debtors and creditors” (the same account as in the document “Write-off from the current account” when transferring funds to the customs authority ) and the method of crediting the advance “Automatically”;

- The “Reflect VAT deduction in the purchase book” checkbox is selected by default. If VAT should be included in the cost of goods, then uncheck this box.

In the customs declaration document for import

on the “Sections of the customs declaration” tab (Fig. 4), the customs value of the goods, the rate and amount of customs duty, the rate and amount of VAT charged are indicated in the upper tabular part; the list of goods with data for each product is displayed in the lower tabular part. The document may have several sections of the customs declaration, each of which groups goods with the same procedure for calculating customs duties and the VAT rate. You can add a section using the “Add” button in the upper table part (each line corresponds to a separate section), and delete it using the “Delete” key on the keyboard. When you select a line in the upper tabular part, the list of goods related to the selected section of the customs declaration is displayed in the lower tabular part.

If the customs declaration document for import

created on the basis of the receipt document, then the lower tabular part “Products by section” will be filled in with the items from the receipt document automatically. If the document was created as a new document (not based on the receipt document) or the document should have several sections of the customs declaration, then click the “Fill” button, select the receipt document, the entire list of goods from the selected document will go into the tabular section, edit it, leaving only the lines, related to the selected section of the customs declaration.

At the top of the table:

- In the “Customs value” column, indicate the customs value for all goods of the section of the customs declaration selected in the table. The customs value for all sections of the customs declaration (for all lines of the upper tabular part) must correspond to the total customs value of goods indicated in the customs declaration in gr. 12 (customs value may be greater than the cost of goods under the contract with the supplier);

- In the “% of duty” column, indicate the percentage of duty for the section of the customs declaration selected in the table. The amount of duty will be distributed among the goods in the lower table “Goods by section” in proportion to their value under the agreement with the supplier. If the duty on goods is determined in a fixed amount, then you can indicate the amount of duty for each product in the lower table in the “Duty” column;

- In the “% VAT” column, indicate the VAT rate for the goods of the customs declaration section selected in the table;

- The VAT amount in the column of the same name is calculated automatically in rubles ((customs value + customs duty) * VAT rate).

In the lower tabular part “Products by section”:

- Check the goods account and VAT account in the appropriate columns;

- If necessary, adjust the duty and VAT in the columns of the same name (if you did not create separate sections of the customs declaration for grouping goods with the same procedure for calculating customs duties and the VAT rate). The totals in the upper table area will change automatically.

- Button Post and close.

Tax agent deduction

Cases of fulfilling the duties of a tax agent:

- lease of state or municipal property from a government authority (except for state unitary enterprises, municipal unitary enterprises or institutions);

- acquisition of property from a government authority (except for state unitary enterprises, municipal unitary enterprises or institutions);

- purchase from a foreign person not registered in the Russian Federation of goods on the territory of the Russian Federation or works (services), the place of sale of which is recognized as the territory of the Russian Federation. In this case, your organization or individual entrepreneur must be registered with the tax inspectorate of the Russian Federation;

- sale of electronic services of foreign companies.

The tax agent is obliged to calculate, withhold and transfer VAT amounts to the budget. In this case, he receives the right to receive a deduction if the following conditions are met:

- goods (work, services) were purchased for activities subject to VAT or for resale;

- goods are accepted for accounting, that is, capitalized on the balance sheet;

- There are documents confirming the right to deduction. Most often this is an invoice received from the supplier. In addition, VAT should be highlighted as a separate line in other settlement and primary documents (invoices, certificates of work performed and services rendered, payment orders, etc.). If a foreign product is purchased, a document confirming payment of tax is presented;

- the amount of tax on these goods (works, services) is withheld and transferred to the budget;

- the tax agent applies OSNO. In special regimes (STS, UTII, patent), VAT deductions and refunds are not provided.

If a tax agent fulfills his duties on transactions for the sale of confiscated and other property converted into state ownership, or on transactions where he is an intermediary of a foreign person, he does not have the right to deduction. At the same time, he is obliged to pay tax, even if he applies a special regime (STS).

The tax agent is required to fill out a VAT return, in particular section 2. In it, he reflects the amount of tax payable to the budget. Section 2 must be completed separately for each foreign organization.

If the tax agent has the right to a deduction, then the related transactions must be reflected in another section of the declaration - the third (line 180).

Let's look at how to issue an invoice for shipment or advance payment in cases where the tax agent has the right to deduct.

1. The tax agent must make an entry in the sales book about the invoice issued to himself, with KVO 06. In the fields “Name of the buyer”, “TIN/KPP of the buyer” he indicates his details (only data on the TIN/KPP is included in the declaration Checkpoint, name not indicated) and fills in the field “Number and date of document confirming payment” with the relevant information.

2. If the conditions necessary to obtain a tax deduction are met, the tax agent makes an entry in the purchase book with details identical to the original invoice. In the “Name of the seller” field, he indicates the details of the counterparty, and fills in the “TIN/KPP of the seller” field only if he has a TIN (in the declaration, information about the TIN/KPP, the name is not indicated).

How to capitalize imported goods in 1s 8 3 accounting

I have noticed more than once that when a novice accountant is faced for the first time with the need to enter goods into the program according to the customs declaration (customs declaration, import), his first reaction is stupor.

Lots of numbers, in different currencies, nothing is clear. Today in the lesson we will learn to read and understand the customs declaration using a real example, enter its data into 1C: Accounting 8.3 (edition 3.0), and also take into account the VAT paid at customs.

So, let's go!

Our gas turbine engine as an example

So, we have 2 sheets of a real customs declaration (main and additional). I only cleared confidential information from them, which is of no use to us for educational purposes.

You can open them on a separate page, or better yet, print them out and put them right in front of you.

Learning to read GTD

We will analyze the gas customs declaration based on the rules for filling it out, which you can read, for example, here.

Our declaration consists of 2 sheets: main and additional. This happens when the import of two or more goods is declared, because information about only one product can be placed on the main sheet.

Parsing the main sheet

Main sheet header

Please pay attention to the upper right corner of the main sheet of the customs declaration:

IM in column No. 1 means that we have a declaration for the import of goods.

Declaration number 10702020/060513/0013422 consists of 3 parts:

- 10702020 is the code of the customs authority.

- 060513 is the date of the declaration (May 6, 2013).

- 0013422 is the serial number of the declaration.

In column No. 3 we see that we have the first (main sheet) form of two (main sheet + additional sheet).

3 goods are declared , which occupy 3 places .

Let's go a little lower:

Here we see that the total customs value of all 3 goods is: 505,850 rubles and 58 kopecks .

The product arrived to us from the Republic of Korea .

The currency in which settlements are made ( USD ) is also indicated here, as well as the customs value in this currency ( $16,295 ) at the exchange rate as of the date of the customs declaration (May 6, 2013). The exchange rate is indicated here: 31.0433 rubles.

Let's check: 16,295 * 31.0433 = 505,850.58. The result was the customs value in rubles.

Import related operations

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction from the territory of the states of the Eurasian Economic Union

Buyer

- Declares the imported goods, fills out an application for the import of goods, pays fees;

- Makes an entry in the purchase book with KVO 19. In the field "Number and date of the seller's invoice" indicates the details (number and date of the mark) of the application for the import of goods and the date of its registration, the fields "Name of the seller" and "TIN/KPP of the seller" are not fills;

- The details of the application for the import of goods are reflected using the formula NNNNDDDMMGGYGGXXXX (16 characters), where:

- NNNN (1–4 characters) - code of the tax authority that assigned the registration number;

- DDMMYYYY (5–12 characters) — date of registration of the application;

- XXXX (13–16 characters) — serial number of the registration record during the day.

Import of goods into the territory of the Russian Federation and other territories under its jurisdiction in customs procedures of release for domestic consumption, processing for domestic consumption, temporary import and processing outside the customs territory

Buyer

- Declares the imported goods, issues a customs declaration, pays fees;

- Makes an entry with KVO 20 in the purchase book, indicating in the field “Number and date of the seller’s invoice” the details of the goods declaration, but does not fill in the field “TIN/KPP of the seller”;

- Details of the declaration of goods are reflected using the formula: XXXXXXXX/YYYYYY/ZZZZZZZ(/SS) - 8 characters, 6 digits, 7 characters / 2 digits, where:

- XXXXXXXX (1–8 characters) - customs authority code established by the Federal Customs Service of Russia;

- YYYYYY (9–14 characters) — date of filing of the declaration (day, month, last 2 digits of the year);

- ZZZZZZZ (15–21 characters) — serial number of the declaration;

- SS (2 digits) - the serial number of the goods indicated in column 32 of the main or additional sheet of the customs declaration or from the list of goods, if a list of goods was used instead of additional sheets during declaration.

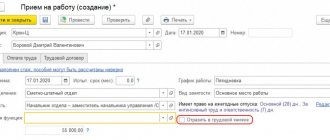

Creating a foreign supplier in 1C

Menu: Directories – Contractors (buyers and suppliers) – Contractors

Let's add a counterparty, indicate its name and check the "Supplier" flag. In addition to the “Supplier” flag, it is advisable to also set the “Non-Resident” flag. In this case, the program will automatically issue documents from the supplier at the VAT rate “Without VAT”.

Let’s save the counterparty using the “Record” button.

At the time of recording, an agreement was automatically created for the counterparty. The contract must specify the currency, for example, Euro. Let’s go to the “Accounts and Agreements” tab, double-click to open the main agreement and change the currency.

Click “OK” to save and close the agreement.

Placing an order to a foreign supplier

Menu: Documents – Purchasing – Orders to suppliers

In the document we will indicate the supplier, warehouse, ordered goods and their cost. Please note that the document is drawn up in Euro currency and the VAT rate for all goods is set to “Without VAT”.

Example of a completed order:

IMPORTANT: all imported goods must have the “Keep records by series” flag. Otherwise, it will be impossible to properly register the receipt of goods at the warehouse in the future.

Receipt of goods to the warehouse

Menu: Documents – Purchasing – Receipts of goods and services

You can issue a document manually or based on an order. We will make the receipt of goods based on the order to the supplier. The document will be filled out: the supplier, goods, cost are indicated.

Additionally, the document must indicate the customs declaration number of the received product in the series field. Each series of goods is a combination of the customs declaration number and the country of origin.

To fill out a product series, click on the selection button in the “Nomenclature” field and add a new element in the “Series” directory that opens. In the nomenclature series, select the country of origin of the goods and the customs declaration number.

Note: CCD numbers are stored in the directory. Do not enter the new gas customs declaration number into the series name from the keyboard - this will cause an error. You need to go to the directory of customs declaration numbers, using the selection button in the “ Customer declaration number ” , and create a new number there or select one of the existing ones from the list.

The name in the series was generated automatically, you can save the series and select it in the document for the product:

Product series can be filled in for all products from the document at once. To do this, click the “Edit” button above the products table. In the “Processing the tabular part” window that opens, select the action “Set series according to the customs declaration”, indicate the civil declaration number and the country of origin:

Next, click the “Run” button to complete the series, and the “OK” button to transfer the changes to the document.

Now the document is completely filled out, you can swipe it and close it.

In this case, you do not need to enter an invoice.

Registration

Example Let's use the condition of the previous example with only one difference.

The package of documents confirming the export of goods was not collected as of May 14 (that is, within 180 calendar days after customs operations). The Exporter's accountant needs to perform the following operations.

1. When shipping goods, you must issue an invoice and register it in the invoice journal.

These operations are discussed in detail in the first example, when the “Exporter” received an advance payment and confirmed the export of goods abroad 180 calendar days after customs operations.

2. The package of documents confirming the application of the 0% rate was not collected within 180 calendar days after the registration of the DT. Consequently, the “Exporter” loses the right to apply the 0% rate.

The date of sale of the goods will be the date of shipment. In our example, this is November 15th.

Therefore, on the 181st day, the accountant needs to issue a new invoice for shipment in 1 copy, highlighting VAT at a rate of 10%. As in the first example, revenue is reflected at the exchange rate effective on the date of shipment.

| INVOICE No. 4 dated November 15, 2015 (in rubles) | |||||||||

| Name of goods (description of work performed, services provided), property rights | Unit | Quantity (volume) | Price (tariff) per unit of measurement | Cost of goods (work, services), property rights without tax – total | Including the amount of excise tax | Tax rate | The amount of tax charged to the buyer | Cost of goods (work, services), property rights with tax – total | |

| code | symbol (national) | ||||||||

| 1 | 2 | 2a | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Door handles | 796 | Thing | 1 000 | 15 000.00 | 15 000 000.00 | without excise tax | 10% | 1 500 000.00 | 16 500 000.00 |

3. You need to register the invoice in an additional sheet of the sales ledger.

Additional sheet of sales book No. 1

Tax period, year in which the invoice was registered before corrections were made to it, Q4 2015. An additional sheet was issued on May 15, 2021.

| SALES BOOK for the period from April 1 to June 30, 2021. | |||||||

| Buyer's invoice date and number | Total sales, including VAT | Including | |||||

| taxable sales | tax-exempt sales | ||||||

| 18% (5) | 10% (6) | 0% | |||||

| sales price excluding VAT | VAT amount | sales price excluding VAT | VAT amount | ||||

| (1) | (4) | (5a) | (5 B) | (6a) | (6b) | (7) | (8) |

| Total | 23 005 000 | – | – | 20 800 000 | 2 080 000 | – | 125 000 |

| 15.11.2015 № 4 | 16 500 000 | – | – | 15 000 000 | 1 500 000 | – | – |

| Total | 39 505 000 | – | – | 35 800 000 | 3 580 000 | – | 125 000 |

After this, invoices previously received from suppliers must be recorded in an additional sheet of the purchase ledger.

Since the goods were actually shipped in the fourth quarter of 2015, entries must be made in an additional sheet of the purchase book for the period from October 1 to December 31, 2015.

Let’s assume that goods shipped for export were purchased from a Russian supplier for a total amount of 5,500,000 rubles, including VAT 10% - 500,000 rubles.

Additional sheet of purchase book No. 1

Tax period, year in which the invoice was registered before corrections were made to it, Q4 2015. An additional sheet was issued on May 15, 2021.

| SALES BOOK for the period from April 1 to June 30, 2021. | |||||||

| Seller's invoice date and number | Total purchases including VAT | Including | |||||

| taxable purchases | tax exempt purchases | ||||||

| 18% (5) | 10% (6) | 0% | |||||

| purchase price excluding VAT | VAT amount | purchase price excluding VAT | VAT amount | ||||

| (1) | (4) | (5a) | (5 B) | (6a) | (6b) | (7) | (8) |

| Total | 9 405 000 | – | – | 8 500 000 | 850 000 | – | 55 000 |

| 17.10.2015 № 4 | 5 500 000 | – | – | 5 000 000 | 500 000 | – | – |

| Total | 14 905 000 | – | – | 13 500 000 | 1 350 000 | – | 55 000 |

Registration of customs declaration for import

Menu: Documents – Procurement – Customs declaration for import

It is most convenient to enter a document based on the receipt of goods and services, so as not to refill the supplier, warehouse and list of goods.

Based on the receipt of goods, we will create a “Customs Customs Document for Import” document. The document must indicate the counterparty-customs and two agreements with customs: one in rubles, and the second in the currency in which the goods were received.

There is no need to put the “Buyer” or “Supplier” flags in the counterparty; other mutual settlements are carried out with customs:

Agreements with customs:

Next, the document contains the customs declaration number and the amount of customs duty and fine (if applicable).

On the “Sections of the Customs Declaration” tab, information about goods and customs duties is indicated.

For ease of entry, amounts can be displayed in currency and in rubles - this is regulated by the flags “Customs value in rubles”, “Duty in currency” and “VAT in currency”.

We indicate the duty rate - 10%, the program automatically calculates the amount of duty and the amount of VAT based on the customs value.

After calculating the total duty and VAT amount, you need to distribute them among goods using the “Distribute” button:

The document is completely completed and can be processed and closed.

Often, when working with imported goods, certificates of conformity are required. An additional module for printing a register of certificates of conformity will help you organize convenient storage and access to printed forms of documents at any time when needed, without going through a pile of documents on your shelves.

Operations related to the sale of raw hides and scrap

Responsibilities of a tax agent

Tax agent operations include the purchase of raw hides, scrap and waste of ferrous and non-ferrous metals, secondary aluminum and its alloys (hereinafter referred to as raw hides and scrap) (Article 161 of the Tax Code of the Russian Federation). When selling them, the taxpayer-seller does not calculate the amount of VAT, but enters into the invoice the entry “VAT is calculated by the tax agent.” The tax agent for such transactions is the buyer (recipient), with the exception of individuals who are not individual entrepreneurs.

If the seller is exempt from the duties of a taxpayer or is not a taxpayer, then the buyer (recipient) does not have the obligation of a tax agent, and the seller does not have the obligation to calculate and pay VAT. In this case, the seller must make the entry “Excluding VAT” in the transaction agreement and invoice. If it turns out that the mark is not reliable, the seller will have to calculate and pay VAT. The same thing happens if the seller has lost the right to be exempt from fulfilling the duties of a taxpayer or to apply special tax regimes.

Regardless of whether the tax agent fulfills the payer’s duties related to the calculation and payment of tax (and other duties established by Chapter 21 of the Tax Code of the Russian Federation), he must calculate, withhold and transfer VAT amounts to the budget. The law does not require tax agents to issue invoices.

The tax agent has the right to receive a deduction. To do this, he must restore to the budget:

a) the amount of VAT that was deducted when he transferred an advance payment to the taxpayer-seller for upcoming deliveries of raw hides and scrap;

b) the amount of VAT that was taken for deduction when the value or volume of shipped raw hides and scrap decreased.

If the seller does not have obligations to calculate and pay tax, then in section 3 of the VAT return he does not need to reflect transactions for the sale of hides or scrap.

The tax agent is required to fill out a VAT return. In section 2, it must reflect the total amount of tax that is payable to the budget (line 060).

If the tax agent has the right to a deduction, then the related transactions must be reflected in another section of the declaration - the third (line 180).

General procedure for using KVO 33, 34, 41, 42, 43, 44

- If an advance is received from the buyer, the seller issues an invoice for the advance and makes an entry about it in the sales book with KVO 33.

- The buyer is a tax agent, therefore he makes an entry about the received advance invoice in his sales book with KVO 41. This reflects the emerging obligation to pay tax to the budget for the seller.

- When the conditions for receiving the deduction are met, the buyer registers an invoice for the advance payment in his purchase book, also with KVO 41.

- The seller ships the goods, issues an invoice to the buyer for sales and makes an entry in his sales book with KVO 34.

- The buyer, as in the case of an advance payment, first registers an invoice for the shipment in the sales book with KVO 42 as a tax agent, calculating VAT on the shipment.

- When the buyer has fulfilled the conditions for receiving the deduction, he registers an invoice also with KVO 42 in his purchase book.

- If the cost of shipment has increased, the seller registers an adjustment invoice with KVO 34 in his sales book. The buyer, as a tax agent, registers an adjustment invoice with KVO 42 in the sales book to receive a deduction.

- If the cost of shipped goods has decreased, the seller registers an adjustment invoice for a decrease with KVO 34 in his purchase book. The buyer, as a tax agent, registers an invoice for a decrease with KVO 44 in his purchase book, since an invoice was entered in the sales book invoice for implementation. If the buyer previously received a deduction for this transaction, then he must restore the VAT: make an entry in the sales book with KVO 44.

- To repay the advance, the buyer, as a tax agent, makes an entry in the purchase book with KVO 43. If the buyer previously received a deduction for the advance, then he must restore VAT: make an entry in the sales book with KVO 43.

Transactions with prepayment (advance payment, sales)

Let's consider how it is necessary to issue an invoice for shipment or advance payment in these cases to the seller and the buyer - the tax agent.

Salesman

1. The seller issues an invoice for the advance payment - makes an entry about it in the sales book with KVO 33. To do this, you must fill in the following fields:

- “Name of the buyer”, “TIN/KPP of the buyer” - details of the buyer for the transaction (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated);

- “Cost of taxable sales according to the invoice, the difference in value according to the adjustment invoice (excluding VAT) in rubles and kopecks, at the rate”;

- “Cost of sales according to the invoice, difference in cost according to the adjustment invoice (including VAT) in the currency of the invoice” - put a dash (in the electronic SF and when generating information in the declaration, indicate “0”);

- “VAT amount on the invoice, the difference in the tax amount on the adjustment invoice in rubles and kopecks, at a rate of 18%” - put a dash (in the electronic SF and when generating information in the declaration, indicate “0”).

The following fields are not filled in:

- “Cost of sales exempt from tax on an invoice, the difference in value on an adjustment invoice in rubles and kopecks”;

- other fields.

2. To reflect the sale of goods, it is necessary to make an entry in the sales book with KVO 34. In the fields “Sales cost (including VAT)” and “VAT amount” you need to put a dash (or “0”), and the field “Sales cost (without VAT) )" - fill in.

Buyer

The tax agent must make an entry in the sales book about the invoice for advance payment with KVO 41, indicate in the fields “Name of the buyer” and “TIN/KPP of the buyer” his own details (when generating information in the declaration, it includes only data on the TIN/KPP, name is not indicated) and fill in the field “Number and date of document confirming payment”. You must also indicate:

- the cost of sales according to the invoice, the difference in the cost of the adjustment invoice (including VAT) in the currency of the invoice;

- the cost of taxable sales according to the invoice, the difference in value according to the adjustment invoice (excluding VAT);

- VAT amount on the invoice.

2. If the conditions necessary to receive a tax deduction are met, the tax agent makes an entry in the purchase book with details that are identical to the original invoice for the advance payment, and indicates in the fields “Name of the seller”, “TIN/KPP of the seller” the details of the real seller for transaction (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated).

3. Upon receipt of the goods, the tax agent must make an entry in the sales book about the invoice with KVO 42. As in the case of an advance payment, in the fields “Name of the buyer”, “TIN/KPP of the buyer” he indicates his own details, enters the cost of sales (including VAT), cost of sales at a rate of 18% (excluding VAT) and the amount of VAT.

4. If the conditions necessary to receive a deduction are met, the tax agent makes an entry in the purchase book with details that are identical to the original invoice for the shipment, and indicates in the fields “Name of the seller”, “TIN/KPP of the seller” the details of the real seller for the transaction (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated).

5. Since the tax agent paid VAT to the budget on the advance invoice for the seller, he has the right to a refund of the advance payment, subject to deduction from the date of shipment. To return, you need to reflect in the purchase book the entries with the data of the original (advance) invoice with KVO 43, while indicating in the fields “Name of the seller” and “TIN/KPP of the seller” the real seller (when generating information in the declaration, only data is included in it about TIN/KPP, name is not indicated).

6. If the tax agent, as a buyer, has previously accepted for deduction the amount of VAT on an advance invoice, he is obliged to return the VAT to the budget: to restore it, it is necessary to reflect in the sales book entries with the data of the original (advance) invoice with KVO 43, indicating in in the fields “Name of the buyer” and “TIN/KPP of the buyer” your own details (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated).

Adjustment invoice for increase

If the cost of shipment increases, then the buyer and seller make records in the same way as in a regular sale. The seller uses KVO 34 in the sales book, the buyer - tax agent uses KVO 42 in the sales book and purchase book. It is also necessary to indicate the number and date of the adjustment invoice.

Adjustment invoice for reduction

Salesman

To reflect the sale of goods, the seller enters an invoice with KVO 34 into the sales book (see “Transactions with prepayment”).

If you need to reduce the amount of a previously registered sales invoice, you should create an adjustment invoice based on it and make an entry about it in the purchase book with KVO 34. In this case, you must indicate:

- in the field “Number and date of the seller’s invoice” - the data of the original invoice;

- in the field “Number and date of the seller’s adjustment invoice” - details of the adjustment invoice;

- in the fields “Name of the seller”, “TIN/KPP of the seller” - details of the real buyer in the transaction (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated).

Buyer

Upon receipt of the goods, the tax agent reflects the transaction in the sales book, making an entry with KVO 42 (see “Transactions with prepayment”).

If the seller sent an adjustment invoice for a reduction, you must make an entry in the purchase book with KVO 44. In this case, you must indicate:

- in the field “Number and date of the seller’s invoice” - the data of the original invoice;

- in the field “Number and date of the seller’s adjustment invoice” - details of the adjustment invoice;

- in the fields “Name of the seller”, “TIN/KPP of the seller” - details of the real seller in the transaction (when generating information in the declaration, only data on the TIN/KPP is included in it, the name is not indicated).

If the tax agent, as a buyer, accepted the amount of VAT for deduction (purchased the goods and made an entry in the purchase book about the received invoice with KVO 42), then if he receives from the seller an adjustment invoice for a reduction, he is obliged to restore the VAT (return to the budget ).

To do this, you need to reflect in the sales book an entry with the data of the adjustment invoice with KVO 44, indicating your own details in the fields “Name of the buyer” and “TIN/KPP of the buyer” (when generating information in the declaration, it includes only data on the TIN/KPP, name is not indicated).

Registration of customs declaration for import before receipt of goods

This option in the program is not very convenient, since you have to enter and fill out the import customs declaration completely manually.

In addition, in this situation, at the time of registration of the customs declaration for imports, the consignment document is not indicated - the receipt of goods and services (it does not exist yet), therefore the amounts of customs duties and fees are not included in the cost of goods.

To adjust the cost of selling goods, a special document “Adjustment of the cost of writing off goods” is used.

Menu: Documents – Inventories (warehouse) – Adjustment of the cost of writing off goods

The document is issued once a month.

Sales of imported goods

Based on the buyer’s order, we will create the document “Sales of goods and services”:

In some cases, the program fills in the product series automatically. For example, if this is the only series of a product. Therefore, the series in our document is already filled.

If automatic filling does not occur, then use the “Fill and Post” button - the program will fill out a series of products and post the document.

Next, enter the invoice document using the “Enter invoice” hyperlink:

Let’s post the invoice using the “Post” button and open the printed form using the “Invoice” button:

The printed form automatically displays the customs declaration number and the country of origin of the goods, which were indicated in the series of goods sold.

VAT refund for export transactions

Confirmation of export later than 180 days from the date of placing the goods under the customs export procedure.

1. The seller makes an entry in the sales book about the issued sales invoice with KVO 01.

2. If the seller failed to collect the necessary package of documents confirming the 0% rate within 180 days from the date of placing the goods under the customs export procedure, then on the 181st day the seller must charge VAT at a rate of 10% or 18% (reflected in section 6 VAT declaration), about which an entry is made in the additional sheet of the sales book for the tax period in which the goods were shipped. Such a record will also have KVO 01.

3. If, after the expiration of the period of 180 days, the package of documents is nevertheless collected, the seller can return the amount of tax paid by him. To do this, you need to make an entry in the purchase book about the invoice with KVO 24 for the period in which the 0% rate is confirmed, indicating:

- in the field “Number and date of the seller’s invoice” - details of the original (entered in the additional sheet of the sales book) invoice;

- in the fields “Name of the seller” and “TIN/KPP of the seller” - your own details (only data on the TIN/KPP is included in the declaration, the name is not indicated).

Please note: from 07/01/2016 (based on Law dated 05/30/2016 No. 150-FZ), you can apply for deduction of “input” VAT for export operations immediately after accepting goods for registration, without waiting for a package of documents to be collected. This concerns the implementation:

- goods that are exported under the customs procedure of export or placed under the customs procedure of a free customs zone;

- precious metals by taxpayers who mine them or produce them from scrap and waste, and then sell them to Gokhran, the funds of precious metals and precious stones of the constituent entities of the Russian Federation, the Central Bank of the Russian Federation, and banks.

An exception is raw materials exported under the customs export procedure or placed under the customs procedure of a free customs zone. For them, the procedure for deducting input VAT has not changed.

These changes apply to those acquisitions that were registered on July 1, 2016.

Customs declaration for import into 1C 8.3 - step-by-step instructions

Step 1. Settings for accounting for imported goods according to the customs declaration

It is necessary to configure the functionality of 1C 8.3 through the menu: Home - Settings - Functionality:

Let's go to the Inventory tab and check the Imported goods checkbox. After installing it in 1C 8.3, it will be possible to keep track of batches of imported goods by customs declaration numbers. The details of the customs declaration and the country of origin will be available in the receipt and sale documents:

For more details on how batch accounting is implemented in the 1C 8.3 program, read our article.

To carry out settlements in foreign currency, on the Calculations tab, check the Settlement in foreign currency and monetary units checkbox:

Step 2. How to capitalize imported goods in 1C 8.3 Accounting

Let's enter the document Receipt of goods in 1C 8.3 indicating the customs declaration number and country of origin:

The movement of the receipt document will be as follows:

The debit of the auxiliary off-balance sheet account of the customs declaration will reflect information about the quantity of imported goods received, indicating the country of origin and the customs declaration number. The balance sheet for this account will show the balances and movement of goods in the context of the customs declaration.

When selling imported goods, it is possible to control the availability of goods moved under each customs declaration:

In the 1C 8.3 Accounting program on the Taxi interface for accounting for imports from member countries of the customs union, changes have been made to the chart of accounts and new documents have appeared. For more information about this, watch our video:

Step 3. How to account for imported goods as assets in transit

If during the delivery period it is necessary to take into account imported goods as material assets in transit, then you can create an additional warehouse to account for such goods as the Goods in transit warehouse:

Account 41 analytics can be configured by storage location:

To do this, in 1C 8.3 you need to make the following settings:

Click on the Inventory accounting link and check the By warehouses (storage locations) checkbox. This setting in 1C 8.3 makes it possible to enable analytics of the storage location and determine how accounting will be kept: only quantitative or quantitative-cumulative:

When goods actually arrive, to change the storage location, use the document Transfer of goods:

The balance sheet for account 41 shows movements in warehouses:

Step 4. Filling out the customs declaration document for import in 1C 8.3

Enterprises that carry out direct deliveries of imported goods must reflect customs duties for the received goods. The customs declaration document for import in 1C 8.3 can be entered based on the receipt document:

or from the Purchases menu:

Let's fill out the customs declaration document for import into 1C 8.3 Accounting.

On the Main tab we indicate:

- The customs authority to which we pay duties and the contract, respectively;

- What customs declaration number did the goods arrive at?

- Amount of customs duty;

- The amount of fines, if any;

- Let's check the box Reflect the deduction in the purchase book if you need to reflect it in the Purchase Book and automatically accept VAT for deduction:

On the Customs Declaration Sections tab, enter the amount of the duty. Since the document was generated on the basis, 1C 8.3 has already filled in certain fields: customs value, quantity, batch document and invoice value. Let's enter the amount of duty or the % duty rate, after which 1C 8.3 will distribute the amounts automatically:

Let's review the document. We see that customs duties are included in the cost of goods:

Study in more detail the features of the receipt of goods in the event that a customs declaration is indicated in the supplier’s SF, check the registration of such SF in the Purchase Book, study the 1C 8.3 program at a professional level with all the nuances of tax and accounting, from the correct entry of documents to the generation of all basic reporting forms - We invite you to our course on working in 1C 8.3 . For more information about the course, watch our video:

Import deduction

Firms usually pay value added tax to the budget at the end of the month or quarter in a total amount. However, there are exceptions to this situation. One of them is the tax paid at customs. Irina Pereletova, General Director of ZAO Consulting Group Zerkalo, will tell us how to take such amounts of VAT into account.

Svetlana BLINOVA GTD instead of an invoice

Importing companies pay VAT at customs when importing goods into Russia. The amount of tax you paid at customs can be deducted in your VAT return. As stated in paragraph 1 of Article 172 of the Tax Code, the basis for such a deduction will be documents that can confirm the fact that you actually paid the tax at customs. Such documents are a payment order (copy) for payment of VAT as part of customs payments and a cargo customs declaration (CCD).

As you understand, a foreign supplier cannot issue an invoice issued in accordance with Russian law. Its functions during import will be performed by the cargo customs declaration. It is the customs declaration data that you will have to enter into the purchase book (clause 10 of the rules approved by Government Decree No. 914 of December 2, 2000).

Paragraph 5 of the rules also establishes that cargo customs declarations or their copies, certified in the prescribed manner, and payment documents must be stored in the journal of received invoices. The Ministry of Finance responded in its letter dated November 12, 2004 No. 03-04-08/122 “On the moment of deduction of VAT paid on the import of goods” about the date on which the customs declaration should be registered in the purchase book. The Ministry of Finance believes that the value added tax that a company paid when importing goods into the customs territory of Russia can be deducted no earlier than the date affixed to the stamp of the customs authority “Release permitted” on the cargo customs declaration. The second essential condition for the deduction is the registration of imported goods (clause 1 of Article 172 of the Tax Code).

The tax is paid for the importer

Often a situation arises when the importing company itself does not pay customs duties (including VAT). This can happen if, for example, goods are imported into Russia by a commission agent. Since he acts in the interests of others, the commission agent cannot deduct the VAT paid at customs. The committent must do this, although he did not pay the tax on his account, but simply reimbursed the customs payments to the commission agent.

Another common case is that the broker who processed the goods imported into Russia transfers customs payments from his account. And the importer subsequently compensates him for all amounts of customs duties. In this case, the importing company may also have difficulty confirming its right to deduct VAT. Letter No. 24-11/17714 of the Department of Tax Administration of Russia for Moscow dated March 15, 2004 explains what should be done in this case. The broker must give written consent that the advance payments he paid at customs must be taken into account against the payments that the importer must make. Plus, customs authorities must issue a certificate confirming payment of customs duties. Such a certificate is given at the request of the payer in accordance with paragraph 5 of Article 331 of the Customs Code. The form of the certificate was approved by Order of the State Customs Committee dated November 27, 200Z No. 647-r “On approval of the Methodological Instructions on the procedure for the application by customs authorities of the provisions of the Customs Code of the Russian Federation relating to customs payments.”

Customs cost and real cost

The tax base for VAT upon import will be the customs value of the goods. Usually the customs value is equal to the amount that the company paid to the foreign supplier (Article 19 of the Law of May 21, 1993 No. 5003-1 “On Customs Tariff”). Other company expenses may also increase the customs cost. For example, the costs of packaging goods and transporting them to Russian customs (Article 19.1 of Law No. 5003-1 of May 21, 1993).

However, in practice, cases often arise when customs authorities do not agree with the value of the goods indicated by the importer. In this regard, they adjust the customs value, increasing it for the purpose of calculating the amount of customs duties. As a result, the amount of VAT that a company will pay at customs may differ greatly from the usual 18 percent of the cost of the goods. Regardless of this, the importer can deduct the entire amount of VAT paid. The fact is that forms for adjusting customs value are an integral part of the customs declaration (clause 3 of Appendix No. 2 to the Federal Customs Service order No. 830 dated September 1, 2006). This means that you can also enter data from these forms into your purchase book. Unfortunately, there are no official explanations for filling out the purchase book when adjusting the customs value. If you enter the contract price of the goods, which you actually paid to the supplier, in the “cost of purchases excluding VAT” column, then multiplying it by the VAT rate of 18 percent, you will not receive the actual amount of tax to be deducted. It will not be possible to automatically enter the customs value of goods into the purchase book. To do this, you need to change the form of the document for the receipt of goods, adding into it the additional detail “customs value”, which will then go into the purchase book. However, for this you need to use the services of a programmer. Alternatively, you can enter data into the purchase book not automatically with a document on the receipt of goods, but with the document “Entry in the purchase book” (or any other similar document), where you will need to indicate exactly the customs value of the goods.

You can also adjust the purchase book manually by filling out an additional sheet, where you indicate the amount of VAT added by the customs authorities (compared to the usual amount of VAT on the contract value), marked CTS (adjustment of customs value).

There is also no official clarification as to whether it is necessary to split the customs value in the purchase book into two lines: the contract value plus an adjustment, or whether one entry is sufficient for the entire amount on which the company paid VAT. The company must decide for itself which option is most suitable for it, reflecting it in its accounting policies for tax purposes.

Special regime officers receive special treatment

Please also keep in mind that VAT paid at customs cannot always be deducted from the budget. Individual companies must take into account the tax in the cost of goods (clause 2 of Article 170 of the Tax Code). For example, if goods were purchased for transactions not subject to VAT, transactions not recognized as sales on the territory of Russia, or for transactions not recognized as sales at all. Also, the price of goods includes tax for those companies that are not recognized as VAT payers.

Simplified companies that apply the taxation object “income minus expenses” can take into account the amount of VAT in expenses that reduce the base for the single tax. To do this, the goods must be paid to the supplier, and their cost must also be taken into account in expenses that reduce the tax base (subclause 8, clause 1, article 346.16 and article 346.17 of the Tax Code).

It should be noted that we are talking about goods, and if the company imported a fixed asset, then in this case the amount of VAT paid to the budget is not included in expenses. It increases the cost of the acquired fixed asset (letter of the Federal Tax Service dated April 7, 2005 No. 03-1-03/553/10). Of course, in the end, this VAT will still be taken into account as an expense, but not as a separate type of expense, but as part of the cost of the fixed asset.

Firms that pay the single agricultural tax can also take into account the amount of VAT in expenses that reduce the base for the single tax (subclause 8, clause 2, article 346.5 of the Tax Code).

If the importing company uses imported goods in activities transferred to UTII, then the amount of tax paid at customs must be included in the cost of the purchased goods (subclause 3, clause 2, article 170 of the Tax Code).

Belarusian goods receive special treatment.

But importers of Belarusian goods do not pay VAT at customs. The company must pay the amount of value added tax to the tax office at the place of its registration. The basis for making an entry in the purchase book will be an application for the import of goods and payment of indirect taxes with notes from the tax authorities on the payment of the tax (clause 10 of the rules approved by government decree No. 914 of December 2, 2000).