Submitting electronic VAT reporting: is there an alternative?

VAT reporting must be submitted by all payers of this tax - individual entrepreneurs and legal entities - electronically through a specialized operator. This procedure presupposes that the taxpayer has:

- electronic digital signature with a valid certificate;

- access to the software through which declarations are sent to the Federal Tax Service;

- Internet access.

If at least one of the above conditions is not met, VAT reporting will not be sent electronically. But the occurrence of such a situation is quite likely: the digital signature certificate may expire or be canceled for one reason or another, the program for sending documents will freeze or become infected with a virus, and failures in access to Internet resources are not uncommon even in the largest cities.

If you have access to ConsultantPlus, find out who, where, when and in what way should submit a VAT return. If you don't have access, get a free trial online access.

What should a taxpayer do in this case?

There is only one option - to submit reports through a proxy. For some time, taxpayers took advantage of the opportunity to submit a declaration in paper form, while paying a fine for reporting not in the form in the amount of 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). However, since 2015, in paragraph 5 of Art. 174 of the Tax Code of the Russian Federation clearly states that a declaration on paper is considered not submitted. And these are completely different fines.

IMPORTANT! If no activity was carried out, then instead of a zero VAT declaration, you can submit a single simplified declaration. It is not subject to the requirement to submit reports electronically under the TKS.

About the benefits of EP

Submitting electronic reporting requires the taxpayer to have not only access to the Internet, but also the installation of special software through which document forms are sent. The declaration is signed with a special electronic signature.

Let us remind you that, based on various purposes, electronic signatures can be simple and enhanced. The latter, in turn, are divided into unqualified and qualified EPs. To submit reports to regulatory authorities, firms and individual entrepreneurs require an enhanced qualified electronic signature created using cryptographic means certified by the FSB of Russia. They are issued only by certain accredited organizations, which certify the issued certificate and act as a guarantor of its authenticity.

Of course, maintaining a valid electronic signature requires additional costs. A license for the right to use a signature and the software necessary for transmitting reports is purchased for a certain period, usually at least a year. The cost will depend primarily on the taxation system used by the taxpayer, in other words, on the number of reports that he needs to submit. OSN is always a more “expensive” tariff, both for companies and individual entrepreneurs.

Of course, now most merchants still have a formalized electronic signature. However, it is not strictly mandatory, and in some situations you can successfully do without it. The exception is the above-mentioned case of the need to submit VAT reports electronically. What to do in a situation where there is no electronic signature, but you need to report on value added tax? The obvious answer is to issue an electronic signature certificate. However, there is an additional solution.

How to submit a VAT return through a representative: nuances

The main condition for using the considered option of sending a VAT return to the tax office is the execution of a power of attorney for the representative. For an individual entrepreneur, it must be notarized; legal entities draw up a power of attorney without the participation of a notary.

The power of attorney must be in the tax office before submitting the declaration (clause 1.11 of the Methodological Recommendations approved by Order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398). Otherwise, there is a risk that the declaration will be refused. This was indicated by the Federal Tax Service in a letter dated November 9, 2015 No. ED-4-15/ [email protected]

Read more here.

Note! From the report for the 4th quarter of 2021, it is necessary to use the updated form, as amended by the Federal Tax Service order No. ED-7-3 dated August 19, 2020 / [email protected]

You can find out what has changed in the report in the Review material from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Technically, this can be done in 2 ways:

- Take or mail a paper copy of the executed power of attorney to the Federal Tax Service in advance.

- Also send a copy of the power of attorney via TKS in advance. The scanned image must be signed by the principal's UKEP. The representative cannot do this. There is no need to provide an additional paper copy of the power of attorney to the tax authorities.

Payment period

The VAT declaration consists of 12 sections. According to the current procedure for paying VAT in 2021, reporting is submitted quarterly. The declaration must be submitted 4 times a year, that is, in April, July, October and January.

It is important to comply with the VAT filing deadline in 2021. The last day for accepting documents is the 25th of each reporting month.

At the same time, taxpayers are not deprived of the right to transfer VAT in 2017 in one amount. The only condition for making a one-time payment is that the transfer must be completed within the first of three eligible months.

Results

VAT reporting can only be submitted to its payers in electronic form. If the company cannot do this on its own, you can send the tax return through a representative. To do this, you need to issue a power of attorney and give it to the tax authorities.

Sources:

- Tax Code of the Russian Federation

- Methodological recommendations approved by order of the Federal Tax Service of the Russian Federation dated July 31, 2014 No. ММВ-7-6/398

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What does the Tax Code of the Russian Federation say about reporting in electronic form?

The Tax Code lists taxpayers who are required to submit electronic returns and calculations. TKS must be used without fail (clause 3 of Article 80 of the Tax Code of the Russian Federation):

- organizations and individual entrepreneurs whose average number of employees over the past year was more than 100 people;

- new or reorganized companies with more than 100 employees;

- largest taxpayers (unless a different procedure is provided for information classified as state secrets).

All other firms and entrepreneurs can independently choose whether to fill out paper reports or send documentation via TKS using electronic formats.

In addition, it is separately stipulated that those entities for whom this obligation is established by the provisions of the Tax Code of the Russian Federation for specific taxes or contributions also report electronically.

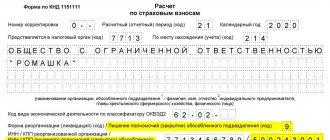

Formation of VAT returns in digital form

The digital format of the VAT payment document, as well as the necessary attachments, is established by Order of the Federal Tax Service No. ММВ-7-3/ The regulations for submitting a VAT return via the Internet are approved by Order of the Federal Tax Service of Russia N BG-3-32/169 dated 04/02/2002.

Sales and purchase books that are generated in CSV, XLSX or older XLS formats must be loaded using operators designed to work with the tax service. All files downloaded in this way will be automatically converted into the universal XML format. The VAT return must be confirmed by an enhanced digital signature in the form established by Article 80 of the Tax Code of the Russian Federation.

Instructions for using an electronic signature on the website of the Federal Tax Service

| Q | Buy electronic signature for the Federal Tax Service |

Attention! In accordance with paragraph 3 of Article 80 and paragraph 5 of Article 174 of the Tax Code of the Russian Federation, tax returns for value added tax are not accepted through the Federal Tax Service. Also, according to paragraph 10 of Article 431 of the Tax Code of the Russian Federation, payments for insurance premiums through this service are not accepted.

Installation of the “Legal Taxpayer” Program

On the Federal Tax Service website https://www.nalog.ru/rn77/program/5961229/ download the file with the latest version of the program and start the installation by double clicking the mouse:

After unpacking and preparing the files for installation, the program installation window will open, in which you need to click “Next”:

Read the license agreement and accept its terms, click “Next”:

Select “Full” installation and click “Next”:

If necessary, you can change the program installation folder by clicking “Change...”.

Then click “Next”:

To start installation, click “Install”:

To complete the installation of the program, click “Finish”:

After successful installation, the “Taxpayer Legal Entity” shortcut will appear on the desktop. Also in the WINDOWS system menu Start – Programs there will be a sub-item “Taxpayer Legal Entity”, containing links to the executable program and user manual.

When you launch the program for the first time after installing the version, a window with a description of the version will be displayed, then the program will be converted, re-indexed, and then a request to accept reporting forms will appear. Then the descriptions in the selected option will be received. After this, the program will be ready to work. Working in the Taxpayer program is described in the file “User Guide.doc” Start – Programs – Legal Entity Taxpayer – User Guide.

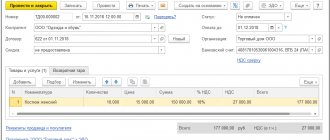

Formation of a transport container in the “Legal Taxpayer” program

After generating a declaration or loading an existing one, it is necessary to unload it to form a transport container. To upload a document, you need to right-click on the report. In this case, if a document or group of documents is marked, the marked documents will be uploaded. If there are no marked documents, the document on which the cursor is positioned will be unloaded.

Select “Internet Transfer” from the drop-down menu.

A list of documents marked for uploading will open:

Click "OK".

A window with service information will open:

It is necessary to fill in the code of the Federal Tax Service to which the reporting is sent. And confirm the entered data by pressing the “OK” button.

If all required fields are filled in, the reporting will be downloaded.

After clicking the “OK” button, the window for creating a transport container will open:

In it you must indicate the folder in which the file with the transport container will be placed, the taxpayer ID, the signature key certificate with which the transferred reporting file will be signed and click the “Generate” button.

To sign the reports, you will be asked for a password for the container:

After entering the password and clicking the “OK” button, the container will be created:

Obtaining a Taxpayer ID

To independently register taxpayers in the tax reporting system and obtain an identifier, you must register in the service: https://service.nalog.ru/reg/Account/Registry:

To register, you must enter your Login, Password, Confirm Password and E-mail:

After clicking the “Register” button, an email will be sent with a link to confirm your registration:

After confirming your email and logging into your personal account, a message will appear asking you to register a certificate and receive an ID:

After clicking on the “Register certificate” button, a form for uploading a certificate will open:

After selecting the certificate file, a window with information about the organization will open, in which you will need to fill in the empty fields (KPP and Tax authority code):

Then click the “Submit for registration” button. The page will refresh and display the status of the certificate registration application:

When the certificate is registered and an identifier is assigned, a message about successful registration and the assignment of an identifier will be sent to the email (specified during registration).

After refreshing the page, the registration status of the certificate will change, and the assigned identifier will be displayed in the organization data:

To submit reports, you must use the “Tax and Accounting Reports Submission Service”.

Submission of reports to the Federal Tax Service

Attention! In accordance with paragraph 3 of Article 80 and paragraph 5 of Article 174 of the Tax Code of the Russian Federation, tax returns for value added tax are not accepted through the Federal Tax Service. Also, according to paragraph 10 of Article 431 of the Tax Code of the Russian Federation, payments for insurance premiums through this service are not accepted.

To submit tax and accounting reports in electronic form, you need to go to the page: https://nalog.ru/rn77/service/pred_elv/:

Next, you need to install the Public Key Signature Certificate MI of the Federal Tax Service of Russia for the data center, the root certificate of the Federal Tax Service of Russia and the list of revoked certificates.

Installing the public key of the Federal Tax Service

To install the MI Federal Tax Service of Russia public key signing certificate for the data center, you need to save it and start the installation by double clicking the mouse.

On the “General” tab, click the “Install certificate...” button:

The “Certificate Import Wizard” will open:

After clicking the “Next” button, a window for selecting a certificate store will open.

You need to click “Next”:

To complete the Certificate Import Wizard, click the “Finish” button:

In the message window about the successful import of the certificate, click the “OK” button:

The MI Federal Tax Service of Russia public key signature certificate for the data center has been installed.

Installing a root certificate

To install the root certificate of the Federal Tax Service, you need to follow the link: https://www.nalog.ru/rn77/about_fts/uc_fns/, download the root certificate of the CA Federal Tax Service of Russia and double-click to open it, to do this, in the file opening window, click the “Open” button ":

On the “General” tab, click the “Install certificate...” button:

The “Certificate Import Wizard” will open:

After clicking the “Next” button, a window for selecting a certificate store will open:

You must select "Place all certificates in the following store", click the "Browse" button and select the "Trusted Root Certification Authorities" store and click "OK":

After selecting the certificate store, click “Next”:

To complete the Certificate Import Wizard, click the “Finish” button:

In the message window about the successful import of the certificate, click the “OK” button:

The root certificate is installed.

Setting up a certificate revocation list

To install a revocation list, you need to save it to your computer, right-click on it and select “Install revocation list (CRL).” In the windows that open, click “Next” - “Next” - “Finish”, without changing the default settings.

After installing the certificates and revocation list, click “Go to “Tax and Accounting Reporting Service”.

Familiarize yourself with the technology for receiving and processing declarations (settlements) and proceed to checking the conditions by clicking “Check compliance with conditions”:

Make sure that all conditions are met and click “Run checks”:

The fourth verification step will ask you to select a digital certificate.

After selecting the required certificate, click “OK”:

After checking the signing key certificate, click “Start working with the service”:

In the window that opens:

You need to fill in the empty fields (Subscriber code, checkpoint) and click “Save”:

After saving the entered data, go to the “File Upload” section:

Click “Browse” and select a container prepared using the “Legal Taxpayer” program.

After selecting the file, click the “Submit” button.

After transferring the file, you will automatically go to the page for checking the processing status:

After the document flow is completed, the status will change to “Completed”:

You can view the sent file and document flow history by clicking on the link in the “Status” column – “Completed (successfully)”:

In the “Document Flow History” you can view or download all regulatory documents.

In the future, you can log into this service at any time (https://service.nalog.ru/nbo/) and view previously sent declarations (calculations).

How to prepare a VAT return for submission. Tips on how to avoid a desk audit for VAT.

To ensure that the VAT reporting campaign does not become stressful for an accountant, in this article we will analyze all stages of VAT preparation, starting with the preparation of the declaration and ending with its analysis. So, some information regarding VAT tax regulation.

Taxable period.

The tax period for all VAT taxpayers is a quarter. This is stated in Art. 163 Tax Code of the Russian Federation.

Deadlines for submitting the declaration.

At the end of the quarter, you are required to report VAT. To do this, you must submit a VAT return to the tax authorities. The 25th day of the month

following the reporting quarter is the last day for submitting a declaration without penalties.

So the deadlines are as follows: for the 1st quarter

- you should send reports before

April 25

, for

the 2nd quarter

- before

July 25

, for

the 3rd quarter

- before

October 25

, and, therefore, the deadline for filing a VAT return for the

4th quarter

- will be

January 25.

(Clause 5 of Article 174 of the Tax Code of the Russian Federation)

Payment deadlines.

You have the right to transfer VAT to the budget after the end of the quarter during the first three months in equal installments also until the 25th

.

For example, you can pay VAT for the 4th quarter of 2015 in equal installments (1/3 of the total amount of VAT payable) until January 25, until February 25 and until March 25

, according to (clause 1 of Article 174 of the Tax Code of the Russian Federation).

Declaration submission form.

Taking into account clause 5 of Article 174 of the Tax Code of the Russian Federation, you should know that all VAT tax returns are submitted exclusively in electronic form. Otherwise, the document will be considered not submitted with all the ensuing consequences. What consequences can we expect?

Fines.

A company that erroneously submitted a VAT report in paper form: 1.

will be fined under Art.

119 of the Tax Code of the Russian Federation. The recovery will be 5%

of the amount of tax payable for each overdue month (full and incomplete), but not less than 1000 rubles.

and no more than 30% of the specified amount. 2.

Moreover, the organization faces blocking of the account if it is late in submitting reports by more than 10 days. This right of tax officials is directly enshrined in the law (clause 3 of article 76 of the Tax Code of the Russian Federation).

Structure of a tax return.

The VAT return was adopted by Order No. 558 of October 29, 2014.

The VAT tax return adopted by Order No. 558 of October 29, 2014 includes 12 sections. But that doesn't mean you have to fill them all out. Here, as in many other reports, the rule applies: we submit only those sheets for which we have completed data.

The tax inspectorate requires

♦ Title page

♦ “Section 1” with the specified amount of tax to be paid according to the calculation data.

If there is no revenue in the reporting quarter?

These rules also apply to those taxpayers who do not have quarterly revenue.

In this case, they submit a “zero” declaration. Let's move on to an overview of other sections: “Section 2” is devoted to the VAT of the tax agent,

therefore, only companies charged with tax agent functions fill it out.

“Section 3” - contains the calculation of the tax payable, after which it is transferred to “Section 1”. For information on how to correctly calculate VAT, read the article “How to calculate VAT. Calculation example."

“Sections 4,5,6”

- for organizations that carried out export transactions taxed at a rate of 0% during the reporting period.

“Section 7”

- here we show transactions that are not subject to taxation.

Naturally, if there are none, then the section is not filled out and is not submitted. “Section 8”

- is filled out by taxpayers claiming tax deductions for VAT, in other words, data

from the purchase book

.

IN

to section 8, companies record information from additional sheets to the purchase book. “Section 9”

- contains data

from the sales book

for the corresponding period.

In this case, each entry in the sales book must correspond to a separate sheet of section 9. Similar to section 8, if there are additional sheets from the sales book, then the organization enters them in Appendix 1 to section 9. “Sections 10,11”

are relevant for those organizations who, by virtue of clause 5.2 of Art. 174 of the Tax Code of the Russian Federation is obliged to maintain and submit to the inspection a log of issued and received invoices.

"Section 12"

— information from invoices, as well as UTII payers who accidentally issued invoices, are transferred to this section.

Important tips on how not to attract the attention of tax authorities to your VAT return.

Tip #1. Check your revenue figures with your income statement.

Before you send the report, it is necessary to analyze it in order to reduce the likelihood of errors and discrepancies in the declaration, as well as to avoid claims from the tax authorities, up to a documentary check. So, tax officials verify all data using control ratios, both within the declaration and compared with external reports. Namely, with a profit declaration. What indicators of the two declarations should be compared.

Since we charge VAT on revenue, the amounts of revenue in the VAT return and in the income tax return must be identical. If for some reason these figures do not agree, then it is advisable for you to immediately write an explanation of the reason for the discrepancy, or wait for a request for explanations from the tax office.

Tip #2. Check the row metrics in section 1.3

Further, if in “Section 1” you showed a tax refund from the budget, then a desk audit is inevitable. This rule is provided for in clause 8 of Article 88 of the Tax Code of the Russian Federation.

Lines 130 and 90 of Section 3.

Let's move on to "section 3". Here, the inspectors are interested in lines 130

and

90.

On line

130

, the buyer takes into account the deduction of VAT from advances paid, and on line

90

, the VAT restored from these advances after the goods are accepted for registration.

Tax workers calculate the tax amounts and periods for which the organization is ready to deduct VAT from the advance and, subsequently, restore it. If inspectors record even the slightest discrepancy in the indicated amounts, they demand an explanation.

Line 170 of Section 3.

Another indicator is line 170

, it contains the amount of VAT on advances received and subject to deduction from the seller.

This figure cannot exceed the sum of column 5 along lines 010,020,030,040.

Tip #3. Check with your counterparties

I would like to give one more important piece of advice on preliminary self-checking of the declaration. Before creating “section 8”, it is worth checking with the counterparties issuing the invoice data.

A situation may occur when inspectors discover invoices for which the company applied for a deduction, and your counterparty did not reflect the sale in its declaration in “section 9”.

In this case, they will require clarification and will also be required to provide all documents regarding these transactions. In particular, they may ask for contracts, invoices (acts), invoices, balance sheets, account turnover, bank statements, etc.

Last tip.

In order to be confident in the correctness of tax calculations and reporting and be able to minimize the risks of a desk audit for VAT and income tax, I strongly advise you to take the course: “Practice of filling out VAT and income tax returns 2015 +1C 8.3.”

Here, together with your teacher, you will examine in detail the procedure for filling out VAT and profit returns for different reporting periods using complex examples from practice. The course is taught by Botova E.V., a member of the NP “International Association of Certified Accountants”, a member of the association of “Professional Accountants in Russia”.

Watch the lesson from

course“3 tips on how to avoid a desk audit for VAT”

Federal Tax Service requirements

The taxpayer is obliged not only to submit VAT, but in addition he has the following interrelated obligations (clause 5.1 of Article 23 of the Tax Code of the Russian Federation):

- ensure the acceptance of electronic notifications, demands and other documents sent via telecommunication channels by tax authorities within the scope of their powers;

- promptly (within six working days) send to the tax authority a receipt of receipt of such documents in electronic form;

- provide explanations for the electronic VAT declaration according to the TKS.

Tax authorities have the right to request such explanations if errors and (or) contradictions are identified in the declaration between the information contained in the submitted documents, or if the information provided by the taxpayer does not correspond to the information contained in the documents available to the tax authority and received by it during tax control. The format for providing explanations was approved by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-15/ [email protected] If the specified explanations are submitted on paper, such explanations are not considered submitted. If these requirements are not met, the Federal Tax Service has the right to block transactions on the payer’s account. The special operator is obliged to provide such an opportunity.

Legal documents

- Article 174 of the Tax Code of the Russian Federation. Procedure and deadlines for paying taxes to the budget

- Article 119 of the Tax Code of the Russian Federation. Failure to submit a tax return (calculation of the financial result of an investment partnership, calculation of insurance premiums)

- Article 15.5 of the Code of Administrative Offenses of the Russian Federation. Violation of deadlines for submitting a tax return (calculation of insurance premiums)

- Article 76 of the Tax Code of the Russian Federation. Suspension of transactions on bank accounts, as well as electronic money transfers of organizations and individual entrepreneurs

- Article 80 of the Tax Code of the Russian Federation. Tax return, calculations

- Article 80 of the Tax Code of the Russian Federation. Tax return, calculations

- Article 174 of the Tax Code of the Russian Federation. Procedure and deadlines for paying taxes to the budget

- <Letter> Federal Tax Service of Russia dated September 30, 2013 N PA-4-6/17542

- Government Decree No. 1137

- Article 23 of the Tax Code of the Russian Federation. Responsibilities of taxpayers (payers of fees, payers of insurance premiums)

- by order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-15/ [email protected]

The time has come

Taxpayers, including those who are tax agents, as well as those taxpayers who are exempt from the obligation to pay VAT, but have issued invoices to their clients with the allocated amount of tax, are required to submit a declaration to the tax inspectorate in electronic form via telecommunication channels through an electronic operator document flow. This must be done no later than the 20th day of the month following the expired tax period (quarter).

A paper version of the tax return is permitted to be submitted only by tax agents who are not taxpayers or who are taxpayers exempt from VAT payment obligations. For this category, troubles will begin on January 1, 2015 (Clause 5, Article 24 of Law No. 134-FZ). If they issue or receive invoices when conducting activities in the interests of another person on the basis of agency, commission or agency agreements, then they will have to submit a declaration in electronic form through TKS: they will need to enter into an agreement with the operator, receive an electronic digital signature, and pay for the service.