For most employees, the duration of annual basic leave is 28 calendar days, for minor workers – 31 days, for disabled workers – at least 30. Moreover, at least one part of the leave must be at least 14 calendar days. The remaining days can be divided into any parts (Articles 123, 125 of the Labor Code of the Russian Federation). But such “fragmentation” requires agreement between the employee and the employer; the intention to divide the vacation must be recorded in the schedule. The document is mandatory for the employer (Part 2 of Article 123 of the Labor Code of the Russian Federation).

All organizations are required to draw up a vacation schedule, regardless of the number of staff. Only individual entrepreneurs can avoid doing this, but it is better for them to draw up such a document in order to avoid disagreements with employees (Article 305 of the Labor Code of the Russian Federation).

The schedule is drawn up once a year. For 2021, the vacation plan had to be approved no later than 14 calendar days before the new calendar year, that is, December 17, 2021, since the deadline falls on a weekend (Article 123 of the Labor Code of the Russian Federation). Employees must be familiarized with the approved schedule against signature.

note

It is possible to take into account insurance premiums from vacation pay for tax purposes in full, even when the vacation income itself does not reduce, and it must be distributed among quarters if the vacation is “transitionable” (clause 1 of Article 264 of the Tax Code of the Russian Federation).

Labor legislation does not regulate what to do if employees were hired after the schedule had already been approved. It follows from the norms of the Labor Code that the right to go on vacation for the first time at a new job arises for a specialist after six months of continuous service. Newly hired employees can go on vacation earlier, but only with the permission of the manager (Article 122 of the Labor Code of the Russian Federation).

Providing leave

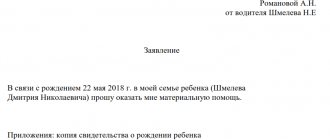

The employer must notify the employee of the granting of leave no later than two weeks before it begins. The specialist must be given a notice or notification drawn up in any form. At the same time, the employee does not have to write an application for leave, since it is granted on the basis of the schedule (even if the employee refuses to go on leave). An order is sufficient, with which the employee must be familiarized with his signature. The application is required only when providing annual paid leave to employees who “go away” on vacation for the first time without having worked for the organization for six months (Article 122 of the Labor Code of the Russian Federation).

Vacation calculation

The calculation period for vacation is 12 months preceding the start of the vacation. For example, if an employee goes on vacation from January 9, 2021, the calculation period for vacation pay is the period from January 1, 2021 to December 31, 2021. If vacation begins on the first working day of January, vacation pay must be paid in the previous month - December. In this regard, if the vacation begins at the beginning of the next month, vacation pay will have to be calculated when the last month has not yet been fully worked. If the exact salary is unknown, vacation pay can be calculated based on the salary, and then, if the amount changes, vacation pay must be recalculated and the difference must be paid. The amount of vacation pay is determined by multiplying the average daily earnings, calculated in accordance with Article 139 of the Labor Code of the Russian Federation and Regulation No. 922 of December 24, 2007 on the specifics of the procedure for calculating average wages by the number of calendar days of vacation (clause 9 of Regulation No. 922).

Average daily earnings for vacation pay are determined by the formula:

Vacation base: 12: 29.3 (part 4 of article 139 of the Labor Code of the Russian Federation, clause 10 of the Regulations).

The base includes wages and other payments provided for by the remuneration system. At the same time, the time when the employee was on any vacation, sick leave, on a business trip, or for other reasons was released from work while maintaining average earnings, in accordance with the legislation of the Russian Federation, is excluded from the billing period. If the month is not fully worked, the average daily earnings are calculated by dividing the amount of wages for the billing period by 29.3 and multiplying by the number of complete calendar months and the number of calendar days in incomplete calendar months. The number of days in an incomplete month is equal to the ratio of the number of days worked to the number of days of the month, multiplied by 29.3 (clause 10 of the Regulations).

Two options for calculating personal income tax from vacation pay in 1C programs

The employee took annual paid leave from January 30 to February 5, 2012 (7 calendar days).

The salary for the 11 days worked in January is 30,187.5 rubles.

The amount of vacation pay was:

- for January 2012 (January 30 and 31) - 2091.68 rubles;

- for February 2012 (from February 1 to February 5) - 5229.2 rubles.

A total of 37,508.38 rubles was accrued. (RUB 30,187.5 + RUB 2,091.68 + RUB 5,229.2).

The employee has two children, and, accordingly, he needs to provide a deduction in the amount of 2800 rubles. (1400 rub. + 1400 rub.) per month.

In the two programs used, the calculation was carried out differently:

The first option for calculating personal income tax (calculation is carried out in the “1C: Accounting 7.7” configuration (release 7.70.534).

The personal income tax amount for January 2012 was 4,512 rubles. .

The second option for calculating personal income tax. In the “1C: Salary and Personnel” configuration (release 7.70.320), the program calculated personal income tax as follows:

- 3832 rub. — for January 2012;

- 316 rub. — for February 2012

The total amount of personal income tax is 4148 rubles. (3832 RUR + 316 RUR).

That is, the program applied a deduction for two children twice - 2800 rubles. for January and 2800 rubles. for February 2012. This is reflected in the certificate on form 2-NDFL.

Question from a forum visitor. Which personal income tax amount is correct - 4512 or 4148 rubles? And how do you need to change the settings so that the program calculates correctly?

Days not worked

If the entire billing period consists of excluded days, the preceding 12 months in which the employee had days worked are taken as the billing period. For a specialist who did not have any days worked in previous periods, the calculation period will be from the 1st day of the month of the start of the vacation to the date preceding the first day of the start of the vacation. For example, if a salaried employee did not have actual accrued wages or days worked for the billing period and before the start of the period (for example, she was on maternity leave), but had wages in the month she went on vacation (she returned from vacation this month and worked several days), then the average salary for vacation pay is calculated by dividing the wages accrued for days worked in a month by the estimated number of calendar days in that month. If, before the day she went on vacation, the employee had no payments included in the calculation of average earnings or days worked, the average daily earnings are calculated by dividing the tariff rate established for her by 29.3.

note

Vacations that are not used for several years do not “burn out” in any case, although not providing them is a violation of the law. And since the employer is still obliged to give a person a rest, vacation pay for “accumulated” vacations is taken into account in full in tax expenses.

The calculation of vacation pay and the procedure for its payment is affected by whether holidays fall on holidays. Difficulties may arise if the holiday starts at the end of December or immediately after the New Year holidays, or during public holidays in February or March. There are many non-working holidays in Russia in January. There are eight of them in total: New Year holidays and Christmas. If these days fall on vacation, they are not considered rest days and do not need to be paid for.

At the same time, the amount of vacation pay for the employee will not be less, since non-working holidays are not taken into account when calculating days of rest. In the application, the employee will indicate the number of vacation days for which he will be paid. In this case, the rest time must be increased by eight days. New Year's holidays and Christmas are non-paid days. The same should be done when calculating vacation pay that falls on February, March 8, or May holidays.

Vacation pay - payment for work?

On the one hand, the amounts of accrued vacation pay are included in the wage system, are guaranteed by an employment contract, and from these positions can be classified as wages. This opinion is shared by some arbitration judges (Resolutions of the Federal Antimonopoly Service of the West Siberian District dated December 29, 2009 in case No. A46-11967/2009, the Federal Antimonopoly Service of the Ural District dated August 5, 2010 No. Ф09-9955/09-С3 and the Federal Antimonopoly Service of the Northwestern District dated September 30. 2010 in case No. A56-41465/2009). And if vacation pay is wages, then it is quite acceptable to apply the norm of paragraph 2 of Art. 223 of the Tax Code: the date of actual receipt of income by the taxpayer is the last day of the month for which the income was accrued to him.

Personal income tax and contributions

Personal income tax from vacation pay must be withheld when paying income and transferred to the budget no later than the last day of the month in which the amounts were paid (clause 7 of article 6.1, clause 6 of article 226 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 17, 2021 No. 03 -04-06/1618). If the payment of vacation pay and the start of vacation fall on different reporting periods, then vacation pay must be “showed” in the calculation for the period in which it was paid. Vacation pay issued in December is reflected only in Section I of the 6-NDFL report for 2021. The date of receipt of such income is the day of payment to the employee (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). You need to fill out lines 020, 040 and 070. And these vacation pay will not be included in section 2 of the 6-NDFL report for the year; the company will reflect them in 6-NDFL for the first quarter of 2018, even if it paid tax last month.

Vacation pay is subject to insurance contributions, including contributions for injuries (Article 420 of the Tax Code of the Russian Federation, Article 20.1 of Law No. 125-FZ). Contributions from vacation pay amounts must be calculated in the month in which they were paid, and reflected in the reporting in the same period, even if the vacation begins in a different period (clause 1 of Article 424 of the Tax Code of the Russian Federation). Therefore, if the vacation falls in January 2021, and vacation pay was issued in December 2021, then contributions should have been calculated in December and reflected in the calculation of insurance premiums and 4 - Social Insurance Fund for 2021 (letter from the Ministry of Labor of Russia dated June 17, 2015. No. 17-4/V-298, dated September 4, 2015 No. 17-4/Vn-1316, dated June 30, 2016 No. 17-3/OOG-994, dated September 4, 2015 No. 17-4/ B-448). The Ministry of Finance of Russia, in letter dated November 16, 2021 No. 03-04-12/67082, allowed for the time being to be guided by the explanations given earlier.

Contributions must be transferred no later than January 15, 2021.

Rolling holidays in 2021: in 6-personal income tax accounting (postings) tax accounting

(14,000 rubles: 28 days ? 7 days) vacation pay, respectively, on the 21st day of October - 10,500 rubles. (RUB 14,000: 28 days ? 21 days).

Arbitration practice

Examples from arbitration practice show that taxpayers have a chance to disagree with the position of the Ministry of Finance, i.e., not to split the amounts accrued to pay for rolling holidays into two parts. For example, in a resolution dated May 11, 2006 No. F04-2610/2006(22165-A46-40), the arbitrators of the Federal Antimonopoly Service of the West Siberian District came to the conclusion that the company reasonably included in the reduction of taxable profit of the current year the amount of vacation pay accrued in December for vacations falling in December - January.

A similar decision was made by the judges of the Federal Antimonopoly Service of the Far Eastern District in a resolution dated May 30, 2007 No. F03-A24/07-2/1446. The court found that the taxpayer rightfully recognized the full amount of accrued vacation pay as expenses that reduce the taxable base for income tax.

“Crushing” of the unified social tax

How to deal with the unified social tax in this case? According to paragraph 3 of Article 236 of the Tax Code, UST is not accrued for payments in favor of an employee that do not reduce the taxable base for income tax. If we return to our example, then, following the logic of the Ministry of Finance, in September the unified social tax must be accrued only for 3,500 rubles.

However, even in a letter dated June 11, 2002 No. 28-11/26610, officials of the Department of Tax Administration for Moscow indicated that the unified social tax in such a situation should be accrued immediately for the entire amount of vacation pay, without breaking it into two parts. It is necessary to transfer the unified social tax from the amount of payment for a rolling vacation before the 15th day of the month following the month in which it began (clause 3 of Article 243 of the Tax Code).

“Transitional” personal income tax

Transferable leave pay is the employee’s income, part of which relates to a future period. This income is subject to personal income tax (clause 1 of article 210 of the Tax Code of the Russian Federation). It is necessary to withhold personal income tax from the entire amount of vacation pay when paying them (clause 4 of article 226 of the Tax Code).

When calculating personal income tax for a rolling vacation, the tax agent has the right to apply all deductions due to the employee for the entire period from the beginning of the year, including the month that has not yet come, in which the second part of the vacation falls.

In section 3 of form 2-NDFL, approved by order of the Ministry of Taxes of the Russian Federation dated October 31, 2003 No. BG-3-04/583, the amount of withheld tax should be reflected in full in the month when the vacation pay was paid. And the accrued tax will have to be divided into two parts (clause 3 of Article 226 of the Tax Code). In the month of payment of vacation pay, the amount of personal income tax withheld will be greater than the amount accrued. This difference must be shown in the line “tax debt due to the tax agent.” Next month the situation will be reversed, the debt will be repaid. At the same time, the accountant needs to track whether the employee has lost the right to deductions in the month the vacation ends. If this right is lost, then the amount of deductions and withheld tax will have to be recalculated.

Olga Ostrovskaya

Information Agency "Financial Lawyer"

Income tax

Organizations take into account the costs of paying the main annual leave established by law when calculating income tax and the simplified tax system with the object of taxation “income minus expenses” as labor costs. Since vacation pay is a labor expense, they are taken into account in the period to which they relate (Clause 7, Article 255 of the Tax Code of the Russian Federation). According to regulatory authorities, vacation pay should be taken into account in income tax expenses in the period to which they relate, regardless of when they were paid.

In the configuration "1C: Salary and Personnel 7.7"

To set up the reflection of vacation pay by payment period, you will have to specify a different personal income tax code for the vacation. We recommend the code “4800 – Other income”. It will not be possible to use code 2012 in this accounting option.

In all types of vacation accruals (including additional ones), on the “Tax Accounting” tab you will need to indicate income code 4800 (see Fig. 3 below).

Rice. 3 In the “1C: Accounting 7.7” configuration, only one option for calculating personal income tax is possible

Unlike the programs mentioned above, the configuration of “1C: Accounting 7.7” does not allow you to perform complex calculations of wages and vacation pay.

So, with its help it is impossible to distribute vacation over several months. Consequently, the amount of vacation pay will be taken into account in full in one month, and deductions will be applied once.

O.Ya.Leonova

Head of Department

automation of personnel records

and payroll