“1C: Salary and Personnel Management” (hereinafter we will use the short name 1C 8.3 ZUP) allows you to prepare and create, within the framework of automation of salary management, a form of calculation for accrued and paid insurance contributions for compulsory pension insurance in the Pension Fund of the Russian Federation and for compulsory medical insurance in the Compulsory Medical Insurance Fund by payers insurance premiums that make payments and other remuneration to individuals (DAM form or DAM report in 1C). You can learn how to do this in this article.

To form a RSV, it is necessary to correctly perform a clearly defined sequence of actions. The process of generating a DAM report in 1C 8.3 ZUP can be roughly divided into three steps

- Prepare information for the DAM report in 1C 8.3 ZUP: complete the settings and enter the necessary data;

- Generate a DAM report in 1C ZUP automatically;

- Submit a report to the Pension Fund.

And now a little more detail about each of these steps:

How to make an adjustment to the RSV in 1C 8.3 ZUP

If, after submitting reports on insurance premiums, it is discovered that errors were made when generating the reports, then using the document “Recalculation of insurance premiums” (Fig. 7) (section “Taxes and contributions”, command “Recalculation of insurance premiums”) you can correct the mistakes made. errors.

Rice. 7 Recalculation of insurance premiums

The taxpayer is obligated to submit a corrective report on the DAM if the amount of accrued contributions is underestimated or the information is not specified or is incomplete.

The corrective RSV is generated in the program in the same way as the original form. It is necessary to indicate the reporting period, the adjustment number, include sections similar to those of the original declaration, enter the correct data and exclude incorrectly submitted data.

Support for the generation of the DAM report in 1C:ZUP

Support for working in 1C, regular consultations, assistance in preparing a DAM report and eliminating errors

from 700 rubles.

To learn more

Integration of 1C: ZUP with 1C: Accounting

We will set up an exchange for simple submission of regulated reporting.

The first consultation is free! from 2,600 rub.

To learn more

Let's consider the features of the corrections in section 3. If there is a need to add previously unprovided information, you should fill in the necessary data in subsections 3.1 and 3.2 of the updated calculation without indicating the adjustment. If it is necessary to exclude erroneous information from the calculation, the section should be marked as corrective; in subsection 3.1, indicate the person whose data is subject to correction. In subsection 3.2, lines 190–300 are filled with zero values. If you need to change information about an employee or the amount of contributions, you must exclude erroneous information in the manner specified in paragraph 2 and add the changed data by entering it in section 3 without indicating an adjustment.

Description of report sections

- The title page is required to be completed by all those responsible for submitting this report.

- Section 1 reflects the total data on insurance premiums that must be paid to the budget. Detailed data on the purpose of these contributions are located in the relevant appendices of this section.

- Section 2 is not displayed in our example, since it is formed by peasant (farm) farms. It will become available when the code for the location of the accounting “124” is indicated on the Title Page.

- Section 3 contains detailed information about individuals, indicating their passport details, TIN, SNILS and other things.

We recommend that you always monitor the relevance of the program to avoid future problems with regulatory authorities.

Payer rate codes

Appendix No. 5 additionally included:

- 20 – small and medium-sized businesses that apply reduced tariffs;

- 21 – organizations and individual entrepreneurs from the industries most affected by the coronavirus, which were exempted from contributions for the second quarter of 2020;

- 22 – companies that design and develop radio-electronic products.

In addition, insured person category codes have been officially adopted for individuals, to payments in whose favor either a cumulative tariff of 15% or 0% is applied.

Features of filling out the DAM for the six months

Standard rules for filling out the DAM for the six months were approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

When creating the calculation, you need to consider the following:

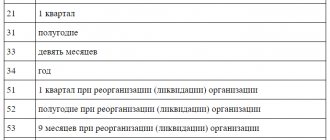

- The period code is set to 31;

- the report is filled out on a cumulative basis from the beginning of the calendar year;

- the company fills out and submits only those sections of the DAM that are related to its activities.

Taking into account the fact that the rates for insurance premiums for NSR subjects were reduced to 15%, filling out the DAM has some nuances. Tax authorities issued a Letter dated April 7, 2020 No. BS-4-11/ [email protected] , according to which:

- in adj. 1 and 2 in page 001 you should put tariff code 20;

- in Sect. 3 you need to enter the following codes for the category of insured persons - “MS” for citizens of Russia, “VPMS” for temporarily staying and “VZhMS” for temporarily residing foreign citizens.

As for insurance premiums at a zero rate, according to Letter of the Federal Tax Service dated 06/09/2020 No. BS-4-11/ [email protected] in the DAM for the six months you need:

- in adj. 1 and 2 in page 001 indicate tariff code 21;

- in Sect. 3 put the following codes for the category of insured persons - “KV” for citizens of Russia, “VPKV” for temporarily staying and “VZhKV” for temporarily residing foreign citizens.

Important! If the employer did not make any payments in the 2nd quarter or even from January 1, he is still required to submit a zero RSV for the six months.

Calculation of insurance premiums in 1C: Accounting 8.3. Control ratios in 1C

Content:

1. Generating reports in 1C

2. Checking control ratios

3. Sending a 1C report to the tax authority and downloading the report

4. Printing a 1C report

Calculation of insurance premiums in 1C 8.3 is a quarterly report that, starting from 2021, all employers are required to submit. The quarterly report form is approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected] Report submission deadline: no later than the 30th day of each month following the billing (reporting) period.

Generating reports in 1C

In the program "1C: Accounting 8" (version 3.0), the report is generated in the section Reports - 1C-Reporting - Regulated reports in 1C 8.3

Next, in the list that opens, click the Create button. In the window that opens, select Calculation of insurance premiums in 1C 8.3

and click the

Select button.

Next in the window you need to select the Organization, period and click the Create button.

An empty insurance premium calculation report form will be created, with all sections. Only the title page will be filled in automatically. Information for the title page will be taken from the organization's registration card. In order to fill out the entire report, you must click the Fill button.

Please note: in the header of the report window, next to the name of the organization, there is an asterisk (* symbol) on the right - this means that changes have been made to the open report, but have not yet been saved. You can save your changes by clicking the Save

. You can also discard your changes when closing the report.

If individual main sections of the report are not filled out and submitted in accordance with the Procedure, then you can set a mode for them in which they will not be displayed in the report form or printed. To do this, click on the Settings

(button

More – Settings

) located in the top command bar of the report form, and on the Section Properties tab, clear the

Show and Print

for these sections.

Checking reference ratios

Before submitting the calculation, it is recommended to check it for errors. To do this, use the button Check – Check control ratios.

After pressing the button, the result of checking the control ratios of the indicators is displayed. Control ratios are calculated in accordance with Letter of the Federal Tax Service of Russia dated March 13, 2017 NBS-4-11/4371.

In this case, you can see either those control ratios of indicators that are erroneous, or all control ratios of indicators (by unchecking the Display only erroneous ratios

).

When you double-click on the required ratio of indicators, in the column “Checked ratio” or “Decoding of values”, a transcript is displayed, which shows where these numbers came from, how they formed, etc.

And when you double-click on a specific indicator in the transcript itself, the program automatically shows this indicator in the report form itself.

Sending a 1C report to the tax authority and downloading the report

If the 1C-Reporting service is connected to this information base, then the generated calculation of insurance premiums can be immediately sent to the 1C report to the tax authority, without intermediate uploading to an electronic submission file and using third-party programs

Before sending, it is recommended to perform format and logical control of filling out the calculation. To do this, click on the Check button - Check on the Internet

.

To send the calculation to the tax authority directly from the program, click on the Send button.

If the Organization uses third-party programs for electronic exchange, then it is necessary to prepare files for transmission to the tax authority in electronic submission of information.

The form of a regulated report supports the function of downloading in electronic form in a format approved by the Federal Tax Service of Russia. It is recommended to first check the report for compliance with the requirements of the format for electronic presentation of information by clicking the Check button – Check upload.

After clicking this button, a report will be generated in 1C. If errors are detected in the report data that prevent the upload from being completed, the upload will be stopped. In this case, you should correct the detected errors and repeat the upload. To navigate through errors, it is convenient to use the error navigation service window, which is automatically brought up on the screen. The transition is carried out by double clicking the mouse.

To download the calculation for subsequent transfer through an authorized operator, you must click on the Upload button - Electronic submission

information and indicate in the window that appears the directory where you should save the calculation file. The program assigns a name to the file automatically.

When you click on the Upload button – Data on individuals, section 3

, a file with data on individuals in section 3 will be uploaded.

The uploaded file can be used in the organization’s “Personal Account” on the Federal Tax Service website to check your full name and SNILS.

Printing a 1C report

To submit the calculation on paper, you should prepare a printed calculation form.

To generate a printed calculation form with a PDF417 two-dimensional barcode, click on the Print

located at the top of the report form.

To print machine-readable forms of regulated reports with a two-dimensional PDF417 barcode, it is necessary that a single module for printing machine-readable forms and machine-readable form templates be installed on the computer. The print module installation kit is included in the configuration. As soon as the need to use the print module arises, it is automatically launched for installation. Templates for machine-readable forms of regulated reports are included in the configuration and are installed along with it, so there is no need to install templates separately.

The calculation form for insurance premiums can be printed without a barcode. To do this, in the report settings (button More - Settings

) you need to check the

Allow printing without PDF417 barcode

and click the

Save button.

After setting this setting, by clicking the “Print” button, a Form with a PDF417 barcode (recommended) or a Form without a PDF417 barcode will be available for printing.

When you select the second option, the program displays the report form on the screen for preview and additional editing, generated for printing sheets (if necessary). Next, to print the calculation, click on the Print 1C report button.

In addition, from this report form (preview), you can save the edited calculation as files to the specified directory in PDF document format (PDF), Microsoft Excel (XLS) or in spreadsheet document format (MXL) (by clicking on the Save button

).

Specialist

Sergey Chernov.

How to change data in RSV-1 reporting in 1C

If in the RSV-1 report you go to the line “Pack of sections 6 RSV-1”, then at the bottom of the screen a list of employees will be presented with the amount of deductions for each of them. This information is subsequently included in “Individual Information”.

You need to double-click on the selected employee, after which a form for manual editing will open. You can correct data in any of the columns, including adding rows.

The “Section 6.8” tab reflects information about the length of service of each employee of the enterprise. If sick leave is available, it is envisaged to form an o. You can edit the data manually, for example, if a person has days without pay in the reporting period.

You can fill out information on special working conditions, preferential periods of work, and so on. Provided that the employee worked in hazardous conditions, he is required to complete section 6.7. You can edit the length of service through the work form in the RSV-1 document.

After clicking on the link, a new form opens, allowing changes to be made for any of the employees. The employee’s early retirement is also indicated here. All changes must be saved.

Instructions for filling out the RSV-1 form in the Pension Fund of the Russian Federation

Step 1. Filling out the title page

At the first step, information indicators about the taxpayer and the reporting period are generated. A sample title page of the RSV-1 form is presented below:

Step 2. Completing Section 2

In the second section of the RSV-1 form, insurance premiums are calculated at the rate established for the taxpayer.

Filling out the section on compulsory pension insurance

In the line Base for calculating insurance contributions for compulsory pension insurance (lines 240 and 241), the base is calculated by age:

- For workers 1966 and older according to the formula (p. 201+ p. 203 – lines 211 -213 -221 -223 -231 -233)

- Let’s say, for example: 80,539.21 + 0 – 0 – 0 – 0 – 0 – 0 – 0 = 80,539.21 rubles. – page 240 ;

- For persons born in 1967 and younger according to the formula (page 202 – lines 212 – 222 -232)

- Let’s say, for example: 321,295.54– 3,195.63 (sick leave benefit) – 0 – 0 = 318,099.91 rubles. – page 241 ;

In the line Accrued insurance contributions for compulsory pension insurance, contributions are calculated: insurance and savings part (line 250, line 251), if their amount is more than the maximum value of the base (line 252) according to the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- So, in our case, the calculation of contributions for the insurance part: 80,539.21 * 22% + 318,099.91 * 16% = 68,614.62 rubles.

- The calculation of contributions for the funded part was: 318,099.91 * 6% = 19,086.00 rubles.

Filling out the section on compulsory health insurance

In the line Amount of payments and remunerations in favor of individuals (p. 271) - the amount of payments is written down by month in the reporting period (columns 4-6) and in total on an accrual basis (column 3). Filling is similar to the indicators of the lines on the OPS (lines 201 + 202 + 203 are summed up).

In the line Base for calculating insurance premiums for compulsory medical insurance (p. 275), the base is calculated using the formula (p. 271 - lines 272 – 273 – 274).

- In our case: 401,834.75 – 3,195.63 – 0 – 0 = 398,639.12 rubles – p. 275;

In the line Accrued insurance premiums for compulsory health insurance, contributions to the FFOMS are calculated using the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- Checking the calculation of contributions to the Federal Compulsory Medical Insurance Fund: 398,639.12 * 5.1% = 20,330.60.

You can also check the amounts of contributions with the balance sheet for the credit turnover of accounts 69.03.01 “Federal Compulsory Medical Insurance Fund”. Similarly, you can check calculations for all columns by month of the period:

Example of filling out Section 2 of RSV-1:

Step 3. Completing Section 1

In the first section of the RSV-1 form, the accrued and paid contributions for compulsory pension and health insurance are calculated, and the balance for them is also indicated.

In the line Accrued insurance premiums from the beginning of the reporting period (p. 110) – the total amount of accrued premiums on a cumulative basis from January 1. The data in the line must match:

- amounts from section 2 column 3:

- insurance part – p.250 + p.252;

- accumulative part – page 251;

- contributions for compulsory medical insurance – page 276;

- the sum of the data from section 1 page 110 of the calculation of the previous period and the data from section 1 page 114 of the calculation of the reporting period.

In lines 111, 112, 113 – the amounts of contributions accrued for the three previous months are entered. The data in the lines must correspond to the data from section 2, columns 4, 5, 6:

- insurance part – p.250 + p.252;

- accumulative part – page 251;

- contributions for compulsory medical insurance – page 276;

Line 114 reflects the amount of insurance premiums for the last three months of the reporting period, which is determined by the formula (lines 111 + 112 + 113).

In line 130 - the total amount of insurance premiums payable, which is determined by summing lines 100+110+120.

In line 140 - you need to indicate the amount of contributions paid on an accrual basis from January 1 to the reporting date. The data in the line must correspond to:

- debit turnover on accounts 69.02.1, 69.02.1, 69.03.1 in correspondence with account 51;

- the sum of the data from section 1 page 140 of the calculation of the previous period and the data from section 1 page 144 of the calculation of the reporting period;

In lines 141, 142, 143 - you need to enter the amount of contributions paid for the last three months. The data in the lines must correspond to the amounts of monthly contributions (debit turnover on accounts 69.02.1, 69.02.1, 69.03.1);

Line 144 reflects the summation of lines 141 + 142 +143.

Sample of filling out RSV-1 Section 1:

Drawing up a payment order for payment of contributions to the Pension Fund

The procedure for filling out the fields of the payment order when paying monthly insurance premiums to the Pension Fund of the Russian Federation (insurance part):

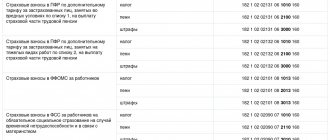

KBK for payment of contributions to the Pension Fund

In field 104 “KBK” you need to enter the budget classification code for the contribution being paid.

Attention! BCC is an important detail; if it is indicated incorrectly, the insurance premium will not be credited correctly and will entail the accrual of penalties.

In our example, the following BCCs are indicated:

Details for payment of insurance contributions must be found in your pension fund or on the official website of the pension fund. For Moscow, you can use the website www.pfrf.ru/ot_moscow.

Pre-setting

Before you start calculating insurance premiums, you need to do a little setup of the program. The correctness of the calculations depends on it. Insurance premiums are a serious matter, so do not neglect the settings and be careful.

If you have not previously indicated the taxation system of your organization, be sure to do so in your accounting policy.

Accounting setup

First of all, let's start setting up accounting for our contributions. They are set up in the same place as the salary. In the “Salary and Personnel” menu, select “Salary Settings”.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

By clicking on the “Insurance Premiums” hyperlink in the “Classifiers” section, you can view the parameters for calculating premiums. We will not focus on them, since the data in these registers is already filled in in the standard configuration delivery according to current legislation.

Now let's move on to setting up accounting for our contributions. In the salary settings form, select “Salary accounting procedure”.

At the very bottom of the form that opens, follow the link to set up insurance premiums.

In the window that opens, go to the “Insurance Premiums” section and fill in the required fields.

The tariff for NS and PP is set depending on the main type of activity for the previous year. The minimum tariff is 0.2 percent. It is approved by the FSS, to which documents are submitted every year to confirm the main type of activity.

Here you can also set up additional contributions for those professions who are entitled to them, and indicate whether there are employees with hazardous working conditions. At the very bottom you can put a mark on the transfer of additional insurance contributions for a funded pension in accordance with Federal Law No. 56 of April 30, 2008.

Expenditures

To correctly reflect insurance premiums in accounting, you need to make one more setting. In the salary setup form, select “Cost items for insurance premiums.” This is where the procedure for reflecting mandatory contributions from the payroll fund on accounting accounts is set up.

A list already filled in by default will open in front of you. If necessary, it can be supplemented or adjusted.

By default, the debit account will be 26, the credit account will be 69.

Accruals

There are many different types of accruals. This includes salary, sick leave, vacation and others. For each of them, you need to configure whether insurance premiums should be paid from them.

Let's return to the salary settings form. In the “Payroll calculation” section, select the “Accruals” item.

A list of all charges will appear in front of you. They can be edited or new ones added.

Open any accrual. You will see the “Type of Income” field. It is the value indicated in it that will determine whether insurance premiums will be calculated on it or not. In our example, we opened one of the standard accruals, so everything is already filled in here, but when adding new ones, do not forget to indicate the type of income.

Preparation for the report

At the preparation stage, it should be noted that it is advisable for the organization to indicate all its details and tax authority registration data. In order to check the availability of details and, if necessary, fill them out, go to the “Settings” block on the main panel and find the “Organizations” item (Fig. 1-3).

Rice. 1. Block “Settings” in the program “1C: Salaries and personnel of a government institution 8”

Rice. 2. Details of the organization in “1C: Salaries and personnel of a government institution 8”

Rice. 3. Registration data of the tax authority in “1C: Salaries and personnel of a state institution 8”

Status for foreign employees in 1C ZUP 3.0 (2.5)

If foreign citizens work at the enterprise, it is necessary to clarify their status. During 2015, the procedure for registering foreign citizens changed several times. In the 1C ZUP 3.0 (2.5) programs, new statuses of foreign citizens were modified or appeared. Accordingly, it is necessary to clarify the current status of the foreign employee.

In August 2015, Kyrgyzstan joined the Eurasian Union. Accordingly, foreign employees from Kyrgyzstan from August 2015 received a different status for calculating contributions. If the organization has such employees, it is necessary to change their status in the 1C database and calculate insurance premiums in a new way.

How are insurance premiums calculated for foreign workers in 1C ZUP 3.0 (2.5) programs?

1C programs establish the following statuses for foreign employees:

- Citizens of the EAEU countries, permanently residing foreigners with a residence permit, as well as refugees with a refugee certificate from the point of view of calculating insurance premiums are equal to citizens of the Russian Federation. That is, the status in 1C is established - equal to citizens of the Russian Federation. Contributions are calculated to all funds: Pension Fund, Social Insurance Fund, Compulsory Medical Insurance. Contributions to the Social Insurance Fund are calculated at a rate of 2.9%.

- For temporarily residing foreign workers with a temporary residence permit in the Russian Federation, insurance premiums are calculated to all funds: Pension Fund, Social Insurance Fund, Compulsory Medical Insurance. At the same time, the Pension Fund uses a special category of coding information about earnings in the form of the symbols “VZh”.

- If a foreign employee has temporary asylum on the basis of a certificate of temporary asylum, then the status in 1C is established as for those temporarily staying in the territory of the Russian Federation. Insurance premiums are calculated to all funds: Pension Fund, Social Insurance Fund, Compulsory Medical Insurance. Contributions to the Social Insurance Fund are calculated at a rate of 1.8%.

- Other temporarily staying foreign workers, except highly qualified foreign specialists, are given the status in the 1C database as temporarily staying in the Russian Federation (except for HQS). Insurance contributions to the Pension Fund are calculated using the “VP” category code. Contributions to compulsory medical insurance are not transferred. Contributions to the Social Insurance Fund are charged at a rate of 1.8%.

There are several categories for highly qualified foreign workers:

- Permanently resides. Insurance premiums are paid to the Pension Fund and the Social Insurance Fund. Compulsory medical insurance contributions are not paid. Contributions to the Social Insurance Fund are calculated at a rate of 2.9%;

- Temporarily resides. Insurance premiums are calculated into the Pension Fund and Social Insurance Fund. Compulsory medical insurance contributions are not paid. Contributions to the Social Insurance Fund are calculated at a rate of 2.9%;

- Insurance premiums are not paid for temporarily staying foreign workers.

For temporarily staying citizens of the PRC, DPRK, and Vietnam, in accordance with an international treaty, pension insurance is regulated by a foreign state. Accordingly, insurance contributions to the Pension Fund and compulsory medical insurance are not paid. However, according to explanatory letters, insurance premiums are paid to the Social Insurance Fund from the National Social Insurance Fund at a rate of 1.8%. In 1C programs, the status is not implemented for such employees. In such cases, it is possible to establish the status - not subject to insurance. Manually calculate contributions to the Social Insurance Fund from the Tax Service and independently generate reports.

Who and when submits the RSV for the six months

All employers making payments to individuals, regardless of their organizational and legal form, must submit the DAM for the first half of 2021. In addition, the calculation must be completed for all insured persons working under both labor and civil employment contracts.

The DAM for the six months must be submitted on a specific date - no later than July 30, 2021. It has not been postponed due to the coronavirus, as, for example, it was done for the DAM for the 1st quarter.

If the number of employees is up to 10 people, the employer has the right to submit a paper DAM, otherwise he needs to submit an electronic calculation.

Conclusion

In our article, we examined in detail how to prepare for submitting a report on insurance premiums in the program “1C: Salaries and Personnel of a Government Institution 8” ed. 3.1. Understanding how to properly check the completeness of reporting, find errors and correct them will allow you to save not only the organization’s budget, but also your time and nerves.

If you still have questions about filling out reports or require the help of a qualified specialist, you can always contact our company.