The assessment of the value of intangible assets can be considered as a comprehensive assessment of the company's fixed assets, including intangible, capital assets and an assessment of the capitalization of the enterprise as a whole.

Assets, both tangible and intangible, have a specific value and market value. It is important to clearly understand all the factors affecting the company's capitalization.

In the context of the country's transition to an innovative path of development, the role of the institution of intellectual property (IP) is increasing, which should contribute to the production of knowledge-intensive, competitive products that ensure high rates of development and structural transformations in the economy.

The process of creating and using intellectual property requires effective management through the development of an integrated system for identifying, registering and managing IP objects.

Currently, every organization investing in the creation of new products and objects, engaged in innovative development, needs to create an intellectual property management system.

Intangible assets can be recognized as assets whose useful life exceeds 12 months, the value of which can be measured quite accurately. Assets must have characteristics that distinguish this object from others, including similar ones. Intangible assets do not have a physical form, can be used in the activities of the organization, and are capable of bringing economic benefits to the organization.

There are three criteria for measuring the value of intangible assets, succinctly formulated by the American economist Leonard Nakamura:

- as a financial result from investments in R&D, software, promotion of the company’s brand, etc.;

- as the costs of creating and developing the results of intellectual activity, purchasing licenses, etc.;

- from the point of view of increasing operating profit through the use of intangible assets.

The norms of Chapter 25 of the Tax Code of the Russian Federation on intangible assets

According to paragraph 1 of Art. 256 of the Tax Code of the Russian Federation for the purpose of applying Ch. 25 of the Tax Code of the Russian Federation, depreciable property is the results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided for in this chapter) and are used by him to generate income. Depreciable property is the results of intellectual activity and other objects of intellectual property with a useful life of more than 12 months and an initial cost of more than 100,000 rubles.

In accordance with paragraph 3 of Art. 257 of the Tax Code of the Russian Federation, for tax purposes, intangible assets are considered to be the results of intellectual activity acquired and (or) created by the taxpayer and other objects of intellectual property (exclusive rights to them) used for production purposes for a long time (over 12 months).

This norm determines that in order to recognize an intangible asset, it is necessary to have not only the ability to bring economic benefits (income) to the taxpayer, but also properly executed documents. They must confirm the existence of the intangible asset itself and (or) the taxpayer’s exclusive right to the results of intellectual activity.

Further in paragraph 3 of Art. 257 of the Tax Code of the Russian Federation contains a list of exclusive rights to certain objects that relate to intangible assets.

In order to correctly qualify an intangible asset, let us turn to the norms of the Civil Code of the Russian Federation.

Intelligence and Energy

The assessment of intangible assets is of enormous importance for companies operating in any high-tech industry, for example, in the energy sector. In a highly competitive industry, only the unique nature of an enterprise's intellectual property can provide sufficiently strong and high barriers in the long term. This will make it possible to receive stable income in the market from the monopoly use of new technologies or the sale of patents and licenses.

The main problems of domestic companies operating in the energy market is the lack of a regulatory framework confirming the development, creation and use of intellectual property. The management of intellectual property of domestic energy enterprises, as a rule, is carried out by specialists who do not know the mechanisms of legal regulation to protect against unfair competition.

Creating an effective system for managing an enterprise's intellectual property can reduce innovation risks and facilitate the process of introducing innovative technologies to the energy market.

Of course, if an organization is well known and has already established a reputation through a long history in the market, the value of intellectual property may represent a significant portion of its total value.

However, we have to admit that the value of intellectual property is quite often underestimated in Russian business practice. Meanwhile, the skillful use of information about the real value of intangible assets can significantly strengthen the market position for a company of any size.

Norms of the Civil Code of the Russian Federation on objects recognized as intangible assets in tax accounting

According to paragraph 1 of Art. 1225 of the Civil Code of the Russian Federation, intellectual property is the results of intellectual activity (works of science, literature and art, computer programs, databases, objects of patent rights, etc.) and means of individualization equivalent to them (trademarks, service marks, commercial designations), which are granted legal protection.

At the same time, intellectual rights do not depend on the ownership of the material medium (thing) in which the corresponding results of intellectual activity or a means of individualization are expressed (clause 1 of Article 1227 of the Civil Code of the Russian Federation).

Article 1228 of the Civil Code of the Russian Federation determines that the author of the result of intellectual activity is the citizen whose creative work created such a result (clause 1). It is the author who initially has the exclusive right to the result of intellectual activity created by creative work. This right can be transferred by the author to another person under an agreement ( clause 3 ).

The copyright holder may dispose of the exclusive right in any way that does not contradict the law and the essence of such right (Clause 1 of Article 1233 of the Civil Code of the Russian Federation), including by:

– alienation under an agreement to another person (agreement on the alienation of an exclusive right);

– granting another person the right to use the result of intellectual activity or a means of individualization within the limits established by the agreement (license agreement). The conclusion of this agreement does not entail the transfer of exclusive rights to the licensee.

The copyright holder may dispose of the exclusive right and, at his own discretion, allow or prohibit other persons from using the result of intellectual activity or a means of individualization. The absence of a prohibition is not considered consent (permission) (clause 1 of Article 1229 of the Civil Code of the Russian Federation).

So, the exclusive right to the result of intellectual activity arises either from the author himself or as a result of the acquisition of such a right under an agreement on the alienation of the exclusive right.

Under an agreement on the alienation of an exclusive right, one party (the copyright holder) transfers or undertakes to transfer its exclusive right to the result of intellectual activity or a means of individualization in full to the other party (the acquirer) (clause 1 of Article 1234 of the Civil Code of the Russian Federation). The agreement is concluded in writing and is subject to state registration in cases determined by the Civil Code of the Russian Federation.

Under an agreement on the alienation of an exclusive right, the acquirer undertakes to pay the right holder the remuneration stipulated by the agreement, unless otherwise established by the agreement. Remuneration can be paid in the form of fixed one-time or periodic payments, percentage deductions from income (revenue) or in another form.

The gratuitous alienation of an exclusive right in relations between commercial organizations is not allowed, unless otherwise provided by the Civil Code of the Russian Federation ( Clause 3.1 of Article 1234 of the Civil Code of the Russian Federation ).

The exclusive right to the result of intellectual activity or a means of individualization passes from the copyright holder to the acquirer at the time of conclusion of the contract, unless otherwise provided by agreement of the parties. If the agreement is subject to state registration, the exclusive right passes at the moment of registration of the agreement (clause 4 of Article 1234 of the Civil Code of the Russian Federation).

Let us recall that under a license agreement , one party - the holder of the exclusive right to a result of intellectual activity or a means of individualization (licensor) grants or undertakes to provide the other party (licensee) with the right to use such a result or such means within the limits provided for by the agreement. According to it, the licensee undertakes to pay the licensor the remuneration stipulated by the contract, unless otherwise specified in the contract (clause 1 of Article 1235 of the Civil Code of the Russian Federation).

The transfer of the exclusive right to a result of intellectual activity or a means of individualization to another person without concluding an agreement with the copyright holder is permitted in cases and on the grounds established by law, including in the order of universal succession (inheritance, reorganization of a legal entity) and when foreclosure on the property of the copyright holder (Article 1241 of the Civil Code of the Russian Federation).

Below (in the table) is a list of intangible assets recognized as such for tax purposes in paragraph 3 of Art. 257 of the Tax Code of the Russian Federation, and references to the norms of the Civil Code of the Russian Federation governing the emergence and use of exclusive rights to these assets.

| Intangible asset | Norm clause 3 art. 257 Tax Code of the Russian Federation | Norm of the Civil Code of the Russian Federation |

| Exclusive right: – patent holder for an invention, industrial design, utility model | Subparagraph 1 | Articles 1345 – 1407 |

| – author and other copyright holder for the use of a computer program, database | Subclause 2 | Articles 1259, 1261, 1262, 1280, 1286, 1296, 1297 |

| – author or other copyright holder for the use of integrated circuit topology | Subclause 3 | Articles 1448 – 1464 |

| – for a trademark, service mark, appellation of origin of goods and company name | Subclause 4 | Articles 1473 – 1541 |

| – patent holder for breeding achievements | Subclause 5 | Articles 1408 – 1447 |

| – for audiovisual works | Subclause 7 | Article 1263 |

| Possession of know-how, secret formula or process, information regarding industrial, commercial or scientific experience | Subclause 6 | Articles 1465 – 1472 |

Income approach

The value of an asset in this approach depends on its ability to generate income and is defined as the net present value of income or the present value of costs that were avoided due to the use of the asset in question in the business.

That is, the basis for applying the approach is to determine the amount of income that can be received from intangible assets in the future.

There are four main methods used.

Added cash flow method

It is most popular when applying the income approach and consists of several stages. At the first stage, it is necessary to make a forecast of cash flows that will be created by the asset being valued. The second step is to check whether they are really created only by this asset. If there is influence from another asset, then it must be excluded. The third stage is clearing the predicted flows from tax payments. The last step is to discount the previously received amount for each year at a rate equal to the weighted average cost of capital of the enterprise.

The advantage of this method is that when used, it takes into account not only the positive, but also the negative effect of owning an intangible asset.

Its disadvantages include, first of all, its labor intensity: when making a forecast, the appraiser needs to keep in mind many factors that can affect future cash flows, so the process takes a lot of time. In addition, a forecast is always a subjective assessment. If the appraiser turns out to be insufficiently professional, the result may represent his opinion of the value of the asset rather than reflect the real state of affairs.

It should also be remembered that when isolating the cash flows generated by the asset being valued, the appraiser must make assumptions, since it is impossible to say for sure whether the income comes from the use of one asset or something else is mixed in. And such assumptions lead to a decrease in the reliability of the results.

Consequently, the more assumptions there are, the less you can rely on the figures obtained during forecasting.

Excess return method

The first of two methods that are used both in the income approach and in the comparative approach. Like the previous one, it is based on forecasting cash flows. The difference is that in this case, the cash flows generated by the company as a whole or some of its projects are forecast. After drawing up the forecast, you need to analyze which intangible assets (in addition to the one being assessed) are involved in generating income, and determine the rate of return for each of them.

Next is the cash flow that was created without the fate of the asset being valued, cleared of taxes and discounted. By subtracting the amount obtained at the last stage from the total cash flow, the appraiser will receive the value of the asset under study.

Like the added cash flow method, the main disadvantage is the forecasting assumptions, which can invalidate the results of the analysis if there are too many of them.

Intellectual Property Market Method

It is also known as the method of saving royalty payments and it was under this name that it was mentioned earlier, in the section on the market approach to the valuation of intangible assets. The basis of this method is the assumption that the asset being valued does not belong to the enterprise, but is at its disposal under a contract. The percentage of revenue determined by this document - royalty - is a payment for the provision of intangible assets for temporary use.

To find out the royalty rate, you need to divide the difference in profit by the entire revenue of the owner of the intangible asset. The amount that an enterprise that does not own the necessary assets is forced to pay for the right to use them is the additional profit created by these assets. The resulting cash flows are capitalized and the final figure is the market value of the asset.

Thus, to correctly value an asset using this method, you need to calculate how much you would have to pay for its use if it belonged to another legal entity.

Profit Advantage Method

Profit advantage refers to the difference between the profit received by an enterprise that owns an intangible asset and a representative of the same industry that produces similar products without using this asset. That is, the value of the intangible asset will be the amount of profit that the organization generated solely due to its presence.

In practice, calculations are made using the prices of identical products at two enterprises: with and without an asset on the balance sheet. The difference between these two numbers is multiplied by the volume of goods produced and is an additional profit, the appearance of which the enterprise owes to the intangible asset. The main difficulty in using this method is the correct choice of analog products. It should have as similar characteristics as possible. Another problem is constant price fluctuations. Because of this, at the beginning of the week there may be one difference, and at the end - another. And since the difference in prices is the basis for calculation, with its change the picture as a whole will change.

Determining the initial cost of intangible assets

Intangible assets purchased for a fee

The initial cost of depreciable intangible assets is determined as the sum of the costs of acquiring (creating) them and bringing them to a state in which they are suitable for use (for example, patent and other similar fees, payment for the services of a patent attorney, etc.). The cost of intangible assets does not take into account VAT and excise taxes (except for cases provided for by the Tax Code of the Russian Federation).

Expenses for the acquisition of intangible assets must be supported by documents: contracts, acts of transfer of exclusive rights, description of the intellectual property object, technical documentation, etc. An intangible asset registration card must be created for each object in the organization. You can use the unified form NMA-1[1]

The cost of intangible assets created by the organization itself is determined as the amount of actual expenses for their creation, production (including material expenses, labor costs, expenses for services of third-party organizations, patent fees associated with obtaining patents, certificates), excluding the amounts of taxes taken into account as part of expenses in accordance with the Tax Code of the Russian Federation.

According to Art. 333.30 of the Tax Code of the Russian Federation for carrying out actions for state registration of exclusive rights to computer programs, databases, topologies of integrated circuits, a state fee is charged, which, on the basis of clause 10 of Art. 13 of the Tax Code of the Russian Federation refers to federal taxes. Thus, when creating the specified objects of intellectual property, the organization does not include the paid state duty for registration in the initial cost of the intangible asset, but writes it off as current expenses. But the costs of paying the duty under the agreement for the alienation of exclusive rights are taken into account in the initial cost of the intangible asset, if the agreement stipulates that these costs are borne by the acquirer.

Intangible asset received free of charge

To begin with, let us recall that in accordance with para. 2 p. 1 art. 257 of the Tax Code of the Russian Federation, the initial cost of a fixed asset is defined as the amount of expenses for its acquisition, and if the fixed asset was received by the taxpayer free of charge, as the amount at which such property is valued in accordance with clause 8 of Art. 250 Tax Code of the Russian Federation. In other words, if the fixed asset was received free of charge, then its market value is reflected in non-operating income and at the same time forms its initial cost, on the basis of which depreciation is subsequently calculated.

There is no such provision for intangible assets. Therefore, if the intangible asset was received free of charge, then its value is reflected in non-operating income on the basis of clause 8 of Art. 250 of the Tax Code of the Russian Federation, but the initial cost for the purposes of calculating depreciation is not formed.

Let us note that this provision contains a reservation - with the exception of the cases specified in Art. 251 Tax Code of the Russian Federation. Subclause 51 of clause 1 of this article establishes that income in the form of exclusive rights to inventions, utility models, industrial designs, programs for electronic computers, databases, topologies of integrated circuits, is not taken into account when calculating the corporate income tax base. production secrets (know-how). In this case, the following conditions must be met: the intellectual property object must be created during the implementation of a government contract, and then transferred to the executor of this contract by its government customer under a gratuitous alienation agreement.

Thus, the property rights specified in paragraphs. 51 clause 1 art. 251 of the Tax Code of the Russian Federation, are not classified as depreciable property and, therefore, depreciation is not accrued on them. In the event of further exercise of such rights, the taxpayer will not be able to take into account expenses in the form of their value on the basis of clause 48.19 of Art. 270 of the Tax Code of the Russian Federation (see Letter of the Ministry of Finance of Russia dated 04/06/2015 No. 03-03-06/1/19204).

Comparative (market) approach

It is based on the assumption that the market values the asset fairly and it will not be bought or sold at a price it does not “deserve.”

That is, when determining the value, they proceed from information about transactions made with similar assets.

The difficulty in using this approach is that any intangible asset is unique. For example, the right to a computer program created by a company is sold. Since all programs are different (area of use, usefulness for business, ease of use), it is not easy to determine what exactly is considered an analogue.

Another problem is the fact that the transaction usually involves not only intangible, but also other assets of the enterprise. Therefore, it is necessary to “isolate” from the total cost the amount paid specifically for the asset under study.

Within the framework of the market approach, multipliers are used for this. The multiplier is the ratio of the transaction price to some characteristic of the asset (for example, profit from its use, customer value, transaction cycle). The resulting value is multiplied by the previously selected characteristic, and the result is the value of the asset, determined using the comparative approach.

Within this approach, there are 3 assessment methods.

Method of comparative analogues

To apply it, it is necessary to find information on the cost of intangible assets that can be considered analogues. The similarity of assets is assessed through their purpose and usefulness. Having received this information, you need to compare the value of the analogue asset with the one being assessed. The indicators by which the comparison will be made are determined in advance in order to look for only the necessary information.

The third stage in the method is adjusting the price of completed transactions, selected as analogue ones, using a correction factor. This coefficient is needed because there are no two absolutely identical assets and no two identical transactions for their sale. The adjustment factor takes into account how the factors listed below affect the value of the property.

- The country where the seller of the asset does business. Naturally, an intangible instrument created in the USA will cost more than a very similar one, but produced, for example, in Mongolia (or Russia).

- Industry sector and area of application of the asset. You cannot compare the right to publish a literary work with a patent for a mining machine.

- Completeness of rights transferred under the agreement. If the buyer gets absolutely everything, it is more expensive than if part of the rights remains with the author.

- Term for transfer of rights. A striking example is book publishing. A six-month contract always costs less than the right to print a manuscript for 3 years.

- The presence or absence of legal protection.

- The impact of the asset on the company's activities. If an organization can work without using the intangible asset that it plans to buy, then it will not pay much for it, preferring to do it on its own. If it is impossible to carry out activities without it, the seller can set any price: the buyer who wants to remain on the market will still purchase the product.

The main advantage of this method is that the calculation error is minimal, since they are based on real market transactions. Provided, of course, that the appraisers have access to the necessary information and it is correct. If for any reason the price fixed in the contracts differs from what was actually paid, the estimate will be incorrect and therefore useless.

Many economists believe that it is best to use the market approach in all situations. However, this comes with a number of problems already mentioned. Firstly, the uniqueness of assets does not always make it possible to find a close enough analogue to conduct a comparative analysis. Secondly, intangible assets are usually sold as part of an ongoing business rather than alone, so it is difficult to know exactly how much was paid for each asset.

Therefore, the use of this method is possible only in countries with developed economies where there is a market for intangible assets. In countries with an undeveloped economic system, there simply will not be the required number of transactions for the purchase and sale of intangible assets so that an assessment can be made on their basis.

The market approach uses two other methods: the royalty saving method and the excess return method. However, they will be covered in detail in the next paragraph, since they are borderline and are also used when determining the valuation of an asset using the income approach.

Intangible assets are not subject to exclusion from depreciable property

Chapter 25 of the Tax Code of the Russian Federation establishes a list of depreciable property that is not subject to depreciation, as well as a list of what is excluded from depreciable property.

The list of depreciable property that is not subject to depreciation is defined in clause 2 of Art. 256 Tax Code of the Russian Federation. The specified list includes acquired rights to the results of intellectual activity and other objects of intellectual property, if, under the agreement for the acquisition of these rights, payment must be made in periodic payments during the term of this agreement (clause 8, paragraph 2, article 256 of the Tax Code of the Russian Federation).

As for the list of depreciable property excluded from this property, it is enshrined in clause 3 of Art. 256 of the Tax Code of the Russian Federation and contains only OS under certain circumstances. In this regard, intangible assets are not subject to exclusion from depreciable property (see Letter of the Ministry of Finance of Russia dated August 12, 2019 No. 03-03-06/1/60597).

How to evaluate intangible assets - step-by-step instructions for beginners

So, your company is the owner of intellectual property, and for certain reasons you need to evaluate it. As a rule, in most cases, professional expertise is necessary, since the value obtained as a result of the research serves as the basis for putting it on the balance sheet, drawing up legal documents, and attracting investments.

The process and features of the assessment are clearly regulated by the legislation of the Russian Federation, and any appraisal company insures its liability in the prescribed manner. However, difficulties can arise even with professional experts, so the customer needs to know how the independent examination takes place.

Step 1. Select an appraisal company

Contact only reliable companies with a good reputation, since the examination of intangible assets is very complex and requires high professionalism.

We discussed in detail what an appraisal company should be like and what requirements are imposed on it in another article.

Step 2. Prepare the necessary information about the object of assessment

To conduct an assessment, you need to prove the right to use intangible assets. It is necessary to provide a patent, license, lease agreement, etc. A list of required documents can usually be found on the appraiser’s website or obtained during a personal visit to the office.

Step 3. Submit an application

At this stage, you need to clearly understand the goals of the assessment - the approach of the experts will depend on the specific tasks.

Example

To evaluate a trademark, you need to provide the expert with a certificate of its registration, financial statements, information on the costs of creating and registering the trademark, data on the profit received (and planned to be received) from its use.

Only with this information will the appraiser be able to determine the value of the intellectual property.

In the application, you need to set out the characteristics of the object as fully as possible, attach the collected package of documents - this will simplify cooperation and speed up the receipt of results.

Step 4. Conclude an agreement

The main part of the contract that regulates further interaction with the appraiser is the assessment assignment.

Before signing, you should carefully study the contract or submit it to competent lawyers for review.

Step 5. Pay for the service

Most appraisal companies have a pricing scale that varies depending on the complexity and labor intensity of the study.

For example, a commodity examination will cost the customer much less than an assessment of equipment, especially rare or custom-made equipment. The final cost of the appraiser’s work is determined upon conclusion of the contract and approval of the appraisal task.

Step 6. Agree on the action plan

The assessment process can be long, and it is important for the customer to know at every stage about the progress of the specialists’ work. The action plan establishes certain deadlines for the examination and allows us to agree on the dates of interim reports and results.

Step 7. Get the report

The assessment report is the result of the work of independent experts. It must be drawn up according to established rules, contain complete information about the object of assessment, the progress of the study and the results obtained, and the qualifications of the appraiser. The report must be certified by the signature of the specialist who compiled it.

If you are interested in how an independent assessment is done, we recommend checking out another article on this topic.

When interacting with appraisal companies, many customers encounter difficulties and disagreements. You should not leave such questions to chance; it is better to contact professional lawyers who have extensive experience in resolving conflicts.

Employees will provide advisory support and help in resolving any legal issues related to the valuation of intangible assets. “Pravoved” also offers its clients an extensive knowledge base where you can find answers to the most frequently asked questions and free online legal advice.

To contact a consultant of the Pravoved company, call by phone and communicate via interactive chat.

On our website there is an article on a similar topic: asset valuation.

The initial cost of intangible assets cannot be changed

The possibility of changing the initial cost of an intangible asset after the start of its depreciation Ch. 25 of the Tax Code of the Russian Federation is not provided for (see Letter of the Ministry of Finance of Russia dated 02/04/2016 No. 03-03-06/1/5716).

Therefore, if in the future the organization incurs costs associated with the intellectual property (updating, refining software, patent fees for renewing state registration of intangible assets), they will be written off as current expenses.

For example, the cost of paying remuneration to an employee who created an official invention, after the exclusive rights to this invention were included in depreciable property, are taken into account for profit tax purposes as part of labor costs (see Letter of the Ministry of Finance of Russia dated April 12, 2013 No. 03 -03-06/1/12207).

Or another example is the cost of updating a computer program, the exclusive right to use which belongs to the organization. These expenses can be taken into account for tax purposes as other expenses on the basis of paragraphs. 26 clause 1 art. 264 of the Tax Code of the Russian Federation (see letters of the Ministry of Finance of Russia dated November 6, 2012 No. 03-03-06/1/572, dated July 19, 2012 No. 03-03-06/1/346). The taxpayer has the right to independently determine the period during which these expenses are subject to equal accounting for tax purposes.

note

Chapter 25 of the Tax Code of the Russian Federation does not provide for the revaluation of the value of intangible assets to market value. Thus, for profit tax purposes, income (expenses) from revaluation (discount) of intangible assets are not taken into account (see letters of the Ministry of Finance of Russia dated October 24, 2019 No. 03-03-06/1/81777, dated February 4, 2016 No. 03-03-06 /1/5716, dated 06/03/2014 No. 03-03-06/4/26501).

IFRS, Dipifr

This is a continuation of the article on the valuation of intangible assets. If intangible assets were acquired separately or created internally (as a result of R&D), then such assets are measured at cost. In this case, the issue of assessing intangible assets comes down to determining which expenses can be included in the cost of an intangible asset and which are expenses of the period. The first part of the article, which concerns the assessment of intangible assets in business combination transactions, was published earlier.

Valuation of intangible assets acquired separately

Let us once again recall the criteria for recognition of an intangible asset prescribed in IFRS 38.

- (a) it is probable that the entity will receive expected future economic benefits from the asset;

- (b) the cost of the asset can be measured reliably.

If a company buys an intangible asset (for example, a license), it does so because it expects to receive economic benefits from it in the future. Therefore, the first criterion for recognizing an intangible asset is automatically considered fulfilled. The cost of an asset at purchase can also be reliably estimated. The purchase price in one way or another reflects the magnitude of the expected economic benefits. This is especially true where the purchase consideration is in the form of cash.

Example 2: Customer Lists – Acquired and Internally Generated

On January 1, 2014, the Gamma company acquired the client list of another company for RUB 200,000. Gamma may sell this acquired customer list to third parties. Gamma's management believes that in 2014, additional costs of RUB 30,000 (salaries of responsible employees) were incurred to maintain and develop this acquired list of clients. In addition, Gamma has built up its list of loyal customers over the years of its activity.

How should two lists of customers be reported in the financial statements?

Solution

1) A company cannot recognize an intangible asset in relation to an internally generated customer list because IAS 38 expressly prohibits the recognition of internally generated intangible assets. The costs of building such a list of clients cannot be distinguished from the costs of developing the business as a whole.

2) The acquired customer list meets the definition of an intangible asset because it is separable (it can be sold to a third party). This intangible asset should be initially recognized in the amount of ₽ 200,000.

3) However, the additional ₽30,000 incurred to maintain and develop the acquired customer list should be recognized as an expense in determining profit or loss for the year. Subsequent costs for customer lists (whether obtained externally or generated internally) are always recognized in profit or loss. This is because such expenses cannot be distinguished from business development expenses in general and, therefore, do not meet the recognition criteria.

Paragraph 20, IAS 38 The nature of intangible assets is such that, in many cases, improvements or partial replacement of such assets will not occur. Accordingly, most subsequent costs are likely to provide the expected future economic benefits embodied in the existing intangible asset, but will not satisfy the definition of an intangible asset and the recognition criteria in this Standard. In addition, it is often difficult to attribute subsequent costs directly to a specific intangible asset rather than to the business as a whole.

Thus, only rarely are subsequent costs—costs incurred after the initial recognition of an acquired intangible asset or the completion of self-creation of an intangible asset—recognized as part of the asset's carrying amount. All subsequent costs for trademarks, title data, publishing rights, customer lists and similar items (whether acquired or self-generated) are always recognized in profit or loss as incurred. This is due to the fact that such costs cannot be distinguished from the costs of business development as a whole.

In this example, the value of the acquired intangible asset is equal to its purchase price. But in addition to the purchase price and the cost of purchased intangible assets, direct costs related to preparing the asset for use are included.

clause 27, IFRS 38 The cost of intangible assets upon acquisition is equal to:

purchase price + import duties + non-refundable taxes - trade discounts - refundable taxes + DIRECT costs of preparing the asset for use.

clause 28, IFRS 38 Examples of direct costs that are included in the cost of an intangible asset:

- (a) employee benefit costs that are directly related to bringing the asset into working condition;

- (b) professional costs directly related to bringing the asset into working order; And

- (c) the cost of verifying that the asset is operating properly.

EXAMPLE 3: Purchasing software for production equipment

On January 1, 2011, the company purchased a software package for manufacturing equipment for the amount of ₽600,000, including refundable purchase taxes of ₽50,000. The purchase was financed with a loan of RUB 600,000 at 10% per annum. The loan is secured by the purchased software license.

In January 2011, the company incurred costs to customize the software to make it more suitable for the equipment used by the company: • Salaries of employees involved in customizing the software - ₽ 70,000 • Depreciation of fixed assets used for customization - ₽ 15,000

In January 2011, the company's production staff completed a training course in using the new software. The cost of an external expert instructor was RUB 17,000.

In February 2011, the company's production team reviewed the software and the information technology team made some changes necessary for the software to function properly. During the testing phase, the following costs were incurred: • Materials - ₽ 21,000 • Salaries of production team employees - ₽ 31,000 • Depreciation of fixed assets when they were used for modification - ₽ 5,000 In addition, as a result of the sale of goods received during the testing phase, the company gained ₽ 3,000.

The new software was ready for use on March 1, 2011. However, due to low initial orders, the company incurred a loss of ₽23,000 on the software during March.

What is the cost of intangible assets (software) upon initial recognition?

Solution

Reimbursable taxes must be subtracted from the purchase price. A purchase loan is a financial liability; interest on it will be written off as expenses for the period. But since the asset was prepared for its intended use within two months, interest on the loan for January-February is included in the initial cost of the asset (IFRS 23): RUB 600,000 x 10% x 2/12 = RUB 10,000.

Software setup and testing are direct costs related to preparing the asset for its intended use and are therefore included in the cost of the asset. Employee training is written off as period costs, since it is not directly related to preparing the asset for use (this is personnel training).

| Description | Sum | A comment |

| Purchase price | 550,000 | Purchase price less refundable purchase taxes |

| Setup costs | 85,000 | Salary 120,000 and depreciation 15,000 |

| Testing costs | 57,000 | Materials 21,000, salary 31,000, depreciation 5,000 |

| Training costs | 0 | Period costs |

| Product at testing stage | 0 | Income of the period |

| Loan interest | 10,000 | According to IFRS 23 |

| Total | 702,000 |

The initial loss of ₽ 23,000 is written off to the income statement. Software as an intangible asset will be amortized from March 1, 2011. Until March 1, all costs for preparing, setting up and testing intangible assets will be collected as part of a separate asset (in Russian accounting on account 08).

Clause 29, IFRS 38 Examples of costs not included in the cost of an intangible asset are:

- (a) costs associated with the introduction of new products or services (including costs of advertising and promotional activities);

- (b) costs associated with conducting business in a new location or with a new category of clients (including costs of personnel training); And

- (c) administrative and other general overhead costs.

- (d) costs incurred while an asset capable of being used as intended by management has not yet been brought into service; And

- (e) initial operating losses, for example, those incurred during the period when demand for the results produced by the asset was generated.

EXAMPLE 4. Valuation of intangible assets acquired partially in exchange for another asset

On January 1, 2015, the company received landing rights at the local airport in exchange for 9,000 liters of aviation fuel and RUB 100,000 in cash. Aviation fuel costs ₽50 per liter.

Landing rights received (an intangible asset acquired in an exchange transaction) should be measured at RUB 550,000 (their fair value) on initial recognition. The fair value of landing rights is determined based on the fair value of aviation fuel RUB 450,000 (ie 9,000 liters × RUB 50 per liter) plus cash of RUB 100,000.

EXAMPLE 5. Exchange of intangible assets

Alpha and Beta companies produce chemicals in different countries (jurisdictions). On January 1, 2015, Alpha and Beta expanded their product lines and granted each other the right to manufacture each other's patented products in their respective home jurisdictions. The fair value of both the asset received and the asset given up cannot be measured reliably. The carrying amount of the patented rights granted by Alpha and Beta was RUB 10,000 and RUB 20,000, respectively.

The resulting trademarks (intangible assets acquired in an exchange transaction) must be measured at initial recognition at ₽10,000 and ₽20,000 respectively by Alpha and Beta (ie they are measured at the carrying amount of the asset transferred in the exchange transaction).

Valuation of an intangible asset when it is created within the company

To assess whether an independently created intangible asset meets the recognition criteria, an enterprise divides the process of creating the asset into two stages:

- (a) stage of research;

- (b) development stage.

Expenses incurred during the research stage are written off as period expenses. IFRS 38 allows expenses at the development stage to be capitalized on the balance sheet as an asset. This asset is not depreciated because it is not yet ready for use (08 account). If a company cannot separate the research stage from the development stage, then all costs are written off to the income statement.

The research stage includes research conducted with the prospect of obtaining new scientific or technical knowledge: new materials, devices, products, processes, services, etc. The development phase involves the application of research results to produce new or significantly improved materials, devices, products, processes, systems or services before commercial production or use. This stage includes the design, manufacture and testing of prototypes, pilot plants, prototypes, etc.

Capitalization of costs is limited to the fulfillment of six conditions, i.e. This is the exception rather than the rule. The Dipifr exam always indicates whether these conditions are met or not. But in real life, reading accounting documents, determining the moment when the development stage began is not so easy. For a correct interpretation, it is necessary to talk with the company’s engineering specialists who know the details of the projects. It happens that in Russian accounting some expenses are capitalized and then written off because the project brought a negative result. When transforming from RAS to IFRS, such costs should not be capitalized initially. Perhaps a good indicator of the transition of a project to the development stage is the fact that a prototype of a future product has been manufactured based on new materials, formulas, etc.

Not only is the capitalization of R&D costs tightly constrained, but the amount of capitalized costs must be tested for impairment at each reporting date. Any excess of the cost of such an asset over its recoverable amount must be written off as an impairment loss in profit or loss.

Note to Dipifr students - such a combined task according to the standards of IFRS 38 “Intangible Assets” and IFRS 36 “Impairment of Assets” may well appear on the exam.

Example 6. Valuation of intangible assets obtained as a result of an R&D project

In 2015, a detergent manufacturer spent the following amounts during a project to find a new chemical formula that would allow the company to gain a competitive advantage by improving the performance of its products.

• ₽ 200,000 - experiments with chemicals to discover improved cleaning compounds • ₽ 30,000 - evaluation of the suitability of various compounds - safety for people • ₽ 15,000 - payment for registering a patent for the most effective chemical compound • ₽ 73,000 - development and testing of experimental prototypes after September 1 • ₽ 20,000 – advertising a new product

On 1 September 2015, the company was able to demonstrate the commercial viability and technical feasibility of the project (paragraph 57 of IAS 38). Cost savings from the new manufacturing process are expected to be at least ₽50,000 annually for a minimum of 5 years after production of the improved formula product begins.

What is the cost of the intangible upon initial recognition?

The following amounts will be recognized as a development asset after 1 September 2015:

| Description | Sum | A comment |

| Patent | 15,000 | Payment for patent registration |

| Testing | 73,000 | Expenses after September 1, 2015 |

| Total | 88,000 |

The following will be written off to the company's profit/loss for the year ended December 31, 2015:

₽ 200,000 + 30,000 = 230,000 - expenses for research work ₽ 20,000 - for advertising a new product.

Total expenses ₽ 250,000

At the reporting date, an entity must test for impairment a recognized asset that is not yet available for use. If the recognized amount of an asset exceeds its recoverable amount, an impairment loss must be recognized. In this case, there is no impairment loss, since even the undiscounted flows from cost savings (₽50,000 x 5 years = ₽250,000) exceed the cost capitalized on the balance sheet (₽88,000).

Conditions for recognition of intangible assets at the development stage:

Clause 57, IFRS 38 Intangible assets created within a company can only be recognized at the moment when the company can demonstrate:

- (1) The technical feasibility of completing the creation of the intangible asset so that it can be used or sold.

- (2) Intent to complete the creation of the intangible asset and use or sell it.

- (3) Ability to use or sell intangible assets.

- (4) How the intangible asset will create probable future economic benefits. Among other things, the company may demonstrate that there is a market for the product of the intangible asset, or the intangible asset itself, or, if the asset is intended to be used internally, may demonstrate the utility of the intangible asset.

- (5) Availability of sufficient technical, financial and other resources to complete the development, use or sale of intangible assets.

- (6) The ability to reliably estimate the costs associated with an intangible asset during its development.

I hope these simple examples will help you understand the theory set out in international standards, which is quite boring to read without examples.

Other articles:

Intangible assets: what they include in accounting, examples, accounting according to IFRS 38

IFRS 36 Impairment of Assets in Plain English (Part 1)

IFRS IFRS 15: examples of accounting for contract modifications

EPS indicator - calculation formula. Basic earnings per share

Go back to main page

Write-off of intangible assets before the end of the SPI

According to paragraphs. 3 p. 2 art. 253 of the Tax Code of the Russian Federation, expenses associated with production and (or) sales include, among other things, the amounts of accrued depreciation.

As noted in the Letter of the Ministry of Finance of Russia dated August 12, 2019 No. 03-03-06/1/60597, expenses for writing off intangible assets, including the amount of depreciation underaccrued in accordance with the established useful life, can be taken into account as part of non-operating expenses on the basis of paragraph . 8 clause 1 art. 265 Tax Code of the Russian Federation.

Where to evaluate intangible assets - review of TOP-3 valuation companies

Valuation of intellectual property and other intangible assets is a rather complex procedure, requiring the highest qualifications and deep knowledge from the expert. To avoid problems with the quality of the examination, the business owner needs to carefully select an appraisal company.

Even in a small city you can find dozens of companies offering independent examination of trademarks, patents and other intangible assets. To avoid wasting money and time, contact only experts with an impeccable business reputation.

We recommend paying attention to 3 large appraisal companies that specialize in the examination of intangible assets.

1) KSK groups

The company has been in the appraisal business for more than 20 years, with a staff of 30 specialists. The company conducts examination of intangible assets of any kind (know-how, goodwill, copyright, research, etc.). There is an assessment of shares (read a separate article on this topic) and more traditional objects - fixed assets, real estate. All company employees are specialists with extensive practical experience. Their professional liability is insured.

2) Atlant Score

One of the largest companies in the industry, operating since 2001.

An examination of any complexity and focus is carried out, including a professional assessment of investment projects (we recommend that you read our article on this topic), examination of contracts, copyrights, assessment of banks, securities, etc.

3) Progress Assessment

A company that specializes in real estate, securities and business valuation. Experts have extensive experience and high qualifications, allowing them to carry out the most complex and time-consuming types of work, including assessing the value of intangible assets.

When choosing an appraisal company, pay attention not only to the cost of services, but also to other important factors: duration of work, portfolio of completed projects, positive reviews, participation in professional communities, place in various ratings.

By choosing a reputable company, you will protect yourself from unnecessary expenses, and the report will be prepared on time. Such a report will not require adjustments and will most likely be accepted by banks, notaries and investment companies.

Read about what features a notary assessment has in a separate article on our website.

Implementation of intangible assets

When selling an object of intellectual property under an agreement on the alienation of exclusive rights, proceeds from the sale are recognized on the date of transfer of the exclusive right from the copyright holder to the acquirer, regardless of the fact of payment. Consequently, if an agreement on the alienation of an exclusive right is subject to state registration, then income from the sale is taken into account for tax purposes on the date of such registration, if not subject - at the time of conclusion of the agreement (unless the parties agree otherwise) (clause 3 of article 271, p. 1 article 39 of the Tax Code of the Russian Federation, paragraph 4 of article 1234 of the Civil Code of the Russian Federation).

The financial result will be determined in tax accounting in accordance with paragraph 1 of Art. 268 Tax Code of the Russian Federation. This norm provides that the taxpayer has the right to reduce income from the sale of depreciable property by its residual value, determined under clause 1 of Art. 257 of the Tax Code of the Russian Federation, as well as the amount of expenses directly related to such implementation (for example, the amount of the fee for state registration of the agreement, if the costs of paying it in accordance with the agreement are borne by the copyright holder). If, as a result of such a reduction in tax accounting, a loss is formed, it is reflected as part of other expenses in equal parts over a period of time calculated as the difference between the useful life of the intangible asset and the period of its actual use (Clause 3 of Article 268, Article 323 of the Tax Code of the Russian Federation) .

[1] Approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

How should the property be initially assessed?

The valuation of an intangible asset is the procedure for determining its value in monetary terms.

It is always carried out according to a regulated method, the choice of which depends on the situation.

The need to carry it out at an enterprise usually arises if it is necessary to solve a specific problem caused by the use of property rights that exist in relation to intellectual property objects or, alternatively, means of individualization.

Estimation of the value of an intangible asset is usually performed in the following typical situations:

- acquisition/creation of a business;

- liquidation of an enterprise (termination of activities);

- obtaining a bank loan on the terms of providing intangible assets as collateral;

- purchase/sale;

- execution of a license agreement;

- assignment of a fee for use (royalty payment);

- other tasks.

Methods

If the useful life of an asset exceeds 12 (twelve) months, the cost of such an object, current when it is entered into the organization’s economic balance sheet, is usually assessed using one of the following three methods:

- comparative (market) method;

- profitable way;

- expensive way.

Comparative (market) method

The essence of this approach is to determine the value of an intangible asset based on market prices of similar assets that have comparable utility.

This method is advisable to use for intangible assets, which are often objects of purchase/sale.

The prices of such transactions are used as input data. A sufficient number of market analogies taken into account in the assessment minimizes the possible error.

Income approach

This method is based on the organization's determination of future (expected) economic benefits brought by the useful operation of the asset being valued. We are talking about establishing the fair value of an object.

This valuation method is usually used when selling or otherwise disposing of property.

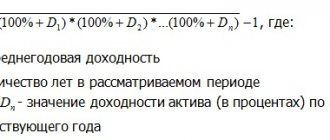

Within the income approach, the value of an asset is calculated using one of two calculation methods:

- discounting expected income (bringing their value to the current point in time);

- direct capitalization of projected income.

Expensive

If you follow this approach, cost is defined as the totality of documented expenses incurred by the organization in creating (developing), acquiring (purchasing) or otherwise obtaining the asset being valued.

Reflection of an intangible asset in accounting at its primary cost is carried out using the costly method of valuation.

The composition of the necessary costs when determining the primary value of an asset depends on the method of its receipt on the balance sheet of the enterprise-right holder (acquisition, creation, exchange, gratuitous receipt).

Order and features

The starting point when performing a valuation is its correct classification.

Evaluation procedures are carried out in accordance with methodological recommendations specially developed by authorized government bodies.

To reliably determine the value of an asset, a description of the corresponding object, title documents for intangible assets, and justification for its service life will be required.

Independent (external) specialists may be involved in performing the necessary procedures.