If your company hires a third-party company to transport inventory, then the relationship between the parties is regulated by the Law of November 8, 2007 No. 259-FZ “Charter of Road Transport and Urban Ground Electric Transport”. You must draw up a contract of carriage. The consignment note is considered confirmation of its conclusion.

(hereinafter referred to as TN). Its form is established by the Rules for the transportation of goods by road, which were approved by Decree of the Government of the Russian Federation of April 15, 2011 No. 272 (hereinafter referred to as the Rules). TN is a mandatory primary document (Article 3, paragraph 2 of Article 9 of the Law of November 21, 1996 No. 129-FZ “On Accounting”). It is necessary to confirm the company’s expenses for profit tax purposes (clause 1 of article 252, article 313 of the Tax Code of the Russian Federation).

The Ministry of Finance of Russia (letters dated December 22, 2011 No. 03-03-10/123, dated November 11, 2011 No. 03-03-06/1/746, etc.) believes that one TN is not enough to confirm transportation services . Officials insist that in addition to the TN, it is necessary to issue a consignment note

(hereinafter referred to as TTN) according to the unified form No. 1-T.

To be honest, this position is surprising. After all, long before the introduction of the Rules, a stable arbitration practice had developed in favor of taxpayers who did not use Form No. 1-T (for example, the decision of the Eleventh Arbitration Court of Appeal dated April 14, 2011 in case No. A55-15139/2010). The fact is that the Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78, which approved the TTN, was not registered with the Ministry of Justice of Russia, and therefore is not a normative legal act. Therefore, it cannot be referred to when resolving disputes and fined for non-application (clause 10 of Decree of the President of the Russian Federation of May 23, 1996 No. 763).

Changes

The form of the waybill will change in the near future. And you don’t have to certify it with seals. These innovations were prepared by Decree of the Government of the Russian Federation of December 30, 2011 No. 1208. However, it has not yet been officially published.

The company must approve the company's document flow, including road transportation, as part of its accounting policy. But before you decide which documents to use to formalize the transportation, you should understand the nuances of this business operation.

Cargo is transported, not goods

Let's say your company sells goods by shipping them to the buyer using a third-party carrier. In this situation, she acts as the consignor, and the buyer acts as the consignee. However, the carrier is presented with packaged (boxed) and marked cargo (clause 30 of the Rules), and not specific goods listed on the seller’s balance sheet. The transfer of goods from the seller to the buyer is confirmed by the consignment note, in most cases drawn up according to the unified form No. TORG-12. The carrier signs it, so for profit tax purposes it has nothing to do with goods. transport services for cargo transportation

Obviously, the TN itself does not prove the transportation of goods. The accountant’s task is to convince controllers to link the transport and delivery notes with each other. And this is not difficult to do.

For information

The bill of lading provides for the indication of the shipping name of the cargo. It is defined in a very general way - based on the reference book “Unified Tariff and Statistical Nomenclature of Cargo” (UTSNG), without indicating the specific characteristics of the goods that are significant in the purchase and sale transaction.

The waybill contains clause 4 “Accompanying documents for the cargo,” which contains a separate line for the list of documents attached to the cargo, including shipping documents. In it it is enough to indicate the details of TORG-12, and in TORG-12 itself - the name of the carrier and the details of the TN. This confirms the connection between the transportation of cargo and the movement of goods. And the waybill with the consignment note attached to it will be an analogue of the consignment note in form No. 1-T. True, Moscow tax authorities object to the use of non-unified forms (letter from the Federal Tax Service for Moscow dated June 16, 2011 No. 16-15 / [email protected] ). But it is unlikely that this point of view will be supported by the court (resolution of the Federal Antimonopoly Service of the Moscow District dated September 13, 2011 in case No. A40-114362/10-4-649).

Why is the act needed, its meaning

Some employees of organizations do not pay due attention to this document, and yet its importance is extremely great. The fact is that the contract for the provision of transport services in itself is like a preliminary agreement, but the act confirms it and indicates that all its conditions have been fulfilled in full and on time. If the customer and the contractor have signed the act, this means that they do not have any claims against each other.

The act refers to primary accounting documentation, that is, with its help, specialists from the accounting department keep records of expenses incurred to provide this service.

In the future, if suddenly any disagreements or conflicts arise between the parties to the agreement, and the matter comes to court or the prosecutor’s office, this document can become evidence on both sides. Therefore, the drafting of the act should be treated with the utmost care, without neglecting the slightest details in its content.

The tax benefit must be justified

Ensuring that the VAT claimed by the carrier is deducted and that freight charges are recognized in income tax expenses is one of the important tasks of an accountant. What standards should we rely on?

From the point of view of tax legislation, cargo transportation is a service (Clause 5, Article 38 of the Tax Code of the Russian Federation).

An invoice can be issued by the carrier subject to the provision of services (clause 3 of Article 168 of the Tax Code of the Russian Federation). And sales imply the provision of services by one person to another person (Clause 1, Article 39 of the Tax Code of the Russian Federation). The deduction is applied only if there are primary documents on the purchase of services (clause 1 of Article 172 of the Tax Code of the Russian Federation).

For profit tax purposes, transport services for the transportation of goods within the organization, as well as for the delivery of finished products (including goods) in accordance with the terms of contracts are classified as material expenses (subclause 6, clause 1, article 254 of the Tax Code of the Russian Federation). The date of such expenses is the date of signing by the taxpayer of the service acceptance and transfer certificate (clause 2 of Article 72 of the Tax Code of the Russian Federation).

As you can see, tax legislation requires confirmation of the provision of services. Only under this condition will the tax benefit from transportation costs be justified. This position corresponds to the definition enshrined in Law No. 259-FZ, according to which the carrier assumes, under a contract for the carriage of goods, the obligation to transport the cargo entrusted by the shipper to the destination and deliver the goods to the person authorized to receive it. This means that the service cannot be considered provided without presenting the goods to the consignee.

At the same time, the Ministry of Finance of Russia in letter dated April 30, 2004 No. 04-02-05/1/33 explains: for the recognition of expenses under civil contracts, the act of services rendered is a mandatory supporting document only if its preparation is mandatory in in accordance with civil law or a concluded contract. But in the case of a contract of carriage, the law does not provide for the drawing up of an act. The delivery of the cargo, that is, the provision of the service, is confirmed by the consignee’s signature on the consignment note. This event will also determine the date the carrier issues an invoice.

The consignor who paid for the transportation remains to take care of receiving a copy of the waybill with the signature of the consignee. There is no need to draw up a new, additional document, that is, an act between the shipper and the carrier.

General procedure for recognizing expenses

As is known, expenses are recognized as justified and documented expenses (Article 252 of the Tax Code of the Russian Federation). Documented costs mean costs that are confirmed by:

- documents drawn up in accordance with the legislation of the Russian Federation;

- or documents drawn up in accordance with business customs applied in the foreign country in whose territory the relevant expenses were incurred;

- and (or) documents indirectly confirming expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

The fourth copy of the waybill

Before the introduction of TN, there was little point in opposing the use of TN. Registration of the TTN, although not considered mandatory, was classified as a business custom (Article 5 of the Civil Code of the Russian Federation). The consignment note was drawn up in four copies, of which the copy with the signature of the consignee was returned to the consignor. This procedure removed the issue of confirming the provision of services by the carrier from the agenda. The appearance of the consignment note raised doubts about the need to preserve the consignment note.

Meanwhile, the Rules establish that the waybill, unless otherwise provided by the contract for the carriage of goods, is drawn up in three copies (originals) - respectively for the shipper, consignee and carrier. In general, the shipper will only have a copy signed by the carrier. It confirms the conclusion of the contract of carriage (clause 20, article 2, clause 1, article 8 of Law No. 259-FZ). And the Rules do not provide for the obligation to return a copy signed by the consignee to the consignor.

Apparently, this feature of the Rules has become a “bone of contention” in the tax sphere. Meanwhile, to restore agreement with the tax authorities, it is enough for the contract of carriage to establish the drawing up of a bill of lading in four copies and oblige the carrier to return to the consignor the fourth copy of the consignment note, signed by the consignee. Such a condition cannot be considered burdensome for the carrier, since no one has removed the obligation to issue an invoice upon the provision of services.

It is important

A set of transportation documents for a consignment of transported cargo consists of a document confirming the fact of transfer of material assets for transportation, and a document confirming the fact of transporting the cargo to its destination. Consequently, documents confirming the taxpayer’s expenses for the purchase of transport services are certificates of work performed (resolution of the Nineteenth Arbitration Court of Appeal dated October 18, 2011 in case No. A14-12511/2010413/28).

And now let’s take a closer look at one of the letters of the Russian Ministry of Finance, published on a topic that worries us - dated November 25, 2011 No. 03-03-06/ 1/780. One can argue with the statement contained in it about the mandatory use of form No. 1-T. But one cannot but agree that document flow based on the TTN provides documentation of the fact of provision of services for the transportation of goods. Really:

1)

a copy of the consignment note is presented to the shipper (customer) after the actual transportation of goods by the carrier and serves as the basis for payment for transport services provided;

2)

the purpose of TN differs from the purpose of form No. 1-T.

However, the document flow proposed by the ministry is redundant and has no regulatory basis. Nothing prohibits the customer from expanding the purpose of the transport vehicle by securing its “tax” interests in the transportation agreement. If the fourth copy of the TN with the signature of the consignee is returned to the consignor (customer), then the need for the TN disappears. The consignment note serves as the transport section of the consignment note. Of course. provided that the TORG-12 form is indicated as a shipping document in the TN, and the latter contains the details of the TN.

As a result, we have to admit: preventing disputes with tax authorities and optimizing document flow can and should be taken care of in advance, at the stage of concluding a transportation contract.

At what point is the act signed?

The act must be signed strictly after drawing up and signing the contract and performing the services. If the procedure in this regard is violated, then in the event of inspections by supervisory authorities, this may subject the organization to serious administrative punishment.

In this case, a fine can be imposed both on the enterprise itself and on officials. Exceptions are those situations when the service is performed at the same moment when the transaction is concluded - if the act of providing services is signed at the same time, this will not be considered a violation.

After the act is signed, the customer of the work makes payment for the services (full or, if there was an advance payment, final).

Re-presentation of transport services. Documenting

The organization is engaged in wholesale trade (general taxation system). When delivering goods, we present transport services to the buyer in one invoice and one waybill form TORG-12 on a separate line. We do not issue a certificate of completed work. At the same time, we re-provide transport services to the buyer, since we do not have our own transport, we have an agreement with the supplier for the provision of transport services.

Is it necessary to issue the buyer a certificate of completion of work for transport services or is it enough to indicate them in the TORG-12 invoice form along with the goods?

In No. 29 "A-E"

We wrote in detail about accounting for supplier transportation costs.

Let us recall the main points concerning your situation.

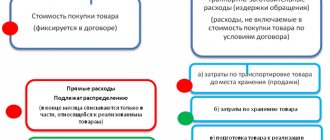

If the cost of shipping the goods to the buyer is not included

in the selling price of the goods, then, as a rule, the terms of the supply agreement provide for the buyer’s obligation

to reimburse the supplier’s costs

for delivery of the goods.

If the supplier does not deliver the goods on its own

, but attracts third-party transport organizations, then in this case transportation services are provided

not by the supplier

, but by the transport organization.

Therefore, the supplier has no right

draw up

documents for the provision of transportation services and invoices on your behalf

According to Art. 168 Tax Code of the Russian Federation

When selling services, the taxpayer is obliged to present the appropriate amount of VAT for payment to the buyer of these services.

An invoice is a document that serves as the basis for the buyer to accept the VAT amounts presented by the seller of services for deduction.

Thus, since the supplier of goods is not the direct seller

transport services, he cannot issue an invoice to the buyer on his own behalf.

Accordingly, the buyer cannot claim VAT on such an invoice.

In this situation, it is necessary to conclude an intermediary agreement, according to which the supplier organizes the delivery of goods on its own behalf, but at the expense of the buyer.

Moreover, it is not at all necessary to conclude two separate contracts: supply and intermediary (for example, agency).

The supply agreement may provide that the supplier undertakes on his own behalf, but at the expense of the buyer

organize delivery of the goods sold.

In this case, there will be a mixed contract with elements of delivery and agency.

The agency agreement is initially recognized as compensated

.

Therefore, the contract must indicate the amount of remuneration

, which the buyer (principal) will pay to the supplier (agent) for organizing the delivery of the goods.

Subject to the above conditions, the procedure for issuing invoices will be as follows.

stores the invoice received from the transport company

in the log of received invoices (clause 3 of the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 No. 914).

The supplier (agent) issues an invoice to the buyer (principal) on its own behalf

reflecting the indicators from the invoice issued by the transport company to the supplier (clause 5 of the letter of the Ministry of Taxes of the Russian Federation dated May 21, 2001 No. VG-6-03/404 “On the use of invoices when calculating value added tax”).

does not record this invoice in the sales book.

, as well as the invoice received from the transport company, the supplier (agent) does not register in the purchase book.

The buyer (principal), purchasing services for the transportation of goods under a mixed agreement, registers in the purchase book

an invoice issued to him by the supplier (agent), reflecting the indicators of the invoice issued to the supplier (agent) by the transport company.

At the same time, in this invoice, line 1 “Sequence number and date of issue of the invoice” indicates the date of issue of the invoice to the supplier (agent) by the transport company

.

This procedure is recommended by the Ministry of Finance of the Russian Federation in letter dated February 22, 2008 No. 03-07-14/08.

an invoice to the buyer (principal)

.

This invoice is recorded in the prescribed manner in the sales ledger.

supplier and in the journal of issued invoices.

The buyer (principal) registers the invoice received from the supplier (agent) for the amount of remuneration in the purchase book and the journal of received invoices (clause 3 of the letter of the Ministry of Taxes of the Russian Federation dated May 21, 2001 No. VG-6-03/404).

The supplier (agent) will have to pay VAT to the budget on the remuneration amount ( Article 156 of the Tax Code of the Russian Federation

).

From the amount of compensation

does not pay

VAT for transport costs (excluding remuneration) .

Expenses for payment for transport company services are recognized as expenses of the buyer

.

Expenses are recognized as justified and documented expenses incurred (incurred) by the taxpayer, provided that they were incurred to carry out activities aimed at generating income ( clause 1 of Article 252 of the Tax Code of the Russian Federation

).

The Ministry of Finance of the Russian Federation in a letter dated February 27, 2007 No. 03-03-06/1/135 noted that if the buyer does not have primary documents

, confirming the costs of payment for services for transporting goods,

there are no

.

Therefore, the supplier must provide the buyer with all primary

documents confirming transportation costs incurred.

A consignment note in form No. TORG-12 is used to formalize the sale (release) of inventory items to a third-party organization.

Drawed up in two copies. The first copy remains with the organization handing over the inventory items and is the basis for their write-off. The second copy is transferred to a third party and is the basis for the recording of these valuables.

That is, this unified form does not serve as a document

, confirming the provision of transport services.

To record the movement of inventory items and payments for their transportation by road, a consignment note is used (unified form No. 1-T, approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78).

At the same time, the second section of the TTN - transport - determines the relationship of shippers of motor transport customers with organizations - owners of motor vehicles that carried out the transportation of goods, and serves to account for transport work and settlements of shippers or consignees

with organizations that own vehicles for the services provided to them for the transportation of goods.

The organization that owns the vehicle attaches the third copy of the TTN, which serves as the basis for calculations, to the invoice for transportation and sends it to the payer, the customer of the vehicle.

The Ministry of Finance of the Russian Federation, in letter No. 03-03-06/1/333 dated May 26, 2008, categorically states that the costs of transport services of third-party organizations for the delivery of goods can be taken into account by the taxpayer as part of material expenses that reduce the tax base for income tax, only if you have a completed bill of lading

according to approved form No. 1-T.

To substantiate their position, officials refer to clause 6 of the Instruction of the Ministry of Finance of the USSR, the State Bank of the USSR, the Central Statistical Office under the Council of Ministers of the USSR, the Ministry of Road Transport of the RSFSR dated November 30, 1983 No. 10/998 “On the procedure for payment for the transportation of goods by road” , according to which the consignment note is the only document used for writing off inventory from shippers and posting them to consignees, as well as for warehouse, operational and accounting.

At the same time, officials do not consider acts on the provision of transport services (without TTN) as supporting documents.

However, the judges think differently.

FAS Volga District in its resolution dated February 28, 2008 No. A55-8614/2007, citing the norm of Art. 252 Tax Code of the Russian Federation

that documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, noted that the legislator

does not provide a list of documents required to be submitted to the tax authority

, but makes confirmation of expenses dependent on an assessment of economic feasibility and documentary evidence of expenses incurred.

If the taxpayer has acts

on the performance of services and documents confirming payment for services rendered, the absence of a contract of carriage and invoices cannot indicate economic unprofitability and undocumented expenses.

The Federal Antimonopoly Service of the Central District, in its resolution dated February 13, 2008 No. A35-1763/07-C21, referred to Art. 75 of the Arbitration Procedural Code of the Russian Federation

, according to which written evidence is containing information about circumstances relevant to the case, contracts, acts, certificates, business correspondence, and other documents made in the form of a digital, graphic record or in another way that allows one to establish the authenticity of the document.

In this regard, the court believes, the absence of invoices

in the presence of other documents,

is not

the only admissible evidence indicating the non-conclusion of a contract of carriage and the incurrence of expenses for its execution.

The fact of costs and their content can be confirmed by contracts, payment orders, acts, that is, documents indicating the actual provision and acceptance of services, confirming the connection of costs with the receipt of services.

According to the judges, if, in support of the expenses incurred for the transportation of goods, the taxpayer presents acceptance certificates for the work performed, as well as attachments to them, invoices in the TORG-12 form, invoices, then these documents indicate the actual completion of the concluded transactions and confirm receipt taxpayer's services of carriers, as well as connection with the type of activity carried out by him.

At the same time, it should be taken into account that the FAS of the Ural District takes the exact opposite position than its colleagues from other districts.

The Ural arbitrators believe that since from the provisions of Art. 9 of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”

and

paragraph 2 of Art.

785 of the Civil Code of the Russian Federation it follows that the primary accounting document confirming transport expenses is a consignment note, then the absence of a consignment note serves as a basis for not accepting expenses for transport services as not supported by documents (see resolutions of the Federal Antimonopoly Service of the Ural District dated October 19, 2006 No. F09-8532/06-S7, dated November 28, 2007, No. F09-9660/07-S3).

Thus, taking into account the long-term unchanged position of the tax authorities and the Ministry of Finance, as well as the arbitration practice of our region, it is still easier for you in your relationship with the transport company and the buyer to draw up a consignment note and present it to the buyer.

How to draw up a deed

Its drafters are also given complete freedom in drawing up the act. The act can be printed on a computer - with mandatory subsequent printing - or written by hand. For the document, you can take a regular piece of paper or a form with company details and a logo.

The act is always made in two copies identical in content and in law, one of which is transferred to the customer, the second remains with the contractor, but if copies are needed, then it is duplicated and all other samples are also properly certified.

Sample act on the provision of transport services

If you need to create an act on the provision of transport services, which you have never done before, look at the example below, the explanations and comments to it - taking them into account, you will create your document without any problems.

- First of all, write the name of the act on the form, assign it a number (if necessary), indicate the place and date of its preparation.

- Be sure to indicate which agreement it is annexed to, also indicating its number and date.

- Form the next part of the act according to the type of agreement:

- indicate the name of the organizations,

- positions and names of employees who participate in drawing up the act,

- if you think it is important, you can enter more detailed details (TIN, OGRN, checkpoint of enterprises, etc.).

- Next, you should break the act into several points. Write in them that the part of the contract relating to the provision of transport services has been completed in full and on time.

- Also, if the funds that were specified in the contract as payment for these services have already been transferred, this should also be noted (they must be entered both in numbers and in words, making sure to indicate whether the organizations work with or without VAT).

- If you consider it necessary, you can supplement the document with other information that is relevant in your particular case (for example, about the route of the vehicle, stops, etc.).

- Also, be sure to indicate all attachments to this act (this could be travel or route sheets, etc.).

- In conclusion, be sure to write that the parties have no claims against each other and all work has been completed in full, and also sign the document on both sides.