On a quarterly basis, tax agents paying remuneration to individuals must report to the Federal Tax Service in Form 6-NDFL. The calculation form was approved by Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] (as amended on January 17, 2018). In 6-NDFL, the amount of tax withheld is reflected according to certain rules, non-compliance with which may lead to a violation of control ratios. There is a fine for inaccurate reporting. Let's look at how to fill out the form for withheld income tax amounts in accordance with the requirements of the tax service.

Zero report 6-NDFL

The obligation to submit a calculation in Form 6-NDFL to the tax authority at the place of registration arises if the taxpayer is recognized as a tax agent, that is, makes payments in favor of individuals.

If employee income is not accrued or paid during the year, there is no need to submit a report. The Federal Tax Service informed about this in a letter dated March 23, 2016 No. BS-4-11/4901. If during 2021 there was at least one payment in favor of an individual in the nature of wages, sick leave, financial assistance, remuneration for services rendered (work performed) as part of the execution of a civil contract, the report must be completed. Since the form is filled out on a cumulative basis, in the future, indicators from the first, second and third quarters will be saved in the future in a cumulative manner. So, in principle, there cannot be a zero 6-personal income tax; the report will still contain information on at least one payment.

If last year an organization was a tax agent, but this year for some reason stopped paying income to employees, you don’t have to submit anything to the tax authority. Although the company is not obliged to explain to the tax authorities what the loss of tax agent status is associated with, to reassure yourself, you can send a letter to the Federal Tax Service regarding the failure to provide 6-NDFL in any form.

The obligation to submit a calculation in Form 6-NDFL to the tax authority at the place of registration arises if the taxpayer is recognized as a tax agent, that is, makes payments in favor of individuals. If employee income is not accrued or paid during the year, there is no need to submit a report. The Federal Tax Service informed about this in a letter dated March 23, 2016 No. BS-4-11/4901.

If during 2021 there was at least one payment in favor of an individual in the nature of wages, sick leave, financial assistance, remuneration for services rendered (work performed) as part of the execution of a civil contract, the report must be completed. Since the form is filled out on a cumulative basis, the indicators from the first and second quarters will be saved in the future in a cumulative manner. So, in principle, there cannot be a zero 6-personal income tax; the report will still contain information on at least one payment.

When making payments of previously accrued income to an individual, the merchant becomes a tax agent. With the advent of this status, he has the obligation to carry out personal income tax calculations and withhold it from the recipient’s income. And although the procedure itself is not difficult for many businessmen, subsequent filling out of reports is usually difficult. Most often, the reason is the date of tax withholding in 6-NDFL.

There are a number of cases when a tax agent should begin to fulfill such an obligation. The reason is when an individual receives:

- Salaries.

- Vacation pay.

- Gifts.

- Other types of income.

One of the important points in 6-NDFL is UN; it refers to mandatory parameters that must be completely filled out. It is worth considering that the information entered in this paragraph may differ significantly each time. This is influenced by the possibility of coincidence of accrual periods, as well as subsequent withholding of personal income tax. Also, the income tax is influenced not only by the type of payment being made, but also by the time when personal income tax is calculated.

To understand the situation, you can imagine that the time has come for payment. In this case, personal income tax is displayed on the day after which the next month begins, in which wages will subsequently be paid. The UN date will be the day of payment of this salary. Upon dismissal, personal income tax is displayed on the day the employee leaves to perform his duties for the last time. But payments to the UN will be made on the day when the calculation of the laid-off employee occurs.

But when it comes to interest savings, personal income tax is displayed on the day the current month ends. The UN date becomes the day when the actual payment of income occurs. You need to know that the UN day is not always in the same period as 6-NDFL. Their presence in the same reporting period is possible only if payments to the individual were made in the same period.

It is also worth taking into account the aspect that the date of withholding personal income tax in 6-personal income tax always differs in the timing of tax calculation. Even paying taxes on the day the income will be paid cannot change this situation. The reason for this is page 120. It indicates the period allocated for the transfer of personal income tax - the day after the day on which the payment was made, or the next closest one.

The obligation to submit a 6-NDFL report arises for all tax agents who pay income to individuals. Russian organizations, individual entrepreneurs, notaries engaged in private practice, lawyers, and separate divisions of foreign organizations in the Russian Federation are recognized as tax agents.

As long as payments are not made to individuals and taxable income is not accrued, i.e. all indicators of the 6-NDFL report are equal to “zero”, the obligation to submit 6-NDFL does not arise. There is no need to submit a “zero” 6-NDFL report. But, if you decide to play it safe and submit a “zero” report, the Federal Tax Service is obliged to accept it from you (Letter of the Federal Tax Service dated May 4, 2016 N BS-4-11/).

It is worth considering that if you made income payments to individuals in the period from the 1st to the 3rd quarter, and in the 4th quarter the income was not accrued and no payments were made, then the obligation to submit 6-NDFL for the 4th quarter remains, because “Section 1” of the declaration is filled out on a cumulative basis (Letter of the Federal Tax Service dated March 23, 2016 N BS-4-11/).

You need to submit your 6-NDFL calculation to the Federal Tax Service at your place of registration. For organizations this is the location, and for individual entrepreneurs this is the place of registration. If the organization has an OP, then the calculation is submitted at the place of registration of each OP.

If an organization has an OP, then the 6-NDFL report is compiled separately for each registered OP (for each checkpoint), even if several OP are registered with the same Federal Tax Service. Accordingly, all reports on OPs are submitted to the place of registration of the relevant OPs.

If you are preparing the 6-NDFL calculation as a whole for an organization that does not have an OP, then everything is simple.

In the “TIN” and “KPP” line, you indicate the TIN and KPP of your organization.

In the Line “Submitted to the tax authority (code),” indicate the code of the Federal Tax Service with which your organization is registered.

In the Line “At the location (accounting) (code)” you must indicate Code “213” “At the place of registration as the largest taxpayer” or “214” “At the location of the Russian organization that is not the largest taxpayer.”

In the “Tax Agent” line, indicate the name of your organization.

In the “OKTMO Code” line, indicate the OKTMO code of your organization.

Reflection of accrued and withheld income tax in the 6NDFL report

Withheld and calculated personal income tax is a common concept for entrepreneurs and enterprises that hire employees. According to Art. 226 of the Tax Code of the Russian Federation, the responsibility of organizations and individual entrepreneurs includes the withholding and calculation of income tax. The tax calculated and withheld in personal income tax have certain differences.

Calculated tax is the calculated amount of personal income tax, which is subsequently withheld from the employee’s salary and sent to the country’s budget. The calculated personal income tax is reflected in certificate 2-NDFL. Withheld is the tax that remains with the employer before being transferred to the state budget.

This type of tax is also reflected in the 2-NDFL certificate in the column “Withheld tax amount”.

Personal income tax calculated and withheld - what is the difference

The generally accepted procedure for calculating withholding and tax transfers is as follows:

- Calculation of tax on all income (at the end of the month).

- Withholding of the calculated tax during the payment of income upon the fact.

- Conducting tax remittances of both types while receiving funds from the bank to pay income to employees.

According to this procedure, it turns out that the employer can only withhold the calculated tax, and only the withheld personal income tax can be transferred. Accordingly, it is impossible to both transfer the unwithheld tax and withhold the uncalculated tax. Let's look at the order in more detail. The first stage is tax calculation.

Tax Code of the Russian Federation Line 070 of Section 1 of the calculation in Form 6-NDFL reflects the amount of tax that will be withheld only in the next reporting period (for example, wages for March paid in April) Failure to comply with the explanations of the Federal Tax Service of Russia. Line 070 of Section 1 of the calculation in Form 6-NDFL indicates the total amount of tax withheld by the tax agent, cumulatively from the beginning of the tax period.

Since the tax agent must withhold the amount of tax on income in the form of wages accrued for May, but paid in April, in April directly upon payment of wages, line 070 of section 1 of the calculation in Form 6-NDFL for the first quarter of 2021 is not filled in (letter of the Federal Tax Service of Russia dated August 1, 2016 N BS-4-11/, question No. 6).

clause 5 art. 226 of the Tax Code of the Russian Federation Erroneous completion of line 080 of section 1 of the calculation in form 6-NDFL in the form of the difference between the calculated and withheld tax.

Also, in the “Payment of salaries” section, check the box next to the line “Simplified accounting of mutual settlements”. That's not all. You then need to re-transfer all payments and accruals in the correct sequence - salary, vacation pay, sick leave. After these operations, the reporting will take the correct form.

Mismatch The same method works for mismatched values. It is also worth checking the presence/absence of a checkmark indicating that the calculated tax is accepted as withheld, and then proceed to transfer all payment documents. Usually, after such an operation, the values begin to coincide, but for this it is necessary to follow the correct sequence of operations and be as careful as possible. Frequently asked questions What deadlines are set for a tax agent to fulfill its obligations to pay personal income tax? According to Art.

Filling out section 1 of Calculation 6-NDFL

The amount of personal income tax withheld in 6-NDFL is shown on line 070 of section 1. In this line they put the amount of tax that the tax agent withheld from the person receiving the income in accordance with Chapter. 23 Tax Code of the Russian Federation. Since deduction is possible when income is actually received, the data in line 070 only appears after the funds are paid or otherwise compensated to the individual. After deduction, the tax must be transferred to the budget.

The calculated and withheld tax in 6-NDFL on lines 040 and 070 may not coincide, and this is not an error. This situation most often arises when wages accrued in one reporting period are paid to employees in the next quarter. Personal income tax should be withheld at the time of payment of income to individuals, therefore, the tax calculated on such salary will be reflected on line 040, but not on line 070, because income in the reporting period has not yet been paid, which means that tax has not yet been withheld at the reporting date.

Such unwithheld tax cannot be included in line 080, which is intended only to reflect personal income tax that the agent failed to withhold from in-kind income or from material gain.

Example 1: The amounts of calculated and withheld tax in 6-NDFL in section 1 are the same

The organization began its work on December 1 last year. The staff includes 3 people with a total income of 105,000 rubles per month. There are no deductions for employees. The amount of accrued personal income tax for each month is 13,650 rubles (105,000 x 13%). Salaries are paid monthly on the 10th, without delays. December wages were paid in January.

How to fill out the form for the 1st quarter:

Income for January-March - 105,000 x 3 = 315,000 rubles.

Personal income tax for the entire quarter - 315,000 x 13% = 40,950 rubles.

- page 010 – 13%;

- page 020 - 315000.00;

- line 040 - 40950 - tax accrued for the 1st quarter;

- p.060 – 3, number of employees who received income;

- pp. 070 - 40950 - income tax is withheld from wages for December, January and February of the current year. Since the March salary will be paid only in the 2nd quarter (April 10), deductions for March do not need to be included in the calculation of the 1st quarter.

Example 2: The amounts of calculated and withheld tax in Section 1 are different

Let's take the conditions from example 1, only change the start date of the organization - from January of the current year.

- page 010 – 13%;

- page 020 - 315000.00;

- pp. 040 – 40950;

- p.060 - 3 people;

- line 070 - 27300 - withheld tax for January and February ((105000 + 105000)x 13%). Tax on wages for March will be withheld on the day of payment, April 10, and will be reflected in the 6-NDFL report for the six months.

It should be taken into account that the amount of the transferred tax is not reflected in 6-NDFL. But tax authorities may decide that the withheld personal income tax is not fully transferred to the budget if the difference between the withheld (line 070) and the tax returned to the individual (line 090) is greater than the amount received by the Federal Tax Service on the reporting date.

Payment of income in kind

When income is issued in kind, tax withholding cannot be made immediately. Personal income tax is withheld from any further monetary income of this person in an amount not exceeding 50% of the paid amount of income (clause 4 of Article 226 of the Tax Code). Line 070 of the section will be filled out only after a cash payment, from which personal income tax will be withheld. The same is done when calculating material benefits.

If there is no more cash income from which tax can be withheld, the agent reflects the unwithheld amount in line 080. Before March 1 of the year following the reporting year, the agent must report the unwithheld amount to the individual and the tax authorities by sending a 2-NDFL certificate with the attribute "2".

Deadlines for submitting 6-NDFL

Form 6-NDFL must be sent to the tax office no later than the last day of the month following the reporting quarter. The annual calculation is provided until April 1 of the following year (Article 230 of the Tax Code of the Russian Federation). For the 1st quarter of 2021, you must report no later than April 30. More detailed timing can be seen in the table.

| Billing period | Deadline |

| For 2021 | until April 1, 2019 |

| For the 1st quarter of 2019 | until April 30 |

| For the 2nd quarter of 2019 (calculation on an accrual basis for six months in section 1) | until July 31 |

| For the 3rd quarter of 2019 (calculation on an accrual basis for 9 months in section 1) | until October 31 |

| For the 4th quarter of 2019 (calculation on an accrual basis per year in section 1) | until April 1, 2020 |

1. For the 1st quarter - until April 30;

2. For half a year - until July 31;

3. 9 months before October 31;

4. For a year - no later than April 1 of the following year.

The 6-NDFL calculation can be submitted both electronically via telecommunication channels and on paper, if the number of people who received income in the tax period (per year) does not exceed 25 people.

Nuances of filling

When filling out the form, you need to know an important nuance: the amount of calculated tax is calculated when the employee receives income. For example, wages are considered paid:

- the last day of the salary payment month;

- the last working day upon dismissal or termination of an employment contract before the end of the salary month;

When it comes to bonuses or temporary disability benefits, the date of payment is considered the date of actual receipt of funds. Consequently, the 6-NDFL report will reflect the benefits and bonuses that were actually paid to employees as of the date of the report. That is, if 6-NDFL is submitted for six months, then the income line includes all actual payments of benefits and bonuses made before June 30. And accrued but unpaid amounts are not included in the calculation (including vacation pay).

Similar articles

- Filling out section 1 6-NDFL

- Calculation of 6-NDFL for the 1st quarter of 2018

- Amount of accrued income 6-NDFL

- Personal income tax calculated and withheld, what is the difference?

- Report 6-NDFL

What is remarkable about the tax calculated and withheld in personal income tax?

The value of line 060 (the number of individuals who received income) must correspond to the total number of 2-NDFL certificates with sign 1 and appendices No. 2 to the DNP submitted for all taxpayers by this tax agent (the ratio is applied to the calculation in form 6-NDFL for the year). clause 2 art. 230 of the Tax Code of the Russian Federation, Section 1 of calculations in form 6-NDFL are filled out not on an accrual basis.

Failure to comply with the Procedure for filling out the calculation in Form 6-NDFL. Section 1 of the calculation in form 6-NDFL is filled out with an accrual total for the first quarter, half a year, nine months and a year (clause 3.1 of section III of the Procedure for filling out and submitting calculations in form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 N MMV-7- 11/[email protected]). Art.

What does calculated personal income tax mean?

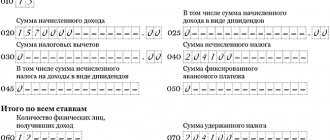

Calculated tax is personal income tax calculations that are made by multiplying the amount of employee income received and the applicable tax rate. It should be noted that the amount of profit received during calculation may be less by the amount of tax deductions (if any are applied to a specific employee). The “amount of calculated tax” is written in field 040, accrued income is written in field 020, and tax deductions are written in field 030.

Thus, cell 040 6-NDFL is calculated using the following expression:

Where CH is the tax rate.

There may be several attachments to the form because income received by employees of an enterprise may be subject to different personal income tax rates. Accordingly, there will be several calculations of taxes calculated and sent to the Treasury. Each calculation is numbered.

It is important to note that form 6-NDFL also contains the following lines:

- accrued income in the form of dividends – “025”;

- calculated tax on income in the form of dividends – “045”.

Field 045 with cells is determined by multiplying the amount of accrued income in the form of dividends and the amount of the tax rate applied to this type of taxable income. Note that the indicated amount of income received in this expression and the amount of calculated income tax are indicated as well, that is, it is included in the total amount of income accrued and in the total amount of calculated personal income tax.

Filling out 6-NDFL for the 1st quarter of 2018

Amount of calculated and withheld tax 6-NDFL

The date of actual receipt of wages is recognized as the last day of the month for which income was accrued in accordance with the employment contract (letter of the Federal Tax Service of the Russian Federation dated February 25, 2016 No. BS-4-11/3058) clause 2 of Art. 223 On line 100 of section 2 of form 6-NDFL, when paying a bonus based on the results of work for the year, the last day of the month on which the bonus order is dated is indicated. Line 100 of section 2 of form 6-NDFL is filled out taking into account the provisions of Art. 223 Tax Code of the Russian Federation.

The date of actual receipt of the annual bonus is determined as the day of its payment (letter of the Federal Tax Service of the Russian Federation dated October 6, 2017 No. GD-4-11/) art. 231 On line 140 of section 2 of form 6-NDFL, the amount of withheld tax is indicated taking into account the amount of personal income tax returned by the tax agent. In line 140 of section 2 of form 6-NDFL, the generalized amount of withheld tax is indicated on the date indicated in line 110. That is, the amount of personal income tax that is withheld is reflected (pp.

Important

Those who run independent businesses, as well as organizations, are constantly faced with various taxes. In this case we are talking about calculated and withheld. How do they differ from each other? Let's find out this question.

Attention

Imputed and Withheld Tax: Definitions, Differences An imputed deduction is a calculated amount. This is when the employer, before paying the employee's salary, deducts tax from it, which is subsequently withheld from the total income and sent to the state treasury. Simply put, the countable type is levied on the salary of an employee of a structure or an individual entrepreneur.

Withholding tax is the amount that a boss withheld from a subordinate's income as a tax agent. Today the two concepts are not very different.

Withheld tax: filling out section 2

The information in section 2 indicates the dates of income payments, divided into accrual periods.

The indicators of section 2 are grouped into blocks along lines 100-140:

- page 100 date of actual receipt of income (determined in accordance with Article 223 of the Tax Code of the Russian Federation);

- page 110 day of tax withholding (on the day of payment of income to an individual);

- p. 120 the deadline for transferring personal income tax to the budget (the next day after withholding, and for vacation and sick leave - the last day of the month in which the income was paid);

- p. 130 amount of income received;

- page 140 amount of personal income tax withheld.

It should be taken into account that even if the amounts of income are paid to individuals on the same day, the timing of tax transfers may differ. For example, for wages the payment deadline is no later than the next day after payment, and for vacation pay paid on the same day - the last day of the month. When filling out the form, you need to take this into account and indicate such income in separate blocks.

The value of line 070 of section 1 can be equal to the sum of lines 140 of section 2 only for the 1st quarter, since section 1 is filled in incrementally from the beginning of the year, and section 2 - only for the last three months of the reporting period.

Reflection of accrued and withheld income tax in the 6NDFL report

1. Income that is completely exempt from personal income tax.

2. Income of individual entrepreneurs, notaries, lawyers, and other persons engaged in private practice.

3. Income listed in paragraph 1 of Art. 228 Tax Code of the Russian Federation. For example, this could be income from the sale of property owned by an individual.

4. Income of residents of other countries that are not taxed in the Russian Federation by virtue of international treaties.

In Section 1 of Form 6-NDFL, all indicators are entered incrementally from the beginning of the year. Withheld tax is no exception; it is also indicated in an incremental manner: when filling out, for example, the Calculation for 9 months, in line 070 you need to show the tax withheld from January to September of the reporting year.

Lines 060-090 are grouped into the subsection “Total for all bets”. All of them, including line 070, are filled out collectively for all applicable rates, and the total amount of tax withheld is shown. When tax on income paid is calculated at different rates, then lines 010-050 for each of them are filled out on a separate page, and lines 060-090 only once - on the first page of Section 1.

The amount of tax withheld in 6-NDFL is indicated without kopecks. This is obvious, because the cells allocated to reflect the amounts of income and tax deductions provide for the indication of rubles with kopecks, but for personal income tax amounts there are no “penny” cells, and they are indicated in full rubles.

What does withheld personal income tax mean?

Withheld personal income tax is the amount of tax that is necessarily withheld from wages and other types of income of individuals. An important point is that tax deductions are made only from the amounts of income actually received. Upon receipt of payments by employees, the employer is obliged to send the amount of tax withholdings by payment order to the Treasury (Article 226, paragraph 1, clause 4 of the Tax Code of the Russian Federation). In 6-NDFL, field 070 specifies the amount of withheld tax liabilities in the total amount for all tax rates. The tax amount is indicated on an accrual basis from the beginning of the reporting period (year).

In the case where the employee’s income is received in the form of material benefits or in kind, withholding personal income tax becomes impossible. But it still must be withheld from any other types of cash receipts. For this calculation, the rule is that according to Article 226, paragraph 2, clause 4 of the Tax Code of the Russian Federation, the amount of deductions cannot exceed 50% of income received in monetary terms. The amount of tax withheld in 6-NDFL is displayed in line 070 only for those payments that were made as of the date of the report.

Code of location (accounting) in 6-NDFL