What exactly is water tax paid for?

Art. 333.8 of the Tax Code of the Russian Federation gives the exact wording of the water tax payer. First of all, these are organizations and individuals (including individual entrepreneurs) using water bodies in activities that require special permission (the so-called special water use).

Special water use is considered to be the use of various types of technical equipment, tools, and buildings for conducting primary activities on the mentioned water bodies. In order for this activity to be considered legal, a special license is issued based on the provisions of the RF CC.

Although the Tax Code of the last decade no longer contains such a term as special water use, its use well conveys the essence of the definition of the payer of this type of tax, which was first announced in 2005 and became a replacement for the Federal Law “On Payment for the Use of Water Bodies.”

REFERENCE. Taxpayers can be enterprises and entrepreneurs who have received permission to use groundwater in their activities, which are also natural resources, but are regulated by the Russian Federation Law “On Subsoil”.

According to paragraph 2 of Art. 333.8 of the Tax Code of the Russian Federation does not include such enterprises and individuals who received water bodies for use by virtue of a relevant agreement/decision as taxpayers.

The right to make decisions is vested in the Government of the Russian Federation, municipal authorities and other executive bodies authorized to independently fix fees for water use, as well as methods for calculating and paying them. All this applies only to contracts and decisions concluded from 01/01/2007.

The water tax is a good help in a rational, careful attitude towards natural resources. This is a kind of flexible tool with the help of which an effective mechanism is created to increase the responsibility of water resource users to the ecology of the country and the whole world. The water tax helps offset the inevitable costs associated with protecting and restoring the country's ecosystems and abundant water resources.

New water tax, but is it new?

There is a lot of speculation on the topic of a new water tax in 2021, and the “theorists” have already combined into one “legal proceeding” an increase in state budget expenditures, constitutional amendments, and COVID-19. According to their theory, all this influenced the fact that the use of groundwater will now be paid, because it is subsoil. The first thing I would like to clarify is that, indeed, the use of subsoil is a paid service, but this has always been the case and will remain so in 2021! At all times, a corresponding license was obtained for the use of subsoil, which clearly defined the conditions, terms and volumes of use of natural resources, and groundwater is the most natural subsoil. However, in the law “On Subsoil” there has long been Article 19 , which reads:

Owners of land plots have the full right to use for their own (non-commercial) purposes common minerals and groundwater (in a volume of no more than 100 m3/day) that are located within the boundaries of their plots.

This article has not gone away and is still “alive and well”, which means we continue to use personal wells on our plots for free (subject to the limit of 100 m3/day and when used for personal (non-commercial) purposes, of course). We also safely draw water for irrigation of our plots from nearby water bodies, since this action is not subject to taxation.

What objects are taxed?

In paragraph 1 of Art. 333.9 of the Tax Code of the Russian Federation provides a list of possible types of activities that may be associated with the permissible use of entrusted water bodies:

- simple water intake to support the production process of enterprises;

- maintaining the operation of power systems located near water bodies that do not require water intake;

- rafting of timber on special rafts/purses;

- conducting activities not related to timber rafting, but using the water area of the facility.

What objects are not subject to taxation?

Clause 2 art. 333.9 of the Tax Code of the Russian Federation contains a list of 15 items containing types of activities not subject to water tax. These include:

- irrigation of farmland, fields and pastures;

- fighting fires and other natural disasters where the use of water is justified;

- creation of summer camps and sanatoriums for children, disabled people and veterans on the territory adjacent to the water body;

- use of nearby territories as hunting and fishing grounds;

- other types of activities related to the interests of the state.

Article 50 of the BC RF. Tax revenues of the federal budget (current version)

Tax revenues from the following federal taxes and fees, taxes provided for by special tax regimes are credited to the federal budget:

corporate income tax at the rate established for crediting the specified tax to the federal budget - according to the standard of 100 percent;

corporate income tax (in terms of income of foreign organizations not related to activities in the Russian Federation through a permanent representative office, as well as in terms of income received in the form of dividends and interest on state and municipal securities) - according to the standard of 100 percent;

income tax of organizations when implementing production sharing agreements concluded before the entry into force of the Federal Law of December 30, 1995 N 225-FZ “On Production Sharing Agreements” (hereinafter referred to as the Federal Law “On Production Sharing Agreements”) and not providing for special tax rates for crediting the specified tax to the federal budget and budgets of the constituent entities of the Russian Federation - according to the standard of 25 percent;

value added tax - according to the norm of 100 percent;

paragraphs six through eight are no longer in force as of January 1, 2021. — Federal Law of April 15, 2019 N 62-FZ;

excise duties on alcoholic products with a volume fraction of ethyl alcohol over 9 percent, with the exception of beer, wines, fruit wines, sparkling wines (champagne), wine drinks produced without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate - according to the standard of 20 percent;

excise taxes on tobacco products - according to the standard 100 percent;

The paragraph became invalid on January 1, 2015. — Federal Law of October 4, 2014 N 283-FZ;

The paragraph became invalid on January 1, 2009. — Federal Law of December 30, 2008 N 310-FZ;

excise taxes on passenger cars and motorcycles - according to the standard of 100 percent;

excise taxes on motor gasoline, straight-run gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines produced in the Russian Federation - according to the standard of 12 percent;

excise taxes on middle distillates produced on the territory of the Russian Federation - according to the standard of 50 percent;

excise taxes on excisable goods and products imported into the territory of the Russian Federation - according to the standard of 100 percent;

tax on the extraction of mineral resources in the form of hydrocarbon raw materials (combustible natural gas) - according to the standard of 100 percent;

tax on the extraction of mineral resources in the form of hydrocarbon raw materials (with the exception of combustible natural gas) - according to the standard of 100 percent;

tax on mineral extraction (except for minerals in the form of hydrocarbons, natural diamonds and common minerals) - at a rate of 40 percent;

tax on mineral extraction on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation, outside the territory of the Russian Federation - according to the standard of 100 percent;

regular payments for the extraction of mineral resources (royalties) upon implementation of production sharing agreements in the form of hydrocarbon raw materials (combustible natural gas) - according to the standard of 100 percent;

regular payments for the extraction of mineral resources (royalties) upon implementation of production sharing agreements in the form of hydrocarbon raw materials (with the exception of natural gas) - according to the standard of 95 percent;

regular payments for the extraction of mineral resources (royalties) on the continental shelf, in the exclusive economic zone of the Russian Federation, outside the territory of the Russian Federation when implementing production sharing agreements - according to the standard of 100 percent;

fee for the use of objects of aquatic biological resources (excluding inland water bodies) - according to the standard of 20 percent;

fee for the use of objects of aquatic biological resources (for inland water bodies) - according to the standard of 20 percent;

water tax - according to the standard 100 percent;

The paragraph became invalid on January 1, 2010. — Federal Law of July 24, 2009 N 213-FZ;

state duty (except for the state duty for carrying out legally significant actions specified in Articles 56, 61, 61.1, 61.2, 61.3, 61.4 and 61.5 of this Code, the state duty provided for in paragraphs thirty and thirty-one of this article) - according to the standard of 100 percent;

The paragraph became invalid on January 1, 2015. — Federal Law of November 24, 2014 N 374-FZ;

state duty for the performance by federal executive authorities of legally significant actions in the case of filing an application and (or) documents necessary for their implementation to the multifunctional center for the provision of state and municipal services - according to the standard of 50 percent;

state duty for the performance by federal executive authorities of legally significant actions in the case of filing an application and (or) documents necessary for their implementation in electronic form and issuing documents through a multifunctional center for the provision of state and municipal services - according to the standard of 75 percent;

excise taxes on petroleum raw materials sent for processing - according to the standard of 100 percent;

excise taxes on dark marine fuel produced on the territory of the Russian Federation - according to the standard of 100 percent;

tax on additional income from the production of hydrocarbons - according to the standard of 100 percent.

Source: https://www.zakonrf.info/budjetniy-kodeks/50/

The tax base

Types of use of water bodies are directly related to the calculation of the tax base:

- If water is withdrawn from sources, the main indicator for calculating the tax base will be the volume of water withdrawn for the reporting period, confirmed by water meter readings. If there are none, the volume can be determined through the productivity and operating time of those. funds. In other cases, standard consumption rates apply.

- When providing electricity to adjacent areas, the calculation is made through the total amount of electricity produced during the reporting period.

- If we are talking about timber rafting, the tax base will be calculated using the formula: V*S/1000, where V is the volume of wood (in thousands of m3), S is the length of the rafting (km).

For other types of activities using water areas, when calculating the tax base, the value of its area will be required.

43. PROCEDURE FOR CALCULATION AND PAYMENT OF WATER TAXTax calculation procedure.

The taxpayer for each type of water use calculates the amount of tax separately in relation to each water body independently.

The amount of tax at the end of each tax period is calculated as the product of the tax base (water area, etc.) and the corresponding tax rate. The total tax amount is the amount obtained by adding the tax amounts calculated in relation to all types of water use.

To calculate this tax, you need to multiply the tax base by the corresponding rate. The tax base is calculated based on the volume of water withdrawn from a water body during the tax period; the area of the provided water space; the quantity of products produced during the tax period. The tax base when using water bodies for the purpose of timber rafting in rafts and purses is determined as the product of the volume of wood rafted in rafts and purses during the tax period, expressed in thousands of cubic meters, and the rafting distance, expressed in kilometers, divided by 100.

Taking into account the seasonal nature of the use of water bodies, there is uncertainty regarding the adjustment of the size of the tax base. Use without withdrawal of water - the use of water bodies, with the exception of timber rafting, for the purposes of hydropower, for the purpose of timber rafting in rafts, bags.

The tax is calculated as the product of the tax base, determined for the quarter based on the area of the provided water space, the amount of electricity produced and the volume of wood rafted in rafts and purses, and the rate.

Tax rates are set for river basins, lakes, seas and economic regions in fixed amounts - in rubles per 1000 cubic meters. m of water. In case of water withdrawal in excess of the established quarterly (annual) water use limits, tax rates in terms of exceeding the limits are set at five times the tax rates.

Procedure and deadlines for tax payment.

The object of water tax is the use of a water body, and therefore, the tax is paid at the place of actual water use. The water tax must be paid no later than the 20th day of the month following the expired tax period. The tax period is a quarter.

When using a water body located on the territory of several constituent entities of the Russian Federation, the water user enters into an agreement with all executive authorities of the relevant constituent entities or, with their consent, with one of them. This agreement can also determine the parameters of the object of taxation of a constituent entity of the Russian Federation.

Water tax for different types of use of the same water body must be calculated at the appropriate tax rates established for each type of water use.

The tax return is submitted by the taxpayer to the tax authority directly at the location of the taxable object within the deadline established for payment of water tax. Taxpayers and foreign persons also submit a copy of the tax return to the tax authority at the location of the authority that issued the water use license within the period established for tax payment.

Tax benefits for water tax are not provided.

Table of contents

Tax rates

The size of water tax rates is influenced by:

- the objects of taxation themselves;

- regions where water resources are located;

- types of water bodies.

For the main types of use, rates are reflected in clause 1 of Art. 333.12 of the Tax Code of the Russian Federation (part two) dated 08/05/2000 No. 117-FZ (as amended on 12/28/2016).

In relation to water supply to the population, there is an individual tax rate (clause 3 of Article 333.12 of the Tax Code of the Russian Federation). In 2021 it is equal to 107 rubles. per 1000 m3 of withdrawn water.

This rate applies to all organizations that are in one way or another connected with the supply of water to the population. All key points associated with this type of activity must be recorded in the agreement for the use of water bodies and confirmed by a license.

IMPORTANT. Water tax rates are applicable when water is withdrawn within limited limits. If the limit was exceeded, the bet will be increased five times. If there are no permissible limits specified in the license, the limit for 1 quarter is calculated as ¼ of the standard annual turnover.

Since 2015, adjustment increasing coefficients , the amount of which is determined at the legislative level until 2025 (clause 1.1 of Article 333.12 of the Tax Code of the Russian Federation). Starting from 2026, the indicators will be calculated based on the actual price increase/decrease for the previous year. Each year the rate will be applied to the previous year's stated rate.

Tax rates are expressed in rubles and are rounded to the nearest zero according to rounding rules.

The Tax Code of the Russian Federation does not consider tax benefits, which means that there are none at the local level either, since this tax is federal.

Who pays the water tax?

So since the use of groundwater for commercial purposes has long been paid, then what happens, the burden of water tax in 2021 is a news canard?

Not quite so, or rather just, as usual, the desire to make a mountain out of a molehill and make an exceptional sensation by dispelling panic.

Yes, indeed, on January 1, 2021, the so-called “water amnesty” expired, but few people understand what this really means. Let me explain.

217-FZ added to the list of subsoil plots of local importance areas used for the purposes of domestic water supply to SNT and ONT (not for commercial purposes), which means now you will have to pay for the use of public wells in SNT and ONT. Those. it is necessary to obtain the appropriate license, install meters on the basis of which payments for consumed water will be made (read more in our article: “License for a well in SNT”).

However, the adopted law does not contain a word about wells and wells located on plots owned or personally used by citizens.

Of course, if there is a well on your site with which you extract groundwater for subsequent bottling and sale, you will have to pay for such use of the subsoil. There is still no need to pay for the use of groundwater for your own needs on your personal plot.

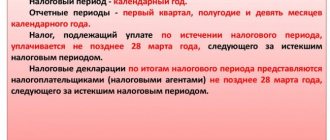

Tax period and tax payment deadlines

A quarter is taken as the tax period. The taxpayer is required to independently calculate the total tax amount for the quarter and make payment within 20 days after its end.

The declaration is submitted to the tax office located at the location of the facility being used. The exception is large taxpayers who submit documents to the tax authority where they are registered. Foreign citizens must submit information and pay tax to the Federal Tax Service at the place where the license was issued.

Water tax - regional or federal

Question

Is water tax a federal or regional tax?

Answer

Consider a water tax. Whether this contribution is federal or regional is regulated by the Tax Code of the Russian Federation. It states that the fee acts in lieu of a fee for the use of water bodies and is classified as federal.

Detailed information about the tax is described in the article “Water Tax”.

The following objects are recognized as subject to water payments:

- rise of water resources;

- use of water areas;

- use of water for timber rafting needs.

The contribution base is calculated separately by water:

- for water intake activities, this is the volume of water resources extracted during the reporting period;

- for water areas - the area of water space;

- when used by electric hydroelectric power stations without raising water resources;

- for hydropower needs, the collection base is calculated as the electrical energy generated during the reporting period;

- for timber rafting needs, the base for payments is calculated by multiplying the number of rafted wood during the reporting period.

Speaking about whether the water tax is paid to the regional or federal budget, we note that the collection is direct. It goes to the federal budget. The state, represented by the tax service, has information in advance about the expected revenues from the collection.

Source: https://nalogobzor.info/publ/vodnyi-nalog/vodnyi-nalog-regionalnyi-ili-federalnyi

Procedure for calculating water tax

Art. 333.13 of the Tax Code of the Russian Federation describes a fairly simple procedure for calculating tax. The latter is the result of the product of the size of the tax base and the increasing coefficient corresponding to the current year.

For each type of use, the tax must be calculated separately, as well as for the water bodies themselves. To obtain the total amount of tax paid to the budget, the results obtained are summed up.

Tax calculation example

Let’s say that a certain company that has a license and has the necessary water measuring instruments, in 2021, collected water from the Don River in the Volga region to maintain the production cycle. The quarterly limit is 280,000 m3. In the first quarter, the company exceeded the limit by 10,000 m3. It is necessary to correctly calculate the water tax for the first quarter.

When is water tax paid by organizations?

In order to operate legally, organizations pay all kinds of taxes to the budget of the Russian state. One of these fees is the water tax.

By whom and where is it paid, how is it regulated, what are the deadlines for payment - all this will be discussed within the framework of this material.

What budget should I pay into?

Water tax is a fee for the use of resources of this type, which are located on the territory of our state. Payment is made to the federal budget of the country.

Until this payment appeared, citizens had to transfer these funds as payment for water. Payers of the fee are persons living in the country and using its resources.

Payment must be made if a person registered as a legal entity or individual entrepreneur uses water for the following purposes:

- ensuring the drinking and domestic needs of the population, supplying its representatives with technical and drinking liquids;

- application within production activities;

- carrying out timber rafting events;

- search for minerals;

- implementation of construction activities;

- achieving other state and public goals.

The corresponding amount is transferred to the federal budget when using seas, rivers, streams, swamps, canals, underground springs, and lakes.

The period and procedures in which payment activities are carried out are prescribed within the framework of Art. 25.2 Tax Code of the Russian Federation. There are additional documents indicating the annual indexation of rates, which is prescribed in Federal Law No. 366 of November 24, 2014. In 2021, the tax rate for the use of resources is 81 rubles. / thousand cubic meters m.

Payers have an obligation to submit reports to the authority where the main facility is located (i.e., where water use actually occurs) during each quarter (the document is submitted by the 20th of the quarter).

The legislator established and adopted tax rates for each object on an individual basis, taking into account the location, economic well-being of the region, and the nature of water use.

Calculation procedure and payment terms

The procedure for settlement actions appears in Art. 333.13 of the Tax Code of the Russian Federation. Article 333.14 displays the basic time frame within which the entity undertakes to contribute the required monetary amount.

The law states that the tax must be paid no later than the 20th day of the month following the reporting quarter, i.e. the payment is made four times a year in the middle month of each time of the year.

If the deadline for payment is a weekend or holiday, then the final period is the first working day following the 20th day.

To calculate the amounts to be paid, special identities are used and certain conditions operate.

- If we are talking about the classic use of water resources, payment is made in the usual manner. At the same time, the declaration is submitted to the tax and duties inspectorate, which is located at the location of the security object.

- If the taxpayer conducts large-scale activities and owns a large business, he is assigned an obligation to pay a fee to the Federal Tax Service at the place of registration.

- If this is a foreign citizen or individual, the declaration paper must be submitted at the location of the body that issued the license to operate the facility.

In Art. 50 of the Budget Code of the Russian Federation states that this payment is credited in full to the federal budget. The government does not provide preferential conditions for paying this fee.

This indicates the absence of any regional relaxations. In the process of registering the BCC, it is necessary to correctly fill out the document, indicating the budget classification code in line 104. This is necessary so that the amount goes “in the right direction” and no errors occur.

To carry out accounting operations, it is necessary to use special entries.

For debit, balances 20, 23, 25, 26 are used, and for credit, it is customary to use the 68th account. This operation indicates the accrual of fees for the fact of using resources and objects.

Posting Dt68Kt51 symbolizes the transfer of federal payments to the budget.

Tax establishment is the prerogative of Chapter 25.2 of the Tax Code of the Russian Federation. It was put into direct operation from 01/01/2005 instead of the fee that was in force for the use of facilities.

As objects of taxation in the Russian Federation, it is customary to understand the amounts paid for the following types of activities:

- withdrawal of water resources from the previously listed objects for use for established purposes;

- practical use of water areas owned by the population and the state;

- lack of water abstraction for hydropower purposes;

- timber rafting in bags and rafts.

The following organizations and enterprises are not subject to taxation:

- extraction of resources from underground objects;

- ensuring fire safety of certain objects;

- process of eliminating the consequences of force majeure situations;

- generation of sanitary passes;

- intake of resources from maritime vessels to ensure technologically advanced operation of equipment;

- use of water for fish farming and ensuring the functioning of biological resources.

This is not an exhaustive list of activities for which the government does not charge taxes.

Along with this, attention should be paid to the tax base. Indeed, for each direction of water use, the base is determined individually.

- In the case of water withdrawal, the definition of the base is made as the volume of the resource taken from the water body within a particular tax period.

- If we are talking about the practical use of water bodies, identification is made in terms of the area of water space that is provided.

- In the situation of using water objects without water intake for hydropower purposes, the calculation is carried out in the form of the amount of electricity produced over an annual period.

- If organizations use water bodies to provide timber rafting, the base is the product of the volume of wood required and the distance of the rafting received (in km).

Tax rates are established by basins of lakes, rivers, seas, as well as by economic regions of the country in the case of the intake of global liquids, the use of water areas, water bodies for hydropower, and wood rafting.

If the collection is carried out in excess of the limits that are established at the state level, rates are set at five times the size indicator.

If there are no approved limits for quarters, they are determined as ¼ of the approved threshold. The rate is 81 rubles. per 1000 cubic meters m.

Reporting for entrepreneurs

The introduction of the water tax and the Water Code in 2005 led to an improvement in the process of using water bodies and receiving payment for them. But the tendency is that the document is gradually becoming obsolete.

Indeed, over the past few years, the State Duma has been actively discussing amendments that will be made to the law. They consist in providing the state with the opportunity to exercise comprehensive and complete control over objects of water importance.

In order to use resources and objects that act as state property, the executive body must issue the payer an appropriate license.

In 2017-2018 The tax return form continues to be valid. Its approval took place through the order document of the Federal Tax Service of the Russian Federation No. MM-7-3/497 dated November 09, 2015. The form of this document in accordance with KND is 1151072.

Practice shows that most facilities submit this declaration. They also ensure the payment of the tax for the use of water resources at the place where the facility itself is located.

Along with this, the largest tax payers submit reports to the inspectorate at the place of registration. And officials are also required to submit documents to the Federal Tax Service at the location of the body that issued the license permit.

The calculation of the period is carried out in accordance with the general procedure.

Many users of water resources are interested in the question of whether there is a need to submit a declaration if there is no water intake. And also, is it necessary to comply with tax filing deadlines in 2018?

Yes, this is mandatory, because in this situation the law was adopted far from being in favor of the fee payers. If an organization has a license for the use of subsoil that allows withdrawal, it is obliged to pay water tax and, accordingly, submit a declaration.

It turns out that even if an organization does not use a water body, it needs to submit a zero declaration.

Thus, a water tax is a financial payment for the fact of using water resources. Its contribution is mandatory for everyone who exploits natural objects for personal gain, i.e., to make a profit and meet public (state) needs.

The fee is paid every quarter, and declaration reporting is submitted no later than the 20th day of the month following the reporting period. A competent approach to carrying out settlement activities and submitting documents will allow you to avoid mistakes and violations of current legislation.

For more information on calculating and paying the water tax, see the video below.

Source: https://znaybiz.ru/fondy/grugaiya-otchetnost/uplata-vodnogo-naloga.html