What are the advantages of the simplified tax system?

The main advantage of the “simplified” system is that businesses do not need to pay VAT, which is 20% from 2021. Also, those organizations that use the simplified tax system do not pay income tax, with the exception of the tax paid on income from dividends and certain types of debt obligations.

Also, the simplified tax system provides a benefit for the property tax of organizations, that is, this tax is not paid. Moreover, from January 1, 2015, for individual entrepreneurs on the simplified tax system, there is an obligation to pay property tax in relation to real estate objects that are included in the list determined in accordance with clause 7 of Art. 378.2 Tax Code of the Russian Federation.

Besides:

- The simplified tax system does not require quarterly payments and declarations. Only one declaration needs to be submitted: for organizations - by March 31 of the year following the expired tax period, and for individual entrepreneurs - by April 30.

- At the “simplified” and at the “income” object and at the “income minus expenses” object there are advance payments. Tax must be paid in advance no later than 25 calendar days from the end of the reporting period.

- The tax at the end of the year is paid by organizations - no later than March 31 of the year following the expired tax period, individual entrepreneurs - no later than April 30 of the year following the expired tax period.

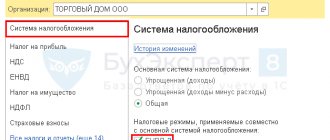

It is worth remembering that under simplified taxation you can choose between two objects of taxation - “income” or “income minus expenses” (Article 346.14 of the Tax Code of the Russian Federation). You need to make a choice right away, since simplified taxation system payers indicate the object during registration. At the same time, the object of taxation can be changed annually. Accordingly, if in 2019 you apply the simplified tax system “income”, then you will be able to switch to the simplified tax system “income minus expenses” only from 2021.

What awaits us in 2021

For taxpayers who want to apply special regimes starting in the new year, it is especially important to familiarize themselves with the changes. In 2021, the Russian Government plans to introduce a number of changes to Russian tax legislation:

- in the document “Main directions of budget, tax and customs tariff policies for 2021 and for the planning period 2021 and 2021.” (approved by the Ministry of Finance of the Russian Federation) dated October 12, 2018, it is stated that for entrepreneurs on the simplified tax system who use online cash registers and apply the taxable object “income”, the obligation to submit a tax return will be canceled. Since the inspectorate can track all transactions received at the cash desk or into a current account, they themselves will determine the amount of tax to be paid, therefore, there is no need for taxpayers themselves to fill out and submit reports;

- according to bill No. 497452-7, companies will be required to send financial statements only to the Federal Tax Service in electronic form - they will no longer have to send reports to Rosstat;

- According to the project of the Ministry of Economic Development of Russia “On changes in deflator coefficients for 2021”, the new value for calculating UTII will be 1.915. Consequently, from 2021, the amount of UTII payable will increase by 2.5%.

Limitations of the simplified tax system

As part of the “simplified” plan, there is an income limit. The income limit for individual entrepreneurs on the simplified tax system has not changed compared to 2021 - until January 1, 2021, the effect of the deflator coefficient is not taken into account. It is assumed that the income limit is 150 million rubles. will continue for 2021 and 2021.

The average number of employees is also taken into account - 100 people. The average annual cost of fixed assets is 150 million rubles.

“Simplified” applies to all types of activities, with the exception of lawyers, banks, insurance funds, pawn shops and other organizations listed in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

The share of participation of other organizations in the capital structure should not exceed 25%.

What is more profitable: simplified tax system or UTII

What to choose: simplified tax system or UTII?

It is impossible to give an exact answer to this question. All organizations and individual entrepreneurs may have different levels of income and expenses and, as a result, different profits. It is necessary to consider both systems from a convenience point of view. Based on the foregoing, we can conclude that UTII is the simplest mode. There is no need to take into account income and expenses, but at the same time, it is almost impossible to optimize the amount of tax, as in the simplified tax system. However, using the “simplified language” you will have to conduct KUDiR. It is more profitable to use UTII when the business brings in much more income compared to the established imputed income, then the organization would pay much less taxes than when applying the simplified tax system.

If the organization’s real income is equal to or less than the imputed income, then the use of the simplified tax system would be more appropriate. It is important to decide which tax object is right for your company.

Materials from the newspaper “Progressive Accountant”,

simplified tax system “income” in 2021: advantages

For the simplified tax system “income” the rate is 6%. That is, in this case, costs do not play any role. Only income is taken into account in the tax base and is multiplied by 6%. In this case, the tax can be reduced.

An organization or individual entrepreneur with hired employees can reduce tax by 50%. According to clause 3.1 of Art. 346.21 of the Tax Code of the Russian Federation, the tax is reduced:

- the amount of insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory health insurance, compulsory social insurance against industrial accidents and occupational diseases paid in a given tax period;

- the amount of expenses for payment of temporary disability benefits for days of temporary disability of the employee, which are paid at the expense of the employer (with the exception of industrial accidents and occupational diseases);

- for the amount of payments (contributions) under voluntary personal insurance contracts.

Individual entrepreneurs who do not provide compensation to individuals reduce the amount of tax on insurance premiums paid for compulsory pension insurance and compulsory health insurance.

Another advantage of individual entrepreneurs using the simplified tax system “income” is rare checks. Using this “simplification” is beneficial for those whose share of expenses is less than 60% of the total.

What you need to know about UTII

This special regime is beneficial for many organizations, but it will only apply until 2021.

For UTII, it doesn’t matter how much you earn - there is no maximum limit. But imputed income is important, which is calculated according to the rules prescribed in Art. 346.29 of the Tax Code of the Russian Federation: calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity. This is what needs to be paid.

Payers of UTII can reduce the amount of tax calculated for the tax period by the amounts of payments and benefits that were paid in favor of employees employed in those areas of activity for which a single tax is paid. In this case, the amount of reduction cannot exceed 50% of the calculated tax.

An individual entrepreneur without employees has the right to reduce the amount of UTII by the amount of insurance contributions paid (for himself) in a fixed amount to compulsory health insurance and compulsory medical insurance without applying the 50% limit.

Transition period from UTII to patent - features

A patent is inherently closest to the UTII regime. To determine tax liability in both cases, it does not matter how much income the taxpayer actually received. The calculation of both taxes is based on how much a business entity could earn, with certain nuances for a specific regime.

Individual entrepreneurs, and only they have the right to apply PSN, must submit an application in a timely manner and pay the amount of the patent that the tax authorities will calculate.

To be able to apply PSN, the Tax Code establishes the following restrictions:

- by type of activity - they are fixed by regional legislation based on the list from Art. 346.43 Tax Code of the Russian Federation;

- in terms of the volume of income received for the year - up to 60 million rubles;

- the average number of staff is up to 15 people.

Taking into account all these points, individual entrepreneurs can safely buy a patent and continue doing business. The transition period from UTII to PSN should not cause any difficulties.

Who benefits from using UTII and why?

UTII is beneficial for those who are engaged in retail, catering, provide household services, as well as transportation services.

Organizations and individual entrepreneurs on UTII providing services to the population, as well as individual entrepreneurs on UTII without employees, engaged in retail and catering, received a deferment on the use of online cash registers until July 1, 2021. This is one of the reasons why many switched to UTII - to save money. However, UTII has limitations:

1. If there is no limit on revenue, then there is one on the number of personnel - no more than 100 people.

2. For UTII in Art. 346.29 of the Tax Code of the Russian Federation and Art. 346.26 of the Tax Code of the Russian Federation specifies certain types of activities:

- retail;

- public catering;

- household and veterinary services;

- repair, maintenance and washing services for motor vehicles;

- distribution, advertising placement;

- services for the temporary use of trading places and land plots;

- temporary accommodation and accommodation services;

- services for the transportation of passengers and goods by motor transport;

- parking services.

3. The share of participation of other legal entities is no more than 25%. If a share in the authorized capital of an organization is sold to another legal entity and its share exceeds 25%, then it will automatically transfer to the OSN.

Also, for UTII there are no limits on the cost of fixed assets.

How can tax systems be combined?

Organizations can combine the simplified tax system and UTII (clause 4 of article 346.12).

An individual entrepreneur can combine the simplified tax system and UTII, the simplified tax system and PSN, and even the simplified tax system with UTII and PSN.

But before you seriously engage in combination, it is worth calculating optimization. When choosing one or another tax regime, calculate the tax burden - this will allow you to understand the benefits.

It is often more profitable for individual entrepreneurs to use the simplified tax system of 6% and combine it with PSN or UTII.

For organizations involved in retail, it makes sense to use UTII.

Why is it necessary to combine special modes at all? Imagine that your organization is engaged in retail, that is, it has several stores that operate on UTII. But since UTII only applies to certain types of activities, tax authorities often try to prove that you sold goods to a legal entity, which is already considered wholesale trade. Therefore, on the amount received for selling goods to a legal entity, you need to pay tax under the OSN.

To avoid such situations, organizations almost always write an application to the simplified tax system at the same time as the UTII. Please note: new organizations can switch to the “simplified” system within 30 days, while existing organizations can only switch to the “simplified” system from the beginning of the year. Therefore, if you are currently on UTII, then in the middle of the year you will no longer be able to switch to the simplified tax system; this can only be done starting next year.

Organizations engaged in trade very often combine UTII with the simplified tax system “income”, and not “income minus expenses”. Accordingly, they divide the indicators. Which ones exactly?

First of all, income.

For “simplified” there is an income limit of no more than 150 million rubles, so income must be divided clearly. Moreover, in Art. 346.13 of the Tax Code of the Russian Federation states that income from UTII is not included in the maximum limit. What can be done in this case?

- The best thing is to divide the income using accounting. That is, create separate accounts in accounting: income within the framework of the “simplified tax” and income within the framework of UTII.

- Divide revenue based on receipt reports. When using cash registers, the required check details are the taxation system that was used in the calculation. Accordingly, UTII will appear on one check, and “simplified” on the other.

- Divide by payment types. For example, everything that comes in “simplified” is by bank transfer, and everything that is in retail is through cash register, etc.

Often organizations switch to the simplified tax system for “income” precisely because expenses in this case are not important and there is no need to divide expenses according to different taxation systems.

If they choose UTII and simplified tax system “income minus expenses”, then expenses must be divided without fail: separately take into account what belongs to UTII, separately what belongs to simplified tax system, and separately maintain general business expenses.

But even when combining the simplified tax system “income” and the simplified tax system “income minus expenses”, the number of employees is necessarily divided. This is important because the UTII includes types of activities where people are the physical indicator - for example, household services. Therefore, you need to determine who will pay and who will not.

On UTII and “simplified” taxes, the tax is reduced by insurance premiums. Therefore, it is necessary to divide insurance premiums.

General in UTII and simplified tax system

Having considered both modes separately above – imputation and simplification, what is the difference between them, it became clear. What do they have in common? Each system has its own pros and cons, but there are also similarities:

- voluntary nature;

- it is possible to combine the simplified tax system and UTII, but separate accounting is necessary; exemption of entrepreneurs from paying a number of taxes (personal income tax, VAT, partially property tax), although they will have to pay other taxes and contributions; simple tax accounting;

- the conditions for application are similar based on the number of employees, the prohibition to combine with the Unified Agricultural Tax;

- if the established limits are exceeded, the right to the simplified tax system and UTII is lost from the beginning of the quarter in which the excess was allowed, and the activities of individual entrepreneurs are taxed according to the general system;

- the amount of tax can be reduced through contributions to funds both under UTII and under the simplified “income” scheme;

- Payment to the budget is made quarterly: tax under UTII, advance payments under the simplified tax system;

- it is necessary to pay tax even if there is no income under UTII and the simplified tax system “income minus expenses”.

Specifics of division

Questions often arise with division. Let's say there is an organization that is engaged in wholesale trade. In addition to this, she also does renovations. Repairs are classified as household services, so the organization switched to UTII. For household services on UTII, the physical indicator is people. Therefore, those who repair must pay UTII.

Nadezhda Samkova, a leading expert consultant on taxation and presenter of the webinar “Combining the simplified tax system with other tax regimes: UTII, patent,” notes that the division by people should be made by employment contracts and time sheets. This way it will be clear that, for example, employee Ivanov repairs for such and such an amount, and only UTII needs to be paid from him. And the other employee - Petrov - is engaged only in wholesale trade and he does not play any role in UTII.

Thus, if an organization combines the simplified tax system and UTII, the number of employees who belong to different areas of activity can be distributed. But if the same employees participate in activities both on the “simplified” and on UTII, it is impossible to divide their number by different types of activities. Such employees need to be fully taken into account.

Difficult situations arise with such employees as the director and accountant. And in companies that, for example, have two repairmen and two wholesale trade specialists, as well as a director and an accountant, they ask themselves the question: for how many people should they pay UTII? According to the explanations of the Ministry of Finance, when combining the simplified tax system and UTII, administrative and managerial personnel are not divided. Therefore, in this case, the tax authorities will force you to pay for two repairmen, as well as for the director and accountant.

Understanding the number of employees is important primarily because of the need to divide insurance premiums.

Another example: the company has wholesale and retail. For retail, the physical indicator on UTII is area. Therefore, if you have a store with an area of 150 sq. m, you need to pay UTII. But a director can work in the same store and engage in wholesale trade. In this case, can you pay UTII not on the area, but in proportion to the revenue? The answer to this question is contained in the Letter of the Ministry of Finance dated September 11, 2012 No. 03-11-11/276: “The area of the trading floor is recognized as the part of the store, pavilion, occupied by equipment intended for displaying, demonstrating goods, conducting cash payments and servicing customers, the control area - cash registers and cash booths, the area of work places for service personnel, as well as the area of aisles for customers. The area of the trading floor also includes the rented part of the trading floor area. The area of utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale, in which customer service is not provided, does not apply to the area of the trading floor.” And one more thing: the procedure for distributing the area of a sales floor (or part of it) when carrying out on it simultaneously a business activity taxed under the simplified tax system and a business activity in respect of which UTII is paid and the area of the sales floor is used as a physical indicator is not defined by the Tax Code.

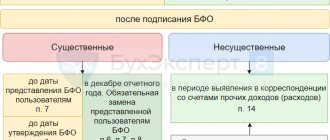

Significance of accounting policies and distribution of insurance premiums

Since the mechanism for maintaining separate accounting is not clearly stated in the Tax Code, when combining regimes it is important to formulate an accounting policy. The wording can be taken from clause 8 of Art. 346.18 and paragraph 7 of Art. 346.26 of the Tax Code of the Russian Federation, as well as improve accounting. To simplify the process, use a special accounting policy creation wizard.

In the accounting policy, first of all, it is necessary to prescribe a mechanism for maintaining separate accounting for taxation. In Art. 346.18 and art. 346.26 of the Tax Code of the Russian Federation specifies that if the same expenses relate to different taxation systems, then these expenses must be divided in proportion to the income from these types of activities in the total.

Let’s say an organization combines “simplified” and “imputed”, the main employees work in different types of activities, but the accountant maintains both the simplified tax system and the UTII. The salary of this accountant is 35,000 rubles. Income from “simplified” is 300,000 rubles, and income from UTII is 100,000 rubles. If the special simplified tax system “income minus expenses” regime is used, then the whole 35,000 rubles cannot be paid. take the accountant's salary in simplified form. It is necessary to determine the share of “simplified” in the total mass, and only within this share take the amount for expenses.

To calculate the share, income received from the “simplified tax regime” is taken and divided by the total amount of income from both taxation regimes. Thus, for the example given, the share of “simplified” will be 75%, and the share of UTII will be 25%.

Then, to determine the share of the accountant’s salary according to the simplified tax system, his salary must be 35,000 rubles. multiply by 75% (0.75) - it turns out 26,250 rubles. The share of the salary for “imputation” is determined by multiplying 35,000 rubles. by 25% (0.25) - it turns out 8,750 rubles.

Insurance premiums from these amounts will be charged to expenses for the relevant types of activities.

Another example is that an individual entrepreneur pays fixed contributions for compulsory pension insurance in the amount of 29,354 rubles. Every year. If the income of an individual entrepreneur is more than 300,000 rubles, then the fixed amount is 29,354 rubles. + 1% of the amount of income exceeding RUB 300,000. How can an individual entrepreneur reduce fixed payments?

If an individual entrepreneur on UTII combines UTII and “simplified” tax, and hired employees work only on UTII, then you need to build on the Letter of the Federal Tax Service dated May 29, 2013 No. ED-4-3/ [email protected] , which states that an entrepreneur who combines The simplified tax system with the object “income” and UTII can reduce the tax under the simplified tax system by the entire amount of insurance premiums paid for itself if it attracts workers only to carry out activities transferred to UTII.

There is also a Letter from the Federal Tax Service dated August 10, 2017 No. 03-11-11/51316, the meaning of which is that insurance premiums that go to different regimes are divided in proportion to income. The Letter of the Federal Tax Service dated December 5, 2014 No. GD-4-3/25258 states that if you combine “simplified taxation” and UTII without employees, then you can send the payment wherever you want. But a problem arises: according to the simplified tax system, an individual entrepreneur pays tax at the place of residence, and according to UTII - at the place of business, and these can be different places. Therefore, it is better to include a fixed payment in any taxation regime, and take 1% into account in UTII and in the simplified tax system, so that there are no problems with the tax inspectorate.

If you have employees, then both the UTII and the simplified tax system can be reduced by only 50%. Until 2021, the rule worked: you could reduce the tax on UTII only for employees, but not for yourself. However, starting from 2021, this rule does not work - now individual entrepreneurs can reduce taxes both for themselves and for employees.

If you combine the simplified tax system “income minus expenses” with UTII, insurance premiums will be reduced by UTII, and in the “simplified tax” they will go to expenses. Therefore, you need to share the costs.

Combination of the general taxation regime and UTII. Understanding VAT

We are on UTII and the general taxation system. We sell spare parts at retail, go to the main warehouse, then to the retail warehouse. What will VAT look like if the cash register is on UTII?

Since you, along with activities subject to taxation in accordance with the general taxation regime, also carry out a type of activity in respect of which UTII is paid

, then

for this activity

you

are not recognized

VAT

payers .

Consequently, accounting for the amounts of “input” VAT

taxpayers transferred to pay a single tax on imputed income for certain types of activities must be carried out

separately

according to the rules

of paragraph 4 of Art.

170 Tax Code of the Russian Federation .

That is, the VAT amounts

, presented by sellers of goods to taxpayers carrying out both taxable and tax-exempt transactions:

– included in the price

such goods – for goods used to carry out transactions not subject to VAT;

– are accepted for deduction

in accordance with

Art.

172 of the Tax Code of the Russian Federation - for goods used to carry out transactions subject to VAT;

– are accepted for deduction or taken into account in their value in that proportion

, in which they are used for the production and (or) sale of goods, transactions for the sale of which are subject to taxation (exempt from taxation), - for goods used to carry out both taxable and non-taxable (exempt from taxation) operations, in in the manner established by the accounting policy adopted by the taxpayer for tax purposes.

Paragraph 9, paragraph 4, art. 170 Tax Code of the Russian Federation

allows you

not to maintain separate accounting in the event

that the share of total costs for the production of goods, operations for the sale of which are not subject to taxation,

does not exceed 5%

of the total value of total production costs.

In this case, all amounts of “input” VAT can be deducted

.

Both the Ministry of Finance and the Federal Tax Service have long argued that the norm provided for in paragraph 9 of paragraph 4 of Art. 170 Tax Code of the Russian Federation

,

is applied only by VAT taxpayers

and Chapter 21 of the Tax Code of the Russian Federation has not established a legislative norm allowing the use of a similar procedure by taxpayers transferred to pay UTII.

Therefore, organizations that are UTII taxpayers in relation to certain types of activities and for which during the tax period the share of total costs for the production of goods, sales operations of which are carried out within the framework of entrepreneurial activities taxed by UTII, does not exceed 5% of the total total costs for production, are not entitled VAT amounts paid to suppliers of goods are deductible in full

(letter of the Federal Tax Service of the Russian Federation dated May 31, 2005 No. 03-1-03/897/ [email protected] , Ministry of Finance of the Russian Federation dated July 8, 2005 No. 03-04-11/143).

The arbitration courts did not agree with the officials and pointed out that the tax inspectorate’s arguments

that the taxpayer is not recognized as a VAT payer and he has no grounds for applying the provisions of

clause 4 of Art.

170 of the Tax Code of the Russian Federation do

not comply with legal norms

.

As a result, the Federal Tax Service of the Russian Federation agreed with the courts, which in a letter dated February 17, 2010 No. 3-1-11 / [email protected] indicated that the provisions of paragraph 4 of Art. 170 Tax Code of the Russian Federation

(including the provisions

of paragraph 9, paragraph 4, Article 170 of the Tax Code of the Russian Federation

)

are equally applied

for transactions exempt from taxation, and for transactions that are not recognized as the sale of goods (work, services), and for transactions carried out by VAT taxpayers,

which, according to certain types of activities are transferred to the payment of UTII

.

That is, tax authorities have officially recognized that UTII taxpayers may not keep separate records of VAT amounts

if the share of total costs for the production of goods (works, services) not subject to VAT does not exceed 5% of the total total costs of production.

Thus, if your share of total costs for the production of goods within the framework of activities subject to UTII does not exceed 5%

of all production costs, you do

not have to keep separate records

and deduct all amounts of “input” VAT.

If you know for sure

, for what transactions you purchase goods (for wholesale or retail), then

for goods purchased for wholesale trade

, you submit the amount of “input” VAT for deduction in the generally established manner.

For goods purchased for retail purposes

(on UTII), you include the amount of input VAT in the cost of these goods.

If you do not know at the time of acceptance of goods for registration

How these goods will be sold (in bulk or through a store), then

you have the right to choose the option of accounting for “input” VAT and register it in the organization’s accounting policy

.

After all, Chapter 21 of the Tax Code of the Russian Federation does not establish rules for similar situations.

P.p. 2 p. 3 art. 170 Tax Code of the Russian Federation

It has been established that

the amounts of VAT accepted for deduction

by the taxpayer on goods

are subject to restoration

in the event of further use of such goods for transactions not subject to VAT.

Tax amounts are subject to restoration in the amount previously accepted for deduction.

.

Recovery

VAT amounts

are made in the tax period in which the goods were transferred or begin to be used

by the taxpayer for transactions not subject to VAT.

You can deduct VAT on all purchased goods.

For goods sold in retail trade

(UTII), VAT will need to be restored and paid to the budget.

This option is confirmed by the Ministry of Finance of the Russian Federation, which, in a letter dated September 11, 2007 No. 03-07-11/394, reported that the VAT amounts on purchased goods were excessively accepted for deduction

, subsequently sold

in the retail trade mode

, transferred to the payment of a single tax on imputed income,

are subject to restoration

in the tax period in which these purchased goods were sold in the retail trade mode.

Please note that VAT must be restored when the goods are transferred

from warehouse to retail, and not when they are sold at retail.

In paragraph 3 of Art.

170 of the Tax Code of the Russian Federation,

“transferred”

is used .

It should be noted that according to officials, if the taxpayer

who sells goods, both subject to VAT and not subject to this tax in connection with the payment of a single tax on imputed income,

deducts tax amounts

on goods purchased for these operations

in full, he does not comply with the obligation to maintain separate records

.

Thus, these deductions of VAT amounts were made illegally

(letter of the Ministry of Finance of the Russian Federation dated December 6, 2006 No. 03-04-15/214).

However, the courts think differently.

On maintaining separate accounting by the taxpayer

, according to the arbitration courts,

the following facts indicate

.

Retail sales of goods were carried out using a cash register

.

Revenue amount

received from retail sales of goods was determined based

on the amount of revenue received at the cash register

.

Wholesale sales of goods

was carried out

with the issuance of invoices and the allocation of VAT amounts in them

.

The amount of proceeds from the sale of goods wholesale

was determined

based on sales book data

excluding VAT amounts.

Consequently, keeping separate records of VAT amounts, based on the distribution of costs in proportion to the revenue received from the sale of goods wholesale and retail, does not contradict the provisions of clause 4 of Art. 149, paragraph 1, 3, 4 art. 170 Tax Code of the Russian Federation

, clause 3 art.

5 of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”

and allows you to reliably reflect data on the sale of goods, both exempt from VAT and subject to the specified tax, necessary for the correct determination of the taxable base.

In addition, such accounting makes it possible to determine

, which goods the taxpayer used for transactions subject to VAT (wholesale sales), and which – in relation to transactions subject to a single tax on imputed income (retail sales) (Resolution of the

Federal Antimonopoly Service of the Central District

dated October 24, 2008 No. A35- 812/08-С21).

This court decision was supported by the Supreme Arbitration Court of the Russian Federation

Decree dated February 12, 2009 No. VAS-957/09.

If part of the goods for which VAT was deducted was used in activities subject to UTII, then VAT must be restored based on how many units of the goods were sold at retail

.

The use in this case of any calculation methods (distribution in proportion to revenue in accordance with clause 4 of Article 170 of the Tax Code of the Russian Federation

) is not justified.

After all, it is always known how many units of goods were ultimately sold, for example, at retail (UTII), and each unit of goods is sold either at retail (UTII) or wholesale (OSN)

.

That is, it cannot be said that this or that unit of goods was used both for carrying out transactions subject to VAT and for transactions falling under UTII.

If you expect that a significant part of the purchased goods will be sold at retail

, then, in order to prevent disagreements with tax authorities,

it is safer to take into account the amounts of “input” VAT in the cost of goods

(based on the fact that the goods were purchased for transactions that are not subject to VAT).

For that part of the goods that will be sold wholesale

under supply contracts, you will restore VAT and take it for deduction.

According to paragraphs

2 p. 3 art. 170 of the Tax Code of the Russian Federation , tax amounts subject to restoration

in accordance with

paragraphs.

2 p. 3 art. 170 of the Tax Code of the Russian Federation are

not included in the cost of goods

, but

are taken into account as part of other expenses

in accordance with

Art.

264 Tax Code of the Russian Federation .

In accordance with paragraphs

1 clause 1 art. 264 of the Tax Code of the Russian Federation other expenses

related to production and sales taken into account when determining the tax base for corporate income tax

include taxpayer expenses in the form of

, in particular,

amounts of taxes and fees

, with the exception of those listed in

Art.

270 Tax Code of the Russian Federation .

However, the Ministry of Finance of the Russian Federation believes that since the organization’s expenses in the form of VAT amounts restored and paid to the budget on goods used by the organization in carrying out operations subject to UTII were made for the purpose of carrying out business activities transferred to the payment of UTII, these expenses are for the purpose of paying income tax organizations are not taken into account

(letter dated October 5, 2006 No. 03-11-04/3/437).

That's why the tax authorities refuse

taxpayers in accounting for recovered VAT amounts as expenses.

Division of non-operating expenses

One of the private questions is where to send non-operating income - to the “simplified” or to the “imputed” income. They can be divided. But there is a Letter from the Ministry of Finance dated January 29, 2016 No. 03-11-09/4088 and a Letter from the Ministry of Finance dated December 19, 2014 No. 03-11-06/2/65762 - they say that non-operating income, which you do not understand what type activities are required to be taken into account in the simplified tax system.

When distributing general expenses, you need to pay attention to Letter of the Ministry of Finance dated November 23, 2009 No. 03-11-06/3/271. It spells out the mechanism for generating general expenses.

Transition points from UTII to the general system

Few of the former imputed people will choose the general regime due to its significant tax burden. After all, general-regime companies pay VAT and income tax, and entrepreneurs pay VAT and personal income tax. However, such cases are not excluded, so we will dwell on the features of the transition to OSNO.

Income tax

There are two ways to account for income and expenses for profit tax purposes: the accrual method and the cash method.

Tax authorities urge you to pay attention to the following points when choosing a taxation regime (letter No. SD-4-3/ [email protected] ):

- Income from the sale of goods purchased on UTII and sold on OSNO is recognized:

- on the date of sale using the accrual method; the same rule also applies if advance payment is received from the buyer before January 1, 2021;

- on the date of receipt of money from sales using the cash method.

- The cost of goods remaining from imputation, but sold on OSNO, can be taken into account when calculating income tax in the period of sale. In addition, costs associated with transportation, storage, and servicing of such goods can also be recognized as income expenses.

VAT

Taxpayers charge VAT for payment to the budget either when selling goods (rendering services) or when receiving an advance payment. Here you need to pay attention to two points:

- After switching to the general regime, VAT must be calculated on any shipment.

- VAT is charged on prepayment only if it is received after January 1, 2021, i.e. already under the general regime. If the advance payment was received when applying UTII, then there is no need to charge tax on it, despite the fact that the shipment will be made under the general regime. The tax authorities remind us of this in our already mentioned letter No. SD-4-3/ [email protected]

For the balances of material assets that were not sold at the time of the transition from UTII to the general regime, VAT is allowed to be deducted, but only if these assets will be involved in taxable activities. The deduction can be issued in the first quarter after the transition.

It will not be possible to obtain a deduction for fixed assets in use at the time of transfer. If commissioning occurs after the transition, then the former owner has the right to claim a deduction for such objects, even if they were purchased when they were still on UTII.