Briefly about the updated declaration

Such a document must be sent to the Social Insurance Fund at the place of residence of the individual entrepreneur or at the place of registration of the LLC. It is also important that it must be in a form that is valid at the time it is submitted. This is stated in paragraph 5 of Art. 81 Tax Code of the Russian Federation.

It happens that errors in the declaration lead to an overstatement of the tax, then filing an amendment will be the right of the taxpayer, and not an obligation. In this case, the tax can be refunded or offset against future payments. A covering letter may also be attached to this return application.

Submission deadlines

It is necessary to respond to a request to clarify the declaration from the tax office within business days, otherwise penalties will be charged, and an audit may also be scheduled. For electronic document management, the period increases to 6 days from the date of receipt of the request .

It is worth noting that the clarifying declaration and cover letter add red tape to the accounting work, however, the correct submission of these documents can save the company from additional checks and corresponding fines.

Compiling a cover letter for the clarification

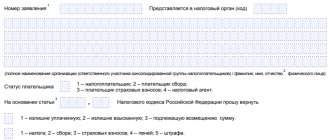

There is no legally developed form for such paper, so it is written in any form. The document must bear the signature of the head of the company, individual entrepreneur or person authorized for these actions.

A cover letter consists of a header and a body. The following information must be included in the header:

- To whom is the letter addressed? Here they write that the letter is intended for the head of the Federal Tax Service to which the entrepreneur belongs. That is, they indicate the tax office number, its address with an index.

- Who is the letter from? Enter the name of the company, its address, OGRN, INN, KPP.

- Letter number.

- The name of the document is a covering letter to the updated declaration.

Next comes the main part. It details:

- the reason why the amended declaration is being submitted;

- the period and tax for which the update was sent;

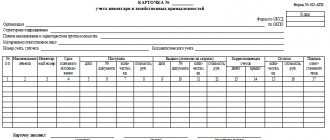

- what changes were made to the document; this item can be presented in the form of a table, where you indicate the line number of the declaration with the correction, the previous data and the new;

- amount to be paid and penalties or overpayment.

You also need to indicate what documents are attached to the letter: this is usually an updated declaration with the number of sheets, copies of payment documents (additional tax and penalties must be paid before submitting the update) or an application for a refund or offset of tax (in case of overpayment).

At the end, the individual entrepreneur or the head of the company signs. The letter must be registered in the outgoing correspondence journal.

The number of copies will depend on the method of submitting the clarification. One will be needed if the letter and declaration are sent by mail or email. Two copies are needed when submitting documents in person. In this case, one copy remains with the tax office, and on the second, the Federal Tax Service employee marks the receipt of the documents.

Attention! To write a letter, you must use a business style; there should be no colloquial or colloquial expressions and various types of errors.

Who writes?

Covering letters are written by persons who are required to declare their income. These include:

- individual entrepreneurs (IP);

- legal entities;

- limited liability company (LLC).

Individuals may also need to submit reports to the tax authorities with an explanatory note. These cases include the sale of property, receipt of income from sources abroad, and the use of inherited intellectual property. Lottery winnings are also taxable.

You can submit documents to the inspectorate and write an appendix with an explanation to them yourself, but it is better to entrust this to a lawyer. The specialist will draw up a note for the documents according to all the rules and take into account all the necessary nuances.

Cover letter sample

To the Head of the Federal Tax Service of Russia No. 9 for the Udmurt Republic 426003, Izhevsk, st. K. Marksa, 130 to Petrov Petr Petrovich from Omega LLC INN/KPP 5611234567/123456789 OGRN 223344556677 426009, Izhevsk, st. Lenina, 21A Ref. No. 131 from 05/11/2019

Covering letter for the updated VAT tax return for the first quarter of 2021

In accordance with paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, we present to you the updated declaration of Omega LLC for the first quarter of 2021.

In the initial declaration, the amount of VAT payable was underestimated by 36,000 rubles. due to non-inclusion of sales proceeds in the tax base under Act No. 234 dated March 29, 2021. The amount of unaccounted revenue amounted to 216,000 rubles, including VAT of 36,000 rubles.

The VAT return has been corrected as follows:

- The indicator in column 3 of line 010 of section 3 is increased by 180,000 rubles. (216000-36000).

- VAT in column 5 of line 010, lines 120 and 230 of section 3, line 040 of section 1 was increased by 36,000 rubles.

- The correct amount of VAT payable based on the results of the first quarter of 2021 was 567,000 rubles.

- The additional tax payment was made by payment order No. 125 dated 05/07/2019, penalties were transferred by payment order No. 126 dated 05/07/2019.

- updated VAT return for the first quarter of 2021 on 12 sheets;

- copy of payment order No. 125 dated 05/07/2019 (for additional VAT paid) in 1 copy. for 1 l.;

- copy of payment order No. 126 dated 05/07/2019 (for penalties paid) in 1 copy. for 1 l.

General Director Romanenko / A.V. Romanenko

Source of the article: https://assistentus.ru/forma/soprovoditelnoe-pismo-k-utochnennoj-deklaracii/

Reasons for request

After submitting a VAT return to the Federal Tax Service, they may find shortcomings in it . Only those errors that directly affect the amount of tax paid for the tax period are subject to correction.

Submission of an amendment and a covering letter is required only if the tax base and amount were reduced as a result of an error, i.e. there was an underpayment (first paragraph of the first paragraph of Article 81).

If the tax amount is overestimated, the decision to clarify it remains with the company.

If the company independently discovers errors in the submitted declaration, it is also necessary to draw up an updated declaration and attach a covering letter to it , without waiting for a request from the Federal Tax Service.

The cover letter provides clarification to the tax authorities about the reasons for re-filing the tax return. It must also include basic information about the changes made.

Read about the purpose of drawing up a cover letter for an updated and other types of declaration here, and from this article you will learn why and how a cover letter is drawn up to the Federal Tax Service.

When and how to submit an updated declaration under the simplified tax system?

When a taxpayer of a simplified tax discovers errors in his accounting, as a result of which the amount of tax was underestimated, his obligation becomes to submit an updated declaration for this tax (clause 1 of Article 81 of the Tax Code of the Russian Federation). The period for submitting updated declarations is not limited by time frame, i.e. if an error is found in a report sent more than 3 years ago, for example in 2015, you need to submit an update for this period as well. But keep in mind that this will only allow you to sync with your tax balance. Any overpayment that is discovered will not be refunded to you.

Find out in ConsultantPlus what time period to submit an update if errors are identified by tax authorities. Get free trial access to K+ and go to the Ready Solution to find out all the details of this procedure.

This is not difficult to do. The main thing is to stick to a simple algorithm:

1. Find the error and determine the period to which it relates.

2. We calculate the amount of arrears, calculate penalties and transfer these amounts to the budget. It is important to do this before submitting the amended declaration (clause 4 of Article 81 of the Tax Code of the Russian Federation) so that there is no fine.

To quickly and without errors calculate the amount of tax, use our simplified tax system 15% calculator or simplified tax system 6% calculator. We also have a separate penalty calculator.

In this case, it is important to correctly indicate the BCC so that the funds are immediately credited for their intended purpose.

This article will help you choose the right KBK according to the simplified tax system.

3. To draw up an updated declaration under the simplified tax system, we use the form of the document that was in force during the period of error (clause 5 of article 81 of the Tax Code of the Russian Federation). On the title page of the declaration, in a special field, indicate the serial number of the clarification.

4. We indicate the correct data in the updated declaration. Simply put, we fill it out again, rather than enter the difference between the primary and secondary amounts.

5. We draw up a cover letter for the updated declaration (we will tell you how to do this below) - this is not a requirement, but a recommendation.

ATTENTION! If an error discovered in the declaration led to an overpayment of tax, i.e. there was no underestimation of the tax base, the taxpayer has the right, but not the obligation, to submit an updated declaration. Most likely, filing such a declaration will attract the attention of tax inspectors, and the likelihood of a tax audit for the specified period will increase sharply.

Is it necessary?

The bureaucracy in the Russian Federation is comprehensive, requiring for each document drawn up at least one more, with the registration of the presented certificates in the appropriate journals. Accompanying letters occupy a special place among certificates and documents. Accompanying the updated declaration with an explanation is not a mandatory document. If the taxpayer sent the reporting without errors and the tax inspectorate has no questions, there is no need to attach an accompanying explanation.

However, if inaccuracies or errors were identified in the declaration, then in this option, the person will have to correct the reporting and send it along with an attached letter indicating the inaccuracies and reasons for such errors. The main thing is that this message contains the necessary information for employees of the Federal Tax Service in relation to the declaration.

In addition, the accompanying letter can be drawn up with a list of attached documents to ensure that not a single piece of paper is lost.

In what cases is it necessary?

As already noted, the accompanying letter is not considered a mandatory message when sending an updated declaration and is not regulated by the legislative norms of the Russian Federation. At the same time, practice demonstrates that the explanation to the declaration helps speed up and facilitate the work of Federal Tax Service inspectors.

It is recommended to attach accompanying explanatory notes to the following types of reports in the following cases:

1) An updated declaration, which is sent to the Federal Tax Service:

- Until the end of the declaration period.

- After the deadline for sending the declaration, but before the final deadline for paying taxes.

- After completion of all deadlines.

2) Zero reporting submitted by individual entrepreneurs in the absence of work.

3) Forest - displaying information about the use of forest resources, with a report on actual deforestation.

4) According to UTII, which represents quarterly reporting, regardless of activity or downtime, as well as in the absence of income.

5) According to the simplified tax system – reporting to the tax office of an individual entrepreneur or LLC for the calendar year, regardless of the presence/absence of profit.

In addition, the attached explanation can be sent if questions arise from tax authorities during a desk audit, for the reasons noted in paragraph 3 of Art. 88 Tax Code of the Russian Federation.

At the same time, it should be borne in mind that many employees of the Federal Tax Service prefer to have explanatory notes, especially when sending corrected reports. In this case, the explanation displays comprehensive data about the reason for clarification of reporting, which simplifies the work of tax authorities.

In all other situations, the accompanying document is not a mandatory element.

Covering letter for the updated declaration under the simplified tax system

Let's take a closer look at the cover letter. It is drawn up to prevent questions from the tax authorities about the reasons that influenced the change in the amounts due for payment to the budget or refund from it.

Basic details that must be indicated in the letter:

- name of the body to which the updated information is provided;

- details of your organization (name, OGRN, INN, KPP, address, telephone);

- outgoing letter number and date;

- signature of the chief accountant and director of the organization; seal, if the company has one.

We recommend including the following information in the body of the letter:

- for what period and for what tax is the updated declaration submitted;

- what exactly was the error discovered by the accountant that resulted in the need to submit an updated declaration;

- what exactly has changed - it is advisable to indicate not only new, but also old values of the changing indicators;

- the amount of tax and penalties to be paid, indicating the details of payment slips for their payment;

- amount of overpaid tax - if you want to refund or offset the overpaid tax, indicate the number and date of the application for refund or offset of tax.

Submission rules

A covering letter is sent to the tax office along with the declaration . You can submit the application along with a package of documents to the organization in person. It is also possible to send reports with an explanatory note by mail.

Covering letters are not mandatory elements when sending reports to the tax authorities, but their presence helps to avoid a number of problems and questions. The main thing is to correctly compose the application and clearly indicate your requests and explanations in it.

Results

Errors are occasionally made during the accounting process. Having considered the procedure for filing an updated tax return under the simplified tax system, we found out that it is not at all difficult to do. Moreover, it will be better for the organization if the accountant himself finds and corrects inaccuracies in accounting, without waiting for auditors. The main thing to remember is that taxes and penalties must be paid before filing an updated return.

Source of the article: https://nalog-nalog.ru/usn/deklaraciya_po_usn/kak_podat_utochnennuyu_nalogovuyu_deklaraciyu_po_usn/

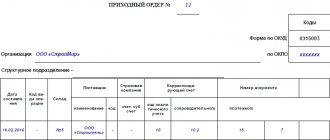

"Late" documents

It is not uncommon for documents to arrive late from a supplier.

The question arises: is it necessary to submit an updated VAT return if, for example, at the end of October an invoice was received from the supplier, dated, say, September? No no need. You can include such an invoice in the current quarter's purchase ledger. This right is given to you by clause 1.1 of Article 172 of the Tax Code of the Russian Federation, according to which VAT deduction can be claimed within three years after goods (work, services) are registered. Let us remind you that this norm is in effect from January 1, 2015.

However, if we are talking about an “advance” invoice, then this rule does not apply (Letter of the Ministry of Finance of the Russian Federation dated 04/09/2015 No. 03-07-11/20290). But if you have proof of the late receipt of such an invoice and if you want to claim a deduction on it, you will be able to reflect it in the current quarter.

How to respond to tax authorities’ demands to explain losses under the simplified tax system

Let's assume your organization is on a simplified basis (income-expenses, 15%). At the initial stage of activity, you suffer losses or have minimal income. A year passes, and after submitting a declaration under the simplified tax system for the reporting period, you receive a request from the tax office asking you to provide an explanation of the funds spent or to adjust the declaration in the direction of increasing the tax. The tax office has access to the bank statement and therefore sees the turnover that occurred during the reporting period. And you have expensed actual transactions for the purchase of goods or services that you use in your future activities.

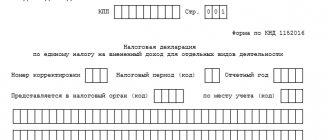

Sample of filling out a simplified taxation system declaration for an individual entrepreneur

Entrepreneurs using the simplified taxation system (STS) do not report quarterly, as in most cases with other taxation systems, but once a year. Their annual reporting is kept to a minimum; you just need to submit a declaration in the required form to the Federal Tax Service (KND 1152017).

This form was approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] The appearance of the document is given in Appendix No. 1 to this order, Appendix No. 2 describes the format of the electronic declaration (required for individual entrepreneurs with 25 or more employees), Appendix No. 3 describes the rules for filling out the declaration.

Individual entrepreneurs submit reports no later than April 30 of the year following the reporting year, legal entities - before March 31. But there are nuances, so you can clarify the deadline using the Report Submission Deadline Calculator.

The sample declaration in question was filled out by the individual entrepreneur using the service presented in the left column of the site. All values in the document are calculated automatically.

We will try to understand how the row values are obtained, and also touch on the basic rules for filling out annual reporting.

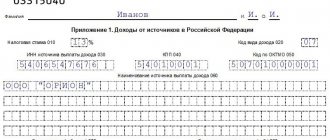

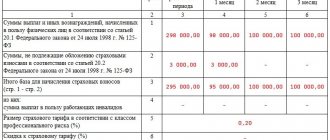

So, we start the calculation from section 2.1.1.

Initial data for calculation (rub.): Tax rate: 6%. Income in the 1st quarter was 450,004.12, in the second quarter 129,042.19, in the third quarter 131,741.05, in the fourth quarter 978,112.87. Contributions were paid (RUB)

): in the 1st quarter 9059.5, in the second quarter 9059.5, in the third quarter 9059.5, in the fourth quarter 9059.5. The object of taxation is “income”. The taxpayer is not a trade tax payer.

The taxpayer has no employees.