To automate the preparation and execution of tax and accounting documents, you will need the latest version of the Taxpayer LE 4.71 for individuals and legal entities. This specialized solution is an excellent option for businessmen who want to work efficiently and in accordance with the letter of the law in current conditions. The product helps not only to prepare reports for state and extra-budgetary funds, but also to generate a variety of documents in electronic form.

Latest version of the program: 4.71

Free download Taxpayer Yul 2021, latest version 4.71:

Download additional files for the Legal Entity Taxpayer program:

Program features

The Taxpayer Legal 4.71 program allows you to forget about the paper boom when you need to prepare reports for regulatory agencies. After all, this product allows you to automate the process, make it faster and better. The software helps generate documents that fully comply with the requirements of Russian legislation.

Some of the key benefits it provides to users include:

- generation of various tax and accounting documents;

- documentation forms are kept up to date by the developer;

- timely updates are guaranteed;

- interface that is understandable even for inexperienced users;

- availability of reference books and tips to help compile reports.

The Russian version of the software package Taxpayer YUL 4.71, presented on the website, can be used by legal entities and individuals. This solution supports all reporting forms required for submission. The program is being developed by a state-owned enterprise. Therefore, you don’t have to worry about the reliability and accuracy of the reporting documents prepared for the inspection structures.

Functionality of the Taxpayer Legal Entity program

Uploading a taxpayer legal entity for an individual entrepreneur under the simplified tax system means “hiring” an assistant who will always be at hand. The Russian version for legal entities and individual entrepreneurs contains current reference books and classifiers. The undoubted advantage of the Taxpayer Legal Entity software is the built-in system for checking available updates. The user can check for a new version without leaving the program. The functionality of the solution is very extensive:

- support for various reporting forms;

- documents are generated semi-automatically;

- there is a support forum, detailed help;

- the ability to use the current list of forms;

- the presence of a variety of forms that are not directly related to reports to the Pension Fund or the Tax Inspectorate, but are useful when doing business;

- Reporting documentation can be printed and saved to a computer in xml format.

The fully functional Taxpayer program helps generate reporting documentation to government agencies (accounting and tax reports, packages of documents for statistics, for credit companies, etc.). The software's capabilities are constantly being improved. Specialists use the solution to prepare all required reports and subsequently submit them on paper or electronically.

The Taxpayer Legal Entity software package also has an accountant’s calculator for the current year. This tool helps generate time sheets and count the number of days and hours of working employees. To start using the product's capabilities, you need to install the solution distribution kit on the hard drive of your personal computer.

The installation and portable version for Windows is located on our website. Download the program for free with a patch and use it for the benefit of your business. The software package will be useful not only for individual entrepreneurs, but also for companies that transfer VAT to the budget.

System requirements

The latest version of Taxpayer Legal Entity 4.71 will work correctly on any version of the Windows operating system, as well as Linux and Vista. The minimum system requirements for such a product are as follows:

- 512 MB of RAM;

- monitor resolution is at least 800x600;

- free hard disk space of at least 1.5 GB;

- video card 1020x768.

Subject to the above conditions, the installation and portable version of Taxpayer Legal 4.71 for Windows will help users who need to prepare tax and accounting documents. This PC software package will allow you to generate reports to the tax service.

Installation and update tips

The developers give the following recommendations:

- Disable the anti-virus program at the time of installation of the complex, and then enable it again.

- If you cannot install the program, you need to look in the system event log . To do this, you need to go through “My Computer” to “Management”, then to “Computer Management” and then to “Utilities”. There you need to look at the records regarding the “Legal Taxpayer” complex. If there are any system comments, they will be displayed on the screen.

- The new basic version of the program can be installed on top of the old one. a backup copy first . Then, in case of unsuccessful installation, the data can be restored. The software package itself will warn you about the need to save existing information and offer a place to place the archive (you can change it if desired). Data recovery is performed through the “Service” .

- Before starting work, you should always check for updates. To do this, in the “Service” , select “Search for updates on the Internet” . current reporting forms and other important changes will not be downloaded

You can send electronic reports to the Federal Tax Service and other authorities through Kontur.Extern. Read about how to submit a report to the tax office through this service.

Functions that the program performs

It is necessary for citizens, non-profit organizations and legal entities to download Taxpayer Legal Entity 4.71 for free from the official website to generate documents for the Pension Fund and the Federal Tax Service. Such software is not just for creating reports. Using it will allow you to find out OKATO codes. All data that this complex helps to generate complies with tax legislation. Despite the fact that it changes quite often in Russia, the developer manages to update his solution.

Among the key features of the Taxpayer Legal 4.71 program:

- generation of a tax return for personal income tax;

- creation of tax returns for companies on the simplified tax system and on UTII;

- submission of information on the average number of personnel of the organization;

- preparation of property tax returns;

- preparation of VAT returns;

- generation of profit and loss statements.

The software package Taxpayer UL 4.71 contains all the necessary information for users. There is an accountant's calendar, a "Document Wizard", and tips for those who use it for the first time. The program allows you not only to create documents that need to be submitted to regulatory authorities. It prints them, uploads them to xml files, and allows you to maintain an archive. At any time the user will be able to make adjustments and necessary changes.

Version update

An entrepreneur needs to regularly monitor the release of new versions. When drawing up a document in an old-style application, there is a risk of making an error, because The Federal Tax Service requirements specified in the program may no longer be relevant.

There are two options for updating the application: on the Federal Tax Service website or directly in the application window after clicking the “Search for updates” button.

When installing a new version, the old program should be automatically removed from the PC. If this does not happen, you need to independently remove it from the computer base to avoid unwanted failures.

The program requires the entrepreneur to have certain knowledge and desire to understand the system. It will significantly simplify the work of a tax agent and accountant, whose responsibilities include regular submission of reports.

Current version of the program

The Taxpayer Legal Complex 4.71, which can be downloaded without registration on our website, is the latest, updated version released by the developer. This installation package with a patch is characterized by expanded functionality, accuracy of all operations, and speed of operation. It helps to generate a variety of reports, working documents, maintain invoice logs, perform analytics, and send requests. This application will allow you to create documents on payments, on opening and closing accounts in banking institutions.

The program Taxpayer Legal Entity 4.71, with adjustments made to the distribution, will function on users’ PCs. Installing the Russian version is not difficult. If difficulties arise, you should disable your antivirus. After installation, all functions of the complex will be available. Download software that will help solve current problems related to the preparation and execution of various documentation.

Opportunities of the “Legal Taxpayer” that you do not know about

Surely you have heard about the “Legal Taxpayer” program and even worked in it. Most likely reporting was generated. But the functionality of the program can be much wider, for example, it can keep records of salaries, personnel, goods and services, and work with non-formalized documents.

The extended version of the Taxpayer is PC “EON”. We briefly talked about its capabilities in the first issue of our blog. And now we want to share the practical experience of our users in working with the program.

Do you know that an organization can submit reports for free through the Federal Tax Service website ? Using a special service. Of course, there are restrictions, for example, you cannot send a VAT return through this resource. You also need to have a valid electronic signature and set up a workplace. However, for small organizations this is a way to save on connecting to an operator.

However, another problem remains - record keeping itself, registration of employees, payroll calculations, etc. Often small companies are not ready to buy expensive programs , and in addition to them, franchisees and developers even add services and services that are unnecessary for business. And no one likes to overpay.

There is nothing superfluous in the EON PC. But our database contains a huge number of forms - more than 270 tax forms, about 40 for the Pension Fund, about 90 for statistics. The program allows you to generate reports and then translate them into any convenient format - printed, electronic xml file for sending through an operator or a transport container for transmission to the Federal Tax Service through the portal of the Federal Tax Service of Russia.

Our clients have already appreciated the convenience of the program and leave us their feedback:

LLC "Software and Hardware Complexes", Evgeny Shevelev.

"Good afternoon! Since 2008, we have been using, first “Taxpayer Legal Entity”, and then PC EON.

I like the program because it has a complete set of reporting forms and the closest approximation of the completed forms to the appearance of the final documents.

Using the program in a network version allows several performers to simultaneously work with one Client base.

The program is not demanding on computer resources, it allows you to work in outdated operating systems, in our case - Windows XP, which is important for long-established organizations with an established software and hardware structure. One of the advantages of PC EON, again “out of step” with fashion, is local rather than “cloud” server installation, which allows you to work in case of problems with Internet connection.

But remote mode can also be used, if necessary, as we did during the quarantine period. We installed remote control programs (in our case, LiteManager) on workstations and successfully completed the work.

For several years now we have been using the EON PC simultaneously with another system (of similar functionality, but a slightly different organization) - “Kontur.Extern” from SKB Kontur.

And, in this connection, PC EON is our faithful, reliable assistant in our work.”

Evgeny emphasized one important detail - the EON PC, unlike many other accounting programs, is really not demanding on equipment resources. This means that you can use, for example, a laptop for work. And as you know, they are most often inferior in power to desktop computers. Businesses now value mobility, so a work laptop will come in handy.

For accountants who manage several organizations at once, we also have a solution. The network version of the EON PC is designed to work online in multi-user mode, including for legal and authorized (tax) representatives of legal entities or individuals (for organizations that create documents for many enterprises, organizations or individuals (represent them in various government agencies).

Please note - you can purchase the program as an individual . This is important, because not all franchisees of other programs work, for example, with self-employed individuals (not individual entrepreneurs). You simply cannot purchase the program from them; you will need to negotiate with one of the clients to buy the product on his behalf. Agree - not very convenient?

To prove that accountants like PC “EON”, here is another review from our client: Andrey Ross “... the EON program is very easy to use, meeting ALL the needs of accountants and all people who work with EON.”

The cost of the network version of the EON PC is 13,000 rubles. The version can operate on a local network on an unlimited number of workstations .

To buy the program, just write to us by email or leave a request using the form at the end of the article. We will send you an invoice agreement, after payment you create and send it to the registration file and in response you will receive a key file by email that needs to be loaded into the program. That's it - you can work with the network version.

Our special pride is maintaining personnel records and salaries. Firstly, it is convenient, especially for those for whom the functions of a personnel officer and an accountant are not separated and one specialist copes with both responsibilities. Secondly, all types of reports are generated based on the data.

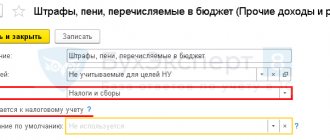

In order not to miss an important event - paying tax, submitting an income tax return, reporting to the Pension Fund - set up the Tax Calendar :

In the EON PC you can keep records of goods and services , issue documents to customers and, based on this information, generate invoice journals, purchase and sales books and a VAT declaration.

If several users work with the program , then you will probably need functions such as:

- keeping a log of work with documents - saving information about who, when, where and what did with documents (entering, adjusting, deleting, uploading);

- saving/recovering information;

- analytics;

- access control.

In addition, the program contains reference books and gives tips on drawing up documents and reports, which allows you to quickly find the answer to a question without being distracted by searching for information on the Internet, for example, on filling out the DAM.

You will find in PC “EON” other documents necessary for the work of the organization:

- taxpayer registration documents;

- request for a joint reconciliation report;

- books on special regimes;

- cash desk, banks, payment documents;

- accounting of income and expenses of individual entrepreneurs;

- log of powers of attorney;

- analytics, risk assessment of IR verification, financial analysis;

- accounting of waybills, contracts;

- accounting for applications for the import of goods and payment of indirect taxes;

- requirements for providing an explanation for VAT;

- registers of information on VAT and excise taxes;

- register of documents (checks) for VAT compensation;

- and others.

Update “Legal Taxpayer” using built-in functionality

You can also use the built-in update function using the program window. Launch your “Taxpayer Legal Entity”, click on the “Service” tab there, and select the “Search for updates from the Internet” option there.

Select the option “Search for updates from the Internet”

If new updates are found, you will see a notification.

Click on "Yes" to install updates

Click on “Yes” and wait for the update to install.

Please note that if a new major version is found (in our case this could be 46.6), then it will need to be installed from scratch, as described in the section above. Otherwise, the program functionality may be unstable.

What does the new version contain?

In the latest version, there have been updates such as changes in the creation of XML files and the transfer of data according to the third form of personal income tax. An improvement has been made here regarding the entry of information on tax returns. The encoding reference book has been updated in the application. Updates can be easily installed on any old version of the program. To do this, simply follow the prompts during download and installation.

Some users note that the hacked version of “Legal Taxpayer” does not work correctly. In this case, failures often occur during unpacking of certain archives. The developers are working on these bugs and fixing the bugs with each new update. If you also encounter this problem, you need to follow these steps:

- Disable all programs that are currently running on the PC.

- Remove old software.

- Restart the application installation process.

Often these actions help resolve the situation.

Download TESTER program version 2.136 checking report files for tax authorities

- Convenient ACCOUNTANT CALENDAR 2018-2019, Deadlines for submitting all reports. Deadline for submitting reports for 2018-2019. Table for submitting balance sheets, tax reporting for organizations and individual entrepreneurs. When to submit the declaration 2018-2019, 1st quarter, half year, 9 months.

- 2-NDFL 2021 certificate SAMPLE of filling out download An example of filling out a 2-NDFL certificate is given. Descriptions of help fields are provided. A link to the 2nd personal income tax certificate is provided.

- 2-NDFL 2021 deadline for submitting the certificate form DOWNLOAD for free New forms of the 2-NDFL tax return are reported. Deadlines for delivery. Where to download for free. Taxpayer program. New format 2-NDFL.

Solving possible problems during the update

Some users encounter errors when trying to update Taxpayer Legal Entity to the latest version. We will look at the most popular of them and tell you how to find a suitable solution in a few steps. If you have any difficulties, find below the recommendation that suits your situation.

- If, after a successful update, the program starts again with the same version, it is recommended to restart the computer. If this does not help, re-run the installer downloaded from the official website and make sure that it really belongs to the latest build and is not the same.

- If the “This installation package cannot be opened” notification appears, either simply skip this step since the “Print RD with PDF417(3.2.4)” package is already installed on your computer, or abort the installation. Make sure that the antivirus is really disabled, deactivate it if necessary and repeat the installation.

- After the update, strange symbols may appear in the main program window instead of Russian letters.

In Windows 10, this can be solved by switching the interface language to English and back, and in Windows 7 you will need to install a language pack if this has not been done previously. These two methods are discussed in detail in other articles on our website using the links below. Read more: Installing a language pack in Windows 7 Changing the interface language in Windows 10

We are glad that we were able to help you solve the problem. In addition to this article, there are 11,828 more instructions on the site. Add the Lumpics.ru website to your bookmarks (CTRL+D) and we will definitely be useful to you. Thank the author and share the article on social networks.

Describe what didn't work for you. Our specialists will try to answer as quickly as possible.

Important information

When updating Taxpayer Legal Entity, it is necessary to take into account several features of the operation of this software. We will talk about them first, so that during installation you do not make mistakes and accidentally delete the database with working information.

- When upgrading to build 4.71 (currently the newest version), you do not need to install every previous version up to the one you are using, since the developer has corrected this situation, significantly simplifying the process of switching to the current version for ordinary users. Let us remind you that previously it was impossible to jump immediately, for example, from version 4.5.2 to 4.6, if 4.5.8 also exists. It was necessary to first install the intermediate version, and then the latest build, which took a lot of time.

- Be sure to disable third-party antivirus if one is installed on your computer.

This will avoid accidental entry of Taxpayer Legal Entity files into quarantine during their unpacking and will prevent conflicts that arise as a result of this error. Read more: How to disable antivirus - If the update applies not to one local computer, but to all connected to the server at once, then it must be installed directly on the server, where both the first launch and re-indexing are carried out. After this, other participants can connect to the software and check if the latest version is available to them.

- When updating, the previous software build is deleted if it is installed in the same folder. At the same time, user data remains, that is, accounts and completed forms that you used previously. Therefore, it is important to follow the installation procedure, which we will describe below.

- Do not download the update file in MSI format to the same folder where the Legal Entity Taxpayer program is currently located, since launching from the root leads to conflicts related to the operating features of this tool.

Once you have read the information presented and understood all the intricacies, proceed to the next sections of the article, made in the format of step-by-step instructions.