- Legislative justification

- Calculation of average earnings to determine the amount of vacation pay

- Dependence of the calculation of vacation pay on the period of wage indexation at the enterprise

- Examples of calculating vacation pay in various situations

- Key points when indexing

- Answers to frequently asked questions

Indexation of vacation payments is a way to protect workers from inflation, which is ensured by Article 130.

Labor Code of the Russian Federation. Indexation itself does not increase income, but helps maintain the employee’s purchasing power. According to Article 134 of the Labor Code, indexation for public sector workers is established by law. Heads of commercial structures prescribe the possibility of indexation in an employment agreement or local act. According to the written order of Rostrud dated 19/IV - 2010, if indexation is not provided for in documents, then it is subject to change in order to correct this situation.

There are cases where the indexation of vacation pay when salaries are increased in 2021 is provided for by an industry agreement. Some commercial organizations provide for quarterly indexation in proportion to the increase in prices for consumer products.

What about salary increases?

Increasing wages is a common procedure carried out by employers. Moreover, such an increase can be achieved using different methods:

- by indexing;

- salary increase.

Despite the fact that these methods are similar in their results, their nature is different in essence. Indexation is a guarantee provided at the state level (Articles 130, 134 of the Labor Code of the Russian Federation). The salary increase is voluntary.

The differences between these procedures are discussed in more detail below:

| Criterion | Indexing | Salary increase |

| Need for use | Mandatory | Voluntary |

| Circle of people | Applies to all employees | Does not apply to all employees |

| Causes | Impact of rising prices | Employer's decision |

| Increase size | Regulated at the state level | Set by the employer |

Salary increases in the form of indexation should be applied by all employers. Moreover, one of the conditions for using such an increase is the presence of a mention of this in the collective agreement or other local regulatory act of the enterprise (definition of the Constitutional Court of the Russian Federation dated November 19, 2015 No. 2618-O, letter of Rostrud dated April 19, 2010 No. 1073-6-1). In addition, it is within the competence of each employer to independently establish indexation rules, as well as determine the indexation coefficient itself.

The indexation coefficient (CI) is determined in the following way:

CI = Salary after indexation / Salary before indexation

NOTE! Since indexation is a government measure to bring the income received by citizens into line with the level of current market prices, the value of the CI provided by the employer is recommended to be correlated with the inflation rate for a specific region or country (determination of the St. Petersburg City Court dated March 21, 2011 No. 3866).

At the same time, it is also necessary to adjust the average earnings (AS). Note that the SZ should be adjusted if the wages themselves (salaries and tariff rates) change. If the size of other payments, for example compensation or incentives, has increased, this does not entail the need to adjust the SZ (clause 16 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, hereinafter referred to as the Regulations).

If you have access to ConsultantPlus, check whether you indexed your average earnings correctly when calculating vacation pay. If you don't have access, get a free trial of online legal access.

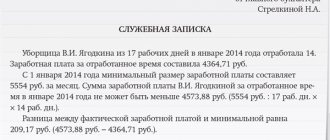

Comparing salary with minimum wage

Labor legislation does not establish a specific salary for workers. At the same time, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation).

According to Part 1 of Art. 133 of the Labor Code of the Russian Federation, the minimum wage cannot be lower than the subsistence level of the working population. However, this rule is not currently in effect, since no federal law has been adopted, which, by virtue of Art. 421 of the Labor Code of the Russian Federation must establish the procedure and timing for the gradual increase in the minimum wage to the subsistence level.

For information: with the minimum wage it is necessary to compare the total amount of accrued (and not paid) monthly wages for fully worked time, which means not only salary (tariff rate), but also compensation and incentive payments (Article 129 of the Labor Code of the Russian Federation, Definition of the Armed Forces of the Russian Federation dated August 30, 2013 No. 93-KGPR13-2). The amount of salary received by the employee in person may be lower than the minimum wage, since, in particular, personal income tax was withheld.

According to the rules of Art. 133.1 of the Labor Code of the Russian Federation in a constituent entity of the Russian Federation, a regional minimum wage may be established by a regional agreement on the minimum wage. It should be remembered that the minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage provided for by federal law. Here are some examples:

The regional agreement on the minimum wage in St. Petersburg for 2021 (concluded in St. Petersburg on September 12, 2016 No. 310/16-C) established the minimum wage in the amount of 16,000 rubles. Moreover, according to clause 1.1 of this document, the tariff rate (salary) of a 1st category employee should not be less than 13,500 rubles;

The regional agreement on the minimum wage in the Novosibirsk region dated November 29, 2016 No. 10 from January 1, 2021 in the region established a minimum wage for employees of public sector organizations in the amount of 9,030 rubles, and for employees of non-budgetary organizations (except for agricultural organizations) – in the amount of 10,000 rubles.

If, after changing the federal minimum wage, the regional minimum wage is still higher, the employer should not change the salaries of employees.

Please note: a regional minimum wage may be provided for employees working in the territory of the relevant constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

What to do if an employee’s salary is less than the established minimum wage?

If an employee has worked the full working time, he must be given an additional payment from the date when the new minimum wage came into effect. To do this you need:

or increase the employee's salary. An increase in salaries is relevant primarily for those organizations that have a salary system, with no additional payments or allowances, and the employee’s salary is equal to the minimum wage;

or prescribe in a local act a special additional payment up to the minimum wage.

When increasing employee salaries to the minimum wage, the employer must:

Issue an order to increase salaries. The order is drawn up in any form, since there is no unified form provided by law

Make changes to the staffing table. If the minimum wage is increased in the middle of the year, the staffing table can be changed by order of the manager, after which this change must be taken into account when approving the staffing table for the next calendar year

Conclude additional agreements to employment contracts with employees. Such agreements are concluded in writing with all employees whose salaries depend on the minimum wage. In the additional agreement, it is necessary to indicate the clause (subclause) of the employment contract where changes are made, and also specify all the changes (how the salary changes and from what date). The additional agreement is drawn up in two copies: one remains in the HR department, the other is received by the employee. The employee must sign an additional agreement to the employment contract

Here is a sample order for a salary increase in connection with a change in the minimum wage.

Limited Liability Company "Matrix" (LLC "Matrix")

Order No. 27-k on increasing salaries due to changes in the minimum wage

June 30, 2021

In connection with the increase in the minimum wage from July 1, 2017 on the basis of Part 11 of Art. 133.1 of the Labor Code of the Russian Federation

1. Establish from July 1, 2021 in the manner provided for in section. 6 of the Regulations on remuneration, approved by Order No. 38-k dated December 23, 2013, salary in the amount of 7,800 rubles. to the following employees:

– Ivanov Igor Alexandrovich; – Sergei Vladimirovich Petrov; – Sidorov Igor Sergeevich.

2. The head of the HR department, T. L. Kashina, prepare additional agreements for employment contracts with I. A. Ivanov, S. V. Petrov, I. S. Sidorov.

The order may not reflect specific names, but rather provide the names of positions for which new salaries are to be established. The order may also contain instructions for the accountant to calculate salaries taking into account the increase in salary for the relevant employees or positions.

What is the procedure for wage indexation?

All changes in working conditions must be fixed in the employee’s employment contract. In this connection, when indexing earnings, the employer should certainly enter into an additional agreement with the employee to the employment contract indicating the updated amount of remuneration. In this case, it is important to make reference to the provision of the local act, in accordance with which the change in wages occurred (Article 134 of the Labor Code of the Russian Federation).

How to correctly index wages, see here.

Additional payment up to the minimum wage

This determines the fact that the comparison of the minimum wage volume and the final amount of the employee’s remuneration must be carried out taking into account all additional charges of the subject, in addition to the salary. A similar situation is recorded in Letter of the Ministry of Finance of the Russian Federation No. 03/03306/1/768 dated November 24, 2009. Also, the indicated legislative act considers the situation when an employee was deprived of a bonus, which brought the salary to a level below the minimum wage. In such conditions, the employer must provide the subordinate with additional payment up to the minimum wage.

However, there is an exception to the above statement that is valid for employees of the Far North. In particular, based on the Review of judicial practice, decided by the Supreme Court of the Russian Federation on February 26, 2014, the salary is correlated with the minimum wage without taking into account local allowances for experience in a special climate and local increasing coefficients.

The wages of employees of budgetary entities should also not be lower than the minimum wage. At the same time, the amount of remuneration for work compared with the minimum wage does not take into account payment for overtime work, sick leave, financial assistance and bonuses for anniversary events. Additional payment up to the minimum wage in a budgetary institution is carried out in the same manner as in commercial organizations - on the basis of an order from the manager of the institution.

An additional payment up to the minimum wage for an incomplete month worked will be due only if the calculated earnings for the time actually worked are below the minimum wage level, also calculated in proportion to the period worked. If, for example, the subject worked 11 days out of 22, the minimum amount of funds will be 50% of the minimum wage.

Is it necessary to index vacation pay?

Due to the fact that the calculation of vacation pay depends on the size of the SZ, the indexation carried out in the organization affects the amount of vacation pay.

SZ for the purposes of the Labor Code of the Russian Federation is determined in accordance with Art. 139 Labor Code and Regulations.

According to clause 16 of the Regulations, an increase in the employee’s SZ is carried out with an increase in tariff rates, salaries (official salaries), and monetary remuneration in the organization (branch, structural unit). From the provisions of this norm it follows that the indexation of SZ is carried out if the increase affected all employees of the company. If such an increase is not carried out in relation to at least one employee, then the SZ is not indexed. The rationale for this conclusion can be found in letters from the Ministry of Health and Social Development of Russia dated January 30, 2009 No. 22-2-176 and Rostrud dated October 31, 2008 No. 5920-TZ. Thus, the indexation of vacation pay is influenced by the fact whether the SZ was increased or not.

Stages of calculating the coefficient for remuneration

The calculation of the coefficient is carried out in several stages:

- Indexing the average salary level by a coefficient for increasing the salary. It is calculated by dividing the salary after the increase by what it was before the new indexation.

- The second stage is to index average earnings by a free coefficient for increase. This method is used if the employee had bonuses, additional payments and extra payments.

In order to calculate the increase factor, you need to divide the total amount of allowances and bonuses after the increase by the amount that was before indexation.

The use of one or another method is applied individually .

How is vacation pay indexed?

The indexation of vacation pay depends on the following factors:

- If the salary increase occurred during the period that is used to calculate vacation pay, then the SZ must be adjusted to the CI for the entire billing period.

- If the increase occurred during a period that is not included in the calculation of vacation pay, but precedes the vacation, then the SZ must be indexed for the calculation period.

- In cases where the salary increase occurred on vacation days, the SZ is adjusted from the date of the salary increase.

To index vacation pay, you must use the CI calculated using the above formula.

Note that the calculation period for determining the SZ for vacation pay is 12 months preceding the start date of the vacation.

For more information about the nuances of calculating vacation pay, see the article “What is the calculation period for vacation - vacation experience .

Calculation of benefits for sick leave and minimum wage

Federal Law No. 255-FZ provides for cases when the minimum wage must be used to calculate benefits:

if the employee has no earnings in the billing period or his earnings are less than the minimum wage (part 1 of article 14 of the law, paragraph 11.1 of Regulation No. 375);

if the employee’s length of service is less than six months (Part 6, Article 7 of the law);

if the employee violated the treatment regimen (clauses 1, 2, part 1, article 8 of the law);

in case of incapacity for work due to alcohol intoxication (clause 3, part 1, article 8 of the law).

From what period should a minimum wage of 7,800 rubles be applied?

In part 1.1 of Art. 14 of Federal Law No. 255-FZ directly states that benefits are calculated based on the minimum wage as of the date of onset of disability.

Thus, in 2021, in the situation under consideration, the amount for calculating benefits (24 times the minimum wage), depending on the date of onset of disability, will be:

from 01/01/2017 to 06/30/2017 – 180,000 rubles. (RUB 7,500 x 24);

from 07/01/2017 – 187,200 rub. (RUB 7,800 x 24).

The average daily earnings of an employee are determined by the formula (clause 15.3 of Regulation No. 375):

Average daily earnings for calculating benefits = minimum wage x 24 / 730

When determining the amount of daily benefit, as a general rule, the average daily earnings must be multiplied by a percentage, which depends on the length of insurance (60, 80 or 100%).

Please note: in order to determine that the average daily earnings, on the basis of which benefits are calculated, is less than the minimum wage, it is necessary to compare two values. You need to divide the average earnings for the two previous calendar years by 730 - this will be the size of the average daily earnings. The second value is the minimum wage, multiplied by 24 and divided by 730. The result is the average daily earnings based on the minimum wage. To calculate the benefit, the largest amount is taken.

When filling out a sick leave certificate, the accountant must indicate the following.

In the field “Average earnings for calculating benefits”

Minimum wage increased by 24 times

In the field "Average daily earnings"

The result of dividing 24 times the minimum wage by 730.

The average daily earnings of an employee are:

– for periods of incapacity for work from 01/01/2017 to 06/30/2017 – 246.58 rubles; – for periods of incapacity for work starting from 07/01/2017 – 256.44 rubles.

From what moment is a benefit paid in an amount not exceeding the minimum wage if the line “Notes on violation of the regime” is filled out on the sick leave sheet (one of the codes from 23 to 28 is indicated in the first two cells)?

In this situation, benefits should be paid in an amount not exceeding the minimum wage for a full calendar month from the date of the violation (Clause 2, Article 8 of Federal Law No. 255-FZ).

The date of violation of the regime is indicated in the line “Notes on violation of the regime” after the code. The maximum amounts of daily benefits paid from the day of violation of the regime are given in the table.

Number of calendar days in a month

The maximum amount of daily benefit for days of incapacity for work falling

For the period from 07/01/2016 to 06/30/2017

The procedure for indexing vacation pay: examples

Let's look at examples of how vacation pay is indexed depending on the indexation period.

Example 1

From June 1, 2021, Markova T.V. was on vacation for 14 days. During the billing period, from June 1, 2021 to May 31, 2021, the employee’s salary was indexed from 20,000 to 25,000 rubles. The indexation date is November 2021. Markova's billing period was fully worked out. She did not receive bonuses or other payments.

To calculate the amount of vacation pay, it is necessary to determine the SZ. To do this, calculate the CI:

CI = 25,000 / 20,000 =1.25

To determine the size of the SZ, it is necessary to divide the billing period into 2 parts: the first part, preceding the increase, was 5 months, from June to October 2021; the second, from November 2020 to May 2021, 7 months. Due to the fact that indexation took place in the billing period, the SZ for calculating vacation pay should be indexed from the beginning of the billing period. Thus, the formula should contain a reflection of indexation for 5 months (20,000 × 1.25 × 5) and the calculation of SZ taking into account the new salary (25,000 × 7).

SZ = (20,000 × 1.25 × 5 + 25,000 × 7) / (29.3 × 12) = 853.25 rubles.

The amount of vacation pay will be: 853.25 × 14 = 11,945.50 rubles.

Example 2

Pushkov A.A. was on vacation from May 17 to May 26, 2021. During the period from May 17, 2021 to May 16, 2021, the employee was not on vacation. The employee’s salary during this period was 759 rubles. On May 22, the organization indexed wages by 5%.

The amount of vacation pay due to indexation must be recalculated starting from May 22.

To calculate the amount of vacation pay, we determine how many days were on vacation before indexation and after indexation: from May 17 to May 21 inclusive - 5 days, from May 22 to May 26 - 5 days. In this case, to calculate vacation pay for the first 5 days, the indexation coefficient will not be applied; for the remainder of the vacation, a coefficient of 1.05 must be used.

Thus, the amount of vacation pay for the entire vacation period will be:

5 × 759 + 5 × 759 × 1.05 = 7779.75 rubles.

That is, the employee’s vacation pay will be recalculated from the moment of indexation.

Using the above examples, you can once again be convinced that the rules that should be followed when indexing vacation pay depend primarily on the moment when the salary indexation was made: before the date of accrual of the corresponding payments or after.

Should average earnings be indexed if the salaries of not all employees of the department were increased? The answer to this question is in ConsultantPlus. And learn the material by getting trial access to the system for free.

We take into account changes in the minimum wage in our work

Author: E. I. Peresypkina , expert of the information and reference system “Ayudar Info”

From July 1, 2021, the minimum wage increased from 7,500 to 7,800 rubles. This is provided for by Federal Law No. 460-FZ of December 19, 2016 “On Amendments to Article 1 of the Federal Law “On the Minimum Wage” (hereinafter referred to as Federal Law No. 460-FZ). It is important for an accountant to monitor changes in the minimum wage, since he must correlate this value with salaries in the organization, in some situations use the minimum wage when calculating sick leave benefits, as well as in some other cases.

Is it possible to hold an employer liable if indexation was not carried out?

Some employers, in order not to increase the organization's costs, do not want to index salaries. However, such savings may entail administrative liability for the employer:

- If a local document contains information about wage indexation, but the actual absence of such a procedure, a fine in the amount of 3,000 to 5,000 rubles is imposed on the employer. (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

- If there is a simultaneous absence of information about indexation in local documents and the indexation itself, a fine for the legal entity employer is from 30,000 to 50,000 rubles, for officials and individual entrepreneurs - from 1,000 to 5,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

These are not the only costs that an employer may incur due to the lack of indexation. If an employee, whose interests are infringed by its failure to carry out the work, goes to court, then the employer, in the event of a positive outcome, will have to pay the lost salary for all periods of violation of the law. And the amount of such payment will be obtained by calculating the difference between the indexed salary and the one actually paid (determination of the Primorsky Regional Court dated August 20, 2015 in case No. 33-7280/2015).

Let us note that some arbitrators take the employer’s side and believe that salary indexation is not his responsibility (appeal ruling of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mordovia dated April 30, 2015 in case No. 33-918/2015).

However, there are a number of valid reasons for not indexing. These include:

- the difficult financial situation of the employer (appeal ruling of the Kostroma Regional Court dated May 26, 2014 No. 33-797/2014);

- a good level of employee salaries that does not require an increase (appeal ruling of the Omsk Regional Court dated November 25, 2015 No. 33-8541/2015).

Index of real and nominal wages

In order to calculate such dynamics, you need to use special indices.

For nominal payment, the calculation is made using a certain formula, which determines the ratio of the current salary to last year’s payments:

Ind n = Salary tek g / Salary pr g x 100 (%)

Ind n is the index value for nominal wages, expressed as a percentage.

Salary tek g is labor payment during the current year.

Salary pr g is the salary for the last year’s period.

This simple formula indicates a direct proportionality between the index value and the growth of nominal payments, which do not depend on the economic situation in the country.

Nominal earnings for an average month are set by enterprises based on statistical reporting.

In order to calculate the activity level of real income, you need to use a calculated value - an index. For these purposes, use the formula:

Ind r = Ind n / Ind pot c (%)

Ind p is the value of the income index in real form. Ind n is a fixed income index of a nominal type. Ind pot c is the value of the price index for consumers.

By comparing the levels of nominal and real wage indices, we can find out:

- current unemployment rate;

- the presence of a qualified staffing shortage;

- inflationary processes;

- identify the need for action.

Results

Not every employer is ready to index wages, despite the fact that this is required by law. However, if the enterprise nevertheless decides on such indexation, it is important to follow all the necessary procedures for the correct calculation of payments that are affected by such a change in wages.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rules for indexing

Before carrying out indexation, it is important to know that it is carried out in relation to all employees carrying out activities for the benefit of the company on the basis of an employment contract.

Unfortunately, those categories of citizens who work under civil contracts do not fall under such indexation provided for by the Labor Code.

Managers themselves must understand that it is necessary to carry out such a procedure in a timely manner in order to show special loyalty to those people who devote a lot of time and effort to the benefit of the organization. The frequency of indexations must be specified in advance in the local regulatory framework of the enterprise.

Indexation must begin when the price index for market products exceeds 101 percent . The calculation is carried out from the beginning of the month after the current published figure. Calculations are carried out by Goskomstat.

If the decision was made in favor of indexing, then some documents need to be completed. If its presence was not specified in the local regulations of the enterprise, then this point must be added immediately. When prescribing indexing, you need to carefully consider such details as:

- What frequency will be indicated for the procedure. This could be a month, six months or a year.

- What payments will be affected by the change? This could be a salary, bonus or additional payment.

- The procedure for choosing the indexing coefficient.