Publication date 04/07/2021

12407 views

Useful for individual entrepreneurs and limited liability partnerships Since April 2021, the value of the MCI has increased in Kazakhstan: the indicator has increased by almost 5%. And since many calculations are tied to the MCI value, the question naturally arose: what value should be used, in particular when calculating daily allowance amounts?

Let us recall that the MCI value is:

- until 04/01/2020 -2,651 tenge;

- from 04/01/2020 -2,778 tenge.

The question is relevant for those business trips on which employees are sent from April to December 2021.

Daily allowances are paid to a posted worker (clause 2, article 127 of the Labor Code of the Republic of Kazakhstan) in the amount established by the organization itself (clause 3, clause 1, article 244 of the Tax Code of the Republic of Kazakhstan). However, regarding what amount of daily allowance should be recognized as an employee’s income, the Tax Code of the Republic of Kazakhstan establishes restrictions, linked to the value of the MCI.

Thus, according to paragraph 2 of paragraph 2 of Article 319 of the Tax Code of the Republic of Kazakhstan, the following amounts of payments as daily allowance are not recognized as income of an individual, and therefore are not subject to personal income tax:

- 6 MCI per day, for a business trip of no more than 40 days (throughout the country);

- 8 MCI per day (for foreign business trips).

At the same time, it is separately stipulated that the MCI valid as of January 1 of the current year is accepted for calculation. Compared to 2021, this figure is equal to 2,651 tenge.

Therefore, both for business trips on which the employee went before April 2021, and for other business trips until the end of the year, the MCI value of 2,651 tenge must be used when calculating. An increase in the indicator during the year does not affect the amount of the calculated daily allowance.

Rate 1 MCI in Kazakhstan since 1996, more details

Vote

| (0) |

Similar articles

Payment of daily allowances for days spent on the road

Thus, to calculate the vehicle tax for 2021, the MCI in force as of January 1, 2021 is used, that is, 2,651 tenge.

Several resolutions and laws have been signed in Kazakhstan, which have brought a number of changes to the lives of all citizens.

Individual income tax in the Republic of Kazakhstan is regulated by a number of documents, the main one of which is the Tax Code. Every year there are certain changes in its calculations, as the indicators that are used change. 2021 was no exception. Calculate without the help of an accountant what the current income tax is in Kazakhstan.

Our team has extensive practical experience and is constantly increasing and improving its efficiency.

Reimbursement of travel expenses

Expenses associated with the performance of production tasks in another location are reimbursed in full based on the documents provided confirming the employee’s expenses during the trip. In cases where an employee for some reason does not provide a rental agreement for residential premises or a hotel check, reimbursement of living expenses is made in accordance with Part 2 of Art. 168 Labor Code of the Russian Federation, art. 217 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia No. 03−04−06−01/30 and does not exceed 700 rubles per night. Also, some expenses, if they exceed generally accepted standards, must be stipulated by internal acts and agreements approved by the team and management. This applies to daily allowances if the local agreement provides for an amount exceeding 700 rubles.

When reimbursing an employee, all payment methods must be taken into account. If the traveler paid for housing in cash, then he provides his organization with a document, an invoice and a hotel receipt (or a rental agreement). When paying by credit card, you must present a hotel receipt and a fiscal receipt upon arrival.

The dates on travel documents must be consistent with the dates of departure from the organization, arrival at the destination and possible movements during the business trip. In addition to round trip travel, commission fees and charges for airport services, travel costs to the place of departure, baggage transportation, and communication services are reimbursed and are not subject to taxation.

What are the consequences for an individual of non-payment of taxes?

From the travel documents it follows that on May 17 the employee left Moscow by train at 19:20. The train arrived at the border with Kazakhstan (Petukhovo station) on May 19 at 09:00. This means that the dates May 17 and May 18 are considered days spent in Russia.

The trip lasts one day. According to paragraph 11 of Government Decree No. 749, daily trips and other guarantees are not provided for one-day trips. But the employer has the right to write off expenses that are documented and justified (Letter of the Ministry of Finance of Russia dated July 16, 2015 No. 03-03-07/40892).

Thus, when filling out an advance report, expenses for renting housing and travel should be reflected in the “Payment” tab according to receipt documents, daily allowances should be reflected in the “Other” tab.

The minimum wage will remain the same - 42,500 tenge (just over 100 dollars. Hereinafter, calculations were made at the rate of 420 tenge per dollar).

Travel expenses norms

All enterprises, be it a state organization, a private firm or a company, regardless of activity and form of ownership, exercise control over the expenditure of travel funds, subject to the Labor Legislation of Russia (Articles 167−168).

Travel expenses include the following charges:

- daily travel expenses up to 700 rubles for each day of a business trip are not subject to taxation, however, if the organization by some internal act has established a different daily allowance, then tax from individuals is levied on the amount exceeding 700 rubles;

- transport costs - the cost of tickets for all types of transport that an employee can use to get to their destination and back, do not have fixed values and depend on the cost of a travel document, which also reduces the tax base. However, if the station, airport or pier is located at a distant distance from the traveler’s place of work, then the additional costs of travel to the place of departure will also be included in transportation costs. In addition, if the collective agreement provides for reimbursement to employees of expenses not only for public transport, but also for a taxi or car rental during a business trip, then letter of the Ministry of Finance No. 03−03−06/4/80 dated July 21, 2011 provides for this option and makes it possible to take these reimbursements into account when taxing profits.

- living expenses take into account all possible payment methods and categories of housing. In addition, there may be a reservation of accommodation, which is not included in the list of additional services and, after the return of funds to the employee, can be included in the tax calculation. Additional services (beauty treatments, sauna, swimming pool, gym, maintenance and leisure clothing) do not affect the tax base. If an organization purchases housing for rent, expenses are recorded in accordance with the rental agreement. In this case, the expenses are classified as “other” and will reduce the tax base.

Beekeeping as a business is a very profitable business in Russia and Ukraine.

What should you consider before going on a business trip? We have created an interesting review about this.

Penalty for failure to pay VOSMS and OOSMS in 2021.

According to paragraph 2 of Article 683 of the Tax Code, in order to apply the STR for small businesses, income for the tax period should not exceed for the STR:

- based on a patent - 3528 times the MCI established by the law on the republican budget and valid as of January 1 of the corresponding financial year;

- on the basis of a simplified declaration - 24,038 times the MCI established by the law on the republican budget and valid as of January 1 of the corresponding financial year;

- using a fixed deduction - 144,184 times the MCI established by the law on the republican budget and valid as of January 1 of the corresponding financial year;

If you go to the tab “Accounting Cost Analytics” – “Subconto Accounting Unit 1” – “Cost Items” - in the window that opens for this cost item in the “Reflection in the income tax return” tab, you can view the declaration line code. Such hours, in accordance with Article 153 of the Labor Code of Russia, are paid double or single with the provision of an additional day off.

In some situations, an employee may receive additional pay while on a business trip - usually if there is a significant difference between the average annual earnings and salary.

We implement an integrated approach to business development, ensuring maximum quality and convenience when providing accounting services to our clients.

In standard solutions, when updating to releases containing “New Year’s” changes, from January 1, 2021, a 90% reduction in taxable income is applied only when calculating personal income tax.

Issue a separate administrative document - an order approving the regulations on business trips. It must indicate under what conditions and from what date the provision begins to apply.

Based on the above calculations, we see that in 2021, compared to the previous year, the tax burden on both the employee and the employer has increased.

Issue a separate administrative document - an order approving the regulations on business trips. It must indicate under what conditions and from what date the provision begins to apply.

This resolution comes into effect upon the expiration of ten calendar days after the day of its first official publication.

Other types of deductions that will reduce the IIT amount will require the direct participation of the person whose income is taxed.

Thus, to calculate the maximum income of the UCP payer, the MCI valid as of January 1, 2021 is used, that is, 2,651 tenge (the amount of the maximum income for 2021 is 3,114,925 tenge).

Every year there are certain changes in its calculations, as the indicators that are used change. 2021 was no exception.

The amount of daily allowance is not limited. Each employer can set the amount of daily allowance that it considers necessary. The main thing is to reflect the chosen option in the organization’s local regulations, for example, in the regulations on business trips.

How to calculate daily allowance for foreign business trips to CIS countries

Russia has concluded intergovernmental agreements with the CIS countries on a visa-free regime, under which a border crossing mark is not entered into the international passport. To correctly calculate the daily allowance, the date of border crossing is determined by travel tickets.

When calculating, it is necessary to determine the number of days of the business trip in total, and how many of them were spent on the territory of Russia, and how many were spent abroad. Daily allowances for trips to the CIS are calculated in a special way (clause 19 of Regulation No. 749):

- dates are determined by travel documents;

- the day of crossing the border of a foreign state upon entry is considered a day of stay abroad;

- The day of crossing the border when leaving a foreign country is considered the day of a business trip in Russia.

The company can establish its own calculation methodology, but for the purposes of including daily allowances in income tax expenses, it is worth following the general procedure.

LLC "Paints" Moscow sent its employee M.A. Lotov. to Belarus in Minsk. He left Moscow by train on October 18, 2018 at 10:55 p.m. Crossed the border and entered the territory of Belarus on October 19, 2018. Lotov left Minsk on October 23, 2018 at 08:00, crossed the border and returned to Moscow at 17:00 on the same day. In the Regulations on business trips, Kraski LLC indicated that for business trips to Belarus, the daily allowance for 2021 is 2,500.00 rubles; for Russian trips, the daily allowance is 700 rubles.

We charge daily allowances:

10/18/2018 is a day in Russia,

10/19/2018 – day of entry (day of border crossing) is considered as a day abroad,

10/21/2018 – 10/22/2018 – days spent abroad,

10.23.2018 – the day of departure (the day of crossing the border) is considered as a day in Russia.

Total days on a business trip: 2 days in Russia (10/18/2018, 10/23/2018), 3 days abroad (10/19/2018, 10/21/2018, 10/22/2018).

2 days x 700 rubles = 1400 rubles per diem throughout Russia,

3 days x 2500 rubles = 7500 rubles daily allowance in Belarus.

In total, Kraski LLC accrued the following daily allowances to Lotov M.A.:

1400 + 7500 = 8900 rubles.

For an accurate calculation, it is necessary to pay attention not only to the dates of departure and arrival, but also to the dates/times of border crossings.

In the absence of tickets, other documents can confirm the dates - a vehicle waybill with refueling receipts along the route, invoices from hotels, and so on (clause 7 of Regulation No. 749).

business trips within the Republic of Kazakhstan in 2021

Daily allowances are exempt from personal income tax and contributions up to 2,500 rubles. for each day you are on a business trip abroad.

If such workers are sent forcibly, the employer will be liable under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation, and in case of repeated violation - under Part 2 of this article.

And also issues of payment for travel allowances can be specified in a collective labor agreement or individual labor agreements.

This is contrary to common sense, which is why enterprises often provide additional payments up to the current salary.

An employee has the right to independently choose what is more important to him - double salary or an additional day off.

And although there are no uniform rules on payment terms, the company can establish them independently and enshrine them in internal regulations. For example, in the regulations on business trips, it is permissible to indicate not only the period, but also the specific method of crediting the advance: in cash or by transfer to a bank card.

Accordingly, daily subsistence allowance expenses can be deducted under CIT in the amounts that are independently approved on the basis of the company’s internal regulations.

However, the daily allowance will have to be included in the advance report - this will be needed to justify the costs of the business trip in tax and accounting.

In order to correctly calculate travel allowances, an accountant does not need to come up with any formulas and schemes, because there is a detailed algorithm of actions developed. Let's go in order.

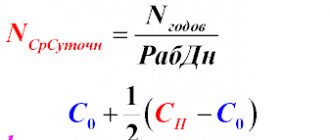

- First, you need to calculate the number of days actually worked by the traveler in the billing period. If an employee has been working at the company for a long time, then we take a year as the billing period, that is, 12 months before the employee leaves on a business trip. If he works for less than a year, then the calculation period will be considered the time from the date of employment;

Attention: Every accountant must remember that when calculating travel allowances, only working days can be taken into account!Calendar days, as when calculating, for example, vacation pay, do not need to be taken into account. It is also necessary to exclude from the calculation period the time spent on previous business trips, vacations, sick leave, time off, etc.

- The next thing you need to do to correctly calculate travel allowances is to determine the average earnings during the billing period. This includes all payments according to the wage system adopted by the enterprise, minus payments for social and material assistance, as well as vacation pay and sick leave - they do not need to be taken into account when calculating the average salary;

Important! It happens that while a company employee is on a business trip, the company’s management decides to revise tariffs and salaries upward.In this case, for the correct calculation of travel allowances, it is necessary to index the average salary of the traveler.

- The third point will be the calculation of the average salary per day and, ultimately, the amount of travel allowances. Everything is simple here: the salary for the billing period must be divided by those days that were actually worked, again, during the billing period. After this, the result of the division must be multiplied by the number of days spent on the business trip. The resulting amount will be the amount of the travel allowance.

Government of the Republic of Kazakhstan dated December 8, 2015 No. 975 “On amendments to the Decree of the Government of the Republic of Kazakhstan dated February 6, 2008 No. 108 “On reimbursement to civil servants of expenses for official business trips abroad at the expense of the republican and local budgets” (SAPP of the Republic of Kazakhstan, 2015 g., No. 62, Art. 490).

Calculation of daily allowances for business trips to the CIS countries and average earnings for business trips - these issues still remain the most pressing.

Government of the Republic of Kazakhstan dated February 6, 2008 No. 108 “On reimbursement to civil servants of expenses for official business trips abroad at the expense of the republican and local budgets” (SAPP of the Republic of Kazakhstan, 2008, No. 5, Art. 60).

In what currency should daily allowances be issued?

The organization has the right to decide for itself whether it will issue an advance for daily allowance in convertible currency, the currency of the destination country, or in rubles at the exchange rate on the day of departure. If the money was issued in foreign currency, then after the employee returns from a business trip and prepares an advance report, daily allowances and expenses abroad in foreign currency are recalculated at the rate of the Central Bank on the date of approval of the advance report (clause 7 and appendix to PBU 3/2006).

Iva LLC sent P.V. Karpov on a business trip. to Kazakhstan 01/10/2019. On the day of departure, Karpov P.V. issued an advance - daily allowance for a business trip to Kazakhstan in 2021 in the total amount of 170,000 tenge. Upon returning, Karpov drew up an advance report. The report was approved by the manager on January 23, 2019.

The tenge exchange rate set by the Central Bank as of January 10, 2019 is 17.80 rubles. for 100 tenge; as of January 23, 2019 - 18.00 rub. for 100 tenge.

To account for daily allowance, the accountant converted the advance payment into rubles on January 10, 2019:

exchange rate: 100 tenge = 17.8 rubles, 1 tenge = 0.178 rubles.

170,000 x 0.178 = 30,260 rubles. – an advance was issued for a business trip in rubles.

On the day of approval of the advance report, January 23, 2019, the accountant recalculated the daily allowance at the current rate of the Central Bank:

advance payment issued in the currency of 170,000 tenge, converted into rubles at the exchange rate of January 23, 2019,

rate: 100 tenge = 18.0 rub., 1 tenge = 0.18 rub.

170,000 x 0.180 rub. = 30,600 rub. – the amount of the advance in rubles as of the date of approval of the report.

This creates a positive exchange rate difference of 340 rubles. (30,600 – 30,260).

Travel expenses in Kazakhstan

In the Republic of Kazakhstan, as well as in Russia and Belarus, travel expenses are processed and reimbursed if there are marks in the travel certificate and all necessary documents are provided. The daily allowance rate is determined based on the monthly calculation index (MCI) and is:

- for business trips within the Republic of Kazakhstan - 6 MCI for each day;

- when traveling outside the state - 8 MCI daily.

Travel expenses are regulated by Article 152 of the Labor Code of the Republic of Kazakhstan, are converted into tenge and require the provision of supporting documents for travel and accommodation.

Thus, the procedure for calculating travel expenses in Russia, Belarus and Kazakhstan does not have significant differences and provides for:

- the employer determines the task and the deadlines for its completion;

- Before the trip, the posted employee must familiarize himself with the order approved by the manager, which clearly defines the tasks and goals of the trip, and obtain a travel certificate indicating the order number and purpose of the trip, passport details and position of the employee, destination and duration of stay. The employee is also given an advance payment, pre-calculated based on daily allowances, transportation costs and living expenses.

- employee advance report and provision of all necessary documents;

- informing the employer in the event of unusual situations and coordinating actions and actions with him.

Calculation of daily allowances for business trips: according to the new or old MCI?

Rational use of the time of an employee sent on a business trip for a short duration (no need to prepare documents for accommodation);3. Minimizing financial violations on the part of the employer when reimbursing travel expenses to employees;4.

The concept of registration of a foreigner is completely excluded. Now it is the responsibility of the receiving party. Within 3 calendar days, a citizen of the republic (the owner of a personal home or hotel) is obliged to notify the migration service that he has foreign guests. In the absence of a registered electronic signature, registration of Russian citizens in Kazakhstan in 2021 is carried out by the receiving party by submitting an application for the arrival of a foreigner directly to the migration service.

By decision of a resident legal entity, its branches and representative offices may be considered as independent payers of deductions and contributions.

Travel expenses abroad

What is common to all travel expenses when performing a work assignment abroad is that both the daily allowance and the cost of renting accommodation must be within the framework of internal regulations. Transport costs have the same provisions as the costs of movement within the Russian Federation. However, travel costs are supplemented by the costs of issuing travel documents and medical insurance, mandatory fees and payments (consular, airfield, entry for vehicles).

The daily allowance for a business trip abroad also has a limit for calculating personal income tax and is 2,500 rubles, which is transferred and paid in foreign currency. The employee also receives an advance in foreign currency based on the number of days spent abroad, while while traveling through the territory of Russia, funds are issued in Russian rubles, when crossing the border outside of Russia - in foreign currency, and when entering the Russian Federation again in Bank of Russia rubles.

If a business traveler leaves the Russian Federation for one day, then the payment of travel expenses in foreign currency is reduced by 50%, and if this is a business trip to the Commonwealth countries, then even a mark on crossing the border is not made.

How to open a private kindergarten - everything you wanted to know about the most popular educational business in Russia.

The government can finance your business endeavors. If you want to know how, read our article.

Trading through online stores can now be carried out on social networks, for example Vkontakte: https://bsnss.net/internet-biznes/internet-magaziny/kak-otkryt-magazin-v-kontakte.html