If for some reason you do not want to continue your business activities, then the right decision would be to officially close the business. Our company provides legal services to support the liquidation of individual entrepreneurs on a turnkey basis without increasing the cost at any stage of paperwork. The service includes detailed consultation, delivery and receipt of documents, payment for terminating the activities of an individual entrepreneur in the amount of 160 rubles.

| Our services | State Duty | Notary | EDS | Total | |

| Liquidation of individual entrepreneurs | 3500 rub. | 160 rub. | 3020 rub. | — | 6680 rub. |

| Liquidation of individual entrepreneurs using digital signature | 3000 rub. | — | — | 2000 rub. | 5000 rub. |

5 reasons to choose us

- Services without failure;

- Assistance in collecting a registration package to close an individual entrepreneur without debt;

- Accompanying the entrepreneur or submitting documents through an authorized person under a notarized power of attorney;

- Execution of documents by a notary out of turn;

- Submission and receipt of documents on the termination of the existence of an individual entrepreneur to the Federal Tax Service by proxy.

The liquidation procedure for an individual entrepreneur implies the termination of the existence of an individual entrepreneur in the form of exclusion from the register of information about its activities. Upon completion of the liquidation procedure, the citizen is released from the possibility of exercising the rights and the burden of bearing obligations that are provided for by regulations for merchants and is excluded from the Unified State Register of Individual Entrepreneurs.

Citizens registered as individual entrepreneurs cease their activities for many reasons. Thus, citizens often liquidate their entrepreneur status due to:

- Unprofitability of commercial activities;

- Employment in the public service;

- For a quick transition to a different taxation system;

- The expiration of the contract granting the right to a foreigner to live and work in the territory of the Russian Federation;

- A court decision on a ban on doing business that has entered into legal force;

The procedure for liquidating an individual entrepreneur is much cheaper and faster than closing an LLC. The entrepreneur himself can initiate the voluntary liquidation procedure remotely or through an authorized person under a power of attorney by submitting an application on the liquidation form code P26001. The IP is also terminated in other cases. For example, in the case when an entrepreneur is declared insolvent (bankrupt), due to his own death or forced deprivation of the right to engage in income-generating activities. There is a procedure for temporarily suspending the activities of an entrepreneur if violations have occurred.

How to close an individual entrepreneur online through the tax office, and what reasons there may be for this

Most often, entrepreneurs decide to close an individual entrepreneur at the tax office (online) for the following reasons:

- Lack of income with a high payment load. As you know, even in the absence of earnings, individual entrepreneurs are required to pay insurance and medical contributions, while zero reporting is submitted to the Federal Tax Service for personal income tax;

- Reluctance to do business. A person can choose another field of activity, even if the individual entrepreneur brings him income. In this case, it will not be possible to carry out liquidation as with an LLC, because the entrepreneur has no founders. The only option is to close the individual entrepreneur online or directly at the tax office;

- Debts. Despite the fact that an entrepreneur can liquidate his business with debts, he will still have to pay for them after deregistration with the Federal Tax Service. If there is no money, you can initiate bankruptcy proceedings in an arbitration court, but here you will need the help of lawyers;

- Desire to open an LLC. In some cases, it is easier to work as a legal entity: you can attract several founders, and organizations have much more powers in business.

Also, the individual entrepreneur is liquidated if significant violations are identified after a court decision is made. In this case, you will not have to submit documents to close the business either in person or online: the entrepreneur is deregistered automatically.

Reducing the tax burden

The main difficulty is usually related to the need to pay taxes. However, as a rule, if the individual entrepreneur continues to make a profit, then suspending activities does not make sense. He actually does business.

But there are also exceptions. Thus, using tax regimes such as UTII and PSN, the entrepreneur pays the agreed amounts regardless of actual income.

The main way to avoid paying additional amounts is not to renew the patent and UTII, but to remain on the simplified tax system or the OSN. Otherwise, you will still have to pay a fixed amount.

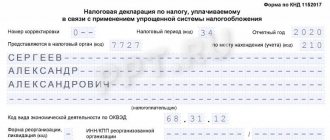

How to close an individual entrepreneur online through the tax service: step-by-step instructions

Having decided to close the individual entrepreneur, you need to submit documents to the tax office to make changes to terminate the activity in the Unified State Register of Individual Entrepreneurs. This can be done in person or online. The last method is considered the easiest:

- We collect a package of documents. It includes a passport, individual entrepreneur registration certificate, TIN.

- Open the website of the Federal Tax Service, go to the “Electronic Services” section, then in “All Services” select the “Submission of an application for state registration” menu.

- We go through authorization through a personal identifier or the “Government Services” portal in order to close the individual entrepreneur online through the tax office.

- Select “Fill out an application”, confirm your consent to the processing of information and select the type of online application – “Close IP”.

- We fill out all fields in the online form. You will need your full name, registration address, and USRIP information.

- At the end, we choose the method of receiving documents from the tax office: by mail, in person at the Federal Tax Service office or through a legal representative.

- Go to the “State Duty” block and check the form. If the data is correct, we pay the fee online - 160 rubles.

- We sign the application with an electronic key, scan the attached documents and upload them to it.

- We check all the information again and send it to the tax office for review.

The tax office has 1 day to receive documents online. If no deficiencies are identified, the individual entrepreneur will receive a notification the next day. You can pick up the deregistration sheet after 5 calendar days.

How to fill out a receipt using the Federal Tax Service website

One way to fill out a receipt for payment of the state fee for closing an individual entrepreneur is to generate it using the website of the Federal Tax Service. Conveniently, all details will be provided automatically online. This will help avoid mistakes in filling out the sample.

So, go to the desired site and then fill out the form fields.

The definition of the tax office number is different for the two options.

- For areas in which documents are submitted to the same place where the individual entrepreneur registration took place, you need to do the following. If you do not know the interdistrict inspection number, leave the corresponding field blank. Select a region, district, city or town of residence. Enter your full registration address in the boxes that appear. The system itself will determine the required Federal Tax Service number.

- For regions other than those where the entrepreneur was registered, you must enter the tax authority code. Then, as in the previous version, fill out all address fields in detail. The system will indicate to you that there is a discrepancy between the address and the district inspection code. Click “next” and the receipt will include the information you need.

Next, select the following data:

- Indicate the form in which payment will be made: cash (through the bank) or non-cash (through your account);

- In the “payment type” item, indicate “0” - this is payment of a fee;

- The status of the person issuing the payment document is indicated as “09” - this is a fee payer (individual entrepreneur);

- Taxable period. Write the date the receipt was issued;

- Enter your personal data: last name, first name, patronymic, taxpayer identification number, registration address.

Indicate the payment amount - 160 rubles.

That’s it, a receipt for payment of the state fee for closing an individual entrepreneur will be generated.

Become an author

Become an expert

Closing an individual entrepreneur online through the tax office: advantages and disadvantages

Let's consider the main advantages that will be useful to individual entrepreneurs who want to close their business activities through the online tax office:

- Simplicity. It is enough to fill out the electronic application form, indicating a complete list of data;

- Availability. If there is an electronic digital signature, an individual entrepreneur can liquidate the business without leaving home. If there is no electronic digital signature, you will have to obtain it through a company specializing in this;

- Cost-effective: the individual entrepreneur pays only the state duty.

Despite all the advantages, there are also significant disadvantages:

- Often the Federal Tax Service Inspectorates violate the deadlines for issuing notices of deregistration of individual entrepreneurs if the application was submitted online;

- Mandatory presence of digital signature;

- High probability of refusal to complete registration actions. This may happen due to incorrect paperwork and other reasons.

To close an individual entrepreneur without any problems, you can leave a request to our lawyers online. They have extensive experience working with the tax authorities, so they can easily liquidate a business in a short time.

Is it possible to suspend the activities of an individual entrepreneur without closing

The main solution to a situation where continuation of entrepreneurial activity is not allowed is closure, that is, termination of registration as an individual entrepreneur. However, this option may not be the most profitable.

A controversial situation arises. If you leave the status of an entrepreneur, you will have to pay fees and do accounting. If you close the IP, then after a while you will have to open it again.

The list of actions that are permissible for an entrepreneur is specified in Federal Law No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001. Individual entrepreneur has the right:

- make changes to the IP status. For example, add additional activities or change the tax system used;

- stop operating as an individual entrepreneur. We are talking about complete closure. Undoubtedly, in the future the individual entrepreneur will be able to obtain the corresponding status again, but everything will have to be done again. Read more about how to terminate the activities of an individual entrepreneur in 2021 in our article >>.

It turns out that in accordance with current legal norms, the suspension of the status of an individual entrepreneur is not provided for.

An entrepreneur cannot officially freeze his status, but closure is not always justified. If activities need to be suspended for a short period of time, then you can independently take advantage of a number of benefits and methods.

Link to document: Federal Law No. 129-FZ of 08.08.2001 “On state registration of legal entities and individual entrepreneurs”

When can they refuse an individual entrepreneur who decides to close an online business through the tax office?

An entrepreneur who decides to close an individual entrepreneur through the tax office online may be denied the application on the following grounds:

- Failure to pay state duty. The service offers to make a payment before sending the questionnaire. If for some reason this cannot be done, the documentation will not be sent to the Federal Tax Service;

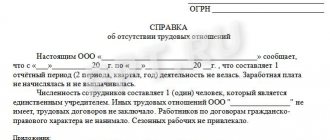

- Providing an incomplete set of documents. Tax authorities have an established list of information for terminating registration, which must be adhered to by all individual entrepreneurs without exception;

- Contacting an unauthorized tax authority;

- Signing of an application and other documents by an unauthorized person.

If the tax office makes a negative decision, the individual entrepreneur is notified about this in writing, indicating the reasons. For trouble-free liquidation, you need to eliminate them and contact the Federal Tax Service again.

To avoid tax refusal, you can order the services of our lawyers online. We will help you close your individual entrepreneur under any circumstances, and within a few days you will receive a ready notice of termination of activity.

How is the state duty paid?

The state fee for terminating the activities of an individual entrepreneur is paid in the same way as regular payments. There is no special template for this payment. Payment can be made in the same way as other budget contributions. The only thing you need to know is exactly the details. They are different for each region. You can find out the details on the official website of the Federal Tax Service or by directly contacting the tax office at your place of registration.

You must fill out the receipt very carefully. There should be no mistakes when writing details, otherwise the payment will not be credited. Many banks offer a receipt service. Typically the cost of the service is approximately twenty rubles and is offered by the bank teller. But please note that bank employees do not check the correctness of the details, but only enter the data you provided into the receipt.

In addition to the details, you need to take your passport with you to the bank, since you will also need to enter your personal data on the receipt.

The state fee for the liquidation of an individual entrepreneur is charged only in the case of voluntary registration of business closure. In case of bankruptcy, for example, you do not need to pay a fee.

The amount of the fee when closing an individual entrepreneur is regulated by the Tax Code of the Russian Federation. Without payment, the liquidation procedure cannot be completed.

Procedure for executing compulsory suspension

The resolution is executed by an FSSP employee. It comes into force and, accordingly, must be executed immediately. The general rules of enforcement proceedings apply.

The bailiff must seal the premises, as well as equipment and materials that are used to make a profit in business activities. Additionally, other measures may be taken.

The bailiff has the right to issue a ruling requiring the elimination of additional violations, as well as to involve specialists for monitoring.

For example, if the activities of an individual entrepreneur were suspended due to high humidity, which caused harm to employees, it will be necessary to attract a specialist who will record the indicator properly.

A petition to terminate the applicable sanction is submitted to the bailiff service. The entrepreneur is informed about the result of the review.

Read: How to appeal a bailiff's decision - procedure and sample applications

Why might there be a refusal?

Sometimes the exclusion of an entrepreneur from the Unified State Register of Entrepreneurs is refused. This is due to the following:

- provision of an incomplete package of documents;

- presence of unclosed bank accounts abroad;

- absence of a power of attorney or expiration of its validity;

- violation of the registration procedure in non-budgetary companies;

- discrepancy between the submitted data and the information specified in the Unified State Register of Individual Entrepreneurs;

- presence of debt to the budget;

- the duty did not go to the budget.

Regulatory authorities carefully inspect the company before closing it. Therefore, you need to approach the preparatory stage responsibly. If it is not possible to do everything yourself, then you can contact specialized companies. For a small fee, they will carry out the required actions to close the company.

Important! The Federal Tax Service has a negative attitude towards intermediaries, despite granting them a general power of attorney. Therefore, it is recommended to resolve issues with this structure independently before submitting an application to the MFC.

We recall the main reasons for stopping a business

The law specifies a list of reasons for which it is possible to close an individual entrepreneur. These include the following:

- death of a businessman;

- bankruptcy;

- forced termination of activities;

- expiration of the validity period of documents allowing a foreign citizen to stay in the country;

- independent decision to close the enterprise.

The list of documents will depend on the specific case. There are several reasons to contact the MFC.

How to collect debt after closing an individual entrepreneur?

Advantages of cooperation with MFC

- high-quality public services that are provided on a non-commercial basis;

- no queues if you make an appointment in advance;

- the ability to resolve several issues at once in one organization;

- Convenient work schedule allows you to come here in the evenings or on weekends;

- receiving full information support at any stage of cooperation.

Important! It is necessary to clarify in advance whether the service of interest is provided in a specific MFC. Not everywhere you can submit documents to close a business.

Feeding features

The legislator provides the opportunity to close an individual entrepreneur by mail with debts, but they are not written off, so they remain with him.

He must repay them after closing like an ordinary individual. Otherwise, penalties and interest will be assessed on debts.

The application can also be submitted through the official website “Unified Portal of State and Municipal Entities”.

It is posted on the Internet to reach a larger number of people in need of various types of services. The service allows you to receive services without wasting time standing in queues that form at government agencies.

The applicant must sign in the presence of a Federal Tax Service employee if it is submitted in person. In other situations, it must be certified in the manner prescribed by the legislator.

It can be submitted by an attorney, but a power of attorney must be executed by a notary. It must indicate his powers. He can also receive documents on the closure of the individual entrepreneur.

Acceptance of the application is confirmed by a receipt indicating the documents presented for closing the individual entrepreneur.

It is returned to the registration authority upon receipt of documents on the closure of the individual entrepreneur. It indicates the date and time of their issue.

Question with insurance payments

The amount of insurance contributions to various funds (pension insurance, medical and social) is fixed. If the income of an individual entrepreneur using OSN exceeds 300 thousand rubles per year, then income exceeding this amount increases the payment amount by 1%.

It is not possible to completely get rid of insurance premiums. The only option is to reduce the amount as much as possible.

Current legislation (Article 430 of the Tax Code of the Russian Federation) establishes a list of situations when an entrepreneur is exempt from contributions to the Pension Fund and the Compulsory Medical Insurance Fund:

- during military service. As a rule, IP is opened before conscription, but is maintained during the period of stay in the army. However, payment of contributions can be “frozen”;

- if a parent is caring for a child who has not yet reached one and a half years of age. The situation is similar to a maternity leave that any properly documented employee receives;

- if you are caring for a disabled child or a disabled person of the first group, as well as a person who has reached 80 years of age;

- spouses of military personnel if they are forced to live in an area where it is not possible to conduct business. The situation turns out to be forced. An individual entrepreneur may plan to conduct similar activities again upon returning to another territory;

- spouses of diplomats who live outside the territory of the Russian Federation. The situation is similar to the previous point.

Quite often, such restrictions are temporary, so closing the status of an individual entrepreneur is not the most profitable option. The entrepreneur actually “freezes” his activities, submits zero reports, shows that the activity is not being carried out, and, if necessary, applies for the necessary benefits.

Read: How to sell property after closing an individual entrepreneur