Payers have the right to return overpaid amounts of taxes and fees or use them to cover other taxes. In this case, you should act strictly according to the recommendations of the Federal Tax Service, observing the provisions of the Tax Code. And also properly prepare all the necessary documents.

Where do overpayments come from?

No one wants to deceive himself and approaches tax calculations responsibly, however, sometimes he pays more than he should. Most often this happens for three reasons.

1

An error occurred when filling out a tax return or payment document.

2

If your tax system involves advance payments, then it is possible that your advance payment was too large. As a result, at the end of the year there will be money left in the advance account, and it will be an overpayment.

3

You were forced to pay taxes again. For example, you paid your taxes on time, but were late in filing your return, and the tax office sent you a second invoice.

Reasons for overpayment

Overpayments in a taxpayer’s personal account appear for three main reasons. Moreover, the type of collection does not matter, which means that all factors are relevant for both individuals and individual entrepreneurs.

No. 1. The tax has not yet been “written off”

After the funds are accrued, the payer, as a rule, has a certain period of time to pay budget contributions. During this period, there is virtually no debt and is formed only when deadlines are violated. By transferring funds at this time, an individual or individual entrepreneur is subject to a so-called “overpayment”, because the payment date has not yet arrived and, therefore, the payer does not owe anything.

No. 2. The Federal Tax Service is checking documents

This applies to both individual entrepreneurs and individuals. The payer makes the payment on time, its deadline passes, but the Federal Tax Service is still checking the declaration. Legally, this may take 3–6 months, depending on the type of tax report (3-personal income tax, simplified tax system declaration, unified income tax).

No. 3. The fee is written off in full, and an excess balance is recorded on the balance sheet (“excess payment”)

There are several reasons for excessive payment of budget charges:

- An overpayment of personal income tax has appeared in the taxpayer’s personal account

- Error in details. If the BCC is incorrectly indicated in the payment order or receipt, then the money is sent to pay for a completely different fee. At the same time, arrears (debt) appear on the primary tax. In this case, you can submit an application to the Federal Tax Service to clarify the amount and indicate the correct BCC, then the mutual settlements will become correct.

- Submitting an updated declaration or information about the right to benefits after payment. After recalculation, the amount payable may be reduced, leaving a surplus in the account.

- Incorrect payment to the budget. A simple situation when the payer mistakenly overestimated the amount and transferred more than required.

How do you know if you paid too much?

Firstly, the tax office itself may call with this news after it has discovered this fact. It doesn't happen often, but it does happen. And here the main thing is not to get confused by the phrase “Good afternoon, this is the tax office,” but to remember the number of the calling inspectorate and the exact name of the tax that you paid in a larger amount. If the tax office requests accounting documents or even a cash register for double-checking, then provide everything required. You should be aware that your refusal in this matter may result in a fine.

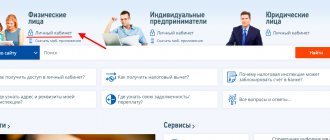

Secondly, such information is visible in your personal account on the tax office website. Your personal account is a convenient service for many issues, so it’s worth creating one. For example, there you can see whether your taxes have been received, track the entire history of tax payments, check the status of your applications, and generally correspond with the tax office.

Thirdly, you can find out about the overpayment by visiting the tax office in person. If you have such suspicions, you can always come and clarify. You can also check your calculations against your budget and even request a certificate about the status of your calculations. The last step should not be considered a manifestation of bureaucracy, since in fact it reveals an overpayment, and also clearly proves it.

Of course, there are deadlines for fulfilling these requests. So, a reconciliation takes 10 – 15 days, a certificate – 5 days. These are unrelated procedures and the certificate can be requested without verification. These actions can be initiated during a personal visit to the tax office, or through your personal account.

How to fill out an application for a refund of an overpayment

The application form is optional. This means that you can find a printed form online and fill it out manually or in a computer editor.

The only thing that prevents the application from being completed on a computer is a

“live signature” . It must be placed by your hand.

- Indicate the serial number of the application page. It should look like: 001. There is no need to write on the checkpoint form, only the TIN;

- Enter the application number;

- Enter your unique tax code;

- It is mandatory to indicate the personal status of the payer;

- And fill out the other fields of the form.

To obtain bank details, open your personal bank account. And find information about the card. The necessary data will be here.

How to get back overpaid taxes

If you know for sure that you overpaid, then you can return the excess contributions.

To do this, you need to contact the tax office to which you sent these taxes. For an individual entrepreneur, this is the tax office at the place of your permanent registration. It is also listed in your personal account.

If, according to your passport, your place of residence is St. Petersburg, and you are engaged in business in Samara (an individual entrepreneur has this right), then you still pay your taxes in St. Petersburg, and your overpayment is also in the St. Petersburg tax office, and not in Samara.

But there are three exceptions when individual entrepreneurs pay taxes not at their place of registration.

1

You work under a patent, then your tax office is located not at the place of your permanent registration, but at the place where the patent was purchased.

2

You pay taxes according to UTII, and this system requires accounting in every place where you conduct your business.

3

And if you pay taxes according to the simplified tax system and at the same time bought commercial real estate in the city where you do business, but are not registered, then pay the tax for this property to the tax office at the place of the property (you must first register with this tax office).

If you pay taxes to several tax authorities (this is possible), then the overpayment must be returned to the tax office where you overpaid.

Once you have found out which tax office your overpayment is in, you need to submit an application there to receive your overpayment. The application is written by hand in free form. In it you indicate your bank details to which the Federal Treasury should transfer the refunded money to you. The application can also be submitted electronically through your personal account, but for this you must have an enhanced qualified signature.

Along with the application, it is advisable to attach scans of documents confirming your overpayment: payment orders, reconciliation certificates, declarations.

After submitting your application, you should receive a response from the tax office. The speed of response depends on various factors, but usually it takes no more than a month. The fastest way to track the response is in your personal account based on the status of your application. The money itself will come to your account only a month after a positive response. If the money should be returned, but after a month it is not there, then you have the right to receive compensation from the tax authorities for each day of delay.

If the tax office takes too long to respond to your application, you can submit it a second time. If the second application remains unanswered or the tax office refuses to refund your overpayment, then you have the right to complain to the tax office itself. You should complain to the Federal Tax Service, which manages all inspections. Such a complaint can also be submitted through your personal account on the official website of the Federal Tax Service. If this does not have any effect, then you have a chance to restore justice in the Arbitration Court.

The law sets a period during which you can return the overpayment to your current account. This is three years. You can then try to write off this overpayment as a bad debt (Order of the Ministry of Finance on accounting), but you have a better chance of success if you do this with a lawyer.

What does “overpayment” mean in the taxpayer’s personal account?

An overpayment displayed in the personal account of an individual entrepreneur or individual taxpayer does not always mean an overpaid amount that is subject to refund . In some cases, this is a fee that has been paid but not yet transferred to the budget. Therefore, you first need to determine where it came from.

Strictly speaking, the term “overpayment” does not appear in the Tax Code of the Russian Federation, which raises questions about the amounts in the LC column of the same name. Based on the operating principle of the interactive service (personal account), these amounts can be understood as a positive balance. This formulation is not official, but most accurately reflects the meaning.

According to a publication on the official website of the Federal Tax Service of the Russian Federation, before submitting a document on the return of finances, it is necessary to obtain confirmation of the surplus from the tax authority. You can contact the Federal Tax Service in person or through feedback in your personal online account. The presence of a positive amount in the “overpayment” column is not an official notification.

Clause 3. Art. 78 of the Tax Code of the Russian Federation states that the tax authority informs the payer about the formation of excess amounts within 10 days from the moment such a fact is discovered. As a rule, the notification arrives by regular mail or letter via other communication channels, with an electronic digital signature.

How much should they return?

According to the law, you must receive a refund of the entire amount overpaid. There shouldn't be anything holding onto it.

You also have the opportunity not to receive this amount in your hands, but to pay off existing debt or use it to pay for future taxes. If you are more attracted to this option, then in the application that you submit for a refund of the overpayment, you must indicate exactly this. If you have more debts than overpayments, then simply indicate in the application which debts should be covered first. This will reduce the amount of debt. But you will still have to pay the rest of it from your personal income.

Reasons for overpayment of taxes

When an overpayment occurs, the citizen worries where it came from. Three main reasons for the appearance of excess funds:

- Incorrect amount in the declaration. An extra zero and when recalculating the tax authorities will find an extra amount. But the money will be debited from the account and will be in the form of an overpayment.

- When making advance funds, when the resident makes an advance payment for the fee. By the end of the year the total amount may be less.

- In case of late payment of personal income tax, since the amount for this tax is written off automatically upon delay. It turns out that the Federal Tax Service employees wrote off the funds on time, but the payer did not know about it and paid the money a second time. It turned out to be double payment. Thus, an overpayment of personal income tax appeared in the taxpayer’s personal account.

But the extra amount will not remain in the tax authorities’ budget; the money still belongs to the citizen.

Questions and answers

“Result of the desk audit: A decision was made to provide a tax deduction. Social deduction amount: RUB 42,700. Standard deduction amount: RUB 10,400. Form a return application." What is this? Do I need to do anything based on this information in my personal account?

You need to submit an application for a tax refund; the inspectorate has approved the deduction for you. So now you need to fill out a refund application, provide bank details (if they were not provided) and wait for your money back.

Portal "Your taxes"

What to do if the tax office does not return funds

According to Art. 78 of the Tax Code of the Russian Federation, the Federal Tax Service is obliged to return funds that are approved after the completion of the desk audit. But if the tax authorities do not return the amounts, then there are reasons for this. For example:

- The desk check has not been completed and the funds have not yet been approved for return.

- Availability of debts on other fees. In this case, the extra money will be used to pay off the debt.

But if there are no errors, the monitoring period has passed, and there are no notifications about errors, then the citizen has the right to go to court with a complaint against the Federal Tax Service.

Paying tax obligations can often result in a larger amount of funds being transferred that must be assessed. There may be enough reasons for such an error, but in any case they lead to the need to determine further actions to eliminate the overpayment that has appeared in the taxpayer’s personal account.

Carrying out netting

Quite often, erroneous accrual of funds occurs for personal income tax. In such a situation, payers often use it to offset other payments, among which the following are legally allowed to be used:

- VAT;

- simplified tax system;

- UTII;

- Fines for listed taxes (for late payment or arrears);

- Income tax.

Important. Transport and property taxes are not included in the list of those that can be repaid by offset using an overpayment of personal income tax.

In the event of an overpayment of penalties transferred to the personal income tax account, according to regulatory legislation, repayment of the same fee, in relation to which the excess amount was formed, is allowed only in the next period. At the same time, the taxpayer can also offset the required amount against other taxes for which an arrear has arisen or, for certain reasons, a penalty or fine has arisen.

If a taxpayer has an overpayment for any other federal tax, then it is worth taking action only 10 days after its formation - usually within this period the error is detected automatically and recalculation is carried out.

Important information. If, after sending the application and making a positive decision on the need to return the funds, no such action was taken, the taxpayer has the right to demand interest accrual for each missed day. The total amount will be determined taking into account the Bank of Russia rate.

So, overpaid funds for taxes and withholdings in relation to citizens, individual entrepreneurs or legal entities should not become a cause for concern. If an error is detected, tax officials will independently recalculate or transfer funds to cover future payments. If there is a need to eliminate such a deficiency, you should be aware that the statute of limitations for resolving such issues is established by law - the taxpayer can file an application within 3 years from the date of the overpayment.

Desk inspection

A desk audit is an audit of the package of documents and the 3-NDFL declaration that the payer sent to the inspectorate. According to paragraph 2 of Art. 88 of the Tax Code of the Russian Federation, monitoring lasts up to 90 days by employees of the Federal Tax Service. In practice, the check ends earlier. But if during this time the tax authorities discover an error, they will notify you about it earlier and send a form for correction.

An individual has the right to check the progress of the verification in his personal account on the Federal Tax Service website. Step-by-step instructions for tracking camera monitoring:

- After sending the papers for audit, the submitted declarations will be displayed on the main page in the Messages from the tax authority tab. The one according to which the resident expects a refund will also be visible here.

- In the line “Desk audit status” you can see the following: “Registered”, “Started”, “In progress”. And if the status is “Completed”, the desk check is over. If there are no other notifications from the service, it means that the procedure was successful and no errors were detected.

When monitoring is completed, you can begin processing a refund of overpaid money.

If the overpayment is more than three years old

An organization can offset or return an overpayment within three years from the date of payment of the excess tax amount. The payment date is calculated differently. For example, for VAT, which is paid without advance payments, the three-year period will be counted from the date of transfer of the tax. And for income tax, which provides for advance payments, the period will be calculated from the moment of filing the declaration.

If the organization missed the deadline for filing an application, you can go to court. When considering a case in court, the limitation period of 3 years will be calculated according to the norms of civil, and not tax legislation. And the countdown of the period does not start from the moment of payment of the excess amount, but from the moment when the organization learned or should have known about it (clause 1 of Article 200 of the Civil Code). But you will have to prove that you learned about the overpayment later than it occurred. And it's not that simple.

Methods of paying taxes in your personal account

If it is necessary to pay a tax or debt, a citizen has the right to use the service. The service for paying funds and sending a report is provided by the service free of charge. Service employees offer two methods of paying the fee:

- "Pay taxes" service. Here, the resident has the right to pay not only fees, but also insurance contributions and state duties. The program allows you to deposit funds for yourself and third parties. Algorithm for using the “Pay Taxes” service to pay funds:

- Agree to the processing of personal data by clicking the checkbox in the appropriate box and clicking on the “Next” button.

- Select the type of fee: tax on property of individuals, land, transport, personal income tax, unified, insurance contributions to the Pension Fund of the Russian Federation, compulsory medical insurance, VNIM. In the example, we will choose personal income tax.

- Determine the personal income tax category: according to form 3-NDFL or by foreign workers who work in Russia. Let's choose - 3-NDFL.

- Selecting the type of payment: fee, penalty, fine - direct fee (tax).

- Enter the amount and click “Next”.

- Fill in the details of the Federal Tax Service and the payer. In the information about the payer, the TIN is required to be filled out when making electronic payments on the Federal Tax Service website. If you do not complete the field, you will only be able to print the completed payment slip.

- Click on the red button labeled “Pay.”

- Select payment type. When paying via personal account, select a card or banking organization.

- If the “card” option is selected, then in the window that appears, agree to the processing of information by clicking the checkbox and clicking “Pay”. Then enter the card details and click on the “Pay XXXX rubles” button, where the amount is indicated instead of X. If a bank is selected, the service automatically takes you to the bank’s page, where you need to enter your personal account login and confirm the operation.

- On the State Services website. Instructions for payment through the State Services portal:

- Log in to your personal account on the Federal Tax Service portal.

- Fill out the payment using the method above.

- In the last paragraph, when choosing the type of payment, click on the button using the organization’s website and select Public Services. Then the program will automatically transfer to the State Services website, where, using the account or card details, the resident has the right to deposit the tax amount.

- Through the My Taxes tab:

- Open the My taxes tab on the main page.

- Select the fee you need to pay and click on this line.

- Select a payment method: by bank card, through the credit company’s website, or create a payment order. Let's choose a bank card.

- Agree to the processing of information by checking the box. Then you need to click on the “Pay” button.

- Enter your card details and click pay.

When choosing a payment method through the website of a specialized company, the program will take you to the company’s page, where you also need to fill in the details and click a button with the appropriate text.

Results

If you have discovered an overpayment of tax, then to offset it or return it to your current account, you just need to write a corresponding application. It should be taken into account that the refund procedure is longer compared to tax offset.

For more information on tax refunds and offsets, see the section “Tax refunds in 2021 - 2021 (application and procedure).”

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Possible options

The return and offset procedure is regulated by Article 78 of the Tax Code of the Russian Federation. For convenience, we present it in the form of a diagram.

The whole procedure can be represented step by step as follows:

- We establish the fact of excessive payment to the budget.

- We check whether there is arrears on any of the taxes, penalties or fines, against which the inspectorate can offset the overpaid amounts.

- We check whether the declaration needs to be clarified at the same time.

- We determine our preferences, two options are available: refund or credit.

- We reconcile payments to the budget.

- We are preparing the necessary applications.

- We send the necessary package of documents to the inspection.

What can you do about overpayments and payments?

According to paragraphs. 1, 6 tbsp. 78 of the Tax Code of the Russian Federation, the payer has the right to return excess funds or offset the money towards the payment of another fee or transfer it to a future tax period. If you transfer money to the next year to pay the next accrued amount, you do not need to fill out 3-NDFL. You just need to send an application for this to the tax authority at the place of registration.

A citizen also has the right to apply for a deduction for treatment, training, purchase or sale of movable and immovable property. In this case, the citizen is returned a portion of the funds spent, in the amount of 13%. But before that, the declaration will be subject to desk review.

Actions in case of overpaid funds

If an overpayment appears in the taxpayer’s personal account, the business entity or citizen first of all has a question as to how such a deficiency can be eliminated and whether it is possible to return the money. If it was formed due to erroneous transactions or any other inaccuracies, an individual entrepreneur, individual or legal entity has every right to return the excess funds.

For reference. When submitting a refund request, overpaid money cannot be transferred via cash payment.

Possibility of return

You can request a refund of erroneously paid money in the following cases:

- if the taxpayer was found to have overpaid due to the fact that he acquired the status of a tax resident of the Russian Federation;

- provided that the employer who withheld a certain amount has already ceased to exist at the time the excess money is discovered in the account. This option is most often observed in the case where the company was liquidated;

- in case of erroneous deductions from a person from several of his incomes. This case may include situations of withholding personal income tax from pensions that were paid on the basis of concluded agreements with the Non-State Pension Fund.

Sources used:

- https://nalog-plati.ru/voprosy/chto-oznachaet-rasporyaditsya-v-lichnom-kabinete-nalogoplatelshhika

- https://lichnyj-kabinet-banka.ru/kak-rasporyaditsya-pereplatoy-v-lichnom-kabinete-nalogoplatelschika/

- https://nalog-prosto.ru/kak-rasporyaditsya-pereplatoj-v-lichnom-kabinete-nalogoplatelshhika/

- https://www.klerk.ru/blogs/moedelo/504166/

Special cases

Sometimes there is an overpayment of federal taxes and an underpayment of those regulated by the subject, that is, payments are made to different levels of the budget system. This is called a violation of interbudgetary regulation, and such cases are regulated not by Article 78 of the Tax Code of the Russian Federation, but by Order of the Ministry of Finance dated November 12, 2013 No. 107n and the Budget Code.

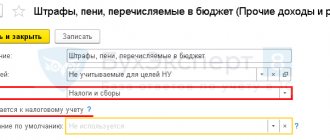

First of all, in such a situation, it is necessary to clarify the tax payment that caused the problem. And then, to correct the situation, write and send a letter to the tax office to clarify the details of the payment order regarding the budget classification code. It is compiled in free form and submitted in written or electronic form.