Accounting entries for VAT when importing goods

VAT transactions when importing goods can be presented as follows:

- posting of imported goods – Debit to account 41 “Goods”, Credit to account 60 “Settlements with suppliers and contractors”;

- customs VAT was calculated - D 19 “VAT on acquired values”, K 76 “Settlements with various debtors and creditors”;

- the customs duty on imported goods is reflected - D 41 “Goods”, K 76 “Settlements with various debtors and creditors”;

- customs duty is reflected - D 41 “Goods”, K 76 “Settlements with various debtors and creditors”;

- the services of an intermediary/agent (customs representative) for customs clearance of goods are reflected - D 41 “Goods”, K 60 “Settlements with suppliers and contractors”;

- value added tax on the services of an intermediary/agent is taken into account - D 19 “VAT on acquired values”, K 60 “Settlements with suppliers and contractors”;

- accepted for deduction of VAT – D 68 “Calculations for taxes and fees”, K 19 “VAT on acquired values”;

- the debt for imported goods was paid - D 60 “Settlements with suppliers and contractors”, K 52 “Currency accounts”;

- the exchange rate difference in settlements with foreign suppliers is reflected - D 60 “Settlements with suppliers and contractors”, K 91 “Other income and expenses” under the subaccount “Other income”.

A person who is not a VAT payer (“simplified”), working without VAT, uses the same transactions upon receipt of imported goods. If an organization (entrepreneur) applies the “income-expenditure” simplified tax system or pays the unified tax system, VAT is taken into account in expenses. Similarly - if goods are purchased by an enterprise on OSNO for activities not subject to indirect taxes. Enterprises and entrepreneurs on UTII and the “income” simplified tax system do not take VAT into account at all.

If the customs authority adjusts the customs value, then the following entries are used in accounting: to reflect the amounts of VAT subject to additional payment under the CTS - D 19, K 68, adjusted VAT - similarly, adjusted VAT previously accepted for deduction - D 68, K 19.

The specified entries are used when paying VAT when importing from any country into Russia, including China, Italy, Turkey, etc. More information about VAT accounting entries for imports can be found here.

Incoterms 2021 provisions

It is a set of eleven rules applied in international trade, reflecting the rights and obligations of each party to the contract in relation to the delivery of goods from the seller to the buyer. Incoterms 2021 rules are in effect from 1 January 2021, but earlier versions can also be used. They reflect current trade practices around the world. The main purpose of this set of rules is to simplify the understanding of a foreign trade contract, distribute obligations and expenses between the parties to the transaction (payment for transportation, costs for customs reporting and duties, transfer of ownership and risks of loss, etc.). Contains 4 groups of basic delivery conditions (table):

| Delivery conditions | Description | Transfer of risks to the buyer | Cost of goods, invoice | |

| Group E (shipment) | ||||

| EXW | The products are placed at the disposal of the buyer directly at their warehouse or enterprise. Literally translated as “ex-warehouse”, actually means pick-up | At the time of shipment at the seller's warehouse | Product cost without additional costs | |

| Group F (when the main transportation costs are borne by the buyer) | ||||

| FCA | The products are transferred to the buyer, loaded onto a specific vehicle at a pre-agreed location and released by customs according to the export procedure. The seller pays basic customs duties. The buyer completes import customs clearance. | At the time of loading onto a vehicle (at the seller’s warehouse or when transferring the goods from the seller’s transport to the carrier) | Cost of goods and cost of export clearance with payment of customs duties, but without transportation costs | |

| F.A.S. | The buyer is handed over the products placed along the ship's side, released by customs under the export procedure. The seller bears the costs of export clearance and duties. The buyer bears the costs of loading the goods on board the vessel, transportation and import customs clearance. Applicable only for transportation by water transport. | At the time of unloading of goods at the side of the vessel (in the absence of a vessel, the shipment is not considered completed) | The cost of the goods, taking into account export clearance and payment of appropriate duties, the cost of delivery to the port of shipment and unloading at the pier. Does not include transportation and freight costs | |

| FOB | It differs from FAS in that the seller is obliged to load the goods onto the ship and secure them. Also used for transportation by water. | At the time the goods are placed on board the vessel. | Same as FAS. Additionally, the costs of loading the goods onto the ship are included. Freight cost does not include | |

| Group C (the main transportation costs are borne by the seller) | ||||

| CFR | The seller places the goods on the ship, completes the export customs procedure, and pays the appropriate export duties and freight costs. The buyer bears the costs of transportation and unloading at the port of arrival, and completes import customs clearance. Transportation by water transport only | In this case, the risk of loss or damage passes to the buyer at the moment the goods are placed on the ship. Although the shipping costs are borne by the seller | Same as FOB, also freight costs. Unloading at the port of destination is paid by the buyer | |

| CIF | It differs from CFR in that, among other things, the seller is required to insure the products sold. Exclusively transport by water transport | At the time of placement on board the vessel. Despite the seller paying for shipping and insurance. | Additionally, the cost of insurance of the goods is included in the price. | |

| C.I.P. | The seller pays for transportation of the goods to the designated point, insurance, and export customs duties. Import customs clearance and unloading remains with the buyer. Changes to Incoterms 2021: the amount of the insured amount has been increased to 110 percent of the value of the insured amount of the goods | At the time of delivery of the goods to the carrier | Final cost of products + costs for export clearance and payment of export customs duties + insurance + delivery to destination | |

| CPT | The seller bears the costs of freight/transportation, export customs clearance and duties. The buyer completes import customs clearance and bears the unloading costs. | At the time of delivery of the goods to the carrier. Risks on the goods and costs pass to the buyer in 2 different places | Is the same | |

| Group D (delivery) | ||||

| DAP | The buyer bears the costs of unloading. Risks and expenses are transferred to the seller in one place | The transfer of risk to the goods passes at the destination | Cost of goods, export duties and clearance, transportation of goods to destination | |

| DPU | It differs from DAP in that the seller is obliged to unload the goods at the destination. These are the only conditions when unloading is carried out by the seller | At the time of delivery to the seller after unloading at the designated place. | The same + costs for unloading goods | |

| DDP | The seller hands over the products to the buyer at the destination, ready for unloading. Moreover, export and import customs clearance and payment of duties also lies with the seller. The buyer bears the costs of unloading the goods. | Risks pass to the seller until unloading at destination. | Cost of goods + customs clearance costs + payment of duties and taxes + costs of delivery to destination and unloading | |

VAT on imports: what you need to know

The Tax Code of the Russian Federation does not make any special differences in taxation between domestic sales and imports: rates of 20 and 10 percent are applied (if the sale of such goods on the territory of the Russian Federation is taxed at the appropriate rate). However, remember that you will have to pay VAT at customs, because without this, the goods will not be released from the temporary storage area at customs. For late payment, be prepared to incur penalties.

Differences in accrual begin from the moment of the tax base - when importing goods, include, in addition to the cost of the product according to the declaration, also customs duties and excise taxes.

You can deduct import VAT. To do this, you must pay tax at customs and confirm the costs incurred for the purchase with the appropriate documents.

SYSTEM: VAT cannot be deducted. The tax amount is included in the cost of the goods under the object of taxation “Income” or is included in the composition of expenses during taxation under “Income minus expenses”.

This type of operation is the exact opposite of import: goods are exported from the country, and there is an obligation to declare the goods and pay customs duties.

Accounting for export transactions should be kept separately from other sales transactions, since they are subject to a special VAT rate.

Let us highlight some accounting features:

- All payments are made both in rubles and foreign currency. To do this, the company must open foreign currency accounts in a bank and keep accounting using account 52 - create your own sub-account for each currency. Exchange differences are usually taken into account as part of other income and expenses.

- The transfer of ownership often does not coincide with the date of shipment of the goods. It all depends on what rules according to Incoterms 2021 were defined in the contract. Important! All conditions of export deliveries should be specified in the contract as precisely as possible - this will avoid most mistakes.

- In essence, sales transactions do not differ from the option of selling goods on the territory of our country.

To facilitate accounting, export sales transactions can be accounted for in separate subaccounts. Since customs duties must also be paid when exporting and declaring goods, specific transactions are added, such as:

| accounting entry | Operation |

| Debit 45 Credit 41 | Products were shipped from the supplier's warehouse, ownership has not been transferred |

| Debit 90 Credit 45 | Revenue recognition. Transfer of ownership according to the terms of the contract. |

| Debit 20, 44 Credit 76 | Duties on export transactions and customs declaration costs have been accrued |

| Debit 76 Credit 51, 52 | Customs duties (duty) paid |

Accounting for the reflection of export VAT deserves special attention. The company has the right to apply a 0 percent rate. But only if the company can confirm the right to use it. To do this, provide the following documents to the tax authorities:

- contract with a foreign counterparty;

- an extract from a credit institution confirming receipt of funds in payment for the delivery;

- a copy of the customs declaration with notes from the customs inspector;

- copies of other documents to confirm export.

For everything – a period of 180 calendar days. Did not have time? The company loses the right to apply a zero rate for export operations. Therefore, you will have to recalculate the tax amount at a rate of 20 percent (10 percent for certain types of goods according to the Tax Code of the Russian Federation).

VAT on advances. In this case, you must pay VAT on the amount of the advance received. Request a refund of the amount paid once title has passed to the buyer. A separate tax return is submitted for this purpose.

Tax deductions. The amounts of tax on advances made by foreign buyers, as well as the amounts of VAT that were paid to counterparties in the production of export goods, are subject to deduction. The right to deduction arises either on the last day of the quarter in which you collected documents confirming the zero rate, or on the day of shipment of the goods, if the special rate is not confirmed.

Important!

It is mandatory to keep separate records of input VAT on external and internal transactions!

Export VAT: postings

| accounting entry | Operation |

| Debit 19 Credit 60 | Input VAT on exports taken into account |

| Debit 90 Credit 68 | VAT is charged on sales at a rate of 0 percent |

| Debit 68 Credit 19 | Input VAT is accepted for deduction. |

| Debit 90 Credit 68 | If the zero rate is not confirmed within the prescribed period, then VAT on sales should be charged at the current rate of 20 (10) percent |

Income tax – when to report revenue?

If income is recorded on a cash basis, then accordingly, we recognize revenue on the date of receipt of funds in a foreign currency account. Do not forget to recalculate it in rubles at the current exchange rate for the currency in which settlements with the foreign buyer are made.

However, most companies use the accrual method, which is where positive and negative exchange rate differences arise due to currency fluctuations. Reflect them as non-operating income/expenses when forming the tax base.

In order to comprehensively solve all problems related to foreign exchange transactions, you can automate the accounting of export-import transactions. Solutions such as “1C:ERP Enterprise Management”, “1C:Holding Management”, “1C:Accounting” and others will help with this. Find out more about the products here >>>

VAT on imports

It is levied by government agencies when exporting or importing products across state borders.

The main duties for foreign trade participants include:

Customs fees

Such payments are charged in the following cases:

- as a fee for processing the product at customs;

- for the presence of products in a customs warehouse;

- for customs escort, etc.

Customs duties are paid when exporting or importing goods.

Excise taxes

Such fees are charged when transporting products and consumer goods, the list of which is established by the Legislation of the Russian Federation.

Article 181 of the Tax Code contains all the necessary information about excisable products.

VAT

VAT - value added tax. This payment must be made before the products are released from customs. The following indicators are used to calculate VAT:

- customs value of transported products;

- excise tax;

- current rate;

- the amount of customs duty that is payable.

To calculate value added tax, you need to add up the cost of the product, excise tax and duty. The resulting number must be multiplied by the current bet.

What does not apply to customs duties?

Payments collected from participants in foreign economic activity:

- Special. Some goods imported into the country may negatively affect domestic production, reducing its profitability. This type of duty protects Russian manufacturers from bankruptcy.

- Anti-dumping. They prevent the sale of goods brought from abroad at dumping prices.

- Compensatory. They are levied only when subsidies were used in the production or transportation of products.

Collection of these types of duties is carried out in a special manner in accordance with the current Legislation.

Payment of import customs duties by accounting entry in 1s 30

I have noticed more than once that when a novice accountant is faced for the first time with the need to enter goods into the program according to the customs declaration (customs declaration, import), his first reaction is stupor.

Lots of numbers, in different currencies, nothing is clear. Today in the lesson we will learn to read and understand the customs declaration using a real example, enter its data into 1C: Accounting 8.3 (edition 3.0), and also take into account the VAT paid at customs.

So, let's go!

Our gas turbine engine as an example

So, we have 2 sheets of a real customs declaration (main and additional). I only cleared confidential information from them, which is of no use to us for educational purposes.

You can open them on a separate page, or better yet, print them out and put them right in front of you.

Learning to read GTD

We will analyze the gas customs declaration based on the rules for filling it out, which you can read, for example, here.

Our declaration consists of 2 sheets: main and additional. This happens when the import of two or more goods is declared, because information about only one product can be placed on the main sheet.

Parsing the main sheet

Main sheet header

Please pay attention to the upper right corner of the main sheet of the customs declaration:

IM in column No. 1 means that we have a declaration for the import of goods.

Declaration number 10702020/060513/0013422 consists of 3 parts:

- 10702020 is the code of the customs authority.

- 060513 is the date of the declaration (May 6, 2013).

- 0013422 is the serial number of the declaration.

In column No. 3 we see that we have the first (main sheet) form of two (main sheet + additional sheet).

3 goods are declared , which occupy 3 places .

Let's go a little lower:

Here we see that the total customs value of all 3 goods is: 505,850 rubles and 58 kopecks .

The product arrived to us from the Republic of Korea .

The currency in which settlements are made ( USD ) is also indicated here, as well as the customs value in this currency ( $16,295 ) at the exchange rate as of the date of the customs declaration (May 6, 2013). The exchange rate is indicated here: 31.0433 rubles.

Let's check: 16,295 * 31.0433 = 505,850.58. The result was the customs value in rubles.

Product #1 (excavator)

Let's go even further down the main sheet to the left:

Here is our first product, which is indicated on the main sheet of the customs declaration. Obviously, the remaining two are declared on the additional sheet.

Product name: “ Hydraulic excavator ”, it ranks 1st.

Move from the product name to the right:

Item number 1 of 3.

The price of the excavator is 15,800 USD , which in terms of rubles (at the rate of 31.0433) forms a customs value of 490,484 rubles and 14 kopecks .

Excavator taxes and fees

Let's go down to the bottom of the document:

The customs duty (code 1010) for all goods (the customs value as a whole for the customs declaration is indicated as the basis for the calculation) amounted to 2,000 rubles .

The duty (code 2010) for an excavator (the basis for calculating its customs value) was 5% or 24,524 rubles and 21 kopecks .

VAT (code 5010) on an excavator (the calculation basis was the sum of its customs value of 490,484.14 and the duty amount of 24,524.21) amounted to 18% or 92,701 rubles and 50 kopecks .

Once again, I draw your attention to the fact that we charge duty on the customs value of the goods, and VAT on (customs value + amount of duty).

Parsing the additional sheet

Additional sheet header

Let's move on to the second (additional) sheet of the declaration.

Pay attention to the upper right corner of the additional sheet:

The number and type of declaration completely coincide with the values on the main sheet.

In column No. 3 we see that we have the second form (additional sheet) out of 2 (main and additional sheets).

Item #2 (hammer)

We go down below to the goods declared on the additional sheet:

Before us is the product “ Hydraulic Hammer ”, which takes 1st place.

First of all, we see that we have 2 products out of 3.

The price of the hammer is 345 (USD) , which in terms of rubles at the rate (31.0433) is 10,709 rubles and 94 kopecks (customs value).

Product #3 (spare parts)

The second product on the additional sheet (the third on the gas customs declaration as a whole): “ Parts of a full-rotary hydraulic single-bucket excavator .”

This is the third product out of 3.

The price of spare parts is 150 (USD), which in terms of rubles at the exchange rate (31.0433) is 4,656 rubles and 50 kopecks (customs value).

Taxes and fees on hammer and spare parts

We go down the additional sheet (column No. 47, calculation of payments):

The duty (code 2010) on the hammer (the basis for calculating its customs value is 10,709 rubles and 94 kopecks) was 5% or 535 rubles and 50 kopecks .

VAT (code 5010) on the hammer (the basis for calculating its customs value plus duty) amounted to 18% or 2,024 rubles and 18 kopecks .

Postings and operational accounts for customs duties for exports

What are wiring? This is an accounting term that means recording various changes in the condition of a particular product in the documentation.

To what account should customs payments be attributed when exporting products? When exporting goods outside the territory of the state, the procedures are written off from account 90, subaccount 5 to account 76. The procedure is documented by posting D90/5 K76.

As a rule, when exporting products, the VAT rate is 0%. In other words, the foreign trade participant receives compensation from the state budget for repayment of this payment. But there are some exceptions for such cases:

- sales and delivery of products are carried out in the Republic of Belarus;

- export of petroleum products.

To receive reimbursement for VAT expenses, you must provide the government agency with the following basic documents:

- a contract concluded between a foreign trade participant and a foreign representative;

- a document from a banking organization confirming a financial transaction;

- cargo customs declaration.

The payer must comply with the deadlines for submitting documents. They are 180 days after drawing up the declaration.

After submitting the required package of documents to the customs authority, VAT refund is carried out within 3 calendar months.

Creating a counterparty Customs

When adding a new position Customs authority , pay attention to filling out the counterparty card:

- Type of counterparty - State body .

- Governmental Authority - Other .

As a result of selecting such analytics, fields 104-110 will be available in the payment order for the payment of VAT, fees, and duties.

The short name of the customs office can be indicated, for example, as FCS .

To which accounts should payments for import transactions be attributed?

The declaration of goods transported to the territory of the state must be carried out within the strictly established time frames established by the Legislation of the Russian Federation. They are 15 days after the day of delivery of products and necessary means of transport.

The following types of payments are charged upon import:

- customs duty;

- excise taxes;

- fees required to cover customs clearance costs;

- value added tax (as opposed to export transactions).

The payer must pay all these payments on time. The deadline for paying customs duties is before drawing up the declaration or simultaneously with its submission. But standard deadlines must be observed - no later than 15 calendar days after the products arrive at the territory of the customs authority.

The import payment account may vary depending on the type of product transported:

- If materials are transported, then the entry for the advance payment for customs is D15 K76.

- If goods are transported, then the wiring is D41 K76.

All customs payments payable by foreign trade participants are expressed in the same currency as the customs value of the imported products.

In order for cargo transportation across the border to go smoothly, it is necessary to calculate customs duties and fees correctly. Foreign trade participants should learn how to calculate payments independently. Information about the types of payments in the customs declaration is in this article. These are mandatory payments for export/import operations.

VAT on import

When accounting for import transactions, special attention should be paid to such payment as value added tax. The main difference between import transactions and export transactions is the taxpayer’s obligation to pay VAT.

The formula for calculating this payment includes the following components:

- excise taxes;

- customs value of transported products;

- customs duty.

All these indicators are added together to obtain value added tax.

Posting for VAT calculation - D19/3 K68/1. In subsequent operations and procedures, the reverse of this wiring is used - D68/1 K 19/3.

In addition, watch the video tutorial “Capitalization of imported goods” in the 1C program:

So, the payment of customs duties is regulated by the Customs Code of the Customs Union. And VAT and excise taxes refer to tax payments. That is why they must be strictly separated in accounting. It allows you to monitor the implementation of payments and compliance with all repayment deadlines established by the Legislation of the Russian Federation.

You can find more information on the topic in the Customs payments section.

Free consultation by phone:

+7 (call is free)

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our specialist will advise you free of charge.

An organization that purchases goods (services) abroad of the Russian Federation must pay VAT when importing the purchased goods (services) at customs. Let's look at how to calculate, charge and receive a deduction for VAT paid at customs when importing, how to reflect import VAT in the purchase book and declaration, as well as transactions generated for VAT when importing goods and services.

Payment of import customs duties by accounting entry in 1s 30

Release 3.0.70 was used.

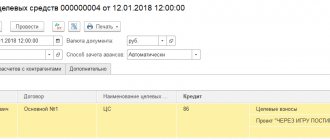

In “1C: Accounting 8”, the customs declaration document for import is intended to account for customs duties paid upon import and indicated in the declaration of goods

.

Customs fees and duties are included in the cost of goods. VAT paid on the import of goods can be deducted (the transaction type code 20 and the customs declaration number are indicated in the purchase book) or taken into account in the cost of goods in accordance with Art. 170 Tax Code of the Russian Federation. document for import

can be created based on the document “Receipt (act, invoice)” or directly in the “Purchases” section.

Please note that for this, Full

functionality or

Selective

functionality must be installed in the program settings with the

Imported goods

on the

Inventory

(section

Main

-

Functionality

) (Fig. 1).

When imported goods are received from a foreign supplier in the Receipt document (act, invoice)

(section:

Main

–

Shopping

):

- in the “% VAT” column, select “Without VAT”, because VAT paid at customs will be indicated in the import customs declaration

; - in the columns “Customs declaration number” and “Country of origin”, indicate the country of origin of the goods and the number of the cargo customs declaration (elements of the directories “Customs declaration numbers” and “Countries of the world” (the element can be added automatically using the “Add from classifier” button).

Create a customs declaration document for import

based on the document “Receipt (act, invoice)”) using the “Create based on” button (Fig. 2) or as a separate document (section:

Main

-

Purchases

).

In the customs declaration document for import

on the “Main” tab (Fig. 3):

- select the customs authority and the customs declaration number in the appropriate fields (the directory element “Customs Declaration Numbers”);

- in the “Deposit” field, select the directory element “Agreements” (only agreements with the type “Other” are displayed in the selection list), which was indicated in the document “Write-off from the current account” when transferring funds to the customs authority;

- using the link indicating the currency and exchange rate, open the “Prices in the document” form to change the document currency to rubles (then on the “Sections of the customs declaration” tab, the customs value can be specified in rubles; by default, the currency specified in the agreement with the supplier of goods is set);

- indicate the amount of customs duty in the field of the same name;

- in the “Settlements” field, follow the link to open the “Settlements” form, indicate the account for settlements with the customs authority 76.09 “Other settlements with various debtors and creditors” (the same account as in the document “Write-off from the current account” when transferring funds to the customs authority ) and the method of crediting the advance “Automatically”;

- The “Reflect VAT deduction in the purchase book” checkbox is selected by default. If VAT should be included in the cost of goods, then uncheck this box.

In the customs declaration document for import

on the “Sections of the customs declaration” tab (Fig. 4), the customs value of the goods, the rate and amount of customs duty, the rate and amount of VAT charged are indicated in the upper tabular part; the list of goods with data for each product is displayed in the lower tabular part. The document may have several sections of the customs declaration, each of which groups goods with the same procedure for calculating customs duties and the VAT rate. You can add a section using the “Add” button in the upper table part (each line corresponds to a separate section), and delete it using the “Delete” key on the keyboard. When you select a line in the upper tabular part, the list of goods related to the selected section of the customs declaration is displayed in the lower tabular part.

If the customs declaration document for import

created on the basis of the receipt document, then the lower tabular part “Products by section” will be filled in with the items from the receipt document automatically. If the document was created as a new document (not based on the receipt document) or the document should have several sections of the customs declaration, then click the “Fill” button, select the receipt document, the entire list of goods from the selected document will go into the tabular section, edit it, leaving only the lines, related to the selected section of the customs declaration.

At the top of the table:

- In the “Customs value” column, indicate the customs value for all goods of the section of the customs declaration selected in the table. The customs value for all sections of the customs declaration (for all lines of the upper tabular part) must correspond to the total customs value of goods indicated in the customs declaration in gr. 12 (customs value may be greater than the cost of goods under the contract with the supplier);

- In the “% of duty” column, indicate the percentage of duty for the section of the customs declaration selected in the table. The amount of duty will be distributed among the goods in the lower table “Goods by section” in proportion to their value under the agreement with the supplier. If the duty on goods is determined in a fixed amount, then you can indicate the amount of duty for each product in the lower table in the “Duty” column;

- In the “% VAT” column, indicate the VAT rate for the goods of the customs declaration section selected in the table;

- The VAT amount in the column of the same name is calculated automatically in rubles ((customs value + customs duty) * VAT rate).

In the lower tabular part “Products by section”:

- Check the goods account and VAT account in the appropriate columns;

- If necessary, adjust the duty and VAT in the columns of the same name (if you did not create separate sections of the customs declaration for grouping goods with the same procedure for calculating customs duties and the VAT rate). The totals in the upper table area will change automatically.

- Button Post and close.

Postings for VAT on imports

Standard accounting entries for accounting for VAT when importing goods:

| Debit Account | Credit Account | Wiring Description | Documentation |

| 60 | 52 (55) | Transfer of an advance to the supplier from a foreign currency account (from a letter of credit) | Bank statement (letter of credit 0401063) |

| 76 | 51 | Paid customs duties are reflected | Payment order, bank statement, customs declaration |

| 41 (10;07;08) | 60 (76) | Reflects the transfer of ownership of imported goods (materials, OS requiring installation, OS not requiring installation) according to the terms of the contract | Certificate of acceptance of goods TORG-1, Certificate of acceptance and transfer of goods and materials for storage MX-1, Certificate of acceptance (receipt) of equipment OS-14 |

| 19 | 68 | The amount of VAT paid at customs upon import of purchased imported goods is reflected. | Bank statement, customs declaration, accounting certificate |

| 41 (10;07;08) | 60 | The amount of expenses for the delivery of purchased imported goods on the territory of the Russian Federation is reflected. | Accounting information |

| 19 | 60 | VAT paid for the delivery of imported goods in the Russian Federation is reflected | Invoice received, Accounting certificate |

| 68 | 19 | VAT paid at customs is presented for deduction after the imported goods are accepted for accounting | Invoice received, Accounting certificate |

| 60 | 91.01 | The positive exchange rate difference when importing in foreign currency is reflected | Accounting information |

| 91.02 | 60 | Negative exchange rate difference when importing in foreign currency is reflected | |

| 60 | 52 (55) | Payment was transferred to the supplier from a foreign currency account (letter of credit) | Bank statement (letter of credit 0401063) |

Setting up settlement accounts with customs

By default, invoice 76.09 is not inserted into the document Write-off from the current account and the customs declaration for import . There are two options for filling out the Settlement account .

Option #1

Account 76.09 can be filled out in documents manually by selecting from the Chart of Accounts .

This method is suitable if settlement transactions with customs are one-time or very rare.

Option No. 2

Account 76.09 is filled in automatically according to the data in the Account for settlements with counterparties .

This is a universal option that is best suited for working in 1C for both rare and frequent transactions involving settlements with the customs authority.

The setup can be done by clicking on the Accounts with counterparties link directly:

- from the counterparty's card;

or from the Agreement .

In the form that opens, you need to fill out settlement accounts, as shown in the figure below. Then click the Burn and close .

How to take into account VAT when importing in accounting using an example

Let's take a closer look at an example of how to reflect VAT on imports in accounting entries:

Let’s say that VESNA LLC, on December 12, 2016, purchased goods from a foreign company for a total amount of $5,000. According to the terms of the contract, ownership passes upon receipt of the goods, that is, on December 12, 2016. Customs duty - 15%. Customs duty - 7,500 rubles. Services for customs clearance amount to 70,800 rubles, incl. VAT 18% - 10,800 rub.

US dollar rates:

- as of December 12, 2016 equals 63.3028;

- as of December 19, 2016 equals 61.7515.

The accountant of Vesna LLC reflected VAT on imports with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 41 | 60 | 361 514,00 | Purchased imported goods were capitalized (5,000 * 63.3028) | Certificate of acceptance of goods TORG-1 |

| 41 | 76 | 7 500,00 | The amount of customs duty on imported goods is reflected | Accounting information |

| 41 | 76 | 47 439,00 | The amount of customs duty on imported goods is reflected ((5,000 * 61.7515+ 7,500)*15%) | Accounting information |

| 19 | 76 | 64 115,37 | The amount of calculated customs VAT is reflected ((308,757.50 + 47,439.00) *18%) | Invoice received, Accounting certificate |

| 41 | 60 | 60 000,00 | The cost of the service for customs clearance of purchased imported goods is reflected. | Accounting information |

| 19 | 60 | 10 800,00 | The amount of VAT on services is reflected (60,000.00 * 18%) | Invoice received |

| 60 | 52 | 308 757,50 | Payment for purchased imported goods has been transferred (5,000.00 * 61.7515) | Bank statement |

| 60 | 91 | 7 101,50 | The exchange rate difference is reflected (5,000.00 *(61.7515-63.1718)) | Accounting information |

| 68 | 19 | 74 915,37 | Paid VAT is accepted for deduction (64,115.37 + 10,800.00) | Invoice received, Accounting certificate |

Offset of advance payment to customs according to documents

On the Main the customs declaration for import document :

- open the link Calculations ;

- establish the method of offset of advances - By document ;

- Click the Add in the Advance document to go to the Selecting documents for settlements with counterparties .

- Generate a list of documents in Selection Mode , for example, By balances .

- In the resulting list, select the document Write-off from the current account for payment orders No. 1 and No. 4. First select payment order No. 1, then through the Add - No. 4.

- The documents will be transferred to the Calculations . In the Offset Amount , you must indicate the amounts that need to be offset for each payment order: paragraph No. 1 - VAT 189,000 rubles. + fee 750 rub. = 189,750 rub.;

- PP No. 4 - duty 50,000 rubles.

The result of posting a customs declaration document for imports can be checked using the Turnover Balance Sheet (SAS) for account 76.09 through Reports – Standard Reports – Turnover Balance Sheet for the account. In SALT Settings Grouping by Documents of settlements with the counterparty .

Payment orders for payment of VAT, fees, duties to customs

Payments to the customs authority are filled out according to general rules, but at the same time they have their own characteristics (Appendix No. 3 to Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 N 107n, Letter of the Federal Customs Service of the Russian Federation dated November 30, 2011 N 01-11/58349, Letter of the Federal Customs Service of the Russian Federation dated December 26 .2013 N 01-11/59519).

Let's consider the main points that you need to pay attention to when processing payment orders to the Federal Customs Service:

The payment is made to the customs office, not the post. Before paying, you need to find out which customs office your customs post (terminal) belongs to. Information can be obtained on the official website of the Federal Customs Service of the Russian Federation or from a broker. For example, the North-West Customs Administration.

Features of filling out fields in a payment order:

- field 21 - payment order - 5;

- field 101 - payer status: Legal entities - 06;

- IP - 17;

- 15311009000010000180 — advance payments

- Baltic customs - 10216000;

The customs code must be filled in in field 107. It is not enough to indicate it only in the purpose of payment. You can find out the code on the official website of the Federal Customs Service of the Russian Federation or from a broker.

The following fields of the payment order are without a specific value:

- field 106 - 0, some banks require DE (declaration of goods);

- field 108 - 0;

- field 109 - 0, some banks require you to indicate the date DD.MM.YYYY;

- field 110 - 0.

There is another option for paying customs duties - customs cards. The Federal Customs Service reports about it on its website: