The concept of leasing appeared in our country relatively recently. This is a kind of form of lending to an enterprise when it purchases fixed assets. Leasing objects can be: equipment, structures, enterprises, transport, etc. In essence, leasing is a long-term lease of property with subsequent acquisition of ownership. Our company provides implementation and maintenance services for 1C software products. If you have any questions about working with the system, contact him, we will be happy to help you.

Arrival of a minibus for leasing

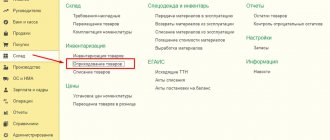

Let's go to the menu “Fixed assets and intangible assets - Receipt of fixed assets - Receipt of leasing” and create a new document.

We indicate the lessor and the contract, the vehicle and the cost. Set the settlement account to 76.07.1 “Rental obligations”. Item accounting account - 08.04.1.

Document postings:

Monthly lease payments

Go to the “Purchases” menu and select “Receipts (acts, invoices)”.

When creating a new document, select the type of operation “Leasing services”. Let's fill out the document, leaving all accounts at default. This payment will be in the amount of 20 thousand rubles.

As a result, this 1C 8.3 document created the postings shown in the image below.

If you need to change the reflection of leasing payment expenses, or make adjustments to depreciation accounting, you can use the document “Asset Depreciation Parameters” from the “Assets and Intangible Assets” menu.

Select the appropriate type of operation when creating a new document, depending on what goals you are pursuing.

Acceptance of a minibus for registration

Since the minibus is registered with the lessee, it must be taken into account. To do this, we will create a document “Acceptance of asset accounting” with the type of operation “Equipment”.

On the “Non-current asset” tab, indicate the method of receipt of fixed assets “Under a leasing agreement”, select the lessor and the agreement.

On the “Fixed Assets” tab, create and add a fixed asset.

On the “Accounting” tab we indicate:

- Accounting account 01.03 “Leased property”.

- Depreciation account 02.03 “Depreciation of leased property.”

- Depreciation calculation settings: calculation method, accounting option, useful life.

On the “Tax Accounting” tab, we will establish that we will calculate depreciation and indicate the leasing parameters:

- The initial cost is the amount of the lessor's expenses to purchase the property.

- Method of reflecting expenses for tax accounting.

We will also indicate the useful life.

Let's go through the document and look at the postings.

The minibus was registered as a rented vehicle.

Leasing accounting in 1C 8.3

The concept of leasing began to gain popularity relatively recently and can be defined as a form of lending to a business entity when it purchases fixed assets.

Enterprises, vehicles, various structures and equipment can be leased objects. That is, leasing is a type of financial service in which the long-term lease of an enterprise’s assets ends with the acquisition of their ownership. Leasing: acquisition and registration

In the 1C 8.3 program, a special document “Acceptance for leasing” is available to lessees. It can be found in “OS and intangible assets - Receipt of OS” and account for leasing on your balance sheet.

It is important to remember that the accounting account is 76.07.1. Data on purchased funds is also entered into the accounting table. We indicate the accounting account 08.04.2* - “Acquisition of fixed assets”

*Does not function on account 08.04.2 release 3.0.66.60

Next, you need to carry it out and check the accounting entries.

The next step is to go to the menu of the current section “Acceptance for accounting of fixed assets”. Here a new document is created, and the necessary details are entered into the upper part of the form:

— Type of operation – equipment (according to the example);

— Number and date – the date is entered, the number is generated automatically;

— MOL (materially responsible person) – it is necessary to identify and appoint a company employee;

— OS location – indicates where the equipment will be used;

— OS event – here it is necessary to note what is registered and put into operation.

Next, you need to enter data in the tabs below, the first of which is Non-current asset. We enter the following information:

— Method of receipt – Under a leasing agreement;

— Counterparty – indicate the lessor;

— In the “Agreement” field we enter our leasing agreement;

— Equipment – subject of leasing;

— In the “Warehouse” field, the warehouse to which the equipment will be received is indicated;

— In the “Account” field, enter 08.04.2 “Purchase of fixed assets”

The Fixed Assets tab is filled in according to the directory of the same name, where you need to create a new position. After clicking “+” we proceed to filling out the directory.

The following fields are required:

— The asset accounting group is Vehicles;

— Name – Car;

— Included in the group – Fixed Assets.

Click the “Save and close” button. Thus, we fill out the tab, selecting new equipment from the list, after which it is displayed in the directory, and the inventory number is assigned automatically.

Accounting data is filled in in the “Accounting” tab:

— Accounting account – 01.03 Leased property;

— Accounting procedure – select “Depreciation calculation”;

— Accrual method – Linear;

— Accrual account – we issue 02.03 “Depreciation of leased property”;

— Method for displaying expenses - you must indicate a debit to the accounting account for which depreciation will be displayed. In our case, 20.01 “OS”.

— Useful life – here you enter how many years the depreciation of this equipment is planned for. We have 10 years, that is 120 months.

In the fields of the next tab, data for the tax office is filled in.

— The procedure for including cost in expenses is to add depreciation;

— The Initial Cost displays the amount of costs excluding VAT of the lessor for the purchase of equipment. This information is contained in the leasing agreement;

— Method of reflecting costs for leasing payments - indicate “Depreciation” (account 20.01);

— Period of use – we set it similarly to 120 months (10 years).

Next, we carry out the document and by pressing the DtKt button, we control the postings: DT 01.03 – Kt 08.04.1 “The asset has been accepted for accounting.”

Every month the lessor will issue an invoice for leasing services, for accounting for which in the 1C 8.3 program there is a tab “Receipts (acts, invoices) in the “Purchases” menu.

To create a receipt, you must select “Leasing Services”.

The required details when filling out the document are: the number and date of the act that was received from the lessor, details of the leasing agreement itself, the organization of the lessor and the lessee. In the “Nomenclature” field the “Leasing payment” is displayed, in the “Amount” - the amount from the lessor’s invoice (act). After entering the invoice number and date, select “Register”.

It is important to remember that the accounting account for settlements with the counterparty is 76.07.2, and for advances – 60.02.

After all the receipt data has been entered, click “Post”. Thus, information on the costs of leasing services is generated in accounting and financial accounting. Click DtKt and check the wiring.

In accounting, leasing payments are not considered expenses, but are shown as debit 76.07.1 Lease liabilities. The cost of fixed assets leased is displayed on the credit of this account. After all lease payments under the lease agreement have been made, account 76.07.1 will be closed.

The concept of depreciation in leasing

Fixed assets purchased under a leasing agreement must be registered and depreciated, despite the fact that they do not belong to the property of the enterprise. This is carried out in “Operations – Period Closing” using a routine closing operation.

It is very important to correctly draw up the accounting policy of the enterprise in 1C 8.3, because There is a difference between accounting and tax accounting of leasing transactions. In tax accounting, leasing expenses are taken into account minus tax depreciation. The 1C 8.3 program will automatically calculate depreciation and leasing expenses, and will also reflect the difference between accounting and tax accounting.

Calculation of leasing payments

The leasing payment will be calculated every month. To do this, we will create a document “Receipts (acts, invoices) with the type of operation “Leasing services”.

In the document:

- We indicate the date and organization.

- We choose a lessor and a contract.

- In the “Settlements” section, we will set the account for settlements with the counterparty 76.07.2 “Debt on leasing payments”. We leave the advances accounting account at 60.02.

- In the tabular section, select the item and indicate its cost. In the example, the leasing payment is 50,000 rubles.

Posting a document.

Payments in subsequent months are calculated in the same way.

Depreciation calculation

Every month, at the end of the month, depreciation on the leased property is automatically calculated.

In postings, depreciation is taken into account on account 02.03.

Also, at the close of the month, leasing payments are recognized in tax accounting.

Payment of leasing payment

To pay the lessor, we will create a document “Write-off from current account” with the transaction type “Payment to supplier”.

Under the terms of the agreement, we pay the lease payment amount of 50,000 rubles, as well as part of the redemption price of 5,555.55 rubles. (RUB 200,000 / 36 months).

Let's look at the document postings.

- According to Dt 76.07.2, leasing debt will be gradually repaid.

- According to Dt 60.02, an advance on the redemption value of the property is reflected.

Payments are made in the same way in subsequent months.

Early purchase of property under a leasing agreement. Accounting with the lessee

The organization entered into a leasing agreement for the purchase of a passenger car for a period of 2 years. The leased item is on the balance sheet of the lessee. Depreciation is calculated with a coefficient of 0.5, the period is 36 months. 12 months after acceptance for accounting, the founders decided to buy out the leased asset at an early redemption price, which is less than the price of the fixed asset put on the balance sheet. A credit balance is formed on account 60, although in fact there is no debt.

What changes need to be made in connection with the early redemption: what transactions, what period?

In accordance with Art. 665 Civil Code of the Russian Federation

on the basis of a financial lease (leasing) agreement, the leased asset is transferred to the lessee for a fee for temporary possession and use.

On the basis of a leasing agreement, the leased asset can be purchased by the lessee in accordance with Art. 624 Civil Code of the Russian Federation

and paragraph 1 of Art. 19 of the Federal Law of the Russian Federation of October 29, 1998 No. 164-FZ “On financial rent (leasing).” In this case, the total amount of the leasing agreement includes the redemption price of the leased asset (Clause 1, Article 28 of the Leasing Law).

Taking into account that a financial lease (leasing) agreement is a subtype of a lease agreement ( Article 625 of the Civil Code of the Russian Federation

), it is subject to general provisions on leases that do not contradict the established rules on a financial lease agreement.

The procedure for purchasing leased property is established by Art. 624 Civil Code of the Russian Federation

.

According to this article, the law or the lease agreement may provide that the leased property becomes the property of the tenant upon expiration of the lease period or before its expiration, subject to the payment by the tenant of the entire redemption price

.

If the condition for the purchase of the leased property is not provided for in the lease agreement, it may be established by an additional agreement

parties, who have the right to agree to offset previously paid rent into the redemption price.

Under lease payments

means the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

The total amount of the leasing agreement may include the purchase price

the subject of leasing, if the leasing agreement provides for the transfer of ownership of the subject of leasing to the lessee (Clause 1, Article 28 of the Leasing Law).

Typically, transactions under a leasing agreement with the repurchase of leased property, if the leased property is taken into account on the balance sheet of the lessee, are reflected in the accounting records of the lessee according to the following rules

.

The fixed asset that is the subject of leasing is taken into account at its original cost (clause 7 of PBU 6/01 “Accounting for fixed assets”

, approved by order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for acquisition, construction and production, with the exception of value added tax (clause 8 of PBU 6/01).

When the lessee receives a fixed asset under a leasing agreement, the initial cost is equal to the total amount of his debt

before the lessor under the leasing agreement.

The cost of leased property received by the lessee is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with other debtors and creditors”, subaccount “Rental liabilities”.

This is provided for in clause 8 of the Instructions on reflecting transactions under a leasing agreement in accounting

, approved by order of the Ministry of Finance of the Russian Federation dated February 17, 1997 No. 15 (these Instructions are applied to the extent that they do not contradict later regulatory acts on accounting).

Costs associated with obtaining leased property and the cost of received leased property are written off from the credit of account 08

“Investments in non-current assets” in correspondence with

account 01

“Fixed assets”, subaccount “Fixed assets received on lease”.

For fixed assets leased and recorded on the lessee's balance sheet, depreciation is charged by the lessee

.

Depreciation is calculated in the generally established manner during the useful life of the leased property (clause 17 of PBU 6/01, clause 50 of the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n).

In cases where the leasing agreement provides for redemption

of the leased asset (that is, the organization will operate the fixed asset received on lease even

after the end of the

leasing agreement), it is advisable to determine the useful life of the leased property as if the company had simply purchased such property - based on the expected period of use of this object in accordance with expected performance or power (clause 20 of PBU 6/01).

Depreciation is reflected in the debit of the corresponding cost accounts (for example, account 26

“General business expenses”) and the credit of

account 02

“Depreciation of fixed assets”, subaccount “Depreciation of fixed assets received on lease”.

The accrual of lease payments due to the lessor is reflected in the debit of account 76

“Settlements with various debtors and creditors”, sub-account

“Lease obligations”

in correspondence with

account 76

“Settlements with various debtors and creditors”, sub-account

“Debt on leasing payments”

(clause 9 of the Instructions).

After payment of the redemption price, the leased property is transferred to its own fixed assets.

In this regard, on accounts 01

“Fixed assets”

and 02

“Depreciation of fixed assets”, internal entries are made related to the transfer of the value of fixed assets received under lease and the amount of depreciation accrued on them from the subaccount for property received under lease to the subaccount of own fixed assets (clause. 11 Guidelines).

In accordance with clause 12 of the Instructions, the amount of early accrued payments

the lessee debits

account 97

“Deferred expenses” in correspondence with

account 02

“Depreciation of fixed assets”.

At the same time, the specified amount is taken into account as a debit to account 76 “Settlements with other debtors and creditors”, subaccount “Debt on leasing payments” in correspondence with account 76 “Settlements with various debtors and creditors”, subaccount “Lease obligations”.

We believe that the posting is Debit 97 Credit 02

currently has no right to exist.

It essentially resets

residual value of the leased property. However, such zeroing is not provided for by PBU 6/01.

Upon termination of the leasing agreement due to the early purchase of this property by the lessee, the property is not disposed of

, it continues to be taken into account on the lessee’s balance sheet.

Therefore, depreciation should continue to be accrued on it in the generally established manner. Grounds for early

PBU 6/01

does not provide for

.

Consequently, depreciation on the purchased leased property is accrued over the remaining useful life of the leased asset (or until it is written off from the balance sheet), and a one-time reflection of the amount of underaccrued depreciation on the credit of account 02 in correspondence with the debit of account 97 (as recommended by the Instructions) should not be made .

Let's look at the order of accounts under a leasing agreement using your example, supplementing it with the necessary information.

To simplify the example, we will take all amounts already “cleared” of VAT; we will not consider the calculation of depreciation.

Let us assume that the total amount of payments under the leasing agreement is 720,000 rubles

, leasing term – 2 years (24 months).

Of which 240,000 rubles

- this is the redemption price of the car, and

480,000 rubles

are the leasing payments themselves, that is, the payment for using the leased item. That is, leasing payments are 20,000 rubles per month (480,000 rubles / 24 months).

According to the terms of the agreement, the organization can pay the entire redemption price ahead of schedule, in which case it is released

from paying the remaining lease payments.

The organization made an early purchase of the car after 12 months. DEBIT 08 CREDIT 76, subaccount “Rental obligations”

– 720,000 rubles – a car was leased;

DEBIT 01, subaccount “Fixed assets received on lease” CREDIT 08

– 720,000 rubles – the car is accepted for accounting as part of fixed assets;

DEBIT 76, subaccount “Lease obligations” CREDIT 76, subaccount “Arrears on leasing payments”

– 20,000 rubles – lease payment accrued to the lessor.

DEBIT 76, subaccount “Debt on leasing payments” CREDIT 51

– 20,000 rubles – lease payment has been paid to the lessor.

Such accrual and payment of leasing payments were made within 12 months, and therefore at the time of early purchase of the property the balance of leasing payments was 240,000 rubles (480,000 rubles - 20,000 rubles x 12 months).

The amount of debt listed to the lessor in account 76, subaccount “Rental Obligations”, is 480 000

rubles (240,000 rubles – leasing payments and

240,000

rubles – purchase price).

DEBIT 76, subaccount “Rental obligations” CREDIT 51

– 240,000 rubles – the amount of the purchase price of the car is transferred to the lessor.

Thus, after paying the redemption price, a credit balance

in the amount of leasing payments that

will not actually be accrued to the lessee

in connection with the early purchase of the property – 240,000 rubles.

And the initial cost at which the car was accepted for accounting (720,000 rubles, i.e. the total amount of payments under the leasing agreement) will ultimately not correspond to the amount of actual costs

for the purchase of a car.

The actual cost of purchasing a car will be 480,000 rubles

(240,000 rubles is the redemption price, and 240,000 rubles is the amount of lease payments for the first year of the leasing agreement before the early purchase of the property).

Consequently, corrective entries should be made in accounting to reduce the initial cost of the car and the debt to the lessor.

To do this you need to make notes:

DEBIT 91 CREDIT 01, subaccount “Fixed assets received on lease”

– 240,000 rubles;

DEBIT 76 “Rental obligations” CREDIT 91

– 240,000 rubles.

Moreover, by making a corrective entry, you do not change

the initial cost of the fixed asset, but only correct

the error

made when registering the car.

In connection with the revision of the initial cost, the amount of depreciation

, accrued until the corrections are made.

Since the original cost of the fixed asset is reduced, the amount of depreciation will also be reduced, which is reflected by the entry DEBIT 02 CREDIT 91

- the amount of excess depreciation.

As for the period for correcting the error, according to clause 11 of the Instructions on the procedure for drawing up and submitting financial statements

, approved by order of the Ministry of Finance of the Russian Federation dated July 22, 2003 No. 67n, in cases where an organization reveals in the current reporting period that business transactions were incorrectly reflected in the accounting accounts last year (this is exactly your case), corrections to accounting and financial statements for the previous reporting period year (after approval of the annual financial statements in accordance with the established procedure) are not included.

Changes in the financial statements relating both to the reporting year and to previous periods (after their approval) are made in the statements prepared for the reporting period in which distortions of its data were discovered (clause 39 of the Regulations on Accounting and Financial Reporting In Russian federation

, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

Therefore, and also taking into account the fact that clause 14 of PBU 6/01 does not allow

changes in the initial cost of fixed assets after their acceptance for accounting (except for cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation), you make a corrective entry in the

current

period.

Note that the methodology for accounting for leased property is one of the “blank spots” of Russian accounting, since the Instructions in accordance with which accounting is kept were adopted quite a long time ago - even before the adoption of the Federal Law of the Russian Federation “On Financial Lease (Leasing)”, which for the first time clearly defined legal basis of leasing.

In this regard, there are alternative options

accounting at almost all stages of accounting - the principles of forming the initial cost of leased property are variable (it is proposed

not to include

in it the amount of leasing payments itself, that is, the payment specifically for the rental of property, but to take into account

only the redemption price

), the formation of the value of leased property upon its redemption and acceptance for accounting as part of own fixed assets (there are proposals to initially accept leased property for accounting

at the full price

of the leasing agreement, and then, when purchasing the leased asset, consider its value equal to

the redemption

price, without taking into account leasing payments), as we have already noted, the application is controversial

account 97

for accounting for early paid lease payments, etc.

We have given the most common accounting scheme.