When recounting goods and other inventory items, it is necessary to draw up paperwork. They are available in the form of prepared standard forms. In this article we will talk in detail about maintaining an inventory list of inventory items with a sample of filling out the statement form. We will also reveal related questions that arise from employees or the inspection body.

What it is

Everyone who works with the material and financial assets of an enterprise faces an audit. Upon admission, they are registered. Then, control is carried out at a certain frequency, during which the correspondence of all recorded and documented objects with the actual presence is established. After the work has been done, the following verdicts are established: excess or shortage.

The process is carried out by special people. They act strictly according to protocol, internal company regulations and recommendations of the Ministry of Finance. The following commercial objects must be analyzed:

- all warehouse premises - the main turnover of the activity is taken into account, equipment is numbered;

- workshops, factories - places where the production cycle is carried out, everything is taken into account, including raw materials and blanks, parts;

- trading floors, showcases;

- cash registers.

We looked at the classic content of inspection, which includes the manufacture and sale of products produced by a commercial enterprise. But at other points everything may happen differently, for example, restaurants, cafes, sports complexes or other places where services are provided. There are no products sold here or they are contained in small quantities, but there are other items in the estimate - dishes, sports equipment, etc.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Government institutions and pharmacies stand separately. For them, this process is more complicated, because any error in reporting or significant shortfall can be considered as negligence, abuse of authority, or even waste of the budget, which can result in not only dismissal and a fine, but also criminal prosecution and even imprisonment.

In the process of this activity, an inventory list is drawn up - this is paper designed to record inventory items, their quantity, and quality. Usually it is drawn up in two identical copies in the presence of the responsible employee and the commission members. All listed persons put their signatures upon completion of the inspection. As a result, one completed form is transferred to the accounting department for storage, and the second remains with the responsible person.

To carry out all the seemingly simple manipulations listed above, you must first obtain a signed decree on conducting an inventory in the INV-22 form. This reporting not only warns of the approaching inspection and authorizes it, but also acts as an important act that is provided as evidence. Therefore, it is kept by the accountant for 5 years.

Procedure for storing inventory records

The inventory form for inventory items is filled out in two copies, one of which must be kept by the financially responsible person, the other in the accounting department. Shelf life, in accordance with paragraph 1 of Art. 29 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, must be at least five years. Similar deadlines are indicated in paragraph 427 of the list approved by Order of the Ministry of Culture No. 558 dated August 25, 2010. For violation of the storage periods for accounting documents, administrative liability is provided (Article 15.11 of the Code of the Russian Federation on Administrative Offenses) for officials in the form of a fine in the amount of 10,000 to 20 000 rubles or disqualification for a period of one to two years. Checks regarding the safety of documents are carried out by tax authorities.

Approved Form

Already in the process of counting values, they use (fill out) a special unified form - INV-3. It was approved by a decree of the State Statistics Committee of Russia back in 1998 and is used to this day without changes for any enterprise, commercial or municipal facility. It can be used as an example of filling out an inventory list.

This is a three-page act, here is its blank and maximally abbreviated sample:

During the work, it is pre-filled; the following information is entered by hand:

- Name of the organization and type of activity.

- Order number, instruction, and date.

- Type of inventory items that are owned by the organization, received for processing.

After this comes the classic formula, according to which the responsible persons confirm and guarantee that all formalities have been met when writing off as expenses and that all evidence and receipts are available.

Then a large table is presented, which indicates each element of the inventory - its number, name, item code, cost, quantity and other tables at your discretion. The more inventory, the more extensive the listings will be. At the end of it follows the line “Total” - this is the amount, the assets of the organization.

After this there are signatures and calculations.

Form INV-3 is classic for all enterprises. It is created unified by the time the activity begins, when all values are put on the balance sheet in the accounting department. But something may change every month - new trading positions appear, others are completely written off and removed from the list. To confirm this and draw up new lists, written confirmation from the manager in the form of an order is required. Such measures are not justified verbally.

How to fill out an inventory list?

Each type of inventory list has its own characteristics for filling out. In this chapter we will look at general points.

To begin with, financially responsible persons fill out a receipt on the first page of the inventory. She says that at the time of the audit, employees do not have documents in their hands that have not been submitted to the accounting department.

In addition, the receipt confirms that there are no unreceived or unwritten goods in the warehouse. Next, the financially responsible persons put signatures, full names (last names, first names, patronymics) and positions.

Also on the first page of the inventory list they put the date and number of the order appointing the audit and its date. The members of the commission are also listed here (names and positions).

During the audit process, all measurement and recalculation results are entered into the inventory. It must indicate all inventory items that are reflected in the order. For example, the manager ordered an audit of the marketers' warehouse. Everything that is there must be included in the inventory. Items from other warehouses do not need to be specified.

When filling out the inventory, you must indicate such data as article number, name, unit of measurement of the product and quantity. For example, we conduct an inventory of an auto parts warehouse. We carefully inspect the part and look for the article number. If it is not on the spare part or its packaging, then you need to lift the invoice and look at its number there.

After we have found the necessary information and counted the goods, we enter in certain columns of the inventory:

- name of goods and materials - headlight;

- article - 254125;

- unit of measurement - piece;

- quantity - 5.

The inventory list reflects the actual presence of valuables identified as a result of the audit, as well as data according to accounting. That is, there will be two columns for the quantity of goods. Data will already be entered into one of them before the audit.

If any columns in the inventory are not filled in, then a dash is required. This is done in order to make it impossible to add information after the revision.

The next stage is summing up the inventory results. After which the inventory is stitched and sealed on the last page. Next, the results of the audit must be signed by members of the commission and responsible material persons.

The inventory list is drawn up in two copies. One for accounting, the second is transferred to financially responsible employees. The storage period for such a document is at least 5 years.

Sources:

Forms of documents for recording inventory results

Order of the Ministry of Finance on property inventory

The procedure for filling out an inventory form with an example

The page is completed in two steps. First, the header and all items of the goods are entered, and then, during the assessment of the quantity and condition of the items, availability is indicated. Afterwards, the signatures of the financially responsible person (MRP) and a member of the commission are affixed.

Let's start with the header. Not all fields that are presented there are required. For example, the type of activity, also known as the OKONKH code, is indicated as the main detail, although in a number of other documents it is omitted. And the “Type of operation” column is often empty, since not all organizations officially use the code system. You can also not write anything in the “structural unit” line. Please note that in places where there is nothing to indicate, there is no need to put dashes or other signs of missing data; it is enough to leave it blank.

The hat was the first step. Here you should also indicate all the information about the document on the basis of which a scheduled or extraordinary inspection is carried out. This can be ordered by the manager. Most often the paper looks like this:

Thus, already at the preliminary stage the following are known:

- the date of the;

- initials and positions of commission members;

- what exactly is subject to inventory.

Therefore, this information, as well as the order number, can be entered in advance into the INV-3 report.

The second step is confirmation that the valuables and funds entrusted to its storage were either capitalized (and confirmations and checks are provided for this) or written off - this fact is also verified. You must be prepared to provide explanatory reasons for the write-off. For example, expired products or goods damaged during transportation. The MOL puts its signature under the relevant paragraph even before the start of the entire procedure.

Sample of filling out an inventory list

How to fill out the inventory list is established by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49. The form consists of at least four pages that can be filled out either using computer technology or manually. Before starting the inventory, it is necessary to issue an order (order, resolution) from the manager on its implementation and on the creation of a permanent commission, which includes employees of the administration, accounting service, and other workers (economists, engineers, etc.). A sample order for approval of the commission is established by Resolution No. 88 (form INV-22), you can use it or make an order to conduct an inspection in any form.

After completing all verification activities, we proceed to drawing up the INV-3 form. On the first page of the “Inventory list INV-3” form, you must indicate basic information (name of the organization, structural unit, details of the order to conduct an inspection, type of activity according to OKVED, start and end date of the inventory), type of inventory items. Also on the first page, the financially responsible persons give a receipt confirming the transfer of all documents (receipts and expenses) to the commission or the accounting department and that all valuables for which they are responsible are included in the receipt, and those removed are included in the expense. Let's look at a sample of filling out the first page in the inventory of material assets.

The following pages indicate the number of inventory objects in the units of measurement in which they are registered (clause 2.9 of the Methodological Instructions).

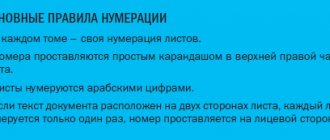

Each page states:

- number of numbers in order (in words);

- type of inventory items in the inventory list;

- the total number of values in physical terms, regardless of the units of measurement (kilograms, pieces, meters, etc.) these values are indicated in (clause 2.9 of the Guidelines).

Empty (unfilled) lines are not allowed; such lines are crossed out on the last pages.

On the last page, a note is made about taxation, price checking, the total is calculated, and the signatures of the persons who carried out the check are placed. The document must be signed by all members of the inventory commission specified in the order and financially responsible persons. At the very end, financially responsible persons draw up a conclusion on the commission’s inspection of the property in their presence, the absence of any claims against the commission members and the acceptance of the listed property for safekeeping (clause 2.10 of the Methodological Instructions).

Sample of filling out the commission's conclusion in the inventory list

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Step #3: go to the table. It includes the main point of conducting a reconciliation, since it contains a detailed list of everything that is included in the goods and materials of the enterprise. This can be: raw materials, parts and blanks, finished products, all commodity units, as well as furniture, equipment and other inventory that has a cost and is on the balance sheet.

On average, any firm has many positions. And accounting is almost impossible without a computer program - manually it will take many hours. Offers the best for commercial properties, warehouses. This is software for conducting inventory of equipment and tools, materials, fixed assets using barcodes. Thus, all the first 9 columns immediately contain information about the product unit, their quantity, cost, and serial number. You only need to enter “Actual availability”. The marks are made by the commission, accompanied by the responsible employee. There can be no data falsification. It is forbidden to fill out the statement, focusing only on the words and assurances of the MOL; everything must be accurately checked, viewed, verified and recorded.

After the listing, a summary is made. For ease of calculation, the final conclusions are drawn page by page. And then they are put together. The number of pages depends on how voluminous the item is.

Step No. 4: all members of the verification commission put their signatures as a sign that they confirm the information received. The financially responsible employee does the same. Who can be part of the inspectors:

- administrators;

- accountant;

- people in leadership positions;

- specialists from the neighboring workshop, etc.

The main thing is that the list of persons is approved in advance by order.

Types of inventory records

There are several types of inventory records. The Federal State Statistics Service (Goskomstat) has developed and approved their form. Let's take a closer look:

- INV-1 is used to account for fixed assets;

- INV-2 - intangible assets;

- INV-3 - inventory items (material assets);

- INV-5 - goods accepted for safekeeping;

- INV-8a - precious metals contained in various products;

- INV-16 - securities and strict reporting forms.

In addition, the State Statistics Committee of the Russian Federation has developed other documents that are used during the audit. For example, inventory acts, matching statements, accounting and control journal.

The document forms listed above are not mandatory. You have the right to use your own sample forms during the audit. In this case, the form of the inventory list and other documents must be approved by the accounting policy of the organization.

However, for convenience, we recommend using forms that are developed and approved by the State Statistics Committee of the Russian Federation. This way you will avoid unnecessary mistakes. You can download inventories and other necessary documents for conducting an inventory using the link provided at the end of the article.

How to fill it out correctly

There are several recommendations and requirements for how to correctly fill out an inventory of inventory items:

- It is prohibited to make changes without the presence of the MOL;

- the committee must always contain the same persons who were announced by the order;

- information is recorded only after actual detection of the actual presence of inventory items (not from the words of anyone).

All results are recorded on paper. In this case, both presence and deficiency are recorded. Based on this, acts will be drawn up that confirm the excess or shortage. If this is detected, then an internal investigation should be carried out or everything should be written off in the “Expenses” column of accounting. Orders should also be signed for all this.

In addition, it is necessary to indicate:

- the cost of a commodity unit - this determines, for example, what amount will be deducted from the employee responsible for this;

- product code - this makes it easier to carry out all procedures according to the article;

- condition, quality.

The latter is important because a number of products are defective or broken. They are usually sold at a deep discount, often to the detriment of the company, and sometimes this is the basis for a write-off. Thus, even damaged items must be recorded on the list.

If there are free columns in the form (in the table), then they are crossed out across the entire width of the space with the letter Z, this is necessary so as not to enter anything unnecessary there.

As mentioned earlier, a form in the INV-3 form is taken. But if the corporation has non-financial assets, then they should be entered in form 0504087. A clean sample looks like this:

In fact, it contains the same fields as those presented above, but the cost of accounting units is not taken into account.

Filling out the INV-3 form

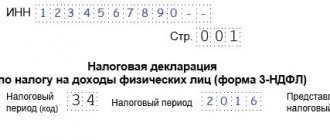

First of all, fill out the header of the form. There you need to indicate:

- name of the company and division,

- document number and date of filling out the form, beginning and end of inventory,

- type of inventory items in the inventory list,

- the basis for conducting an inspection is an order, resolution, order.

You need to choose one of three options. Cross out two unnecessary ones.

Next is a receipt stating that all expenditure and receipt documents have been submitted to the accounting department, and inventory items have been capitalized. Financially responsible persons must sign.

Then in the INV-3 form there is a tabular part in which the inventory items that came under inspection are indicated.

An inventory list of goods and materials is compiled for only one type of property. If, for example, you need to check raw materials and goods, you need to draw up two documents. INV-3 (excel) is available for free here.

In the INV-3 table, fill in:

- line numbers,

- account and subaccount,

- name and item number of goods and materials,

- unit of measurement

- price and inventory number,

- Availability: actual and according to accounting data.

In our example of filling out INV-3, all required fields are marked.

The quantity of inventory items is actual and according to accounting data may differ. If there are discrepancies, this information is entered into the comparison sheet INV-19.

The last page of the INV-3 form summarizes the inventory results. All members of the commission and financially responsible employees must sign.

Inventory details

This is the name of the very tables that make up the bulk of the act. The important thing is that for one type of value there must be a special form. Thus, if raw materials, goods and furniture are to be accounted for, three reports should be prepared and completed.

All columns are numbered, there are thirteen in total. One of them, No. 9, is filled out optionally, that is, optionally. Let's look at an example:

Here we see that this column remains blank. The fact is that registration of technical devices or jewelry is more complicated, since they have a passport. It is in such cases that the line is needed. Also pay attention to columns 10, 11 and 12, 13. These are the ones that often diverge, since actual availability may be more or less than stated in accounting. If this is confirmed, then you should fill out form INV-19: matching statement based on inventory results.

Why do we need an inventory of property (including those proposed for write-off)?

The results of the inventory (based on the information reflected in the inventories and reconciliation sheets) can be recorded in a separate primary document, for example, in an act. Note that an act is sometimes referred to as a document that corresponds to the purpose of the inventory, for example:

- inventory report of shipped goods and materials (INV-4 form);

- act of inventory of precious stones and metals (forms INV-8, INV-9);

- act of inventory of funds (form INV-15).

The act may reflect:

- establishing shortages and surpluses for certain accounting items;

- performance by the inventory commission of actions aimed at offset (in case of misgrading), writing off shortages (to the guilty party, to other expenses);

- circumstances of identifying the guilty persons (in case of shortage, mis-grading).

In some cases, the act complements the inventory records.

For example, a separate inventory report of the property proposed for write-off may be drawn up. As an option, in the TORG-16 form (used at commercial enterprises). In budgetary organizations, form 0504835 of the act on the results of inventory is used. Many private firms use its direct analogs (or it without changes, having approved the procedure for using the form in their accounting policies).

Let's take a closer look at the specifics of filling out the universal form 0504835, used by both budgetary enterprises and private firms, and get acquainted with a sample act based on the results of an inventory of the assets of a business entity.

Entering information into paper on fixed assets (Fixed Assets)

This process is carried out at least once every three years. In this case, the INV-1 form is used, which in content is practically indistinguishable from the one presented above. Its design follows the above order. Here the following columns will be indicated:

- real estate;

- cars and other vehicles, including agricultural machines;

- equipment and electrical engineering;

- household equipment;

- adult draft animals;

- special tools and other means that are essential to ensure the activities of the enterprise.

When is inventory taken?

Typically, the process is preventive, carried out according to a predetermined schedule and does not represent anything special or unexpected for the staff. So checks can be carried out every month - reconciliation of the cash register and goods, and for fixed assets - once every 3 years. But there are also unscheduled recalculations; they are shown in the following cases:

- the management person changes, the company is transferred for use to another owner or tenant;

- an annual report is prepared;

- there is a change of financially responsible persons - the old one must sign the act of delivery of valuables, and the new one must sign the act of receipt;

- during an official investigation for theft or abuse of authority;

- a situation that is caused by force majeure - flood, fire, that is, when it is necessary to calculate losses;

- during reorganization or liquidation of the entire company.

Responsibility for compilation

All persons who take part in the process of recounting values are responsible. Therefore, each member of the commission who signs is responsible for the documented results. Also, the responsibilities are not removed from the person who was initially responsible for the inventory items. Usually this is a seller, storekeeper, manager. If mistakes are made, the listed people may be fined with the indication of causing material damage to the enterprise. If one of the commission members does not come for the inspection, its results can actually be considered invalid.