Individual entrepreneurs engaged in private practice and without employees are offered to be exempt from insurance premiums in 2021 if their monthly income does not exceed the minimum wage. Senator Ivan Abramov sent a corresponding letter to Prime Minister Mikhail Mishustin (available to Izvestia). These payments go towards compulsory pension and health insurance (the total amount is about 40 thousand rubles per year) and exemption from their payment will help businesses that suffered during the pandemic, the authors of the initiative believe. The idea was supported by the Chamber of Commerce and Industry and the Moscow Association of Entrepreneurs, noting that in the force majeure situation that has arisen due to the pandemic, fulfilling many of the duties of an individual entrepreneur simply becomes impossible.

Who should pay the fees “for themselves”

In accordance with the Tax Code of the Russian Federation, there are two categories of contribution payers:

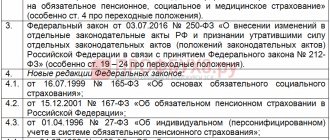

- making payments to other employees (tax agents);

- working without an employer (for themselves).

According to subparagraph 2 of Article 419 of the Tax Code of the Russian Federation, taxpayers who pay contributions independently include:

- individual entrepreneurs;

- heads of peasant farms;

- notaries, detectives and lawyers in private practice.

- appraisers;

- arbitration managers and patent attorneys.

Such categories of taxpayers must be registered as persons engaged in private practice or individual activities.

It is worth noting that self-employed

(NPD payers) are not listed in paragraph 1 of Article 419 of the Tax Code of the Russian Federation, which means that they are exempt from paying insurance premiums “for themselves”.

The amount of insurance premiums and payment deadlines differ slightly depending on the category of insurance premium payers.

Pension calculation for individual entrepreneurs

Compared to employees, individual entrepreneurs are least protected by the state in terms of pensions. This happens because individual entrepreneurs pay only fixed contributions and 1% of excess profits, while the employer transfers a much larger amount of money to the employee’s personal account in the Pension Fund. However, Law No. 166-FZ guarantees a pension to individual entrepreneurs.

This is interesting: Pensioners have discounted travel on hundreds of St. Petersburg trains from what date 2021

Pension and individual entrepreneur are compatible concepts

The procedure for calculating the pension of an individual entrepreneur in 2021 is the same as for hired employees:

- age - 55.5 years for women and 60.5 years for men;

- Entrepreneur's insurance experience for pension is 10 years;

- The minimum number of pension points is 16.2.

Starting this year, all retired entrepreneurs will not pay insurance premiums. This follows from the draft of the Ministry of Economic Development, the document has been submitted to the Government. The law on the abolition of personal contributions from individual entrepreneurs from professional income has already been adopted. For individual entrepreneurs, contributions have been canceled for the year. The amount of such payment is calculated annually. The date July 1 of the year was not chosen by chance - this day is the last day when it is necessary to complete calculations for individual entrepreneurs’ contributions for the year. Therefore, retired individual entrepreneurs will not pay contributions for themselves for the entire year.

Amount and terms of payment of insurance premiums

The amount of insurance premiums “for yourself” increases annually and is approved by Article 430 of the Tax Code of the Russian Federation. But for individual entrepreneurs and other persons engaged in private practice, an additional payment for compulsory pension insurance is established if the amount of income exceeds 300 thousand rubles. Heads of peasant farms are exempt from paying this additional payment

.

| Taxpayer category | Standard insurance premiums “for yourself” – 2021 | Additional amount of insurance premiums if the amount of income exceeds 300 thousand rubles | ||

| Amount, rub. | Payment deadline | Size | Payment deadline | |

| Individual entrepreneurs and other specialists engaged in private practice | 40874,00 | Chooses independently, the main thing is until the end of the current year (December 31, 2021) | 1% of income over 300 thousand rubles on compulsory pension insurance* | Until July 1 of the year following the reporting year (for 2021 - until 07/01/2022) |

| Heads of peasant farms | 40874,00 | Monthly, no later than the 15th day of the month following the reporting month. For December – until December 31 | – | – |

*the total contribution to the compulsory pension insurance must not exceed 8 times the standard contribution

, that is, for 2021 – 259,584.00 rubles

An individual entrepreneur independently determines the procedure for paying insurance premiums. He can pay the entire amount in one payment at any time during the current year or monthly or quarterly.

Fixed contributions “for yourself” are paid for two types of insurance: compulsory pension

and compulsory

health

insurance.

Standard contribution amounts

(excluding an additional payment of 1% of the amount of income over 300 thousand rubles for individual entrepreneurs) for each type of insurance in the context of the next three years, we indicated in the table below.

| Insurance type | 2021 | 2022 | 2023 |

| OPS, rub. | 32 448,00 | 34 445,00 | 36 723,00 |

| Compulsory medical insurance, rub. | 8 426,00 | 8 766,00 | 9 119,00 |

| Total, rub.: | 40 874,00 | 43 211,00 | 45 842,00 |

Possible reasons for non-payment

The legislation provides for the liability of individual entrepreneurs for non-payment or untimely payment of insurance premiums. It applies to different types of insurance - pension, medical, social. The forms of punishment can be different - penalties, fines. Thus, the imposition of fines in accordance with is provided if non-payment or incomplete payment of contributions arose for the following reasons:

- Understating the amount of the insurance base. For example, if an individual entrepreneur forgot to include a quarterly bonus for an employee.

- Incorrect calculation of the contribution amount. The most common reason is using the wrong bet.

- Various forms of misconduct or omissions that do not involve foreign companies or controlled transactions.

As a rule, such errors are identified by the tax authorities themselves during the audit of reports. As a result, arrears arise. Based on the inspection, a demand for payment of the missing funds is drawn up. Additionally, there is a need to pay penalties and fines.

When you can not pay contributions “for yourself”

According to paragraph 7 of Article 430 of the Tax Code of the Russian Federation, individual entrepreneurs, heads of peasant farms and everyone who is engaged in private practice do not pay insurance premiums “for themselves” in the following cases:

- military service;

- during the period of child care up to 1.5 years (but not more than 6 years in total);

- during the period of caring for a disabled person of group I, a disabled child or an elderly person whose age is 80 years or older;

- detention or serving a sentence in places of deprivation of liberty or exile (unreasonably);

- when moving with a military spouse (under contract) to another area when it is impossible to carry out activities (but not more than 5 years in total);

- during the period of residence abroad with a spouse sent on a diplomatic trip (diplomats and consuls of government agencies);

- upon suspension of the status of a lawyer.

In the above cases, taxpayers have the right not to pay insurance premiums without deregistration with the Federal Tax Service.

They only need to submit documents to the tax office confirming their inability to carry out activities.

What taxes do retired entrepreneurs need to pay?

With the exception of the cancellation of compulsory medical insurance and compulsory medical insurance premiums for certain categories of individual entrepreneurs (in relation to small and medium-sized businesses), these payers are required to pay:

- mandatory pension payments for recruited personnel;

- similar deductions for compulsory health insurance for employed employees;

- social insurance contributions against possible accidents at work (to the Social Insurance Fund) for yourself and employees on staff.

In addition to insurance premiums, individual entrepreneurs are required to pay taxes:

- the main ones provided for by the chosen taxation system;

- additional, depending on the type of activity performed.

The full composition of the assigned mandatory contributions is determined by the specified features of the work of an individual entrepreneur.

Consequences of late payment of contributions

Late payment of insurance premiums in full is recognized as a violation of the legislation of the Russian Federation. And for those who violate the norms, responsibility for such actions is provided. And everything would not be so scary if everything was limited to penalties - but there are worse situations.

Penya

In accordance with Article 75 of the Tax Code of the Russian Federation, for late payment of taxes or insurance contributions, individual entrepreneurs, heads of peasant farms and persons engaged in private practice may be required to pay a penalty. The amount of the penalty is calculated as 1/300 of the refinancing rate for each day of delay

.

Blocking accounts

Individual entrepreneurs, heads of peasant farms and specialists engaged in private practice are, in accordance with the law, liable for their debts with all personal property. In addition, such taxpayers are not required to open special accounts to which funds from the provision of services or the sale of goods will be transferred.

Therefore, in case of evasion of payment of insurance premiums, the Federal Tax Service has the right to go to court and, in summary proceedings, obtain a decision according to which the bailiff has the right to seize or block all accounts of the entrepreneur or head of the peasant farm.

Moreover, a seizure is usually placed not on the card, but on the bank account. As soon as the money arrives using the specified details, it will be automatically transferred to the Federal Tax Service account.

But not all proceeds can be written off to pay off debt to the state. For example, benefits received with a special mark will not be written off by the bailiff.

The card blocking will be lifted only a few days after the debt is fully repaid

on insurance premiums.

Impossibility of reducing the tax base for income tax or special regime

Individual entrepreneurs and heads of peasant farms can reduce income tax or under the applicable special regime by the amount of insurance premiums only if they were paid in the current period. That is, if a taxpayer paid tax for 2021 in January 2022, then he will not be able to reduce the amount of tax by the amount of insurance paid later than the deadline.

contributions “for yourself”.

Seizure of property

If an individual entrepreneur or the head of a peasant farm does not pay insurance premiums for himself in a timely manner, the Federal Tax Service may apply to the court with a demand for forced collection of the debt. The court decision (if it is not executed within the specified period on a voluntary basis) is transferred to the bailiff, who seizes all the property of the debtor, including property.

Individual entrepreneurs and other taxpayers specified in subparagraph 2 of paragraph 1 of Article 419 of the Tax Code of the Russian Federation are liable for debt with all their property

. That is, unlike organizations, they bear full responsibility, not subsidiary.

If an entrepreneur or the head of a peasant farm has property (a car, a second apartment or a dacha) that can be seized and put up for auction for sale, then this is exactly what the bailiff will do.

Consequently, by evading payment of insurance premiums, an individual entrepreneur or the head of a peasant farm may lose his own property

.

Amounts of fines

Failure to pay or only partial payment of insurance premiums is grounds for increasing the amount of debt due to penalties and fines. Moreover, their size and applicability depend on the characteristics of the situation. Thus, legally, the amount of the fine can have the following values:

- 20% of the amount of the debt – if we are talking about unintentional non-payment (i.e. the situations listed above, when the individual entrepreneur himself did not realize that the error had occurred);

- 40% of the amount of arrears - if the contribution was not made or was not paid in full by the entrepreneur intentionally.

For example, if the amount of debt on insurance premiums for an entrepreneur is 2,000 rubles, he will be required to pay a fine of 400 rubles. – if the arrears arose unintentionally, 800 rubles. - if he deliberately did not pay this money.

If we are talking about non-payment of contributions for injuries, then the amount of the fine is not determined by tax legislation, since contributions are made to the Social Insurance Fund. And the amount of financial liability is determined by a completely different regulatory act -. At the same time, the size of the fine will not change; they will also be 20 and 40% for unintentional and intentional failure to transfer funds, respectively.

Read: Illegal entrepreneurship - features of prosecution

This might also be useful:

- Changes to the simplified tax system in 2021

- Changes to UTII in 2021

- Tax calendar for 2021

- Insurance premiums to the FFOMS in 2021

- Payment of personal income tax on dividends in 2021

- Fines for late submission of 6-NDFL in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Tax on professional income or for self-employed

A tax is being introduced for individual entrepreneurs who do not have employees, as well as for the self-employed. If they work with individuals, the tax rate is 3%. If with legal entities - 6%. You will have to pay through the “My Business” mobile application. There is no need to submit reports.

The income limit to pay taxes in this way is planned to be 10 million rubles.

The new tax does not cancel or prohibit “simplified taxation”. Individual entrepreneurs have a choice: stay on the simplified tax system or switch to a new system.

Plus: there is an opportunity to make your life easier.

Are there any benefits for retired entrepreneurs?

In addition to the specified exemption for fixed insurance contributions for themselves, individual entrepreneurs of retirement age do not have other benefits regarding social insurance payments.

Support measures provided for by law include:

- abolition of the tax on real estate owned personally and not involved in business activities;

- additional preferences established by resolutions of local authorities.

For example, the Moscow government, by regional resolutions, provides for the provision to pensioners of:

- the right to free travel by public city transport (excluding taxis and minibuses);

- preferential (free of charge or with significant discounts) purchases of medicines according to prescriptions prescribed by doctors;

- discounts on travel on commuter trains.

Certain subsidies are awarded to pensioners for paying for the services of utility organizations.

But otherwise, the legislation does not provide benefits for individual entrepreneurs of retirement age. On the contrary, while engaging in entrepreneurship, an individual entrepreneur retains the status of a working pensioner, which cancels the annual indexation of pensions as compensation for the adverse impact of inflationary processes.

It is also important to take into account that tax and insurance benefits are not provided for individual entrepreneurs who are pensioners in the event of being assigned a disability group.

Patent extensions

The Ministry of Finance has expanded the list of activities that can be carried out under a patent. Crop and livestock production and services related to these activities will be added.

However, regions received the right to limit the use of patents in their own countries. For example, restrictions may affect the rental business, when a room is rented that is larger than the established area, etc.

Plus: it’s easier to pay tax with a patent, and this has become possible for a larger number of individual entrepreneurs.

Cancellation of movable property tax for an organization

If an organization has movable property, then from January 1, 2019 it will not be taxed. Changes are expected in the Civil Code related to the exact wording of what constitutes movable property, which, in fact, can be deducted from the tax base. Only property owners will pay the tax and report on it.

Plus : you can save on something.

Other registration of individual entrepreneurs

The state fee for registering an individual entrepreneur is canceled when this procedure is completed electronically. However, the financial benefit is questionable, since such a submission requires you to have a digital signature. And this signature costs money, on average from 1000 to 1500 rubles.

Disadvantage: it will cost the same or more.