The consignment note is the primary accounting document on the basis of which the release of inventory items to third parties is issued and records of relevant transactions are kept. According to laws No. 402-FZ “On Accounting” and No. 63-FZ “On Electronic Signatures”, a delivery note can be generated and stored both in paper form and electronically. Moreover, Order of the Federal Tax Service of Russia dated March 21, 2012 No. ММВ-7-6/ [email protected] approved the recommended format of the electronic TORG-12 XML file. Taxpayers will be able to send invoices drawn up in this format to the tax office via the Internet (TKS).

Filling rules

There is no unified form of the TORG-12 form; it was canceled in 2013. But many organizations and entrepreneurs continue to use the previously approved form and this is permitted. From January 1, 2013, an organization or entrepreneur can approve its own form and use its own form.

Federal Law “On Accounting” Art. 9 p. 4

The forms of primary accounting documents are determined by the head of the economic entity on the recommendation of the official responsible for maintaining accounting records. The printed form of the TORG-12 consignment note can be individually developed by an organization or entrepreneur at its discretion.

Required data when filling out

There is a mandatory list of details that must be reflected in the delivery note. Due to the absence of at least one mandatory detail, it becomes invalid; Such an invoice cannot be used for accounting.

Federal Law “On Accounting” Art. 9 p. 2

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the event;

- signatures of persons provided for in Art. 2 clause 6 of the Federal Law “On Accounting”, indicating their last names and initials, or other details necessary to identify these persons.

How to correct a delivery note when returning goods

Paper

According to the law, if errors are detected, the bill of lading must be corrected as follows: cross-outs are made in both copies of the document, which are certified by signatures on both sides. Next to the signatures is the date of the amendments (Clause 5, Article 10 of the Accounting Law).

Often in practice, a new document is retroactively generated to replace an incorrect document. However, accounting rules do not imply the need or ability to prepare or correct primary documents in this way.

Electronic

For documents, even partially created in an automated way (using a computer), no correction rules are established. This allows organizations the right to define such rules themselves. This right follows from clause 8 of PBU 1/98: “if the regulatory documents do not establish accounting methods for a specific issue, then when forming an accounting policy, the organization develops an appropriate method based on this and other accounting provisions.” Therefore, the accounting policy can indicate a method for correcting the primary document by drawing up another document. In this case, it is recommended to indicate in the correction document that it is an integral part of the original one.

Since the electronic invoice cannot be corrected in the manner proposed by law, a solution to this situation can be the preparation and signing by the parties of a separate document, on the basis of which corrective entries will be made in the accounting (this correction format will need to be specified in the accounting policy and the agreement with the counterparty). The organization draws up an act on the established discrepancy or independently develops such a document, subject to the inclusion of mandatory details (clause 2 of Article 9 of the Federal Law of November 21, 1996 No. 402-FZ “On Accounting”), and coordinates it with its counterparties.

For example, there is a practice when the parties, upon acceptance of goods and detection of errors, draw up acts (in the form TORG-2 and 3), which are used to formalize the acceptance of goods and materials that have quantitative and qualitative discrepancies in comparison with the data in the supplier’s accompanying documents. The acts are drawn up at the place of receipt of the goods and are the legal basis for filing a claim with the supplier.

Receipt of goods by proxy and filling rules

The TORG 12 invoice can be filled out by proxy. The goods can be received by an authorized person by providing a power of attorney form M-2, M-2a, executed in the prescribed manner, with the obligatory presentation of an identification document (passport). The power of attorney remains with the Seller.

Filling out TORG 12 forms by proxy. If the goods are received by proxy, the following three columns must be filled in:

- By power of attorney No. _ - indicates the number and date of issue of the power of attorney. If the power of attorney is without a number, then the identification number and the date of its issue are indicated.

- Issued _ - indicates the name of the organization that issued the power of attorney (for example, LLC “Buyer”, forwarder A.V. Ivanov).

- Next, in the Cargo Accepted column, the position, signature and full name of the person to whom the power of attorney was issued is entered. If the power of attorney is issued to a person who is not an employee of the organization, then the position is not indicated.

A consignment note is documentation that is needed by both parties: those sending and receiving the goods. The buyer, using the invoice data, will be able to keep records of expenses and material assets, and the seller will be able to keep records of income.

What is it for?

TORG-12 is used to formalize the transfer (sale) of goods or other material assets to an outside organization. That is, with its help you can prove the fact of transfer, and on the other hand, receipt of goods.

Read more about why you need a consignment note here.

Can it be used not only for trade turnover, but also for services?

In theory, no law prohibits this possibility. Practically, any accounting program has the ability to generate a standard form of act of services performed , which is most often used in such cases. If we return to the issue of audits and other checks, you may encounter problems from inspectors.

If you look from the point of view of the receiving party, then the technical document instead of the act can be capitalized correctly, but posting an extract from the service warehouse (sale) raises many questions.

In what cases is it necessary to issue an invoice?

There are several rules that must be followed in order to avoid making unnecessary mistakes.

One of them is related to the volume of inventory items. The invoice is issued regardless of the size of the shipment of inventory items. It often happens that the buyer is an individual who does not need a consignment note (waybill). In this case, you need to remember that you are interacting with the tax service, so you need to officially write off the materials as expenses, which means document the shipment.

The next rule concerns the external design of documentation. There are several ways to write out an invoice: you can use one of the most common forms (TORG-12), or you can develop a sample yourself, using generally accepted rules and procedures for preparing such documentation (the main thing is not to forget about the details).

In order for the invoice to appear in accounting, it is necessary to make 2 copies: one for the supplier, the other for the buyer.

How to properly issue an invoice?

The filling template helps to facilitate the search for information related to the rules for completing documentation. It is enough to focus on the given standard and ensure that the instructions are followed. Then you can easily enter into the documentation data that is understandable to you, the buyer and the tax service.

If you are ready to develop the form yourself, please note that there are required fields that the form you create must contain:

- First of all, your invoice must have a number, as well as the date it was compiled.

- Do not forget to indicate the name of the sender and recipient of the goods, as well as the details of both parties.

- The document must indicate the basic data on the release of goods, namely: contract, invoice, etc.

- The invoice necessarily contains a tabular version of the list, which indicates all the released item items (number of units for each item, amount).

- In order for the information to be complete, you must indicate your full name. and the positions of those specialists who released the goods and accepted them. The document must be signed by the persons responsible for acceptance and shipment of the goods.

- If each party uses seals, they must be on the delivery note.

If you use an electronic invoice, it must be issued according to the same rules and supplemented with a digital signature.

At what stage of shipment of goods is an invoice generated?

The invoice is drawn up immediately at the time of the transaction.

Since accounting entries are made on its basis, you should be very careful when filling it out. In particular, it is undesirable to make any errors or inaccuracies in the invoice or make corrections.

And it is absolutely forbidden to enter unreliable or deliberately false information into the form - if such facts are revealed by regulatory authorities, the responsible persons or even the organization may incur serious administrative punishment, in the form of large fines.

It should also be borne in mind that in some cases the invoice may acquire the status of a legally significant document - when one of the parties, due to some unfavorable circumstances, decides to go to court.

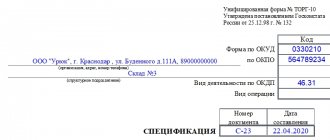

Filling out the invoice according to the TORG-12 model

If you do not want to draw up an invoice yourself, you can complete the documentation in accordance with the existing TORG-12 sample. It was approved on December 25, 1998 by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132. It also contains an example of an invoice.

The document can be in paper or electronic form. TORG-12 is a very convenient form for recording and storing information regarding trading operations and the sale of any material assets. The general rules for filling out also state that the invoice must be certified by authorized persons: the owner of the company, the chief accountant or another authorized person holding a power of attorney. The document must also be executed in two copies.

There is a certain procedure for filling out TORG-12:

- In order for the shipment dates indicated in the invoice to be realistic (i.e., correspond to the actual state of affairs), it is necessary to indicate the exact date - which means filling out the documentation at the very moment of shipment or immediately upon completion of the process.

- If you pay VAT and issue an invoice to the customer, make sure that the information specified in the invoice and delivery note is identical. It concerns information about the supplier itself and all existing positions.

- In the invoice you will find columns (“Shipping Organization”, “Consignee”, “Supplier”, “Payer”) in which you must enter the exact name and correct details of the supplier and customer of the goods.

- In the sample you will find the column “Bases”, in which you must indicate on the basis of which document this transaction (shipment) is being carried out. Such a document can be an agreement concluded between the customer and the contractor. It is enough to indicate the document details in the column.

- You need to be very careful when filling out the tabular section, which should list all shipped items. For each type of value there must be information about its name, code, unit of measurement, weight, cost, price with and without VAT.

- For those who do not pay VAT, there is a template for filling it out. The only difference is that in the column “VAT, amount” you must enter 0, and in the column “VAT, rate” - “without VAT”.

- Do not forget that authorized persons of both parties must sign and seal.

In general, filling out the invoice is not difficult. Thanks to the developed sample, you will be able to quickly navigate the specifics of document preparation.

When using unified forms of documentation, the consignment note is drawn up according to the TORG-12 form. The form and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. You can visit our website.

If necessary, you can enter additional fields, columns, and details into the form (see also Resolution of the State Statistics Committee of the Russian Federation dated March 24, 1999 No. 20) or use an independently developed and approved form of the consignment note (Part 4 of Article 9 of the Law “On Accounting” dated 06.12 .2011 No. 402-FZ).

Read more about this in the article

“Primary document: requirements for the form and the consequences of its violation .

Is TORG-12 necessary when transporting goods?

Paper

The consignment note is handed over to the driver along with other documents and the driver is obliged to hand over the documents to the consignee.

According to a number of regulatory documents, such as:

- Rules for the transportation of goods by road, approved by the Ministry of Automobile Transport of the RSFSR on July 30, 1971;

- Federal Law of November 8, 2007 N 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport”;

- Decree of the Government of the Russian Federation of April 15, 2011 N 272 “On approval of the Rules for the transportation of goods by road”;

- Traffic Rules dated 07/01/94;

On the way, the driver does not have to carry a bill of lading with him.

Electronic

If the waybill is transmitted via the Internet, then there is no need to hand it over to the driver: the document can be sent directly to the consignee. On the way, the driver does not need a consignment note; he has a cargo transport note, and in it, albeit in a general form, the items of the transported cargo are listed.

The difficulty lies only in the case of transporting goods by an intermediary carrier. The law requires filling out the lines “By power of attorney No.” and “Cargo accepted”, in which you indicate information about the power of attorney for the transportation of goods and materials, as well as the full name and position of the forwarder. In this case, there are two options:

- When creating the electronic TORG-12, the seller indicates the number and dates of the consignment note in the appropriate columns: the consignment note itself already contains the position and full name of the forwarder, as well as information about the power of attorney.

- Upon receipt of the electronic TORG-12, the buyer himself fills in the lines “By power of attorney No.” and “Accepted the cargo” and signs the TORG-12 with an electronic signature.

When and why is the TORG-12 form used?

The unified form TORG-12 is used to register the sale (release) of inventory items to a third party. The main scope of the document is wholesale trade.

The seller issues a delivery note. For him, it is a document on the basis of which the write-off and sale of goods is reflected.

For the buyer, the TORG-12 invoice is one of the documents confirming the acquisition of inventory items and serves as the basis for their capitalization.

Accounting for invoices and storage

Paper

There are no statutory rules for recording invoices. Therefore, the organization has the right to independently approve the rules for the transfer and storage of documents.

In practice, a warehouse usually draws up a commodity report (the primary document on the basis of which data on the sale of goods and their cost is reflected in accounting), to which invoices are attached in chronological order.

Individual entrepreneurs and organizations using the simplified tax system keep books of expenses and income, which are compiled on the basis of primary documents. Books can be kept electronically, but at the end of the tax period they are printed. Paper documents are stored in archival rooms.

Electronic

Electronic goods invoice and goods report - originals of primary documents. They can be stored exclusively in electronic form, either on a local computer or on a specially dedicated server of the organization.

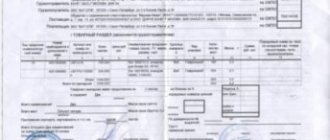

What information does the delivery note contain?

The set of sections of the unified form TORG-12 is as follows:

- Information about the delivery participants (seller, consignor, consignee, payer), including their names, addresses, telephone numbers, bank details and OKPO and OKVED codes.

- Details of the contract on the basis of which the delivery takes place, and the waybill.

- Details of the consignment note itself - its number and date.

- Information about the product: name, unit of measurement, quantity, price, as well as the cost and VAT charged to the buyer ( for information on filling out an invoice without VAT, read the material “How to fill out an invoice (TORG-12) when working without VAT (sample)”

). - Information about attachments to the invoice (for example, certificates, passports, etc. for goods).

- The document ends with a section with numerous signatures. On the seller’s side, it is signed by the employee who authorized the release of the cargo, the chief accountant and the employee who directly released the cargo. On the other side, signatures are affixed by representatives of the buyer and consignee. Information about the power of attorney on the basis of which the buyer’s representative accepts the goods is also provided here, and the dates of signing the document by the parties are indicated.

The unified form TORG-12 also provides for the affixing of seals of the parties to the delivery. At the same time, the seal is not a mandatory requisite of the primary document (Article 9 of Law No. 402-FZ), therefore organizations that have officially abandoned the seal may not certify the invoice with it (see also letter of the Ministry of Finance of Russia dated 06.08.2015 No. 03-01 -10/45390).

Electronic consignment note TORG-12

Primary documents can be prepared not only in paper, but also in electronic form (Part 5, Article 9 of Law No. 402-FZ).

Read about what signature you need to use for electronic documentation.

For the electronic consignment note, the format for transmission via TKS has been approved ( from July 1, 2017

— Federal Tax Service order No. ММВ-7-10/ dated November 30, 2015), which allows not only to establish an electronic exchange of invoices with counterparties, but also to submit invoices electronically at the request of tax authorities.

Reception of goods and delivery note

When accepting the goods, the responsible person checks the unloaded goods with the documents.

Paper

With a paper consignment note, everything is simple - the driver hands over the documents to the responsible person for verification on the spot. The person responsible for receiving the goods signs the documents and transfers them to the accounting department.

Electronic

If the supplier sent an electronic consignment note, the person responsible for receiving the goods should be able to receive such documents and promptly process them (sign, print or forward) - i.e. he must have an organized workplace and Internet access.

What is the TORG-12 form

The TORG 12 consignment note is quite often used by organizations to register inventory items (material assets), measured in pieces or weight. The head of the organization may not use this form (see Federal Law-402 “On Accounting”). The consignment note (you can download it below) has a number of advantages, which we will discuss in this article.

You can download TORG 12 at the end of the article.

The TORG 12 consignment note form is included in the album of unified forms (OKUD 0330212). However, with the entry into force of Law 402-FZ, primary documents do not necessarily have to be in a unified form. It is enough that the document contains the entire list of mandatory details specified in the law.

However, the unified form TORG 12 (can be lower) is so convenient that many entrepreneurs have not abandoned the use of this consignment note for several reasons:

- It is familiar and understandable.

- Meets regulatory requirements.

- If necessary, the delivery note will serve as the basis for resolving controversial situations, for example, claims regarding the quality of the purchased goods (Law No. 2300-1).

- Confirms the fact of receipt or shipment of goods (Article 458 of the Civil Code of the Russian Federation).

- Is the rationale for the adoption of VAT.

- Serves as confirmation of the expiration of the warranty period (Law No. 2300-1), etc.

Basis for registration of consignment note TORG-12

If the sale of goods is envisaged, then the basis for issuing a consignment note is the contract.

As a rule, the price and quantity of transferred products are indicated in the contract or in annexes (specifications). An option is possible when, under the terms of the contract, the price of the goods is determined by the current price list of the company, and the quantity is determined in the application from the buyer.

An alternative form is the universal transfer document (Letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/).

Consignment note TORG-12, filling rules

The TORG 12 consignment note is prepared by the seller. The form contains information about the seller, buyer, name of the product, its quantity and cost, information about the financially responsible persons who shipped and received the goods.

| Invoice column TORG 12 | Invoice TORG 12, filling rules |

| Shipper organization, address, telephone, fax, bank details | The name fits both full and short. |

| Structural subdivision | Maximum complete information (name, contact details). |

| Provider | Full and short name, address and bank information. |

| Consignee | Same as for the supplier. |

| Payer | The purchasing organization is indicated (if it independently purchases and pays for the cargo). |

| Base | The data of the contract or work order on the basis of which the transaction took place is indicated. |

| OKUD and OKPO codes, type of activity according to OKDP | The codes assigned to the organization by the statistics body upon registration are indicated. |

| Tabular section TORG 12 | The supplier lists the goods sold, their units of measurement and quantity, gross and net weight, price and VAT rate. The amount of goods with and without VAT is also indicated here. |

| The consignee received the cargo | Signature of the manager or employee who has the right to sign (order, power of attorney). |

| Accepted the cargo | Signature of the financially responsible person receiving the goods (storekeeper, driver, manager, etc.). |

| By power of attorney No. | Power of attorney details of the employee who received the cargo. Not to be filled in if the manager signed the line “The cargo was received by the consignee”. |

| The consignee received the cargo | To be completed when the cargo is received by the head of the organization. |

| Supplier side printing location | The supplier's seal is affixed, if available. |

| Place of seal on the part of the consignee | The consignee's stamp is affixed. If the cargo is received by proxy, then stamping is not required. |

| Date indicator | The actual date of shipment must match the date on the invoice. |

How to draw up and sign a delivery note

Paper

Primary documents are signed by the manager and chief accountant or authorized persons. The list of persons authorized to sign primary documents is approved by the manager in agreement with the chief accountant. Thus, the manager can transfer the right to sign the delivery note and formalizes this right with a power of attorney or order.

The consignment note is issued in two copies. The first copy remains with the seller (the organization that hands over inventory items) and is the basis for their write-off. The second copy is transferred to the buyer and is the basis for the recording of these valuables. TORG-12 can have 5 signatures:

- three from the seller’s side: (manager, accountant, responsible for shipment). In some large organizations, one person signs the delivery note upon shipment. Usually this is a certain “operator” who, based on information received from the accounting department and warehouse, generates a document and signs it with his signature. This operating procedure is legally established either in an order, or in a power of attorney, or in the job descriptions of the “operator”;

- one from the buyer’s side (responsible for receiving the goods) - in the line “The cargo was received by the consignee.” This line must contain the signature of an officially authorized representative of the buyer - this can be a person under a power of attorney or under the Charter. Therefore, either the head of the consignee organization (buyer) or an authorized person with a power of attorney for the right to sign the primary documents must sign.

- another signature - in the line “Cargo accepted” - is placed by any financially responsible person who actually accepts the cargo (data on the power of attorney for the transportation of goods and materials is filled in in the same line). This can be either a carrier of a third-party transport organization or a representative of the purchasing organization. The head of the enterprise can accept the goods without a power of attorney - in this case, he signs in the line “Cargo accepted” and does not fill in the lines indicating the details of the power of attorney.

Of course, in both lines “The cargo was received by the consignee” and “The cargo was accepted” the same person can sign (if he has both a power of attorney for goods and materials and the right to sign primary documents). And in this case, more often the signature is placed only in the line “Cargo received”, based on business practice, as well as arbitration judicial practice (Resolution of the Federal Antimonopoly Service of the North-West District of March 1, 2006 N A13-5001/2005-05).

Electronic

The form and procedure for compiling an electronic invoice are no different from the form and procedure for compiling its paper counterpart, with the exception that the electronic document is compiled in one copy, which consists of two files. One of them is formed on the seller’s side, and the second, when sending a document, on the buyer’s side. To sign electronic invoices, instead of a handwritten signature, use an electronic signature (ES), and in accordance with the recommended format TORG-12 (approved by Order of the Federal Tax Service of Russia dated March 21, 2012 No. ММВ-7-6 / [email protected] ), as well as court materials (in in particular, according to the resolution of the Supreme Arbitration Court of the Supreme Higher Military District dated 08/11/2010 in case No. A43-5226/2010), the electronic consignment note is signed with one electronic signature on the part of the seller, and one on the part of the buyer. Total of two signatures.

At the same time, in the lines “Vacation authorized”, “Chief (senior) accountant”, “Cargo released”, “Cargo accepted” and “Cargo received by consignee” the full names and positions of the relevant persons are indicated, and in the line “By power of attorney No.” - information on the power of attorney of the authorized person.

Partly, the ability to sign TORG-12 with one ES is due to the fact that affixing an ES on a document does not mean filling out the signer’s line, but means protecting information and identifying the signatory (No. 63-FZ “On ES”). And one electronic signature is enough to fulfill these conditions.

Responsibility for compilation and accounting

Employees of organizations should pay attention to the details of filling out the document. This often helps to minimize the legal and tax risks of companies.

Pay attention to the seal! So, for example, a seal is not a mandatory requisite (it is not named in the list of mandatory requisites in 402-FZ). But the TORG 12 consignment note must have a stamp, since it is provided for by the form. On this issue, disagreements may arise when offsetting VAT with the tax office. On the other hand, if the consignee received the goods under a power of attorney certified by the organization’s seal, then it is not necessary to include it in the invoice. In this case, it is enough to attach a power of attorney to the invoice and ensure that these two documents are stored together.

Persons who signed the invoice on the part of the seller and the consignee bear, among other things, criminal liability in the event of, for example, theft or theft of goods. Therefore, accountants need to pay special attention to the presence of all the necessary signatures in the document when accepting it for accounting.

TORG 12 is also filled out by the buyer in case of returning the goods to the supplier. In this case, the “reverse” implementation occurs. The rules for filling out the document in this case remain unchanged.

Document preparation

Just like the content, the design of the form depends entirely on the vision of the document by representatives of organizations and their needs. The form can be drawn up on a simple blank A4 sheet or on the company’s letterhead, and it can be filled out either by hand or on a computer.

Important condition! The invoice must contain “live” signatures of materially responsible employees: the one who authorized the release of products, the one who directly carried it out, and the buyer.

At the same time, it is necessary to certify the invoice using stamped products only if the norm for their use is enshrined in the internal regulations of the company.

The document is always made in at least two identical copies , one of which is handed over to the representative of the receiving party, the second remains with the employee of the company distributing the products.