How to file an application to the court to reduce the fine for late submission of SZV-M?

Based on the results of the audit, the Pension Fund of Russia prepared a Decision on discrepancies in reporting: SZV-M from February 2021 to December 2021 is not represented by 1 ZL for each month.

Please advise how to apply to the Arbitration Court in order to reduce the Fine (11*500=5500 rubles). Extenuating circumstances are listed below. Please provide a link to a sample application and the cost (fee) for conducting the case (if there is a fee). And what are the overall prospects for reducing the Fine?

For information. Regarding the PFR Act, I (general director of the LLC) sent a Petition to the PFR with the following content:

Based on the results of the inspection, Act No. XXX dated December 17, 2019 (hereinafter referred to as the Inspection Act) was drawn up.

When reconciling SZV-STAZH for 2021 and SZV-M, discrepancies in the reporting were identified: SZV-M from February 2021 to December 2021 is not represented by 1 ZL for each month.

The amount of the fine is calculated at 500 rubles for each insured person.

In accordance with the Constitutional Court Resolution No. 349-O dated November 5, 2003 and No. 2-P dated January 19, 2016, the sanction must be proportionate to the violation and the damage caused, and the inability to individualize the punishment taking into account mitigating circumstances leads to a violation of the rights of contribution payers

An organization may cite the following as circumstances mitigating liability for committing the offenses specified in the Inspection Report:

1. The offenses reflected in the Inspection Report were committed unintentionally;

2. The organization is a bona fide taxpayer, charges and pays taxes in the manner established by the legislation of the Russian Federation, and also maintains accounting records in accordance with current rules (standards);

3. Lack of intent to commit an offense;

4. Disproportionate amount of the fine to the nature and severity of the violation, since no damage was caused to the budget;

5. Conducting activities in socially significant areas: organizing events in universities for students, donating educational literature to universities and enterprises;

6. At the time of the violation, the Limited Liability Company had been operating for less than a year; the outsourced accountant was on sick leave.

Based on the above circumstances, based on the above-mentioned norms of current legislation, XXX LLC requests a mitigation of the punishment for the offenses committed by reducing the amount of accrued penalties several times.

Sample petition to reduce a fine to the tax office

Templates and forms We will understand the features of drawing up a petition to the Federal Tax Service to reduce the tax fine or its complete abolition; we will fill out sample documents using specific examples.

January 18, 2021 Evdokimova Natalya

The Tax and Duties Service administers the timeliness and correctness of calculation of tax liabilities to the budget of the Russian Federation, submission of reports and required documentation.

The Federal Tax Service has the right to punish an organization or private entrepreneur for violating fiscal legislation on many grounds, but we will focus on the most widespread:

- violation of reporting deadlines;

- violation of deadlines for transferring payments to the budget system of the Russian Federation;

- erroneous determination of the tax base when calculating liabilities;

- failure to provide required documentation;

- concealment of information about current accounts, changes in management, etc.

The Tax Code provides for separate articles regulating the amount of penalties. But not many people know that the amount specified in the request for payment of a fine can be reduced several times. To do this, you will need to submit a petition to the tax office to reduce the amount of the fine.

Procedure for compilation

Let's figure out how to draw up a sample petition to the tax office to reduce the fine.

From the date of receipt of the payment request, the organization has 10 days to ask the Federal Tax Service to mitigate the punishment. It takes tax authorities no more than 10 days to consider the application if there is no need to verify the information. If there is such a need, the review will last up to 30 days (1 calendar month), in special cases - 2 months.

The document should be drawn up according to general requirements, regardless of the taxpayer’s status. An incorrectly drawn up document will be considered void, even if the citizen or institution had legal grounds for reducing the fine.

There is no unified form, so we draw up a request to reduce the tax penalty in any form. Don't forget to provide the required information:

- Full name of the head of the tax office.

- Information about your organization: name, INN/KPP, address, telephone.

- Name, number and date of the document establishing the tax penalty.

- A detailed description of the results of the inspection performed.

- Indication of mitigating factors.

- Request for mitigation of punishment.

- List of attached supporting documents.

- Date and signature of the responsible person (manager or chief accountant).

- Institutional seal, if available.

It is important to submit a letter to the tax office to reduce the amount of the fine not only on time, but also correctly drafted, so that the Federal Tax Service will accept it for consideration. This document should reflect the following points:

- to whom the application is sent to the tax office to reduce the fine - as a rule, this is the head of the inspectorate,

- taxpayer information,

- description of the circumstances under which a tax violation was discovered (on-site or desk audit, other circumstances),

- listing of circumstances mitigating the degree of responsibility of the taxpayer with references to the norms of the Tax Code, materials of judicial practice;

- request to reduce the amount of the fine due to mitigating circumstances,

- list of attached supporting documents,

- date and signature of the taxpayer.

The tax service imposes a fine as a result of certain violations of the law. The amounts of fines differ depending on the offenses committed.

In this case, the guilty person has the opportunity to submit a petition to the tax office to reduce the fine if certain circumstances exist.

General points

Taxpayers are unaware that the penalty may be slightly reduced. To do this, you need to perform a number of actions and meet certain requirements, but still such an opportunity exists.

Situations are different and in some cases the reduction of the fine is unjustified. We are talking about either a deliberate violation of the law, or situations where the payer has committed violations not for the first time.

But the actual right to petition for a reduction of the fine remains with the person in any case. An application and accompanying documents can be submitted, but the result will depend on many factors.

Controversial situations may arise due to deadlines if the declaration is submitted on paper.

As a result of filing information and declarations, errors, both intentional and unintentional, may occur.

They may cause additional inspections, as well as fines against such citizens and organizations.

If the fine cannot be avoided, it is recommended to exercise the right to file a petition to reduce it.

What it is

A petition to the tax office to reduce the fine is a statement that reflects the reasons for the violation, substantiates them and contains a request to mitigate the sanction against the violator.

Most often, such statements are effective if there was some reason for the violation of the law.

They are conditionally divided into several subgroups, therefore, for example, a petition to the tax office to reduce the fine for late payment of personal income tax will have some differences from other applications and these differences should be taken into account

What is his role

The role of this petition is to actually regulate the relationship between the tax authority and the payer, be it a budget organization, a commercial company or an individual.

The petition must contain reasons why the fine should be reduced.

Reasons determining the lack of guilt of the debtor in committing a violation or evidence of unintentional commission of an offense.

As arguments, you can additionally use references to the difficult financial situation of the payer, lack of profit, and so on.

Legal basis

Relations between the Federal Tax Service Inspectorates and tax residents, including the limits of their responsibility, mutual rights and obligations, as well as other aspects, are regulated by the Tax Code of the Russian Federation.

Everything related to the request to reduce the fine is also determined by this legal act, namely Article 112.

: tax penalties

Materials from judicial practice, as well as by-laws of the tax service, which define the features of the process and fill in the gaps, will be important.

The correctness of the application directly affects the final result. The application must include all necessary information, such as:

- Details of the applicant, including his name (or full name, if the application is submitted by an individual or individual entrepreneur), as well as TIN.

- Details of the tax authority to which the corresponding application is submitted.

- Title of the application.

- Indication of events of significance (date of the fine, reasons, essence of the violation).

- An indication of the reasons why the fine should be reduced.

- Link to relevant legislation.

- If the offense was committed for the first time, then this fact should also be indicated.

- Please take these factors into account and reduce the fine.

- A list of applications, followed by a date and signature.

Procedure for compilation

Art. 112 of the Tax Code of the Russian Federation contains a list of mitigating circumstances that allow one to apply for a reduction in sanctions several times. When submitting your request, be sure to indicate mitigating circumstances. Don’t forget to indicate one of the types when creating a sample petition to the tax office to reduce the fine.

All circumstances that may reduce the established punishment are divided into 4 groups:

- are common;

- for individual entrepreneurs;

- for legal entities;

- for individuals.

Let's present a list of mitigating circumstances in the form of a table.

Are common

| |

| For individual entrepreneurs and individuals | For legal entities |

|

|

Procedure for compilation

The perfect document. A letter to the fund will reduce the fine for late reporting by several times

Natalya Matveeva, UNP expert

Newspaper “Accounting. Taxes. Law" No. 14/2011

As we found out, fund specialists began to request written explanations from policyholders who were late with their annual reports as to why this happened. On the one hand, the company has the right not to provide such explanations - there is no penalty for refusal. But on the other hand, it is beneficial for her to give an explanation to the fund, because this is a real chance to significantly reduce the fine for late delivery. The Pension Fund of the Russian Federation confirmed to us that the head of the department has the right to make a decision on the amount of the fine, taking into account circumstances excluding or mitigating the company’s guilt (clause 4, part 6, article 39 of the Federal Law of July 24, 2009 No. 212-FZ).

Explanations can be provided in the form of a letter (see sample). It should start with the period for which the reports were not submitted on time and how many days were overdue.

Then provide detailed reasons that prevented the calculation from being submitted on time: a program failure, a computer breakdown, overloads in the work of the FSS RF portal or the submission of the calculation on a day when the Pension Fund of Russia server was especially busy, etc. It is in the interests of the company to document all the reasons. For example, a letter from a special operator about failures when accepting payments, a report about a computer breakdown. The list of circumstances excluding and mitigating the company’s guilt in violation is open. And the fund independently decides which circumstances to take into account when making a decision on a fine and which not (clause 4, part 1, article 43, clause 4, part 1, article 44 of Law No. 212-FZ). So the more valid reasons there are in the letter, the greater the chance that the fine will be reduced or cancelled.

It is also worth asking the fund to take into account that the company paid its contributions for the year on time and in full, but violated the deadline for the first time and only slightly. Copies of payment slips and individual cards can be attached to the letter.

Let us note that the company has the right to provide such explanations on its own initiative, without waiting for a request from the fund (clause 5, part 1, article 28 of Law No. 212-FZ). And even if the fund does not take such explanations into account, in court they will become an additional argument in favor of the company. Taking into account mitigating circumstances, judges sometimes reduce fines for late reporting by several times, for example from 14 to 1 thousand rubles (resolution of the Second Arbitration Court of Appeal dated December 20, 2010 No. A29-7119/2010).

Limited Liability Company "Company" OGRN 1045012461022 INN 7701025478 KPP 770101001 127138, Moscow, st. Basmannaya, 25

Head of Department No. 4 of the State Institution - Main Directorate of the Pension Fund No. 8 for Moscow and the Moscow Region

Ref. No. 91 from 04/18/11

EXPLANATIONS about the reasons for the late submission of the DAM-1 calculation for 2010

We inform you that Company LLC submitted the RSV-1 calculation for 2010 with a delay of one day (February 16, 2011) due to a failure in the work of the special communications operator Connect LLC, which occurred on the last day of reporting on February 15, 2011 . LLC "Company" timely and in full transfers insurance contributions for compulsory pension and compulsory health insurance, violated the deadline for submitting the RSV-1 calculation for the first time and insignificantly.

When making a decision to bring to justice on the basis of Articles 43 and 44 of the Federal Law of July 24, 2009 No. 212-FZ, we ask you to take into account the above circumstances as mitigating and excluding the company’s guilt in committing an offense.

Applications:

1. A copy of the letter from Connect LLC about a malfunction in the program dated 04/11/11 No. AS-104/11 on 1 sheet in 1 copy.

2. Copies of payment orders for January–December 2010 on 12 sheets in 1 copy.

General Director Astakhov (I. I. Astakhov)

Petition to reduce the personal income tax fine in 2019 - to the tax office, sample, for late payment

Reducing various measures of influence on an individual or legal entity is carried out using several methods. It is worth understanding whether it is possible to file a petition to reduce the personal income tax fine in 2021.

After all, the petition is the main and simplest document in this area. And its application does not require extensive knowledge in the field of legal regulation.

What it is

The petition is the document that puts forward any request to the regulatory authority.

In its functions, goals, structure and information content, a petition is similar to an application. Therefore, you can use any of the concepts in the title of the document.

Submitting such a document is very important. If there are grounds, this petition allows you to reduce the fine several times. And this situation applies even to several minimal penalties.

Mitigation of punishment involves the use only of normative and legislative acts. Within their framework, the selection of those points that are applicable to a particular case is carried out.

Here it is important to select not only legal norms, but also related documents. Official papers become a support in confirming the words stated in the petition.

Required terms

| Concept | Its meaning |

| Fine | The imposition of punishment in the form of a financial penalty, which involves paying for a violation of legal legislation. It is used within several regulatory and legal spheres of life. The fine can be ordered either by the court or by the regulatory authority in a particular area. |

| Personal income tax | Income tax, which is assessed on the income of individuals in the country. It can only be applied to those profits that are official and have a pure legal origin. Payment of such tax usually falls on the tax agent - the employer. An individual entrepreneur pays such a fee independently |

| Mitigating circumstance | The presence of factors that influence the amount of punishment for the offender. Within the framework of a certain law, there is a list of such reasons and grounds. They should be studied and applied to your individual case, which will allow you to achieve a reduction in penalties according to the primary order |

04.04.2019

The Federal Tax Service may impose a fine for failure to comply with the deadline for submitting this form. If the violation is committed for the first time, as well as if there is a good reason, the amount of the fine can be significantly reduced; the main thing is to submit an application and indicate all the necessary information in it.

The application will not differ fundamentally from applications submitted in case of other violations.

What the law says

In this legal field, one should rely only on one legal document. This is the Tax Code of the Russian Federation. It includes those provisions on the basis of which the Federal Tax Service can decide to mitigate fines.

You should rely on Article 112 of the Tax Code of the Russian Federation. It establishes all the main points of regulation of mitigating circumstances.

You can also use the provisions of Article 110. It determines the forms of guilt of the offender. And in this case, paragraph 3 talks about the negligence that led to this event. Which can also be taken into account in the application.

To more accurately support justifications, judicial practice is used. Its application depends on the individual situation. Most often they rely on the decisions of the Supreme Court. Explanations regarding fines given by the Federal Tax Service are also used.

04.04.2019

Therefore, it is worth understanding all the meanings of the terminological base that may be useful when considering the issue: Concept Its meaning Fine The imposition of a penalty in the form of a financial penalty, which involves paying for a violation of legal legislation.

It is used within several regulatory and legal spheres of life. The fine can be prescribed either by the court or by the regulatory authority in a specific area of personal income tax. Income tax, which is assessed on the income of individuals in the country.

It can only be applied to those profits that are official and have a pure legal origin. Payment of such tax usually falls on the tax agent - the employer.

An individual entrepreneur pays such a fee on his own. Mitigating circumstance The presence of factors that influence the amount of punishment for the violator.

Each physical the person is obliged to timely transfer the income declaration document to the tax office. But it happens that the document is submitted late or with incorrect formatting.

Then it is impossible to avoid a serious penalty, but it is quite possible to reduce its amount. To do this, you need to timely submit a request to reduce the fine to the tax office.

But does the tax office always agree to reduce the fine? Of course, there are also quite controversial situations regarding the timely transmission of the declaration. This applies to cases where the document is transmitted in paper form via mail.

Despite the fact that mail now works quite efficiently, there are times when the delivery of letters is delayed at the most inopportune moment. And you shouldn’t expect sympathy and understanding from the tax inspector.

A fine will definitely be assessed, and a petition will no longer help. But if the reason for the delay in transferring the document was the Internet, then you should immediately contact the tax office with a petition. In addition to errors and delays related to filing an income tax return, there are a number of other reasons that can subject the payer to serious punishment.

Attention

A particularly serious reason not only for charging a fine, but also for a desk audit is the erroneous or deliberate understatement of taxes through a fictitious reduction in the amount of income received. The reason for charging a fine will be the absence of a cash register. Even if sales are made in small volumes, the payer is guaranteed to be charged a penalty.

The accrued fine may significantly exceed the previously unaccounted income.

Order on appointment to the position of chief accountant These documents confirm that there is only one accountant on staff. That is, in his absence no one could do his work. General Director D.V. Mokin If your inspection ignores the petition received, do not give up.

Send a complaint to the Federal Tax Service stating that when making the decision to prosecute, the mitigating circumstances you stated were not taken into account (although they should have been!).

The Tax Service itself says that they must be indicated in the complaint, this is necessary “for the correct and timely consideration of the case” Information from the Federal Tax Service dated 02/09/2011 “On the content of the complaint...”.

If the higher tax authority does not heed your request, and the amount of the fine is significant, it is advisable to challenge the tax authority’s decision in court. Judges, as a rule, are willing to take into account existing mitigating circumstances.

Legal basis

: tax penalties

Required terms

Today there is no need to spend money on the services of commercial lawyers. To receive practical advice and effective recommendations from lawyers, all you need is an Internet connection.

Our website employs highly qualified legal experts around the clock, who always competently approach solving applicants’ problems.

Remote online consultations allow Russians to develop an individual algorithm of actions to reduce or cancel tax penalties, provide an example of an application, while saving their effort, time and personal resources.

It is important to understand that each case is individual and requires a qualified approach. The court will carefully study the circumstances of the case and make a reasoned, legal decision. If citizens are not satisfied with the essence of the definition, they have the right to appeal it in court.

- Failure to submit a document on time (Tax Code, Art. 119). The amount of the fine is affected by the length of delay. This happens due to the human factor or delays beyond human control - failures in the transmission system, the need for additional calculations, etc. It is best to take such subtleties into account when filing a declaration.

- Deliberate underestimation of the base or errors in calculating payments (NC, Art. 112).

- Refusal to use a cash register in trade. The price of an unaccounted product and the amount of non-payment of tax on it are not an obstacle to the accrual of penalties.

- Failure to inform about the creation or closure of bank accounts.

The tax authority provides a week for this procedure. Otherwise, the organization or individual will be fined 5 thousand rubles, the directors of the company will be punished separately in the amount of 1-2 thousand rubles.

The application to the head of the inspection must be completed in accordance with all the rules. An incorrectly executed document may contain legitimate mitigating facts for reduction, but its pleading part calls for recognition of the act as invalid.

Late reporting: fines 2020

Organizations and individual entrepreneurs making payments and other remuneration to individuals are required to submit a report in the SZV-M form to the territorial divisions of the Pension Fund of Russia. This obligation was enshrined in 2020 in paragraph 2.2 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” The same law also provides for liability in the form of fines for late delivery of SZV-M. Article 17 of the law states that failure by the policyholder to submit within the prescribed period or submission of incomplete and (or) false information will entail a fine of 500 rubles in relation to each insured person.

If you want to know how much you will be fined for late submission of SZV-M in 2021, then you need to multiply 500 rubles by the number of individuals about whom you must report - employees and those with whom your organization has entered into civil law contracts.

An example of calculating a fine.

Let’s assume that the organization is late submitting the SZV-M report for January 2021. It had to be submitted no later than February 15th. However, in fact, the report was submitted to the Pension Fund only on February 22. A total of 105 people are listed in the report. Therefore, the fine for late submission of SZV-M in 2021 will be 52,500 rubles (500 × 105). Below in the table we present the amount of fines for late submission of SZV-M in 2020. As an example, we give fines from 1 to 25 individuals in the report (inclusive).

Reduced fine

In 2021, as before, the legislation does not provide that the fine for late submission of the SZV-M report can be reduced due to mitigating circumstances. In principle, there is no mechanism for reducing the fine.

However, it is worth noting that the absence of such norms in the legislation does not mean that the fine for late delivery of SZV-M cannot be reduced in any way. An organization or individual entrepreneur can apply to the court at the location of the PFR unit that issued the fine with a claim to partially invalidate the decision to prosecute and ask to reduce the sanctions (clause 5 of the reasoning part of the Resolution of the Constitutional Court of the Russian Federation dated January 19, 2016 No. 2-P) . Among the mitigating circumstances, one can indicate the commission of such a violation for the first time, a short period of delay, etc.

Note that in practice there have been cases when judges reduced the fine for SZV-M by 100 times - from 19,000 rubles. up to 190 rub. (decision of the Arbitration Court of the Sverdlovsk Region dated September 12, 2021 in case No. A60-33366/2016).

Another organization asked the court to reduce the fine by half - from 43,000 to 21,500 rubles. The court reduced it by that much (decision of the Arbitration Court of the Orenburg Region dated September 9, 2021 in case No. A47-6249/2016).

For more information about this, see “Recent judicial practice on SZV-M: how to reduce fines.”

Tax penalties can be canceled or mitigated

Tax offense, according to Art. 106 of the Tax Code of the Russian Federation is an illegal action (or inaction) that led to a violation of tax legislation. Types of tax offenses include:

- submission of knowingly incorrect information about income to the Federal Tax Service Inspectorate (INFS);

- concealment of income;

- understatement of the tax base;

- violation of deadlines for filing a declaration or paying taxes, etc.

Organizations and individuals starting from the age of 16 are responsible for tax offenses. For minor offenses, a fine or penalty may be imposed. For more serious crimes, for example, concealing income over a long period of time, using fraudulent money laundering schemes, etc.

In addition to the investigation by the Federal Tax Service, other cases are opened, depending on the crime - criminal, administrative and others. There are also circumstances that exclude or mitigate the taxpayer’s guilt. In these cases, an individual or organization can submit a petition to the tax office for a reduction in the fine or a complete exemption from it.

Let's consider under what circumstances this is possible.

You can submit a petition to the tax office if individuals and organizations are unlawfully brought to justice, or if there are circumstances that mitigate or exclude guilt.

A taxpayer can be held accountable only on the grounds provided for by the code and if the fact of an offense has been established. In this case, it is impossible to attract someone twice for the same tax offense (Clause 2 of Article 108 of the Tax Code of the Russian Federation).

- Prosecution does not relieve either an individual or an organization from paying taxes (fees or insurance premiums) due under the law. That is, all debts must be paid without waiting for the results of the investigation, which may result in additional punishment.

- The presumption of innocence also applies in tax law: a taxpayer cannot be found guilty until his guilt is proven. In this case, the suspect does not have to prove his own innocence. Tax authorities are obliged to collect facts proving a tax crime.

- If doubts about the guilt of the person brought to justice are not overcome, this person is considered innocent (Clause 6 of Article 108 of the Tax Code of the Russian Federation).

Thus, the basis for filing a petition or complaint against the actions of tax officials may be the unlawful prosecution of a person:

- if the protocol on bringing to justice is violated (lack of corpus delicti and guilt of the person);

- the person has already been charged with this offense;

- The INFS made the decision to find the person guilty without sufficient facts and in the presence of doubts;

- upon expiration of the statute of limitations;

- if at the time of the offense the person was under 16 years of age;

- the offense occurred during transactions with property owned by foreign companies that declared their assets and accounts (Clause 2 of Article 109 of the Tax Code of the Russian Federation).

Guilty plea

A person who has committed an offense is found guilty:

- intentionally, that is, with awareness of the illegality of one’s actions or the consequences that have occurred;

- through negligence, that is, without awareness of guilt and the severity of the consequences.

The organization is found guilty, depending on the form of guilt of the officials (representatives) who committed the criminal act or inaction (Article 110 of the Tax Code of the Russian Federation).

To circumstances excluding guilt, on the basis of Art. 111 NK, include:

- Natural disasters and emergency circumstances (force majeure), if they are indisputable, confirmed by the media or other sources of facts. In this case, the person cannot be held accountable (clause 2 of Article 111).

- Committing an offense in an uncontrolled state, when one does not give an account of actions and actions, for example, in case of mental disorders, delirium and other painful conditions.

- Actions of the taxpayer within the limits of their competence based on a written explanation or motivated opinion of the tax authorities, subject to: the availability of documents confirming the facts of monitoring by the INFS;

- the reliability of the information provided by this person to the INFS, on the basis of which written explanations were given by the tax authorities and a reasoned opinion was presented.

Fine for non-compliance with order

Since 2021, the legislation on personalized accounting has introduced a new fine related to SZV-M. Note that it is not related to the out-of-date presentation of monthly reporting. The new fine concerns the method of submitting the SZV-M.

Please note that in 2021 it is possible to report using the SZV-M form “on paper” only if the report includes information for less than 25 people. If the report includes 25 or more insured persons, then you need to submit the report in the form of an electronic document signed with an enhanced qualified electronic signature (paragraph 3, paragraph 2, article 8 of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) ) registration in the compulsory pension insurance system").

If in 2021 an organization or individual entrepreneur does not comply with the specified requirement regarding the method of submitting the SZV-M, then inspectors from the Pension Fund of the Russian Federation will have the right to impose a new fine of 1000 rubles. Since 2021, this fine has been added to Article 17 of Federal Law No. 27-FZ dated April 1, 1996.

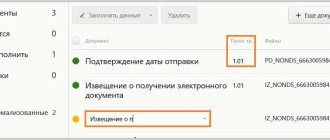

How the Pension Fund will collect fines in 2020

The procedure for collecting fines for late submission of SZV-M and for failure to comply with the procedure for submitting a report is described in Article 17 of Federal Law No. 27-FZ of April 1, 1996. The procedure for collecting fines consists of several stages. So, in particular, an act will be drawn up. Then you will be required to pay a fine for late submission of the SZV-M. It will need to be paid within 10 calendar days from the date of receipt. Or, a longer period may be set for payment of the fine directly in the requirement itself. You will need to pay the fine for late submission of SZV-M in 2020 at KBK 392 1 1600 140. It has not changed.

In 2021, PFR units have the right to collect any fines for SZV-M exclusively in court. This is directly stated in Article 17 of the Federal Law dated 04/01/1996 No. 27-FZ (as amended by the Federal Law dated 07/03/2016 No. 250-FZ). Pension Fund authorities do not have the right to write off fines for SZV-M directly from bank accounts. Accordingly, apply the form of the decision on collection from accounts (2-PFR), approved by the Decree of the Melting of the Pension Fund of July 29. 2021 No. 684p, they shouldn’t either.

It is worth noting that in 2021, the PFR authorities actually had the right to write off fines for SZV-M in a pre-trial manner and write off fines directly from the accounts of payers. This possibility was provided for in Article 17 of the Federal Law of April 1, 1996 No. 27-FZ. However, starting from 2021, the Pension Fund does not have such an opportunity.

If you find an error, please select a piece of text and press Ctrl+Enter.

Deadline for submitting a request to cancel a fine to the tax office

A letter requesting a reduction in tax penalties or their cancellation must be drawn up and sent within the prescribed period. This period is the same, regardless of how the tax offense was detected:

- if a tax audit was carried out (desk or on-site), the period is 1 month from the date of receipt of the audit report by the taxpayer (clause 6 of Article 100 of the Tax Code of the Russian Federation);

- in other cases – 1 month from the date of receipt of the Federal Tax Service Inspectorate’s report on the tax offense (clause 5 of Article 101.4 of the Tax Code of the Russian Federation).

Competent objections = good solution to the “stock” check

The article from the magazine "MAIN BOOK" is current as of July 3, 2015.

Contents of the magazine No. 14 for 2015 M.A. Kokurina, lawyer

How to write explanations or objections to an inspection report conducted by the Pension Fund of Russia or the Social Insurance Fund

Checks of extra-budgetary funds. 1 tbsp. 3, sub. 2 hours 1 tbsp. 29 of Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ) are no less exciting for an accountant than tax audits. It is good that some disagreements with fund auditors can be resolved during the audit or immediately after its completion, without waiting for a decision to be made on it. This is done using:

- <or explanations if a desk audit was carried out and errors or contradictions were found in the documents. 3 tbsp. 34 of Law No. 212-FZ;

- <or>objections to the inspection report, if an on-site or desk inspection was carried out, as a result of which violations were identified. 5 tbsp. 34, part 5 art. 38 of Law No. 212-FZ.

If the request remains unanswered

It is quite possible that the application sent to the tax office will not be taken into account and the amount of the fine will remain the same. Then you should contact the Federal Tax Service with a complaint that the mitigating circumstances stated in the letter to the tax office about reducing the fine, a sample of which we provided above, were not taken into account when the tax inspectorate made a decision. The content of such a complaint is discussed in detail in the Information of the Federal Tax Service of the Russian Federation dated 02/09/2011.

If in this case a positive result is not obtained, and the amount of the fine remains significant, the decision of the tax authorities will have to be challenged in court.

Explanations during the camera session

The legislation on insurance premiums provides for the right of inspectors to request explanations in writing from the payers of contributions if a desk audit reveals... 3 tbsp. 34 of Law No. 212-FZ:

- <or>errors in the calculation of accrued and paid insurance premiums;

- <or>contradictions between the information contained in the submitted documents;

- <or> discrepancies between the information provided by the payer of insurance premiums and the information contained in the documents available to the fund.

Is any explanation needed at all?

Someone may decide that it is possible not to respond to the requirement to provide explanations during desk audits. The organization is not fined for this. After all, the legislation:

- it is stipulated that giving explanations is the right, and not the obligation, of the contribution payer. 5 hours 1 tbsp. 28 of Law No. 212-FZ;

- no liability has been established for failure to provide explanations and for failure to make corrections in the calculation of accrued and paid insurance premiums Resolution 7 of the AAS dated March 15, 2013 No. A27-15920/2012.

And if there is a practice when magistrates fine a manager or chief accountant for failure to provide explanations, then this is only 300-500 rubles per hour. 3 tbsp. 15.33 Code of Administrative Offenses of the Russian Federation; Resolutions of the magistrate of the Kutuzovsky judicial district of the city of Syktyvkar, Komi Republic, dated 08/14/2013 No. 5-721/13, dated 11/06/2013 No. 5-946/2013

In addition, some organizations successfully appeal the requirements to provide explanations in court. Resolution of the Federal Antimonopoly Service No. F03-6286/2013 of 02/03/2014.

But look at the explanations from a different angle. With their help you can:

- formulate your position, convey to the inspectors why you put exactly this amount in the calculation and not another;

- indicate the existing judicial practice on the controversial issue or clarifications of the Pension Fund of Russia, the Social Insurance Fund.

That is, you can try to remove the auditors’ claims at the inspection stage. And if you fail to convince them with the help of explanations, then you will already be aware of the problem and will be able to substantively prepare your counterarguments in objections to the inspection report.

How to write explanations

If you did not find any obvious formal violations when the fund asked you for “office” explanations, we advise you to provide such explanations. The legislation does not establish a special form for them. Therefore, you can compose explanations in writing in any form, for example like this.

In response to your request dated 04/15/2015 No. 05900113 ZP 0000115 for clarification on the Calculation of accrued and paid insurance contributions for compulsory pension insurance in the Pension Fund and for compulsory health insurance in the FFOMS for 2014 (delivered on 04/17/2015), we report the following.

Molniya LLC (hereinafter referred to as the policyholder, organization) was created on December 3, 2014 through the transformation of Molniya CJSC. The policyholder calculated insurance premiums for December 2014 using reduced rates according to the tariffs established by law (Part 1, Article 58.2 of Law No. 212-FZ dated July 24, 2009), reaching the maximum base for calculating insurance premiums in relation to employees, the amount payments of which exceeded 512,000 rubles. from the beginning of the billing period.

We consider this calculation to be legitimate for the following reasons.

1. When the organizational and legal form of the insured changes, the rights and obligations of the reorganized legal entity are transferred to the newly established legal entity in accordance with the transfer act (clause 5 of Article 58 of the Civil Code of the Russian Federation).

The legal successor of a reorganized legal entity, when fulfilling the obligations assigned to it to pay insurance premiums, enjoys all rights and performs all duties in the manner prescribed by law (Article 58 of the Civil Code of the Russian Federation; Part 16 of Article 15 of Law No. 212-FZ of July 24, 2009).

2. The transformation of the employer cannot be the basis for terminating employment contracts with employees of the organization (Article 75 of the Labor Code of the Russian Federation): labor relations with the consent of the employees continue and wages are accrued to them according to previous employment contracts. Consequently, the reorganization does not change the conditions and procedure for remuneration of employees. The employer’s obligation to pay contributions in favor of the employee after the reorganization remains and does not arise again due to the fact that the employment relationship continues both during the reorganization process and after its completion.

Therefore, when determining the taxable base for insurance premiums, the successor employer is obliged to take into account: - payments under the employment contracts of the predecessor employer; — the period of work of employees with the predecessor employer.

3. Law No. 212-FZ dated July 24, 2009 does not establish a different procedure for determining the base for calculating insurance premiums in the event of reorganization of an organization that pays insurance premiums. There are also no special conditions for interrupting the procedure for such calculation; therefore, the law does not establish a special procedure for calculating insurance premiums in the event of reorganization of a legal entity.

Due to the fact that employment contracts with employees were not terminated, Molniya LLC legally: - calculated the billing period from 01/01/2014 to 12/31/2014 (Parts 1, 2, Article 10 of Law No. 212-FZ dated 07/24/2009); — took into account in the taxable base for insurance premiums payments and rewards accrued in favor of employees before the change in the organizational and legal form.

Appendices 1. Copy of the decision of the participants of ZAO Molniya on transformation into LLC Molniya. 2. Copies of employment contracts with employees of ZAO Molniya who remained to work at LLC Molniya, the amount of payments to whom for 2014 exceeded 512,000 rubles.

You can attach any documents (including extracts from accounting registers) confirming the correctness and reliability of the information included in the calculation of accrued and paid insurance premiums. 4 tbsp. 34 of Law No. 212-FZ

| General Director of Molniya LLC | E.R. Thunder |

04/22/2015Your explanations must be submitted no later than 5 working days from the day you were served with a request for an explanation. If you do not submit them to the inspectors within this period, they will draw up a desk inspection report describing the violations identified. You will be able to give explanations on them in objections at the stage of reviewing the inspection materials. 3, 5 tbsp. 34 of Law No. 212-FZ; Resolution of the AS Far Eastern Military District dated January 21, 2015 No. Ф03-6043/2014

We object after the check is completed

Objections are submitted after the inspection, when you are given the certificate. It must be compiled. 6 tbsp. 4, part 1, 2 art. 38 of Law No. 212-FZ:

- <if a desk audit was carried out that revealed violations of the law, then no later than 10 working days from the date of expiration of 3 months from the date of submission of the calculation by the payer of insurance premiums. 2 tbsp. 34 of Law No. 212-FZ;

- <if an on-site inspection was carried out, then no later than 2 months from the date of drawing up the certificate of the inspection.

STEP 1. Receive an inspection report

- <or>the act will be handed over to a company representative against receipt. Surely, it is not the head of the company who will go to the fund to collect the document, so the person who is sent there must be given a power of attorney to receive such documents. 8 tbsp. 5.1 of Law No. 212-FZ; Art. 85 Civil Code of the Russian Federation. He will have to sign on the last page of the act and indicate the date of its receipt;

- <or>the act will be sent by registered mail. Regardless of when you actually receive it, it will be deemed received 6 business days from the date the registered letter is sent to you. By the way, even if your company does not shy away from receiving the act handed to it, inspectors have the right to send it by mail;

- <or>the act will be sent electronically via telecommunications channels (TCS).

STEP 2. We study the inspection report and draw up objections to it

Read the act carefully and try to find errors by the inspectors - procedural (made by the inspectors during the process of conducting and completing the inspection) or substantive. State them in objections, which must be submitted to the fund no later. 4, 5 tbsp. 38, part 6 art. 4 of Law No. 212-FZ:

- <if the act arrived by mail - then 21 working days from the date the fund sent you the act;

- <if>the act was delivered to a representative of the company or received under the TKS - then 15 working days from the date of delivery or receipt of the act under the TKS.

Objections to the on-site inspection report dated June 26, 2015 No. 304

According to the on-site inspection report dated June 26, 2015 No. 304 (a copy of the report was handed over to the representative of the insurance premium payer on June 29, 2015), it is proposed to charge additional insurance premiums and hold the insurance premium payer accountable in the form of a fine for violating the legislation on insurance premiums (Part 1, Article 47 Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ)) - for incomplete payment of insurance premiums as a result of the unlawful application in 2014 of the reduced insurance premium rate provided for in Part 3.4 of Art. 58 of Law No. 212-FZ.

Flashka.ru LLC does not agree with the facts stated in the inspection report, as well as with the conclusions and proposals of the inspectors, and therefore, on the basis of Part 5 of Art. 38 of Law No. 212-FZ Support all your arguments with references. In addition to links to laws and regulations, these may be links to: letters from the Pension Fund of Russia or the Social Insurance Fund confirming the legitimacy of your position; for judicial practice. Try to select the latest solutions or at least those adopted no more than 3 years ago. Arrange links to judicial practice in the following sequence: acts of the Armed Forces of the Russian Federation, the Supreme Arbitration Court of the Russian Federation (decrees of the Plenum, Presidium, information letters, definitions) → decisions of the Court of Justice of your district → acts of lower courts in your region → acts of courts of other regions presents its objections to the inspection report.

The organization has the right to apply a reduced tariff established by Part 3.4 of Art. 58 of Law No. 212-FZ, since the following conditions are met: - the organization has been applying the simplified tax system since 2013 (Fleshka.ru LLC was registered and registered for tax purposes on 08/06/2012); — the main type of activity of the organization is the type of activity given in subparagraph. “i.7” clause 8, part 1, art. 58 of Law No. 212-FZ. The main type of activity is recognized if the share of income from the sale of products and (or) services provided for it is at least 70% of the total income (Part 1.4 of Article 58 of Law No. 212-FZ; Article 346.15 of the Tax Code of the Russian Federation). At the end of 2014, the amount of income of Flashka.ru LLC for 2014 amounted to 3,166,064 rubles. Flashka.ru LLC carries out the activities specified in the constituent documents - software development and consulting in this area (code 72.20 OKVED). In 2014, the share of income from this type of activity in total income was 100%.

Thus, Flashka.ru LLC lawfully applied in 2014 the reduced rate of insurance premiums provided for in Part 3.4 of Art. 58 of Law No. 212-FZ. Consequently, we consider it unlawful: - additional accrual of insurance premiums to Fleshka.ru LLC in the amount of 37,500 rubles. and penalties in the amount of RUB 3,453; — a proposal to hold accountable for non-payment or incomplete payment of insurance premiums as a result of understating the base for calculating insurance premiums.

If you have several comments on the inspection report, you can break the objections into points. For example, like this: “1. On the issue of unlawful application of the reduced tariff of insurance premiums provided for in Part 3.4 of Art. 58 of Federal Law No. 212-FZ. … 2. Regarding the content of the on-site inspection report. When drawing up inspection report No. 304, the inspectors did not indicate in the descriptive and motivational parts of the report the circumstances of the commission of the violation imputed to the company: not all documents inspected were listed; are indicated as unsubmitted documents that were not requested from the policyholder. Therefore, it is impossible to draw a conclusion from the act about the investigation, establishment and proof of the guilt of the company. As a rule, courts cancel inspection decisions made on the basis of an act that does not contain a description of the offense charged to the payer of insurance premiums (Chapter 5 of Law No. 212-FZ; Resolution of the AS UO dated November 26, 2014 No. F09-7363/14).”

Considering the above, in accordance with Articles 38 and 39 of Law No. 212-FZ, I ask:

Based on the results of the consideration of the materials of the on-site inspection of Flashka.ru LLC, make a decision to refuse to prosecute for committing an offense and not to collect arrears on insurance premiums and penalties for late payment of insurance premiums.

Appendices 1. Copy of the notice of the transition of Flashka.ru LLC to the simplified tax system (form No. 26.2-1). 2. A copy of the tax return for the tax paid in connection with the application of the simplified tax system for 2014. 3. A copy of the book of income and expenses for 2014: the title page and the section “Income and expenses” for the fourth quarter with the total for the year. 4. A copy of the certificate confirming the main type of economic activity dated April 14, 2015. 5. Copy of the power of attorney for the chief accountant of Fleshka.ru LLC dated June 25, 2015 No. 14.

Representative of Flashka.ru LLC by proxy

| Chief Accountant | BY. Simka |

06.07.2015

You can send your objections by mail in a valuable letter with a list of attachments. But it is better to bring two copies of the text to the office of the fund branch so that your copy can be marked as accepted.

If for some reason you do not have time to submit objections to the inspection report on time, prepare them for the day of consideration of the inspection materials, to which you must be invited. They must also accept your written objections.

STEP 3. Participate in the review of inspection materials

The fund department is obliged to notify you about the time and place of consideration of the audit materials. 2 tbsp. 39 of Law No. 212-FZ. The legislation does not establish a special form for such notification. Therefore, you may simply be given a paper from the fund indicating the date, time and place where you need to appear.