Can the Federal Tax Service re-request previously provided documents?

If an inspected person or a consolidated group of taxpayers was previously subjected to a desk or field audit by tax authorities, during which the documents requested by FTS specialists were transferred to the Federal Tax Service, the tax authorities do not have the right to request from this person during a new audit or other tax control activities persons (groups of persons) the same papers or documents that were provided during the inspection in the form of certified photocopies (clause 5 of Article 93 of the Tax Code of the Russian Federation).

However, such a restriction does not apply to all cases. The tax office has the legal right to submit a second request if:

- documents transferred to the Federal Tax Service employees were lost due to force majeure circumstances (for example, a natural disaster, a fire in the tax office building);

- the requested papers were transferred to the Federal Tax Service in the form of originals, and tax authority specialists returned them back to the taxpayer.

It should also be borne in mind that the norms of paragraph 5 of Art. 93 of the Tax Code of the Russian Federation do not apply to cases where the taxpayer transfers papers to the Federal Tax Service outside the framework of organizing tax monitoring. That is, paragraph 5 of Art. 93 of the Tax Code of the Russian Federation is not subject to broad interpretation. This is stated in the Letter of the Federal Tax Service of the Russian Federation dated December 4, 2015 No. ED-16-2/304.

Important!

The provisions of the Tax Code of the Russian Federation do not contain a ban on conducting an on-site tax audit after the completion of a desk audit. But the taxpayer is not required to provide the same documents that were previously provided during the first audit.

The tax inspectorate does not have the right to demand that the person being inspected re-send the following documents to the Federal Tax Service:

- previously submitted to the tax authorities in the form of certified copies as part of the organization of a tax audit;

- previously sent to employees of the Federal Tax Service when the tax service conducted an on-site or desk audit of the person in question (consolidated group of taxpayers).

At the same time, current Russian laws on taxes and fees do not limit the tax authorities from sending a repeated request for the person being inspected to provide the following documents:

- relating to the work of the counterparty, previously requested from the taxpayer (tax agent, payer of the fee) during an audit of his counterparty and provided to the tax service on the basis of clause 1 of Art. 93.1 Tax Code of the Russian Federation;

- for a specific transaction, provided earlier after receiving a request from the Federal Tax Service outside the framework of tax monitoring (in accordance with clause 2 of Article 93.1 of the Tax Code of the Russian Federation);

- previously requested in connection with any other tax control measures (for example, the cashier-operator’s journal, previously provided when deregistering the cash register machine).

Fine for failure to provide documents requested by the tax authorities

According to the new rules, inspectors are deprived of the opportunity to re-demand documents (regardless of the purpose) if they have already been submitted by the taxpayer. And when, in spite of everything, a company receives a request to prepare and submit documents previously sent to the Federal Tax Service, the company should hedge its bets by writing an official letter to the tax office indicating the fact of violation of the tax authority’s powers, and present the taxpayer’s position in detail and with reason. A repeated request for documents, as already noted, is permissible only in the event of force majeure circumstances, for example, a fire, flood, other natural disaster or catastrophe. If you sent documents to one tax office, and then you changed your registration address, then the tax office, where you register at the new location, will have access to the documents submitted earlier.

In what situations can the Federal Tax Service request materials under Article 93.1 of the Tax Code of the Russian Federation? Can inspectors require documentation during meetings that is not directly related to your counterparty?

How is a request made under Article 93.1 of the Tax Code of the Russian Federation?

Is it possible to ignore a requirement regarding a certain transaction if it does not contain accurate data about this transaction?

Can the inspection request documents under Art. 93.1 of the Tax Code of the Russian Federation, if they relate to years more than three years ago?

Results

Despite the fact that it is not necessary to submit documents that were previously requested to the tax service, taxpayers from September 3, 2021

are obliged to inform the inspectors when and to which Federal Tax Service he previously submitted the newly requested papers. It is also necessary to provide the details of the document to which such documents were attached. Repeated requests for documents cannot be left unanswered.

The Federal Tax Service must respond to the request within 10 working days from the date of receipt of the request (according to clause 5 of Article 93 of the Tax Code of the Russian Federation as amended by Federal Law No. 302-FZ dated 08/03/2020).

Tax officials have updated the forms of documents used in control activities, including the request form for the submission of explanations and documents.

In addition, the requirements for documents submitted to the tax authority on paper have been adjusted. The entire volume of papers for inspectors must be divided into parts of no more than 150 sheets each. Each such volume is separately bound, numbered and certified by the personal signature of the person confirming the authenticity of the papers. According to the new rules, a company seal is not needed to certify them. Documents of more than 150 pages are not divided into parts.

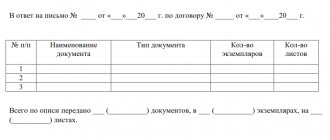

The collected package must be accompanied by a covering letter indicating the details of the inspectors' request or another basis for submitting papers. The letter must contain a list of all documents, or this information must be included as an attachment to it.

If documents are submitted electronically through TKS or a personal account, a list of data submitted to the inspection is generated automatically. In addition, based on the text of the regulations, a cover letter must be drawn up only when sending papers at the request of the Federal Tax Service.

Their voluntary submission does not fall under the new requirement.

Repeated requests for documents cannot be left unanswered

Despite the fact that it is not necessary to submit documents that were previously requested to the tax service, taxpayers from September 3, 2021

are obliged to inform the inspectors when and to which Federal Tax Service he previously submitted the newly requested papers.

It is also necessary to provide the details of the document to which such documents were attached. Repeated requests for documents cannot be left unanswered.

The Federal Tax Service’s request must be responded to within 10 working days from the date of receipt of the request (according to clause 5 of Article 93 of the Tax Code of the Russian Federation as amended by Federal Law No. 302-FZ dated 08/03/2021).

Is it prohibited to re-request documents?

During desk audits, the powers of tax officials are limited by Article 88 of the Tax Code of the Russian Federation. It contains a list of cases in which additional information and documents can be requested. It is quite extensive, but closed. All requirements outside its limits are illegal and can not be fulfilled without fear of being brought to tax liability.

Such clarifications were given by both the Ministry of Finance of Russia (letter dated March 2, 2017 No. 03-02-07/1/12009) and the Federal Tax Service of Russia (letter dated February 22, 2017 No. ED-4-15/3411 and clause 7.7 of the letter dated July 17. 13 No. AS-4-2/12837).

For convenience, we have prepared a table with the most common grounds for demands within the framework of “camera chambers”.

In this case, it is worth attaching a covering letter to the documents with an explanation that such and such documents cannot be submitted, they do not relate to the period under review.

- Documents that you have already submitted are required

The inspectorate does not have the right to repeatedly demand documents that the company has already submitted to it once as part of a desk or on-site inspection (Clause 5 of Article 93 of the Tax Code of the Russian Federation). Therefore, if such documents are still named in the request, they do not need to be submitted. But in response to the request, you must inform the inspectorate in writing of the reason for the non-submission and attach confirmation (for example, a copy of the inventory). Important! If the request is made in violation, do not ignore it completely; it is better to explain to the tax authorities in writing the reason for your refusal with reference to the relevant article of the Tax Code of the Russian Federation.

Despite the fact that it is not necessary to submit documents that were previously requested to the tax service, taxpayers from September 3, 2021

are obliged to inform the inspectors when and to which Federal Tax Service he previously submitted the newly requested papers. It is also necessary to provide the details of the document to which such documents were attached. Repeated requests for documents cannot be left unanswered. The Federal Tax Service’s request must be responded to within 10 working days from the date of receipt of the request (according to paragraph 5 of Article 93 of the Tax Code of the Russian Federation as amended by Federal Law No. 302-FZ of August 3, 2019).

Previously, government orders approved similar lists of certificates and documents that federal authorities can independently request from regions, and regions can request from each other electronically using a unified system of interdepartmental electronic interaction. The only exceptions are so-called personal documents, for example, passports, education diplomas, medical examinations and some others. If they are required, the applicants themselves must still present them to the departments when applying for government services. According to Boris Slavin, scientific director of the Faculty of Applied Mathematics and Information Technologies of the Financial University under the Government of the Russian Federation, approval of the list will make it possible to fully implement the legislative requirement adopted in 2010 to prohibit asking citizens for documents already available to government agencies when providing public services. And the unification of interdepartmental interaction between regional and municipal authorities and federal authorities will speed up the flow of information through interdepartmental channels. “This is a natural continuation of the process of automation of public services,” he noted. However, according to the expert, it is advisable to extend such a ban not only to authorities. For example, all university teachers are forced to regularly provide police clearance certificates, although it would be more correct for universities to receive information about the criminal records of their employees themselves. The situation is even worse with pensioners of non-state pension funds, who are forced to confirm in person that they are still alive. “It would be more humane to provide such information to pension funds automatically from the registry office,” says Slavin.

If an inspected person or a consolidated group of taxpayers was previously subjected to a desk or field audit by tax authorities, during which the documents requested by FTS specialists were transferred to the Federal Tax Service, the tax authorities do not have the right to request from this person during a new audit or other tax control activities persons (groups of persons) the same papers or documents that were provided during the inspection in the form of certified photocopies (clause 5 of Article 93 of the Tax Code of the Russian Federation).

Common mistakes

Error:

The documents were provided by the taxpayer during a counter-inspection of the taxpayer's counterparty. He refuses to provide these documents to the Federal Tax Service again.

A comment:

Documents must be provided. See Resolution of the Eleventh AAS dated 08/05/2014 No. 11AP-10085/14.

Error:

On September 1, 2021, the taxpayer received from the Federal Tax Service a request to provide documents previously provided to inspectors. The taxpayer left the request unanswered.

A comment:

Repeated requests for documents cannot be left unanswered starting from September 3, 2021.

Desk tax audit: requesting documents

Error:

The documents were provided by the taxpayer during a counter-inspection of the taxpayer's counterparty. He refuses to provide these documents to the Federal Tax Service again.

A comment:

Documents must be provided. See Resolution of the Eleventh AAS dated 08/05/2014 No. 11AP-10085/14.

Error:

On September 1, 2021, the taxpayer received from the Federal Tax Service a request to provide documents previously provided to inspectors. The taxpayer left the request unanswered.

A comment:

Repeated requests for documents cannot be left unanswered starting from September 3, 2021.

Sanctions under paragraph 1 of Art. 126 are applied for failure to provide documents to the Federal Tax Service, including those requested by tax authorities during audits. The fine for late submission of documents to the tax office will be 200 rubles. for each unsubmitted document. Refusal to provide the tax authorities with a declaration of profit of a controlled foreign company and documents related to it (clause 5 of Article 25.15 of the Tax Code of the Russian Federation) will entail the collection of a fine in a fairly large amount - 100 thousand rubles.

Fine under clause 2 of Art. 126 threatens organizations and individual entrepreneurs who refused to submit the information they have about another taxpayer at the request of the Federal Tax Service, or provided false information about him. This norm is applied during “counter” checks. The tax inspection fine for legal entities and individual entrepreneurs will be 10 thousand rubles, for individuals who are not individual entrepreneurs - 1000 rubles.

Punishment under Art. 129.1 applies to taxpayers who unlawfully failed to provide Federal Tax Service employees with the necessary information or failed to transmit the required information in a timely manner. In particular, the norm is applied for the lack of explanations in case of failure to submit on time the “clarification” requested as part of a desk audit (clause 3 of Article 88 of the Tax Code of the Russian Federation). Violators face fines in the amount of RUB 5,000. If such a violation is repeated within one calendar year, the fine will increase to 20 thousand rubles.

- During inspections, tax authorities have the right to request from the organization only those documents that relate to the period and tax being audited. You cannot be fined for failure to provide those documents that the Federal Tax Service does not have the right to demand.

- Representatives of the tax service do not have the right to repeatedly request documents previously provided to them. Accordingly, it is impossible to impose penalties for failure to provide in this case.

- In paragraph 1 of Art. 126 of the Tax Code of the Russian Federation states that fines are imposed only for failure to provide documents that are mentioned in accounting and tax legislation. If the Federal Tax Service requests other documents, but the organization has not submitted them, this is not a violation and cannot be punished with a fine. The courts come to this conclusion.

- If an organization does not provide the requested papers or information for the reason that it does not have them, it cannot be fined either. To avoid problems with tax authorities, it is necessary to promptly inform the Federal Tax Service in writing about the absence of the necessary documents.

Despite the fact that it is not necessary to submit documents that were previously requested to the tax service, taxpayers from September 3, 2021

are obliged to inform the inspectors when and to which Federal Tax Service he previously submitted the newly requested papers. It is also necessary to provide the details of the document to which such documents were attached. Repeated requests for documents cannot be left unanswered.

The Federal Tax Service must respond to the request within 10 working days from the date of receipt of the request (according to clause 5 of Article 93 of the Tax Code of the Russian Federation as amended by Federal Law No. 302-FZ dated 08/03/2020).

1. Response to the request for the production of documents

2. Repeated submission of documents to the Federal Tax Service

3. Document codes in the requirements of the Federal Tax Service

4. How to certify documents for the tax office upon request

5. The tax office requests documents regarding the counterparty

6. Failure to provide documents requested by the tax authorities

Now let's look at each of the questions in more detail.