Using an example, let’s look at accounting and payment for inter-shift rest.

The organization has introduced a rotational work method.

In November 2021, employees were on shift from November 2, 2020 to November 16, 2020. During this period, they worked 13 shifts of 11 hours each - a total of 143 hours. On November 17, 2020, the shift workers were en route from the place of work to the location of the organization. Departure day for the next shift is 12/01/2020.

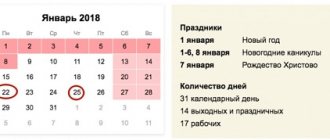

During the accounting period, the standard working time for employees is established according to a 40-hour work week. The norm according to the production calendar during the period when workers are on shift is 79 hours. As of November 1, 2020, employees do not have any remaining unused inter-shift rest hours.

It is necessary to calculate the number of overtime hours on a shift and provide employees with inter-shift rest days for overtime hours.

Employees are paid based on an hourly rate of 200 rubles/hour. It is necessary to calculate the payment for inter-shift rest days for November 2021.

Let us first consider the general solution scheme. We will need:

- Create a new Type of use of working time (Settings - Types of working time) to reflect days of rest between shifts.

- Create a new Accrual (Settings – Accruals) to pay for inter-shift rest days. Inter-Shift Rest was entered .

- Calculate the number of overtime hours. In ZUP 3, you can use one of the following methods for this:

- partial automation using analytical reports;

- full automation if only working hours are planned in the schedule;

- full automation, if the schedule includes additional types of time . All three methods will be discussed further using specific examples.

- Determine the number of days of inter-shift rest that are required to be provided to employees in the current month. In the article Shift - the basics of working time recording, it is discussed why inter-shift rest days should not be planned immediately Employee work schedule (Settings – Employee work schedules). It is better to register them using documents:

- Timesheet (Salary – Time tracking – Timesheets). We will consider this option for registering days of inter-shift rest in this case;

- Data for salary calculation (Salary - Data for salary calculation). You can configure the entry of data on days of rest between shifts in the same way as the settings for travel time. For more details, see the article - Payment of travel days for shift workers - Method 2. Reflection of travel days in separate documents;

- Individual schedule (Salary – Time tracking – Individual schedules). inter-shift rest days using this document is discussed in the article - Shift - setting up payment for time worked. The only thing that should be taken into account is that this document adjusts the time standard. Therefore, it is not suitable for salaried and part-time employees.

- If at step 3 the full automation technique is used (option 2 or 3), then it is necessary to “write off” the used inter-shift rest hours in the accounting. This can be done using the Data Transfer (Administration – Data Transfers). For partial automation, we skip this step.

After all actions, payment for inter-shift rest days will be calculated automatically for employees in the document Calculation of salaries and contributions . If the option with full automation was chosen to account for the remaining hours of overtime, then the remaining hours of rest between shifts can be seen in the reports Vacation balances and Vacation balances (briefly) in the Personnel – Personnel reports section.

Period of watch and inter-shift rest

Payment for inter-shift rest days

The organization of rotational work is carried out in accordance with the requirements provided for by Chapter 47 of the Labor Code of the Russian Federation. According to the provisions of labor legislation, the rotation method provides for the organization of work, within the framework of which the employee does not have the opportunity to return home from work every day.

The shift period includes the period during which the employee performs his work duties at the production site, as well as rest time in a specially designated place (the so-called rotation camp).

Based on Art. 299 of the Labor Code of the Russian Federation, the total duration of the shift cannot exceed one calendar month. In exceptional cases, the shift period is extended to 3 months, provided that the employer proves the production necessity of such an extension and obtains approval from the elected body of the trade union organization.

Involvement in work on a rotational basis is carried out by the employer with the consent of the employee and only after receiving documentary approval from the trade union body.

Shift work - what features need to be understood?

The rotation method assumes that a person returns to his place of residence during breaks from full-time work. The standard option is that the watch lasts 14 days, and rest is given for 14 days. There are other options, but the labor time should not exceed thirty calendar days. In exceptional cases, upon agreement with the trade union, the amount of working time can be increased to 60 days.

People for whom shift work is their main source of income usually live in special housing. There is everything necessary for life - electricity, heat, water, medical care, stable communication. It is not uncommon for this type of work to involve a change of location.

Housing for a shift worker

Many people consider this activity to be both difficult and very profitable. Each person who is about to leave for this type of trip undergoes a thorough medical examination. If there are any health problems, he is immediately excluded from the group. The fact is that the amount of oxygen in places where work is performed on a rotational basis is 30% lower than normal. This leads to diseases of the cardiovascular system, so usually a person should not work in this way for more than 7 years. Unfortunately, Russian realities dictate different conditions.

There is a category of people who cannot get a shift job. These include:

- People without a passed medical examination and medical permission.

- Children under 18 years of age.

- Pregnant women or representatives of the fair sex whose children are less than 3 years old.

Payment procedure for working days on shift

Payment for days of work during the shift period is determined on the basis of the tariff rate approved by the employment contract. If the enterprise has established shift wages, then the calculation of remuneration for the “shift worker” is calculated using the following formula:

Salary shift schedule = Tariff * Quantity cm,

where Tariffsmena is the tariff rate established for one work shift; Quantity – number of work shifts during the reporting period.

When an hourly work schedule is approved, the employee is paid a salary calculated as follows:

SalaryHourly Schedule = TariffHour * PeriodShiftHour * QuantitySm,

where Tariffhour is the tariff for 1 hour of work; PeriodShifthour – duration of one shift in hours; Quantity – number of work shifts during the reporting period.

If during the period of the shift the employee’s work shifts fell on weekends or holidays, then the employer is obliged to pay double for this period.

Let's look at an example. Ivolgin works at a diamond mine on a rotational basis with shift pay. Ivolgin’s watch period is from 05/01/2020 to 05/31/2020. During his shift, Ivolgin worked 15 shifts, two of which fell on holidays - 05/01/2020 and 05/09/2020.

Ivolgin’s tariff rate is 2,030 rubles. per shift.

When calculating Ivolgin’s salary, the employer took into account double pay for 2 shifts on holidays and the standard rate for the remaining 13 shifts:

13 shifts * 2,030 rub. + 2 shifts * 2 * 2,030 rub. = 34.510 rub.

Why is this not a business trip?

Sometimes personnel services confuse shift work with travel, but there are differences:

- Payment. A seconded specialist’s salary will include a working day and small tariff allowances. The shift worker draws up a special document in which all tariffs, terms and conditions are prescribed. Workers are considered to work full days.

- Body check. Before going to another city for a couple of days, you will not need to undergo an examination and confirm your health.

- Deadlines. There are no restrictions on weeks of stay for a business traveler. Upon his return, he goes to work. If people go to development, then they cannot be there for more than 1-3 months, after which a rest period follows.

- Goals. People go on a business trip to fulfill a specific assignment - to increase sales, to launch a line. The rotation method simply involves a regular 12-hour shift.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Shift work method, annual schedule. Calculation of days of rest between shifts

Good afternoon. Far North, shift month after month on the 20th. The schedule is designed so that after a month shift (300 working hours), a vacation of 37 calendar days plus 5 days off begins, and after the vacation the shift is 45 days. Is it legal to draw up such a schedule? How many days between shifts should there be before or after vacation?

In accordance with clause 7.1 of the Basic Provisions on the rotational method of organizing work, approved by the Decree of the State Committee of Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions and the Ministry of Health of the USSR dated December 31, 1987 N 794/33-82, leave can be granted to employees only after they have used their rest days. That is, you should be granted leave not at the end of your shift, but after days of rest.

after a month's shift (300 working hours), Yuri's vacation begins

This shouldn't happen.

Inter-shift rest and vacation generally cannot coincide with each other.

According to Art. 106 of the Labor Code of the Russian Federation, rest time is the time during which the employee is free from performing work duties and which he can use at his own discretion.

In Art. 107 of the Labor Code of the Russian Federation provides a list of types of rest time, among which are vacations. And, although the days of inter-shift rest are not directly indicated in this article, from subsequent provisions of the law it becomes obvious that the specified days and vacation days represent two different periods of rest.

Thus, days of inter-shift rest are provided to an employee only in connection with overtime working hours within the work schedule on a shift (part three of Article 301 of the Labor Code of the Russian Federation), while the provision of leave does not depend on the presence or absence of overtime. It is provided to the employee annually (part one of Article 122 of the Labor Code of the Russian Federation), and the length of service that gives the right to its provision includes the time of actual work, the time when the employee was absent from work, but he retained his job (including days inter-shift rest), as well as the time of forced absences, being on leave without pay for a period of no more than 14 days, the period of suspension from work due to failure to undergo a medical examination through no fault of the employee (part one of Article 121 of the Labor Code of the Russian Federation).

Thus, annual paid leave and days of inter-shift rest are two independent types of rest that do not coincide with each other.

Article 301 of the Labor Code of the Russian Federation establishes that an inter-shift day of rest is understood as each day of rest in connection with the processing of working hours within the work schedule on a shift. Hours of overtime within the work schedule on a shift, not multiples of a whole working day, can accumulate over the course of a calendar year and be summed up to whole working days, followed by the provision of additional days of rest. Moreover, the additional days provided must be free from work (clause 4.3 of the Basic Provisions).

Thus, inter-shift rest actually represents the summed time of daily and weekly rest (unused and accumulated during the shift period), which, due to the specifics of this type of work, is provided after the shift period, the Supreme Court of the Russian Federation came to this conclusion in its decision dated 02/09/2011 N GKPI10 -1462.

In addition, inter-shift rest is in the nature of compensation for overworking hours during the accounting period. Consequently, if the days of inter-shift rest coincide with the days of vacation, this will lead to the fact that there will be no actual compensation for overtime and the number of hours worked by the employee during the accounting period will exceed the established norm, which will directly violate the provisions of part one of Art. 104 of the Labor Code of the Russian Federation (see also the decision of the Supreme Court of the Russian Federation dated July 4, 2002 N GKPI02-398).

We solve shift problems

The article from the magazine “MAIN BOOK” is relevant as of May 20, 2021.

Contents of the magazine No. 11 for 2021. Questions answered by E.A. Shapoval, lawyer, Ph.D. n.

Shift work is a special mode of work. Therefore, even standard situations under this regime raise questions.

Is it possible to work overtime on shift?

Z.M. Bunchuk, Ryazan

Is it possible to involve workers in overtime work during a shift period and do overtime hours need to be taken into account when calculating the duration of rest between shifts?

- daily work (shift) should not exceed 12 hours;

- working two shifts in a row is prohibited;

- daily (between shifts) rest, taking into account breaks for rest and food, can be reduced to 12 hours;

- There must be at least one day off per full week.

That is, during the shift period overtime is provided, since shift workers usually work 10-12 hours a day, 6 days a week, with a norm of 40 hours a week. For this overtime, shift workers after the shift period are provided with inter-shift rest (Articles 91, 301 of the Labor Code of the Russian Federation); Decree of the Constitutional Court dated September 29, 2015 No. 1883-O.

Involvement of shift workers in overtime work is allowed in case of non-arrival of shift personnel. 5.5 Basic provisions.

However, the work of shift workers can be overtime not only in this case. For example, if shift workers, on the basis of an order from the employer, were involved in work. Determination of the Supreme Court of the Komi Republic of May 21, 2012 No. 33-1573AP/2012:

- <or>in excess of the working hours established by the work schedule during the shift period (for example, this is work in excess of 10 hours, if the shift according to the schedule is 10 hours);

- <or>in excess of 12 hours, that is, in excess of the maximum duration of the working day (shift) established by law, if there is no work schedule during the shift period.

Such hours worked overtime on a shift do not need to be taken into account when determining the duration of rest between shifts. After all, they are compensated not as overtime during the shift period, but as overtime work.

An employee can choose the method of compensation:

- <or>payment in an increased amount based on the results of the accounting period (since with the rotation method, summarized accounting of working time is used, Article 300 of the Labor Code of the Russian Federation);

- <or>additional rest of the same duration as overtime work. 152 Labor Code of the Russian Federation.

How to calculate and provide inter-shift rest

L.A. Bobrovskaya, Moscow

How to correctly calculate the number of days of inter-shift rest if the shift workers worked during the shift period from January 4 to January 23, 2021, 18 days for 10 hours? The normal working week for them is 40 hours. How to provide inter-shift rest days for a rotation worker: in calendar days or in working days, that is, excluding weekends and non-working holidays?

: Inter-shift rest is additional days of rest provided to shift workers for overtime on working days on shift (as a rule, they work more than 8 hours a day, 6 days a week) Art. 301 Labor Code of the Russian Federation.

We calculate the number of days of inter-shift rest. 301 Labor Code of the Russian Federation:

* Remaining hours that are not multiples of a whole working day are summed up during the calendar year to a whole working day (days) and subsequently added to the days of the next inter-shift rest. 301 Labor Code of the Russian Federation.

In your case, employees are entitled to 12 full days of inter-shift rest ((18 days x 10 hours – 80 hours (standard working hours from January 4 to January 23, 2021 according to the production calendar)) / 8 hours).

Days of inter-shift rest are provided in consecutive working days according to the calendar of a five-day working week, that is, they should not coincide with regular weekends (Saturday and Sunday) and non-working holidays. 112 Labor Code of the Russian Federation.

How to pay for work on shift on a holiday

R.A. Katorova, Smolensk

For an employee whose salary is set, the working day on shift coincides with a non-working holiday. How to pay for such a day: as a regular working day on shift or as work on a holiday?

: Work on a holiday is always paid at least double the amount. 153 Labor Code of the Russian Federation. Work according to a schedule on a shift on a non-working holiday is included in the standard working time, since for shift workers a summarized accounting of working time is used, Articles 153, 300 of the Labor Code of the Russian Federation; clause 1 Explanation of the State Committee for Labor of the USSR dated 08.08.66 No. 13/P-21; Decision of the Supreme Court dated 02/08/2006 No. GKPI05-1644; section 5 Recommendations of Rostrud, approved. Protocol No. 1 of 06/02/2014. Consequently, it is paid in the amount of at least a single daily part of the salary in addition to the salary.

How to reflect the work of shift workers on a timesheet

M.A. Solnyshkina, Krasnoyarsk

Our employees work on a rotational basis. We use a unified time sheet form. How to reflect on the time sheet work during the shift period, rest between shifts and days on the way to the shift site and back?

: To reflect in the report card (as a basis you can take the unified form No. T-12 or T-13 Resolution of the State Statistics Committee dated 01/05/2004 No. 1) the duration of time worked on working days according to the schedule during the shift period, you can use the standard letter code “VM” or digital “ 05" indicating in the column under the code the duration of time worked. To account for the time spent working under conditions deviating from normal on these days, enter additional lines and use to reflect:

- work at night - letter code “N” or digital “02”;

- overtime work - letter code “C” or digital “04”;

- work on weekends - letter code “РВ” or numeric “03”.

In the additional line below the code, indicate the duration of time worked under such conditions.

To designate days off both during the shift period and during the inter-shift rest period, you can use the standard letter code “B” or the numeric “26”. But for the convenience of calculating payments for days of inter-shift rest, you can enter additional designations for these days by order, for example, the letter code “MO”. And the days on the way to the place of duty and back, for which there is also no standard designation, can be reflected, for example, with the additional code “DP”.

Is it necessary to pay for inter-shift rest days not used due to dismissal?

M.I. Volkova, Moscow

The employee submitted a resignation letter of his own free will. On the day of dismissal, he had not used 10 days of inter-shift rest. Are we obligated to pay the employee for inter-shift rest days not used due to dismissal?

: Yes, we must. After all, such days were earned by the employee during the shift period before dismissal. 3, 4 tbsp. 301 Labor Code of the Russian Federation; Resolutions of the Supreme Court of the Komi Republic dated May 21, 2012 No. 33-1573AP/2012; CC dated July 12, 2006 No. 261-O. This is also confirmed by the fact that upon dismissal, the employer is obliged to pay overtime hours on shift that are not multiples of whole working days, which accumulate over the course of a calendar year up to whole working days. 5.4 Basic provisions; Determination of the St. Petersburg City Court dated September 17, 2013 No. 33-12614/2013.

Is it necessary to provide an employee with inter-shift rest that was not used due to study leave?

A.Yu. Bastanyan, Moscow

The employee presented a certificate of challenge for the session. Part of the study leave falls on inter-shift rest days. Does the employee need to provide inter-shift rest days not used due to study leave?

: Yes need. After all, study leave is granted for the period specified in the call certificate. Order of the Ministry of Education and Science dated December 19, 2013 No. 1368, regardless of whether the days included in this period are working days or weekends. 107 Labor Code of the Russian Federation. At the same time, study leave is not a time of rest, which means that the employee did not use his right to inter-shift rest. 107 Labor Code of the Russian Federation.

Is it possible to provide leave to an employee during inter-shift rest?

O.I. Babaeva, Ekaterinburg

According to the vacation schedule, the employee’s vacation start date falls on the last day of inter-shift rest. Is it possible to grant a shift worker leave from the date specified in the leave schedule, or does leave need to be postponed?

: Annual leave can be granted to a shift worker only after using the inter-shift rest days. 7.1. Basic provisions; Decision of the Supreme Court dated 02/09/2011 No. GKPI10-1462. Therefore, the start date of the vacation needs to be postponed. To do this, make changes to your vacation schedule. This can be done at the request of the employee after approval of the shift work schedule, which is brought to the attention of employees no later than 2 months before it comes into effect. 301 Labor Code of the Russian Federation.

What to do if part of the employee’s vacation falls during the inter-shift rest period

A.I. Ilnitskaya, Rostov

The organization's employees work on a rotational basis. The vacation of one of the employees ended while his shift had a period of rest between shifts. He has no unused days of rest between shifts. What should we do in such a situation?

: In such a situation, the employee experienced downtime. By agreement with the employee, you can. 72.2 Labor Code of the Russian Federation; clause 7.1 of the Basic Provisions:

- <or transfer him to another job before the start of the next shift;

- <or>transfer him to another shift;

- <or grant him leave without pay.

If the employee does not agree, then he must be paid for the time until the next shift in the amount of at least 2/3 of the average salary as downtime due to the fault of the employer. 157 Labor Code of the Russian Federation.

Is it possible to set part-time working hours for a shift worker on maternity leave?

I.I. Smirnova, St. Petersburg

The shift worker is on maternity leave to care for a child under 3 years of age, as he is raising him alone (without a mother). After the child turned 2 years old, he applied for a part-time job. How can we satisfy an employee’s application if the shift lasts 3 weeks and the shift workers work in another region?

: It is prohibited to involve women with children under 3 years of age in work performed on a rotational basis. 298 Labor Code of the Russian Federation. This prohibition also applies to fathers of children under 3 years of age who are raising children without mothers. 264 Labor Code of the Russian Federation.

Therefore, you cannot allow such an employee to work on shift. But with the employee’s consent, you can transfer him to another job on a part-time basis for up to 1 year. 72.2. Labor Code of the Russian Federation.

Is it possible to stipulate in an employment contract a condition on a shift work method after the conclusion of an employment contract?

L.N. Popova, Tver

An employment contract was concluded with the employee, in which there was no provision for a rotational work method. Six months later, it became necessary to involve him in shift work. Can we include such a condition in an employment contract?

: If the employee agrees to such a change in the employment contract, then you need to conclude an additional agreement with him to the employment contract. 72.1 Labor Code of the Russian Federation.

At the initiative of the employer, such a condition can be included in the employment contract only if there have been changes in organizational or technological working conditions (for example, structural reorganization of production). If the employee agrees to your proposal, then the condition on the shift work method will begin to apply 2 months after you notify him of this. 74 Labor Code of the Russian Federation. If he does not agree, then 2 months after notification he can be fired due to refusal to continue working, provided that you do not have a vacant position to which he agrees to move. 7 hours 1 tbsp. 77 Labor Code of the Russian Federation. If the employee subsequently challenges the transfer or dismissal, then in the absence of evidence confirming that the change in the terms of the employment contract was a consequence of changes in organizational or technological working conditions, the court may declare them illegal. Appeal ruling of the Supreme Court of the Sakha Republic dated September 19, 2012 No. 33-3171/2012.

Is it possible to fire a pregnant employee if there is no non-shift work?

Z.M. Chikanova, Moscow

A fixed-term employment contract was concluded with the employee for a year to perform work on a rotational basis. After 6 months, she submitted a certificate of pregnancy and a medical certificate for another job. There is no work that can be provided to her in the Moscow office. Can we fire her?

: If you do not have a job to which you can transfer the employee, then you need to release her from work before the start of maternity leave with payment of the average earnings for her previous job for all working days during this time. 254 Labor Code of the Russian Federation. Then, based on the certificate of incapacity for work and the employee’s application, you will need to grant her such leave. 255 Labor Code of the Russian Federation. And you can fire an employee only after the end of maternity leave. 261 Labor Code of the Russian Federation.

How to pay for sick leave during inter-shift rest

A.M. Bakhteeva, Izhevsk

The shift worker fell ill during the period between shifts. Are we obligated to pay him sick leave for days of incapacity for work that fall on inter-shift rest days, and do we then need to provide the employee with unused inter-shift rest days due to illness?

: Yes, you must pay the employee sick leave for the entire period of illness. 8 tbsp. 6 of the Law of December 29, 2006 No. 255-FZ; Letter of the FSS dated January 26, 2012 No. 15-03-11/12-782. Days of inter-shift rest not used due to illness must be provided to the employee later. After all, due to illness, he was unable to rest.

What to do if an employee is late for the start of the shift

M.I. Mishulina, Vologda

The employee, for good reason, did not go to the place of work at the beginning of the shift. Can he himself get to the place of the watch after it has begun?

: Yes maybe. At the same time, you are obliged to reimburse him for transportation expenses from the place of assembly to the place of duty according to the standards for business trips. 5.8 Basic provisions.

Payment for inter-shift rest days

What is inter-shift rest and why is it worth paying for it?

First, a little theory:

Art. 91 TRK RF. The concept of working time. Normal working hours

Working time is the time during which an employee... must perform work duties...

Normal working hours cannot exceed 40 hours per week.

Art. 104 TRK RF. Summarized working time recording

When, due to the conditions of production (work) ... the established ... daily or weekly working hours cannot be observed, it is permissible to introduce summarized recording of working hours so that the duration of working hours for the accounting period (month, quarter and other periods) does not exceed the normal number of workers hours…

Art. 301 Labor Code of the Russian Federation Work and rest regimes when working on a rotational basis

Working time and rest time within the accounting period are regulated by the shift work schedule... (Part 1).

Each day of rest due to overworking hours within the work schedule on a shift (day of inter-shift rest) is paid in the amount of the daily tariff rate, daily rate (part of the salary (official salary) for the day of work) ... (part 3).

clause 4.3. Basic provisions on the shift method of organizing work, approved. Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 No. 794/33-82

The duration of daily (between shifts) rest for workers, taking into account lunch breaks, can be reduced to 12 hours. The hours of daily (between shifts) rest that are underused in this case, as well as the days of weekly rest, are summed up and provided in the form of additional days off from work (days of inter-shift rest) during the accounting period. The number of days of weekly rest in the current month must be at least the number of full weeks of this month. Weekly rest days can fall on any day of the week.

The essence of the problem:

With the introduction of summarized working time recording when working on a rotational basis, the duration of daily (and weekly) working hours will differ from the normal working hours (40 hours per week).

When working within the work schedule on a shift, overtime cannot occur, since the working time is determined by the schedule itself. Consequently, there cannot be “processing of working time” “within the schedule”, which is referred to in Part 3 of Art. 301 TRK RF. There may be “overtime in excess of normal working hours” “within the schedule” or “overtime in excess of the schedule”. The wording of clause 5.4 speaks in favor of the first option. Basic provisions on the shift method of organizing work (the origin and meaning of the dispositive norm of paragraph 2 of this paragraph, in the presence of a similar imperative requirement of paragraph 1, remains vague).

The nonsense of “processing working hours within the limits of the schedule” turns into days of rest - “a day of inter-shift rest.” Moreover, in clause 4.3. Basic provisions. a completely different definition of “days of inter-shift rest” was given as “additional days off from work during the accounting period, provided for underused hours of daily (between shifts) and days of weekly rest.”

If we consider the requirement of Part 3 of Art. 301 of the Labor Code of the Russian Federation as a requirement to pay for “days of rest in connection with the processing of working hours within the schedule,” then there cannot be such days.

If we consider the requirement of Part 3 of Art. 301 of the Labor Code of the Russian Federation as a requirement to pay for “days of inter-shift rest”, determined in accordance with clause 4.3. Basic provisions..., and identical to the requirements of clause 5.4. Basic provisions. then during a shift, for example, “30 days after 30 from the 15th of the next month” with an accounting period of 1 calendar year leads to the following problems:

1). Double payment is made for the same hours: first, the employee receives payment for the hours worked, and then for the days of inter-shift rest, formed from the hours worked.

2). At the end of the accounting period, with the summarized accounting of working hours, the employee has days of inter-shift rest that he has not yet received (physically and payment). The employer is obliged to pay compensation for the specified days (based on the meaning of Article 104 of the Labor Code of the Russian Federation).

3). At the beginning of the accounting period, when accounting for working hours in total, when the employee of the second half of the shift has not yet left for the shift, he has unpaid days of forced downtime, with the obligation of the employer to pay for them accordingly. Consequently, double payment is made for the specified days (taking into account compensation under clause 2).

4). If a shift moves from one accounting period to another, then for the first part of the shift, when days of inter-shift rest are not provided, compensation must be paid (see clause 2), and for the second part of the shift he does not work on the days of inter-shift rest and the employer is obliged pay for forced downtime.

5). In each intershift period, the employee has 1..4 days of rest, which he has not earned, but is not involved in work, since another shift is working according to the schedule. Payment for these days as days of inter-shift rest cannot be made (because they are not earned), therefore, they should be considered as forced downtime with appropriate payment.

Example 1. Partial automation of calculation of processing using analytical reports

Let’s leave the original data of our case and supplement it with the condition that the organization stores the remaining overtime hours and calculates them in third-party programs.

In ZUP 3, we need to obtain the initial data for calculating overtime for employee A.V. Varezhkin. for November 2021

The partial automation option involves setting up analytical reports to determine:

- time standards according to the normal duration schedule during the shift period;

- time worked by employees during the shift period.

Next, we calculate processing hours manually, for example, in Excel. The remainder of unused overtime hours will also have to be stored in a separate program.

This option is convenient when:

- it is not possible to apply fully automated methods (for example, employees have “regular” time off);

- or their use seems impractical (for example, with a small number, when it is easier to make calculations and store the balance of unused hours in Excel).

Let's get to the solution.

- Let's set up a report to obtain the time norm for the watch period. We will determine it according to the standard schedule Five days. This will help you avoid manually calculating the rate for an arbitrary period according to the schedule each time. To configure we will use Universal report (Administration – Printed forms, reports and processing). Let's create it according to the information register Work schedules by type of time.

How to load report settings, see - How to connect report settings After downloading, you need to set the selection by Work Schedule = Five-day and Type of time recording = Working time from your information base.

Below are the steps to configure the report yourself to obtain the time standard for the watch period. In the Change report option (More – Other change report option), we will leave only the grouping by Work Schedule . For the Report on the Fields indicate Work Schedule and Additional value norm .

Let's rename the field Additional value norm for the report. To do this, select More - Set title and enter a new name - Hours according to the norm .

On the Selection , we will set the conditions: by Work Schedule , Type of time recording (we will collect only information about Working hours ) and Date .the Change report variant

mode . To make the selection conditions by Date visible in the report header, open Settings and mark these conditions with the “star” icon.

As a result, with the help of this report we will always be able to obtain data on the standard time for any selected period. It is convenient to indicate the period for which we collect data on the norm in the header of the report.If employees have a reduced work week, the setting will not be different. The only thing is that the selection will need to indicate a schedule with reduced working hours.

- Let's set up a report to analyze the time worked by employees while on shift. Let's take a standard report as a basis. Time sheet (T-13) (Salary – Salary reports – Time sheet (T-13)) and convert it into analytical form.

How to do this is described in the material - Setting up a report for time analysis based on the standard report “Timesheet T-13”

How to load report settings, see - How to connect report settings After downloading, you will need to set the selection by Types of time recording for grouping by organization and for columns from your information base (which ones to choose are described below).

Below are the steps to independently set up a report to analyze the time worked by employees on shift. In the Edit report option , we will build the report structure. It will be output as a table:

- the lines of which are grouped by Organizations and Employees ;

- columns - by Types of time tracking.

To exclude columns with unnecessary Time Types in the report, add a Selection for grouping Time Accounting Type by Time Types . We will indicate only those Types of time that are working on a shift: Shift , Night shift .

For the Organization on the Fields , we indicate that we need to display Working hours .

On the Selection for the Organization , we will set 2 conditions: by Time Type and Working Hours is not equal to 0. This will allow us to exclude employees who did not have shift work hours during the reporting period.

After completing the setup, we will set the reporting period (from 11/02/2020 to 11/16/2020) and generate a report. According to the report, we will see how many hours each shift worker worked during his shift. Varezhkin A.V. worked 143 hours. - We can then save the report on hours worked in Excel. In a third-party program, you can calculate overtime hours by subtracting the standard hours received from the time worked. Step 1. You will also have to keep track of the balance of unused overtime hours in another program.

If the calculation of overtime hours for shift workers is not carried out in ZUP 3, but there are other employees for whom overtime is calculated in the program, the shift workers may erroneously end up in the document Registration of overtime . To avoid this, in the settings of the Shift Work Schedule, you can specify that the norm for calculating overtime hours is determined according to the Data of this schedule . With this setting, employees for whom this schedule is set will not be included in the document Registration of overtime .

Payment for inter-shift rest days

The hours of daily (between shifts) rest that are underused in this case, as well as the days of weekly rest, are summed up and provided in the form of additional days off from work (days of inter-shift rest) during the accounting period. The number of days of weekly rest in the current month must be at least the number of full weeks of this month. Weekly rest days can fall on any day of the week. 5.4. Basic provisions on the shift method of organizing work Days of rest (time off) in connection with work beyond the normal working hours in the accounting period within the work schedule on a shift are paid in the amount of the tariff rate, salary (.) received by employees by the day of rest ( time off), based on a seven-hour working day.

Legal regulation

Before applying for a job in a company on a rotational basis, it would be a good idea to familiarize yourself with the Labor Code of the Russian Federation; such activities are regulated by a specific article of the Law. According to Article 297 of the Labor Code of the Russian Federation, a shift is a type of legal labor activity when the daily return of a worker to his place of registration is impossible. This type of employment is not a business trip; all working time spent at production (shift) and rest between shifts are considered a shift. Registration is carried out according to the employment contract.

Working hours should not exceed one month in duration, although the employer can increase the period of service to three months, having previously justified its decision with an order indicating the reasons for the increase in shifts and facilities. The length of the working day by law should not exceed 12 hours. Anything in excess can be considered processing and is paid additionally (Part 1 of Article 299 of the Labor Code of the Russian Federation). The schedule is established by the employer.

On shift, labor time is constant, without days off, the working day is 12 hours, then taking these hours into account, overtime occurs and unused weekends remain, of which there must be at least 4 per month. These overtime hours are compensated by payment at the daily rate, or days off. Time off or vacation, in this case, is carried out outside the rotational facility at the place of residence (Part 3 of Article 301 of the Labor Code of the Russian Federation).

Often the shift is located at a considerable distance from the employee’s place of residence and you need to somehow get to the point. From the collection point, which is designated by the hiring company, to the office, the cost of travel is paid by the employer, while the days spent on travel are considered working days and are paid at the daily rate (Part 8 of Article 302 of the Labor Code of the Russian Federation). But the employee will have to get to the collection point on his own; according to the law, the employer does not pay for this period of travel, unless otherwise provided by internal orders and agreements of the shift site.

What is a shift according to the Labor Code of the Russian Federation

The rotation method is a special form of carrying out the labor process “away from home”, the basis of which is the impossibility of ensuring the daily return of workers to their place of permanent residence (Part 1 of Article 297 of the Labor Code of the Russian Federation). It is understood that the employer guarantees the provision of all living conditions, ensures vital functions, and organizes delivery from the collection point to the destination.

Order of the enterprise on the organization of rotational work

Before making a decision to introduce a rotational method of labor organization, the enterprise carries out a technical, economic, economic calculation, on the basis of which the feasibility and effectiveness of the transition to a new type of work activity is determined. The administration or manager issues an order that the enterprise transfers or introduces rotational work. Approval of the order includes:

- the fact of change, transfer and their implementation at the enterprise;

- summarized time tracking;

- for what period is the summarized working time taken into account;

- terms of remuneration, specifically:

- private enterprises set their own level of premium for shifts; in government agencies this allowance is regulated by law;

- district coefficient;

- allowance and bonus percentage “northern”;

- duration of the shift, number of days of work and days of rest;

- sometimes a list of employees who are prohibited from being involved in this type of activity is displayed;

- a note on the minutes of the trade union meeting (why is a trade union protocol needed in this case? A trade union is a means of regulating and agreeing on all the terms of an agreement with employees so that all procedural and legislative acts are observed);

- It is obligatory to note that employees are familiar with the contents of the order.

Payment for shift work

The period for which the calculation is made is set in the local document (month, quarter, year), but it should not exceed 12 months.

It includes working time, travel time (from the collection point to the place where work is performed and back) and rest time falling within the corresponding calendar period (Article 300 of the Labor Code of the Russian Federation). Regardless of whether a regular or rotational work method is used, wages in any organization will be introduced according to one of the generally accepted systems:

When calculating the main part of earnings, the system chosen by the employer will be used. We can conditionally divide payroll into the following stages:

- calculation of earnings depending on the system used - according to the production rate, tariff, unit of time worked;

Which companies can use this method?

More often than others, it is used by those who open enterprises in the regions of the North and areas related to them. But in recent years it has been actively used in “ordinary” areas, because in the Labor Code there are no restrictions on areas, and the delivery time can be significantly reduced.

The main condition is the presence of an object, which is inconvenient to get to due to its remoteness or lack of roads. If a specialist has to travel more than 3 hours each time, then it is advisable to offer him a shift.

Sometimes the tax service tries to challenge the legality of its use, but usually the court sides with the employers.

Payment for inter-shift rest days: calculations, examples

If the enterprise has established shift wages, then the calculation of remuneration for the “shift worker” is calculated using the following formula: Salary shift schedule = Tariffsmena * Quantity cm, where Tariffsmena is the tariff rate established for one work shift; QuantitySm – the number of work shifts during the reporting period. When an hourly work schedule is approved, the employee is paid a salary calculated as follows: Salaryhourly schedule = Tariffhour * PeriodShifthour * NumberSm, where Tariffhour is the tariff for 1 hour of work; PeriodShifthour – duration of one shift in hours; Number of work shifts during the reporting period. If during the shift period an employee’s work shifts fell on weekends or holidays, then the employer is obliged to pay double for this period. Let’s look at an example. Ivolgin works at a diamond mine on a rotational basis with shift pay.

Additional days for vacation

Vacation during rotational work should be the same as for all 28 calendar days. But in some cases, for example, for workers in the far north, additional days are given for this vacation. That is, if, for example, a person comes to the north to work from Moscow or another city with mild climatic conditions, then he is given 8 additional days of vacation. If a person works in the far north and lives in the far north region, then in this case the employee receives 16 additional days of vacation.

Thus, a visitor will have a vacation of 36 calendar days, and a person living in the far north will have 44 calendar days. Additional days on vacation must be paid; the organization providing them decides how much they will be paid.

How to calculate overtime hours when working on a rotational basis?

Therefore, calculate the time worked based on the results of the accounting period (for example, month, quarter, half-year, year).* If the accounting period is less than a year, calculate the duration of overtime work at the end of the last month of the accounting period.

From the answer "" 2. Answer: Should an employee work out the time he is on vacation or on sick leave when accounting for working hours in total? Nina Kovyazina, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Ministry of Health of Russia No, he should not.

How to calculate earned days of inter-shift rest?

In this case, according to clause 4.3 of the Basic Provisions on the shift method of organizing work, approved by the Decree of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 N 794/33-82 (applied to the extent that does not contradict the Labor Code of the Russian Federation), underused hours of the daily ( inter-shift) rest, as well as days of weekly rest are summed up and provided in the form of additional days off from work (days of inter-shift rest) during the accounting period.

Analysis of Part 2 of Art. 300 Labor Code of the Russian Federation, etc.

4.3 of the Basic Provisions on the Shift Method allows us to conclude that inter-shift rest should be provided within the accounting period. 301 of the Labor Code of the Russian Federation, clause 5.4 of the Basic provisions on the shift method of organizing work, approved by the Resolution of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31, 1987 N 794/33-82, during the calendar year, incomplete balances

Shift method: setting up accounting and calculation in “1C: Salary and personnel management 8”

The schedule is approved by the enterprise administration in agreement with the trade union committee (Art.

4.2 of Resolution No. 794/33-82), rest between shifts cannot be less than 12 hours.

Work shift time includes paid working time and intra-shift breaks, such as lunch. The Watch time type in the program is preset, does not require additional configuration and is intended to describe work shifts on a watch. This type of time is enough for shift planning, since it is obvious that the rest of the day is spent on intra-shift breaks and rest between shifts.

Example 3. Full automation of calculation of overtime with additional types of time in the schedule

Let’s leave the initial data of our case and supplement them with the condition that the organization stores the balance of overtime hours and calculates them in ZUP 3. Also, in the Employee Work Schedule, not only working hours are planned ( Shift and Night shift ), but also additional types time: Days on the road and Weekends on shift .

It is necessary to calculate overtime hours for employee O.I. Grelkin. for November 2021 and ensure storage of the balance of unused processing hours in ZUP 3.

The main solution algorithm is the same as Example 2. But in this case there is one peculiarity. If additional Types of time (hours of Days on the road and Weekends on shift ), when filling out the Registration of Overtime , they will increase the time worked. The calculation of overtime hours will be incorrect. To work around the problem, we suggest, in addition to the settings described in Example 2 , to carry out additional actions:

- create a schedule for shift workers that will take into account only working hours ( Shift and Night shift );

- monthly, before entering the Overtime Registration, transfer all shift workers to this schedule using the document Changing the work schedule by list ;

- after calculating the overtime, cancel the document Change of work schedule list .

Let's move on to the solution.

- First, let’s make sure of the necessity of the described “dances with a tambourine.” Let's open the chart settings of Grelkin O.I. and check the completion of the document Registration of processing on it. IN Work schedule planned Days on the road And Weekends on shift. The total number of working hours for November, taking into account these types of time:

- 130 day + 13 night + 22 on the road + 2 weekends on duty = 167 hours.

When you try to fill out the Overtime Registration, all 167 hours are included in the document as time worked. The number of processing hours is determined incorrectly - 88 hours.In order not to forget about the incorrect calculation of overtime for shift workers with such a schedule, you can completely eliminate their filling in the document Registration of overtime . When the document is not filled out by shift workers, this will be a signal that in order to calculate overtime, the employees need to temporarily change their schedule. In the parameters of the permanent Work Schedule for shift workers, we indicate that the norm for calculating overtime hours is determined according to the Data of this schedule .

Then the employees for whom this schedule is set will not be included in the Overtime Registration until a schedule with only working hours is set for them. - Let's create a new shift Schedule, in which only working hours will be scheduled. According to this chart, working hours in November 2021 will be 143 hours.

The time norm for calculating overtime hours for this schedule is set according to the Data of another schedule - the norm schedule, which we set up in Example 2, Step 1. - Let's create a new document Changing the work schedule by list (HR - Hiring, transfers, dismissals - Changing the work schedule by list). With the help of this document we will translate O.I. Grelkin. from 01.11.2020 to a schedule in which only working hours are planned.

If you need to transfer several employees, you can do this through the Selection or specify the Division . Then, when you click the Fill , all employees of the selected Division .

- Let's fill out the document again Registration of processing. Now the data on Grelkin O.I. it is reflected correctly. 143 hours worked. After clearing the value in the column Already paid at the increased rate, processing will be determined correctly - 64 hours.

- Let's bring back O.I. Grelkin. back to his schedule. To do this, mark the document Change of work schedule for deletion in the list .

Between shifts pay

Consequently, the normal working hours under this regime are observed by redistributing working hours within the corresponding accounting period. By virtue of Part 2 of Art. 91 of the Labor Code of the Russian Federation, the normal working time is 40 hours per week. Based on the Procedure for calculating the norm of working time for certain calendar periods, this norm is calculated according to a five-day work week with two days off and, with a 40-hour work week, is 8 hours a day.

The procedure for calculating the norm of working time for certain calendar periods of time (month, quarter, year) depending on the established duration of working time per week was approved by Order of the Ministry of Economic Development of Russia dated August 13, 2009 N 588n. At the same time, according to para.

3 clause 4.2 and para. 1 clause 4.3 of the Basic Provisions with a rotational method of organizing work, the duration of daily work (shift) can be increased to 12 hours, and the duration of daily (between shifts) rest, taking into account lunch breaks, can be reduced to 12 hours. Paragraph 1 p.

Payment for inter-shift rest days: calculations, examples

5.4 Basic provisions on the shift method of organizing work, approved by the Decree of the State Committee of Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions, the Ministry of Health of the USSR dated December 31. 1987 N 794/33-82, during the calendar year, non-integer balances of inter-shift rest days can be accumulated and summed up to whole days and only then provided.

Thus, in this case, at the end of the shift, it is permissible to provide the employee with 10 days of inter-shift rest, and take into account the balance of 0.63 days and provide it as a day of rest when a full day has accumulated. Payment for days of inter-shift rest Each day of inter-shift rest provided in connection with overtime is paid in the amount of the daily tariff rate, daily rate (part of the salary for the day of work).