Which organizations are required to apply the professional standard?

Article 195.3 of the Labor Code of the Russian Federation is devoted to the application of professional standards.

It states that if a law or other regulatory legal act establishes any requirements for an employee’s qualifications, then the employer is obliged to use the professional standard in relation to these requirements. Currently, the qualification requirements for chief accountants are established by several laws. Thus, Part 4 of Article 7 of the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” states that chief accountants of OJSCs (except for credit organizations), insurance companies and a number of other organizations must have a higher education and work experience related to accounting , reporting or auditing for at least 3 years out of the last 5 calendar years. And if their education does not relate to the field of accounting and auditing, their professional experience must be at least 5 years out of the last 7 calendar years of work.

Complete training to comply with the professional standard “Accountant” (code A, B) at OSNO

Another example is the chief accountants of payment system operator companies (which are not credit institutions). They must have a higher economic, legal education or higher education in the field of information and communication technologies. And if you have another higher education - experience in managing a department or other division of a credit organization or payment system operator for at least 2 years (clause 2, part 9, article 15 of the Federal Law of June 27, 2011 No. 161-FZ “On the National Payment System”) .

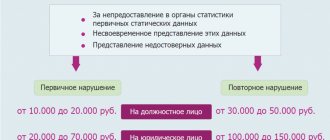

If you do not apply the professional standard in a situation where it is required by law or other regulatory legal acts (NLA), violators (the organization and its leader) can be held accountable on the basis of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. For an organization, the fine ranges from 30 thousand to 50 thousand rubles, and for a repeated violation - from 50 thousand to 70 thousand rubles. The sanctions for the manager are as follows: a fine from 1 thousand to 5 thousand rubles, and in case of repeated violation - a fine from 10 thousand to 20 thousand rubles or disqualification for a period of one to three years.

If the chief accountant works in an organization for which the law or other regulations do not establish requirements for the qualifications of the chief accountant, then the employer is not obliged to apply the professional standard to him. The same applies to “simple” (i.e., not chief) accountants, as well as other positions mentioned in the new professional standard (we will discuss them below). For them, the professional standard “Accountant” is also advisory.

Introduction of professional standards

How to implement the professional standard “Accountant” of 2021 is determined by each organization independently (Article 8 of the Labor Code of the Russian Federation).

For example, you can create a working group by a separate order from the manager and instruct it to develop the stages of implementing a new professional standard.

ADVICE

Include representatives of key departments in such a group. For example, personnel officers, lawyers, accountants.

But state unitary enterprises and municipal unitary enterprises implement professional standards according to plan, taking into account the opinion of the trade union. This must be done before January 1, 2021 (clauses 1-2 of the Decree of the Government of the Russian Federation dated June 27, 2016 No. 584).

What threatens an accountant who does not meet professional standards?

An employee’s compliance with the professional standard (both in the case of mandatory and in the case of voluntary application of the standard) is confirmed by a qualification assessment. You can carry out such an assessment on your own, or you can involve independent appraisers (see “What employers and employees need to know about independent assessment of qualifications”).

But even if an independent assessment shows that the employee’s qualifications do not meet the professional standard, the person cannot be fired. The fact is that the Labor Code of the Russian Federation does not contain such grounds for dismissal as “insufficient qualifications” or “non-compliance with professional standards.” Dismissal for these reasons is unacceptable, regardless of whether the employer is obliged to adhere to professional standards or does it voluntarily. If, based on the results of an independent assessment of qualifications, it turns out that the employee does not meet the established requirements, more “gentle” measures can be taken, for example, sending him to advanced training courses, reducing the bonus, etc.

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Professional standard for chief accountant

An employee holding the position of chief accountant is subject to a number of special requirements. For this reason, an employee with a specialty as a teacher or economist must undergo professional retraining courses in order to be eligible to occupy such a position.

A person with the following education can apply for the position:

- higher education (bachelor's and additional professional education);

- secondary vocational education in the form of training programs for mid-level specialists;

- secondary and additional vocational education.

With the advent of a new standard, problems arise. This is due, first of all, to the inconsistency of the training program: for example, the bachelor's degree course in accounting was developed relatively recently, but many employees were trained a long time ago, and today their qualifications do not meet current requirements - they need to improve their level of knowledge.

Is it possible to hire a chief accountant who does not meet the standard?

But if we are talking about a candidate for the position of chief accountant, then his failure to meet the professional standard can lead to serious consequences. In a situation where an employer is obliged to apply a professional standard, he does not have the right to hire a person unless an independent assessment of qualifications confirms that the candidate meets the requirements of the professional standard. This conclusion can be drawn from the provisions of paragraph 6 of the information of the Ministry of Labor of Russia dated 04/05/16 (also see “Professional standards: when and how employers should apply them”).

If an employer applies a professional standard voluntarily, then it may (but is not obligated) to refuse to hire a candidate who has not passed an independent qualification assessment. Please note: employers are not prohibited from setting requirements for candidates that are higher than the requirements of the professional standard.

Let's consider what rules and criteria are prescribed in the new professional standard “Accountant”.

Professional standard for an accountant

The new resolution states that an ordinary accountant must have a fifth qualification sublevel. His direct job responsibilities include performing the following types of work:

- preparation, reception and verification of primary accounting documentation;

- identification of violations of the document flow schedule on the part of responsible persons;

- systematization of primary accounting documents for the reporting period;

- providing services with the data necessary for inventory;

- data registration;

- collection and analysis of the results of revaluation of accounting objects;

- preparation of calculations;

- comparison of inventory with data contained in accounting registers.

Positions and labor functions

The previous professional standard “Accountant” (valid until April 6, 2019) spoke of two positions: “accountant” and “chief accountant”. For each of them a generalized labor function was provided. For an accountant - accounting, and for a chief accountant - drawing up and presenting financial statements of an economic entity (see “The professional standard “Accountant” has been approved: what are the requirements now for the profession”).

Complete training to comply with the professional standard “Accountant” (code A, B) under the simplified tax system

In the current professional standard, the list of positions is much wider. In addition to the “simple” accountant and chief accountant, it also has an accountant of the first category and an accountant of the second category, the head of the accounting department, the director of operational management and a number of other positions.

The list of generalized labor functions has also been expanded. It added the preparation and presentation of financial statements of an economic entity that has separate divisions; preparation and presentation of consolidated reporting; provision of accounting services to economic entities, including the preparation of accounting (financial) statements.

Each generalized labor function consists of “ordinary” labor functions. For example, the preparation and presentation of consolidated financial statements includes two functions. The first is the management of the process of methodological support for the preparation of consolidated financial statements of a group of organizations. The second is managing the process of compiling and presenting consolidated financial statements.

In turn, each “ordinary” labor function consists of labor actions. Thus, managing the process of drawing up and presenting consolidated statements consists of ensuring the implementation of consolidation procedures in accordance with established requirements, ensuring the formation of numerical indicators of reports included in the consolidated financial statements, etc.

In addition, the necessary skills and knowledge are named for all generalized job functions. In particular, accountants (including categories I and II) must be able to draw up primary documents in electronic form, use reference and legal systems, know the legislation of the Russian Federation on archival matters, etc.

Receive “primary” information from clients, keep records and submit reports via a web service

Materials on the application of the professional standard

Materials on the application of the professional standard “Accountant”, prepared by experts from the IPB of Russia

IPB Russia, the main developer of the professional standard “Accountant,” ensured the updating process and supported the project at all its stages. Therefore, the IPB of Russia is starting a series of publications that will help employers and accountants themselves take advantage of all the advantages of the new edition of the standard and “expand” the bottlenecks associated with the use of professional standards. standards. The materials were prepared by experts from the IPB of Russia and are based on questions received by the developer, and also take into account the nuances of discussions that took place for more than two years on different platforms.

Let us highlight the main and most significant changes in the updated professional standard “Accountant”:

- For employees of accounting services, there are 4 qualification levels (in the previous version there were 2). Thus, depending on the nature of the work functions and actions performed, as well as the degree of authority and responsibility, the qualifications of accountants are differentiated from level 5 to high level 8. The new 7 and 8 qualification levels are intended for employees of accounting services of economic entities with a complex organizational structure, large holdings and accounting outsourcing companies.

- The introduction of additional qualification levels will ensure that the specifics of the work of heads of accounting services are taken into account, which involves increased complexity and is accompanied by increased responsibility, and will also help improve educational programs for accountants.

- Clarifications have been made to the qualification requirements for employees at levels 5 and 6, which will help heads of accounting and personnel services in determining the need for advanced training of accountants.

- There is a requirement for advanced training in the amount of at least 120 hours over 3 years for employees of accounting services, starting from level 6. This requirement, similar to the requirement established for auditors, will reinforce actual practice, since the accountant is required to keep abreast of constantly changing legislation.

Other materials

- Recommendations for applying professional standards in an organization are available on our website

Our website contains Recommendations for the application of professional standards in organizations, developed by the Federal State Budgetary Institution “All-Russian Research Institute of Labor” of the Ministry of Labor of Russia.

- Assessment of the completeness and quality of the professional standard “Accountant”: results

The working group to assess the completeness and quality of the professional standard “Accountant”, formed by the Commission on Professional Qualifications in Accounting, summed up the results of the survey of employers. The working group conducted this survey in accordance with the commission’s decision dated June 3, 2021.

- Professional standard “Accountant”: explanations and comments

The professional standard “Accountant” has been in effect for a year and a half. IPB Russia, as the developer of this document, is obliged to monitor its application. The analysis showed that the application of the professional standard raises many questions among both employers and employees of accounting and financial services. We discussed these issues during the round table.

- All government agencies must approve schedules for the implementation of professional standards

This was announced by Deputy Minister of Labor and Social Protection of the Russian Federation Lyubov Eltsova at a seminar on the application of professional standards, which was organized by the Russian Ministry of Labor for federal executive authorities and their subordinate institutions.

- Changes will be made to the professional standard “Accountant”

On April 22, 2021, by decision of the Council for Professional Qualifications of the Financial Market, a new edition of sections 3.1 and 3.2 of the professional standard “Accountant” was approved. This edition was prepared by the IPB of Russia.

- Open webinar on the system of professional qualifications

On March 30, 2021, the RSPP hosted the first open webinar on the system of professional qualifications.

- The law on independent assessment of qualifications has been submitted to the State Duma

The bill provides for the formation by associations of employers and trade unions of a system of independent assessment of qualifications for compliance with professional standards, based on trust in the quality of this assessment on the part of employers and citizens.

- The Russian Ministry of Labor explained how to apply professional standards

The website of the Russian Ministry of Labor contains information on the application of professional standards. The document, in particular, states that state and municipal organizations should analyze the professional competencies of employees for compliance with professional standards.

- The costs of assessing qualifications can be taken into account for taxation

At a meeting of the Government of the Russian Federation, which took place on March 24, 2016, the issue of forming a national system of professional qualifications was considered. As follows from the report of the Minister of Labor and Social Protection of the Russian Federation M.A. Topilina, several bills have been prepared that should have a positive impact on the process of introducing professional standards.

- Who and how will determine that an accountant’s qualifications meet the requirements of the professional standard “Accountant”?

Currently, the country is creating a national system of professional qualifications. By Decree of the President of the Russian Federation of April 16, 2014 No. 249, the National Council under the President of the Russian Federation for Professional Qualifications was established.

- Are accountants required to confirm their qualifications in accordance with the professional standard “Accountant”?

Currently, the legislative basis for the national system of professional qualifications continues to be formed. Some of the regulatory legal acts have already been adopted, the other part is in the process of discussion.

- “The qualifications of a specialist who has passed our certification meet the requirements of the professional standard “Accountant”” - interview with the President of the IPB of Russia L. I. Khoruzhy

We talk with the President of the IPB of Russia Lyudmila Ivanovna Khoruzhy about the reasons why the IPB of Russia took the initiative to independently develop the professional standard “Accountant”, the prospects for its application, and the Institute’s certification system based on this professional standard.

- IPB of Russia conducts a series of meetings and webinars on the application of the professional standard “Accountant”

The Directorate of IPB of Russia holds webinars and meetings with managers and employees of the educational center and TIPB on issues of approval of the professional standard “Accountant” as the basis for professional certification of the IPB of Russia.

- Report on the round table “Application of the professional standard “Accountant” by economic entities of Russia”

On February 25, 2015, a round table “Application of the professional standard “Accountant” by economic entities” was held, which was organized by the IPB of Russia. The purpose of the round table was to explain the provisions and logic of the development of the professional standard on the part of the IPB of Russia, as well as to discuss the procedure for applying the standard and its further development.